Q41 Do You Have Additional Eligible Dependants

For 2016/2017 applications.

For StudentAid BC purposes, eligible dependants are any dependants for whom you receive the Canada Child Tax Benefit or for whom you claim a benefit on your 2015 income tax return. Eligible dependants include:

- your child under 19 years of age as of the start of the applicants classes, for whom you have custody or provide care at least two days per week during the applicants entire study period or

- your child age 19 or over who are Dependent students or

- your permanently disabled child age 19 or over, who you fully support and declare on your income tax return or

- your foster children, if foster parent income is claimed on Appendix 1 on line 35 or

- your elderly relatives who you fully support and declare on your income tax return.

Compare Your Financial Aid Offers

The financial aid offices at the colleges you apply to will use the information from your FAFSA to determine how much aid to make available to you. They compute your need by subtracting your EFC from their cost of attendance . Cost of attendance includes tuition, mandatory fees, room and board, and some other expenses. It can be found on most colleges’ websites.

In order to bridge the gap between your EFC and their COA, colleges will put together an aid package that may include federal Pell Grants and paid work-study, as well as loans. Grants, unlike loans, do not need to be paid back, except in rare instances. They are intended for students with what the government considers “exceptional financial need.”

Award letters can differ from college to college, so it’s important to compare them side by side. In terms of loans, you’ll want to look at how much money each school offers and whether the loans are subsidized or unsubsidized.

Direct subsidized loans, like grants, are meant for students with exceptional financial need. The advantage of subsidized student loans is that the U.S. Department of Education will cover the interest while you’re still at least a half-time student and for the first six months after you graduate.

Direct unsubsidized loans are available to families regardless of need, and the interest will start accruing immediately.

In both cases, note that interest on student loans from federal agencies has been suspended until at least Sept. 30, 2021.

Determine How Much You Can Borrow

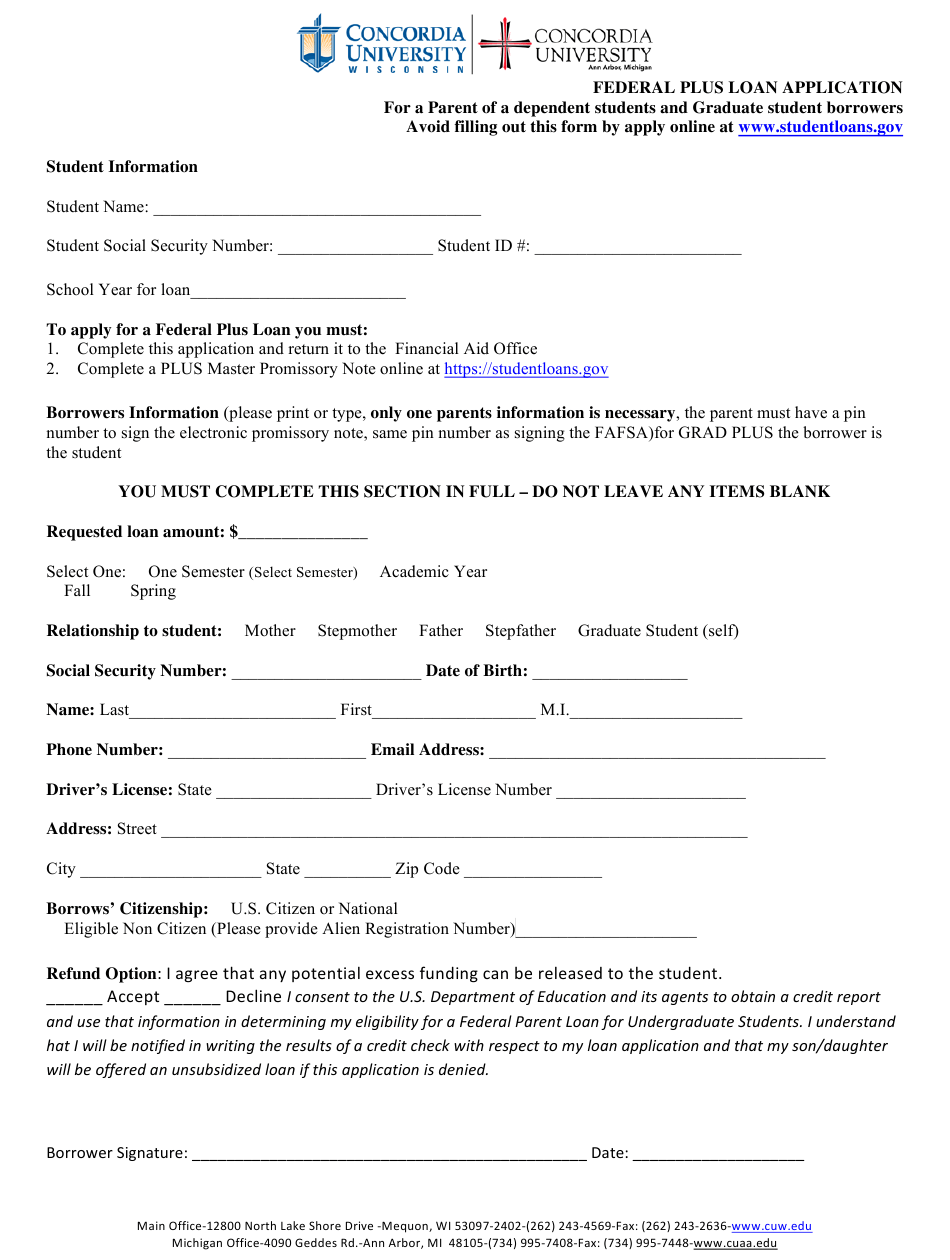

Parent PLUS loans allow you to borrow up to the cost of attendance at the college or university your child plans to attend, minus any other financial aid received. The cost of attendance includes tuition, room and board, and other educational expenses such as books. Your school will provide the cost of attendance to help you determine how much you’ll need to borrow.

Because you can borrow up to the total cost of attendance doesn’t mean you should, however. If you have savings, such as money in a 529 plan, or monetary gifts from your child’s grandparents, for example, subtract those amounts from your financial need. Also consider additional ways your student can get money for college that can reduce your future financial burden, such as through scholarships and grants as well as working a part-time job while in school.

Recommended Reading: Paypal Business Loan Reviews

How To Apply For Student Loans Federal And Private

The student loan application process varies by loan type.

Many college students finance their educations through federal student loans or private student loans. If you need help paying for college, youll need to learn how to apply for student loans.

Though the process isnt complicated, it does vary based on which type of loan youre seeking. In many cases, you may end up applying for both types of student loans.

When deciding between federal loans and private loans, you’ll want to compare interest rates as there are distinctions in how these loans charge interest.

Generally, you’ll want to start with federal loans, which typically come with lower interest rates and more favorable repayment options. When you’ve exhausted that resource, you can always turn to private student loans to fill in the gaps. There are several reasons to choose private student loans, which can help finance additional college expenses.

Here’s a step-by-step guide on how to apply for student loans.

Q35 Enter Your Reported Income From Line 150 Of Your 2014 Income Tax Return If You Did Not File A 2014 Income Tax Return Enter Your Total Income From All Sources Both Inside And Outside Of Canada

For 2015/2016 applications.

Enter the amount from line 150 of your 2014 income tax return. The line 150 amount you report will be verified against Canada Revenue Agency records. If the amount you indicate is different from their records, CRA data will be used in the applicants needs assessment calculation. If CRA records are incorrect, you must submit an Appendix 1 with documentation showing the correct amount. If you did not file a Canadian Income Tax Return, enter your total 2014 income from all sources both inside and outside Canada, including employment, pension, investment, net rental, RRSP, foster parent, net professional income, workers compensation, employment insurance, disability assistance, etc. Convert foreign currency into Canadian dollars. If you are married or living common-law, both Parent #1 and Parent #2 incomes must be completed even if 0. Round all amounts to the nearest dollar. Single parents must complete and sign the Parent #1 section of Appendix 1.

Recommended Reading: How To Transfer A Car Loan To Someone Else

How To Apply For Student Loans: Federal And Private

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Learn more about private student loans

-

Find a student loan: Compare private student loans, types and rates

-

How to apply: Wondering where to apply for student loans first?

Student loans arent created equal. Some are federal, some are private, some are designed to help financially needy borrowers, some offer lower rates or important borrower protections. Many students have to combine different types of loans to cover their college costs.

» MORE:Types of student loans: Which is best for you?

I am a huge fan of comparing what works best for each family, says Jodi Okun, founder of College Financial Aid Advisors, which helps families figure out how to pay for college. I dont think theres a set rule that works best.

If you have to take out loans to pay for college and most students do its important to understand all your federal and private student loan options before you make any decisions.

» MORE: Your guide to financial aid

Other Student Loan Applications

In addition to the FAFSA and private lender applications, some colleges and universities require students to fill out and submit the College Scholarship Services Profile. The CSS Profile is used by universities to determine a students eligibility for many non-federal financial aid programs. It should be noted, however, that unlike the FAFSA the CSS Profile is not free. A registration fee is required for each application. So, if students are considering three possible choices of colleges to attend, and are applying to each for information on available financial aid, than three separate fees will be incurred.

Also Check: Nslds.ed.gov Legit

What Can You Pay For With Student Loans

Your total college costs will include much more than just tuition. Room and board alone could easily cost over $10,000, and that doesnt include transportation, books and fun money. But, can you use your student loans to pay for housing and living expenses?

You can use your student loans to pay for school-certified education expenses, which includes most living expenses. This includes tuition, fees, books, room and board, study abroad and computers. Costs of food, transportation, health care and child care are also eligible. Its important to stick to these essentials so that you dont end up taking on excessive debt.

If you end up borrowing more than you need, you can return your unused student loans. Remember, every dollar you borrow will likely cost about two dollars once you pay it back.

Closed School Discharge Program

You might be qualified for a 100 % discharge of your William D. Ford Federal Direct Loan Program loans, in other words, Direct Loan, Federal Family Education Loan , or Federal Perkins Loans. If you were not able to achieve your program because your school closed, you might qualify.

Closed School Loan Forgiveness program can wipe out your students loans entirely if:

- you were enrolled when your school was closed

- you were on an allowed leave of absence during the closure of your school

- your school was shut down within 120 days after you withdrew.

But if the following statements are correct, you are not eligible for discharge of your loans:

the school was shut down more than 120 days already

You are completing a similar program of study at a different school, by a teach-out,

you transfer academic credits or hours you have earned at the closed school to another school

Even if you had not received a diploma or certificate, you had completed all the coursework for the program.

Besides, ensure that you dont stop making the payment on your loan while they handle your discharge application.

If you meet the qualifications and have not enrolled at another school in three years after your school closed, you will automatically receive a closed school discharge.

The U.S. Department of Education will launch this discharge, and your loan servicer will notify you.

Recommended Reading: Genisys Loan Calculator

Ascent Student Loans Disclosures

Ascent loans are funded by Bank of Lake Mills, Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations and terms and conditions may apply. For Ascent Terms and Conditions please visit: AscentFunding.com/Ts& Cs

Rates are effective as of 09/01/2021 and reflect an automatic payment discount of either 0.25% OR 1.00% . Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month. For Ascent rates and repayment examples please visit: AscentFunding.com/Rates.

1% Cash Back Graduation Reward subject to terms and conditions, please visit AscentFunding.com/Cashback. Cosigned Credit-Based Loan student borrowers must meet certain minimum credit criteria. The minimum score required is subject to change and may depend on the credit score of your cosigner. Lowest APRs are available for the most creditworthy applicants and may require a cosigner.

What To Do Before Your Loan Application

Before applying for a student loan to fund your college education, ask yourself these questions.

- Whats the real cost of attending college? Beyond tuition and fees, add up all costs, like room and board if you live on campus, meal plans, books and supplies, transportation to and from campus and any personal expenses youll owe.

- Will you work while attending college? Getting a job can help offset the cost of college. Some employers offer tuition reimbursement. Consider a work-study program if your school offers one.

- Will you live on- or off-campus? The average cost to rent a studio apartment in 2020 was $1,690, according to Rent.com. A large three-bedroom rented for more than $2,000 per month. The average cost to live on campus is between $4,000 and $5,000.

- Do you plan to apply for grants and scholarships? Grants and scholarships are free money to help pay for college. Unlike student loans, you dont have to pay them back unless your enrollment status changes or you withdraw early from a program. Grants are usually need-based, while scholarships can be merit- or need-based.

Also Check: Aer Allotment

Compare Private Student Loans

Before taking out a private student loan, its best to exhaust all federal loan options, scholarships and grants, and work-study programs before applying. Interest rates are generally higher for private student loans than for federal student loans.

Private lenders have their own methods to evaluate applications, so comparison shopping is the only way to know if youll qualify. Its also the easiest way to make sure youre getting the very best interest rates. By shopping around, you also show your cosigner that you put in the time and effort, which may help them feel a bit more at ease accepting the risk that comes with cosigning your student loans.

With Credible, you can compare private student loan rates from multiple lenders.

A Note On Private Student Loans

Private loans are , which has its pros and cons. On the good side, theres a chance you might get a better interest rate than you would on a federal loan. The downside? You will need to have a stellar credit history to secure it. Usually, private loans dont come with the same perks as federal loans, either .

Don’t Miss: How To Transfer A Car Loan

What If You Have Limited Or Bad Credit

Bad credit or no credit isn’t necessarily the end of the road for successfullylanding private student loans, but without a verifiable credit history, you should be realistic about your potential for getting a loan.

Lenders like to see a variety of credit successes in your past, including steady credit card payments, satisfaction of mortgagesand on-time automobile loan payments. Utility companies report your payment history too, so don’t underestimate the importance of paying all your bills on time. If your credit history is sketchy, or non-existent, you might need a cosigner to secure privately funded student loans.

How To Fill Out The Federal Direct Consolidation Loan Form

- Who its for: Anyone with a federal student loan

- Eligible loans: All federal loans

- When to fill it out: After your student loans are in the grace period or repayment

Taking out a federal Direct Consolidation Loan allows you to roll all of your federal loans into one by taking out a new loan. It can make repayments easier if you have multiple servicers or allow you to switch servicers if youre not happy with the one youre working with. It can also make some of your loans eligible for a more flexible repayment plan if they arent already.

The downside? You could end up with a longer term, which often means youll pay more in interest. And if youre already paying it off on an income-driven repayment plan with the intention of applying for forgiveness, you have to start over from square one.

Read Also: How To Get An Aer Loan

Talk To Your Financial Aid Office And Accept Your Financial Aid Offer

Youll need to check in with your financial aid office and accept your offer for aid.

Although each school might be different, before your loan funds are dispersed, youll typically be required to complete entrance counseling and sign a Master Promissory Note. This is a document stating the terms of your loan and your obligation to repay it.

But be sure to check in with the schools financial aid office to get the exact details of what you need to do to get your funds.

Learn more:

How Long Does Fafsa Take To Complete

According to the Office of Federal Student Aid, it takes most people less than an hour to complete and submit the FAFSA. That estimate includes the time it takes to gather necessary information or data, complete and review your information, and read the confirmation page youll receive once you submit your application.

If you submitted the FAFSA for a previous year and are simply doing a renewal application, the process can be much faster.

Recommended Reading: How To Get An Aer Loan

If Tax Information From Two Years Ago Does Not Reflect The Student’s Financial Situation Today How Should The Student Fill Out The Fafsa Form

If the student’s income is lower than it was two years agoor will be reduced once the student starts school and needs to work fewer hourshe or she should contact the school’s financial aid office as soon as possible. The school might ask for proof of the change in income and may use that information to recalculate the student’s eligibility for federal student aid.

Create A Federal Student Aid Id

If applying for the FAFSA online or via the mobile app, your next step is to create a FSA ID. This is a unique identifier used to complete the FAFSA each year youre in college. It takes about 10 minutes to create, and it can be done entirely online. Students have their own unique FSA ID. If youre a parent, your FSA ID will be separate from your childs.

Don’t Miss: How To Get Loan Originator License

How To Prepare For The Fafsa

You must submit the FAFSA annually while youre attending school. Before you sit down to fill it out, make sure you have the information youll need at hand. The FAFSA is free to submit, so no need to get your credit card number ready. Gather the below details in advancewith the help of a parent or guardian, if applicableto speed up the process:

Familiarize yourself, too, with federal, state and college FAFSA deadlines so you can plan to complete the form by those dates. Ideally, submit the FAFSA as early as possible after it becomes available in October each year. That will help ensure you have the best chance at funding thats only available on a first-come, first-served basis, like work-study money.

- Federal deadline. For the 2020-21 school year, which could include summer courses at some colleges, the FAFSA is due at 11:59 p.m. Central Time on June 30, 2021. Updates or corrections are due by 11:59 p.m. Central Time on Sept. 11, 2020.

For the 2021-22 school year, the FAFSA will be available starting Oct. 1, 2020, and will be due at 11:59 p.m. Central Time on June 30, 2022.

- State and college deadlines. States and colleges often have FAFSA deadlines far in advance of the final federal deadline. Check the website for your states higher education agency and your colleges financial aid office for applicable dates.