You Do Not Have To Sell First

If you dont want to sell your house to buy another house, a HELOC might be a good option.

There are many reasons why homeowners would want to hang on to their home, says Deshpande. In this instance, a HELOC could be a good alternative to selling.

A lot of times the scenario is that somebody is planning to retire six years from now, but they still need to live in their existing property for six years, so they keep their house while buying a house in a foreign country, says Deshpande.

The other thing is that people want to have one foot in the U.S. and one foot abroad. A lot of the rationale has to do with staying close to their family. They have children and grandchildren in the U.S. so they dont want to completely move.

Interest Rates Will Likely Be Lower

Lenders spend less time originating home equity loans, which may save you money, as it typically means lower fees and closing costs. But perhaps the biggest advantage of this option is the potential to lower your interest rates.

Home equity loans offer lower interest rates because they are secured by collateral in the form of real estate. This means by utilizing a home equity loan, you can avoid the hefty interest rates you would encounter through other forms of financing, like hard money and personal loans.

What Are Some Alternative To Rental Property Helocs

There are other products besides home equity loans that you can use to tap into your equity or otherwise borrow funds:

Cash-out refinancing: allows you to rewrite an existing mortgage for a higher amount and receive the excess funds at closing. The qualifying criteria are stricter and highly regulated for first mortgages, but the rates and terms are more favorable .

Cross-collateralization: is a unique lending tool that allows you to group two or more properties under the same overarching loan. This can make access to the equity in your investment property more straightforward, as its effectively pooled with the equity in other properties. The drawback is that it can be difficult and costly to separate interest in the properties later on.

Unsecured personal loans: or signature loans are another alternative if you are looking for options that dont require you to leverage your equity. Since these loans arent tied to collateral , the interest rates will depend solely on your credit score and debt to income ratio, and are typically higher than rates for mortgage loans and HELOCs.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Recommended Reading: Is It Too Late To Apply For Ppp Loan

How To Use A Home Equity Loan For An Investment Property

Buying a home is one of the best investments out there, especially if you know how to leverage it properly. Owning a house is a gold mine of opportunity. As youre gradually paying off your mortgage, your house value accrues and can be used as a wealth-building asset.

Home equity refers to how much of your property you own: how much youve paid for versus how much mortgage is left to pay off. When you borrow against your home equity, your property becomes collateral, and youre able to leverage the gained equity to your benefit.

Read on for the complete guide on how to use a home equity loan for an investment property in Ontario.

You Are Leaving Yourself Vulnerable To Shifts In The Housing Market

All homeowners are technically vulnerable to these shifts, but by owning two properties, you are essentially doubling your potential risk to changes in the housing market. If either homes value lessens, you may end up owing more on your mortgage and home equity loans, which can spread some homeowners too thin.

And if you default on the loan, you could potentially lose both your primary and secondary properties, as both are held as collateral. You should also note that reduced market values could affect your ability to resell the investment property.

Read Also: What’s Better Refinance Or Home Equity Loan

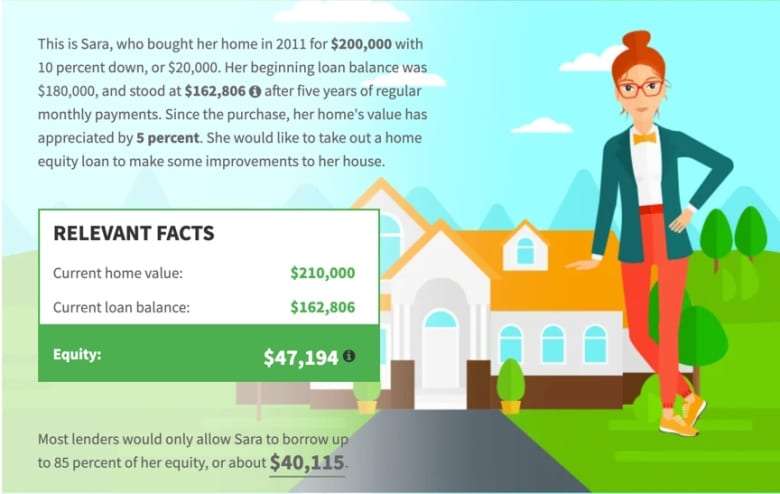

Home Equity Loan Rates And Other Calculations

Home equity loans are distributed in a lump sum, and the interest rate is fixed. According to Bankrate.com, todays average home equity loan rate is 7.94 percent.

But what is home equity, exactly? And how much can you borrow, anyway?

Lets talk about;the concepts of market value and loan to value . For simplicitys sake, Im leaving closing costs out of these equations.

in simple terms is what the home is worth. Its best to hire an appraiser to determine the true market value, but alternatively, you can save around;$600 and get good feel for what it likely is based on a comparative market analysis .

Say you own a home with a market value of $100,000. If you own it outright, you have $100,000 of equity in it. But if you have a mortgage of $45,000, you have $55,000 of equity in it.

Some lenders will lend you up to 90 percent of your equity in your primary residence. This equates to a 90 percent LTV.

So, in a $100,000 house with a $45,000 mortgage, that means you can borrow:

$100,000 X 0.9 $45,000 = $45,000

This is not the case for a rental property. Most lenders offer 75 to 80 percent LTV on rental properties.

In a $100,000 rental house, that means you can borrow:

$100,000 X 0.75 $45,000 = $30,000

Of course, these loan opportunities come with some pretty stringent conditions. For instance, it can be difficult to secure a home equity loan if you have bad credit, dont meet certain debt-to-income ratio requirements, and so on.

Investment Properties In Canada

Buying an investment property is a popular option for Canadians looking at different ways to invest their money. However, unlike the mortgage you took out on your principal residence, financing an investment property is a little more complex. The number of units in the building and whether or not you’ll be occupying one of the units are the two major components that control what your financing will look like. Lets take a look at how investment property mortgages work in Canada.

Recommended Reading: Is Jumbo Loan Rates Higher

Using Equity : How Does Equity Work

Accessing the equity in your loan is easy. With a simple;mortgage refinance, you can be steps closer to buying a second home. Using equity in an investment property to buy a home works pretty much the same too. The equity from your home or investment property can be used as a deposit on a second property, while your current property becomes a security on the new debt. Using equity allows you to;buy a second property;with no cash deposit.

When the value of your home rises, the equity does too. A home’s value may rise because of capital growth or dedicated mortgage payments. You could also increase the value in your home by making renovations .

Your lender will calculate your loan to value ratio to ensure some equity is held as security. After this, you can;determine how much equity;you have after refinancing.

Consider the earlier example, where the equity is $350,000.

If your lender offers an 80 per cent LVR – note than anything higher than this will likely require Lenders Mortgage Insurance – you have $230,000 usable equity. This amount can be used for a home mortgage for another property. Keep in mind that you’ll need more than the deposit – stamp duty and legal fees will have to be factored in.

Not sure how much equity you have in your home? Use our home equity calculator to find out.

How Much Can You Borrow

Using the example above, letâs say your home is valued at $400,000 and your mortgage is $220,000. Hereâs the breakdown of sums:

- value of your property – $400,000

- value of your property at 80% – $320,000

- minus your mortgage – $220,000.

Learn how to estimate your propertyâs equity using the NAB app.

Read Also: What Is The Lowest Car Loan Rate

How Can I Apply For A Mortgage

When applying for a mortgage for a primary residence, second home or investment property, here are some common steps:

Choose a mortgage lender and apply: When you first start looking for mortgages, you may see offers from lots of lenders. Compare rates and services before choosing the one that’s right for you.

How To Qualify For An Investment Property Heloc

In order to qualify for a HELOC, borrowers must meet three specific requirements:

- Equity

Know Your Credit Score

Not unlike just about every source of capital, lenders will pay special considerations to ones credit score. After all, banks will use credit score to determine whether or not a borrower is a risk. Therefore, the better the credit score, the more likely someone is to qualify for a HELOC. It should be noted, however, that there isnt a universal standard for an acceptable credit score; different lenders have different criteria. What one lender may consider a good score, another may consider poor, or even risky perhaps. Traditionally, borrowers will want to boast a credit score of at least 740 if they want to tip the scales in their favor, but again, everyone is different.

Know Your Debt-To-Income Ratio

Along with a good credit score, borrowers will want to prove that taking out another loan wont upset the balance they currently have between income and debt. In doing so, banks will calculate your debt-to-income ratio to see if you can afford to borrow more, in addition to what you already owe. Unlike credit scores, however, lenders have set a precise debt-to-income ratio minimum: somewhere between 40% and 50%.

Understand Equity

Don’t Miss: What Does Jumbo Loan Mean

Using Equity In Your Current Property To Buy A Second Home

When buying your second home, you could use the available equity in your current property as your deposit. Equity in your home can be built up by paying off the amount you owe on your loan, or if the value of your current property has increased since you bought it. This equity can be used instead of a cash deposit when buying your second home.

The more equity you have in your current home, the greater the amount you can borrow to put towards buying another home . You can estimate your borrowing power with our mortgage calculator.

Drawbacks Of Home Equity Loans And Helocs

Would using this strategy mean that youd be more leveraged? Absolutely! It goes without saying that the deals that you do need to be not just good dealsbut great.

That being said, here are a few drawbacks:

You May Like: How To Eliminate Student Loan Debt

Investing With An Equity Loan

Your home equity can be a financial safety net in case of job loss or a medical emergency. If you have an emergency fund then you may want to use your equity for investment. Real estate can be a sound investment for an equity loan, especially if it provides rental income that covers the loan payments. Before taking on additional debt, make sure you understand the risk involved. Missing payments on your home equity loan puts you at risk of losing both your primary home and your investment property. If youve analyzed the risk and decide to proceed, using a home equity loan to finance the down payment or the entire purchase price is no different than using any other source of money to buy real estate.

Investing In Home Improvements

Whether youre looking to improve your home to get it ready to sell or just want to give your living space an update, using your home equity to invest in home improvements is a popular decision. Plus, certain improvements can even increase your homes value above and beyond their sticker price, helping you build even more equity in your property.

There can be a downside to this, though. Its important that homeowners research the types of home improvement projects that offer the best returns in their area. Some may not be worth the expense, especially if youre only making the improvements to boost your homes resale value. This is especially true for very personalized remodeling projects.

Lastly, consider when to invest in home improvements based on how long you plan to stay in the house. If its your forever home, this doesnt matter so much. If youre planning to sell, though, you may want to enjoy your efforts before selling the property, especially if your improvements dont retain as high of a resale value.

Don’t Miss: When To Apply For Ppp Loan Forgiveness

Second Homes And Investment Properties

If you decide to take out another mortgage to pay for a second home, lenders will look carefully at your debt-to-income ratio to determine whether you can manage two mortgage payments. A low DTI also works to your advantage because it helps you qualify for a lower interest rate on the loan. For second homes, lenders prefer a DTI below 36%.

If your DTI is high, you have several options. You can pay off more debt before buying another home, buy a less expensive home or increase the amount of your down payment. Some lenders want a down payment of 10-20% on second homes, potentially more if its purely an investment property.

When shopping for a second home loan, it makes sense to first talk with the lender who holds the mortgage on your primary residence. This is because youre already doing business together and have an established financial relationship. However, you may find a better deal with another lender.

While many second-home buyers consider their purchase an investment, whether its considered an investment for tax and loan purposes is another story. Think about why you want to purchase the home. Is it exclusively for personal use, or do you expect to rent it out part of the year? Whether its considered a second home or investment property could make a big difference in your tax situation.

Effective January 1 2020 Until Further Notice

Information Requested at Application

Qualifying GuidelinesNew monthly mortgage payment plus all other mortgage & installment loan pymts. should not exceed approximately 43% of stable gross income of $40,000.00 or more. Ratio will be different on lower income. . Real Estate must be located in the state of Oklahoma & meet TFCUs guidelines.

| Closed End Equity Mortage Information |

| Loan Purposes |

You May Like: How To Calculate Amortization Schedule For Car Loan

Investing In Real Estate

Whether youre looking for an investment property, want to start flipping houses or are interested in buying a second/vacation home, you can use the equity in your home to buy another property.

Still, real estate investing, and especially flipping, comes with risks. Investors need to have an in-depth understanding of the market theyre going into, how to price the property to move or rent quickly and how to handle other concerns. If youre renovating an investment property, build strong relationships with the contractors doing the work and be prepared to support the carrying costs of the property until its sold or rented out.

Mortgages On Second Homes Are Harder To Secure

First, securing a second home mortgage is more difficult than a first mortgage. Mortgage lenders scrutinize your ability to make payments on two mortgages and know that in a crunch, youll default on the new home.

In addition, many low-cost investment properties do not adhere to codes and specifications that mortgage lenders may require. Using the funds from a home equity loan or HELOC allows a borrower to avoid those difficulties.

Also Check: How Much Can I Borrow Personal Loan Calculator

How Does Borrowing From Home Equity Work

Whether youre looking to free up cash for a home renovation or find ways to consolidate debt, borrowing against the value of your home could be a good option. While you pay off your home, you build equity that you can later use for home equity loans or home equity lines of credit .

Because you can use equity for loans or tap into it when selling your home, its a great financial tool. The bigger your down payment and the more you pay toward your mortgage, the greater chance you have at increasing your total equity.

If youre considering using your home equity, keep the following in mind:

Using Your Home Equity

Lets be real. While REITs are great, they dont offer the tangible benefits of owning an investment property. You cant collect rent or make improvements that have a direct impact on your investments value.

Thankfully, you can unlock these and all other benefits of owning an investment property by tapping into your existing homes equity and using those funds for a down payment. You can even buy an investment property outright if you have enough equity in your home!

Home equity loans are incredibly simple. At Alpine Credits, we take your homes value and subtract the amount remaining on your mortgage. The resulting number represents the equity you have built up in your home. Whether this amount is $10,000 or $500,000, we can lend you those funds for just about anything you want, including to purchase an investment property.

to learn more about how our home equity loans work for property investors.

Don’t Miss: How To Take Loan From 401k To Buy House