Requirements For An Fha 203 Loan

An FHA 203 loan is a special type of home improvement loan that allows you to include the cost of certain repairs and home improvements in the mortgage used to purchase or refinance a home. The 203 allows you to borrow up to 110 percent of the projected value of the home after improvements as part of a single loan to purchase/refinance and improve a home.

There are two types of FHA 203 loans: streamlined and standard. The Streamlined 203 allows you to borrow up to $35,000 for minor repairs and improvements things like new appliances or a furnace, new roofing, window/door replacement, interior/exterior painting, new siding, septic repairs, etc. You can sometimes do some of the work yourself with a Streamline 203.

A standard 203 has stricter requirements but potentially allows you to borrow more, depending on how much value the improvements are expected to add to your home. A standard 203 is for major repairs or improvements and involves more paperwork. A standard 203 can be used for projects like adding new rooms, structural repairs like shoring up a basement wall, any work requiring blueprints or other professional plans, or work lasting more than three months. Pretty much anything you do with a standard 203 will require the use of a contractor or other building professional.

Fha Loans Arent Just For First

FHA loans are not for first-time buyers only. First-time and repeat buyers can finance houses with FHA mortgages.

The FHA loan is often marketed as a product for first-time buyers because of its low down payment requirements.

But not all repeat homebuyers have excellent credit or lots of money saved for a down payment on a home. The FHA home loan program is open to them, too.

You couldnt use this type of mortgage for a second home, investment property, or commercial real estate only home purchase loans for primary residences.

The FHA will insure mortgages for any primary residence. There is no requirement that you must be a first-time buyer to use the FHA loan program.

Can I Refinance An Fha Mortgage

Yes. FHA-backed homeowners get access to the FHA Streamline Refinance the fastest, easiest way to lower your mortgage rate. When mortgage rates are down, homeowners can switch to lower-rate mortgages irrespective of their work status, money in the bank, or credit score. You dont even need a home appraisal.

Don’t Miss: How To Get Business Loan From Government

Home Equity Conversion Mortgage

Also called a reverse mortgage, the HECM loan gives borrowers aged 62 or older multiple ways to convert their home equity to cash and avoid a monthly payment. To be eligible, the borrower usually must have at least 50% equity in their home. The amount of equity available is based on the youngest homeowners age.

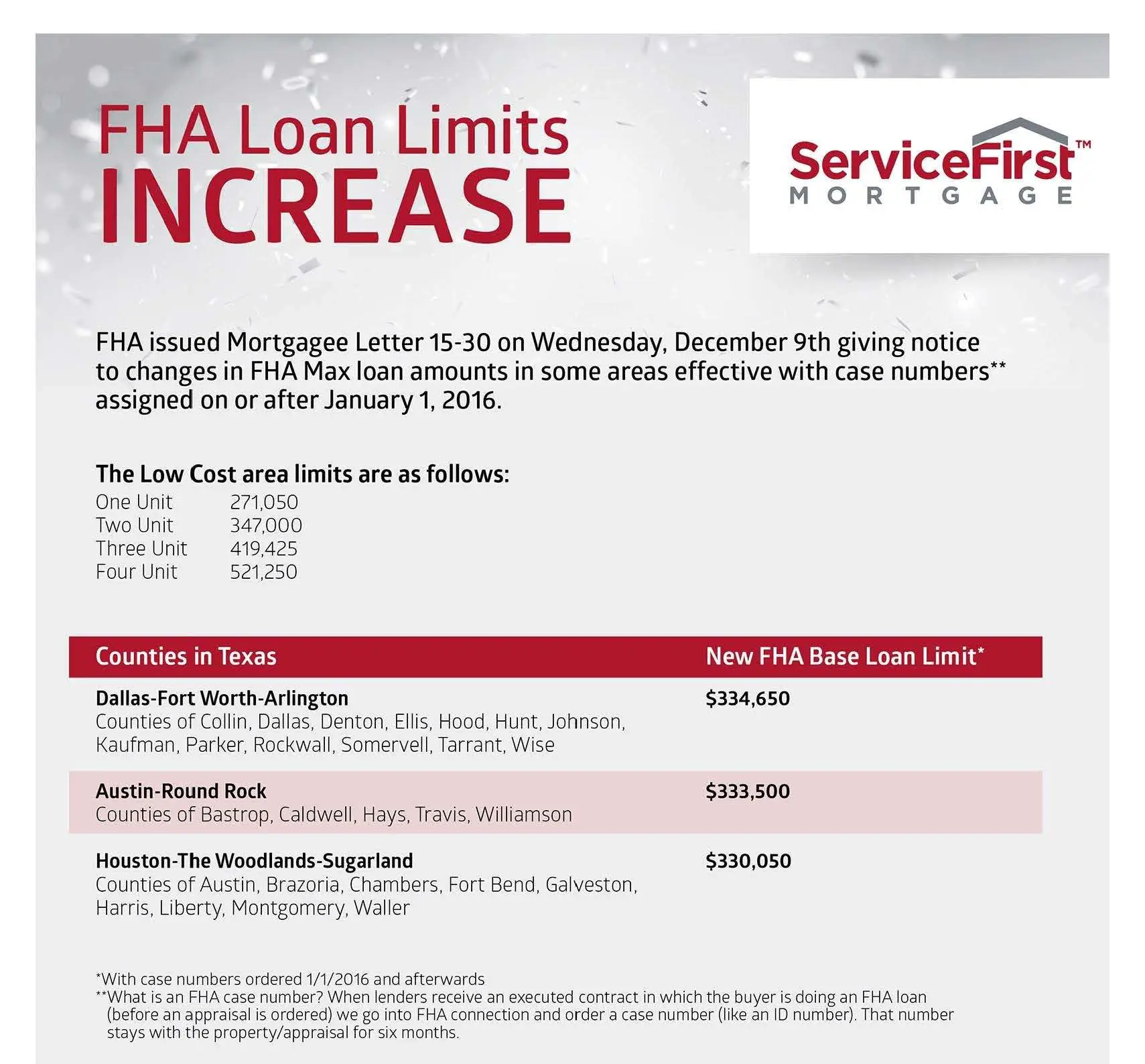

What Are The Federal Housing Administration Loan Limits

FHA loans have limits on how much you can borrow. These are set by region, with lower-cost areas having a lower limit than the usual FHA loan and high-cost areas having a higher figure .

There are “special exception” regionsâincluding Alaska, Hawaii, Guam, and the U.S. Virgin Islandsâwhere very high construction costs make the limits even higher.

Elsewhere, the limit is set at 115% of the median home price for the county, as determined by the U.S. Department of Housing and Urban Development .

The chart below lists the 2022 loan limits:

| 2022 FHA Loan Limits |

|---|

Also Check: Can I Refinance My Santander Car Loan

Can You Apply For An Fha Loan More Than Once

There’s good news and there’s bad news here: FHA loans aren’t limited to first-time home buyers, and there’s no restriction on how many times you can take out an FHA loan in your lifetime.

However, because these loans are for primary residences only, you generally can’t have more than one at a time. There are some exceptions, however, such as if you’re relocating for an employment-related reason or if you’re permanently vacating a jointly owned property .

Good Neighbor Next Door: Best For Public Service Professionals

Firefighters, educators, law enforcement officials, and EMTs can purchase HUD homes in low- and moderate-income areas at 50% off their list price through the Good Neighbor Next Door program.

Buyers are required to live in their homes for at least three years, except for members of the military who receive clemency for time spent on active duty.

Read Also: What Determines Your Mortgage Loan Amount

How Often Are Fha Loans Denied In Underwriting

According to a Consumer Financial Protection Bureau report, approximately 14.1% of FHA applications for home purchases were denied in 2020 . This is higher, compared to the denial rate of 9.3% for home purchase loans in 2020 overall.

But that doesnt mean you wont qualify for the FHA loan you need. Just make sure you meet the requirements and review your credit report before applying.

Title I Home Improvement Loans

Under Title I, HUD insures lenders against losses on loans that finance home improvement loans. The maximum loan amount for a single-family home is $7,500 for unsecured loans or $25,000 for loans secured by a mortgage or deed of trust. A Title I loan may be used to purchase or refinance a manufactured home.

Read Also: Can You Get An Fha Loan With No Down Payment

How To Qualify For An Fha Loan

FHA loans can be great for first-time homebuyers as they may qualify for a down payment as low 3.5% of the purchase price. And people with lower incomes and credit scores may also qualify for FHA loans. This loan type makes homeownership possible for many.

Taking out a loan to buy a home is exciting, but its also a big decision that takes significant time and consideration. We want to provide you with the right information to help you make the best choices for you and your family, and this guide will help you understand what an FHA loan is and how to apply for one.

Fha Minimum Down Payment: 35%

With an FHA loan, the minimum down payment depends on your credit score. If you have a credit score that’s 580 or higher, the minimum down payment is 3.5%.

If your score falls between 500 to 579, the minimum down payment required is 10%. FHA guidelines sometimes refer to this as the Minimum Required Investment it just means the down payment.

You May Like: How To Calculate Dti For Home Loan

Fha Home Loans In The Carolinas

Are you looking for an FHA loan in North Carolina or South Carolina? Dash Home Loans offers FHA loans for qualified home buyers throughout the Carolinas.

FHA loans, which are backed by the Federal Housing Administration , may help qualify for a home if you do not meet other requirements. Theyre ideal for individuals and families with low to moderate income and less-than-perfect credit scores.

Learn More About Eligibility And Fha Loan Applications

FHA loans help make buying or refinancing a home more affordable in communities across the United States. The benefits of FHA loans include competitive interest rates, low down payments, flexible credit scores, and easier refinancing with the streamline program.

How you apply for an FHA loan is similar to the way you apply for other mortgages. There are differences you will want to understand, however. Read on to learn more about how to apply for an FHA loan!

Don’t Miss: What Does Loan Discount Points Mean

How Do I Qualify For An Fha Loan With Better Mortgage

-

FHA loans at Better Mortgage are only available to customers trying to purchase a home with a 30-year term. All FHA loans must be used to fund the purchase of a one or two-to-four unit primary residence, meaning no secondary or rental/investment properties are eligible. To qualify, borrowers must have a credit score of at least 580 and be able to make a minimum down payment of 3.5%. If there is a non-occupying co-applicant/co-borrower, the minimum down payment is 25%. Better Mortgage customers can only have one FHA loan product at a time, and all FHA loans require both upfront and monthly mortgage insurance payments. To find out how much you pre-qualify for, get started here.

Related questions

Better is a family of companies serving all your homeownership needs.

We cant wait to say Welcome home. Apply 100% online, with 24/7 customer support.

Connect with a local non-commissioned real estate agent to find out all the ways you can save.

Shop, bundle, and save on insurance coverage for home, auto, life, and more.

Get a loan up to $50,000 for all your home needs, including moving, renovations, and furniture.

Get free repair estimates, 24-hour turnarounds on reports, and rest easy with our 100-day inspection guarantee.

Get transparent rates when you shop for title insurance all in one convenient place.

Better Attorney Match will help you find experienced attorneys to help with negotiations, closing, and more.

Fha Loan Requirements For 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Mortgages backed by the Federal Housing Administration have different requirements from other types of home loans. Though you don’t have to be a newbie, FHA loans are often popular with first-time homeowners because they couple lower down payment requirements with more lenient standards for credit scores and existing debt. Here’s a rundown of the key FHA loan requirements.

Also Check: How To Apply For Second Home Loan

Understanding And Learning To Qualify For An Fha Loan

In 1934, Congress established the Federal Housing Administration, which became part of the Department of Housing and Urban Development in 1965. The FHA serves one primary purpose: to provide mortgage insurance to lenders, allowing them to offer mortgages to higher-risk borrowers.

Federally backed mortgage insurance protects a lender against future losses, meaning approved lenders can offer more mortgages to homebuyers. By loosening the reins on mortgage terms and qualifications, homebuyers can qualify for mortgages with lower incomes and credit scores.

Fha Loans Dont Have Income Or Geographic Limits

Other low-down-payment mortgage programs may have special eligibility requirements. Many are limited to those with low, very low, or moderate income. Or they are available to only certain groups.

The VA loan, for example, allows 100% financing. But you must be an eligible military borrower to use it.

The USDA Rural Development loan also allows 100% financing, but the program requires you to buy in a designated rural area and imposes income limits, too.

For most buyers, FHA mortgages require a 3.5% down payment. This makes the FHA mortgage one of the most lenient mortgage types available nationwide.

Your down payment money could be a gift from a family member, employer, charitable organization, or government homebuyer program.

Recommended Reading: What Is California Jumbo Loan Amount

Our Advice Consider An Fha Loan If You Havent Already

Since 1933, the FHA 203b loans have made homeownership more affordable and accessible to Americans in all 50 states its the original low-down-payment loan.

To check whether the FHA mortgage is best for you, start a pre-approval with Homebuyer and let a mortgage guide help you put your best foot forward.

Get pre-approved for a mortgage today.

Dan Green

Dan Green is a former mortgage loan officer and an industry expert. He’s appeared on NPR and CNBC, and in The Wall Street Journal, Bloomberg, and dozens of local newspapers. Dan has helped millions of first-time home buyers get educated on mortgages, real estate, and personal finance. Have mortgage questions? Ask Dan in the chat.

How To Apply For An Fha Loan:

1. Research down payment assistance programs

Many states have programs to help low-income earners and first-time homebuyers purchase homes. To qualify for an FHA loan, you need to make a down payment of at least 3.5%. This money can come from your savings, gift money or down payment assistance programs.

2. Find an FHA lender

To find a lender that offers FHA loans, go to the HUD Lender List and search for qualified institutions in your area. Our list of the best mortgage lenders may also be a good place to start.

3. Compare loan offers

Shop around and request quotes from more than one lender to make sure youre getting the best loan terms and mortgage rates. Interest rates can vary between lenders, even for federally-regulated programs like FHA-backed loans. Our mortgage calculator can help you determine which loan is right for you.

4. Apply for the loan

Once youve selected a lender, fill out its application and provide all the information it needs to process your request, including pay stubs, bank statements and old tax returns. The lender will also look into your credit history to calculate your debt-to-income ratio. Feel free to use our debt-to-income ratio calculator to get this information on your own.

Read Also: Can You Use Fha Loan For Land

What Is An Fha Mortgage

Created in the 1930s as part of the New Deal, FHA loans are designed specifically to help more Americans become homeowners. Also known as 203 Basic Home Mortgage Loans, they remain one the most popular loan products in the U.S., representing about 1 out of 7 mortgages, according to the National Association of Realtors.

While issued by private lenders, FHA loans are backed by the U.S. government. The government guarantee allows them to have more flexible borrowing requirements than conventional loans, such as those backed by Fannie Mae or Freddie Mac.

For instance, while a conventional loan requires you to put 20% down to get the best possible interest rate, with an FHA loan you can access decent rates with as little as 3.5% down. FHA loans also have relaxed requirements regarding credit scores, allowing borrowers with scores as low as 500 to qualify. While you dont have to be a first-time home buyer to use an FHA loan, more than 8 in 10 home buyers who do are.

While FHA loans come with competitive interest rates that are often at or below market average, they come with extra costs you should budget for. Thats because of mortgage premiums, which you pay both upfront when you close on your home and annually as long as you keep your loans, that can add to your monthly bill. It may be possible to roll these fees into your FHA loan.

Fha Loan Down Payment Requirements

FHA Mortgages are a great way to get into a home with a low down payment. One benefit of FHA loans is that they allow gift funds from family members for the down payment, and also allow home sellers to pay for closing costs. This means you dont have to wipe out your bank account to get into the home of your dreams.

Though the down payment requirements are more flexible than those of other mortgage options, youll typically need to have enough saved to cover at least a 3.5% down payment on the home youre purchasing.

You May Like: What Is The Best Student Loan Provider

Fha Costs: Mortgage Insurance

FHA loans often come with attractive interest rates, as a result of their government guarantee. But you should expect your savings to be at least partially offset by extra costs in the form of mortgage insurance premiums, which are designed to cover costs if you default on the loan.

If your down payment is 10%, youll pay these premiums for 11 years. Otherwise, youll be stuck paying them until you sell your home or refinance your mortgage.

Heres what the upfront and annual mortgage insurance premiums typically cost:

- Upfront mortgage insurance premium: 1.75% of your loan amount

- Annual mortgage insurance premiums: 0.45% to 1.05% of your loan amount, depending on your term and other factors

Lets say, for example, that you borrow a $200,000 FHA loan. Expect to pay an upfront mortgage insurance premium of $3,500 and annual charges of $900 to $3,000. On a monthly basis, those annual premiums would cost somewhere between $75 and $250.

Assuming your FHA loan has a 7% interest rate, youd be responsible for monthly payments of $1,331 on a 30-year term. Adding in premiums, that monthly bill would range from $1,406 to $1,581. That sum is based on the loan and premiums alone it doesnt include additional costs like taxes or utilities.

Summary Of Money’s Guide To Fha Loans

- FHA loans help make homeownership more affordable for those who don’t have good credit or enough money for a down payment on a conventional loan.

- The FHA doesnt lend money, FHA-approved lenders do the FHA is responsible for settling the debt if you fail to repay the loan.

- The most common type of FHA loan is the Basic Home Mortgage Loan 203.

- To apply for a 203 loan, you need a credit score of at least 580 for a 3.5% down payment or 500579 for a 10% down payment.

- With an FHA loan, the down payment can come from your savings, gift funds or government programs.

- You must pay monthly mortgage insurance premiums and an upfront mortgage insurance premium upon the origination of an FHA loan.

You May Like: What Is The Minimum Jumbo Loan Amount

Fha Loan Requirements In 2023

Find out if you qualify for an FHA loan and what you’ll need to apply

CONTENTS

If you dont qualify for a conventional mortgage, a mortgage backed by the Federal Housing Administration could be your next best option. These FHA loans have lower income and credit requirements for borrowers. Read on to learn more about FHA loan requirements, how to qualify and apply, get answers to frequently asked questions, and discover if FHA loans are worth it.