Best Trusted Name: Bank Of America

Bank of America

-

Minimum monthly income requirements

AutoPay specializes in auto loan refinancing, so itâs no wonder they offer great deals for many individuals. They often cater to clients who have improved their credit score in the time since they took out their original auto loan, and because of this, they are usually able to offer steeply discounted loans. On their site, you can compare offers for loans from many different lenders without having to fill out more than one application. They also pull your credit with a soft check, which is easy on your credit score and a great option if you are not seriously considering refinancing your loan right this second . AutoPay makes it easy to shop around and often partners with credit unions. The lowest rate offered by AutoPay is 1.99% but this is only available if you have a top-tier credit score. The average customer sees their interest rate reduced by 6.99%. Knowing your credit score ahead of time makes a big difference in estimating what your APR will be on refinancing a car loan.

Auto Loan Features You Should Pay Attention To

Before you start your search for the best car loan you can find, remember these key factors to keep an eye on:

- Interest rate: The lower the interest rate on the loan, the less youll pay for the car in the long run.

- Fixed/variable rates: Fixed-interest car loan rates in Canada remain the same for the term of the car loan, while variable rates can fluctuate with a change in the lenders prime rate. Variable rates offered are typically lower than fixed rates, but you might nonetheless consider going with a fixed rate if your cash flow is tight or youre risk averse.

- Simple/compound interest: Simple interest is based on the principal amount of the car loan, while compound is based on the principal + the interest that accumulates during the compounding period.

- Repayment schedule: If youre looking to maximum monthly cash flow, you may go with a longer loan term, although the tradeoff is youll pay more interest over the life of your loan.

- Payment frequency: Lenders often let you choose the payment frequency of car loans. Common payment frequencies include weekly, bi-weekly, semi-monthly or monthly payments. In terms of cash flow, its easiest if you choose a payment frequency that matches your pay schedule at work.

Read Also: Does Va Loan Work For Manufactured Homes

Best Auto Loan Companies With Rates Starting At 15%

Our list of auto loan companies includes both lending networks and direct lenders. Rates vary from a low of 1.5% to a high of 30%. In all cases, a poor credit score is not an insurmountable obstacle to getting a loan.

| 2 minutes | 7.5/10 |

myAutoloan.com is a lending network that works with credit scores as low as 550. You can expect to pay up to 27% for a bad credit auto loan, but the direct online lender will ultimately set the interest rate.

To prequalify, you must demonstrate a monthly income of at least $2,000 and be a U.S. citizen, 18 or older. You can apply for a new or used car loan, an auto refinance loan, or a lease buyout.

Also Check: Refinance Car Loan Usaa

How To Calculate Car Loan Emi

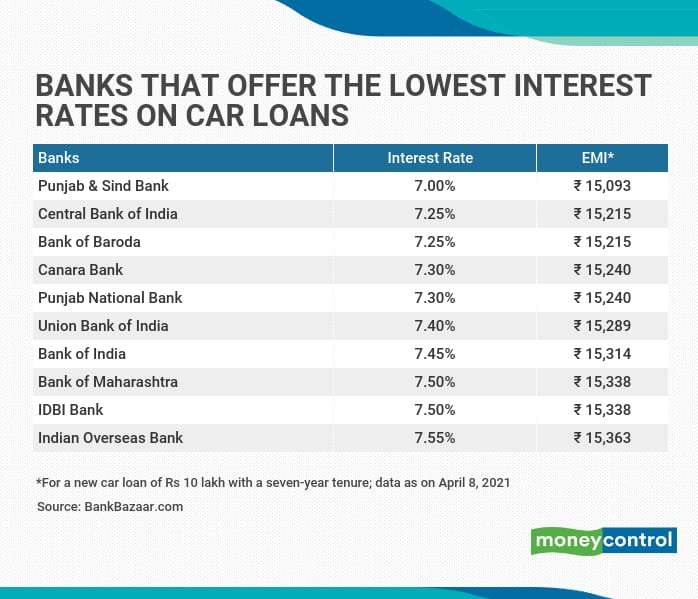

The Equated Monthly Installments that you will pay will depend on a few key factors.

- The size of the loan

- The interest rate that is applicable to the loan

- The tenure of the loan

- The processing fees

The higher the loan amount, the higher your EMI will be. Similarly, the shorter the loan tenure the higher the EMI. To find the best compromise between an affordable EMI and duration you should check out our car loan EMI calculator.

How To Calculate Interest On A Car Loan

When youre thinking about applying for a Car Loan in San Diego, its a good idea to know how much youre likely to pay each month with todays interest rates. This Auto Loan Calculator allows you to make adjustments in your potential down payment, interest rate and loan term to help you choose the right Credit Union Auto Loan for you. You can also use it to calculate your monthly payment, total interest paid, how long youll make payments on your loan and more.

Read Also: Can I Transfer My Mortgage To Another Bank

You May Like: How Much Does An Auto Loan Affect Credit Score

Best Online Auto Loan: Lightstream

LightStream

- 2.49% to 10.99%

- Minimum loan amount: $5,000

LightStream offers a fully online process for its extensive list of vehicle loan options. It’s very transparent about its rates and terms, and it has few restrictions on what kind of car it will finance. It’s also strong on customer service, receiving the top score in the J.D. Power 2020 U.S. Consumer Lending Satisfaction Study for personal loans.

-

No restrictions on make, model, or mileage

-

Offers unsecured loans to borrowers with excellent credit

-

Prefers borrowers with good credit

LightStream is the online lending arm of SunTrust Bank. It stands out for its online lending process. Borrowers can apply online, e-sign the loan agreement, and receive funds via direct deposit as soon as the same day.

LightStream also offers a remarkably wide range of auto loan options, including new and used dealer purchases, refinancing, lease buyouts, and classic cars. It even offers unsecured loans for those with excellent credit.

Rates from the lender start as low as 2.49%, which includes a 0.5%-point discount for autopay. The maximum APR on an auto loan is 10.99%.

What Should You Consider When Choosing An Auto Loan

In a recent interview with Kathryn J. Morrison, consumer affairs expert and instructor at South Dakota State University, she said “When shopping for an auto loan, one needs to consider more than just the interest rate. Are there any additional fees that you will be charged? Do you need to have a down payment to qualify for this rate? What is the total loan amount, and how much interest will you be paying over the life of the loan?”

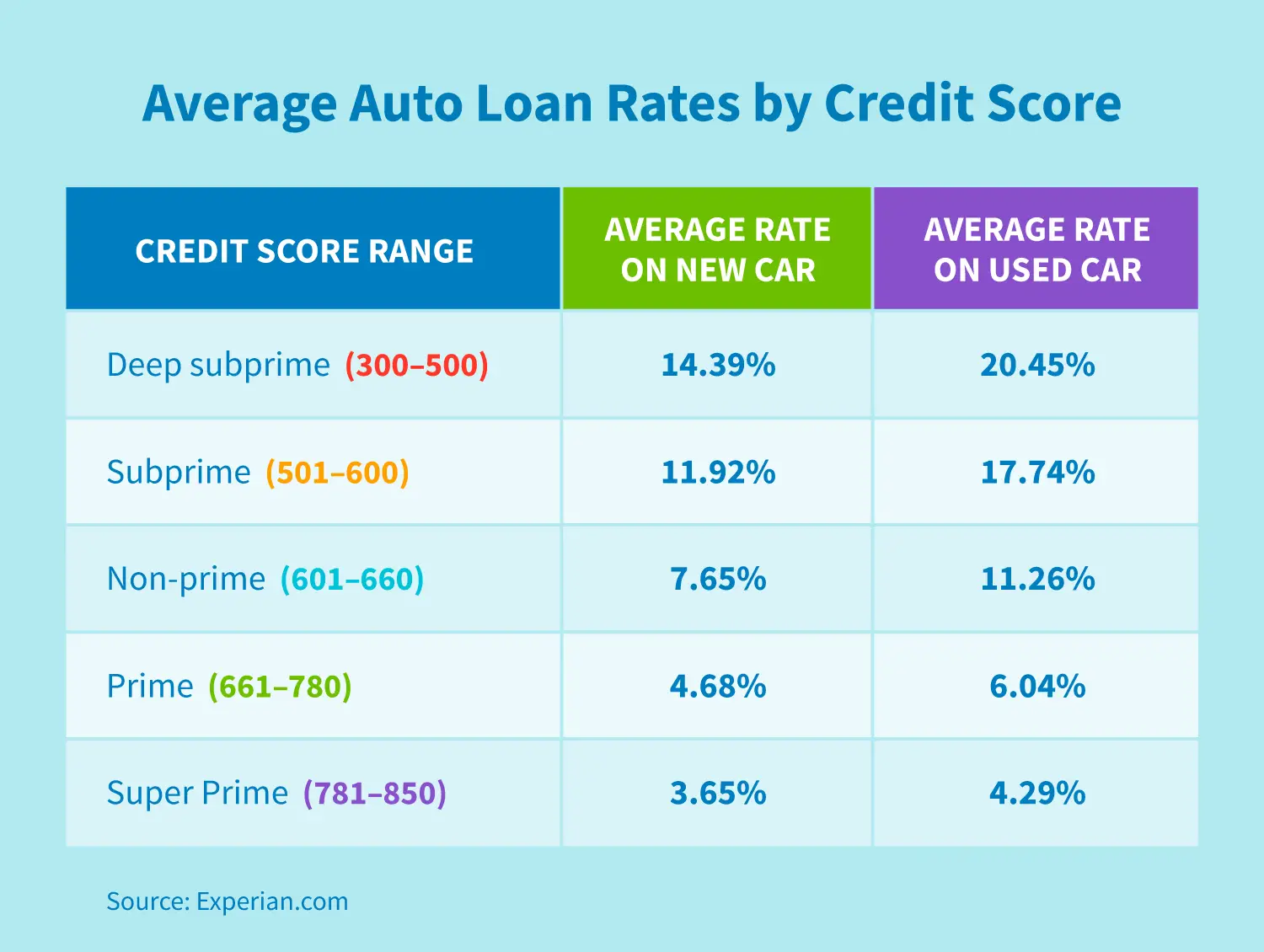

There’s a lot to take into account when choosing an auto loan. Your credit score, for example, has a major impact on the rates you get. The best rates typically go to those with excellent credit. At the end of Q2 2021, the average credit score was 732 for a new-car loan and 665 for a used car loan, according to a report from Experian.

In Q2 2021, borrowers who received the lowest rates had a score of 781 or higher. Those borrowers, also known as super-prime borrowers, received an average APR of 2.34% for new cars and 3.66% for used cars. Prime borrowers with a credit score between 661 and 780 received an average APR of 3.48% for new loans and 5.41% for used loans, while nonprime borrowers with credit scores between 601 and 660 received an average APR of 6.61% for new car loans and 10.49% for used.

It’s also important to consider what term fits your financial situation. Longer terms generally have lower payments but cost more over the life of the loan.

Read Also: What Do Loan Officers Look For In Bank Statements

Car Loan Versus Car Lease

Financing and leasing are two methods through which people can get a new car. In both cases, the car owner/lessee would have to make monthly payments. The bank/leasing company would have a stake in the vehicle as well.

There are several differences between car leasing and car purchase through a loan. Listed below are some of the differences:

- People who like to change cars every 3-4 years may find it more advantageous to lease a car as opposed to financing it. This way, the hassle of maintenance is also taken care of by the lessor.

- When the lease period expires, the lessee can return the car to the leasing company. He/she does not have to go through the process of car valuation and sale, as would be the case if he/she owned the vehicle.

- In the event of leasing a car, there is a restriction on the distance you can drive it for. This kind of restrictions are not there when you are the owner of a financed car.

- Another disadvantage of leasing a car is the fact that you will be unable to customise the vehicle based on your personal preferences.

What Is A Good Interest Rate On An Auto Loan

Interest rates on auto loans depend on your creditworthiness, the vehicle being financed, the details of the loan, and market rates. Creditworthiness is a combination of your , payment history, income, and if youve financed a vehicle before. Whether the car is new or used impacts the rate, as does the loan term, which is the loan length.

Current market rates also affect your auto loan rate. Typically, credit unions offer customers lower rates than other lenders. The market constantly fluctuates, but a rate less than 5% generally is considered good.

Recommended Reading: Usaa Prequalify Mortgage

Best For Tech Junkies: Carvana

Courtesy of Carvana

Carvana offers a completely online shopping experience, from financing to delivery with no minimum loan amounts, and is our choice as the best for tech junkies.

-

Prequalify with a soft credit check

-

No minimum credit score requirement

-

End-to-end online shopping experience

-

Financing for Carvanas vehicles only

-

$4,000 minimum annual income required

-

Only used vehicles

It seems like every industry is cutting out go-betweens these days, and the car industry is no exception. If you would rather skip the dealership and the bank altogether, Carvana is the site for you. Without ever leaving your home, you can apply for a car loan, choose your car, and get it delivered. If you want to trade your old car in, you can do so while you’re at it. Carvana will give you an offer and pick it up from your home.

Best of all, these loans aren’t just easy to get they are great deals for all kinds of borrowers. There is no minimum credit score, so anyone 18 years old, has no active bankruptcies, and makes at least $4,000 per year is eligible.

Carvana offers custom loan terms based upon your situation and the vehicle you’re buying. Each vehicle you might want to buy could have different loan terms from Carvana. You can see your loan terms by prequalifying with a soft pull that won’t hurt your credit. Plus, without pushy salespeople, you can be sure that you can relax and choose the car you want.

What Are The Requirements To Refinance An Auto Loan

Different lenders have different requirements to refinance an auto loan, but most require that you:

- Wait at least 60â90 days after the original loan so the title on your vehicle has been transferred

- Meet a minimum credit score set by the lender

- Show proof of income and identification documents

- Have a car under a certain number of miles

Read Also: Usaa Auto Loan Refinance Calculator

What Is A Good Interest Rate For A Car Loan

The average APR for an auto loan was 9.46% in 2020, but its possible to get a lower rate, especially if your credit is strong. tend to offer some of the lowest starting rates weve seen if you meet their membership requirements, which may be easier than you think. Car manufacturers offer 0% financing, but those deals require high credit scores and only apply to certain models. Used car loans tend to have higher starting rates than new, but manufacturers do offer APR deals on certified pre-owned cars.

Myautoloan: Most Popular Marketplace

Starting APR:2.14% for new vehicles, 2.39% for used vehiclesLoan amounts:$8,000 purchase minimumLoan terms: 24 to 84 monthsAvailability:48 states Minimum credit score:575

The myAutoloan online marketplace lets you comparison shop for the best auto loan rates from a number of lenders. You can enter personal information into the sites online form and receive loan offers from lenders almost immediately, allowing you to compare offers side-by-side.

Our research indicates that myAutoloan rates are low for the industry. Borrowers can access rates as low as 2.14% APR for new vehicles through the marketplace. With a minimum credit score requirement of 575, myAutoloan can be a good option for people with below-average credit.

That said, the companys $8,000 purchase minimum loan amount may mean you need to spend more on a car than you planned to get a loan from the company. In addition, myAutoloan wont authorize a loan on a car more than 10 years old or with more than 125,000 miles on it. Some may find these restrictions a little too cumbersome.

You May Like: How Much Car Can I Afford Based On Income

Bank Of America Reviews

Bank of America is one of the countrys biggest and most established financial institutions. The company holds both an A+ rating and accreditation from the BBB.

Bank of Americas customer review scores tend to be slightly lower. While most of the loan providers we reviewed dont have great customer scores from the BBB, Bank of Americas 1.1-star rating out of 5.0 from nearly 500 reviews was among the lowest. The company also has a 1.4-star rating out of 5.0 from customers on Trustpilot.

People who give a positive rating to Bank of America often mention helpful customer service and user-friendly online services. Negative reviews consistently mention high fees and frustrations with phone support.

Our team reached out to Bank of America for a comment on these reviews but did not receive a response.

Why You Might Buy A Car In Cash:

- No monthly payments: If you have the cash, you might consider buying a vehicle outright. When you do, you dont have any monthly car payments to worry about, which will reduce the mortgage amount youll qualify for if youre planning to buy a home. You also wont have to worry about going to a lender for financing.

- Cash incentives: To entice you to pay in cash, the car dealership may offer you cash incentives as a sweetener.

Also Check: Car Loan Through Usaa

The Verdict: Should I Get A Car Loan

As long as you choose a loan that fits your budget and you make regular payments, a car loan is a great option if you dont have a wad of cash stashed under the mattress. Understanding car loan rates in Canada can be daunting, but if you keep in mind the tips and information above, youll be able to successfully navigate the process and get a car loan for your next vehicle.

If you liked this article, you may also like:

Best For Used Cars: Chase Auto

Chase

Chase Auto offers the security of a stable financial institution with competitive rates, high loan amounts, and a concierge car-buying program that makes it easy to get the best rates and financing options for a used car.

-

Pre-qualify with a soft credit pull

-

Car-buying and car-management services

-

0.25% discount for Chase Private Clients

-

Must finance from a Chase network dealer

-

New application needed when switching dealers

Chase Auto is the car financing arm of J.P. Morgan Chase & Co., the largest bank by assets in the U.S., and allows users to shop for, finance, and manage their vehicle all from one account.

Although Chase Auto doesnt list rates online, it has a calculator that will allow you to get an idea of your potential rate. Chase also offers generous loan amounts ranging from $4,000 to $600,000 and 12 to 84 months flexible repayment terms.

Chase Auto doesnt require you to make a down payment for a loan, though putting money down can reduce the total amount you need to borrow and your monthly payments. You can also get a 0.25% interest rate discount as a Chase Private Client, which requires you to have a minimum average daily balance of $150,000 in qualifying personal, business, and investment accounts or a Chase Platinum Business Checking account.

Recommended Reading: How Long Does Sba Loan Take

Myautoloan: Best For Shopping For Multiple Loan Offers

Overview: If you want to compare multiple loan offers but you dont want to spend a lot of time doing it, myAutoLoan is a great option. This platform lets you enter your information once and receive multiple loan offers in one place.

Perks: After filling out a single online loan application, youll be given up to four quotes from different lenders. To qualify, you must be at least 18 years old, have an annual income of $21,000, have a FICO score of 575 or greater and be purchasing a car with less than 125,000 miles and that is 10 years old or newer. By comparing multiple auto loan offers at once, you can pick the one with the interest rate, loan term and conditions that work for you and your budget without having to shop around.

What to watch out for: If you have poor credit, your interest rate could be on the higher side. Also note that you can use this platform if you live in most states, but not in Alaska or Hawaii.

| Lender |

|---|

Car Financing: Is It Better To Get A Loan

Paying in cash is simply risky for buying a car. It destroys your cash flow and even before a normal working Pinoy has that amount of cash, the value of the car has already diminished. Car financing through a loan is the best option for anyone who plans to enjoy the benefits of the car and to also make sure that someones cash flow is in top shape.

Also Check: Does The Capital One Pre Approval Car Loan Work