Who Has The Best Rates For Car Loans

Automakers, credit unions, banks and online lenders could all potentially provide a low rate. Youll never know what you qualify for until you apply. Applying to multiple lenders within a two-week window will not hurt your credit score any more than applying to one lender. Any drop to your credit score will be slight and temporary.

Car Loan Application Checklist

You can expedite your car loan application by getting your finances in order and by being ready to provide any required documentation.

Proof of Employment: Most lenders want to see that you are employed and earning enough income to cover your car payments. Copies of your bank statements, pay stubs, or notice of assessment should be adequate. Some lenders also accept government assistance or benefits.

: Your 3-digit credit score is a measure of your creditworthiness. If you are not sure what your credit score is, you can check it for free here.

Your credit report also details how you have managed your finances over time. Typically, lenders want to see your debt-to-income ratio, payment history, and account balance. You can improve your credit score by paying bills on time.

Bank Details: You will need to show that you have a bank account in Canada. A void cheque to set up your monthly payment is typical.

Drivers License and Proof of Residence: A government-issued ID such as your drivers license is used to confirm your province of residence and address. Other documents that may be requested include your utility bills.

Vehicle Information: Duh! Of course, you need to know the type, make, and purchase price of the vehicle you want.

Proof of Car Insurance: Before driving off the lot, you may have to show you have purchased car insurance.

Best For Refinancing: Openroad Lending

OpenRoad Lending

OpenRoad Lending specializes in auto refinancing saving customers an average of more than $100 per month, making it our choice as the best for refinancing.

-

No option to prequalify and check rates with a soft pull

-

Vehicle age and mileage restrictions

While getting a new set of wheels is exciting, theres something to be said for sticking with a reliable ride. However, if your credit improved, you paid off debt, or you got a raise since you first financed your auto loan, you may be paying too much.

OpenRoad Lending allows eligible applicants to refinance existing loans and save an average of $100 per month on their car payments. The application process is simple and entirely online. Within as little as a few minutes of applying, you can receive your decision with complete details about the loan.

If you run into any trouble with your application, OpenRoad Lending’s customer service team can help. Perhaps that’s why 98% of customers say that they are satisfied with their loans. Before applying, you should know that there is only the option to apply with hard credit pull and it is not possible to prequalify or check rates with a soft pull, so this service is only for people who are serious about refinancing. The higher your credit score the lower your rate will be.

Recommended Reading: Minimum Credit Score For Rv Loan

Can I Get 0% Financing On A Car Loan

You may see dealerships advertising 0% financing on their cars. With 0% financing, you buy the car at the agreed-on price, and then make monthly payments on the principal of the car with no interest for a set number of months. However, keep these points in mind:

- 0% interest may only be offered for part of the loan term.

- To be approved, youll need spectacular credit .

- Negotiating the car price will be difficult.

- 0% interest car financing is only available to certain models.

- You may not get as much money for your trade-in vehicle.

- The loan structure will likely be set in stone.

Can I Get An Auto Loan With Bad Credit

It is possible to get a car loan with bad credit, although having bad credit will raise the rates you’re offered. If you’re having trouble getting approved or finding acceptable rates, try taking these steps:

- Improve your credit: Before applying for an auto loan, pay down as much debt as you can and avoid opening new accounts, like credit cards.

- Make a large down payment: Making a larger down payment will lower your monthly payment, but it could also help you qualify for better rates.

- Consider a co-signer: A co-signer with good credit will take on some responsibility for your loan if you default, but they can also help you qualify.

Read Also: How To Reclassify A Manufactured Home

Can You Negotiate Apr On A Car

Yes, you can negotiate APR the same way you negotiate the cars price by showing the dealer that your own lender gave you a lower rate. You can also ask the dealer what it would take to get a tier bump. Dealers sort borrowers into tiers by credit score the higher the tier, the lower your APR. They may say that you need to put more money down or get a cosigner in order to reach a higher tier.

Can You Refinance A Car Loan

Yes, many lenders offer auto loan refinance opportunities, and several promise to make the process quick and easy. It can pay to refinance your loan in several different circumstances. For example, you might be able to improve your rate and monthly payment, shorten the term of your loan repayment, or extend the term if you’re having trouble making payments.

You May Like: Becu Used Car Loan

What Is The Current Interest Rate For Car Loans

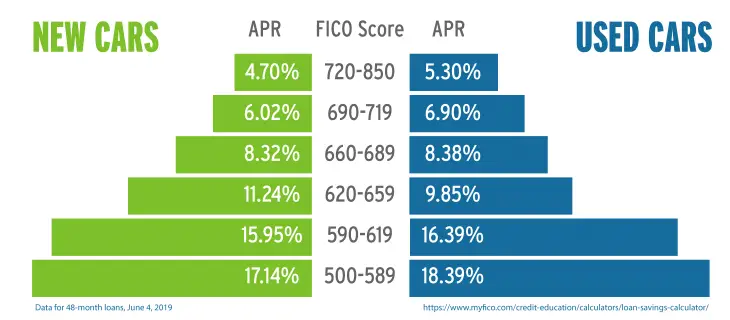

Your credit score plays a major role in determining your interest rate. Below, we have listed some average rates based on different ranges of credit scores.

- Excellent credit: 850 740 = 3.2% interest rate

- Average credit: 739 680 = 4.5% interest rate

- Sub-par credit: 680 and below = 6.5 12.9% interest rate

When you have a higher credit score, you can expect a lower interest rate on your vehicle. There are ways you can boost your credit score so you can enjoy a lower interest rate. One great way to do this is by making small purchases and paying them off right away.

What Is A Good Used Car Loan Rate

Loan rates for used cars are higher than rates for new cars. For a 48-month term, a good used auto loan rate from a bank is 5.16% or lower. A good used car rate from a credit union is 3.16% or lower.

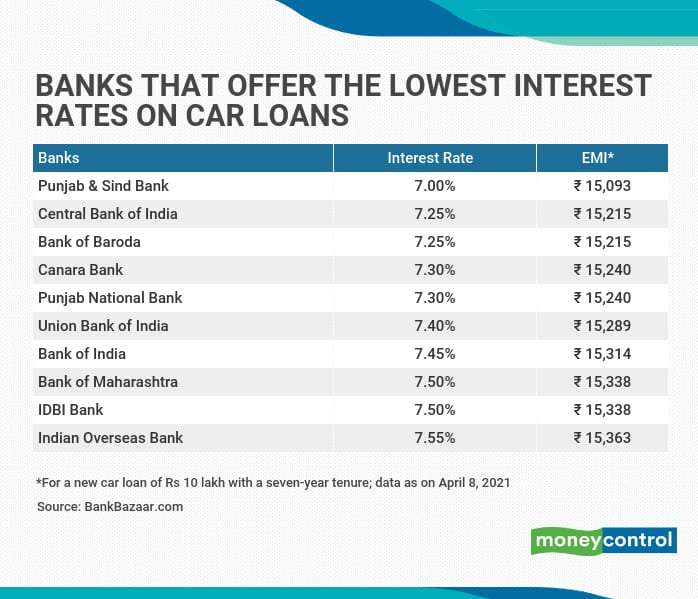

Below is a chart with NCUA data for average credit union and bank rates for both new and used vehicles.

| New or Used Vehicle Loan | Loan Term |

|---|---|

| 5.16% |

Read Also: How Do I Find Out My Auto Loan Account Number

Common Car Loan Terms

This is the loan amount expressed as a percentage of the car’s value. For example: if a bank offers a margin of financing of 90% for a car valued at RM100,000, the bank is effectively agreeing to lend 90% x RM100,000 = RM90,000 to the borrower.

Guarantor

A guarantor is a person who agrees to pay off a loan on a borrower’s behalf if the latter defaults on the said loan. In Malaysia, a guarantor may be required for a car loan especially if the borrower does not have stable income, or have opted for a loan amount that goes above a predetermined percentage of his or her income.

Repossession

This is when the lender takes away the car from a borrower when the latter fails to service the car loan instalments in two consecutive months. In Malaysia, a car cannot be repossessed if more than 75% of the car loan has been settled.

What Is A Car Loan

Auto loan is one of the most sought after financial products in the market right now. Transportation has grown to be more of a necessity rather than a luxury in the Philippines mainly due to substandard transportation system and the heavy traffic around the metro. Whether it’s for a used or brand new car, auto loan gives the opportunity for Filipino families, especially the growing middle class, the chance to purchase their own car.

Read Also: What Car Loan Can I Afford Calculator

Get Current Auto Loan Rates And Choose A Loan Thats Right For You

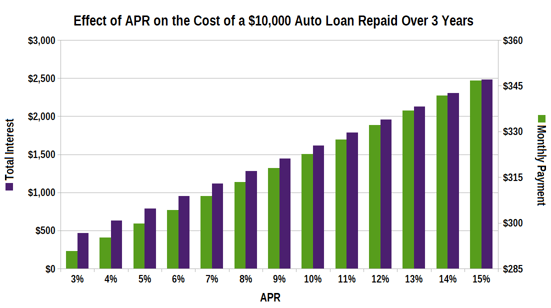

Car loan interest rates change frequently, so its important to keep track of them. Your loans interest rate influences how much youre going to pay for month to month. And a lower interest rate can mean thousands of dollars in savings. Our rate table can help you know the best time to buy a new or a used car.

Current auto loan interest rates| 4.43% |

Best For Bad Credit: Oportun

Oportun

- Capped at 35.99%

- Minimum loan amount: $300

Opportun is our choice as the best for bad credit since it offers personal loans with limited credit score requirements and an easy online application, and funds available within two hours.

-

No minimum credit score required to apply

-

Easy online application with instant approval

-

Pre-qualify with a soft credit check

-

Only available in 24 states

-

High interest rates

Having less-than-perfect credit shouldnt keep you from getting the car you need. While you shouldnt expect the low rates that those with great credit have, you can avoid overpaying with Oportun. Through this online lender, you can get a loan for a car that you purchase from an auto dealer or a private party. Since buying through a private party can be cheaper, this can save you big bucks over dealerships. If you have a great car and you want a better loan to match, you can use Oportun’s refinancing options.

Oportun will lend to people with limited or no credit history. You should have proof of income to apply. Loan amounts can range from $300 to $10,000, so you can get the car you want. Best of all, Oportun does not require a hard credit check when prequalifying and checking rates. So, looking around wont hurt the score youre trying to fix. The application takes only a few minutes, is completely online, and results in an instant decision. If you live in one of the states where Oportun is available, this is an excellent choice.

You May Like: What Kind Of Loan Do I Need To Buy Land

Auto Loans For Good And Bad Credit

Compare car loans from multiple lenders to find your best rate and learn what you need to know before you apply.

Shopping for the lowest interest rate on your auto loan before you buy your next car puts you in a stronger negotiating position and saves you money over the life of your loan. If you already have a loan, you may be able to lower your monthly payment and save money by refinancing your car loan.

You can compare multiple offers below for auto purchase loans, auto loan refinancing, even online car dealers with financing. Bookmark our auto loans calculator to estimate your monthly payment.

Shopping for the lowest interest rate on your auto loan before you buy your next car puts you in a stronger negotiating position and saves you money over the life of your loan. If you already have a loan, you may be able to lower your monthly payment and save money by refinancing your car loan.

You can compare multiple offers below for auto purchase loans, auto loan refinancing, even online car dealers with financing. Bookmark our auto loans calculator to estimate your monthly payment.

Does It Matter How Long My Term Length Is

The longer the loan term, the lower the monthly payment. But, paying for longer than 60 months on your auto loan could leave you owing more than your car is worth.

Cars depreciate quickly, and if you’re paying for more than five years on an auto loan, your loan could end up in this situation, also called being “upside-down.” As auto loans increase in length, auto loan delinquencies tend to increase, too.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Where Can I Find Competitive Car Loan Rates In Canada

Comparing car loan interest rates offered by different banks, credit unions and online lenders is critical to finding the deal thats best for you.

- Banks or credit unions. Since you have an established relationship with your bank already, it might be easier to get approved for a car loan, even if you dont have the best credit. Banks and credit unions also tend to offer the most competitive rates.

- Online lenders. Some online lenders may be willing to loan money to people with average or poor credit, even if they cant get approval from their bank though they may not get the lowest rate available. Online lenders also tend to be the quickest to approve loans and disburse funds.

- Dealerships. Local car dealers are often willing to work with borrowers of all credit ratings. But because many dealerships offer financing through an external lender, dealers may inflate interest rates in order to make a profit.

Best Trusted Name: Bank Of America

Bank of America

Bank of America is a good choice for an auto loan refinance for borrowers looking to work with an established brick and mortar bank with widespread availability.

-

Discount for Preferred Rewards members

-

Car must be fewer than ten years old

-

Minimum loan amount of $5,000

-

Car must have fewer than 125,000 miles

If you opt for an auto loan refinance from Bank of America, you get a trusted financial institution â and a decision in less time than it takes you to tie your shoes. Thereâs no fee to apply, and you can help yourself to all of their helpful online tools once you are a member of the Bank of America family. To qualify, your car will need to be fewer than ten years old and have less than 125,000 miles on it, and you will also need to have $5,000 or more remaining on your loan. Bank of America’s current APR for refinancing a vehicle is 4.13%. It is smart to pay off your existing loan with proceeds from a new loan to take advantage of lower monthly payments, lower interest rates, or save on financing costs. Compare prices and use a car loan calculator to help determine the savings.

Recommended Reading: Fha Loan Limits Fort Bend County

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. The average APR for a new car is anywhere from 3.24 percent to 13.97 percent, depending on your credit score, while the average APR for a used car is 4.08 percent to 20.67 percent.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

BEST OF

Don’t Miss: Is Usaa Good For Auto Loans

Best Credit Union For Auto Loans: Consumers Credit Union

Consumers Credit Union

- As low as 2.24%

- Minimum loan amount: None

-

No minimum or maximum loan amount

-

Offers new, used, and refinance loans

-

Offers transparent rates and terms

-

Lowest rates require excellent credit

-

Membership in credit union is required

Consumers Credit Union offers auto loan rates to its members as low as 2.24% for new car loans up to 60 months. Like other credit unions, it requires membership, but it’s easy to join. You can become a member by paying a one-time $5 membership fee. There are no geographic or employer requirements.

CCU doesn’t have a minimum or maximum loan amount. Your loan is approved based on your credit score, credit report, and vehicle information. There’s also no minimum loan termyou submit a request based on what you need.

Generally, borrowers with excellent credit will qualify for the lowest rates from Consumers Credit Union. But even members who have less than excellent credit have access to discounts. There’s a 0.5% discount available for those who autopay from a CCU account. The discount falls to 0.25% for those who make automatic payments from an outside financial institution.

What Are The Disadvantages Of A Car Loan

- Car loans can come with various fees. For example, there may be establishment fees, service fees, late payment fees, extra repayment fees and early repayment fees.

- You must make your repayments or your lender could repossess your car or take you to court .

- You will pay more than just the principal cost of a car if you take out a car loan. Youll also usually need to pay interest, and this can add to the total cost of purchasing a car overall.

- If you take out a car loan and do not consistently make the repayments on time, there may be a negative effect overall on your . This may, in turn, impact how lenders perceive you as a borrower for future requests for credit. If you have a low credit score, it can impact the interest rate you pay on personal and car loans.

Read Also: What Credit Score Is Needed For Usaa Auto Loan