How Fha Loan Limits Are Determined

Where do these limits come from? How are they determined?

These are two of the most common questions we receive from mortgage shoppers. Heres a quick overview, starting with the geographical nature of these caps:

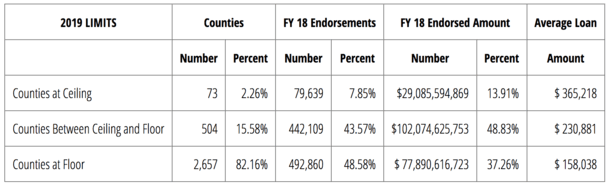

FHA loan limits are determined by the county where the home is located, except for properties that are located in metropolitan or micropolitan statistical areas. In metro areas, the limits are set using the county with the highest median home price within the metropolitan statistical area, according to HUD.

Thats the geographical aspect of it. The maximum lending amounts for this program are based on a percentage of conforming loan limits, which are set by the Federal Housing Finance Agency and are based on home prices. For instance, FHAs minimum national loan limit floor for low-cost areas is typically set at 65% of the national conforming amount for the U.S.

Heres what home buyers and mortgage shoppers need to know:

The 2022 FHA limits vary from one county to the next. They are based on the Home Price Index and get updated or at least reviewed every year. They were increased from 2021 to 2022 in most counties, to account for home-price gains that occurred during the previous year. To find the current and complete loan limits for your area, you can conduct a database search on the HUD website via the link below.

https://entp.hud.gov/idapp/html/hicostlook.cfm

What Are The Current Fha Loan Limits

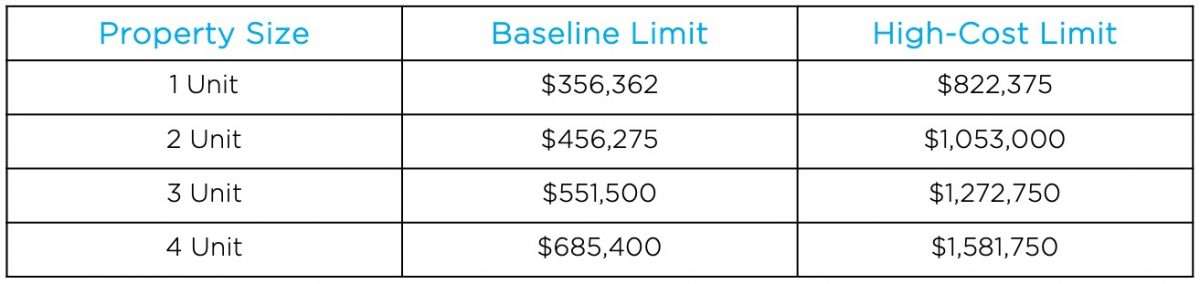

FHA loans may be used to purchase a primary residence, but you arent limited to a single family home. FHA loans can be used to purchase homes of up to four units, says Andrina Valdez, chief operating officer of Houston-based Cornerstone Home Lending.

In addition to the propertys location, the number of units will also impact the loan limit. Below the standard limit and maximum limit for high-cost areas are listed, although some areas of the country have limits that fall in between these two.

| Number of Units |

|---|

How Does An Fha Loan Work

The Federal Housing Administration doesnt actually lend money to homebuyers. Instead, it guarantees loans, making lenders less wary of extending mortgages and helping more Americans build equity in a home of their own. When you shop around for an FHA loan youre really shopping for an FHA-backed loan.

Recommended Reading: Usaa Loan Refinance

What Is The Fha

The Federal Housing Administration better known as the FHA has been part of the U.S. Department of Housing and Urban Development since 1965. But the FHA actually began more than 30 years before that, as a component of the New Deal.

In addition to a stock market crash and the Dust Bowl drought, the Great Depression saw a housing market bubble burst. By early 1933, roughly half of American homeowners had defaulted on their mortgages.

The FHA was created as part of the National Housing Act of 1934 to stem the tide of foreclosures and help make homeownership more affordable. It established the 20% down payment as a new norm by insuring mortgages for up to 80% of a home’s value previously, homeowners had been limited to borrowing 50%-60%.

Today, the FHA insures loans for about 8 million single-family homes.

» MORE: Facts about FHA home loans

How Does This Affect Reverse Mortgages

In addition to handling FHA loans, the FHA also is responsible for insuring conforming home equity conversion mortgages, more commonly referred to as reverse mortgages.

Reverse mortgages do not vary by county and have one set limit across the U.S. The FHA raised the limits on reverse mortgages from $822,375 in 2021 to $970,800 in 2022.

Rocket Mortgage® doesnt currently offer reverse mortgages, but a cash-out refinance could be a great alternative.

Recommended Reading: Transferring Car Loan To Another Person

Calculated And Updated Annually

The FHA sets annual lending limits for home loan amounts that it will insure. These limits are determined based on the county in which you live and the type of property you’re purchasing. Low-cost areas of the country have a lower limit, known as the “floor,” and high-cost areas have a higher figure, called the “ceiling”. It’s not uncommon for the ceiling loan limit to be more than double the floor for single-family properties.

The limits also vary based on the type of property. For instance, Houston, TX loan limits for duplexes can be almost 30% higher than for a single-family home. That number increases to more than 50% for a triplex.

How Fha Loan Limits Work

Not every future homeowner can find easy financing or qualify for a conventional loan. An FHA loan is a mortgage that is backed by the Federal Housing Administration, which operates under the Department of Housing and Urban Development. The FHA also insures these loans, meaning they protect your lender from loss in the case that you default on the loan.

Generally, FHA loans appeal to first-time home buyers and people with less than desirable credit since they offer low down payments and accept people with lower credit scores. However, you are required to pay mortgage insurance for them.

In addition, FHA loans come with maximum loan limits that cap how much you can borrow. The FHA uses two crucial factors to determine these limits: the propertys location and the type of property .

While both FHA and conventional loans have limits, they are different. During 2021, conventional loans for a one-unit family home have a $647,200 limit in the lower 48 states. Alaska, Hawaii and high-cost areas have a loan limit of $970,800.

The FHAs low-cost area limits are set at 65% of the nations conforming limit for a one-unit property and 150% of the nations conforming cap for high-cost areas. Thats a low of $420,680 and a high of $970,800, respectively, for a one-family unit.

Recommended Reading: Bayview Loan Servicing Loan Modification

You Might Not Qualify For The Maximum Loan Amount

The FHA loan limits are just one part of the equation. In other words, just because the FHA is willing to guarantee a $1.5 million-dollar home loan in your area doesn’t necessarily mean that you can qualify to borrow that much.

Lenders consider a few different factors when determining how much you can borrow, with debt-to-income ratio, or DTI, being chief among them. This is your monthly debt obligations divided by your pre-tax monthly income, expressed as a percentage. For example, if your monthly payment obligations are $2,000 per month and you earn $5,000, your DTI is 40%.

Your DTI — and thus the maximum loan limit — will be influenced by the following factors:

- Your income.

- The interest rate on your FHA loan.

- Your expected property taxes, insurance, and homeowners association fees on your new home.

- Your lender’s maximum DTI ratio .

- The FHA home loan limit in your area.

Keep in mind that there are two types of DTI ratios. The front-end DTI is the percentage of your income that will go toward your mortgage payment. The back-end DTI is the percentage of your income that will go toward all of your monthly obligations, including your mortgage payment.

While many lenders have front-end DTI maximums for FHA loans, the back-end DTI ratio is the more important of the two when it comes to loan approval, so expect a lender to look at your other debt payment obligations closely.

If Theyre So Great Why Doesnt Everybody Get An Fha Loan

When interest rates are low across the board and credit requirements are loose, homebuyers tend not to flock to FHA loans. Thats because they can get favorable interest rates with low down payment requirements from any old lender, and pay less in insurance over the life of the loan.

But when banks boost their down payment, income and credit requirements, as they did after the financial crisis, the popularity of FHA loans rises. Basically, when it is more difficult to get a conventional loan, FHA loans become more popular.

More from SmartAsset

You May Like: Usaa Refinance Car Loan

Do I Need A Jumbo Loan

There are always cases where potential homebuyers want to a purchase a house that exceeds the FHA’s loan limit for that county. In this case, FHA Jumbo Loans come into play.

Jumbo loans are mortgages which exceed the FHA’s county limit for home loans in a given zip code. When a lender approves a jumbo loan, they are essentially taking on an even greater risk. That’s why the FHA has a more stringent set of requirements for borrowers looking to apply for such a large loan.

Instead of the FHA’s established minimum credit score of 580, the minimum for a jumbo loan is 600, and 640 for refinances. Additionally, jumbo loan borrowers cannot receive down payment assistance the FHA mandates that the minimum 3.5% down payment is paid with the homebuyer’s own funds to ensure there are sufficient financial resources to cover closing costs.

An FHA Jumbo Loan might require two separate appraisals if the market is declining or the borrower is making a down payment of 5% or less. It is also important to note that FHA jumbo loans typically have higher interest rates than conventional jumbo loans. Keep in mind that FHA lending limits vary by area, which means what constitutes a Jumbo Loan in one county isn’t the same as another.

Rising Home Prices Bring Higher Limits

Each year, the Department of Housing and Urban Development reviews the FHA loan limits for counties across the country and compares them to median home prices. Sometimes the limits are increased from one year to the next, to keep up with home price appreciation. Thats what happened from 2021 to 2022 with FHA loan limits in Washington State.

In December 2021, the HUD announced that it would be increasing Washington FHA loan limits for 2022.

These changes are a direct response to the significant home-price gains that occurred during 2021. In Washington State, house values have risen steadily in recent years. According to the real estate information company Zillow, the median home price for the state rose by 22.8% from October 2020 to October 2021 to $555,943 according to Zillow. As a result, FHA loan limits for Washington State has gone up for 2022.

Check out our mortgage loan limit tool for conventional, FHA, and VA loans.

Also Check: Fha Title 1 Loan Lender

How To Qualify For An Fha Loan

To qualify for an FHA loan, youll need to apply with an FHA-approved lender.

Although FHA guidelines are more flexible than those for conventional loans, there are several steps you can take to boost your chances of approval.

- Check your credit score. The minimum credit score for an FHA loan with a 3.5% down payment is 580.

- Figure out how much down payment you can afford. Youll need a 3.5% down payment to qualify for an FHA loan if your credit score is 580 or higher. If its between 500 and 579, youll need to put down 10% and find a lender that allows credit scores that low..

- Check 2021 FHA loan limits in your area. Loan approval will depend on your financial circumstances, but knowing the loan limits can set realistic expectations for how much you might be able to borrow.

- Review your employment history. Most lenders require two years of steady employment to approve a loan, although FHA is more lenient in most cases. Organize documents such as pay stubs and tax forms so your lender can verify your employment.

- Calculate your debt-to-income ratio. FHA lenders generally require that your total monthly debts are less than 50% of your gross monthly income.

- Get preapproved with an FHA lender. Prequalification lets you know if the bank will approve you for a loan and gives you an idea of how much house you can afford.

Fha Loan Limits By Property Type

FHA loan limits vary by property type. They are lowest for one-unit properties, increase for two-unit properties, increase again for three-unit properties and max out for four-unit properties.

If you want to use an FHA loan to buy a duplex, the limit will be higher than if you want to use an FHA loan to buy a single-family house. And you can, in fact, use an FHA loan to buy a multi-unit property, up to four units, as long as you live in one of the units as your primary residence.

Also Check: Is Prosper A Legit Company

How To Apply For An Fha Loan

Applying for an FHA loan will require personal and financial documents, including but not limited to:

-

A valid Social Security number.

-

Proof of U.S. citizenship, legal permanent residency or eligibility to work in the U.S.

-

Bank statements for, at a minimum, the last 30 days. You’ll also need to provide documentation for any deposits made during that time .

Your lender may be able to automatically retrieve some required documentation, like credit reports, tax returns and employment records. Special circumstances like if you’re a student, or you don’t have a credit score may require additional paperwork.

» MORE: Detailed FHA loan requirements

Paying Off An Fha Loan:

When you go to payoff a FHA loan, under the old FHA loan limits in California and the new limits for 2021, youll owe daily interest. Unlike Conforming loans, youll owe daily interest for the entire month no matter what day you close. For Conforming loans, youll only owe interest to the day your loan is paid off.

So if you are selling your home or if you are refinancing your current mortgage, and you have a FHA loan, youll want to close and payoff the original FHA mortgage at the end of the month .

You May Like: Auto Loan Usaa

Fha Loan Income Limits & Affordability

One of the most serious issues in real estate concerns is the matter of affordability. The fact is that property values are generally rising faster than incomes. Thats good news for real estate owners but a considerable concern for those looking to buy a home.

Heres what we know.

- Where you live impacts affordability. A study by ATTOM Date Solutions found that in the first quarter median home prices were not affordable for average wage earners in 335 of 473 U.S. counties analyzed in the report .

- Home values have generally been rising. According to the National Association of Realtors , median buyers typically paid $249,500 for a home in February 2019. Thats the 84th straight month of year-over-year gains.

- While home prices have generally been rising they have not been rising universally. Another NAR study shows that single-family home prices increased in 163 out of 178 metropolitan statistical areas in the fourth quarter . That also means home values were steady or actually fell in 15 metro areas. And, as we know from the great recession of 2006 – 2008, no one can promise that home values will increase tomorrow or at all.

- While home prices have generally been rising incomes have not. There has been little or no real income growth for most people for decades, says billionaire Ray Dalio. He explains that prime-age workers in the bottom 60% have had no real income growth since 1980.

Fha Loans And Credit Score

There are a lot of factors that determine your , including:

- The type of credit you have

- Whether you pay your bills on time

- The amount you owe on your credit cards

- How much new and recent credit youve taken on

If you have a higher score, you might be able to qualify with a higher debt-to-income ratio, or DTI. DTI refers to the percentage of your monthly gross income that goes toward paying debts. Your DTI is your total monthly debt payments divided by your monthly gross income . This figure is expressed as a percentage.

To determine your own DTI ratio, divide your debts by your monthly gross income. For example, if your debts, which include your student loans and car loan, reach $2,000 per month and your income is $8,000 per month, your DTI is 25%.

The lower your DTI, the better off youll be. If you do happen to have a higher DTI, you could still qualify for an FHA loan if you have a higher credit score.

The FHA states that your monthly mortgage payment should be no more than 31% of your monthly gross income, and that your DTI should not exceed 43% of monthly gross income in certain circumstances if your loan is being manually underwritten. As noted above, if you have a higher credit score, you may be able to qualify with a higher DTI.

You May Like: Usaa Rv Interest Rates

Why Do Fha Loan Limits Matter

FHA-insured mortgages offer many benefits, particularly for first-time homebuyers.

- FHA loans can be easier to qualify for than conventional loans. Lenders might be more willing to lend to you because the FHA insures your mortgage. It makes them feel protected in the event of a default.

- FHA loans are available to those with less-than-perfect credit. Even if you have had credit problems in the past, such as a bankruptcy, you might be eligible for an FHA mortgage even when you wouldn’t qualify for a conventional loan.

- FHA mortgages require down payments of just 3.5 percent a much lower down payment than conventional loans require. Your down payment can come from a family member, employer or charitable organization as a gift. Other loan programs do not treat gifts for down payments so liberally.

- FHA mortgages offer competitive interest rates.

The FHA is not a lender. It does not lend to buyers directly, nor does it establish the interest rates on FHA loans. That’s why it’s essential to shop around and compare mortgage interest rates and terms from different lenders.

But interest rates are not the only terms that matter. The loan limits are especially important as well because they determine the upper limit on how much you can borrow, which influences the maximum price of the house you buy.