Will I Pay More In Closing Costs With Bad Credit

Your closing costs will depend on the type of loan you get, the price of the property youre purchasing and other factors. For example, VA loan borrowers will need to pay a funding fee, while FHA loan borrowers will pay an upfront mortgage insurance premium. Borrowers may be able to roll such fees into their loan amount.

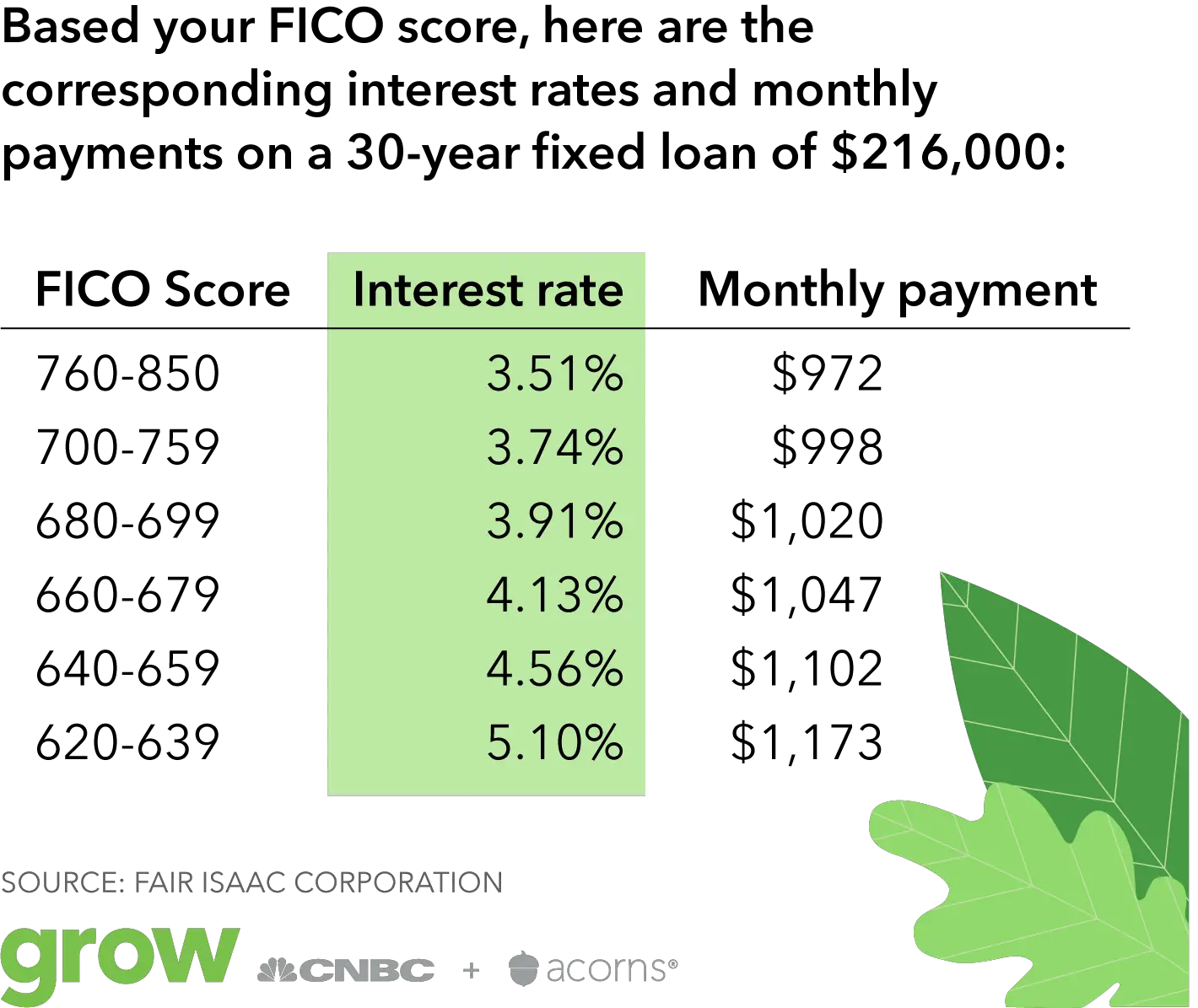

Your Credit Score Impacts Your Loan Terms

Its important to understand how your credit score impacts the terms of your home loan.

Your FICO credit score ranges from 300 to 850 and your score can vary slightly at different credit bureaus.

But what is a good score?

A good score can be subjective but when it comes to the credit score needed for a home loan, there are some general guidelines to consider.

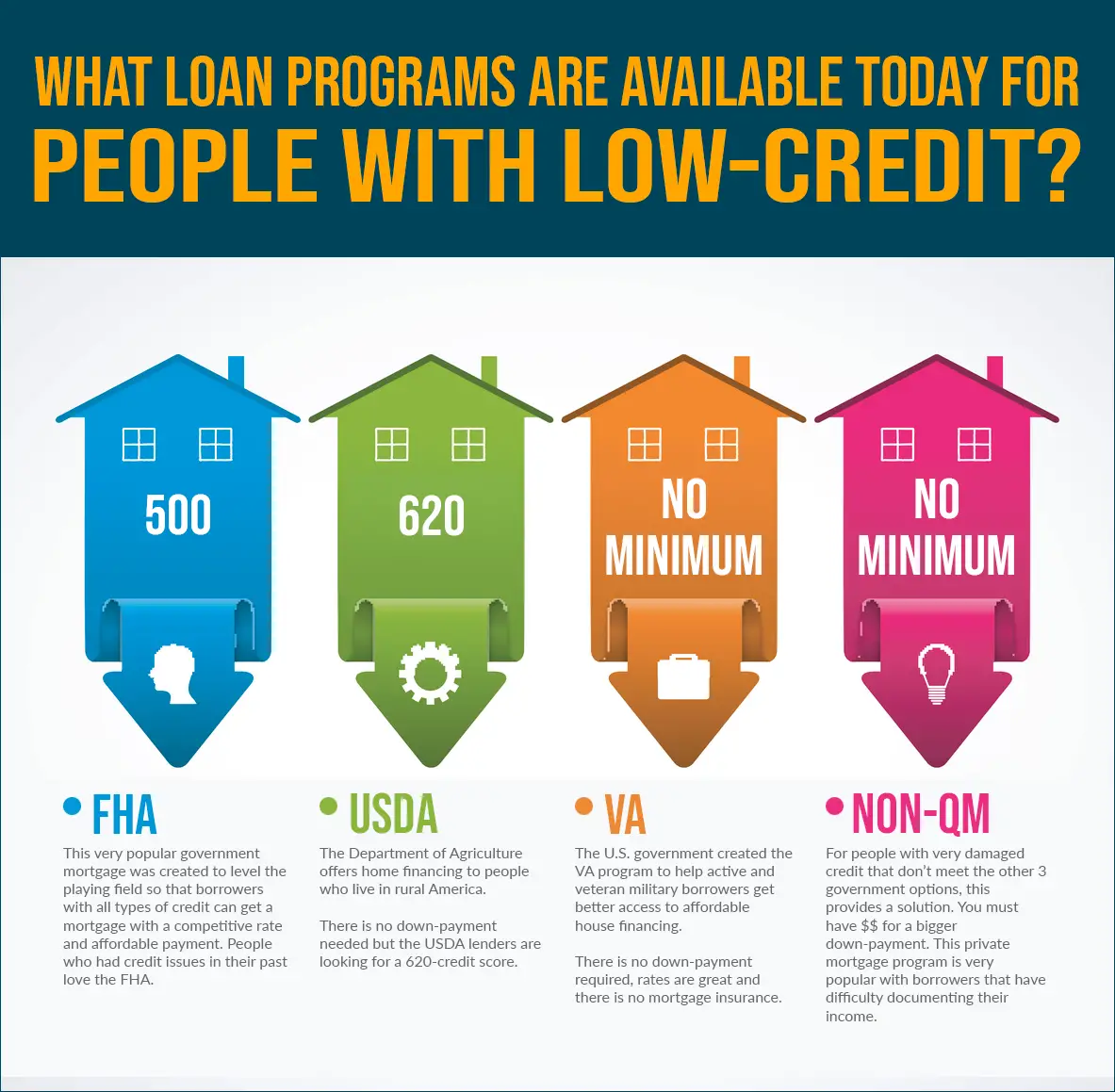

If you are seeking a Federal Housing Administration loan, your credit score should be at least 580. If you want a Freddie Mac or Fanny Mae loan, you typically need a minimum credit score of 640 or more.

But to get the best loan terms, you should have a credit score that is much higher.

Take The Next Step And Get Pre

The only way to know for sure what kind of home loan you can get with your credit score is by getting a mortgage pre-approval. Once lenders take a detailed look at your finances and how much you want to borrow, youll have a much better idea of your strength as a potential homebuyer.

Credible makes getting an instant streamlined pre-approval letter easy. We let you adjust your down payment so that you can figure out how much home you can afford.

Ready to get pre-approved?

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Read Also: How Many Type Of Mortgage Loan

Minimum Credit Score Required For Mortgage Approval In 2021

Categories

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.;

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.;

How Do You Get A Low Credit Score

It is harder to get a high credit score than a low credit score. But, sometimes, all it takes is one wrong move on your part to lose a lot of points in your FICO rating.

Bad credit goes so much more beyond missing your bills. Some people have lower credit scores despite never having once filed for bankruptcy or experiencing a foreclosure.

Here are some reasons why you might have a bad credit score:

- Applying for several loans all at once. Every time you apply, this entails a hard pull on your credit, taking points off your score.

- Frequently maxing out your credit cards even if you can pay on time. Part of your FICO Score considers how much debt you owe across all your credit lines.

- Having recently closed an old credit account. The more loyal you are to a lender or a card issuer, the stronger your credit score. It implies that there is a long history of trust in a financial relationship.

- You have yet to gain more experience in borrowing and paying back the money. Maybe you only have credit cards, and youve never applied for any other type of loan.

It is also worth noting that the more recent your last late payment is, the more impact it has on your credit score. A late payment is defined as a delayed payment of at least thirty calendar days. So even if youve made several late payments before, if these happened way back in the past, they wont have as much effect on your credit, as long as youve made more on-time payments since then.

Recommended Reading: How To Pay Home Loan Faster

Can You Get A Home Loan If You Have A Poor Credit Score Learn Here

The mortgage industry plays a big part in keeping the national economy healthy. In addition, because mortgages make homeownership more accessible for the average person, more people can achieve their American Dream.

Whenever someone purchases a house, this has a domino effect on a lot of other industries. Homeowners will need to furnish their brand new home, which will entail many other purchases. They might want to do some renovation, which will need the help of carpenters and skilled workers. This increase in the local population also means more buying power to boost the local economy. In all, the real estate market must remain strong, which is kept by ensuring that more people can avail mortgages.

It is never a good day to find out that you have a poor FICO Score. But what exactly is a poor score, and does this mean you cant purchase a home through a mortgage?

In this article, we will discuss how you can buy a house through a home loan. You will also find out if you truly have a poor FICO Score and whether it is the best time to apply for a mortgage.

How To Find Low Rates

Finding low rates is a matter of sifting through the competition. Today, you can do this automatically with the help of lender portals like LendingTree that aggregate thousands of offers to give you low rates at a glance.

Additionally, if you want to get low mortgage rates, you should start by improving your credit score. You can do this by removing any erroneous marks on your report, paying off loans, resolving any credit issues that are related to your accounts, and consistently making on-time payments to your credit cards and other forms of debt.

Also Check: Should I Get An Unsubsidized Student Loan

Can You Get A Mortgage With Bad Credit

A bad credit score for a mortgage is below 620. While its possible to get a mortgage with a low credit score, youll pay higher interest rates and have higher monthly payments.

If your credit score is lower than the minimum required, you might still be able to get the loan if you add a co-signer to the mortgage, use a larger down payment or lower your debt-to-income ratio.

Get Your Credit Score Where It Needs To Be

Check your credit report to make sure all the information it contains is accurate. If not, contact the credit bureau to correct it. If the information is accurate, find out your credit score.

You can get your score from the credit bureaus , for free from some websites, or from your bank. Your score will be between 300 and 850, and the higher, the better. Your credit score needs to be at least 620 for a conventional loan and could be as low as 500 for an FHA loan.

If you need to raise your score, you can most likely ignore those companies that say they can clean up your credit. Here are some examples of what it actually takes:

Try to use 30 percent or less of your available credit.

Make sure to pay your bills on time.

Keep older accounts open, even if you dont use them.

Dont take out any new credit accounts.

If you find any errors on your credit report, dispute them with the creditors and the credit bureaus.

Also Check: How To Transfer Car Loan To Another Person

How Can You Get A Mortgage Without A Credit Score

Look at it this way: Lenders treat credit scores like stories. The higher your credit score, the better your story with paying off debt. The lower your score, the more likely your story ends in mounds of unpaid bills. But if you dont have a credit score, you can still tell your financial story. Youll just have to go about it in a different way.

While getting a mortgage without a credit score is more difficult, its not impossible. You just need to find a lender who does manual underwriting, like Churchill Mortgage.

While getting a mortgage without a credit score is more difficult, its not impossible. You just need to find a lender who does manual underwriting.

How Much Should I Spend On A House

An affordability calculator is a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Also Check: How To Check Credit Score For Home Loan

What Should My Credit Score Be To Buy A House

You might be surprised at the minimum . On paper, mortgages backed by the Federal Housing Administration otherwise known as FHA loans allow a minimum credit score of 500, so long as you’re making a 10% down payment. That’s about as low as it gets.

However, with all types of mortgages, lenders can set their own minimum credit scores. So if your credit score could use some work, or if you’re close to the dividing line between two , you should get quotes from multiple lenders. While your score might not qualify for the loan type you want with one, it could be high enough for another.

Bear in mind that your credit score isn’t all lenders look at when they’re considering you for a home loan. Your debt-to-income ratio, employment history and the size of your down payment all play a role in determining how much you’ll be approved to borrow.

Good Credit Score Home Loans

Once your credit score climbs into the 700 to 749 range, youre in the good credit score range for a home loan. Qualifying will usually be easier and loans will most likely be less expensive. All types of mortgages are available once you have good credit:

- Conventional loan: A conventional mortgage becomes easier to get with good credit, even if youre carrying a lot of debt relative to your income. Instead of needing a debt-to-income ratio of 36% or less, you might get approved with a ratio as high as 45%. That means your existing monthly obligations and proposed mortgage payment must total no more than 45% of your gross income. If youre putting down less than 20% on a conventional mortgage, a good credit score will reduce your PMI premiums.

- Jumbo loan: If your income is high enough, jumbo loans become accessible with a credit score of 700 or higher.

- FHA loan: These loans become less advantageous as your credit score increases because youre more likely to qualify for a less expensive conventional loan.

- VA loan: Veterans Administration loans are still a great option for those who qualify. The average VA borrower in June 2020 had a credit score of 733 if they were refinancing and 720 if they were buying, according to Ellie Mae.

Learn More: Mortgage Qualifications: How to Qualify for a Mortgage

Recommended Reading: What Credit Score Do You Need For An Fha Loan

Why Is It Hard To Get Approved For A Mortgage On A Low Credit Score

Most people only have to buy a house once in their lives, so it is likelier that you will only have one mortgage.

According to Statista, the average price of a home in the U.S. in 2021 is 408,800 dollars. Its a significant increase compared to 2019s 383,900 dollars.

Today, there can be very tight competition in the real estate market due to the low supply of houses in the wake of the COVID-19 pandemic. More often than not, you will have to prepare more money to pay over the asking price to win over a house seller. So it is truer this year than in the previous years that you will need to have a higher credit score to buy a house. The better your credit, the higher the loan amount awarded to you and the cheaper the mortgage costs.

Whatever your credit score, you can still get a home loan. However, your options can get a lot limited. If you keep getting rejected for a home loan, this can imply that you are not applying for the right kind of mortgage.

Each mortgage has its own minimum credit score requirements. Aside from the starting credit score that the government advises for federally-backed loans, lenders also include further requirements of their own.

As weve mentioned in the previous section, every time you apply for a loan, this deducts points from your credit score. So with this in mind, its better to know what you should use for before you go ahead, as it will give you a better chance of getting approved.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Recommended Reading: How Much Is House Loan Interest

The Minimum Credit Score Needed To Qualify For A Home Loan

Now you know what your credit score takes into account, you need to know how high it should be for a home loan. The short answer is, it depends on what kind of loan you want.

In general, the higher your credit score is, the better. With most conventional loans, a credit score of 620 or higher, youll be able to get the best home loan interest rates.

If you have a lower credit score though, that doesnt mean that you cant get a loan. There are some loans out there that require you to have a credit score of just 500, so you have options.

There are other home loans out there that will require you to have a higher credit score. For example, if youre taking out a jumbo loan, youre taking out a loan thats outside of the maximum agreed limits.

Because of this, the loan is considered to be high risk. Thats why lenders want to issue these loans to people with credit scores of 700 or higher.

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Read Also: How To Get An Rv Loan With Bad Credit

When Can Lower Credit Score Borrowers Apply For Fha

The new policy has been rolled out for a few years , so your chosen lender may have changed its internal policy already. But some are slower to adopt new regulations.

Typically, theres a step-down effect across the lending landscape. One lender will slightly loosen guidelines, followed by others until a majority function similarly. If the new standards work, lenders loosen a bit more.

Lower credit home shoppers should get multiple quotes and call around to multiple lenders. One lender might be an early adopter of new policies, while another waits to see results from everyone else.

Despite when lenders adopt FHAs new policy, there is strong reason to believe that they will. Thousands of renters who have been locked out of homeownership due to an imperfect credit history could finally qualify.

Want to know if you qualify now? Contact an FHA lender now who will guide you through the qualification process.