What Is A Balloon Payment

A balloon payment is a large, lump-sum payment made at the end of a long-term loan. It is commonly used in car finance loans as a way of reducing monthly repayment figures. Be aware that once you reach the end of your loan period, the balloon amount becomes payable. You can learn more about balloon payments in our article, What is a balloon payment?.

If you have any problems using this car loan payoff calculator then please contact me.

Should I Pay Off My Car Loan Early

Can you pay off a car loan early? What are the disadvantages of paying off a car loan early? Is it easy to pay off a car loan early? If youve ever asked yourself any of these questions, youve come to the right place. Before you decide whether paying off your car loan early is the right decision, you need to weigh all of the pros and cons. We take a look at the obvious benefits, the things you need to consider first, and how you might want to go about it.

- Save Money

Can I Get 0% Financing On A Car Loan

You may see dealerships advertising 0% financing on their cars. With 0% financing, you buy the car at the agreed-on price, and then make payments on the principal of the car with no interest for a number of months. However, keep these points in mind:

- 0% interest may only be offered for part of the loan term.

- To be approved, youll need spectacular credit .

- Negotiating the car price will be difficult.

- 0% interest car financing is only available to certain models.

- You may not get as much money for your trade-in vehicle.

- The loan structure will likely be set in stone.

Also Check: Usaa Auto Loan Rates And Terms

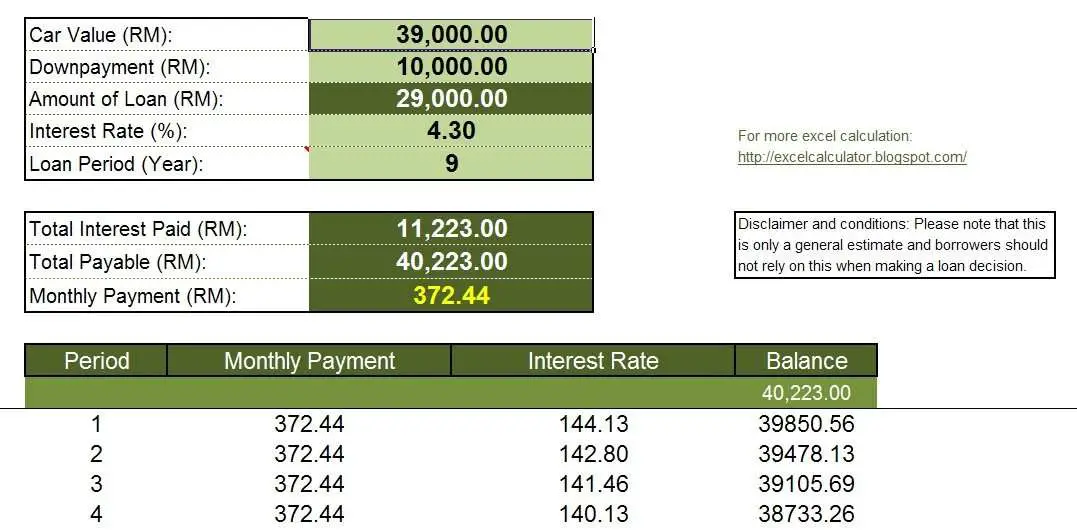

Calculate Your Total Interest Paid

Once you have the interest rate, it is time to calculate the total interest. Luckily, you can find free calculators online. Look for a vehicle interest calculator, as these take into account amortization, which means the principal and interest are reduced at different rates, with the interest being paid off more at the beginning of a loan and then gradually switching over to paying off more of the principal toward the end of the loan.

Step 1: Use an online amortization calculator. This calculator takes the information you provide and figures how much interest is paid each month and for the life of the loan. You can find auto loan calculators online at such sites as Bankrate, Auto Loan Calculator, and Amortization Schedule Calculator.

Input your data, such as the principal loan amount, loan term, and interest rate. Some calculators allow you to look at the amortization schedule and add extra payments to see how they affect your overall payment schedule.

- Warning: Check with your lender before making any extra payments. Some put provisions in the loan paperwork stating that you will be penalized for paying off the loan early.

Step 2: Print or save the calculations you receive. Find the area that gives you the total amount of interest paid and highlight it.

When To Consider Paying Off A Car Loan

This is a big financial decision and you should give it enough careful thought, just like you did when you first got the car loan. Consider paying off your car if:

- You can afford it. If you dont have any other major, more expensive financial obligations, paying off your car loan makes sense. Youll free up money in your budget to put toward other things. But if you dont have the cash on hand, you may want to explore other options.

- You dont have other outstanding debt. Look at your budget, including how much you bring in and what youre paying out. If you want to save on total interest, you may have other types of debt thats a bigger obligation. Credit cards or personal loans often have higher interest rates than car loans, which means you may want to direct extra financial resources there.

- Youre saving for a big purchase. A car purchase itself is a major financial decision, but if youre trying to save for a home, lowering your DTI ratio and boosting your cash on hand is a big deal. You can do that through paying off your car loan early.

Not everyone has the financial power to pay off a car loan early. If you dont have the funds to do so, you may want to look into other options. Refinancing your car loan gives you the chance to lower your interest rate and reduce how much interest you pay over the life of the loan. But it could also extend your monthly payments, so its important to choose a financial path that fits your situation.

You May Like: Loaning Signing Agent

How Do Lenders Come Up With Car Loan Interest Rates

A few different factors help lenders determine the car loan interest rates youll be offered. The more well-rounded your application, the better your chances of scoring a low rate. Although there are many factors that may play a role in your interest rate, these are the four main points lenders consider when reviewing your application:

- Those with higher scores generally have access to lower car loan rates, so improving your credit history is an important part of getting a low interest rate on your car loan.

- Income. Lenders consider your income because it reflects your ability to pay back the loan. They also want to see a low debt-to-income ratio to make sure you can afford your loan.

- Loan term. The loan term impacts the interest rate that youre offered as well as how much interest youll pay over the life of the loan. A lender could offer you a lower interest rate on a longer loan term, but this doesnt mean youll save money: youll pay more interest on a longer loan term.

- Vehicle. Your vehicles make and model can also play a role car loan rates, especially if youre buying a used car. Since its possible that your car will be used as collateral to secure the loan, lenders often charge higher interest for cars that are of poorer quality and are more likely to break down.

- Type of interest rate. Banks and credit unions can offer fixed and variable interest rates on a car loan. Generally, variable-rate car loans have lower starting rates than fixed-rate car loans.

Auto Loan Payment Calculator Results Explained

To use the car loan calculator, enter a few details about the loan, including:

- Vehicle cost: The amount you want to borrow to buy the car. If you plan to make a down payment or trade-in, subtract that amount from the car’s price to determine the loan amount.

- Term: The amount of time you have to repay the loan. In general, the longer the term, the lower your monthly payment, but the higher the total interest paid will be. On the other hand, the shorter the term, the higher your monthly payment, and the lower the total interest paid will be.

- New/Used: Whether the car you want to buy is new or used. If you don’t know the interest rate, this can help determine the rate you’ll get .

- Interest rate: The cost to borrow the money, expressed as a percentage of the loan.

After you enter the details, the auto loan payment calculator automatically displays the results, including the dollar amounts for the:

- Total monthly payment: The amount you’ll pay each month for the duration of the loan. Some of each monthly payment goes toward paying down the principal, and part applies to interest.

- Total principal paid: The total amount of money you’ll borrow to buy the car.

- Total interest paid: The total amount of interest you’ll have paid over the life of the loan. In general, the longer you take to repay the loan, the more interest you pay overall. Add together the total principal paid and total interest paid to see the total overall cost of the car.

Recommended Reading: Fha Limits In Texas

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

Benefits Of Paying More On Your Car Payment

There are a couple of reasons you might want to pay extra on your car payment each month.

- You’ll pay less interest overall. If you have a 60-month, 72-month or even 84-month auto loan, you’ll pay quite a bit in interest over the loan term. As long as your loan doesn’t have precomputed interest, paying extra can help reduce the total amount of interest you’ll pay.

- You’ll pay off your loan faster. The faster you can pay off your loan, the sooner you’ll have extra cash to toward other needs, such as a down payment for your next car, paying off credit card debt or saving for your summer vacation.

Don’t Miss: Usaa Auto Loan Calculator

How Paying More On Your Car Payment Affects Your Credit

Paying more on your car loan affects your credit scoreand not necessarily in a positive way. Here’s what you need to know.

If you make an extra car loan payment once or twice, it probably won’t impact your credit score at all. However, if you consistently make extra payments and pay off your car loan early, it can actually hurt your credit scoreespecially if you’re just starting to build credit, don’t have many credit accounts or are trying to improve your credit score.

Once your loan is paid off, the account will be closed. Although closed accounts may show you successfully managed credit in the past, open credit accounts have a greater impact on your credit score because they show lenders how well you’re managing credit in the present. Your credit score also takes into account how long you have been using credit, so if your auto loan is your oldest credit account, closing it can hurt your credit score.

Finally, paying off your car loan could hurt your credit score if all of your other credit accounts have high balances. That’s because is a factor in your credit score. Find out more about how paying off a car loan early can hurt your credit score.

What To Consider Before Paying Extra

Before you pay extra on your car loan, however, it’s important to consider these questions:

- Does your lender allow extra payments? Some auto lenders prohibit early repayment altogether. Others charge prepayment penalties, which can eliminate any savings from making extra payments. Check with your lender to find out what your loan terms allow.

- Do you have other, higher interest debt? In general, auto loan interest rates are fairly low compared with, say, credit card debt. For example, the average credit card interest rate is currently 17.86%, while the average interest rate for a 60-month new-car loan is 4.73%. If you have extra money, use it to pay down high interest debt before tackling low interest debt.

- How will making extra car payments affect your budget? Make sure the extra payments won’t stretch your budget to the breaking point. If you end up short of cash, you might be tempted to put expenses on your credit card, creating high interest debt.

- Could this money be put to better use? Depending on your current needs and future plans, there may be more productive uses for your money than paying extra on a car loan. For instance, you might want to increase your 401 contribution, build up an emergency savings fund or start saving for a down payment on a home.

Also Check: Usaa Pre Approval Auto Loan

Should I Use An Auto Loan Calculator

Yes, its always a good idea to use an auto loan calculator before you start shopping. This lets you see how much you can reasonably afford, better prepares you to negotiate at a car lot or dealership, and helps you understand whats the best auto loan for you.

You can also play around with the numbers by changing the variables to see how they affect the monthly payment, total interest, and total paid. For example, try plugging in a shorter loan term to see if you can afford the payments and if youd pay less overall.

How Long Will It Take Me To Pay Off My Student Loan

The value of your student debt depends on a number of factors: where you studied, when you studied, and how long for. Ultimately though, the general rule remains the same: the more you pay towards it, the faster the debt will shrink.

Whether you really need to concern yourself with overpaying to shrink the debt is dependent on where you studied. British students have a more relaxed, means-tested approach, whilst US students face a harsher system and therefore more urgency in paying off their loans.

You May Like: Usaa Used Auto Loan Rates

An Auto Loan Calculator Reveals More Than Payments

In addition to looking at the monthly car payment result, be sure to consider the total amount you’ll spend on the car loan. If you’re using the calculator to compare loans, a lower payment may be appealing, but it can also result in much higher interest and overall cost.

Be aware that you could have costs on top of the auto loan payment calculator’s “total cost of car” result, since it does not reflect state and local taxes, dealer documentation fee and registration fees. You can search online or call the dealership and ask them for estimates of these costs in your area.

An auto loan calculator is a tool that does more than just show you a monthly car loan payment. Use it to compare lender offers and try different interest rates and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation.

NerdWallet recommends that you shop for an auto loan before you visit dealerships you’ll give the dealer a rate to beat and won’t worry that you won’t be approved for loan.

Why Use The Early Loan Repayment Calculator

The early loan repayment calculator will help you to calculate the monthly interest repayments and compare how alterations to the loan payments can reduce the overall cost of the loan. With this calculator, you can also compare the loan repayments over different periods of time and opt for the most affordable option. The early repayment loan calculator provides interest repayment options over a variety of time periods starting from 1 year to 10 years. You can also compare them to monthly repayment periods of your choice.

It’s quite easy to use, you just need to input the current loan balance, annual interest rate, current monthly repayment and additional monthly repayment and the calculator will automatically show you the minimum and increased monthly payments itself. You can instantly learn about the interest paid, number of payments, etc. Using a calculator will help you discover various options and make informed financial decisions.

Whatever be your option of loan repayment, you should always make sure that you are capable of affording them. Remember, the best loan is the one which can be repaid quickly.

Don’t Miss: Maximum Fha Loan Amount In Texas

If Your Lender Wont Accept Principal

If your lender will not accept principal only payments, you have two choices:

- Refinance the loan with a lender who will accept principal-only payments. Make sure that you get written verification before doing the refinance. You can get multiple different online with just one simple application.

- Make your additional principal payments to a dedicated savings account, and when the savings account balance is high enough, pay off the loan completely.

But before you do any of that, check to see what the laws are in your state in regard to principal-only car-loan payments. If your lender doesnt allow it, but state law does, you can cite the law and require that they make a provision to accept the payments.

How Long Will It Take Me To Pay Off My Student Loan: Uk

In the UK, student loans are repaid as a percentage of earnings, and only when your annual income is over a certain threshold. So when youre not earning or not earning much you dont need to make any loan repayments.

Of course, interest still accrues over this time, so any downtime where youre not paying off your loan means that there will be more to repay in the long run. However, and this is the critical part, the slate is wiped clean in the end there will never be a knock at the door demanding a huge, snowballed sum of money if youve been making low or no repayments.

Depending on the year in which you took out your loan, it will simply be written off after 25 years, 30 years, or when you turn 65. Phew. For this reason, repaying a student loan in the UK can be considered to work a bit like a graduate tax, applied in a similar way as income tax or national insurance.

You May Like: How To Become A Mlo In California