Supports For Students Affected By Wildfires

Are you affected by the current wildfire situation? Do you need help with your student loan payments?

- If you have Canada loans, or Canada and Alberta loans, contact the National Student Loans Service Centre to fast track your application for the Repayment Assistance Plan.

- For Alberta Student Loans, call 1-855-606-2096

Currently in School

If your studies have been disrupted as a result of the wildfires, and you have:

- Extended your study period

- Withdrawn from studies, or

- Your financial circumstances have changed.

Notify the Alberta Student Aid Service Centre, or login to your;Student Aid Account and submit a Request for Reconsideration. Eligible students may receive up to $7,500 in Alberta Student loan funding to help cover unexpected costs relating to the wildfire. Supporting documentation may be required to verify the costs.

More About The Fsa Id

The FSA ID replaced the Federal Student PIN in 2015, so students who havent taken out new student loans or havent logged into the Federal Student Aid website since 2015 might not have an FSA ID yet.

Students who dont have an FSA ID can create one on studentaid.ed.gov.. Once you sign up for an FSA ID, the federal government will verify your information with the Social Security Administration. Once your information is verified, you will be able to use your FSA ID to obtain information about your federal student loans.

The site, managed by the U.S. Department of Education, can provide a convenient way to get a full picture of all your federal loans, including:

;; How many federal student loans you have;; Their loan types;; The original balance on each loan;; Current loan balances;; Whether any loans are in default;; Loan service providers names;; Contact information of the loan service providers

Select A Repayment Plan For Your Federal Student Loans

Within the grace period you may receive information about repayment from your lender. Youll have a choice of several repayment plans. Find the right one for you.

Most federal student loans are eligible for at least one income-driven or income-based repayment plan . These repayment plans are based on a percentage of your discretionary income. Theyre designed to make your student loan debt more manageable by reducing your monthly payment amount.

Also Check: How To Take Personal Loan From Bank

Consumer Financial Protection Bureau Resources

- Student Loan Payback Playbook

- A Consumer Financial Protection Bureau website for people to provide feedback on how to help student loan borrowers better understand available repayment options for paying off student debt. On this site, you can share your thoughts on the CFPB student loan Payback Playbook that borrowers could receive from their servicers, informing them of the available repayment options.

A program of the Bureau of the Fiscal Service

Refinancing Student Loans Pros And Cons

Another option to consider is to refinance your student loans. There are pros and cons to that strategy, with pros including the following:

;; Loans can be combined into one single loan and payment, which can be easier to manage.;; Some private lenders, including SoFi, will consolidate federal and student loans and refinance them into one loan.;; Terms can be adjusted; a longer-term can help to lower the payment, while a shorter one can help to reduce the amount of interest paid back over the loans life.

In addition, there may be choices between fixed-rate and adjustable-rate loans, and a cosigner with good credit and solid income may help the borrower get a better rate.

Cons of refinancing include:

;; Refinancing federal student loans with a private lender means that borrowers will lose access to benefits associated with federal student loans, including income-driven options and loan forgiveness programs.;; Other federal protections that will no longer apply include federal deferment or forbearance where payments may be temporarily paused.;; Most federal student loans have a grace period during which you dont have to make any loan payments. If you refinance your loan soon after graduation, you might lose out on that benefit if your private lender doesnt honor existing grace periods.

Recommended: Pros and Cons of Refinancing Student Loans

Don’t Miss: How To Apply For Direct Loan

Option : Assistance With Login To Myloan Or Loan Repayment

Choose Option 3 if you need help with:

- Your;username and/or password for;your MyLoan online account.

- Your current loan balance.

- Accessing Repayment Assistance Programs if you are having difficulty repaying your loans.

- Updating your address if you are in repayment status.

- If you will be returning to school, you should also update your address in your Alberta Student Aid account:

|

7th Floor, 9940 106 StreetEdmonton, Alberta T5K 2V1 |

When submitting a form,;please follow the instructions given on the form.Notice:;Alberta Student Aid;no longer accepts;student loan and scholarship;applications dropped off in person.

Wells Fargo Private Student Loans

Wells Fargo has exited the student loan business. Our private student loans are being transitioned to a new loan holder and repayment will be managed by a new loan servicer, Firstmark Services, a division of Nelnet.

For assistance:

- Visit Firstmark Services online

Avoid processing delays: After your student loan has transferred to Firstmark Services, please ensure that payments are being sent using your new Firstmark Services account number and payment address. Wells Fargo will only forward misdirected payments for 120 days after transfer. After that 120-day period has passed, misdirected payments will be returned.

Alert: If you need assistance or services related to COVID-19, learn more about how we can help.

General student loan questions?Visit CollegeSTEPS® for guidance to help you manage your money confidently during college.

After your student loan is transferred, your student loan will no longer appear on Wells Fargo Online. If your student loan is your only account with Wells Fargo, you will no longer have access to Well Fargo Online after this transfer is complete. Firstmark Services will mail you written instructions describing how to set up online access using your new account number.

If you are a borrower or cosigner with a pending disbursement, please call us at Monday to Friday: 9 am to 5 pm Central Time, or login to check your loan status.

If your student loan payments are made by someone other than you, please advise them of these changes.

You May Like: Can I Pay Off Personal Loan Early

Department Of Education Resources

- MyEDDebt.ed.gov

- A U.S. Department of Education website for borrowers who are in default. On this site, you can setup an account, view your loan amount, view your payment history, see options for resolving your loans, access forms, make payments, download hearing forms and several other actions are available on this site.

- Federal Student Aid

- A U.S. Department of Education website for people to find information about student loans. On this site, you can find out how to prepare for college, read about what types of aid you can receive, see how you can qualify for aid, learn how you apply for aid, and find information on how to manage your loans.

- National Student Loan Data System

- A U.S. Department of Education’s central database for student aid. NSLDS receives data from schools, guaranty agencies, the Direct Loan program, and other Department of ED programs. NSLDS Student Access provides a centralized, integrated view of Title IV loans and grants so that recipients of Title IV Aid can access and inquire about their Title IV loans and/or grant data.

Get The Status Of A Recent Payment

You May Like: How Long Does Student Loan Approval Take

For School Aid Offices

COLLEGESERV®

Providing support for schools to assist with borrower related issues/repayment counseling, enrollment updates, or guidance with our online reports.

Call us toll-free at 888-272-4665Monday Thursday 8 am 9 pm and Friday 8 am 8 pm ETFax: 866-266-0178Email: ELECTRONIC SERVICES

Employment Verification Visit The Work Number or call 1-800-367-2884.Resources are available to assist borrowers who have tried unsuccessfully to resolve a problem through their servicer. Please refer to your state’s relevant authority.For federal loans, you can also write to the U.S. Department of Education, FSA Ombudsman, 830 First Street, Fourth Floor, NE, Washington, DC 20202-5144.

Just Announced: Student Loan Repayments To Restart After Jan 31 2022

We are updating our websites and systems as quickly as possible. We appreciate your patience. Visit StudentAid.gov/coronavirus for updates.

For more information on your federal student loans serviced by GSM&R on behalf of Federal Student Aid , please visit our COVID-19 information page for Direct Loans. To view information regarding the servicing of all other GSM&R loans , including federal and alternative loans, please visit our COVID-19 information page for FFEL and Alternative Loans.

Don’t Miss: How To Take Out Equity Loan

How Do I Find My Student Loan Account Number To Verify My Identity For The Irs

;Check with the lender from whom you have the student loan.;;Wouldn’t it be on the information you use when you make your payments?; Look on the loan website.

If you are trying to enter student loan interest you paid you need your 1098E.

STUDENT LOAN INTEREST

Only the person whose name is on the student loan and who is legally obligated to pay the loan can deduct the student loan interest. If you co-signed then you are legally obligated to pay if the primary borrower defaults or does not pay.;;If you did not sign or co-sign for the loan you cannot deduct the interest.

You cannot deduct student loan interest if you are being claimed as someone elses dependent, or if you are filing as married filing separately.

The student loan interest deduction can reduce your taxable income by up to $2500

There is a phaseout for the Student loan interest deduction, which means the amount you can deduct gets reduced when your modified adjusted gross income hits certain income levels and is even eliminated at certain income levels – ;

If your filing status is single, head of household, or qualifying widow, then the phaseout begins at $65,000 until $80,000, after which the deduction is eliminated entirely.

If your filing status is married filing joint, then the phaseout beings at;;$130,000 until $160,000, after which the deduction is eliminated entirely.

;Enter the interest you paid for your student loan by going to Federal>Deductions and Credits>Education>Student Loan Interest Paid in 2020

Manage Your Student Loan Balance

Sign in to your student loan repayment account to:

- check your balance

- see how much youve repaid towards your loan

- see how much interest has been applied to your loan so far

- make a one-off repayment

- set up and amend Direct Debits

- tell the Student Loans Company if youve changed your contact details

- tell SLC if youre going overseas for more than 3 months

This service is also available in Welsh .

You can also make one-off repayments towards your student loan, or towards someone elses loan, without signing in.

To sign in youll need your:

- customer reference number or email address

- password

- secret answer, for example your mothers maiden name

If you do not know these, you can reset them using the email address you had when you applied for your loan. Contact SLC if youve changed your email address.

Don’t Miss: Is Prosper Personal Loan Legit

Student Loan Default: What It Is And How To Recover

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Student loan default can feel overwhelming. But if youve defaulted, youre not alone: Within three years of entering repayment, 9.7% of student loan borrowers default, according to the Education Department.

» MORE:

As part of the first coronavirus relief bill, the government stopped federal student loans from entering default and paused collection activities on those that already had. These protections are in place through Jan. 31, 2022.

During this break, you can get loans back in good standing with options like loan rehabilitation and consolidation. Take action as soon as possible to avoid penalties like and ;when collection activities resume.

Student loan default means you did not make payments as outlined in your loans contract, also known as its promissory note. Default timelines vary for different types of student loans.

Before federal student loans default, they enter a status known as delinquency. Loans are considered delinquent as soon as you , although your servicer wont report these late payments to credit bureaus until 90 days have passed.

» MORE:

» MORE:

Repayment

Rehabilitation

Consolidation

» MORE:

Online Transfers And Payments

You can make a payment by transferring funds from a Wells Fargo deposit account or a non-Wells Fargo account through Wells Fargo Online®.

Sign On to Wells Fargo Online®, select your student loan account then Make a Payment.

It could take 1 2 business days for this payment to reflect on your account. Payments received by Midnight Pacific Time online will be effective as of the date of receipt. If received after Midnight Pacific Time they will be effective the following day.

Also Check: How Much House Can I Afford Physician Loan

Paying Back Student Loan Debt

With federal student loans, there are multiple payment plans available:

;; Standard repayment plan: This is a ten-year repayment plan and students who choose this will typically pay less back, over time, than in other plans. This isnt a good choice if the student is interested in obtaining Public Service Loan Forgiveness .;; Graduated repayment plan: With this plan, payments increase every two years. This can help students who expect their income to increase, but they would pay more interest over time than if on the standard repayment plan.;; Extended repayment plan: Payments can be made during a period of up to 25 years. This can help with monthly payment amounts, but students will pay back more over the life of the loan than those who use the standard or graduated repayment plans.;;Income-based repayment plan : There are four different plans where student loan payments factor in the borrowers income; this can be a good choice for those who plan to use PSLF, but borrowers will typically pay back more than under the standard plan.

PSLF is a forgiveness program that borrowers employed by a governmental or non-profit organization might qualify for. If a student has been denied for PSLF in the past, there is currently a Temporary Expanded Public Service Loan Forgiveness program to explore.

Recommended: How Much Do I Owe in Student Loans?

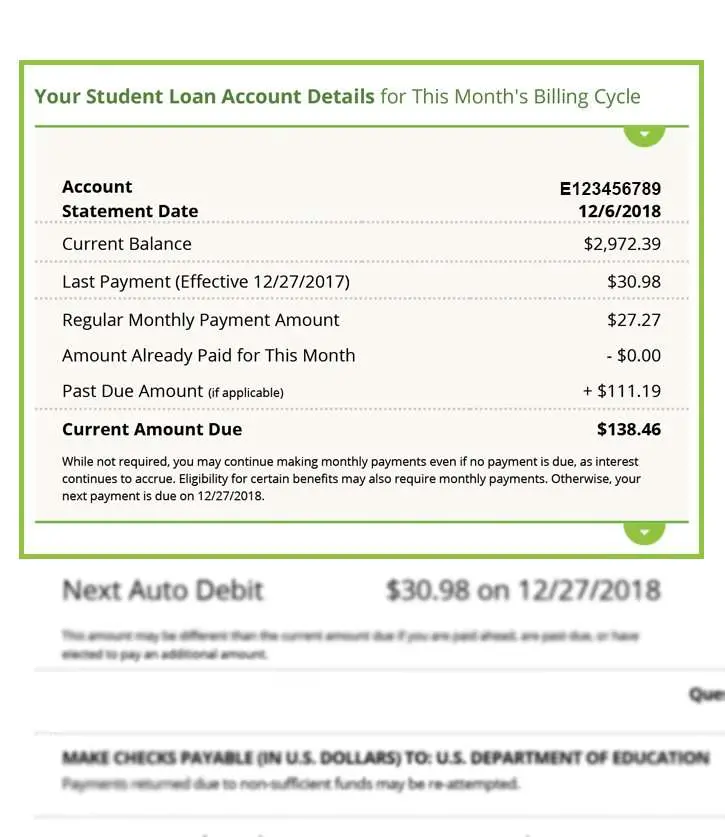

Student Loan Billing Statement

Every month that you owe a payment, youll receive an official billing statement to repay your student loan.

Your account number will be plainly listed as account number, on your billing statement.

Think of a credit card billing statement. Your account number is plainly identifiable on it.

Your student loan account number should be plainly noticeable near the top of your billing statement.

Corporate lending and facilitation services like Fannie Mae and various other federal student loan services feature plainly distinguishable account numbers on their billing statements.

Recommended Reading: How Long Until You Can Refinance An Fha Loan

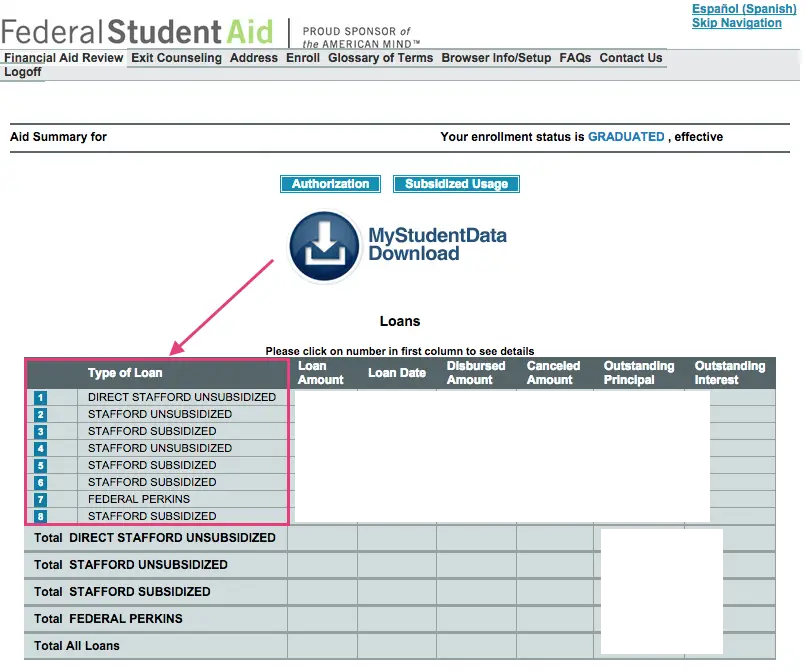

Find Student Loan On Fsa

If you dont have access to your information through the student loan provider, you can find your student loan account number from StudentAid.gov.

Just log in to your account using FSA ID which is the user ID you created when you made your FAFSA. Dont have access to your FSA ID? Use your e-mail or phone number instead.

Once youre logged in, you can locate the student loan account number in your documents. These documents are also printable. So if a proof is asked, you can take a document that shows your student loan account number.

How Do I Find My Student Loans

The process for finding your loan servicer will be different depending on whether you have federal or private student loans.

If you have federal student loans, you can find your loan servicer by signing into your Federal Student Aid account. Youll log in with your FSA ID. Once youve accessed your dashboard, youll see your student loan servicer and other details about your loans.

Alternatively, you can find your federal student loan servicer by calling 1-800-4-FED-AID .

Along with identifying your loan servicer, you will also find other information on your student loans, including the type of student loans you have, the loan amounts, interest accrued and outstanding balances.

Read Also: What Is The Best Debt Consolidation Loan Company