How Car Title Loans Work In Canada

Recent research by SEMrush between March to September 2020 has revealed an increase in search demand for Canadian car title loans. According to the Boston-based marketing company, the internet search trends on car title loans for the period was 16,900 searches per month.

Compared with 5900 searches per month in the same period in 2019, this is an increase of about 11,000. This could be due to the effect of the global pandemic, Covid-19, which crumbled several economic activities and made millions of people lose their jobs and income.

Car title loans are short-time secured loans with minimal requirements and mostly no . Hence, they come with high-interest rates. The high annual percentage rate can be as high as 30% to 300% interest. Lenders usually consider the value and condition of the vehicle to approve the loan to the borrower.

Borrowers who get title loans are required to enable the lender to temporarily possess the hard copy of their vehicle title and also place a lien on their car title. This is done as a form of security in case of default by the borrower. As a result, you must own your car entirely and have no other liens or obligations against your vehicle if you want to obtain a car title loan.

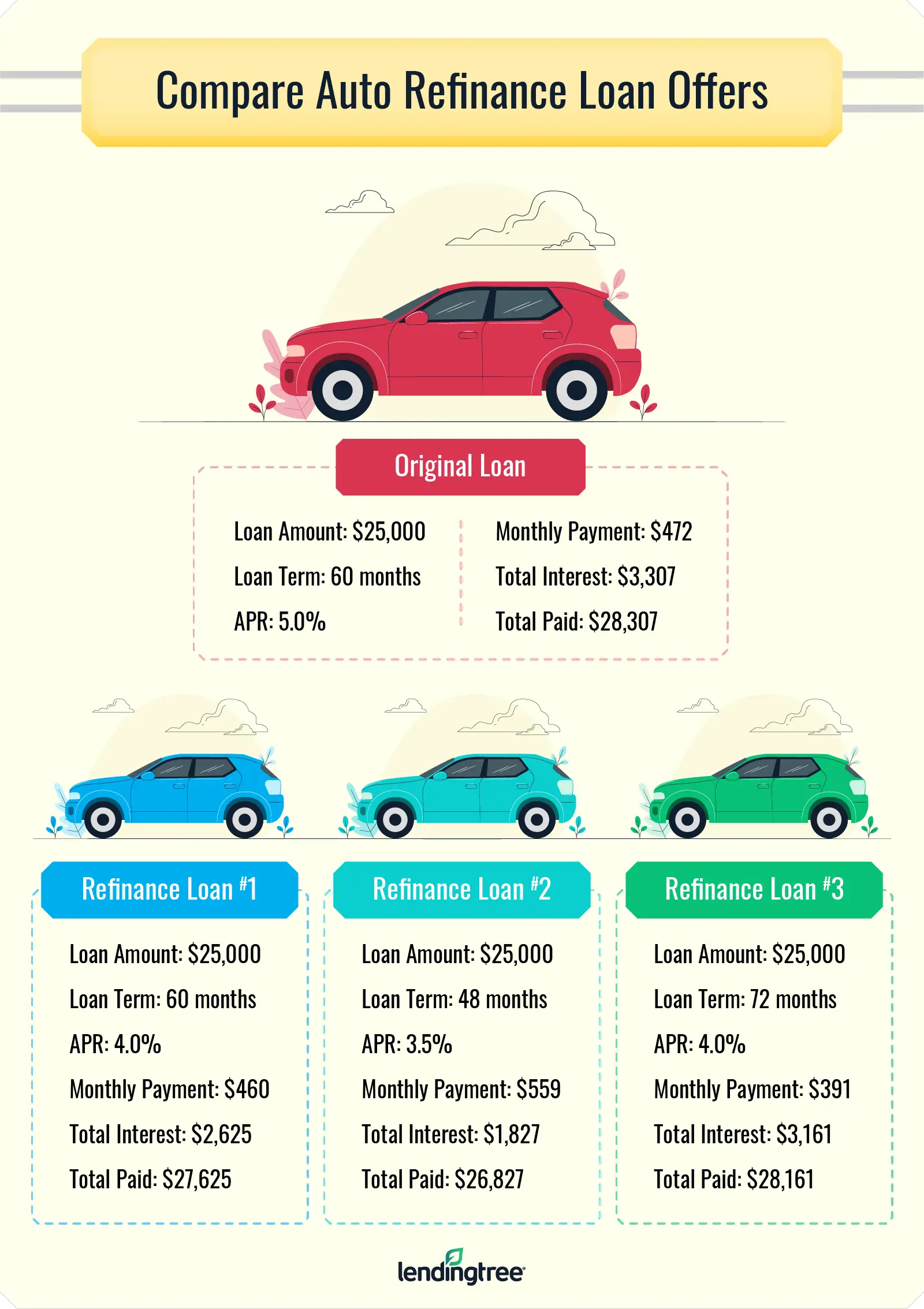

Compare Auto Loan Refinance Banks

In order to make your auto loan refinance a success, itâs important to choose a bank that meets your needs. Some things to consider when evaluating lenders include:

- Rates: The lower the rates, the more youâll save on interest. Be sure to compare multiple lenders in order to lock in the lowest rates possible.

- Required credit score: Some lenders have minimum credit score requirements.

- Vehicle restrictions: While some banks and lenders work with all vehicles, others have certain restrictions when it comes to vehicle type, age, and mileage.

- Prequalification options: If possible, look for a lender that allows you to prequalify for an auto loan refinance without affecting your credit score.

- Application process: Look for a lender that offers a simple application process and fast funding.

- Customer service: You should choose a lender with a history of good customer service and high customer satisfaction.

How Can I Get A Car Loan With Bad Credit And No Co

Applying for a car loan with both bad credit and without a co-signer limits ones financing options. Lenders use credit history to evaluate if a lender will pay back a loan. Borrowers with no or poor credit history benefit from having a co-signer. That person helps reassure the lender that someone will pay back the loan. Without one, alternative lenders, particularly online lenders, are the best option. Unfortunately, they too will consider a borrower with bad credit and no co-signer as a risk. Expect higher interests rate and less favourable terms.

Also Check: What Is The Commitment Fee On Mortgage Loan

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Hear From Our Editors: The Best Auto Refinance Loans And Rates Of 2021

This date indicates our editors last comprehensive review and may not reflect recent changes in individual terms.

Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesnt affectour editors opinions. Our marketing partners dont review, approve or endorse our editorial content. Its accurate to the best of our knowledge when posted.

Recommended Reading: How Much To Loan Officers Make

Youre Having Trouble Keeping Up With Bills Each Month

Even if youre not able to secure a lower interest rate, it may still be worth trying to find a loan with a longer repayment period in order to reduce your monthly car payments.

If you cant find a suitable loan, you may also be able to renegotiate the repayment period on your current loan. But keep in mind that more time spent paying back your loan is also more time spent paying interest. In general, youll pay more interest overall if you have a loan with a longer term.

Coronavirus Auto Finance Relief

COVID-19 has hurt lots of peoples finances. If youre worried about being able to keep your car, you may be able to get some help. Credit Karma has gathered a list of automakers and lenders that are offering relief options. We also have some other resources if youre looking for financial assistance.

But you may be looking to refinance to take advantage of lower interest rates which resulted from the Fed dropping its rates because of the pandemic. If thats the case, youll want to consider the advice in the article above.

In addition, some dealers are offering extreme financing deals for new vehicles, which may make sense for you if you were already considering trading in your car.

About the author:

Read More

Read Also: How To Calculate Amortization Schedule For Car Loan

How To Refinance Your Car Loan

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

Refinancing a car loan can help you save money by lowering your interest rate. The process involves replacing your current car loan with a new one, typically with a different lender. Your car will act as collateral on your new loan, just as it did on the original loan. Here’s how the auto loan refinance process works and what to think about before you apply.

The Best Reason To Refinance: Pay Less Interest

The ability to borrow at a lower interest rate is a primary reason to refinance a loan. That lower rate means you pay less for your car after taking all of your borrowing costs into account. Because the interest rate is also part of your monthly payment calculation, your required payment should also decrease. As a result, managing your monthly cash flow becomes an easier task.

When you can replace your existing loan at a lower rate, its best to refinance as early as possible. Most auto loans are amortizing loans, which means you pay a fixed monthly payment with interest costs built into the payment.

Over time, you pay down your debt, but you pay most of your interest costs at the beginning of the loanso get that rate down sooner than later to start cutting costs. An amortization table can show you exactly how much you can save by refinancing.

Also Check: Can You Use A Va Loan To Buy Land And A Manufactured Home

You Can Get A Better Rate

Loan rates have decreased to the point where it may make sense to refinance so you pay less interest. Or maybe when you purchased your car, you chose dealer financing which might not have been the lowest rate. If your credit score has increased since you purchased your car, you might qualify for a lower rate, too.

Best Auto Refinance Company Reviews

- Compare rates with various lenders

- Quote request form takes less than five minutes

- You may not qualify for advertised rates

- There may be limits on some loans

LendingTree is a marketplace where you can compare rates for just about any financial product, including auto refinance loans. The companys approach is simple: complete a short form online and connect with up to five different lenders that can help you refinance your car loan. LendingTree also has its own customer support team. If you have any queries regarding your lender or LendingTrees services, its staff is there to help you.

- Loan terms between 36-72 months

- 150+ partnered auto refinance companies

- Requires a hard credit check

- Approval can take up to 48 hours

rateGenius, another rate comparison site, offers refinancing options that match your existing term length so you dont pay more over the life of the loan. If you can get a better rate with one of their lenders, youll work directly with rateGenius lending specialists to complete your loan application process. rateGenius will even handle the back-end work, such as making sure your old loan gets paid off on time and that your new auto loan is set up correctly.

- Rates as low as 1.99% with no application fee

- 94% loan approval rate

- May require a down payment

- May charge a prepayment penalty

- Excellent credit required for best rates

- Membership is required

- PenFed auto loans are not eligible

- No cash-out refinance or lease buyout

- Minimum credit score requirement of 575

Read Also: How Can I Get An Rv Loan With Bad Credit

Waiting Too Long To Refinance

If you run the numbers and you determine that it makes sense to refinance, waiting can cost you. Rates are typically lowest on new vehicles, and some lenders wont refinance loans for cars over a certain age . You might even get a new car rate if you refinance immediately after purchasing from a dealer and taking advantage of dealer incentives. Used car loan rates are typically higher than new car rates.

What Is A Car Loan

A car loan is simply a loan to help purchase a new or used vehicle.

Whether it is new or just new to you, you may not have the money to buy a car or truck outright. A car loan gives you the option to pay in installments over several years. The installments can stretch from 24 to 96 months. Interest rates are lower than many other types of loans because the vehicle itself serves as collateral. The lender can repossess the car or truck if the borrower does not pay back the loan.

Financing is available from diverse sources, including dealerships, traditional banks, and online lenders.

| What type of lender is best? | Pros |

|---|---|

|

Compare the best car loans interest rates in Canada and save money on your vehicle purchase.

Read Also: Usaa Auto Refinance

How Do I Refinance My Car Loan

Applying for a loan refinance is just like applying for a new loan so the steps are the same. As well as proof of income and your drivers license, you will need details about your vehicle. Your old car loan will be repaid with the funds from your new loan, then the new interest rate and terms will apply to your monthly payments.

Here Are Some More Details About Rategenius

- Lending platform RateGenius is an online platform that partners with more than 150 lenders to provide refinance offers to people who qualify for a loan.

- Eligibility requirements Your vehicle must be no more than 10 years old and have fewer than 150,000 miles. Plus, your existing auto loan must have a balance of at least $10,250, and you must have a combined household income of at least $2,000 per month. Keep in mind that this lender may offer different terms on Credit Karma.

- Range of credit histories considered Lenders in the RateGenius network consider applicants with less-than-perfect credit, though interest rates could be significantly higher than someone with good or excellent credit would get.

Don’t Miss: How Long For Sba Loan Approval

Why Refinance My Auto Loan

Depending on the details of your original loan, refinancing can save money on interest, reduce your monthly payment, or both. Here are the situations where it makes sense to consider applying for an auto refinance:

- If your car dealer financed your loan. Dealers often add a few points as a commission. So if your original loan was financed by your car dealers preferred lenders, theres a good chance you didnt score the best rate possible.

- If your credit score has improved. A difference of just 30 points on your credit score can make a huge impact on your rate. If your score has improved since your original auto loan, theres a chance youll save money with a refinance.

- You need a lower monthly payment. Refinancing for a longer loan term can reduce your monthly rate.

Here Are Some More Details About Motorefi

- Lender network MotoRefi partners with multiple lenders, so you could receive more than one offer with a single application if you prequalify.

- Refinancing fee MotoRefi charges a $399 loan fee to cover costs associated with retitling your car and processing paperwork. This fee is included in your new loan amount.

Also Check: Va Loan Manufactured Home With Land

Can I Refinance My Car With Bad Credit

Yes, it is possible to be approved for a refinance loan with bad credit but again, you want to make sure refinancing with a bad-credit refinance company is to your benefit. Like you would with any loan, make sure you apply to a few lenders, not just one, so that you know what you qualify for and get the best deal for you. It may even be possible to refinance after bankruptcy.

How Do I Get A Car Loan For A Pre

Financing exists for used cars and trucks sold by a dealership or by private sellers. Dealership or their banking partner may offer them. They resemble a loan for a new vehicle. If you buy a used car in a private sale, your lender a traditional car loan may not be available. In this instance, a personal loan is an option. Typically unsecured by the vehicle itself, the interest rate on a personal loan for a used car will be higher than a traditional car loan for a new one.

Considering buying a used car with a personal loan? See Safes guide to personal loans to learn more.

Don’t Miss: 20/4/10 Car Calculator

When Can You Refinance A Car Loan

- Your current deal isnt great: If you didnt do some careful comparison shopping between dealers when you bought your car, your loan may not have the best terms or rates. For instance, if your current APR is around 20-25%, you might be able to get a better offer by shopping around. This is particularly true if your loan is two years older or more, as many loans with high APRs charge most of the interest amount during that time period.

- Your credit score has gone up: An improved will likely give you access to much better terms and lower interest rates.

- Your current loan payments are too high: Whether youve lost your job or your budget changed, a refinance can lower your monthly payment by extending the loans term length. This does mean youll pay more in interest over the long run, but sometimes that may be the least bad choice.

How Can I Get A Car Loan With Bad Credit

It is still possible to get financing for a vehicle with bad credit. Credit history is not the only factor considered by lenders. They will also look at the size of your down payment, your financial statements, and your employment history. Having a co-signer or guarantor with a better credit score can also help.

Remember that you are more likely to be approved for a smaller loan, so consider a less expensive car. You should expect to pay a higher interest rate than a borrower with a better credit score. Borrowers with fair or poor credit can pay in excess of 10 or 15%. A shorter loan term can help offset this expense.

Good news! Paying your car loan back on time every month is a fantastic way to improve your credit score.

Also Check: How To Get An Aer Loan

Apply For Your Auto Loan Refinance

Before you apply for an auto loan refinance, you should make sure that your own finances are in order. You should try to establish a high credit score, low debt to income ratio, and a history of stable income before applying for an auto loan refinance.

In order to apply for an auto loan refinance, there are a few documents youâll need to have on hand. These include personal information like your name, address, and Social Security number, as well as proof of insurance, your current loan and lender information, and your vehicleâs make and model, age, and mileage.

Some lenders may allow you to prequalify and view your loan options before submitting an application. Once you decide on a lender, you can submit your application for an auto refinance loan. In some cases, you could receive funding in as little as one business day.