How To Get The Best Deal On A Loan

This one is simple: get a loan that helps you manage your monthly payments.

Now that you know how to calculate your monthly payment, and understand how much loan you can afford, it’s crucial you have a game plan for paying off your loan. Making an extra payment on your loan is the best way to save on interest . But it can be scary to do that. What if unexpected costs come up like car repairs or vet visits?

The Kasasa Loans® is the only loan available that lets you pay ahead and access those funds if you need them later, with a feature called Take-BacksTM. They also make managing repayments easy with a mobile-ready, personalized dashboard. Ask your local, community financial institution or credit union if they offer Kasasa Loans®.

Taking out a loan can feel overwhelming given all the facts and figures , but being armed with useful information and a clear handle on your monthly payment options can ease you into the process. In fact, many of the big-ticket items like homes or cars just wouldn’t be possible to purchase without the flexibility of a monthly loanpayment. As long as you budget carefully and understand what you’re getting into, this credit-building undertaking isn’t hard to manage – or calculate – especially if you keep a calculator handy.

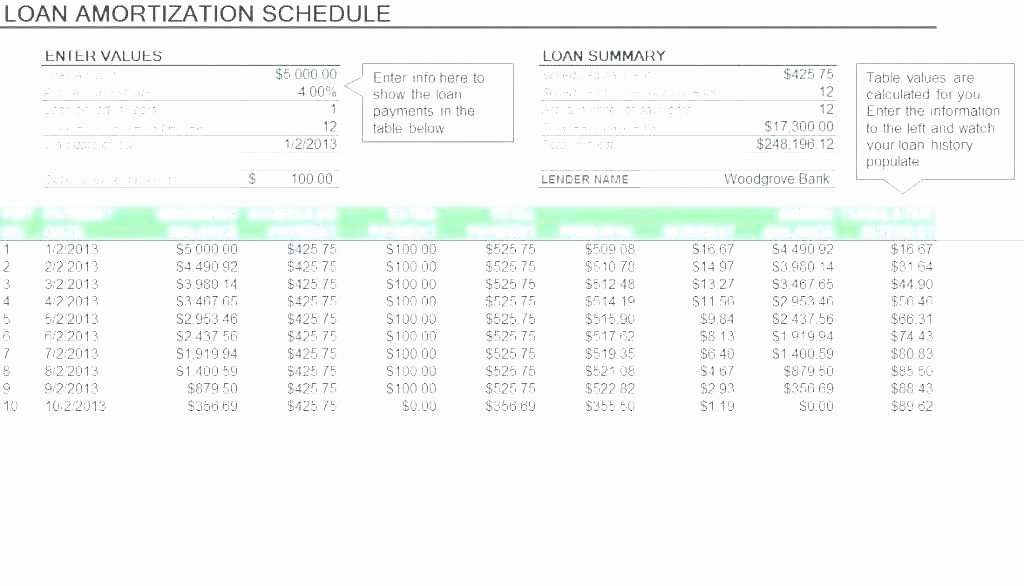

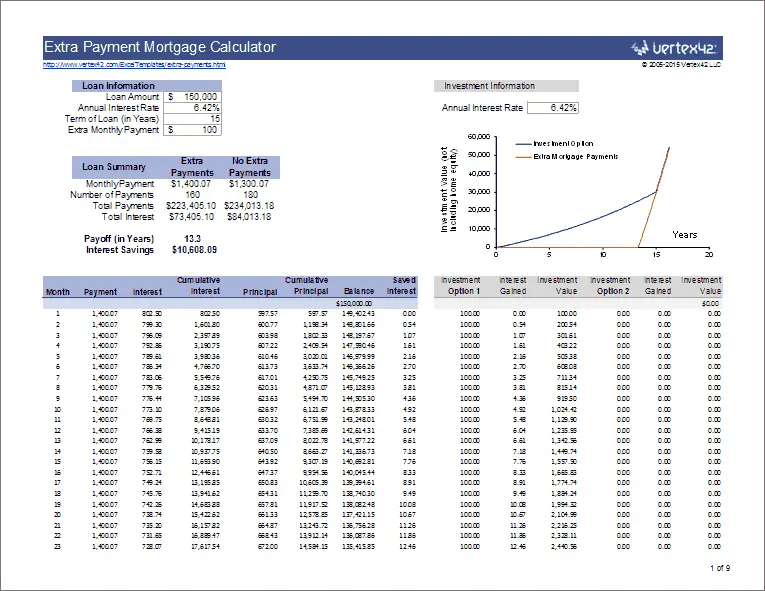

Help With Amortization And Extra Payments

The accelerated payment calculator will calculate the effect of making extra principal payments. A minimal extra principal payment made along with a regular payment can save the borrower a large amount of interest over a loan’s life, particularly if those payments start when the debt is relatively new.

For example, assume that you have taken out a loan for $260,386 for 360 monthly periods with an annual interest rate of 4.25%. If with the six months after the start date, you pay an extra $200, you will save over $50,000 in interest payments, and the schedule shows us that you’ll have paid off the loan in 272 payments instead of the original 360 payments.

It is straightforward to calculate many different scenarios quickly. Note that the higher the interest rate, the greater the savings for any extra payment amount. Also, for a standard amortizing loan, the interest savings will be more significant the sooner the additional payments start. That is, you will save a lot more in interest if you pay an extra $50 a month for the last 20 years than if you pay an extra $100 a month for the previous ten years.

As with many of our other calculators, this calculator will also solve for an unknown input. For example, if you want the calculator to calculate the regular monthly payment, enter ‘0’ for the “Periodic Payment Amount” and a non-zero value for “Loan Amount/Current Balance,””Number of Payments,” and “Annual Interest Rate.”

Auto Loan Payment Calculator Results Explained

To use the car loan calculator, enter a few details about the loan, including:

- Vehicle cost: The amount you want to borrow to buy the car. If you plan to make a down payment or trade-in, subtract that amount from the car’s price to determine the loan amount.

- Term: The amount of time you have to repay the loan. In general, the longer the term, the lower your monthly payment, but the higher the total interest paid will be. On the other hand, the shorter the term, the higher your monthly payment, and the lower the total interest paid will be.

- New/Used: Whether the car you want to buy is new or used. If you don’t know the interest rate, this can help determine the rate you’ll get .

- Interest rate: The cost to borrow the money, expressed as a percentage of the loan.

After you enter the details, the auto loan payment calculator automatically displays the results, including the dollar amounts for the:

- Total monthly payment: The amount you’ll pay each month for the duration of the loan. Some of each monthly payment goes toward paying down the principal, and part applies to interest.

- Total principal paid: The total amount of money you’ll borrow to buy the car.

- Total interest paid: The total amount of interest you’ll have paid over the life of the loan. In general, the longer you take to repay the loan, the more interest you pay overall. Add together the total principal paid and total interest paid to see the total overall cost of the car.

You May Like: Prosper Loan Approval Time

How To Use The Auto Loan Payment Calculator

Heres a guide for the information you will need to input into the auto loan payment calculator.

Car price: In this field, put in the price you think youll pay for the car. To estimate new car prices, you can start with the vehicles sticker price . Subtract any savings from dealer negotiations or manufacturer rebates. Then add the cost of options and the destination fee” charged on new cars.

For used cars, estimating the sale price is a bit trickier. You can start with the sellers asking price, but you may be able to negotiate it lower. To get an idea of a fair price, use online pricing guides or check local online classified ads for comparable cars.

Interest rate: There are several ways you can determine the interest rate to enter. At the top of the calculator, you can select your credit score on the drop down to see average car loan rates. You can also check online lenders for rates. If you get pre-qualified or preapproved for a loan, simply enter the rate you are offered.

Trade-in and down payment: Enter the total amount of cash youre putting toward the new car, or the trade-in value of your existing vehicle, if any. You can use online sites for appraisals and pricing help. When using a pricing guide, make sure you check the trade-in value and not the retail cost . You can also get cash purchase offers from your local CarMax, or online from services such as Vroom or Carvana, as a baseline.

An Auto Loan Calculator Reveals More Than Payments

In addition to looking at the monthly car payment result, be sure to consider the total amount you’ll spend on the car loan. If you’re using the calculator to compare loans, a lower payment may be appealing, but it can also result in much higher interest and overall cost.

Be aware that you could have costs on top of the auto loan payment calculator’s “total cost of car” result, since it does not reflect state and local taxes, dealer documentation fee and registration fees. You can search online or call the dealership and ask them for estimates of these costs in your area.

An auto loan calculator is a tool that does more than just show you a monthly car loan payment. Use it to compare lender offers and try different interest rates and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation.

NerdWallet recommends that you shop for an auto loan before you visit dealerships you’ll give the dealer a rate to beat and won’t worry that you won’t be approved for loan.

Read Also: Car Loan Interest Rates Credit Score 650

Find Out How Much You Can Save With This Calculator

Determining how much you can save in interest when you make extra payments can be extremely difficult if you attempt to do this by hand. By using an advanced calculator, you can see the savings in a matter of seconds and persuade yourself to bite the bullet and pay more every time you receive your car or mortgage loan statement. Even just an extra payment of $20 per month can make a huge different over a 30 year term. You can see the savings for yourself by inputting all of the correct information in the fields above and pressing calculate.

The extra payment calculator allows you to enter the following figures:

- Loan amount

- Years to payoff

- Annual Interest Rate

- Extra payment per month

After you enter all of the figures, simply press calculate. The calculator will use all of the date you have entered and will display the following information for you to review:

- Original total cost The total cost of the loan plus interest if no extra payments were made.

- With extra payment The total cost of loan plus interest if extra payments are made.

- Total saved How much you will save in interest by making extra payments consistently.

If you want to calculate how much you would save by paying more or less of an extra payment, simply press the back button and you can modify the extra payment amount. All of the data entered in the fields will be saved if you press the back button that is located within the calculator.

Calculating The Total Interest

Calculating the total interest paid is a simple matter of summing the values in column C. However, we will make use of our defined name, and offset that range by 3 columns to the left:

=SUM)

For this example, you should get $146,991.83. Of course, you could get the same answer with =SUM, but that wouldnt be as much fun.

Don’t Miss: Bayview Loan Servicing Foreclosure Listings

Why Making Extra Payments Now Can Save You Tons In The Future

Your monthly payment consists of two parts: principal and interest. The principal is the amount you borrow. The interest is the money the lender makes from the loan.

The earlier you start making extra payments on the loan, the better because most loans are amortized. Amortization is the upfront payment of interest on the loan that decreases over time. So, at the beginning of the loan, most of your monthly payment goes to interest, and very little of it goes toward the principal. Over the life of the loan, more and more of your monthly payment goes to the actual principal on the loan.

If your lender allows it and if you make additional extra payments specifically to the principal you can dramatically pay down the balance without paying interest on it.

Future Value : Desired Balance After The Last Payment Is Made

While determining future value is optional, it can be useful for calculating a savings goal instead of paying down a loan balance. Since the vast majority of loans are based on paying the loan off completely, this is automatically defaulted to $0 for the PMT function.

If youre saving money instead of paying a loan, you can enter “0” for the PV and your savings goal as the future value.

Also Check: Capital One Auto Loan Private Party

Should You Pay Off Your Car Loan Early

Whether you should pay off your car loan early depends on the contract you signed. Since lenders make their money on the amount of interest you pay, its possible there will be a repayment fee if you decide to pay it off early. What youll need to do before deciding to pay it off is calculate the amount of interest youd pay if you were to continue making monthly payments. Once youve done that, compare it to how much youd pay for the repayment fee then ask yourself if its worth the cost difference. If you do decide to pay it off early, remember that your could also drop for multiple reasons. These reasons include a decrease in the age of accountsthe number of months/years youve had the loan foror the number of installment loans also known as a loan where you borrow a certain amount of money at once and pay it off on a month-to-month basis.

Finding The Payoff Period

Because we are paying extra principal, the loan will be paid off early and we would probably like to know when. This is easily done by using the Match function to find the row in which the balance equals 0. In D2 enter the label Payoff and then in E2 enter the formula:

=MATCH-1

In this case, the loan will be paid off in period 218 .

An alternative method that will usually work if you make the same extra payment in every month is to use the NPer and RoundUp functions. RoundUp is required to ensure that the result is an integer value, since you must make a whole number of payments. The alternative function is:

=ROUNDUP,0)

In this case we simply report the monthly payment as the sum of the regular payment amount and the extra payment. Again, this will not work if your extra payments are different in any period. Sometimes they are because the balance may fall low enough before the payoff so that making an extra payment would result in overpaying the loan.

Don’t Miss: How Much Does An Auto Loan Affect Credit Score

Calculating Your Mortgage Overpayment Savings

Start Paying More Early & Save Big

Want to build your home equity quicker? Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost. Making extra payments early in the loan saves you much more money over the life of the loan as the extinguised principal is no longer accruing interest for the remainder of the loan. The earlier you begin paying extra the more money you’ll save.

Use the above mortgage over-payment calculator to determine your potential savings by making extra payments toward your mortgage. Put in any amount that you want, from $10 to $1,000, to find out what you can save over the life of your loan. The results can help you weigh your financial options to see if paying down your mortgage will have the most benefits or if you should focus your efforts on other investment options. As you nearly complete your mortgage payments early be sure to check if your loan has a prepayment penalty. If it does, you may want to leave a small balance until the prepayment penalty period expires.

How Much Will You Save By Paying Off Your Car Loan Early

The amount youll save by paying off your car loan early depends on the terms established by the lender. Its not uncommon for a lender to have a repayment term/cost when you sign a contract. Lets say you take out a $20,000 loan with a 60-month repayment term and 5% interest rate, in the end, youll be paying $22,645the $20,00 principal and then an additional $2,645 in interest.

Read Also: Does Upstart Require Collateral

News Result For Auto Loan Amortization Calculator With Extra

Using Your 401 to Pay off a MortgageYour browser indicates if you’ve visited this link

Investopedia

loancalculator

OppLoans Personal Loans Review 2022Your browser indicates if you’ve visited this link

Forbes

loanalternativeextra

Best Small Business Loans Of 2022Your browser indicates if you’ve visited this link

Forbes

Extraloanalternative

Income Share Agreements Can Help Pay for College, but Experts Recommend Maxing Out Federal Student Loans FirstYour browser indicates if you’ve visited this link

Time

loansalternativeextra

If You’ve Fallen Behind on Your Mortgage, a Loan Modification Could Help. Here’s How It’s Different From RefinancingYour browser indicates if you’ve visited this link

Time

loan

Best Medicare Advantage Plans in TexasYour browser indicates if you’ve visited this link

NerdWallet

alternativeextras

Medicare Advantage Plans in MichiganYour browser indicates if you’ve visited this link

NerdWallet

alternative

New Residential Investment Corp. Announces Fourth Quarter and Full Year 2021 ResultsYour browser indicates if you’ve visited this link

Benzinga.com

Want To Make Irregular Payments Do You Need More Advanced Calculation Options

- Biweekly Payment Method: Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment.

- Extra Payments In The Middle of The Loan Term: If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. For example, if you are 3.5 years into a 30-year home loan, you would set the loan term to 26.5 years and you would set the loan balance to whatever amount is shown on your statement. If you do not have a statement to see the current balance you can calculate the current balance so long as you know when the loan began, how much the loan was for & your rate of interest.

- Irregular Extra Payments: If you want to make irregular extra contributions or contributions which have a different periodicity than your regular payments try our advanced additional mortgage payments calculator which allows you to make multiple concurrent extra payments with varying frequencies along with other lump sum extra payments.

For your convenience current Los Angeles mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.

Read Also: California Mortgage Loan Originator License

How To Pay Off A Car Loan Early Using A Lump Sum Calculator +

Dropping a huge sum on the principal balance is an excellent way to shorten the life of a car loan and cut spending on loan interest. You can use our auto loan early payment calculator to do this effectively. Crunching the numbers with this calculator will tell you exactly how much you’re saving in terms of time and money.

How fast can I pay off my car loan? +

This is up to you. There is no limit to how fast you can clear your car loan. The quicker you pay it off, the less you will pay in the long run. This is because you will accrue less cost in terms of interest. However, to create a realistic budget and financial plan, you need to use an auto loan early payment calculator to guide you.

When will my car be paid off? +

Judging by your current monthly payment and extra monthly payment, the time it will take to pay off the loan can be accurately computed using the auto loan early payment calculator.

How to determine the payoff amount on my car loan? +

You can use the auto loan early payment calculator backward to find out how much you’ll be spending to pay off the car loan within a specific period. In doing so, you will arrive at the payoff you will need to pay every month over the life of the loan. You can pay extra payments to save on the loan interest.

What about car loan amortization calculators with extra payments? +