Who Should Apply For An Fha Loan

Apply for an FHA loan if:

- Your credit score is below 620.

- Your total DTI ratio is higher than the 50% conventional DTI ratio maximum.

- You dont need a loan amount above the current FHA loan limit in the county youre buying in.

- You want to buy and live in a two-to-four unit multifamily home with a 3.5% down payment.

- You want to buy a fixer-upper home with a 3.5% down payment and roll the renovation costs into your loan amount.

- You need the income of a co-borrower who wont live in the home in order to qualify for a mortgage.

- Youve had a bankruptcy two or more years ago.

- Youve had a foreclosure in the past three or more years.

- You wouldnt otherwise qualify for a conventional loan.

How To Apply For An Fha Mortgage

To apply for an FHA loan, you’ll need to fill out your chosen lender’s application. Most lenders allow you to do this online, though in some cases, you may need to hop on the phone or meet in person with a loan officer.

On the loan application, you’ll fill out information about your income, employment, and debts. You will also need to submit documentation to support this info, including:

- Your last two tax returns.

- W-2s and 1099s from the last two years.

- Your last two pay stubs.

- The last two months of statements for any bank accounts, retirement accounts, and investments.

- A copy of your driver’s license and Social Security card.

You’ll also need to agree to a credit check. The lender will pull your credit report and analyze your history and score to gauge how risky a borrower you are. This is a hard credit pull and could ding your credit score slightly.

Note: If you’re buying a home with your spouse or another cobuyer, they’ll need to fill out the application too, as well as submit to a credit check.

What Is It Like To Get An Fha Loan Right Now

Although HUD’s minimum requirements for FHA loans havent changed, FHA-approved lenders seem to favor applicants with higher credit scores. Nearly 74% of FHA borrowers had FICO scores of 650 or above in June 2021, with an average score of 677 for FHA purchase loans, according to data from ICE Mortgage Technology.

On average, it took longer to close an FHA purchase loan in June 2021 than in June 2020 54 days compared with 46 days a year earlier. Conventional purchase loans, meanwhile, closed in an average of 49 days in June 2021, according to ICE data.

HUD data shows that from April to June 2021, over 30% of FHA loans were for amounts between $250,000 and $399,000 by far the most common range. Nearly 70% of FHA loans issued during this period covered at least 96% of the homes estimated value, implying that most FHA buyers are making the minimum FHA down payment of 3.5%.

Recommended Reading: Loan Originator License California

Fha Vs Conventional Loans

Unlike FHA loans, conventional loans are not insured by the government. Qualifying for a conventional mortgage requires a higher credit score, solid income and a down payment of at least 3 percent for certain loan programs. Heres a side-by-side comparison of the two types of loans.

| Conventional loan |

|---|

Down Payment Assistance In 2021

Down payment assistance programs make the mortgage process more affordable for eligible applicants who are interested in purchasing a home but need financial help to do so. Money is usually provided in the form of a non-repayable grant, a forgivable loan, or a low interest loan. Homebuyer education courses may be required.

Typically, a property being purchased must serve as the applicants primary residence and must be located within a specific city, county, or state. It may also need to fall within a program’s maximum purchase price limits. Income limits may apply, and will look something like this :

- 1 person household: $39,050

Recommended Reading: Amortization Schedule For Auto Loan

What Happens After You Apply For An Fha Loan

The typical timeline from application to closing with an FHA loan ranges from 30 to 45 days.

During this time, your loan file goes through underwriting. The underwriter takes a closer look at your application and reviews supporting documents to ensure you meet the minimum guidelines for FHA financing.

- The underwriter will review your current debts and minimum payments, then calculate your debt-to-income ratio

- The underwriter will review your bank statements and other assets to confirm that you have enough in reserves for the down payment and closing costs. If your down payment is coming from a cash gift or down payment assistance, youll need documents verifying the source of the funds

- The underwriter will review your previous tax returns and W2s statements to confirm a two-year history of stable, consistent income

- The underwriter will review your recent pay stubs to confirm youre still employed and earning income

- The mortgage lender will schedule an appraisal to determine the homes current market value. You cannot borrow more than the property is worth

You should also schedule a home inspection after getting a purchase agreement. A home inspection isnt required for loan approval, but its recommended because it can reveal hidden issues with the property.

If your offer was subject to a satisfactory home inspection, you can ask the seller to correct these issues before closing.

Submit requested information as soon as possible to keep closing on schedule.

Fha Loan Interest Rates

Below are todays average FHA interest rates. You can also use Zillow to the see FHA interest rates for your particular situation. Just submit a loan request with less than a 20% down payment and you will instantly receive custom FHA quotes from multiple lenders. Use the filter button to filter solely on FHA mortgage rates.

To see what interest rate you would qualify for, enter your specific details such as credit score, income, and monthly debts . Then when youre ready to talk to a lender, you can contact any of the lenders that appear on your search.

| Program | |

|---|---|

| 3.49% | 0% |

A 30-Year Fixed FHA loan of $300,000 at 2.63% APR with a $10,880 down payment will have a monthly payment of $1,206. A 20-Year Fixed FHA loan of $300,000 at 2.69% APR with a $10,880 down payment will have a monthly payment of $1,617. A 15-Year Fixed FHA loan of $300,000 at 2.67% APR with a $10,880 down payment will have a monthly payment of $2,024. A 10-Year Fixed FHA loan of $0 at 0% APR with a $0 down payment will have a monthly payment of $0. A 7/1 ARM FHA loan of $0 at 0% APR with a $0 down payment will have a monthly payment of $0. A 5/1 ARM FHA loan of $300,000 at 2.95% APR with a $10,880 down payment will have a monthly payment of $1,257. All monthly payments displayed assume a maximum Loan to Value of 100% and 680 credit score, and do not include amount for taxes and insurance. The actual monthly payment may be greater.

You May Like: How To Reclassify A Manufactured Home

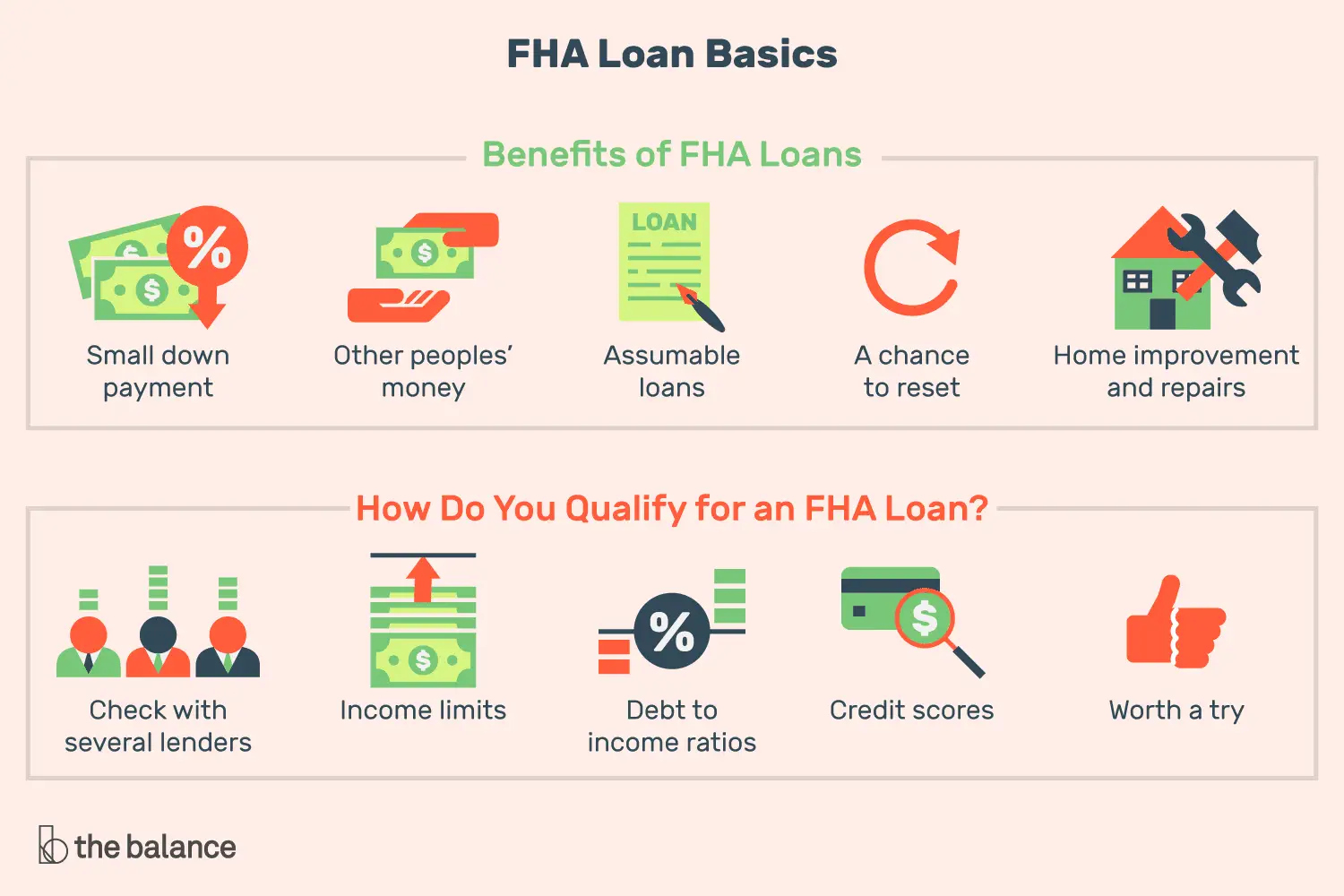

Why Use An Fha Loan

An FHA loan can be an option to consider if you cant qualify for a traditional mortgage due to poor credit history or insufficient funds for a larger down payment. Homes can be purchased with as little as 3.5% down, as opposed to the 20% recommended for conventional mortgages.

While its a good idea to save up for a 20% down payment before buying a home if you can, the FHA loan does allow a path for first-time homebuyers to buy a home sooner than theyd otherwise be able to.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Aer Loan Requirements

Work Mortgage Insurance Into Your Monthly Budget

In addition to that 1.75% upfront cost, you are required to pay a monthly mortgage insurance premium that is incorporated into your mortgage payments.

Mortgage insurance often reads as mortgage insurance premium on your FHA loan statements and usually costs you around 0.5% to 1% of your loan value each year. That could translate to around $130 a month for a home loan of $210,000, for example.

What Is An Fha Loan

FHA loans have more lenient qualification requirements than a conventional loan, and can be a great option if you have minimal cash savings to put down or less-than-perfect credit. FHA loans are insured by the Federal Housing Administration and issued through administration-approved mortgage lenders, which include credit unions, banks and direct lenders.

You may qualify for an FHA loan with a down payment as low as 3.5%. There’s also the option to roll a portion of the closing costs into your loan. However, FHA loans can be more costly in the long run due to the mortgage insurance premium you’re required to pay to minimize the lender’s risk. There are also limits on the amount you can borrow with an FHA loan, depending on where the property is located.

In addition to traditional FHA loans, there are four other FHA loan options:

- FHA 203 loans: These are rehabilitation loans that grant you up to $35,000 for home upgrades, improvements or repairs.

- Home Equity Conversion Mortgages : These loans are designed for homeowners age 62 and older and act as reverse mortgages.

- FHA Energy Efficient Mortgages : These loans allow homebuyers to roll the cost of energy-efficient improvements into their mortgage payments.

- FHA Section 245 loans: These mortgages have a graduated repayment structure in which monthly payments increase in amount over time. They cater to borrowers who expect their income to increase.

Recommended Reading: How To Get An Aer Loan

Fha Loan Requirements For 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Mortgages backed by the Federal Housing Administration have different requirements from other types of home loans. Though you don’t have to be a newbie, FHA loans are often popular with first-time homeowners because they couple lower down payment requirements with more lenient standards for credit scores and existing debt. Here’s a rundown of the key FHA loan requirements.

What Are The Requirements For An Fha Loan

MISHKANET.COM” alt=”Fha vs conventional loan calculator > MISHKANET.COM”>

MISHKANET.COM” alt=”Fha vs conventional loan calculator > MISHKANET.COM”> To qualify for an FHA mortgage loan, the FHA guidelines state that applicants must meet the following requirements.

Don’t Miss: Aer Loans

How Do Fha Loans Work

FHA loans can give people with lower incomes or those with lower credit scores the ability to become homeowners. In order to offer a more relaxed credit requirement and a lower down payment, FHA requires you to pay mortgage insurance. If you defaulted on your loan, FHA would be responsible for paying off the remainder of your loan. Mortgage insurance limits the amount of money the lender may lose.

Mortgage insurance is considered a closing cost. Closing costs are the upfront fees required when you close on a home, and they’re separate from your down payment. Lenders and third parties can cover up to 6% of closing costs on FHA loans, including attorney, inspection and appraisal fees.

FHA-backed loans allow for financial gifts from family, employers and charitable organizations to help cover closing costs.

The borrower is responsible for paying two FHA mortgage insurance fees:

You Might Not Get Approved If You Have Lots Of Debt

FHA loan officers wont approve your loan if theres a good chance you wont be able to afford the mortgage and your other debt, such as car and credit card payments.

A good rule of thumb is that your mortgage payment shouldnt be more than 31% of your income before taxes. Your mortgage payment PLUS your other monthly debt payments usually cannot be more than 41% of your income, though in certain cases you can get approved if your debt obligations total 50%.

You May Like: How To Get Loan Originator License

Explanation Letter For Job Change

If you switched careers or changed jobs recently, sending a letter of explanation to the lender may improve your chances of qualifying for an FHA loan. Describe how your new job is related to your previous employment. Enumerate the skills youve learned and from your past job that youre using in your current job.

What Does Fha Stand For

FHA stands for Federal Housing Administration, and the FHA is a government agency that insures mortgages. It was created just after the Great Depression, at a time when homeownership was prohibitively expensive and difficult to achieve because so many Americans lacked the savings and credit history to qualify for a loan. The government stepped in and began backing mortgages with more accessible terms. Approved lenders began funding FHA loans, which offered more reasonable down payment and credit score standards.

Today, government-backed mortgages still offer a safety net to lendersbecause a federal entity is guaranteeing the loans, theres less financial risk if a borrower defaults on their payments. Lenders are then able to loosen their qualifying guidelines, making mortgages available to middle and low income borrowers who might not otherwise be approved under conventional standards.

Don’t Miss: Aer Loan Balance

Can You Apply For An Fha Loan More Than Once

There’s good news and there’s bad news here: FHA loans aren’t limited to first-time home buyers, and there’s no restriction on how many times you can take out an FHA loan in your lifetime.

However, because these loans are for primary residences only, you generally can’t have more than one at a time. There are some exceptions, however, such as if you’re relocating for an employment-related reason or if you’re permanently vacating a jointly owned property .

How Do You Get An Fha Loan

A lender must be approved by the Federal Housing Authority in order to help you get an FHA loan. You find FHA lenders and shop for mortgage quotes for an FHA loan quickly and easily on Zillow. Just submit a loan request and you will receive custom quotes instantly from a marketplace filled with hundreds of lenders. The process is free, easy and you can do it anonymously, without providing any personal information. If you see a lenders loan quote that you are interested, you can contact the lender directly.

Also Check: Nslds Ed Gov Legit

The Home Inspection And Appraisal

The FHA home appraisal is required before closing to determine the market value of the property. Depending on the size of the house, the average appraisal cost is $300-$600. The FHA home inspections are done before closing to ensure the home meets minimum property requirements. Home inspections cost $250-$400 on average, depending on the homes square footage.

How Do I Apply For An Fha Loan

An FHA mortgage is a great way to buy a house without needing a big down payment or perfect credit score.

While theyre backed by the federal government, FHA mortgages are available from just about any private lender. So its easy to apply and shop around for low rates.

You can start your application online and even close online in some cases. Or you can work one-on-one with a loan officer for extra guidance. You get to choose your lender and how you want to apply.

Also Check: Mortgage Commitment Fee