Questions About Your Billing Statement Or Account

Capital One Auto Finance lists all current APRs and rates on the Current Rates for Auto Loans page. If you need more information on service charges, late payment fees and other fees appearing on your bill, the best contact number is 1-800-946-0332 if you already have an auto loan and 1-800-689-1789 if you are not currently a customer.

Refinance Auto Loan From Capital One

Capitol One saves consumers an average of about $500 per year on their monthly car payments when they refinance their auto loan through them. There are various terms and conditions to their program that will need to be met in order to receive this form of assistance. However when qualified this is the average savings level obtained.

Not all applications are approved and not all borrowers will save money, but an auto loan refinance from Capital One is another option that should be explored. It can offer help to lower income families that are struggling to keep up with their car payments, and it can also just assist anyone who is looking to save money each month. If you apply for this offering from Capital One, some or all of the conditions below will need to be met.

How To Pay Your Capital One Auto Loan

Pay capital one car loan with debit card. In addition to income from credit card account interest capital one makes a tidy sum from late fees. By transferring your auto loan s balance to a 0 apr credit card you could save hundreds in interest charges. It s important to note that this method transforms your auto loan from a secured loan into an unsecured loan as revolving credit.

Most lenders won t allow you to use a credit card to pay your loan directly but you know those convenience checks your credit card company sends in the mail encouraging you to transfer a balance you can use one of those in a pinch just be prepared to bite the bullet and pay whatever fee it entails. Set up one time and recurring payments in minutes. Checking or savings accounts.

The capital one mobile app ranked 2 in overall satisfaction in j d. Pros of paying a car loan with a credit card. Well yes technically you can.

The capital one mobile app has a 4 7 5 star customer rating on apple s app store and is in the top 10 in the finance app category as of 5 12 2020. The payment phone number to call at capital one is 1 800 946 0332. Not only that but you get to pay off your car faster too.

Capital one can help you find the right credit cards. And other banking services for you or your business. Power s most recent u s.

Pay capital one auto finance with a credit or debit card online using plastiq a secure online payment service.

Pin On Nigeria Website Design

Business One Credit Card

Also Check: What Car Loan Can I Afford Calculator

Should I Get An Auto Loan From The Dealership Or The Bank

Choosing between a dealership and a bank for an auto loan is complicated. In general, dealerships may offer higher rates than banks but this may not be the case for used cars. Regardless, it’s important to get quotes from a few banks or online lenders first that way you can come to the dealership prepared. Ask for a quote from the dealership as well, comparing rates, terms and any additional fees.

Capital One Payoff Address Overnight

Capital One Payoff Address Guys!! If you have no idea about the Capital One Payoff Address? and Are you looking for Capital One Payoff Address Overnight? We provided complete information from multiple sources and sorted them by user interest. Therefore, you can easily access information about Capital One Payoff physical Address by following this article at last.

Capital One Auto Loan Payoff address is single, and everybody and every branch have to refer it for the process. So no matter which broker you preferred or which city you live in, You can send the Money order or Payoff Cheques to this official Capital One Auto Loan Payoff Address.

Don’t Miss: What Happens If You Default On Sba Loan

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what’s known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

You Can Shop For A Car In The Auto Navigator App Too

Then I could shop from the cars in the Auto Navigator database. There are a number of filters for different types of cars, price, features, etc, and I could set a distance from home. I liked that I could shop with a dealer that wasnt close to homeIm willing to drive a ways to get the car at the price I want. As it turned out, we drove to a dealer about an hour away, so I was glad to have my financing lined up it wouldnt be convenient to come back to process loan paperwork.

Luckily for us, the car we were eyeing was at a dealer in the Auto Navigator database. So, we went to take a test drive.

Even when negotiating the purchase at the dealership I could adjust the terms of the loan on my Auto Navigator app, changing the downpayment, price and loan length to see the interest rate and monthly payment. This is so great when youre in a negotiation the power of the sale is literally in your hands.

Related: Buying a New Car? 9 Things You Need To KnowRight there on the Window Sticker

Don’t Miss: How To Get An Aer Loan

Should You Get An Auto Loan Through Capital One

A Capital One auto loan might be for you if you have a nonprime or subprime credit score. In these credit categories, borrowers may be rejected by many lenders or offered high interest rates.

Capital One works with borrowers with credit scores as low as 500. Auto loan interest rates at Capital One tend to start lower than the typical interest rates, and could help people in this credit category get lower interest rates, too.

Easy Online Application For Pre

Shopping around for an auto loan and comparing offers is the best way to know that you’re getting a good deal. With Capital One, it’s easy to pre-qualify online and walk into a dealership with an idea of what you might pay.

If you pre-qualify in advance, you have more bargaining power with the dealership when it comes to talking interest rates. The interest rate on your auto loan is negotiable, and you could use your pre-qualification offer to beat an offer or be confident that you’ve got the best deal.

You May Like: How To Get Loan Originator License

What Does Auto Navigator Show

Auto Navigator clearly shows various specifications of vehicles like the model, mileage, kilometers covered, etc. from its inventory. It also indicates payment options so that you can plan your expenses and savings accordingly before deciding to buy your dream car. It shows monthly payment amount, APR, and other personal terms so that there is transparency in the selected offer.

Box 60511 City Of Industry Ca 91716

Mellon 1st Business Bank Auto Finance. Capital One Auto Loans – Auto Refinance Applications. Reverse Phone Number Lookup. Payment Processing 2525 Corporate Place 2nd floor Suite 250 Monterey Park CA 91754. Capital One Auto Finance Phone Number. Financial Services Loans Banks. City of Industry CA 91716. Capital One Auto Finance Attn. 1-888-263-4582 Business Hours. 1-866-722-0410 Please include reference number. Box 60511 City of Industry CA 91716.

You May Like: How Does Paypal Business Loan Work

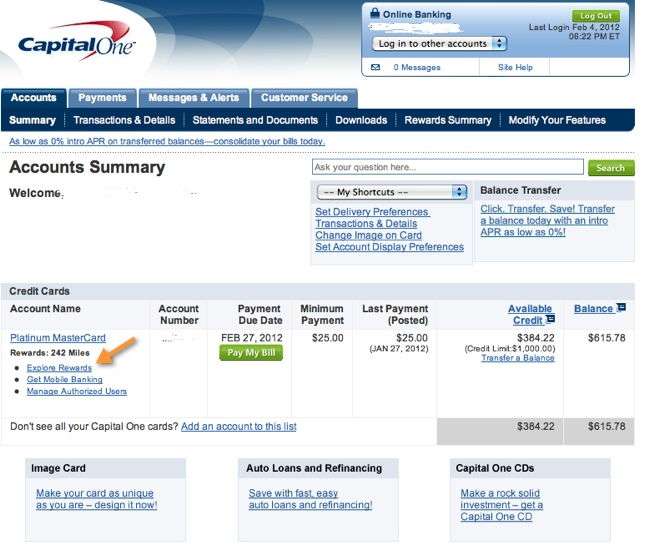

How Do I Set Up Bill Pay

Pay anyone in the United States that you would normally pay by check, automatic debit, or cash.

To set up Bill Pay:

How To Apply For A Loan From Capital One Auto Finance

Applying for an auto loan from Capital One Auto Finance is simple and straightforward.

You can go directly to the Capital One website and fill out the online application if you are ready to take out a loan, and if you want to check your possible interest rates, you can use the free pre-qualifying tool.

Recommended Reading: How To Get Loan Officer License In California

Bank Of America: Best Big Bank Option

Overview: Bank of America offers flexible and convenient auto loans you can apply for directly on its website. Rates are competitive, and you can qualify for additional discounts if youre an eligible Bank of America customer.

Perks: Bank of America will finance a minimum of $7,500 and requires that the car be no more than 10 years old, with no more than 125,000 miles and valued at no less than $6,000. Financing is available in all 50 states and Washington, D.C. Bank of Americas APRs start at 2.89 percent for a new car and 2.99 percent for a used car.

If youre a Bank of America Preferred Rewards customer, you can qualify for a rate discount of up to 0.5 percent off.

What to watch out for: If you’re applying online, the term range you can apply for is limited you can pick only a 48-, 60 or 72-month term.

| Lender |

|---|

| None |

Tips For Paying A Car Loan With A Credit Card

- Before you actually begin the card application process, take stock of your monthly budget looking at income and expenses. Most 0% APR credit cards will have six- to 18-month balance transfer options. Determine whether you can feasibly pay off your loan within the given time and make sure you get one of the best balance transfer credit cards to help you.

- If you do end up getting a 0% APR credit card, be sure to read over the cards agreement papers. In the event that you dont repay the whole loan before the introductory period ends, many credit card issuers can charge you interest on the whole balance, not just whats left. Also pay attention to the balance transfer APR after the intro period. That will give you an idea of how expensive things could get if you have to start paying interest.

Recommended Reading: Amortization Schedule For Auto Loan

Re: Capital One Debit Card Payment Online

I don’t see that option on my end, both webpage and mobile app. Also, the FAQ specifically states they don’t accept debit cards. Got a screen shot? Perhaps something new being tested? It would help with some of these CU’s that require some amount of debit card usage.

wrote:

I don’t see that option on my end, both webpage and mobile app. Also, the FAQ specifically states they don’t accept debit cards. Got a screen shot? Perhaps something new being tested? It would help with some of these CU’s that require some amount of debit card usage.

I just checked, and the only payment option I have is a bank checking account my FAQ also states that payment by debit card isn’t available online.

Perhaps they are rolling this out only to select customers?

How Do Repayments Work

Although the dealership you buy from will be the primary lien holder on your vehicle, Capital One will still service your loan. To make a repayment, you can log in to your Capital One account online or through its mobile app. From there, you can schedule a one-time payment or set up recurring payments. If needed, you can also change your due date but it isnt clear how many times you can do this.

You can also make payments by mailing a cashiers check, money order or personal check to Capital One or by sending a payment through Western Union or MoneyGram.

You May Like: Can You Transfer Car Payments To Another Person

Capital One: Best For Convenience

Overview: Capital One will let you borrow as little as $4,000, but it requires you to purchase the car through one of its participating dealers. In a lot of ways, its financing works as a one-stop shop for your auto loan and vehicle purchase.

Perks: The Capital One Auto Navigator site lets you search for inventory in your area and gives you the ability to see how different makes, models and features will impact your monthly payment. This will give you a lot of information before you head to the dealer. Also, the quick prequalification allows you to check your rate through a soft inquiry, so your credit score wont be impacted.

What to watch out for: You can only use Capital One auto financing to shop at one of its participating dealerships, which makes this a poor option if you find a car you love elsewhere.

| Lender |

|---|

| Late fee |

Message From Capital One Auto Finance

At Capital One, our mission is to change banking for good by bringing humanity, ingenuity and simplicity to banking. In support of our mission, the Capital One Impact Initiative advances socioeconomic mobility by advocating for an inclusive society, building thriving communities and creating financial tools that enrich lives. It is fueled by an initial $200 million multi-year commitment to catalyze economic growth in low- and moderate-income communities and close gaps in equity and opportunity.

Looking to finance a new or used car? See if you pre-qualify for financing in minutes with no impact to your credit score. Plus, know your estimated financing terms before heading to a participating dealer.

You May Like: Is Bayview Loan Servicing Legitimate

Must Buy A Car From A Participating Dealer

Capital One only finances auto loans with participating dealers in its car dealership network.

Although there are over 12,000 eligible dealerships across the country, this may be a limiting factor for customers who prefer to shop at dealerships that fall outside of the Capital One Network.

However, there are benefits to shopping within the Capital One Network because you know that you will be working with one of the most reputable banks on the market since the dealership has an existing relationship with them.

Aba Routing Number For Capital One Bank

If you are seeking a company to refinance your car loan, thus you are on the right page!

Refinancing could lower your auto loan fee and monthly payment when offering you hundreds of dollars. You can save money by refinancing, which is when you transfer your loan to a loan with better terms.

When you refinance your vehicle loan, you replace your current loan with a new loan. The loan is from a different lender, typically having a lower rate of interest. You are able to shorten, keep or extend the period of the loan.

Read Also: Mortgage Commitment Fee

Buyer Beware Caveatsyes There Are Some

From there the dealership finished the loan process by completing my credit report and printing out all the paperwork for me to sign. One buyer beware note: Make SURE the dealer processes the loan terms you selected our dealership tried to process a 6 year loan which had a higher interest rate. We insisted they re-work the paperwork with the loan terms I found on the Auto Navigator app, and they did.

Also be aware that not all dealers participate in Auto Navigator, so if you find a car that isnt in their database you cant use the app for this purchase though you can visit your Capital One branch to ask about a traditional loan. Auto Navigators pre-approval looks for a minimum income and a minimum credit score . And, the Auto Navigator pre-approval doesnt mean you are fully approved. You still have to go through the loan approval process.

My new car! We got the 2016 Infiniti QX50 we were looking for. Scotty Reiss

Capital One Auto Finance’s 800

This Capital One Auto Finance phone number is ranked #3 out of 4 because 35,604 Capital One Auto Finance customers tried our tools and information and gave us feedback after they called. The reason customers call 800-946-0332 is to reach the Capital One Auto Finance Auto Loans department for problems like Recover Account, Update Account Info, Extension on Payment, Disputes, Cancel or Change Account. As far as we can tell, Capital One Auto Finance has call center locations in California or Minnesota or India and you can call during their open hours Mon-Fri 8am-9pm EST. Capital One Auto Finance has 4 phone numbers and 6 different ways to get customer help. We’ve compiled information about 800-946-0332 and ways to call or contact Capital One Auto Finance with help from customers like yourself. Please help us continue to grow and improve this information and these tools by sharing with people you know who might find it useful.

Don’t Miss: Aer Loan Balance