Income Driven Repayment Options

-

Department of Education Income-Driven Plan Web site

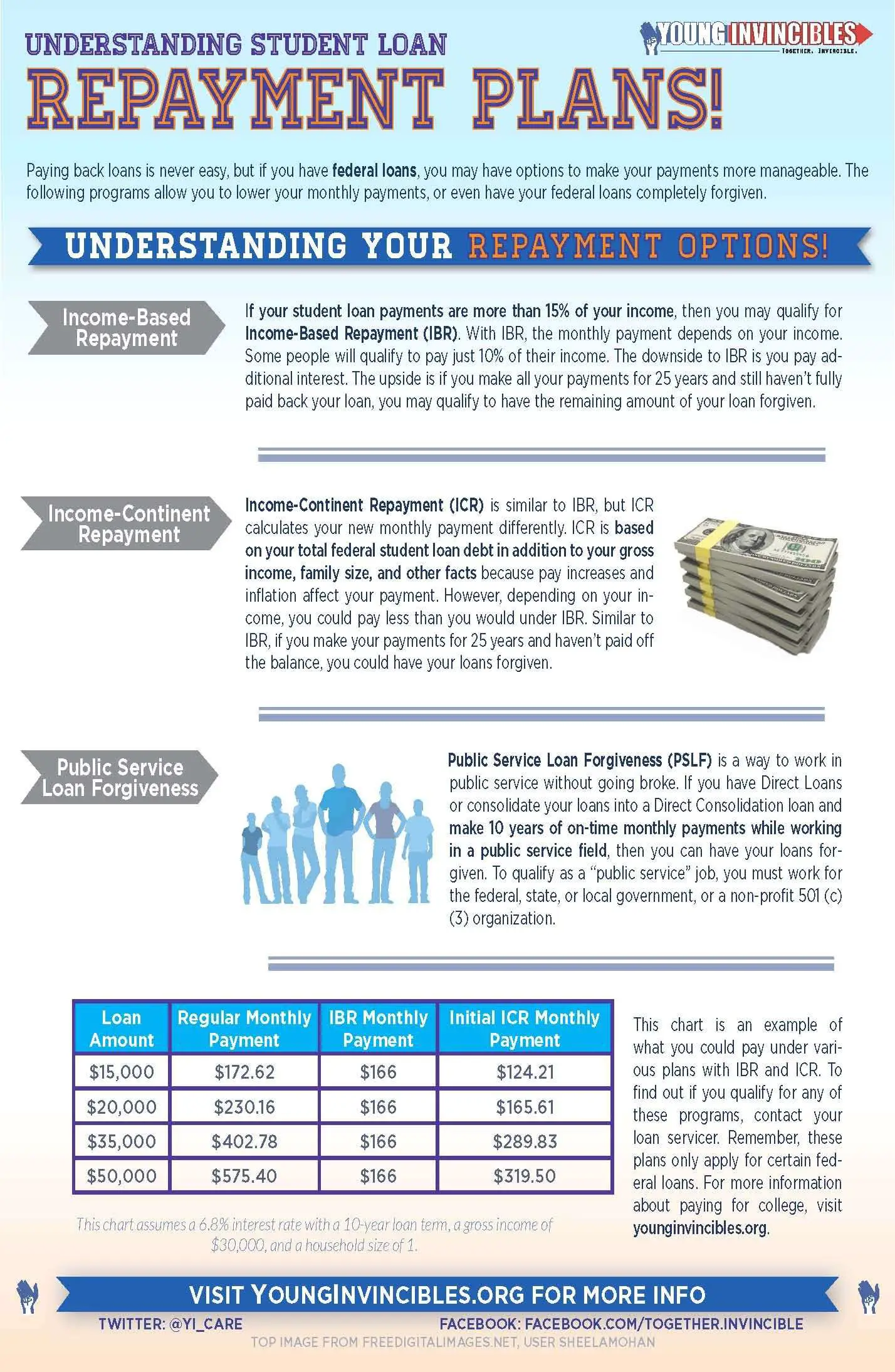

Income-driven repayment options help many borrowers keep their loan payments affordable with payment caps based on their income and family size. There are a number of income-driven repayment plans: Income-Based Repayment , Pay As You Earn , Revised Pay As You Earn and Income Contingent Repayment . Eligibility for each program depends on the type of loan and often when the loan was taken out.

After the initial calculation, your payment may be adjusted each year based on changes in income and family size. You will have to verify your income every year. If you are in default, you must first get out of default in order to select an income-driven repayment plan.

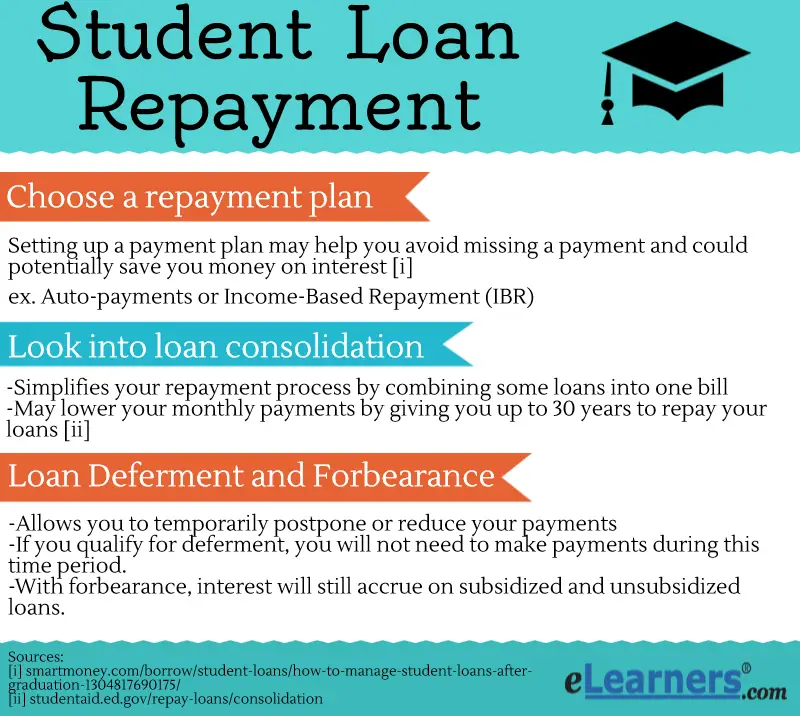

Learn About The Different Student Loan Repayment Plans

Your first step in choosing your best repayment plan for your student loans is learning about your options.

Federal student loans come with eight different plans. Not every loan type qualifies for every plan, but you can follow the links to learn about each plan and its eligibility requirements in full detail.

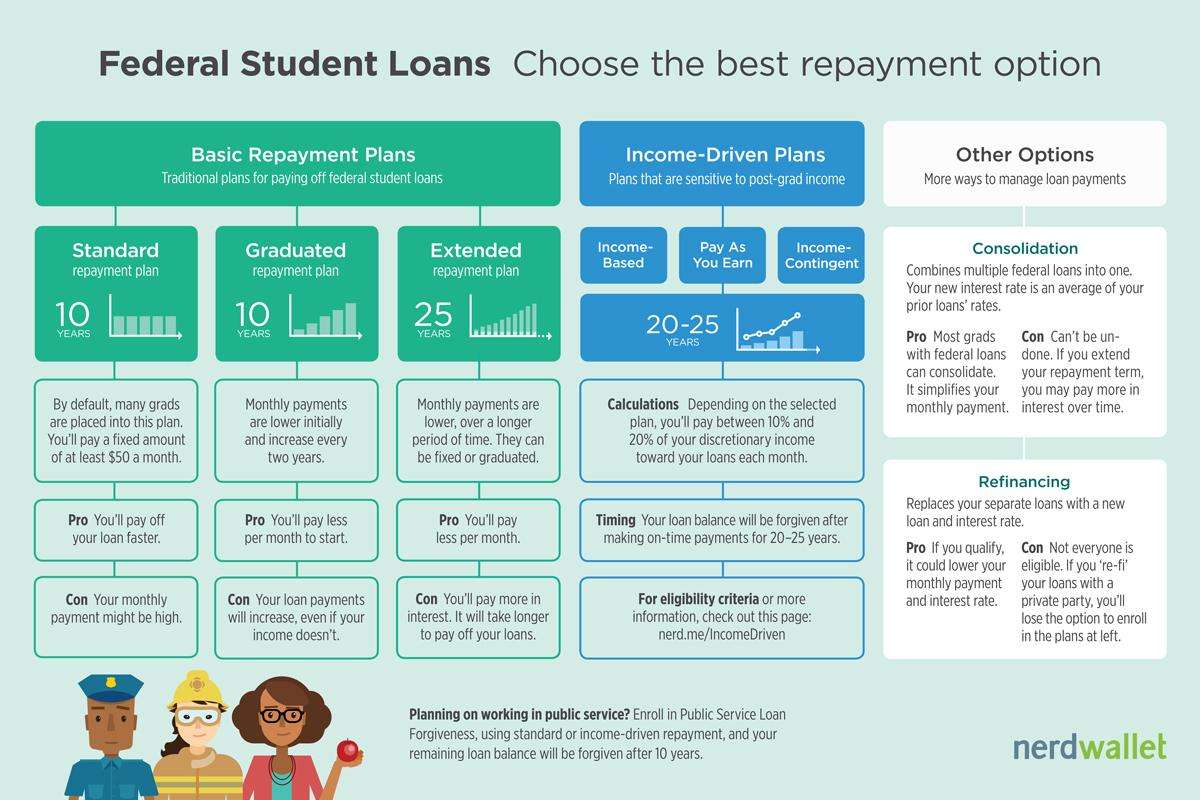

- Standard repayment: This plan spans 10 years. Youll have the same fixed payments every month.

- Graduated repayment: This plan also gives you 10 years to pay off your debt, but with one key difference: Your monthly payments will start out small and increase regularly, generally every two years.

- Extended repayment: This plan lowers your monthly payments and extends your repayment term to up to 25 years. You can choose fixed payments, which stay the same every month, or graduated payments, which increase over time.

- Income-driven repayment : IDR plans cap your monthly payments at 10% to 20% of your discretionary income. They include:

- Income-Sensitive Repayment

Most of the income-driven plans end in loan forgiveness if you havent paid off your balance after 20 or 25 years.

If you dont request an alternative plan, youll make payments on your federal loans under the standard 10-year repayment plan. But for some borrowers, the standard plan is too burdensome. For others, though, this approach is not aggressive enough for paying off debt.

Select A Repayment Plan For Your Federal Student Loans

Within the grace period you may receive information about repayment from your lender. Youll have a choice of several repayment plans. Find the right one for you.

Most federal student loans are eligible for at least one income-driven or income-based repayment plan . These repayment plans are based on a percentage of your discretionary income. Theyre designed to make your student loan debt more manageable by reducing your monthly payment amount.

Read Also: Who To Call About Student Loan Garnishment

Do You Have A Private Loan

You can choose to make higher payments if you can afford it while you are in an IDR plan. You might want to do this to try to pay off the principal sooner. You should tell your servicer in writing, along with the loan payment, that you want the extra money to be applied to the loan principal. Be sure to follow up to make sure that the payment was applied properly. Payments under these plans can be very low, sometimes 0. This means that it will usually take more time to pay off your loans, but this is better than going into default and facing the governments powerful collection tools.

Parent PLUS borrowers are not eligible for any of the IDR plans. However, parent PLUS borrowers can consolidate the PLUS loans and then choose ICR for the new Direct Consolidation loan.

It can be very confusing to figure out which plan is best for you. If you prefer, you can check a box on the income-driven repayment plan request form requesting that you get the plan with the lowest monthly payment. The Department has a web site with information about all of the income driven repayment plans. The Institute for College Access and Success created a summary chart to help borrowers understand the various income-driven repayment plans. There are pros and cons to the different plans that vary depending on individual circumstances.

Avoiding Delinquency And Default

If you don’t make payments on your student loans, your loan is delinquent. Your loan is considered delinquent from the day after you miss a payment until you make up that missed payment or it enters default. When a loan is delinquent, late fees may be charged to your account, and missed payments are reported to the four nationwide credit bureaus. If you haven’t made a payment for more than 270 days, your loan enters default. In default, the full balance of your loan is due immediately, and there may be other financial and legal consequences. Fortunately, there are options for turning things around.

Default Dangers

- Negative impact on your credit score and your ability to borrow money in the future

- Withholding of federal tax refunds

- Wage garnishment

- Loss of future federal aid eligibility

Fix-It Options

Also Check: Can I Get An Auto Loan With No Credit

Here’s How To Choose A Plan Based On Your Income And How Much You Owe

Student loan borrowers have a variety of options when the time comes to start repaying their loans. Federal student loans offer the most flexibility, while the choices with private student loans are more limited. The best way for you to repay will depend on the kind of loans you have, how much you owe, and where you stand financially after graduation. This guide explores your current choices.

Loan Repayment Letter Format / The Answer Poem By Sara Teasdale

Please understand that our phone lines must be clear for urgent medical care needs. Two of the most common forms of credit, especially for small businesses, are loans and letters of credit. Returns as of 4/17/2021 returns as of 4/17/2021 founded in 1993 by brothers tom and david gardner, the motley fool helps millions of people attain fina. Figuring out which loans are best, however, isn’t always easy. If you can borrow from friends and family at little.

Also Check: Is Prosper Personal Loan Legit

Unable To Repay Student Loans

If you cant pay the full amount due on time or have to miss a student loan payment, your loan may be considered delinquent and you may be charged late fees. Contact your loan servicer immediately for help, and ask them about your options.

Learn about COVID emergency relief for federal student loans that has been extended through September 30, 2021.

Indicate Whether You Want Your Story Included In The Cfpb Consumer Complaint Database

Once youve described what happened, youll have the option of choosing whether you want your story included in the Consumer Complaint Database a public database that anyone can view.

If youre not sure whether to make it public, keep in mind your story could be helpful to another borrower who is having a similar issue.

Of course, even if you decline to have your description of the situation made public, the details of your complaint may still be included in the database, minus any personal details. This includes basic information, such as:

- Date you submitted the complaint

- Product type

- Issue

- Description

- Name and location of your servicer

- Their response to your complaint

- Whether you disputed the response or not

Browse through the database to see for yourself.

You May Like: What Credit Score Is Needed For Conventional Loan

Great Lakes Educational Loan Services Inc

Student Loans in Default? Here’s what to do…

Covid-19 Student Loan Relief–How to legally stop…

Donald Trump’s New College Student Loans Forgiveness…

How To Choose A Student Loan Repayment Plan

How To Delete Private Student Loans In Default 2021

The Vocational Rehabilitation and Employment Program:…

130 People Learned

How To Choose The Best Repayment Plan

Students who have taken out federal loans have a lot of options when it comes to picking a repayment plan. The benefit of having so many choices is that the student is able to find the best plan that fits his or her budget. However, the other side of this double edge sword is that the more choices you have, the harder it becomes to discern which one is really the most ideal. Here are some things you should consider to make the best choice.

Pick the Plan that Pays Back the Least Amount in Interest

Most of the students who take out loans are going to school full-time and are working either a part-time or full-time job on top of it. Naturally, the biggest concern is their budget each month, which causes them to pick a plan that has the lowest monthly payment. Having just that little bit of extra cash in the moment feels good, and seems very rational as you just try to make ends meets. However, in the long run, it can come back to bite you.

What many borrowers overlook is the importance of looking at how much they will be paying back in interest. In some cases, getting the most amount of money forgiven could also mean getting the lowest monthly payment. For those that arent eligible for forgiveness, and have an average level of debt, you should look at what you can afford payment wise.

Calculate Your Budget and Pick a Plan You Can Afford

Don’t Miss: Can You Use Fha Loan If You Already Own House

Determine How Much You Can Pay Each Month

After learning about the different student loan repayment plans, its time to take a close look at your budget. Use a spreadsheet or to get a clear picture of your monthly cash flow.

Based on your income and expenses, figure out how much you can afford to pay toward your student loans each month. Then, use a tool like the Federal Student Aid Loan Simulator to calculate your payments on different plans.

What Happens If You Never Pay Your Student Loans

If you never pay your student loans, you will go into default. For most federal student loans, youll default after 270 days of nonpayment, although loan servicers may declare a Perkins loan defaulted if its not paid by the due date. For private lenders, the time frame may vary.

The default is reported to credit bureaus, and your credit score will drop. This mark on your credit report makes it harder to borrow future credit, like a credit card or auto loan. It also makes you ineligible for additional federal financial aid.

Your wages can also be garnished, and lenders might send your loans to collections or take legal action. If you default on federal loans, youll lose protections like deferment and forbearance, and the entirety of your unpaid balance will immediately become due.

Read Also: How To Apply For Small Business Loan From The Government

How To Contact Customer Service

ECMC has several different ways to get in touch with its customer service team and different contact information depending on your question.

-

Over the phone

Send an email

Rather not rely on the phone or snail mail? You can also send ECMC an email by filling out a form on its website:

Servicemembers Civil Relief Act Interest Rate Cap

The Servicemembers Civil Relief Act allows veterans who areon active duty to have the interest rate on their student loans decreased to 6%. This applies to both federal and private loans. The interest rate deduction will be applied automatically on federal loans, but borrowers with private loans will have to file a request manually. The deduction will be retroactive for their full time on active duty.

This interest rate deduction can also apply to other loans, like auto loans, personal loans and credit cards.

In addition to the SCRA interest rate cap, federal law dictates that if you for served 12 months or more in a hostile area, you may qualify for a 0% interest rate on your federal loans for up to 60 months. This can also be applied retroactively, even if youre no longer in the military. Veterans should contact their loan servicers to find out how to apply.

You May Like: How To Receive Loan Forgiveness

Revised Pay As You Earn

REPAYE sets your monthly payment at 10% of your discretionary monthly income. Under this plan, your repayment period is 20 years if all of your loans were for undergraduate studies. If any loans were for graduate studies, the repayment period jumps to 25 years. For the purposes of this program, discretionary income equals the difference between your annual income and 150% of the poverty guideline for your family size and state.

The REPAYE plan is good for those with high balances and a modest income. It is also a solid plan for an individual who doesnt mind if their monthly payment is larger than what it would be under the standard repayment plan, since there is no cap. Additionally, for those with very large loan balances, the government subsidizes some of the interest that accrues if your monthly bill is not large enough to cover the interest payment.

Pros

- Any borrower with eligible federal loans can choose REPAYE

- Access to loan forgiveness at the end of your repayment period

- Monthly payments will decrease if your income decreases, keeping the payment affordable

Cons

- If you dont recertify your income and family size annually, you will be removed from the plan, which could make your payment jump

- Depending on your income and family size, your monthly payment might be higher than the amount youd pay under the standard repayment plan

- Due to the longer payment period, you may pay more in interest

If You Want To Pay Less Interest

Best repayment option: standard repayment.

On the standard student loan repayment plan, you make equal monthly payments for 10 years. If you can afford the standard plan, youll pay less in interest and pay off your loans faster than you would on other federal repayment plans.

How to enroll in this plan: Youre automatically placed in the standard plan when you enter repayment.

You can prepay loans to save on interest with any repayment plan, but the impact will be greatest under standard repayment. Just be sure to tell your student loan servicer to apply the extra payment to your principal balance instead of toward your next monthly payment.

Recommended Reading: How Long Does It Take To Get Student Loan Money

Qualifying For Loan Forgiveness

If you’re planning to apply for the Public Service Loan Forgiveness program or a similar program, it may make sense to go with the repayment plan that requires you to pay less money overall.

With PSLF, for instance, you need to make 120 qualifying payments in addition to meeting other requirements. If you have a 10-year standard repayment plan, there won’t be anything left over to forgive once you make your qualifying payments.

An income-driven repayment plan is typically best if you’re planning to pursue loan forgiveness.

Federal Student Loan Repayment

Most undergraduate students in the United States have either subsidized or unsubsidized federal loans.

For subsidized loans, the government pays the interest for you while youre in school, during your six-month grace period after graduation and while your loan is in deferment. For unsubsidized federal loans, youre responsible for the interest that accrues as soon as funds are disbursed, though you can choose to defer payments until after graduation. In that case, any loan interest that accrues would be added to your total loan balance.

Federal loans dont require a co-signer and are put on the standard repayment plan by default.

Also Check: How Do I Get My Student Loan Number

How Much Could Refinancing Save You

Some private lenders also refinance federal student loans, which can save you money if you qualify for a lower interest rate. But refinancing federal student loans is risky because you lose access to benefits like income-driven repayment plans and loan forgiveness. Refinance federal loans only if youre comfortable giving up those options.

The Benefits Of Federal Student Loans

- Student loan forgiveness program. The Public Service Loan Forgiveness, or PSLF program is for federal loans only. You may qualify for the remaining balance of your federal loans to be forgiven if youve worked at a non-profit organization for 10 years or 120 loan payments.

- Income-based repayment plans. Repayment programs are offered that are based on your income. This means your monthly payments may be lower when your paycheck hasnt reached its full potential.

- No credit check. Federal loans do not require a credit check for qualification, but your payment history does get reported on your credit report.

- No co-signer required.

- Fixed interest rates.

- Potentially lower interest rate. Depending on what you qualify for with private loans, a federal loan may have a lower interest rate.

- Forbearance and deferment options: There are federal forbearance and deferment options available if youre unable to make payments.

- Your interest accrual begins after graduation, versus a private loan which begins right away.

- Repayment grace period. A 6-month grace period is available for some federal loans.

- Longer default period. The default period is 90 days for federal loans, while most private loans have a shorter default period.

- Loans can be discharged. If a borrower passes away or is permanently disabled, the government can discharge the loan.

Read Also: How To Calculate Amortization Schedule For Car Loan

Federal Student Loan Repayment Plans

There are three main options to choose from when it comes to repaying your federal student loans: the standard repayment plan, alternative repayment plans and income-driven repayment plans.

1. Standard repayment plan

A standard repayment plan divides your total student debt equally across a 10-year term. This option makes loan payments predictable, saves you more money over time and gets you out of student debt fastest.

Eligible loans: Direct Subsidized and Unsubsidized Loans, Subsidized and Unsubsidized Stafford Loans, PLUS loans and all consolidation loans.

Time frame: 10 years up to 30 years for Direct Consolidation Loans.

Takeaway: If you can afford higher monthly payments when you graduate, a standard repayment plan is the most affordable long-term option.

2. Alternative repayment plans

In addition to the standard repayment plan, there are also graduated and extended plans. A graduated repayment plan starts you out with small payments that slowly increase over time, with payment completion after 10 years. An extended repayment plan lets you repay your loan balance over 25 years.

Eligible loans: Direct Subsidized and Unsubsidized Loans, Subsidized and Unsubsidized Stafford Loans, PLUS loans and all consolidation loans.

Time frame: 10 or 25 years up to 30 years for Direct Consolidation Loans.

3. Income-driven repayment plans

Eligible loans: Direct Subsidized and Unsubsidized Loans, student PLUS loans and student Direct Consolidation Loans.

Time frame: 20 or 25 years.