Is The Interest Paid On A Jumbo Loan Tax Deductible

While deducting the interest paid on a conventional mortgage from your taxes has long been an option for homeowners. Recent changes in tax law now allow holders of jumbo mortgages to deduct the interest paid on the first $750,000 of your primary or second home. However, you should always consult a tax professional about your situation.

Comparing Jumbo Loans & Conforming Loans

If youre buying an expensive home, you can expect its peripheral costs to also be a bit pricey. The same principal applies to jumbo loans, especially if theyre well above the conforming loan limit for your county.

While many lenders will consider lowering their down payment requirements for jumbo loan applicants, most still call for the industry standard of 20%. If you make a down payment of less than 20%, you may be on the hook for private mortgage insurance , which isnt cheap. These stipulations are the same with conforming loans.

Any time youre dealing with a larger mortgage, fees are inherently going to be higher. These usually include origination fees, title insurance, inspection fees and service fees, which are all collectively known as closing costs. Be prepared to pay for these when you finally close on your new home.

Because a jumbo loan cannot be backed by Fannie Mae or Freddie Mac and they are quite large, their interest rates may be higher than their conforming loan counterparts. On the bright side, many lenders jumbo and conforming rates are getting closer than they once were. In general, though, expect to get a somewhat high interest rate.

A Brief History Of Non

Non-agency MBS were most heavily issued from 2001 through 2007. This came to an end in 2008 after the mortgage crisis in the U.S.

The rapid growth in the non-agency MBS market is widely cited as being a key factor in the crisis. This is because these securities provided a way for less creditworthy buyers to gain financing. Over time, it led to an increase in delinquencies.

The result was that non-agency MBS collapsed in value in 2008. The issue quickly spread to higher-quality securities. This sped up the crisis. Banks and other groups stopped issuing non-agency MBS for years.

Starting in 2015, a few hedge funds and private-equity firms began issuing new non-agency MBS. In 2016, Lone Star Funds issued the first non-agency MBS that were backed by mortgages originated after the crisis and rated by credit rating agencies.

Money managers can still invest in pre-crisis non-agency MBS today. This is because the securities issued prior to the crisis still trade in the open market. The asset class has done very well in the recovery. This has rewarded money managers who took the risk of buying into a very depressed market in 2009.

You May Like: How To Get Loan Originator License

Jumbo Vs Conventional Loans

Are you looking to buy a house? Before you start daydreaming about your new home, you need to consider which type of mortgage you’re going to use to buy it. You could opt for a regular conforming mortgage. But what if you want to buy an expensive home? For that, you probably need a jumbo mortgage.

Jumbo mortgages are large loans that fall above the federal loan limit. These loans are typically harder to qualify for than conforming loans, but they can offer competitive interest rates. Theyre also a convenient way for borrowers to secure the money they need to purchase expensive homes.

Purchasing Or Refinancing Investment Properties With A Jumbo Mortgage

Jumbo loans are not limited to primary residences, making them a viable financing option for investors who want to buy or refinance their high-end properties. However, not all lenders may offer jumbo loan options for secondary or investment properties, and the ones that do could have specific requirements and loan limits. Be sure to do your research beforehand.

The Jumbo Smart loan from Rocket Mortgage® is a great example of a loan option for primary households and rental properties alike. With the Jumbo Smart loan, you can borrow up to $2 million for an investment property. If you want to purchase or refinance a vacation home, the property must be a single-family dwelling. Otherwise, rental properties can be either a single or double unit.

Similar to primary home requirements, youll need at least a 680 FICO® Score and a DTI below 45% to qualify for the Jumbo Smart loan for your investment properties and secondary homes. Requirements may be higher depending on your loan purpose.

Don’t Miss: How To Get An Aer Loan

When Is A Loan Considered Jumbo In Your Area

A jumbo loan is a type of mortgage that is too high to be guaranteed by Fannie Mae or Freddie Mac, which are government-sponsored enterprises that set mortgage underwriting standards and purchase qualified loans from lenders. Loans that can be purchased by Fannie Mae or Freddie Mac also called conforming loans are considered safer investments for lenders than jumbo loans, and it can be easier for borrowers to meet their requirements.

With home prices rising in most areas of the United States, the FHFA has increased conforming loan limits for 2021. How large a loan you can get before its considered jumbo depends on where you live, as certain more expensive areas like Hawaii or San Francisco have higher limits. If youre concerned about meeting the more stringent lender criteria required for approval for a jumbo loan, these new limits could allow you to finance a high-priced home with a conventional loan instead.

For 2021, the maximum limits for conforming loans are:

-

$548,250 for a single-family home in most areas of the country.

-

Up to $822,375 for high-cost areas where single-family home prices tend to be above average. When setting conforming loan limits, the FHFA has defined high-cost areas as places where 115% of the local median home value is more than $548,250.

You can find the exact conforming loan limits for your area using the tool below.

» MORE: Find and compare the best jumbo mortgage rates

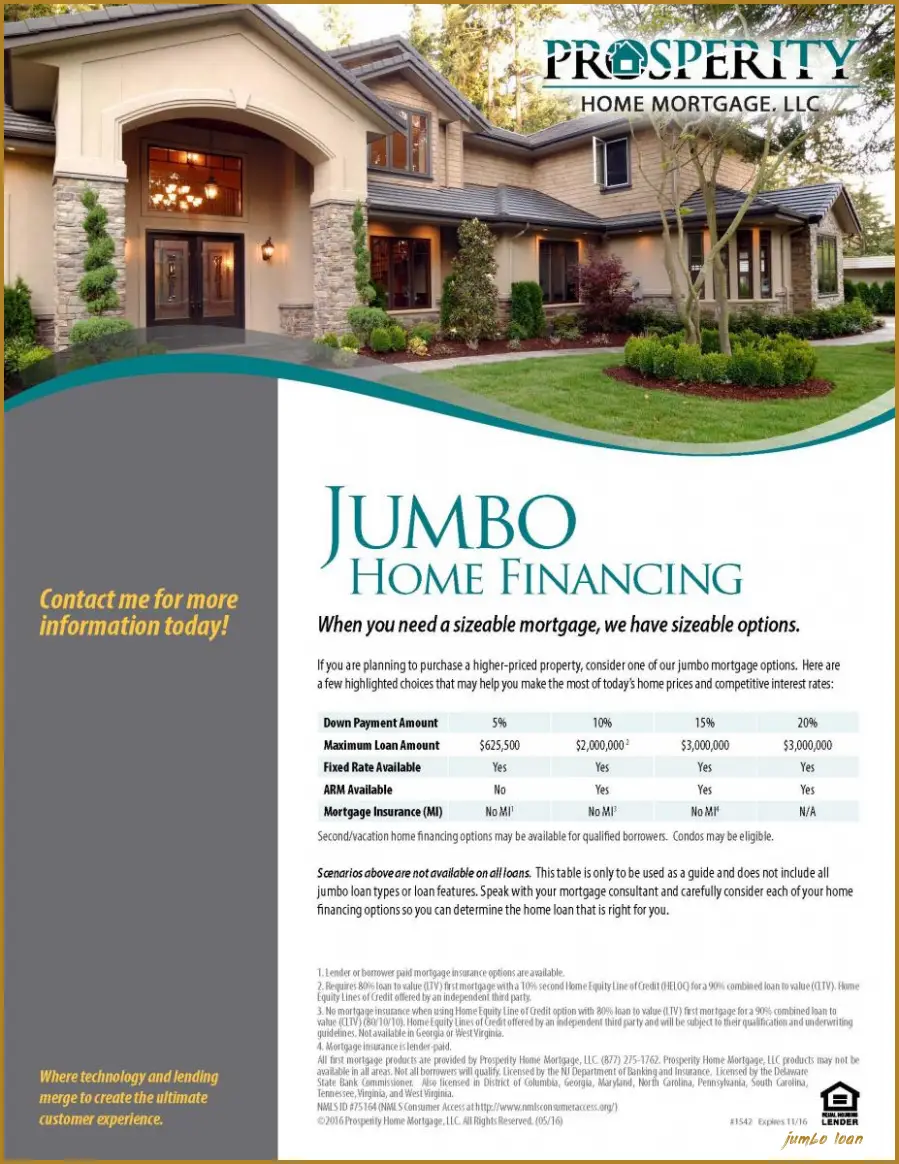

Characteristics Of A Jumbo Loan

- Interest rates for a jumbo mortgage tend to be higher than those for a conforming loan, depending on market conditions

- Available in both fixed and adjustable rate terms. Fixed options include 30, 20 and 15-year terms. ARM options include fixed period of 5, 7, or 10 years

- Tend to have higher down payments and cash reserve requirements, depending on lender guidelines

- Financing is possible for loans of up to $5 million

- Delayed purchase financing options are available

You May Like: Does Va Loan Work For Manufactured Homes

Can You Refinance A Jumbo Loan Into A Conforming Loan

If youve secured a jumbo loan, you may be wondering if you can refinance your loan into a conforming mortgage. Though it is possible, refinancing can be a challenge. Depending on your circumstances, it may be worth the effort if it means big savings by reducing your monthly payments and your interest rate.

To refinance your jumbo loan, youll need:

Is A Jumbo Loan A Good Idea

Whether a jumbo home loan is a good idea for you depends on your financial situation. Keep in mind that qualifying for a large loan doesnt necessarily mean its a wise choice to borrow that amount.

Jumbo loans can be expensive, and lenders may view jumbo loans as riskier than smaller mortgages. Thats probably at least partly because they arent guaranteed by Fannie Mae or Freddie Mac. Plus, when a mortgage is large, even small drops in home value could put the lender at risk. After all, a 10% drop in home values will make a smaller dent in the value of a $100,000 home than a $1 million home.

And lenders may charge higher interest rates on jumbo mortgage loans because of the perceived higher risk.

As with any mortgage youre considering, its best to think about whether youll be able to afford the monthly payments while leaving room for other expenses, including home maintenance. You may find that you need to budget more for upkeep on a large, expensive property than you would on a less costly house.

Also, youll likely want to make sure that youll still have money left over to meet your savings and retirement contribution goals after you make your monthly housing payments. Buying a larger house shouldnt be a substitute for meeting your savings goals.

Also Check: What Is The Commitment Fee On Mortgage Loan

What Is Considered A Jumbo Loan

A mortgage is considered a jumbo loan when the mortgage amount is greater than the conforming loan limits laid out by the Federal Housing Finance Agency. These conforming loan limits serve as the maximum amounts that Freddie Mac and Fannie Mae can legally guarantee.

Mortgages that arent insured by the government pose a bigger risk to lenders and jumbo loans fall into this category. Because jumbo loans exceed conforming loan limits, they tend to have stricter criteria that borrowers must meet to secure this type of mortgage.

How Big Is A Jumbo Loan

In 2019, Fannie Mae and Freddie Mac set conforming limits at $484,350 for most of the United States. In areas with higher housing prices, like Washington, D.C., and San Francisco, a loan is considered jumbo if it exceeds $726,525, and loan limits can be even greater outside of the continental U.S., like in Alaska, Hawaii and Guam. Lenders set their own maximum jumbo loan limits, and so the highest amount that youll be able to get through a jumbo loan will be determined by a variety of factors.

Also Check: How Do I Refinance An Auto Loan

Closing Costs On Jumbo Loans

Simply put, jumbo mortgages have higher closing costs than normal mortgages. Theres a lot more to assess and those extra qualification steps take time.

As well as higher closing costs, you may also need to pay for a second home appraisal. Lenders do this to offset some of their risk. Make sure youve considered all the closing costs, as well as the down payment and cash reserves youll need to have on hand before applying for a jumbo mortgage.

How Assets America Can Help

Assets America® plays an important part in the CMBS market by arranging commercial property loans possibly suitable for securitization. We offer financing starting at $10 million, with no upper limit. If you are in the market for commercial-property financing, call us to schedule a confidential conversation: Commercial Financing Personal Service Outstanding Results!

Don’t Miss: How To Find Your Student Loan Number

When Should I Use A Jumbo Mortgage

Youd use a jumbo mortgage when youre seeking a loan amount thats greater than the conforming loan limit in your area. In most of the country, that means youll use a jumbo mortgage if your loan amount is greater than $548,250.

In certain areas that are deemed high cost, the conforming loan limits go above $548,250, and you have to look up your areas loan limits to know exactly. The FHFA site has this information.

Certain lenders will categorize anything above $548,250 as a jumbo, even if the loan is being made in a high-cost area where the conforming limit goes as high as $822,375.

But dont assume this applies if youre in an area where your conforming limit goes above $548,250. You must ask your specific lender what kind of loan youll be eligible for.

Qualifying For A Jumbo Mortgage

The qualification process for a jumbo loan is similar to the conforming loan process. The lender will review your assets, income and credit score, but there are some differences. Jumbo loans typically have higher qualification standards than conforming loans since lenders take on extra risk with jumbo loans. Because of this, lenders are looking at several key factors to determine your risk level. Generally, this means higher credit, income and cash reserve requirements.

Here are some of the main qualification differences between jumbo and regular mortgages.

Read Also: When Can I Apply For Grad Plus Loan

Bottom Line: Should I Get A Jumbo Loan

If you want a nice house in a pricey market and meet the eligibility requirements, a jumbo loan could be the right loan for you. The most important thing to remember is that jumbo loans were not created to help you push the limit of how much you can borrow. Rather, jumbo loans are available to creditworthy home buyers who want to invest in a house thats more expensive than the average house in their area.

The total loan amount that a lender will be able to lend to any borrower will be determined by their credit score, current debts, assets and a variety of other personal financial factors. The best jumbo loan lenders will always offer competitive rates and employ knowledgeable loan offers who will help you decide if a jumbo loan is the best financial move for you to make.

Michele Lerner, author of HOMEBUYING: Tough Times, First Time, Any Time, has been writing about personal finance and real estate for more than two decades. Michele writes for regional, national and international publications in print and online for a variety of audiences including consumers, real estate investors, business owners and real estate professionals.

Rc: Lp: U: 3071 Underwriting Jumbo Loans

This is a single-family/residential course.

Jumbo mortgage loans provide customers a financing opportunity to purchase or refinance a home when the first mortgage loan amount exceeds conforming loan limits. Industry statistics report an increase in jumbo loans in recent years. This increase is due to an increased availability of jumbo loans, and jumbo loan interest rates that have become more affordable. Additionally, it is not only the mortgage giants offering jumbo mortgages. Smaller regional and local banks are also participating in this market and can usually provide faster service for purchase and even refinance of jumbo mortgage loans.

The conforming loan limit adjustments of Fannie Mae and Freddie Mac may fluctuate annually and are based on the October-to-October changes in the mean national home price, as published by the Federal Housing Finance Agency . Typically, a home requiring a jumbo mortgage exceeds the mean, hence the need for a higher loan amount.

Topics:

Also Check: How To Get An Aer Loan

Jumbo Vs Conventional Loan

Jumbo loans and conventional loans are both issued by private lenders, and neither is insured by a government agency. The difference between a jumbo loan and a conventional loan is that a conventional loan meets conforming limits set by government-sponsored enterprises and jumbo loans do not. If a loan amount is larger the governments conforming limits, then it cant be securitized by Fannie Mae and Freddie Mac. Private lenders then must set their own rules and regulation in order to make a jumbo, or nonconforming, loan to borrowers.

The interest rate on a jumbo mortgage loan is usually higher than a conventional loan, though weve seen that gap close since 2010. Similarly, jumbo mortgage loans typically require a higher down payment, but some lenders are lowering their minimum down payments to be closer to that of a typical conventional or conforming loan.

Conforming Vs Jumbo Loan Limits

Most mortgage lenders prefer to work with conforming loans because they are highly liquid, easy to package and sell to investors, and quickly free up more cash that can then be used to issue more loans. To reduce market volatility, lending limits are set by the federal government.

The Housing and Economic Recovery Act requires an annual review of loan limits to ensure they reflect changes in the average U.S. home price. Since 2008, according to the FHFA, various legislative acts have increased the loan limits in certain high-cost areas in the United States.

As of January 2021, conforming loan amounts are capped at $548,250 for a single-unit home in most parts of the country. However, because the FHFA acknowledges prices can easily exceed this in higher-cost housing markets, like Hawaii, Washington D.C., San Francisco, or Los Angeles, maximum loan limits can reach as high as $822,375 in more expensive areas. But even in high-cost areas, its easy to exceed those limits, making jumbo loans a useful tool.

Read Also: Rv Loan With 670 Credit Score

Jumbo Vs Conventional Mortgages: An Overview

Jumbo and conventional mortgages are two types of financing used by borrowers to purchase homes. Both require homeowners to meet certain eligibility requirements including minimum , income thresholds, repayment ability, as well as minimum down payment requirements. Government-sponsored enterprises , such as Fannie Mae and Freddie Mac, the Federal Housing Administration , the U.S. Department of Veterans Affairs , or the USDA Rural Housing Service do not back either mortgage product. While they may be used for the same purposeto secure a propertythey are inherently different.

Jumbo mortgages are used to purchase properties with steep price tagsoften those that run into the millions of dollars. Conventional mortgages, on the other hand, are more in line with the needs of the average homebuyer and can be conforming or nonconforming. Keep reading to find out more about these two kinds of mortgage products.

When Should Jumbo Loans Be Avoided

You may want to avoid a jumbo loan if you doubt your ability to meet its stiff qualification requirements. In addition, if you feel you may need to resell the property quickly at some point in the future, you may want to consider how energetic the local real estate market is. If the market is slow, or if the property is vastly more expensive than most neighboring properties, it may prove difficult to resell. Even in vigorous markets, potential buyers will likely be subject to the same lengthy mortgage-vetting process you’d have to go through as a buyer, and that can lengthen the amount of time required to complete the sale.

Qualifying for a jumbo mortgage can be a daunting process, and the loan will likely be costly in terms of interest rates and fees even for applicants with very good credit. If your sights are set on an exceptionally expensive property, and you have the means to qualify, a jumbo loan may be the best option for financing your dream home.

You May Like: Usaa Auto Refinance