How Much Money Should You Expect To Place In Escrow When You Refinance

You can expect to place an additional 1-2 months of taxes and insurance into a new escrow account in addition to your current escrow balance. For example: you owe $100,000, your current escrow balance is $1,500, and your current monthly escrow payment is $200. At settlement, your payoff will be $98,500. Your new lender may require you to place $1,800 into the new escrow account, $300 of which is new money, and $1,500 representing the balance in your existing escrow account.

If you are not refinancing with your current lender, you will have to fund the new escrow account at the time of settlement and then wait to receive a check back from your existing lender.

Fha Loan Escrow Guidelines

With traditional mortgages, your experience with escrow usually ends at this point. If you are buying a house with a Federal Housing Administration loan, however, your dealings with escrow accounts continue in a different way, for different reasons.

FHA loans require an escrow account be maintained for property taxes, homeowner’s insurance, and mortgage insurance premiums . The latter is required for borrowers making less than a 20% down payment. Rather than paying taxes directly to the government and insurance premiums to the insurer, an FHA borrower pays one-twelfth of these expenses each month, in addition to his mortgage principal and interest payment, into the account. The escrow account holds this money until the bills become due at the end of the year.

Mortgage insurance premiums may be canceled for FHA borrowers when the loan balance reaches 78% of the home’s appraised value at the time of purchase.

At this point, monthly escrow payments for the following year are adjusted up or down based on whether there was a shortage or surplus in the account for the current year’s payment. Mortgage-holders are obligated to send you an annual statement regarding the activity of your escrow account, which may also be referred to as a mortgage impound account.

What Happens At Citrus Heritage Escrow

During the escrow period, our title department begins researching and examining all historical records pertaining to the subject property. Barring any unusual circumstances, a commitment for title insurance is issued, indicating a clear title or listing any items which must be cleared prior to closing. The commitment is sent to you for review.

Your escrow officer follows instructions on your contract, coordinates deadlines, and gathers all necessary paperwork. For example, written requests for payoff information are sent to the Sellers mortgage company and any other lien holders.

When choosing an escrow company there can be many important factors to evaluate. Fees, location, staff and even recommendations from friends and colleagues are all things to consider. With Citrus Heritage Escrow by your side, you can rest assured that when you receive your settlement check, youve gained the maximum benefit from your home sale or purchase.

Also Check: How To File Bankruptcy On Car Loan

How Much Does Escrow On A House Cost

The cost of escrow services on a home purchase typically ranges from 1% to 2% of the final selling price. The fee is included in a buyers closing costs and can be negotiated between buyer and seller. Note that the cost of escrow is separate from the buyers 1% to 3% earnest money check.

Also, the amount you need to put down for the earnest money check varies. This cost may be higher or lower depending on your escrow agent and your location. Plus, if there are other buyers competing for the property, that can raise the cost of the earnest money check.

The amount you pay into your escrow account for the duration of your loan depends on the cost of your property taxes and homeowners insurance. In most cases, youll initially pay a few months in advance of each. Then, youll pay 1/12th of the annual cost each month.

Establishing An Escrow Account

When you close on your loan, Caliber will collect funds to open an escrow account. Each month, a portion of your mortgage payment will go into your escrow account, and we will use the escrow account to pay your taxes and home insurance bills. This spreads the expenses over 12 months, making it easier on your budget. And since were making the payments, you wont have to worry about remembering when theyre due.

Recommended Reading: Are Jumbo Loan Rates Higher Than Conventional

How Can I Set Up An Escrow Account

Let’s say you want to figure out how to set up an escrow account yourself. Before doing anything else, determine the annual cost for homeowner’s insurance and property taxes. Then divide that number by 12 for the minimum amount you’ll be responsible for every month.

Keep in mind that most mortgage servicers today set up a mortgage escrow account on behalf of their clients. However, if that’s not the case with your situation, take some time to research account options through various financial institutions. Once you make a decision and the first few payments, follow up with your escrow company to ensure they’re staying current with these funds.

What Happens To Your Current Escrow Account When You Refinance

Once mortgage payoff funds are posted, money held in escrow with your;current lender will be returned to you from that lender. The existing escrow account cannot be transferred unless your current lender is the same as your new lender, in which case your payoff will be reduced by your current escrow balance.

Don’t Miss: What Is Portfolio Loan In Real Estate

The Benefits Of An Escrow Account

The biggest benefit of an escrow account is that youll be protected during a real estate transaction whether youre the buyer or the seller. It can also protect you as a homeowner, ensuring you have the money to pay for property taxes and homeowners insurance when the bills arrive. Youll find that there are a few other great benefits for home buyers, owners and lenders, too.

Who Pays For Escrow Services

Costs for escrow services are detailed, along with other fees, in the Loan Estimate and Closing Disclosure. Escrow fees are sometimes called settlement agent fees. Escrow charges can also be rolled into the title insurance provider’s fee.

In some housing markets, buyer and seller split escrow fees. In other places, escrow fees might be paid solely by either the buyer or the seller. Regardless of local custom, you may negotiate who pays which fees.

» MORE:Get an overview of mortgage closing costs

Don’t Miss: How To Return Ppp Loan

What Is Escrow For A Mortgage

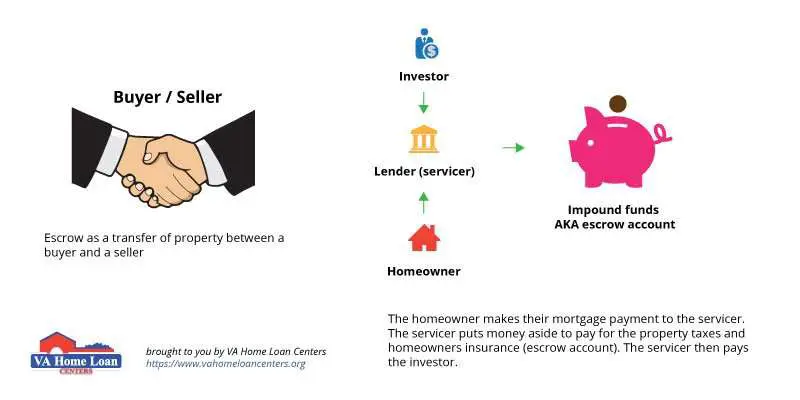

In the mortgage process, an escrow company holds onto thecash involved like your earnest money deposit until the transaction has beenfinalized.

Escrow makes real estate transactionssafer and smoother.

- When buyers put up a good faith or earnestmoney deposit, the escrow company holds the money untilthe sale closes

- The escrow company combines down payment funds and loan moneyto pay the home seller

- If the seller still has amortgage on the property, the escrow company pays it off with proceeds from the home sale

- Escrowofficers also disburse other expenses like real estate commissions, lender fees,propertytaxes, and homeowners insurance

Escrow agreements make real estate transactionssafer. For example, its a lot easier to get your good faith money backfrom an escrow company than from a seller whos already spent it.

What Is An Escrow Account And How Does It Work

Escrow is;an;important part of buying and owning a;house. It protects;and benefits homebuyers,;home sellers, and;homeowners. Sometimes an escrow account is required, and sometimes its optional, depending on the type of loan you get and your financial profile. Discover more about escrow accounts and how they work.;

Recommended Reading: What Type Of Loan Is Needed To Buy Land

Escrow Accounts For Taxes And Insurance

After you purchase a home, your lender may establish an escrow account to pay for your taxes and insurance. After closing, your lender takes a portion of your monthly mortgage payment and holds it in the escrow account until your tax and insurance payments are due.

The amount required for escrow is a moving target. Your tax bill and insurance premiums can change from year to year. Your servicer will determine your escrow payments for the next year based on what bills they paid the previous year. To ensure theres enough cash in escrow, most lenders require around 2 months worth of extra payments to be held in your account.

Your lender or servicer will analyze your escrow account annually to make sure theyre not collecting too much or too little. If their analysis of your escrow account determines that theyve collected too much money for taxes and insurance, theyll give you a refund. If their analysis shows theyve collected too little, youll need to cover the difference. You may be given options to make a one-time payment or increase the amount of your monthly mortgage payment to make up for a shortage in your escrow account.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Homeownership Costs: Pmi Taxes Insurance And Hoas

In addition to paying the monthly principal and interest on your mortgage, youâll have other required expenses to factor in.

As your lender shared with you during the financing process, there are homeownership costs beyond your mortgage payment that require your attention. Most of these costs are due monthly and typically include Private Mortgage Insurance , taxes, homeowners insurance and Homeowners Association fees.

The good news is that most lenders require you to set up an escrow account under the terms of your mortgage that fold in most of these costs for you. This means that your monthly mortgage payment will also include an escrow payment to cover your property taxes and insurance premiums. Your lender will deposit this amount into your escrow account and will pay for these items on your behalf when they are due.

Regularly scheduled monthly escrow payments are a good option for many homeowners because they eliminate the surprise of large annual or semi-annual payments when property taxes or insurance premiums are due.

Don’t Miss: Is Jumbo Loan Rates Higher

What Does Escrow Mean

Escrow refers to a third-party service that’s usually mandatory in a home purchase. When a buyer and seller initially arrive at a purchase agreement, they select a neutral third party to act as the escrow agent. The escrow agent collects what is known as “earnest money” from the buyer: a deposit that is equal to a small percentage of the sale price. In exchange, the seller takes the property off the market. Until the final exchange is completed, both the buyer’s deposit and the seller’s property are said to be in escrow.

Escrow “accounts” have more to do with your monthly mortgage payment than the initial home purchase. When you borrow money from a bank or a direct mortgage lender, you’ll usually be given an escrow account. This account is where the lender will deposit the part of your monthly mortgage payment that covers taxes and insurance premiums. By collecting a fraction of those annual costs each month, the escrow account reduces the risk that you’ll fall behind on your obligations to the government or your insurance provider.

Mortgage Escrow Account: What You Need To Know

Generally, mortgage escrow accounts are used to collect and pay property taxes and insurance payments on a home. Lenders want to make sure that your property is insured and that the taxes are paid on time, reducing the risk to the bank that you will default on the loan or incur liens on the property. The amount needed to cover these payments is added onto your mortgage payment each month.

While there is no law requiring lenders impose an escrow account on borrowers, certain loan programs or lenders require escrow accounts as a condition of the loan. The Real Estate Settlement Procedure Act protects you by strictly controlling how a lender handles an escrow account for a mortgage.

Don’t Miss: How Long Does It Take To Get Student Loan Money

How Do You Set Up An Escrow Account

Most of the time, an escrow account will be set up for you by your real estate agent.

In rare circumstances, such as when engaging in a private home sale, you may need to know how to set up an escrow account yourself. Banks and title insurance companies can both typically serve as escrow holders, as can some credit unions.

What’s An Escrow Account

An escrow account allows us to pay the required insurance and/or taxes on your property for you. You pay a portion of your taxes and/or insurance premiums as part of your monthly mortgage payment. Then, when taxes and/or premiums are due, well pay them on your behalf with the money in your escrow account.

Don’t Miss: Is My Loan Fannie Mae

The Bottom Line On Escrow Accounts

When buying a house, opening an escrow account is an important part of the process. Depending on your type of loan, it may be required. An escrow account can offer peace of mind as it offers protection and a convenient solution for paying your taxes and insurance.

If youre looking to buy a home, speak with a mortgage expert today.

What Is An Earnest Money Check

If you want to buy a house, youll have to make an offer or sign a purchase agreement. At this time, youll typically give your escrow agent a deposit, usually for 1% to 3% of the final sale price. This payment is called an earnest money check. In return for your earnest money check, the seller will take the home off the market.

Why do you have to provide an earnest money check? Putting cash on the table demonstrates your seriousness to the propertys seller, and reduces the risk that youll back out on the deal.

Once youve made your deposit, the escrow agent places the check into a short-term escrow account. Neither buyer nor seller can access this account until the deal closes.

Once the sale of the house closes, the deposit in escrow goes toward the buyers closing costs and down payment. If the sale falls through, the seller will usually keep the deposit.

You May Like: Does Applying For Personal Loan Hurt Credit

Why Do I Have To Put Extra Money In The Escrow

There are several reasons for the overage in the initial escrow account. Lenders can put a small cushion in the account in case next year the taxes and insurance go up. This is typically one month of taxes and one to two months of insurance. There will also be an extra month of insurance and taxes because in the first year you will typically only make 11 payments. They need the extra month to get the full 12 months.

Escrow is one of the more confusing parts of the mortgage process. My team is here to help walk you through the process.

Petrovich Team Home Loan is your Omaha Lender. We here to help with all of your home financing needs in Omaha and the surrounding area.

What To Do Next

Mortgage And Property Tax

Your monthly mortgage payments include the principal, interest, property tax, mortgage insurance, and homeowners insurance. Usually, the lender determines how much property tax you pay each month by dividing the yearly estimated amount by 12. This is added to your monthly mortgage payment.

Since the yearly property tax used in the calculation is an estimate, there is a chance you may have to add more money at the end of the year if the property tax was underestimated. If it was overestimated, you would get a refund.

Property tax is paid to the local government and its usually collected yearly or twice a year. When you pay your property tax, the lender pays your monthly property tax payment into an escrow account. Then, the lender uses the money in that account to pay the taxes at the end of the year .

Lenders generally prefer that you pay your tax this way so they can protect themselves. The property can get foreclosed if the lender leaves the property tax payment to the homeowner and the homeowner does not make the payment. When this happens, the lender has to pay the property tax lien before reselling the property.

Don’t Miss: Is Homeowners Insurance Included In Fha Loan

Escrow Companies And Escrow Agents

When youre buying a home, escrow may be managed by a specialized company or agent. The escrow agent or company is sometimes the same as the title company.

The escrow company not only manages the buyers deposit; they may also be responsible for holding on to the deed and other documents related to the sale of the home.

Because the escrow company is working for both the buyer and the seller in the real estate transaction, the fee for their services is usually split evenly between the two parties.

Types Of Escrow Accounts

In real estate, escrow is typically used for two reasons:

Because of the different purposes it serves, there are two types of escrow accounts. One is used during the home buying process, while the other is used throughout the life of your loan.

Read Also: Can You Use Fha Loan If You Already Own House

What Is Escrow On A Mortgage

Escrow is an account thats paid from each month as a part of your monthly mortgage. This is done to ensure there is always enough money available to pay for property taxes and homeowners insurance. Your realtor will create an escrow account during the home purchasing process. This account is only temporary. There is another escrow account that will be created on your behalf by the lender. This escrow account will be used for the entire life of the loan.;

During the process of calculating your monthly mortgage payment, the lender will account for things such as property taxes and homeowners insurance. You wont pay those from your checking account. They have been built into your monthly payment in the form of an escrow account. When property taxes and homeowners insurance payments are due, they will be paid by your lender from your escrow account. This is a safe way to ensure you dont miss those very important payments which would cause a lien to be placed against your home.;

Now that you understand what is escrow on a mortgage, it is important to know how this differentiates from the escrow process.;