How Much Can I Borrow If I Have Partial Entitlement

If you have partial entitlement, you will be subject to loan limits.

The VA loan limits are the same as the conforming loan limits. These are set each year by the Federal Housing Finance Agency . Loan limits depend on the property you buy and where youre buying, since the limits are based on home prices in a given area.

2021 VA loan limits for buyers with partial entitlement

| Property type |

|---|

| $1,581,750 |

You can look up the loan limits in your county on this FHFA map.

Keep in mind, though, that while its easy enough to find your countys loan limit, knowing how the limit affects your home loan isnt always so easy to measure.

Lenders use a complicated equation to determine whether you need a down payment on the new VA loan. If youd like to dig into that, see our guide to buying an additional home with a VA loan.

But if you just want to know how much house you can afford with a VA loan, talk to a VA lender. They can look up your COE and calculate your potential home price for you within a few minutes.

Va County Loan Limit Factors

If you are willing to make a downpayment, you might be able to borrow a loan more than your countys loan limit. Besides your county limit, the amount of your loan also depends on a number of other factors, including:

- Your credit history and credit score Though the VA does not mandate you to have an outstanding credit score, you must have a minimum credit score of 620 to qualify for the loan. Additionally, if you have a good credit score, you might qualify for a higher loan limit.

- Your income Your income can be a major determining factor when it comes to loan limits. An applicant with a higher income might qualify for a higher loan limit.

- Your assets Assets like investment accounts, savings, and retirement pensions can help you qualify for the most VA loan benefits.

Market factors like inflation, current mortgage rates, and more can also affect your countys loan limits.

What Are The Qualifications For A Va Home Loan

All borrowers must have satisfactory credit history, sufficient income, and a valid Certificate of Eligibility , to meet qualification requirements for a VA loan.

It is worth noting that VA benefits can be used more than once and the benefit never expires. Veterans, active-duty service members, reservists, and surviving spouses should work directly with a lender to apply for a Certificate of Eligibility and to prequalify for the loan based on affordability.

Hawaii State FCU is here to help you buy a home. Get started with your VA home loan application by reaching out to one of our Mortgage Loan Officers.

Want more information on homeownership? Check out our eLearning module on mortgages.

Also Check: What Happens If You Default On Sba Loan

How Much Can You Qualify For With A Va Loan

When you’re considering buying a home and using your VA home loan benefit, one of the first questions you want answered is “How much can I qualify for?” VA loans are guaranteed, meaning any loan that the VA lender approves, has a government-backed guarantee of 25% of the loan amount. As long as the lender followed established VA lending guidelines, the guarantee is in place. The VA doesn’t approve the loan but establishes specific rules that lenders must follow in order to receive the VA guarantee. One of those rules limits how much you can borrow based upon a formula called the debt to income ratio, or simply “debt ratio.”

Va Loan Vs Conventional Mortgage

VA loans offer many benefits over conventional mortgages in regards to down payments, mortgage insurance requirements and qualifications. VA loans allow for no down payment mortgages verse conventional mortgage which may require up to a 20% down payment.

Mortgage insurance is not required for the program while PMI or mortgage insurance is required on conventional mortgages if a borrower does not have 20% equity. Lastly VA loans are backed by the government which adds security to banks and mortgage companies and makes qualifying for a VA loan much easier.

Read Also: Usaa Auto Loan Eligibility Requirements

Key Information You Need To Know About Va Home Loans

The federal Veterans Affairs guaranteed home loan is a great benefit to eligible veterans, active-duty service members, reservists, and surviving spouses that others often wish they could access. Here are some facts about the VA home loan program to help eligible borrowers better prepare for homeownership.

What Are Current Loan Limits

VA loan limits are determined at the end of each year, which means they often change year to year. As of 2021, in most cases the current loan limits range from $548,250 to $822,375.

Understanding a VA Loan is important before you obtain one. Going into the buying process is an exciting time and undoubtably youre going to navigate through new waters. Doing your research up front is a great start!

And whether you have full entitlement or remaining entitlement, it doesnt hurt to get with one of our Mortgage Bankers for more information on the VA loan and what might be possible for you!

Read Also: How Do I Find Out My Auto Loan Account Number

Recent Changes And How They Improved Va Home Loans

- Submitted by Phil Georgiades and Myriel Legaspi

- May 10, 2021

In its almost 77-year history, VA home loans have given more the 25 million Veterans and Active-Duty Service Members the opportunity of becoming homeowners. The success of this program is a result of the continuous updates that VA home loans have gone through which have improved and expanded the benefits offered by these loans.

VA Home Loan Update History

After its initial establishment as part of the Servicemens Readjustment Act of 1944 to reward service members returning home from World War II with government guaranteed home ownership loans, VA home loans have been time and again improved.

The first of these updates took place in 1970 when the Veterans Housing Act was signed into law by President Richard Nixon. This law removed termination dates for benefits meaning that now borrowers can use their benefits whenever they want to. Improving the odds that Veterans will be more financially ready to take advantage of these loans.

Another significant update made to VA home loans was the signing of the 1992 Veteran Home Loan Program Amendments by President George H.W. Bush. The changes that this law brought include the expansion of VA home loan benefits to members of the National Guard and military reservists. Giving millions of more service members the opportunity to achieve the dream of homeownership.

The Bluewater Navy Vietnam Veterans Act of 2019

Changes to VA Funding Fee

Removal of VA Loan Limits

Va And Lender Dti Benchmarks

Lenders can set their own benchmarks for the maximum allowable DTI ratio. Those caps can vary based on a host of factors, including the presence of compensating factors and whether the loan file needs to be underwritten manually.

Some lenders might allow a DTI ratio above 50 percent, even well above it, in some cases, depending on the strength of the borrower’s overall credit and lending profile.

In these cases, borrowers will get an up-close look at the link between DTI ratio and the VA’s guideline for discretionary income, known as residual income.

Also Check: Usaa Pre Approved Car Loan

How This Va Loan Change Helps Veterans

The new law repealed loan limits on VA loans. That means veterans buying in pricey metros can get a large loan amount with no down payment.

Before 2020, a loan over the limit required a down payment equal to 25% of the amount over the limit.

For example, a veteran buying a $600,000 in a location where the limit is $500,000 would need to make a down payment of 25% of the $100,000 overage. That comes out to a $25,000 down payment.

The new bill says the veteran can get that same house with zero down, saving significant out-of-pocket expenses.

Now, veterans can shop for more expensive homes, especially in high-priced cities, without worrying about upfront costs.

What Are Va Home Loan Limits For Remaining Entitlement

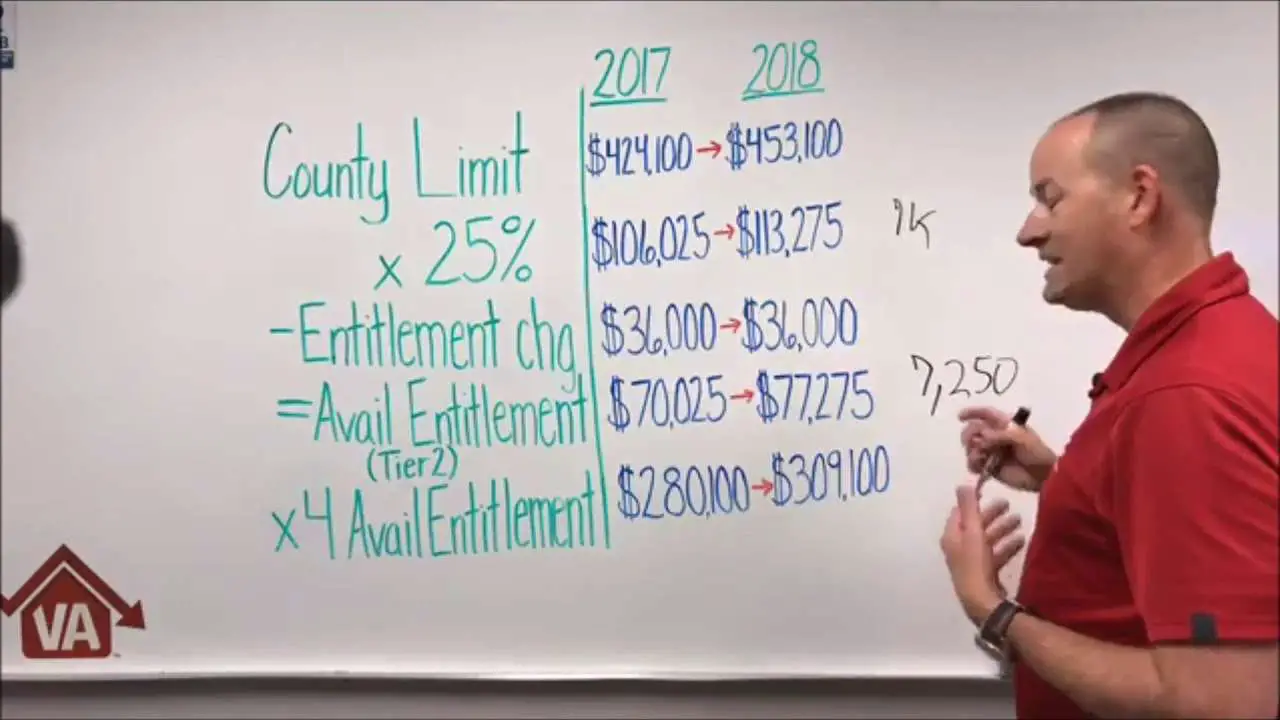

In some cases, you may have a “remaining entitlement” you can use on a second VA loan. These cases can include having an active VA loan you are still paying back or having fully paid off a previous VA loan for a home you still own. When you have your remaining entitlement, your Certificate of Eligibility will say your basic entitlement is more than $0 but less than $36,000.

Loan limits often apply when you would like to get a VA loan using your remaining entitlement. These VA home loan limits are based on county loan limits published by the Federal Housing Finance Agency. You may also need to make a down payment when you are buying a home with your remaining entitlement. See the VA website for more information.

Also Check: Can You Refinance A Car Loan With The Same Lender

How To Take Out A Second Va Loan

If your entitlement is reduced, its possible to have your full entitlement restored in certain circumstances. If this isnt possible, youll be limited by the amount of entitlement you have left.

Keep in mind, when we say limited, we dont mean you cant take out a larger loan than what your entitlement will guarantee, but that you wont be able to take out that loan without making a down payment. This is because lenders will typically require that 25% of your loan amount is covered either by your entitlement, a down payment or a combination of the two.

What Really Changed With Va Loan Limits

Veterans and active-duty servicemembers have always been able to use VA home loans to buy homes over the $548,250 loan limit. These jumbo VA loans had different rules, however they required a down payment of 25% of the difference between the purchase price and the relevant loan limit.

For example, if you wanted to purchase a home for $584,350 in a county where the loan limit was $484,350, then youd be borrowing $100,000 more than the cap. Youd be responsible for 25% of that difference as a down payment. Thats $25,000.

But now that the new laws provisions are implemented, these jumbo loans dont carry the same down payment requirement from the VA. In theory, a homebuyer who meets the eligibility, income, and credit requirements can get a million dollar home with zero money down, for example.

This likely means that the new rules benefit only a small proportion of Veterans and fewer of those who are still serving. A $750,000 home loan with zero down payment and 3.4% interest rate has an estimated monthly mortgage payment of $4,100 thats a lot more than the average homebuyer can afford.

Don’t Miss: How To Transfer Car Loan To Another Person

The Max Va Loan Amount No Longer Exists

If youre lucky enough to qualify for a VA loan, then youve got some serious advantages on your side.

With no down payment requirements, no mortgage insurance, and some of the lowest interest rates around, a VA loan is one of the best mortgage products you can come by.

Plus, VA loan changes enacted at the start of this year introduced another perk: theres no longer a max VA loan amount.

Now, to be clear, that doesnt mean you can get a VA loan in whatever amount your heart desires.

There are still some boundaries on what youll be able to take out they just depend more on your unique financial situation, rather than a nationwide limit.

Va Loans For Military Veterans

The US Department of Veteran Affairs created a military loan guarantee program to assist returning veterans in purchasing homes called the VA Loan. This VA mortgage program is available directly through banks and mortgage companies and guaranteed by the US government. A VA home loan is a zero down home loan that allows home buyer to purchase a home with added flexibility and low monthly payments.

Michigan VA Loan Update

For more information on a VA Loans in Michigan call 1-800-555-2098 or apply online today!

Online Security Policy: By clicking “Submit” , I agreen to I agree to Riverbank Finance LLC ‘s Privacy Policy and Terms of Use and authorize contacts via telephone, mobile device and/or email, including automated means even if your telephone number is currently listed on any state, federal or corporate Do-Not-Call list. This no obligation inquiry does not constitute a mortgage application. To apply now or get immediate assistance, call us at 1-800-555-2098.

Recommended Reading: How Long For Sba Loan Approval

Notes From The Va On High

Lenders may make loans to veterans greater than the maximum county loan limit however, lenders may require Veterans to make a down payment for the amount borrowed in excess of the applicable county loan limit. VA loan limits are based on county median home values reported by the Federal Housing Administration. These values are the basis for which VA calculates limits for their program.

For 2019, some limits increased, some stayed the same and a few decreased. The maximum guaranty amount for loans over $144,000 is 25 percent of the 2019 VA county loan limit shown below. Veterans with full entitlement available may borrow up to this limit and VA will guarantee 25 percent of the loan amount. If a Veteran has previously used entitlement that has not been restored, the maximum guaranty amount available to that Veteran must be reduced accordingly. Lenders should check their own investor requirements regarding guaranty amounts and down payments.

Questions about VA loans in a particular county may be directed to the VA Regional Loan Center of jurisdiction.

NOTE: For all counties not listed below, the limit is $484,350.

Regional loan center contact information is below this chart.

| STATE |

| DENVER |

Regional Loan Center Info:

ClevelandDepartment of Veterans AffairsVA Regional Loan Center1240 East Ninth StreetCleveland, OH 44199

What Will Not Pass A Va Appraisal

Insufficient Heating Homes that do not have adequate heating systems will never pass the VA appraisal. For this reason, homes that employ the use of a wood stove as the main heat source must have a secondary heating system that can maintain a minimum temperature of 50 degrees in plumbing areas of the home.

Recommended Reading: How To Transfer A Car Loan To Someone Else

When Do Va Loan Limits Apply

Service members and veterans who have one or more active VA loans, or who have defaulted on a VA loan, will still be subject to loan limits.

For a single-family residence in a typical U.S. county, the limit in 2021 is $548,250. Thats the maximum a VA loan borrower subject to the limit can finance for no money down in those counties.

Higher limits are established in high-cost areas, such as Honolulu, New York and San Francisco counties, where the one-unit residential limit in 2021 is $822,375.

Is A Va Loan Worth It

If you stack up a VA loan against a conventional mortgage, youll see that despite the benefits, when it comes to the cold hard cash, youre best going with a conventional loan!

Youd have a better interest rate at around 3.6%, and you would also have no PMI.8 And youd really see the savings when you looked at the interest paid over the life of the loan.

So, what if you decided to save up a 20% down payment on a $200,000 home and went with a 15-year fixed-rate conventional mortgage instead?

Lets compare the numbers. Well use a current interest rate on a 15-year VA loan of around the 4% mark.9

| DESCRIPTION |

| $208,156 |

With a 15-year fixed-rate conventional loan, your total interest paid is $48,156thats almost $20,000less than what you would pay in the VA loan example!

When you factor in the loan amount, the funding fee, and the total interest paid, the entire cost of the VA loan is $272,013. So youre paying more over the course of the 15-year term compared to a conventional mortgage. Think of what you could do with all the money youd save!

The bottom line is this: VA loans are usually one of the most expensive ways to buy a home. If you have to take out a loan in order to buy a home, go with a 15-year fixed-rate conventional mortgage with a 20% down payment to avoid paying PMI. Outside of buying your home with cash, its the best way to go.

About the author

Ramsey Solutions

Recommended Reading: What Car Loan Can I Afford Calculator

What Does Full Entitlement To A Va Loan Mean

Full entitlement means you do not have an active VA loan and can use your full benefits when applying for a mortgage. You can have full entitlement if youve never used your loan benefit before, if youve paid off a previous VA loan and sold the house, or youve repaid the VA in full after a foreclosure or short sale.

When you have your full entitlement, your Certificate of Eligibility will say “This Veterans basic entitlement is $36,000.” When you have used your full entitlement, your COE will say “This Veterans basic entitlement is $0.”

What Are The Va Loan Limits

Technically, there are no limits on how much you can borrow with a VA loan. Instead, VA loan limits mark how much you can borrow without a down payment at closing, and even these limits only apply to homebuyers who dont have their full VA loan entitlement available.

If youre willing to put money down, you can take out a loan as large as you financially qualify for. There is a cap on what the Department of Veterans Affairs will insure or how much the VA will pay back a lender if you default on your loan. As long as you have your full entitlement , the VA will back a quarter of your loan amount, with no limits.

If you have less-than-full entitlement, on the other hand, there will be a limit on how much you can borrow. These limits will depend on the conforming loan limits for your county.

Also Check: How To Transfer A Car Loan