Where Should I Go If I Have Questions

For detailed information on the application, Covered Periods, the type of costs that are eligible for forgiveness and what documentation you will need to submit in connection with your application, please visit the U.S. Treasury and SBA websites.

For additional assistance with PPP loan forgiveness documentation, view our documentation guide.

Why Are Forgiveness Applications Not Widely Available Right Now

When the second stimulus bill rolled out on December 27, 2020, big changes were made to the Paycheck Protection Program. This included:

- A simplified PPP forgiveness application form for loan amounts of $150,000 or less.

- New forgivable expenses such as operational expenses, supplier costs, and property damages related to 2020 riots or public disturbances.

- A second draw PPP loan for businesses needing additional funding.

Both the SBA and lenders need time to update their forgiveness application process to account for these changes.

Will A Borrowers Loan Forgiveness Amount Be Reduced If The Borrower Reduced The Hours Of An Employee Then Offered To Restore The Reduction In Hours But The Employee Declined The Offer

No. In calculating the loan forgiveness amount, a borrower may exclude any reduction in full-time equivalent employee headcount that is attributable to an individual employee if:

Also Check: Can I Refinance My Car Loan With The Same Lender

Can I Use Ppp Fund To Pay Employees Who Are Not Currently Able To Work Due To Business Being Closed Or For Any Other Reason

Yes.

If you are not able to operate or are operating at a limited capacity when the PPP loan proceeds are received, you may choose to pay employees who are not able to work. This may help you maximize loan forgiveness, as current SBA guidance states that at least 60% of loan forgiveness must be attributable to payroll costs.

Ppp Loan Forgiveness Deadlines When Is The Last Day To Apply For Ppp Loan Forgiveness

To know the PPP loan forgiveness deadlines you also need to know when is the last day to apply for PPP loan forgiveness? The correct question you should be asking yourself is, When is the last day to apply for PPP loan forgiveness without having to start paying the loan to the bank? In this video we are going to show you how to determine the PPP loan forgiveness due date.

DISCLAIMER

This video is intended for education purposes and should not be taken as legal, financial or tax advice. You should consult with a professional about your unique situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc., Freedom Insurance Financial Inc., Freedom Realty Source Inc., and Freedom Immigration International Inc. are providing educational content to help small business owners and individuals become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc., Freedom Insurance Financial Inc., Freedom Realty Source Inc., and Freedom Immigration International Inc. or its members cannot be held liable for any use or misuse of this content.

Transcript

Hello from freedom tax accounting, we are an accounting firm where we have been providing quality tax and accounting services now for over 20 years. If youre new to this channel, we provide strategies for small business owners so they can achieve their financial goals.

You May Like: What Credit Bureau Does Usaa Use For Auto Loans

Ppp Loan Forgiveness Calculation Form

Now that the calculations in the worksheets are completed, you should be able to fill out the rest of the application. Well go back to page 1 of the application.

First youll fill out some basic information about your business:

This information should be straightforward, and you will generally use the information you used to apply unless it has changed from the time you applied.

If this is your first PPP loan, check the box that says First Draw PPP Loan. If its your second PPP loan, check the box that says Second Draw PPP Loan.

Note: You must submit a forgiveness application for your first PPP loan before, or at the same time, as the second draw forgiveness application is submitted.

SBA PPP Loan Number: ________________________

This is the number assigned by the SBA to your loan. If you dont have it, ask your lender.

Lender PPP Loan Number: __________________________

Enter the loan number assigned to the PPP loan by the Lender. Again, if you dont know, ask your lender.

PPP Loan Amount: _____________________________

This is the amount you received.

PPP Loan Disbursement Date: _______________________

Again, this is when the funds were deposited in your bank account. If you received more than one disbursement, use the date of the first one.

Employees at Time of Loan Application: ___________

Enter the total number of employees at the time of the Borrowers PPP Loan Application.

Employees at Time of Forgiveness Application: ___________

Covered Period: _________ to __________

How Long Does It Take To Receive A Decision On Forgiveness

The lender has 60 days from the time they receive a complete forgiveness request to make a decision and pass it along to the SBA. The SBA, in theory, then has 90 days to make their decision. Early on, the forgiveness process even for smaller loans was taking a long time three months, often more. Lenders seemed not to have worked out all the kinks in their systems and processes, and the SBA was focused on processing loan applications, not forgiveness applications.

Forgiveness requests for loans under $2 million are moving much quicker now generally, just a few weeks to a couple of months. However, for loans over $2 million, the process is taking quite a bit longer. Until a few weeks ago, very few loans over $2 million had been approved for forgiveness by the SBA despite the fact that the forgiveness applications had been with the SBA for far longer than the 90-day review period specified by the CARES Act. Over the last few weeks, however, we have seen several loans over $2 million now forgiven. The forgiveness process for loans over $2 million will likely continue to be longer than for the smaller loans, but we are hopeful that most will be processed within the prescribed 150-day window.

Read Also: Usaa Rv Loan Rates Calculator

How Does A Change In Ownership Affect My Ppp Loan Or Loan Forgiveness

If you are considering a change of ownership for your business, which could include a merger, asset sale, stock sale or transfer due to the death of a business owner, please notify Wells Fargo as far in advance of the change of ownership transaction as possible. You will need to request prior approval from Wells Fargo before you initiate the change of ownership and provide a copy of the proposed change of ownership agreement and other relevant documents. If you do not obtain prior approval of any change of ownership, it will be considered a default event and may affect your ability to apply for PPP loan forgiveness.

To contact us about a change in ownership if you are a Wells Fargo Business Online® user or a Wealth & Investment Management customer, please call 1-844-304-8911. If you are a Commercial Electronic Office® user, please contact your relationship manager for assistance. We will work with you to complete the process as quickly as possible, but we cannot make any assurances regarding the exact timing for completion of your request, due to the many variables involved.

Providing the requested documentation and responding to questions quickly ensures the best outcome. We anticipate that it will likely take a minimum of 30 days to fully complete the request. The timeframe will depend on our evaluation, your responsiveness during each step of the process, and applicable SBA requirements.

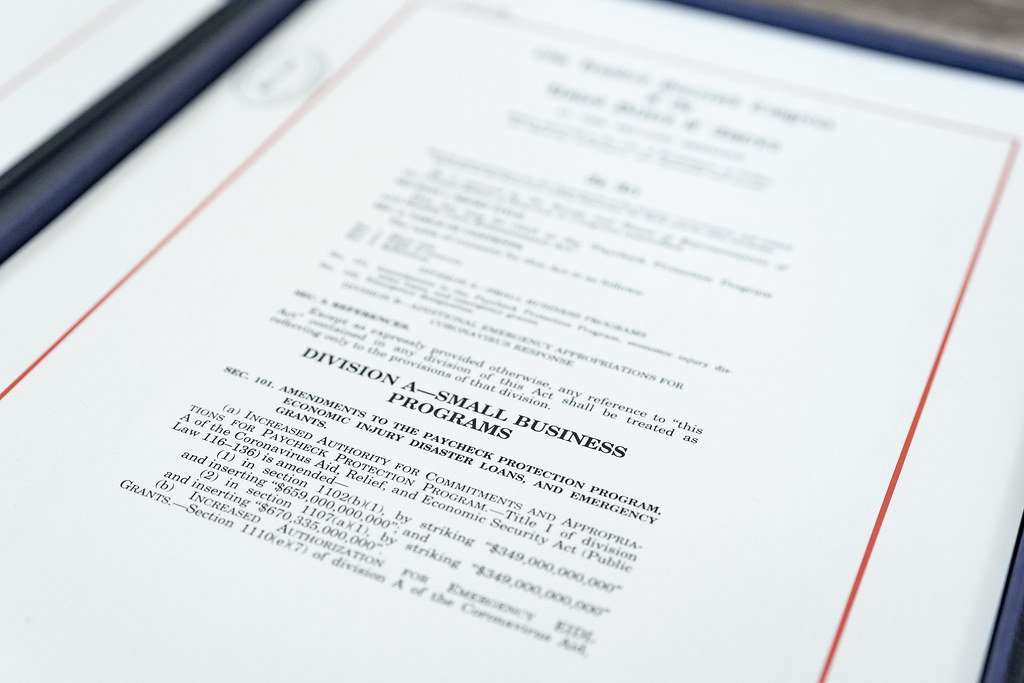

What Is The Paycheck Protection Program

The Paycheck Protection Program is a federal relief program established by Congress and implemented by the U.S. Treasury Department and the Small Business Administration with rules, requirements, protocols and processes that all participating lenders, including Bank of America, must follow.

The eligibility requirements are outlined for applicants on the U.S. Treasury and SBA websites.

Don’t Miss: Arvest Construction Loan

Ppp Loan Forgiveness Application Due Date

David Neuman, JD

If you received a PPP loan, and spent the funds properly, your loan is fully forgivable. Once you have used up the PPP loan funds, you should start the PPP forgiveness process.

In order for the PPP loan to be fully forgiven, the forgiveness application must be submitted within 10 months after the last day of the Covered Period.

Lenders will continue accepting PPP forgiveness applications so long as borrowers have PPP loans. Its highly recommended, however, that you apply for forgiveness before the first PPP loan payment is due.

PPP loans have a Covered Period of 8 or 24 weeks after the disbursement of the PPP funds. Once that Covered Period ends, your loan payments are deferred for 10 months. Simply put, you dont have to worry about making the first payment for approximately a year after the disbursement date.

If borrowers do not apply for forgiveness within 10 months after the last day of the Covered Period, then PPP loan payments and interest are no longer deferred, and borrowers will begin making loan payments to their PPP lender with loan terms of 1% interest on a two to five year term.

If you have received a PPP loan and have not yet started the PPP loan application process, please reach out to your LMC contact and they will put you in touch with our LMC PPP forgiveness team.

Are There Caps On The Amount Of Loan Forgiveness Available For Owner

Yes. Forgiveness is capped at 2.5 months worth of an owner-employee or self-employed individuals 2019 or 2020 compensation . The individuals total compensation may not exceed $100,000 on an annualized basis, as prorated for the period during which the payments are made or the obligation to make the payments is incurred.

For example, for borrowers that elect to use an eight-week covered period, the amount of loan forgiveness requested for owner-employees and self-employed individuals payroll compensation is capped at eight weeks worth of 2019 or 2020 compensation or $15,385 per individual, whichever is less, in total across all businesses. For borrowers that elect to use a ten-week covered period, the cap is ten weeks worth of 2019 or 2020 compensation or $19,231 per individual, whichever is less, in total across all businesses. For a covered period longer than 2.5 months, the amount of loan forgiveness requested for owner-employees and self-employed individuals payroll compensation is capped at 2.5 months worth of 2019 or 2020 compensation in total across all businesses.

Owner-employees with less than a 5 percent ownership stake in a C- or Scorporation are not subject to the owner-employee compensation rule.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

The Conditions Of The Paycheck Protection Program

Letâs first review the terms of using your PPP loan.

The funds from your PPP loan can be used for the following purposes:

-

Payrollâsalary, wage, vacation, parental, family, medical, or sick leave, health benefits

-

Mortgage interestâas long as the mortgage was signed before February 15, 2020

All expenses that fall under the above listed categories are eligible for forgiveness. The following conditions will also apply:

Sba Settles Confusion Over Ppp Forgiveness Application Due Date

The U.S. Small Business Administration released guidance Tuesday confirming that Paycheck Protection Program loan forgiveness applications are not due on Oct. 31.

Fears of a late-October PPP surprise came to the SBAs attention because the programs loan forgiveness application forms display an expiration date of 10/31/2020 in the upper-right corner. This prompted the SBA to release a new entry in its loan forgiveness frequently asked questions document answering the query, Is October 31, 2020, the deadline for borrowers to apply for forgiveness?

In its answer, found in Q& A No. 4 in the General Loan Forgiveness FAQs section, the SBA explains that borrowers may submit a loan forgiveness application any time before the maturity date of the loan, which is either two or five years from the loans origination, depending on the borrowers agreement. But the SBA also reminds borrowers that loan payments are deferred only until 10 months after the last day of each borrowers loan forgiveness covered period.

For example, the SBA wrote, a borrower with a covered period that ends Oct. 30, 2020, has until Aug. 30, 2021, to apply for forgiveness before loan repayment begins.

Also Check: Mortgage Loan Officer Salary Plus Commission

How Can I Get My Ppp Loan Forgiven

Small business owners were eligible for two roundsor “draws”of PPP loans. If you received more than one draw, you must submit a separate application for each loan you received. You qualify for full loan forgiveness if, during the eight- to 24-week covered period following each loan disbursement, you:

- Maintained employee and compensation levels

- Spent your loan proceeds on payroll costs and other eligible expenses

- Used at least 60% of the proceeds to cover payroll costs

You must also spend all of your PPP money before you submit a request for forgiveness.

An Sba Interim Final Rule Posted On May 8 2020 Provided That Any Borrower Who Applied For A Ppp Loan And Repays The Loan In Full By May 14 2020 Will Be Deemed By Sba To Have Made The Required Certification Concerning The Necessity Of The Loan Request In Good Faith Is It Possible For A Borrower To Obtain An Extension Of The May 14 2020 Repayment Date

Yes, SBA extended the repayment date for this safe harbor to May 18, 2020, to give borrowers an opportunity to review and consider FAQ #46. Borrowers did not need to apply for this extension. This extension was implemented through a revision to the SBAs interim final rule providing the safe harbor.

Womply is not a PPP lender, and is not in the business of providing legal or tax advice. We are a technology company offering a web platform designed to assist businesses access the PPP. Nothing on our website should be interpreted to mean that Womply can or will determine your eligibility or ineligibility for PPP, apply for a PPP loan on your behalf, check the accuracy, completeness, or lawfulness of your PPP loan application, help you skip legally required steps, accelerate your application with the SBA, or increase your chances of receiving funding. Womply is compensated by lenders, including for helping you apply with them. There are over 5,000 PPP lenders with whom you may choose to apply, for free. If you would like more details on other PPP options or program details, please visit sba.gov/ppp.

Also Check: Can You Transfer Car Payments To Another Person

First Draw Ppp Loan Forgiveness Qualifications

Your first Paycheck Protection Program loan is a First Draw PPP loan. According to the SBA, borrowers qualify for full loan forgiveness if the following was in place during the 8-24 weeks following the disbursement of loan funds:

- Employee and compensation levels are maintained,

- The loan proceeds are spent on payroll costs and other eligible expenses, and

- At least 60% of the proceeds are spent on payroll costs.

Have Money Left Over From Your Ppp Loan

If you have any funds left from your PPP loan that were not spent during the covered period, you can either return those funds to your financial institution or you can hold onto them with the understanding that you will need to repay them in accordance with your loan repayment schedule at a 1% interest rate.

Don’t Miss: How To Transfer Car Loan To Another Person

When Is My Application Due

After much confusion surrounding the actual due date, the SBA released this guidance to all who are in the process of submitting for loan forgiveness. Listed under FAQs, businesses will see that the SBA explains âborrowers may submit a loan forgiveness application any time before the maturity date of the loan, which is either two or five years from the loanâs origination, depending on the borrowerâs agreement.â Within this newly added guidance, the SBA also reminds borrowers âthat loan payments are deferred only until 10 months after the last day of each borrowerâs loan forgiveness covered period.â This was a relief to small businesses that began rushing to complete their applications, believing they needed to be submitted by the end of October 2020.

When Is Your Ppp Loan Forgiveness Application Actually Due

Many businesses applying for loan forgiveness were shocked when they saw an October 31st deadline listed on the upper right corner of their application forms. With so much uncertainty about the actual deadline, the Small Business Administration released extra guidance to ensure business owners had the right deadline dates expected to submit their loan forgiveness applications.

Recommended Reading: Va Loan Lenders For Mobile Homes

Forgiveness Applications Through Your Lender

You can submit a forgiveness application any time after your covered period ends. You dont have to wait the ten months.

There are three type of application forms:

- Form 3508S Used when the PPP loan amount was less than $150,000.

- Form 3508EZ Used when your headcount of employees didnt lessen by more than 25%. Also used if you couldnt regain your original staffing levels due to Covid-related health guidelines.

- Form 3508 You are operating at the same capacity.

Check with your lender for more details.

Image: Depositphotos

What Are The Terms And Interest Rate Of The Ppp Loan

The PPP loan will accrue interest at an annual rate of 1%. No payment is due during the deferral period, which ends the earlier of:

- The date when the SBA remits the amount of forgiveness on your loan or

- 10 months after the last day of your covered period, if you have not applied for forgiveness.

- If your loan is forgiven, any interest accrued during the deferral period is eligible for forgiveness.

After the deferral period any balance that is not forgiven will become a term loan. Monthly payments will be due up to the maturity date, which is generally:

- Two years from the date your loan was made if your loan received an SBA guarantee number before June 5, 2020 or

- Five years from the date your loan was made if your loan received an SBA guarantee number on or after June 5, 2020.

Read Also: Usaa Auto Loan Reviews