Do I Need A Down Payment When Assuming A Mortgage

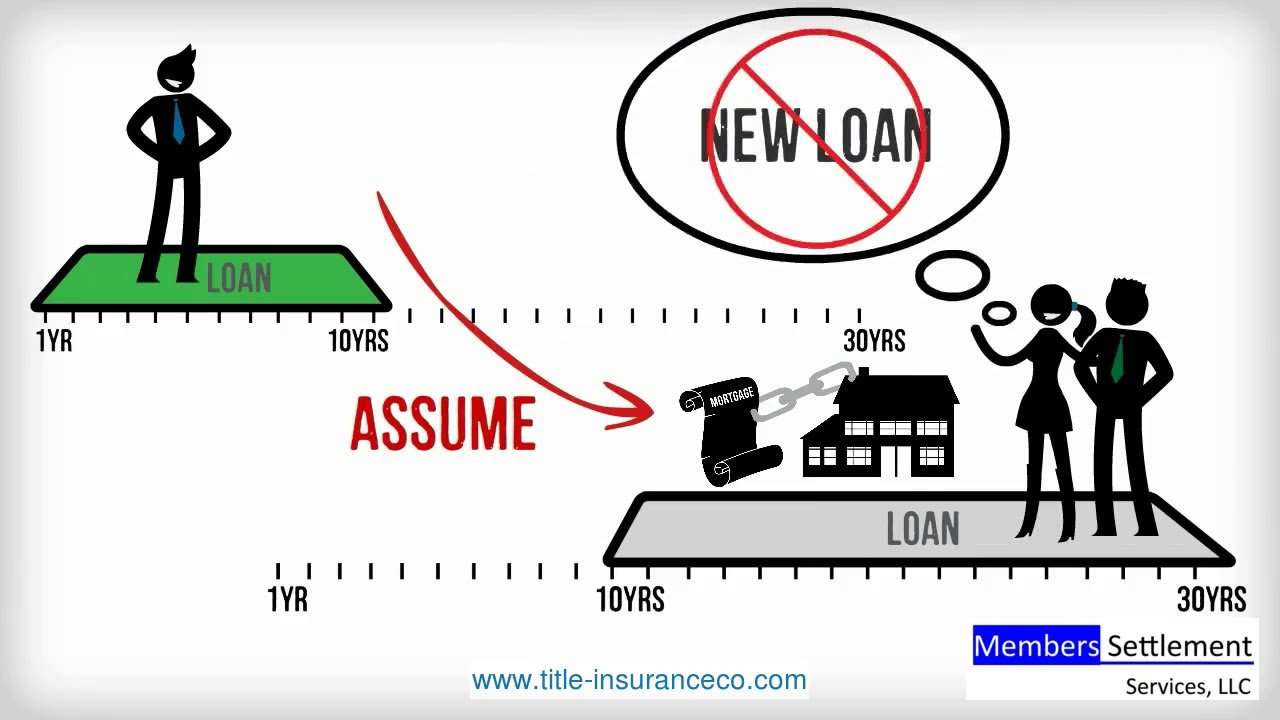

When you assume a mortgage, you take over the homeowners remaining principal balance.

The current borrower has likely paid off a chunk of their mortgage. The home may have also increased in value since it was purchased. So there will be a difference between the loan amount you assume and the purchase price.

That difference is your down payment. And it may be higher than the down payment youd have to make on a new loan.

Lets go back to the example we used above: Say the seller got a $200,000 mortgage at 2.6% in January 2021.

Imagine its now January 2023, and you want to assume that mortgage.

Well, the original borrower made a 3.5% FHA down payment of $7,500 on a $207,500 home. And home price inflation means the market value is now, perhaps, $220,000.

Working out your down payment amount

Because the homeowner made all their monthly payments over the past two years, they reduced the mortgage balance to around $190,900.

Imagine youre buying the house at its exact market value: $220,000.

- Youre paying $220,000

- But your assumed mortgage is only $190,900

- You need a down payment of $29,100

- Thats a 13% down payment

If youre assuming a VA or FHA loan, the minimum down payment is 0% or 3.5%, respectively. So youre putting a lot more money down than youd need to on a new mortgage.

But, youre also securing a far lower interest rate than youd likely get otherwise.

Using a home equity loan to fund your down payment

Hud 232 Loan Assumability Allows Borrowers To Avoid Prepayment Penalties When Selling A Property

A final benefit of HUD 232 financing is the fact that it can allow borrowers to avoid paying a prepayment penalty if they decide to sell their property just a few years after purchasing it. As long as they buyer assumes their loan, the seller will not be responsible for any prepayment penalties. However, the new borrower will have to accept that they will face prepayment penalties if they decide to sell the property before the prepayment period is up. Of course, if the new borrower also decides to sell quickly, they can always have a new buyer assume their loan.

Are Fha Loans Assumable

All FHA loans are assumable, according to the U.S. Department of Housing and Urban Development , which oversees the FHA. However, there are three different sets of loan assumption rules for FHA home loans, depending on when the loan was taken out.

- If the loan originated before Dec. 1, 1986: There are no restrictions on assuming a loan, meaning theres no need for the lender to review the creditworthiness of a buyer taking over a mortgage.

- If the loan originated between 1986 and 1989: Some loans that were first borrowed between 1986 and 1989 may have language that restricts assumability. These loans are assumable despite that language, due to congressional action taken at a later date.

- If the loan originated after Dec. 15, 1989: The lender must approve the buyers creditworthiness, ensuring that they meet minimum FHA loan requirements.

Recommended Reading: How To Take Out Loan For Car

When Is An Assumable Mortgage Used

Assumable mortgages allow homebuyers to take over an existing mortgage with its current interest rate and term. As a result, assumable mortgages become more popular when interest rates are high.

During the week of February 22, the average rate on a 30-year fixed-rate mortgage was 3.04%, a very low level in historical terms. Now imagine that a few years down the road, mortgage rates might rise again. Rather than taking out a new mortgage, a future borrower might assume a mortgage from someone who borrowed when rates were low, therefore locking in that low rate for themselves.

Depending on how the next four years go, we could definitely see a situation where rates are headed in an upward direction, Grech says. If rates are double what they are now, I would think wed see these more often.

So what savings might make this type of mortgage worth it?

Three-quarters of a point, says Nicole Rueth, branch manager at Fairway Independent Mortgage Corporation in Englewood, Colorado. Theres not a science to that, its an art. A quarter-point might be worth it, but somehow that three-quarters of a point seems to be the tipping point.

In other words, homeowners might opt to assume someone elses mortgage rather than applying for a new one if the existing loan has an interest rate three-quarters of a point below the current market rate. as interest rates increase, so does the likelihood of someone choosing an assumable mortgage.

How Does An Fha Assumable Mortgage Work

An FHA assumable mortgage requires a credit score of at least 600 . Mortgage insurance for life is mandatory, unless you assume a loan that was created prior to this requirement being implemented. A debt-to-income ratio of 43% is also mandated. So, for example, if you earn $5000 per month, your mortgage cannot exceed $2,150.

The concept behind an assumable mortgage is quite simple. Basically, it allows the home buyer to take over the mortgage of the seller, as long as the mortgage lender approves it. For example, if the seller has an assumable mortgage of $100,000 but the house is selling for $150,000, then the buyer will need to come up with an additional $50,000 to purchase the home.

It is important to note, however, that even though the buyer has agreed to assume the sellers mortgage, the lender is entitled to change the terms of the agreement, if necessary. Reasons for this often include the buyers credit risk as well as the current market conditions.

This leads us directly into the next topic, which is whether assuming an FHA loan is actually beneficial to the seller as well as the buyer.

You May Like: When Do I Pay Back Student Loan

Why Do Homebuyers Assume Mortgages

Homebuyers can be interested in assuming a mortgage when the rate on the existing loan is significantly lower than current rates. For example, if the seller has a 2.25% interest rate on their mortgage and current rates are 3.25%, it might make sense for you to assume the sellers mortgage.

Homebuyers can also be interested in assuming a mortgage when the seller does not have much equity in their home. Thats because these purchases do not require a large down payment.

For example, pretend you want to buy a home for $275,000 by assuming a mortgage that has a principal balance of $250,000. This means you will only need to make a $25,000 down payment to buy the home.

If you want to buy a home for $275,000 by assuming a mortgage that has a principal balance of $150,000 however, you will need to make a $125,000 down payment or get a second mortgage.

How Does Mortgage Assumption Work

The assumable mortgage applies only to the balance remaining on the original loan and may not cover the homes current value. As a buyer, youre responsible for making up the difference by either paying cash out of pocket or taking out a second mortgage, such as a home equity loan.

For example, if the seller has a $200,000 loan balance on a $300,000 home, youd need to bring $100,000 to the table to compensate the seller for the equity theyve built.

If youre financing the difference between the assumable mortgage and the home price, youd need to find a lender whos willing to qualify you for a second mortgage and ensure youre meeting combined loan-to-value ratio guidelines for your loan program, Becker said.

There are two primary types of mortgage assumption: simple assumption and novation.

Read Also: Does Car Insurance Go Down When You Pay Off Loan

Fha Loan Eligible Properties

Detached or semi-detached homes, manufactured homes, townhouses, and condos are eligible properties for the FHA program, so long as they are safe, secure, and sound. An appraiser will determine if the property meets FHA conditions.

There are many areas where the FHA does require problems to be remedied in order for the sale to close. Common issues include electrical and heating, roofs, water heaters, and property access .

You Pay The Seller Instead Of Making A Down Payment

If you choose to get a new loan, you will typically be required to make a down payment of 3.5 to 20 percent or more. When you assume a loan, you do not have to make a down payment.

Instead, you pay the seller compensation for the equity they have built in the home, or the difference between their mortgage balance and what the home is worth.

Also Check: How To Get Credit Score For Home Loan

Transfer From You To Them

To complete an assumption that wont follow you to your grave, follow all FHA procedures. To release you from your loan, your lender completes a form HUD-92210, Request for Credit Approval of Substitute Mortgagor, or a similar proprietary form.

Your lender also completes form HUD-92210.1, Approval of Purchaser and Release of Seller, or a similar proprietary form, which constitutes a formal release of liability.

Only your lender can execute this release of liability. Its critical because it covers you if your buyer subsequently defaults on your old loan. The lender must release all parties from liability once it approves the assuming borrower.

Fha Loan Assumption Faqs

Which types of mortgages are assumable?Government-backed loans are usually assumable. This includes FHA-insured loans, and those guaranteed by the U.S. Department of Veterans Affairs and U.S. Department of Agriculture . Some conventional loans standard adjustable-rate mortgages may also be assumed.

What is the due-on-sale clause?The due-on-sale clause permits a mortgage lender to demand that a loan be paid in full immediately if ownership of the loan is sold or transferred without the lenders consent. FHA loans are due on sale if there was no credit approval before the assumption took place, unless an exception is met.

Whats the difference between simple assumption and novation?A simple assumption usually happens between a home seller and buyer in private. The buyer takes the title to the home, but the seller is still liable for the loan. Novation involves transferring the rights and responsibilities of the loan, including the title, from the seller to the buyer, and a lender must approve the transaction.

How can I make sure Im not overpaying for an assumable mortgage?You could pay for an independent home appraisal to verify the homes current value. This may help you determine the down payment amount to negotiate with the seller.

Read Also: What Is The Average Motorcycle Loan Interest Rate

Should You Assume A Loan

The answer to this depends. A buyer will enjoy the greatest advantage if the seller’s loan has more attractive terms than are typical at the time. For example, the interest rate can be significantly lower than current average rates, potentially saving buyers hundreds of dollars a month on their mortgage payment.

Assuming a loan is usually a good deal if the buyer does not need to pay more than 10 to 20 percent of the purchase price, in cash, to the buyer.

Taking Over Your Parents Mortgage Here Are 3 Tips Yahoo

Jul 12, 2019 If youre thinking of being transferred an assumable mortgage loan from your parents, youre going to have to make sure that the mortgage

Jan 24, 2020 Unless youre assuming a loan from a relative, you generally must qualify for mortgage assumption once the home seller confirms they have

Mar 18, 2021 An assumable mortgage could help you secure a low interest rate on a home! Can I assume a mortgage from a family member?

Depending if you are the home buyer or home seller, there are reasons both for and against assuming a VA loan.

You may have questions about handling existing mortgage affairs. Maybe you arent sure where Can I receive loan information if Im not a family member?

Nov 4, 2020 VA loan assumption is a powerful benefit for buyers and sellers that you wont find with other mortgage options.

An assumable mortgage is, simply put, one that the lender will allow another borrower to take over or assume without changing any of the terms of the

One of those could be the assumable mortgage, a home loan alternative that enables buyers to essentially take over the home sellers existing mortgage loan

The bank or lender will want to be sure the person assuming the mortgage can make the payments. Pay a down payment to the seller and the assumption fee to the

Get your mortgage loan questions answered with our mortgage and home equity FAQs. How do I know if my mortgage is assumable?

Also Check: How To Refinance Sba Loan

Which Mortgage Loans Are Assumable

Government-backed loans, like FHA, VA and USDA loans, will generally allow for assumptions. They typically dont include the “due on sale” clauses that would prevent the loan from being assumed. The “due-on-sale” clause was popularized for conventional loans in the 70s and 80s due to changes in lending practices. If you see a “due on sale” clause in your mortgage contract, you may be out of luck as far as loan assumptions go, although it never hurts to ask the lender directly.

Are FHA Loans Assumable?

FHA loans made after Dec. 1, 1986 are assumable, but require that the lender verify the creditworthiness of the buyer in order to qualify. This means meeting current FHA underwriting guidelines for income, assets and credit:

- You will need a minimum credit score of 580, though individual lenders can have a higher score requirement.

- Your debt ratios should not exceed 31% for your housing expenses and 41% for your total monthly expenses.

Are USDA Loans Assumable?

USDA loans are usually assumable, but require the prior approval of the USDA. They will not grant an approval if the seller is behind or in default on their payments. In order to qualify:

- You will need a minimum credit score of 580 to 620, depending on individual lender guidelines.

- Your household income cannot exceed 115% of the average median income for the area.

- Your debt ratios should not exceed 29% for your housing expenses and 41% for your total monthly expenses.

Are VA Loans Assumable?

Allows Another Borrower To Take Over

An assumable mortgage is, simply put, one that the lender will allow another borrower to take over or assume without changing any of the terms of the mortgage. For example, say you purchased a property for $200,000 with a mortgage of $150,000 and $50,000 of your own money. If part way through the mortgage term you decide youd like to sell the home, you would have the option of essentially selling the mortgage as well. The person who buys the home from you could take over the balance of the mortgage and the associated payments and give you cash for the remainder of the value of the home. So, if your mortgage balance is now $140,000 and the home is now valued at $210,000, a buyer who is assuming the mortgage would need to pay you, the seller, $70,000.

In cases where a home and a mortgage are being sold together, the interest rate environment can affect the selling price of the property. If rates have risen since the mortgage term began, that mortgage is now more valuable because it comes with an interest rate lower than what you would find if you applied now. Thus the calculation of the homes value becomes a little more complicated as the beneficial interest rate needs to be taken into account.

Don’t Miss: How To Apply For Student Loan For Masters

Assumable Mortgage Pros And Cons

Clearly, an assumable mortgage makes little sense when mortgage rates are falling. Theres no advantage in taking over an existing loan when its rate is higher than one you can get by making a new application.

Thats why theres very little awareness of this option: nobody has wanted an assumable loan during the many years that rates have been falling.

But rates are starting to swing back upward. So theres a chance assumable mortgages could look more attractive in the coming months and years.

Assumable mortgage pros

For a home buyer, the upsides of assuming a mortgage loan include:

- Low interest rates Assuming rates are rising, you could lock in an older, lower interest rate

- Capped closing costs The FHA, VA, and USDA impose limits on closing costs when a mortgage is assumed. And you probably wont need a new home appraisal

- Long-term savings Youll likely save on interest because youre borrowing less over a shorter time than with a new mortgage

Those pros may not be numerous. But theyre powerful.

Assumable mortgage cons

Again for buyers, the downsides tend to be:

That higher down payment could be a big drawback of assuming a mortgage. But when does it apply?

The down payment requirement will depend on the unique circumstances of the loan youre assuming.

Why The Change In Credit Score Requirements

The COVID-19 pandemic forced mortgage lenders to raise credit score standards on most loans. With many homeowners struggling to stay current with their payments, lenders are doing what they can to minimize risk. We encourage you to look into these mortgage lending changes yourself and to get in touch with our team for further assistance.

Don’t Miss: How To Reduce School Loan Debt

Benefits Of An Fha Assumable Loan

The only time that it becomes beneficial for both the buyer and the seller is if the current mortgage rates are higher than the loan that will be assumed.

For example, if the home was financed 10 years ago with an FHA loan at a rate of 5%, but now the rates are up to 7%, then assuming the sellers FHA loan can be beneficial. In this situation, the buyer has an opportunity to buy a home today with the benefit of having yesterdays lower rate. This rate benefit means the loan assumption brings additional value.

Another benefit is if the original FHA loan was dated prior to July 3rd, 2013, the mortgage insurance premium may be removed once the loan balance drops to 78% of the original purchase price. We suggest reading our article on FHA mortgage insurance premiums to learn more.

The benefit for the seller is he or she may be able to get full price for the home due to the lower mortgage rate on their loan.