What Is A Good Mortgage Interest Rate

Mortgage rates are typically based on the prime rate. The prime rate set on March 16, 2020, for example, was 3.25%. That rate for a mortgage right now would be considered a good mortgage interest rate.

However, if a lender is using the prime rate as an index, it would add on fractions of percentage points or more based on factors in your specific credit profile. Those factors can include your credit, how much you are borrowing, the value of the home, and other data.

The prime rateand mortgage rates in generalcan rise or fall on average for many reasons. At one point during the COVID-19 pandemic, for example, the Federal Reserve lowered the federal funds rate to 0 to 0.25%, which could have impacted mortgage loans issued during that time.

The Consumer Financial Protection Bureau provides a tool that lets you explore what the average lender is offering at various times. You enter a credit score range, state, home price, down payment amount, and terms of the loan. The CFPB uses its database of lenders to let you know what rates banks are offering on those loans at that time.

Production Starts For The Skoda Octavia Ahead Of Its Launch In The Country

Production has begun for the Skoda Octavia ahead of its launch in India. The car will launch later in April and deliveries will begin from the end of May. The car was earlier spotted testing in the country. Some of the main features of the vehicle are leather upholstery, three-zone climate control, and an electric sunroof. The car is powered by a 2.0-litre petrol engine that is BS6 compliant. The vehicle is expected to be priced between Rs.18 lakh and Rs.24 lakh. The new Octavia will compete against the Hyundai Elantra.

7 April 2021

Penfed Credit Union Reviews

PenFed is not accredited by the Better Business Bureau , but it does carry an A+ rating from the organization.

Customer ratings for PenFed Credit Union are among the highest in our research. The organization has an impressive 4.7-star rating out of 5.0 on Trustpilot. Customer ratings are considerably lower on the BBB website, however, where reviewers give PenFed 1.2 out of 5.0 stars.

Positive reviews consistently mention a smooth and easy loan application process and low rates. Customers reporting negative experiences tend to mention slow processing times for loan applications.

Our team reached out to PenFed Credit Union for a comment on these reviews but did not receive a response.

Recommended Reading: How Big Of An Auto Loan Can I Get

Loyalty Programme Introduced By Hyundai For New Customers

A new loyalty programme known as Hyundai Mobility Membership has been launched by Hyundai. Individuals who buy a car on or before 13 August 2020 will be eligible to avail the membership. However, according to Hyundai, all existing customers will also be eligible for the membership in the next phase. The steps that are involved to enrol for the programme are installing the Hyundai Mobility Membership app are registration, interest selection, details of the vehicle, and completing the registration. Details such as the email ID, mobile number, and VIN are needed to complete the registration. The three categories of the programme are lifestyle, mobility, and core. Hyundai has entered into a partnership with several companies so that various benefits will be provided under the programme. Various needs of the vehicle such as tyres, oil, and accessories are provided under the programme.

18 August 2020

How Do You Get A Better Rate For A Car Loan

There are many ways for you to influence your chance of getting a better rate. Lets take a look at a few of them:

Improve Your Credit Score Before Applying

Improving your credit score doesnt happen overnight. Over time, you need to show that you are responsible with your debts. This includes making your credit card payments on time and keeping the balance within 30% of your limit and building a diverse but manageable combination of debt. For more information about improving your credit score, check out Loans Canadas article on Improving Your Credit Score.

Increase Down Payment

No-money-down car loans may seem like a great deal, especially if you have trouble saving however, this route can almost certainly guarantee you a higher interest rate. Consider waiting a little longer before purchasing your car so that you have a sizeable down payment. Experts recommend at least 20%.

Get A Co-signer

Compare, Research, and Consider Pre-Approval

If you want to be prepared and well informed about the different deals and interest rates available to you, you might want to consider pre-approval for a loan. Dont worry a pre-approval wont damage your credit score. On the contrary, they can actually be quite helpful in helping you assess what youre eligible for. Furthermore, being able to compare rates with loans you are pre-approved for gives you more knowledge and in turn more power in negotiating a rate with a dealership.

Negotiate

Also Check: Usaa Rv Buying Service

How To Apply For An Auto Loan

You can apply for an auto loan online, at a financial institution, or at the dealership when purchasing a car. Some lenders allow you to browse the inventory of participating dealerships after your loan is preapproved. Because most loan applications require vehicle information, you may need to have a particular car in mind before applying.

When you apply for a car loan, be sure to have the following information handy, as it may be required to prequalify and will certainly be required before you submit your formal loan application:

- Personal details such as name, address, and age

- Social security number

- Gross annual income information

- Vehicle information such as age, mileage, and vehicle identification number

While not required during prequalification, before you can secure your loan, you may need additional documentation such as your driver’s license, pay stubs, and personal references.

If you plan to have someone cosign your loan, that person will also need to supply the information and documents mentioned above.

How Do You Get A Car Loan

Some consumers can pay cash for a new vehicle, but most use financing from a bank, credit union, nonbank auto lender, or dealer. Here are steps you can take in order to get a car loan:

Don’t Miss: Usaa Pre Approved Loan

Auto Approve: Top Choice For Refinance Auto Loans

Starting APR:2.25%Loan amounts:$5,000 to $85,000Loan terms:12 to 84 monthsAvailability:50 statesMinimum credit score:580

Auto Approve has a reputation as a refinance auto loan specialist, but the companys lease buyout option makes it a viable choice for people looking to purchase vehicles. And given the companys strong industry reputation and high customer ratings, our team felt it was worth including.

Auto Approves rates start at 2.25% APR for refinancing, though only borrowers with high credit scores will have access to the best auto loan rates. People who want to buy out their loans or refinance their vehicles need a minimum credit score of 580. That means that while people with fair credit may not get the lowest rates on their auto loans, they may get approved by Auto Approve.

Again, you cant use Auto Approve loans for buying a new or used car, so if thats what youre looking to do, you should consider other lenders. However, if you need to refinance your current auto loan or are considering buying your current lease out, Auto Approve could be a great choice for you.

What Interest Rate Should You Expect On A Car Loan

Car loan interest rates vary widelyoften more than mortgage rates do. Lenders are more likely to take a chance on someone with poorer credit buying a car because the amount is much less than a typical mortgage. But those lenders hedge their bets by charging higher interest rates.

According to data published by the Federal Reserve, 48-month new car loans through commercial banks had an average 5.21% interest rate in the first quarter of 2021. From 2017 through 2020, the average ranged from as low as 4.42% to 5.5%.

If your interest is around those averages or lower, then its probably a good rate. However, you can always check current Federal Reserve averages or shop around to find a better APR if you think an offer isnt ideal.

Recommended Reading: Avant/refinance/apply

Best For Bad Credit: Oportun

Oportun

- Capped at 35.99%

- Minimum loan amount: $300

Opportun is our choice as the best for bad credit since it offers personal loans with limited credit score requirements and an easy online application, and funds available within 24 hours.

-

Wide range of credit situations accepted

-

Easy online application with instant approval

-

Pre-qualify with a soft credit check

-

Only available in 35 states

-

High interest rates

Having less-than-perfect credit shouldnt keep you from getting the car you need. While you shouldnt expect the low rates those with great credit receive, you can avoid overpaying with Oportun. Through this online lender, you can get a loan for a car that you purchase from an auto dealer or a private party. Since buying through a private party can be cheaper, this can save you big bucks over dealerships.

Oportun will lend to people with limited or no credit history. You should have proof of income to apply. Loan amounts can range from $300 to $10,000, so you can get the car you want. Best of all, Oportun does not require a hard credit check when prequalifying and checking rates. So, looking around wont hurt the score youre trying to fix. The application takes only a few minutes, is completely online, and results in an instant decision. If you live in one of the states where Oportun is available, this is an excellent choice.

What Is A Good Interest Rate On A Car

What is a good interest rate on a car? Several factors can influence the interest rate that lenders will offer you. It’s wise to come prepared with knowledge and strategies before entering into negotiations for a car loan.

What is a good interest rate on a car? Several factors can influence the interest rate that lenders will offer you. It’s wise to come prepared with knowledge and strategies before entering into negotiations for a car loan. You can take steps to potentially reduce your car loan rate if you prepare beforehand.

Don’t Miss: How To Get A Mortgage License In California

What Is A Good Interest Rate For Your Car Loan

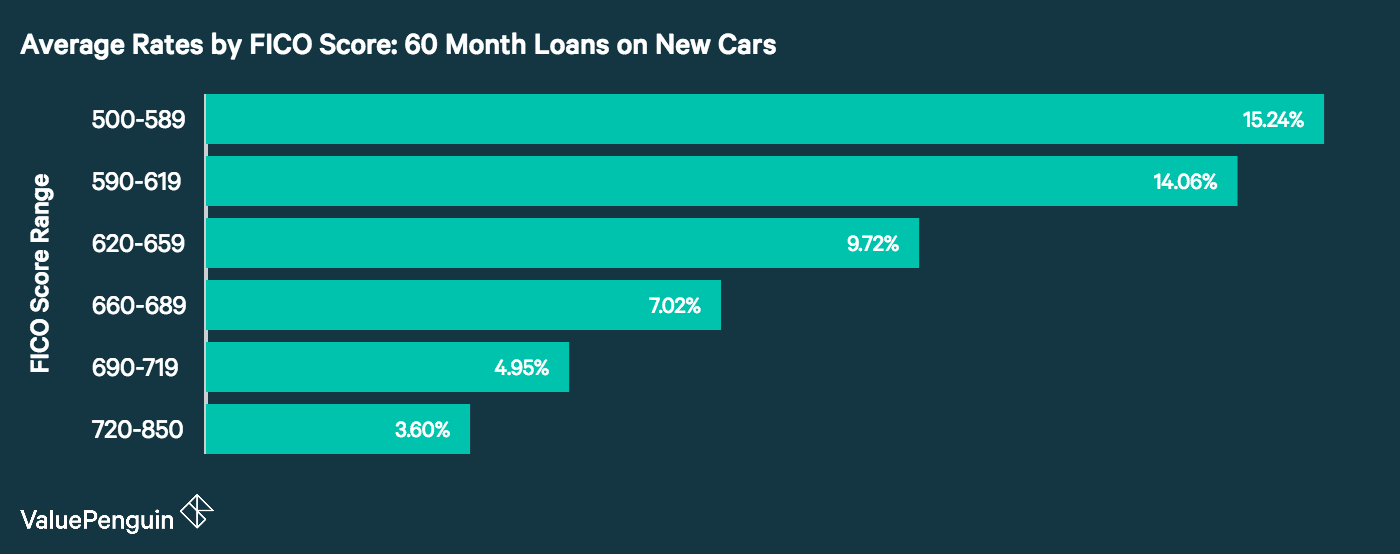

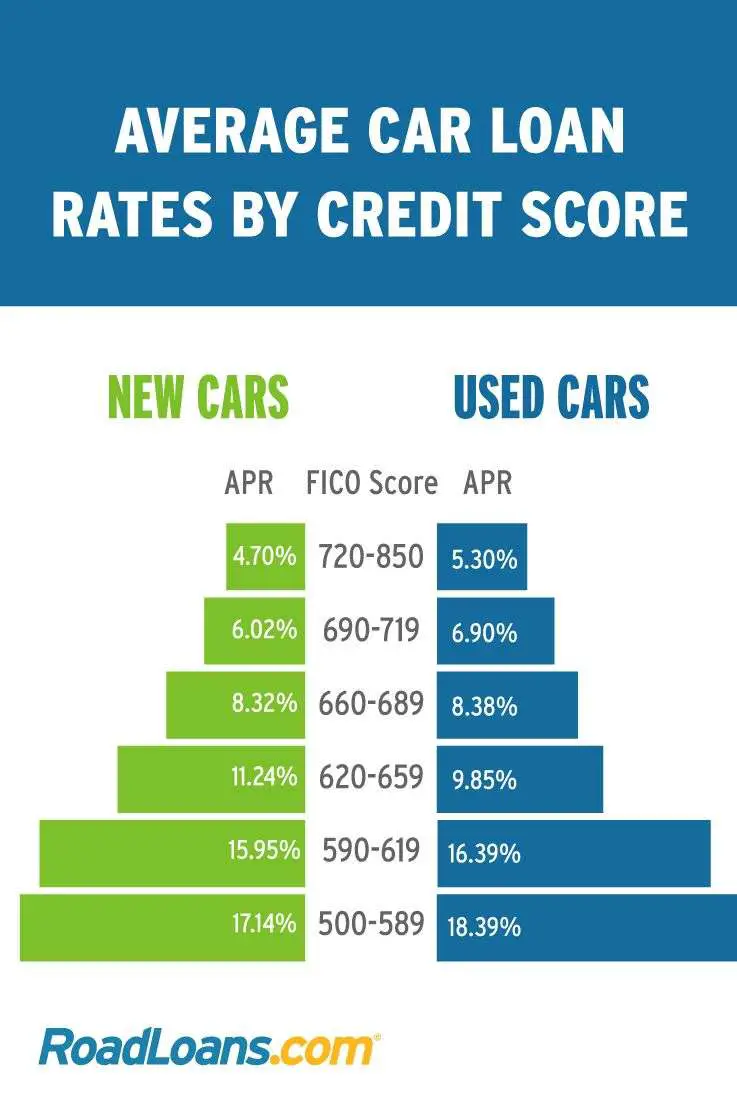

When you are , you want to avoid overpaying and make sure you get the best interest rate possible for your car loan. Keep your credit score in mind when taking a look at the chart below. Here, you can learn more about the average new and used car loans based on credit scores and the APR, or Annual Percentage Rate, for that average. To take some of the hassles out of shopping for a new car, you can apply for financing in advance from the comfort of home.

Wells Fargo Auto Loan Details

Unlike many other auto loan providers, you cannot sign up for a Wells Fargo auto loan directly through Wells Fargo. Instead, the company works through a network of about 11,000 local dealers to provide financing to drivers purchasing a new or used vehicle. This means that the application process is handled by your dealership, and certain contract details may differ depending on the dealer.

| Wells Fargo Auto Loan Details |

|---|

| Minimum Loan Amount |

| None |

While you cannot apply for an auto loan through the Wells Fargo website, existing customers can enroll in the Wells Fargo online banking program and make loan payments online or through the banks mobile app.

You May Like: Drb Vs Sofi

How Will Your Credit Score Affect Your Car Loan

The higher your credit score, the better rate youll receive on an auto loan. Borrowers with good credit can expect to receive an APR around 5.59% or lower for used car loans and 3.69% or lower for new cars. Its possible to get 0% financing from auto manufacturers, but 0% APRs are typically reserved for those with excellent credit and may only be available on certain makes and models.

Do I Have To Pay Estimated Taxes For 2021

Additionally Is 7 percent interest high for a car? According to Middletown Honda, depending on your credit score, good car loan interest rates can range anywhere from 3 percent to almost 14 pierce. However, most three-year car loans for someone with an average to above-average credit score come with a roughly 3 percent to 4.5 percent interest rate.

Is 10 APR on a car good? A 10% APR is not good for auto loans. APRs on auto loans tend to range from around 4% to 10%, depending on whether you buy new or used.

Read Also: How To Qualify For Loan Modification

Bank Of America: Best Big Bank Option

Overview: Bank of America offers flexible and convenient auto loans you can apply for directly on its website. Rates are competitive, and you can qualify for additional discounts if youre an eligible Bank of America customer.

Perks: Bank of America will finance a minimum of $7,500 and requires that the car be no more than 10 years old, with no more than 125,000 miles and valued at no less than $6,000. Financing is available in all 50 states and Washington, D.C. Bank of Americas APRs start at 2.89 percent for a new car and 2.99 percent for a used car.

If youre a Bank of America Preferred Rewards customer, you can qualify for a rate discount of up to 0.5 percent off.

What to watch out for: If you’re applying online, the term range you can apply for is limited you can pick only a 48-, 60 or 72-month term.

| Lender |

|---|

| None |

How Do You Get The Best Interest Rate

If you are looking to get the best interest rate that you can, it is important to do a little planning before you shop. Learn before heading to the dealership. Check your credit history and note the score. The higher the credit score, the lower your interest rate. Remember to prepare for negotiations as well.

So what is a good car loan rate? According to the chart, this can range between 3.17% and 13.76% based on credit score.

If you are offered a higher interest rate than you were anticipating, you can try to negotiate a better offer. When you receive the offer, look at all of the details, dont just focus on the payment amount.

Also Check: Usaa Auto Loan Approval Odds

What Is The Difference Between An Auto Loan And A Personal Loan

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.

What Is A Good Auto Loan Interest Rate

Anything below four percent is an excellent auto loan interest rate. However, depending on your circumstances and credit score, finding a rate below four percent may not be possible.

To give you an idea of what average auto loan rates you can expect based on your credit score, see the table below. These outline average auto loan rates for new and used cars based on information from the second quarter 2021 Experian State of the Auto Finance Market report.

Average Auto Loan Rates By Credit Score| 20.58% |

You can see that rates change drastically by credit score. This also affects what you pay back to a large degree. Let’s say you took out a $10,000 auto loan with 60-month terms to purchase a new vehicle. If you have excellent credit and get a rate of 2.34 percent, you would pay an extra $606 in interest. In other words, it costs $606 to take out a loan of $10,000 with that interest rate.

Now, let’s say you have a decent score of 650 and get a rate of 6.61 percent. In this case, you would pay an extra $1,771 in interest on top of the loan.

If a fair score gives you an average auto loan rate of 11.03 percent, you’d pay $3,054 in interest. And if you had a very high rate of 14.59 percent, you’d pay $4,145 in interest on the $10,000 loan. Ouch.

Also Check: Usaa Consolidate Student Loans