How Va Loan Rates Compare Other Mortgage Rates

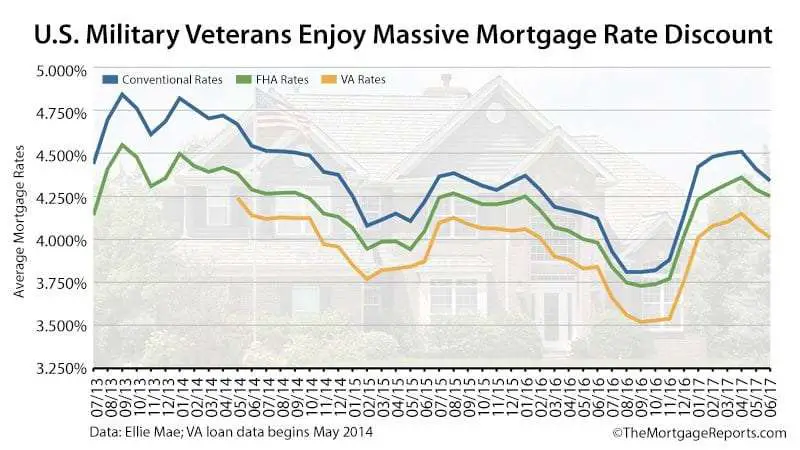

Thanks to the government insurance of these mortgages, lenders are able to offer competitive VA loan rates that are usually lower than conventional mortgages.

For example, in March 2021, a typical 30-year fixed mortgage would come with an interest rate of 3.125%. In that same month, a VA loan on the same 30-year plan would come with 2.875% interest attached.

A difference of less than a percent might not seem like much, but throughout the term of the loan, you will have saved thousands in interest with the lower rate. Check out the links below for interest rates on other types of mortgages and how they stack up to VA loans:

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

Sample Va Loan Rates By Credit Score: 620 To 639

| Fico score | |

|---|---|

|

3.25 % |

$871.00 |

*Updated 6/1/21 Rates are based on a $250,000 loan with a 20% down payment and a 30 year VA mortgage. Rates change often and differ based on your state, down payment, length of loan, and loan amount.

Keep in mind that rates constantly change so it is best to contact us directly for the correct rate.

You May Like: How Much Do Loan Officers Make In Commission

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Best Va Loan Rates Of 2022

- Starting Interest Rate: Contact for rates

- Loan Terms: 30 years

Veterans United won best overall for VA loan rates because this lender specializes in VA loans, veterans are their primary clients, and they have many loan program options.

-

No minimum credit score disclosed

-

Only 30 year terms

Founded in 2002 and built for veterans, Veterans United Home Loans was honored in 2019 by the Department of Veterans Affairs for issuing the official 24 millionth VA mortgage for the 75-year-old VA program. Veterans United closed more VA loans than any other lender in 2016, 2017, 2018, 2019, and 2020.

Veterans United won best overall because they were founded for veterans and service members and they continue to be solely focused on this consumer category. The companys website and support staff lead the veteran from loan eligibility to if necessary, and then quoting. They have no-down-payment programs and programs tailored for first-time homebuyers.

The company offers nine VA loan programs. Their six 30-year programs include a Fixed-Rate program, a Streamline Interest Rate Reduction Refinance Loan , 30-Year VA Cash-Out, VA Fixed Jumbo, 30-Year Streamline Jumbo, and 30-Year Cash-Out Jumbo.

The Lighthouse Program offers free credit counseling as well as tools to improve your credit score and financial profile.

Consumers can get service online or by phone from one of their 24/7 operators at 800-884-5560.

Don’t Miss: Usaa Approved Dealerships

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisors mortgage rate tables to get the latest information.

The lower the rate, the less youll pay on a mortgage. Todays rate environment is considered extremely well-priced for borrowers. However, depending on your financial situation, the rate youre offered might be higher than what lenders advertise or what you see on rate tables.

If youre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

What Determines My Va Loan Rate

There are lots of factors that influence your unique VA loan interest rate, including the larger economy, inflation, and more. Your credit score, payment history , your down payment, and your debt-to-income ratio also factor in. Higher credit scores and larger down payments typically qualify you for a lower interest rate.

You May Like: Penfed Credit Score Requirement Auto Loan

Quicken Loans: Best Online Experience

Quicken Loans provides the best online experience for military members seeking a more self-service approach to banking, with available access to live mortgage experts when needed. In order to qualify for a VA loan through Quicken Loans, veterans and military members will need to provide a certificate of eligibility and prove that they have a minimum FICO® score of 620 or higher. In addition, the debt-to-income ratio should be no more than 60%.

Currently, Quicken Loans offers 30-year, 25-year, and 15-year fixed VA loans with VA home loan rates of 3.75%, 3.75% and 3.125%, respectively. The APR for 30-year, 25-year and 15-year fixed loans is 4.21%, 4.282% and 3.931%, respectively.

How Are Va Loan Rates Determined & By Who

There are a variety of financial aspects that are factored into determining VA interest rates. However, one thing to make clear is that the Department of Veteran Affairs does not set VA home loan rates, your lender does.

While individual mortgage lenders set VA interest rates, their decision to adjust VA home loan rates is usually dependent on the loan terms, the economy, supply and demand for mortgages, and individual financial factors.

Recommended Reading: Usaa Auto Refinance Calculator

S To Acquiring A Va Home Loan

Acquiring a VA home loan involves a relatively straightforward, simple process. Before going ahead with it, though, you should familiarize yourself with what you’re going to be expected to do. Below, the basic steps for acquiring a VA home loan are outlined for your convenience. Although everyone’s experience is going to vary slightly, you can expect yours to go in roughly the following order:

Qualify – First, you need to make sure that you are actually qualified to receive a VA home loan. Look over the eligibility requirements as outlined in the previous section. If you are still unsure about whether or not you qualify, you should use the Veteran Affairs Eligibility Center to see what they have to say. Covering this base is important if you want to proceed with obtaining a VA home loan.

Apply For A COE – Next, you’re going to need to apply for a COE, or Certificate of Eligibility. You will need this certificate when you approach a VA-approved lender for a home loan.

Find A Lender – Not all lenders offer VA home loans. You should check around to see what your available options are. Lenders must be approved by the U.S. government, so double check that the one you’re interested in working with does participate. Otherwise, you will end up wasting a lot of time.

Best Jumbo Loan: Usaa

-

No loans over $3 million

-

No auto pay discount

USAA is an organization that offers military members and their families a comprehensive range of financial products and services that are competitively priced. They offer benefits, insurance, advice, banking, investment products, specialized financial resources, and member discounts.

USAA lends nationwide to veteran borrowers seeking a jumbo home loan up to $3 million without needing to pay private mortgage insurance, and wrapping the VA funding fee into the loan.

USAAs VA loan products include a fixed-rate 30-year purchase loan with rates starting at 2.625%, a jumbo fixed-rate purchase loan at 2.828%, and a VA refinance option: the VA interest rate reduction refinance loan at 2.625%. USAA also has non-VA loan options.

To service your loan, USAA offers an autopay process, however, there are no discounts for using the program. Customer service is available through online chat, mobile app, and by telephone at 800-531-USAA .

Also Check: Usaa Loan Refinance

Will I Have To Pay The Va Funding Fee

If youre using a VA home loan to buy, build, improve, or repair a home or to refinance a mortgage, youll need to pay the VA funding fee unless you meet certain requirements.

You wont have to pay a VA funding fee if any of the below descriptions is true. Youre:

- Receiving VA compensation for a service-connected disability, or

- Eligible to receive VA compensation for a service-connected disability, but youre receiving retirement or active-duty pay instead, or

- The surviving spouse of a Veteran who died in service or from a service-connected disability, or who was totally disabled, and you’re receiving Dependency and Indemnity Compensation , or

- A service member with a proposed or memorandum rating, before the loan closing date, saying you’re eligible to get compensation because of a pre-discharge claim, or

- A service member on active duty who before or on the loan closing date provides evidence of having received the Purple Heart

You may be eligible for a refund of the VA funding fee if you’re later awarded VA compensation for a service-connected disability. The effective date of your VA compensation must be retroactive to before the date of your loan closing.

If you think you’re eligible for a refund, please call your VA regional loan center at . Were here Monday through Friday, 8:00 a.m. to 6:00 p.m. ET.

What Is Va Loan Interest Rate & What Is Apr

When comparing the VA loan rates today, you may see that APR is higher than the standard interest rate. But why is that, and what is the difference between these rates?

First, lets recap by answering, what are VA loan rates? VA home loan interest rates are solely the expression of how much interest youre going to have to pay on your loan.

While APR is also expressed as a percentage, it is very different from the interest rate. The APR on your home loan includes more than just the interest rateit comprises the annual cost of the loan. This includes the other fees, such as closing costs, loan origination fees, broker fees, discount points, etc. Because APR consists of all of these cost factors, APR is higher than the interest rate youll see when comparing them.

Think you qualify for a loan? Contact us today to find out!Contact Us

Think you qualify for a loan? Contact us today to find out!

Recommended Reading: Drb Refinance Reviews

Do Va Loans Vary By Lender

The two main ways a VA loan can vary slightly from lender to lender are the rate and the minimum credit score. The Veterans Administration does not underwrite the loan it provides a guarantee to the lenders who offer the loan program. The lenders determine the rate they will offer, as well as the other underwriting guidelines they will adhere to, such as your credit history and debt-to-income ratio.

The benefits of a VA loan are the same no matter which lender you choose. The key benefits of the program are no down payment requirement, no PMI requirement, and no prepayment penalties, with a VA funding fee taking the place of the PMI.

Work With A Ramseytrusted Mortgage Specialist

To make the smartest decision when shopping for a mortgage, contact our friends at Churchill Mortgage. For decades, their home loan specialists have coached hundreds of thousands of people on how to get a mortgage that actually helps them pay off their homes faster.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Don’t Miss: Do Mortgage Loan Officers Make Commission

Compare Lenders To Get The Best Rate

If you want to get the lowest possible interest rate on your VA home loan, shopping around for lenders is essential.

Start by looking for a VA lender who works with borrowers like you.

How do you know which lenders will work with you? Check out the lenders website to find its minimum requirements, including credit score threshold, to see whether youre likely to qualify.

Request at least 3 to 5 quotes

Find at least three to five lenders and request quotes from each. The more lenders you apply with, the better your chance of finding a low rate.

Make sure that you request quotes for the same loan terms from every lender so that youll be doing an apples-to-apples comparison.

Review your loan estimates

Each lender is required by law to provide a quote in a standardized format called a Loan Estimate. Each LE will come in an identical format, which makes it easy for you to compare each one side-by-side. This Loan Estimate will contain all the figures you need including interest rate and closing costs to identify your best deal.

Take note especially of the Comparisons section near the top of page 3. It will show your annual percentage rate , which represents your total loan costs as an annual amount. APR can help you determine which lender is least expensive in the long term when all costs including interest and upfront fees are considered.

How To Get The Lowest Va Mortgage Rate

Strengthen your finances Increase your credit and down payment, if possible, to get access to todays lowest VA mortgage rates

Shop around Rates can vary a lot by lender. Get personalized quotes from at least 3-5 VA-approved lenders to find the best deal

Consider discount points If you have extra cash, you can pay more upfront for a lower VA mortgage rate over the life of the loan

In this article

Recommended Reading: Refinance Conventional Loan

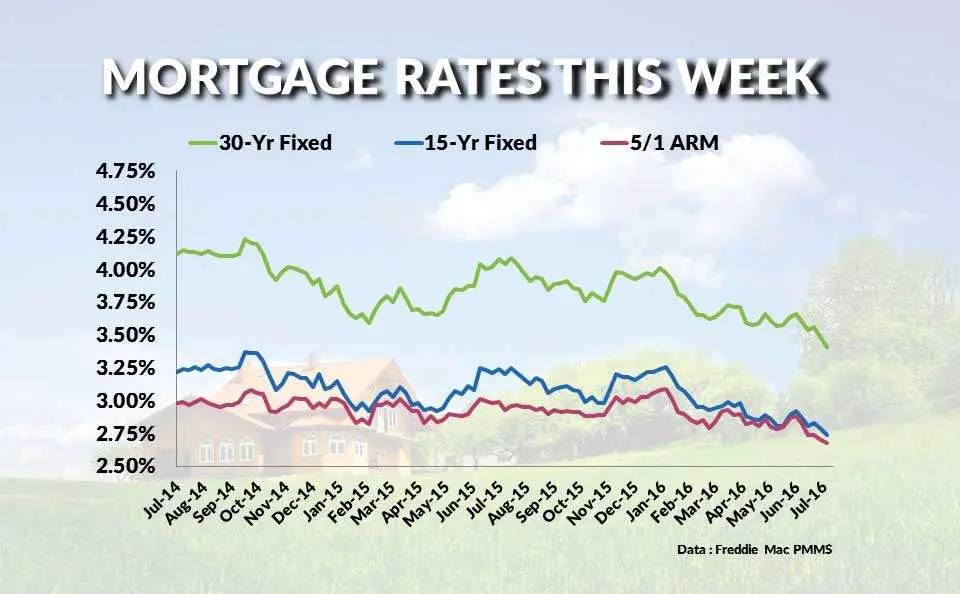

Comparing Current Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whos suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you dont have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wont show up on your credit report as its usually counted as one query.

Finally, when youre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

When Should I Use A Va Loan

If youre looking to buy a home but dont want to make a down payment or pay for private mortgage insurance, it may be the right time to use a VA loan.

Additionally, a VA loan must be used on your primary residence and may carry additional fees if its not the first time youve used it. VA loans also carry a maximum loan amount that changes each year, which may limit the options available if youre planning to buy a more expensive home.

For most U.S. counties, the 2020 limit is $510,400 an increase from $484,350 in 2019. However, in more expensive housing markets, the limit can be as high as $756,600 an increase from $726,525 in 2019.

If youre looking to secure the best loan rate in 2020 without making a large down payment, it may be the right time to consider a VA loan. If you want to see how a VA loan can benefit you and your family, be sure to check out our helpful mortgage calculator.

Recommended Reading: Mortgage Loan Signing Agent

The Bottom Line On Va Home Loans

With their low interest rates, relaxed qualification standards, no down payment requirements and private mortgage insurance needed, VA home loans are exceptional deals for the people who are qualified to receive them. If you or your spouse is a veteran of any branch of the United States military – or if either you are actively serving right now – then you should find out whether or not you qualify. If so, a VA home loan is more than likely going to offer you the most competitive benefits out of any other mortgage product that’s currently available.

The advantages of VA home loans cannot be overemphasized. For borrowers with poor credit or very little spare cash, there’s no other mortgage product out there that comes close to offering the affordable options that VA mortgages do. Weight your options carefully, but be sure to give a lot of consideration to VA home loans.