Fha Mortgage Insurance Vs Pmi For Conventional Loans

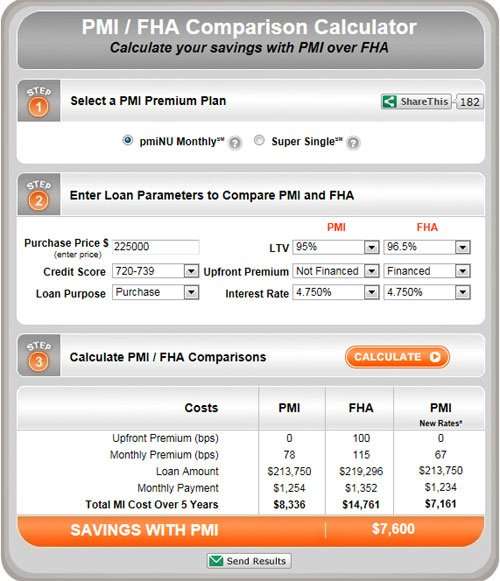

There are a few significant differences between FHA mortgage insurance premiums and PMI for conventional loans. Conventional PMI is calculated using the loan amount, credit score and LTV as the main factors in determining your monthly PMI payment. Here are some other things to know:

PMI can be cancelled or removed if you pay the balance down below 80% of the original appraised value. If you forget, the lender is required to do it automatically once it reaches 78%.

The PMI monthly insurance payment will likely be more than FHA mortgage insurance , but it is not enforced for the life of the loan.

In our example above with the $243,500 purchase and $235,000 loan amount, the monthly PMI payment would be $236.96 versus $166.46 for the FHA mortgage insurance. We used theMGIC calculatorto determine the PMI payment.

Fha Mortgage Insurance Costs

There are two components to FHA mortgage insurance. First, theres an upfront mortgage insurance premium of 1.75% of the total loan amount. So if you borrowed $150,000, youd be required to pay an upfront fee of $2,625.

Youre also required to pay an annual mortgage insurance premium of 0.45% to 1.05% of the loan amount, depending on a few factors.

Wait Until Your Loan Reaches Its Midpoint

The HPA requires a mortgage lender to drop PMI when a mortgage balance hits 78 percent of the homes original purchase price as long as the borrower is in good standing. They are also required to do so at the halfway point of the amortization schedule. Those with a 30-year loan will reach the midpoint after 15 years. Even if the mortgage balance has not risen to 78 percent at this point, the lender must still cancel the PMI in what is known as final termination.

Also Check: How To Calculate Amortization Schedule For Car Loan

How To Get Rid Of Fha Pmi

Based on the current rules for case numbers on or after June 3, 2013, a borrower cannot request that a lender remove FHA PMI. But, if the loan meets the 11 year cancellation, the lender must remove the mortgage insurance at that time. So, to answer this question how to get rid of FHA PMI, a borrower must have one of the following scenarios:

Can You Negotiate Out Of Pmi

Whether you have an FHA loan or a conventional loan, mortgage insurance is ordinarily not negotiable. With conventional loans, your PMI rate is partially dependent on your credit, so optimizing your credit score may lower your payments. Otherwise, mortgage insurance is automatically determined based on your loan amount, loan term, and LTV.

Read Also: What Car Loan Can I Afford Calculator

Us Department Of Veterans Affairs Home Loans

A benefit of employment in the U.S. armed services is eligibility for a VA loan. VA loans do not require a down payment or monthly mortgage insurance.

Key Takeaways

VA Loan Insurer

The VA pays most of the cost for insuring VA loans. The VA limits the amount it will insure based on the location of the home.

VA Loan Insurance Cost

Most VA borrowers pay an upfront funding fee. The fee ranges from 1.25 percent to 3.3 percent of the loan amount, depending on the borrowers category of military service, down payment percentage and whether the loan is the borrowers first VA loan. The fee can be paid in cash or financed.

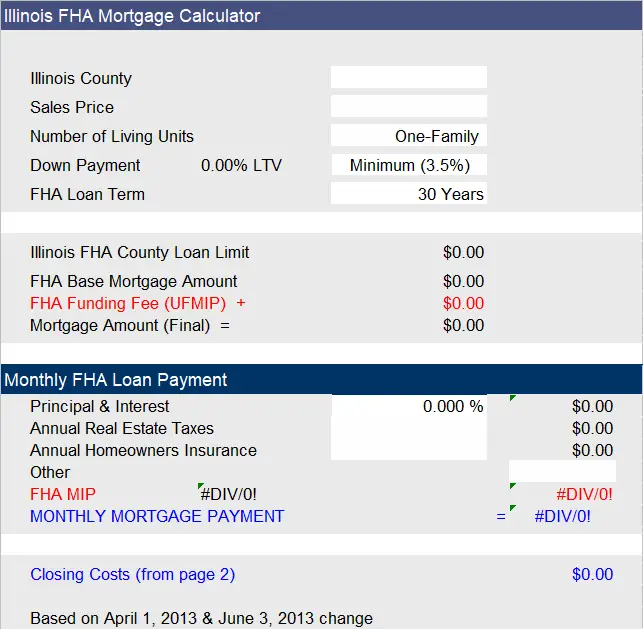

How To Calculate Mortgage Insurance On An Fha Loan

Related Articles

Federal Housing Administration loans are generally easier to get because of the low down payment requirements and relatively relaxed qualifying guidelines. In exchange for this flexibility, however, borrowers pay a premium known as mortgage insurance. The FHA’s mortgage insurance premium is an annual fee you remit with each mortgage payment for at least the first several years of your loan.

Tip

You can calculate the annual mortgage insurance premium and installment by using a base loan amount and the latest mortgage insurance premium rate published by the Department of Housing and Urban Development, which oversees the FHA’s loan programs.

You May Like: Do Pawn Shops Loan Money

Fha Mortgage Insurance Premium

If you cant qualify for a conventional loan product, you might consider an FHA loan. Like some conventional loan products, FHA loans have a low-down payment optionas little as 3.5% downand more relaxed credit requirements.

Lenders require mortgage insurance for all FHA loans, which are paid in two parts: an up-front mortgage insurance premium, or UFMIP, and an annual mortgage insurance premium, or annual MIP. Both costs are listed on the first page of your loan estimate and closing disclosure.

How To Get Rid Of Pmi Mip On An Fha Loan

An FHA loan sounded like a good idea at the time.

But now that youre paying high mortgage insurance premiums, month after month and year after year, you might not be so sure. In fact, someone with a $250,000 FHA loan can expect to pay about $30,000 in mortgage insurance premiums over the life of the loan.

The good news is you can cancel your FHA mortgage insurance and you can start today.

There are two methods for removing your FHA mortgage insurance, commonly known as FHA MIP.

Don’t Miss: Do Loan Officers Make Commission

How Much Does Fha Mortgage Insurance Cost

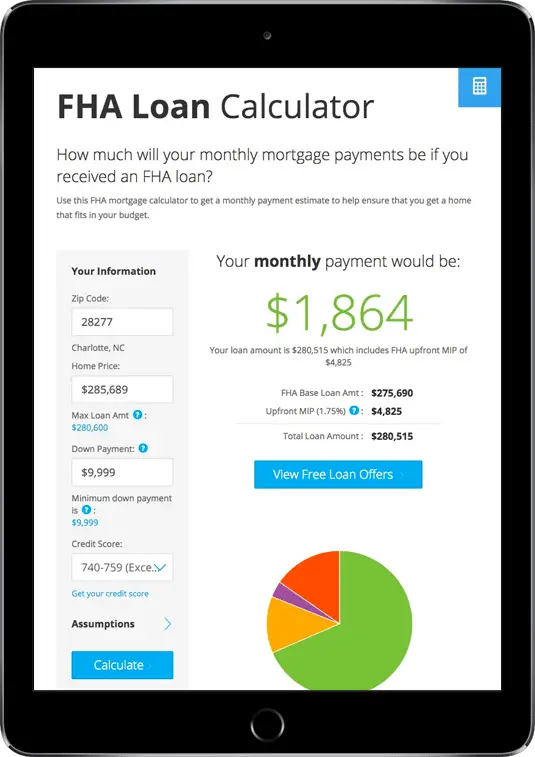

FHA mortgage insurance involves two components: an upfront mortgage insurance premium and an annual mortgage insurance premium .

The upfront premium is paid when the borrower gets the loan. The borrower doesnt pay the fee immediately or in cash. Instead, the premium is added to the borrower’s loan amount. The current FHA upfront premium is 1.75 percent of the loan amount.

Loan amount: $200,000UFMIP: 1.75 percent or $3,500Loan amount with UFMIP included: $203,500

The down payment percentage is based on the loan amount without the UFMIP, so a minimum 3.5 percent down payment would still be $7,000, not $7,122.50.

How Long Do You Have To Buy Private Mortgage Insurance

Borrowers can request that monthly mortgage insurance payments be eliminated once the loan-to-value ratio drops below 80%. Once the mortgage’s LTV ratio falls to 78%, the lender must automatically cancel PMI as long as you’re current on your mortgage. That happens when your down payment, plus the loan principal you’ve paid off, equals 22% of the home’s purchase price. This cancellation is a requirement of the federal Homeowners Protection Act, even if your homes market value has gone down.

Read Also: What Is The Maximum Fha Loan Amount In Texas

How Fha Mortgage Insurance Works

An FHA loan is a certain type of mortgage thats backed by the Federal Housing Administration. Its designed to help prospective homeowners who wouldnt otherwise qualify for an affordable conventional loan, especially first-time homebuyers. FHA loans are available to borrowers with credit scores of at least 500. Its possible to put as little as 3.5% down with a credit score of at least 580, otherwise a down payment of at least 10% is required.

Unlike private mortgage insurance, FHA mortgage insurance is required on all FHA loans regardless of the down payment amountand cant be cancelled in most cases.

Currently, if you put down less than 10% on an FHA loan, youre required to pay mortgage insurance for the entire length of the loan. If you put down 10% or more, the mortgage insurance can be removed after 11 years of payments.

Pmi: A Necessary Evil

Like many these days, I bought a home in an expensive coastal city, with expensive coastal listings and I only put 10% down instead of the standard 20%. I did this intentionally so I’d be able to more easily afford remodeling the condo I bought.

Unfortunately, since that meant I had less than 20% equity in the home, I had to settle for PMI as well. This ended up costing $120 a month it didn’t break the bank but it wasn’t pleasant, either. I certainly wasn’t the first with PMI, either. It’s a necessary evil in cities like Seattle, San Francisco and New York with expensive housing and competitive markets. I wish I had known the techniques for avoiding PMI that I know now, but you live and learn. One thing is for certain: from the moment I started paying PMI I was wondering how to get rid of PMI insurance.

Don’t Miss: Minimum Credit Score For Rv Loan

Determine Your Loan Amount

The FHA caps the amount you can borrow based on your geographic area. FHA loan limits depend on home prices in a given county or area, which can vary widely and are subject to change each year. For example, you could borrow only up to $294,515 in low-cost areas of the country as of the time of publication, and up to $679,650 in high-cost areas, such as the San Francisco Bay Area. You can find your area’s maximum loan amount by using HUD’s website search tool. The exact loan amount you qualify for depends on how much you can afford based on your debt and income. Maximum loan limits simply establish the highest amount you can borrow in a given area using an FHA loan.

Pay Down Your Current Mortgage Balance

If you’re planning to refinance your home but the current LTV is over 80%, consider paying off more of your mortgage balance first. If your mortgage servicer doesn’t penalize you for prepayments, you can consider paying off more of your mortgage right away. Otherwise, you may have to wait until you’ve made a few more monthly payments.

Read Also: How To Transfer Car Loan To Another Person

How I Knew I Could Start Getting Rid Of Pmi

In my case, I knew I would have to get an appraisal. The moment i remodeled my condo , I started the PMI removal process by contacting Wells Fargo directly. They pointed me to an approved appraiser who valued the home at juuust over the number I needed to meet the 80% LTV value and have my PMI removed. .

The total cost was around $600, which equates to about a year of PMI payments. But, it would have been 4-5 more years before PMI was removed automatically, so I saved thousands overall.

If you didn’t type in your numbers into the calculator above, give it a go. Dont know your numbers? No problem.

You can track your homes value for free with Personal Capital. Simply enter your home as a new asset, and then you will see its Zillow Z-estimate displayed as below. Enter your mortgage as a separate account for the full picture. Then, enter the values you see on your Personal Capital dashboard into the Current Value field in the calculator above.

Use Personal Capital to keep track of your home equity, along with the rest of your investments

So, can you remove your PMI?

Va Loans Offer No Money Down & No Monthly Pmi

For current service members, Veterans, or surviving spouse, VA home loans are tough to beat. Combined with no money down, fixed interest rates, and no monthly PMI, it creates quite the affordable option for a buyer. Furthermore, VA is the only loan that offers the ability to waive the funding fee. Veterans who are considered 10% or more disabled by VA are not charged the VA funding fee. Otherwise, most VA funding fees are more expensive than FHA, but they are financed like FHA.

Don’t Miss: What Car Loan Can I Afford Calculator

Canceling Mip On Fha Loans

Depending on when you applied, FHA guidelines may allow for MIP to be canceled if you:

- Applied between January 2001 and June 2013: Please contact us when you meet all three of the following conditions, and we will review your loan for MIP removal eligibility:

- Applied after June 2013: If your original loan amount was less than or equal to 90% LTV, MIP will be removed after 11 years.

- Closedbetween July 1991 and December 2000

- Closed before December 28, 2005 on a condo or rehabilitation loan

- Applied after June 2013 and your loan amount was greater than 90% LTV

Calculate Your Equity To Get Rid Of Pmi

I’ll be right up front with it. PMI is the biggest ripoff in real estate… but not necessarily for the reason you’d think. PMI itself makes sense. If you can’t pay for a standard 20% down payment, your bank will make you pay for PMI to insure their loan against default. So, PMI is a reasonable concept overall, but it’s still a huge ripoff.

After the price appreciation since 2012, millions of homeowners have more than 20% equity in their home and could have their PMI removed or refinance into a new loan without PMI. But… they’re still paying it. Use this PMI removal calculator to see if you can remove yours.

If one of the bars turns green and says “Yes”, you should be able to remove your PMI. If they are both red, you’ll see how much more equity you have to build before it can be removed. Here it is, the remove PMI calculator, or more accurately, the “When can I get rid of PMI calculator”.

Hopefully, you can remove your private mortgage insurance PMI? Or, refinance into a loan without PMI? Or, at least you have some better context for when does PMI go away? Or, when PMI will be eliminated based on the current value of your home. I’ll let you know how to actually go about removing your mortgage insurance premiums below, but I wanted to add a little context from my mortgage insurance experience first.

You May Like: Can You Use A Va Loan To Buy Land And A Manufactured Home

To Get Rid Of Fha Mortgage Insurance: Check Your Loan Balance

You can request the cancellation of your FHA mortgage insurance when you meet certain requirements.

If you bought a house with an FHA loan some years back, you may be eligible to cancel your FHA PMI today. This option is attractive because it wont require you to get a new mortgage. If your loan balance is 78% of your original purchase price, and youve been paying FHA PMI for 5 years, your lender or service must cancel your mortgage insurance today by law.

While a low mortgage balance is a sure-fire way to cancel FHA mortgage insurance, it can take a while to get there. On a 30-year fixed FHA loan, it will take you about ten years to pay your loan down to 78% of the original purchase price. If youre not quite there, continue making payments for a few more years, or make a one-time principal payment.

Borrowers who have hit the magical 78% loan-to-value ratio can potentially start saving hundreds on their monthly payments and keep their existing FHA loan and interest rate intact.

Making A Plan To Get Rid Of Fha Mortgage Insurance Is A Great Financial Decision

When youre youre making a home purchase, youre mainly focused on getting into a place where you can set down roots and build a solid future. The down payment can be a big hurdle so high FHA PMI costs can be a worthwhile trade-off.

But now youre settled in, its time to think about getting rid of FHA mortgage insurance. These high monthly PMI payment costs could and should be going into savings, a childs college fund, or toward loan principal.

Dont delay. Even if youre not able to cancel your mortgage insurance now, make a plan for how youre going to do it.

Ten or twenty years down the road, youll be glad you did.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Fha’s Mortgage Insurance Premium Through The Years

The FHA has changed its MIP multiple times in recent years. Each time the FHA raised its MIP, FHA loans became more expensive for borrowers. Each increase also meant some prospective borrowers weren’t able to qualify for or afford the higher monthly mortgage payments due to the MIP.

In January 2015, the FHA reversed course and cut its MIP to 0.85 percent for new 30-year, fixed-rate loans with less than 5 percent down. The FHA projected that this decrease would save new FHA borrowers $900 per year, or $75 per month, on average. The actual savings for individual borrowers depends on the type of property they own or purchase, their loan term, loan amount and down payment percentage.

Changes in FHA’s MIP apply only to new loans. Borrowers who’ve closed their loans don’t need to worry that their MIP will get more expensive later.

- Company

How Does Mip Work

If you have an FHA loan, you pay a portion of the premium up front at the close of the loan and then continue to pay mortgage insurance premiums on a monthly basis. The upfront premium is always 1.75% of the loan amount. If you cant afford to pay this at closing, it can be financed into your loan amount.

In addition to the upfront premium, theres an annual premium thats based on your loan type as well as your down payment or equity amount. If you have a standard FHA loan with a 3.5% down payment on a loan of no more than $625,500, the annual MIP is 0.85% broken into monthly payments.

If you have an FHA Streamline where you go from one FHA loan to another for the purpose of lowering your rate and/or changing your term, the MIP rates are a little better. In this case, theres an upfront rate of 0.01% of your loan amount and an annual MIP rate of 0.55%.

Don’t Miss: Does Va Loan Work For Manufactured Homes