How To Get The Best Car Interest Rates

If you are like many prospective car buyers, you will need to take out a car loan in order to make the purchase of a new car. There are many considerations to think about when youre figuring out how much car you can afford and how much your loan will cost you in the short and long term.

But theres one often-overlooked factor that can make a big difference: your auto loans interest rate.

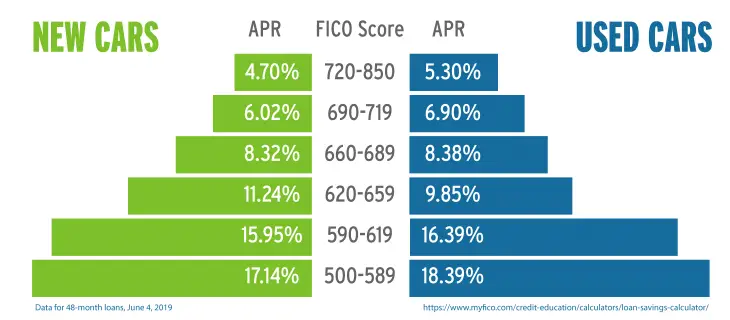

The chart below shows the average 60-month auto loan rates by credit score

Getting the best interest rate possible on a car loan can save you hundredsif not thousandsof dollars on the total cost of your vehicle over the long run. While it may not always be possible to get the interest rates that you see advertised on TV, it is still possible to secure a good interest rate if you put in some preparation ahead of time.

Here, you can learn what it takes to get the best interest rate on your next big car purchase.

You Can Still Get An Auto Loan With A Score Below 700

If your credit score is below 700, Dundas says you’ll likely be looking at a higher interest rate and down payment for your car purchase. You may also want to be more selective about the kinds of vehicles you’re considering.

“The salesperson oftentimes knows that your loan is risky, and they may try to steer you towards more expensive cars, because that way they’re going to make more money on you to help potentially offset the cost that they might have to pay to have a lender do business with you,” says Dundas.

To avoid paying more than you want, go in with a clear idea of your goals are for your monthly payment and interest rate. If you’ve done your research in advance, you’ll have an idea of what’s considered a reasonable payment and interest rate for your score.

The earlier you can begin preparing to buy a new vehicle and paying attention to your credit score, the better.

Get Current Auto Loan Rates And Choose A Loan Thats Right For You

Car loan interest rates change frequently, so its important to keep track of them. Your loans interest rate influences how much youre going to pay for month to month. And a lower interest rate can mean thousands of dollars in savings. Our rate table can help you know the best time to buy a new or a used car.

Current auto loan interest rates| 4.43% |

Recommended Reading: How Many Years After Foreclosure For Conventional Loan

What Is A Commercial Auto Loan How Can You Get One

Aug 6, 2021 This type of loan is offered by banks, credit unions, finance companies and alternative lenders. Its quite similar to a consumer auto loan,;

Aug 12, 2021 You can apply for auto loan pre-approval at your bank, or you can apply online. Many consumers find online applications much easier to;

You can apply for one from a bank, credit union, or other lending Your auto loan interest rate will have a big impact on your monthly car payment.

Maintain Good Credit For Future Auto Purchases

While improving your credit for your next car purchase can save you money in the short term, maintaining good or excellent credit can provide even more savings in the long run, on future auto purchases as well as other financing options.

Make it a goal to monitor your credit regularly to keep an eye on your credit score and the different factors that influence it. Keeping track of your credit can also help you spot potential fraud when it happens, so you can address it quickly to prevent damage to your credit score.

Read Also: Is My Home Loan Secured

Bank Of America : Best Auto Loan Rates For Those Who Prefer A Bank

- New car loan rates start at 2.39%

- Terms range from 1275 months

- Amounts start at $7,500

While the starting APR for a Bank Of America auto loan is higher than the two credit unions above, you dont need to qualify for membership. B of A offers convenience. It could be your one-stop shop with competitive auto loan rates for any type of auto loan youd like: new, used, refinance, lease buyout and private party.

WHAT WE LIKE

Bank of America has a variety of auto loans that you dont always see from one lender; it has no membership requirements and it is the second-largest U.S. bank by assets.

WHERE IT MAY FALL SHORT

Bank of Americas minimum loan amount is relatively high at $7,500; you could easily find a used car from a private seller for less. By comparison, Navy Federal CU minimum loan amount is $250.

HOW TO APPLY

You could apply for a Bank of American auto loan online or by calling 844-892-6002. If you like to do business in-person, you could schedule a visit online. Be sure to follow all COVID-19 safety precautions if you go in-person.

Car Loan Interest Calculation And Formula

You can calculate the car loan interest using the mathematical formula as mentioned below:

- Flat Rate Method: Interest is calculated on the entire principal amount throughout the loan tenure. EMI = / loan tenor in month Where Total Interest Payable = Principal x Interest Rate x Loan Tenure/100)

- Reducing Balance Method: Interest is calculated on the outstanding loan amount EMI= / Where P = Principal Amount

| 18,100 |

Read Also: Who Should I Refinance My Car Loan With

Factors That Affect Car Loan Interest Rate

There are a number of factors that affect car loan interest rates. These are listed below:

- A credit score of 700 and above is considered a good CIBIL score to avail car loan. In case of a relatively low credit score, you may either get a car loan at a high rate of interest or your application for a car loan may get rejected.

- Income : Income is another factor that ensures the lender of your loan repayment ability. Thus, the higher the income, the lower would be the car loan interest rate.

- Occupation : The rate of interest varies for both salaried and self-employed borrowers. Banks generally have a high rate of interest for self-employed professionals as compared to salaried individuals.

- Existing relationship with the bank : In case you are an old customer of the lender via a savings or investment account, then it is likely that you will be offered a lower interest rate from that bank.

- Your organizations reputation : The reputation of the organization you are currently working for plays an important role in helping you grab a car loan at a lower interest rate.

You Could Always Wait

If you do not want to risk a higher interest rate or use a credit union, you could spend the next six months improving your credit. Your first step should be to request your free credit reports by going to www.annualcreditreport.com. By addressing any issues on your credit report, you can boost your score quickly. After looking your credit report over, why not work on lowering your credit card debt? Since amounts owed account for 30 percent of your credit score, paying your balances down will boost your score each month.

Application Secured by SSL Encryption

Also Check: Are Va Loan Interest Rates Lower

Best For Refinance: Autopay

- As low as 1.99%

- Minimum loan amount: $2,500

AUTOPAY offers several different refinance options, competitive rates, and has flexible credit requirements. Borrowers can easily compare offers from different lenders on AUTOPAY’s site and choose the best deal.

-

Considers all credit profiles

-

Excellent credit required for the best rates

While AUTOPAY’s rates start at 1.99%, only those with excellent credit will qualify. According to AUTOPAY, they can, on average, cut your rate in half on a refinance.

AUTOPAY offers more refinance options than many lenders. In addition to traditional auto refinancing, borrowers can choose cash-back refinancing and lease payoff refinancing.

AUTOPAY is a marketplace that makes it easy to shop around for the best deal. It caters to individuals who are rebuilding credit or improving their credit.

The Bankrate Guide To Choosing The Best Auto Loans

Auto loans let you borrow the money you need to purchase a car. Since car loans are considered secured, they require you to use the automobile youre buying as collateral for the loan.

This is both good news and bad news. The fact that your loan is secured does put your car at risk of repossession if you dont repay the loan, but having collateral typically helps you qualify for lower interest rates and better auto loan terms.

Auto loans typically come with fixed interest rates and loan terms ranging from two to seven years, but its possible to negotiate different terms depending on your lender.

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Don’t Miss: What Is Interest Rate For Commercial Loan

Average Used Car Loan Interest Rates By Credit

Setting realistic expectations is the first step on the route to financing a used car the smart way. Although theres always going to be some wiggle room, the average used car loan interest rates are as follows:

- Excellent Credit 5.1% APR

- Good Credit 4.91% APR

- Average Credit 5.89% APR

- Poor Credit 11.24% APR

- Little to No Credit Loan Unlikely

From the table above, youll see that just about anyone with a credit score over 600 can secure a good interest rate on a used car loan, close to five or six percent APR! If your credit score needs some work, keep reading for steps you should take before you apply for financing.

Remember that if your credit improves at some point down the line, you might be able to refinance for a more affordable monthly payment.

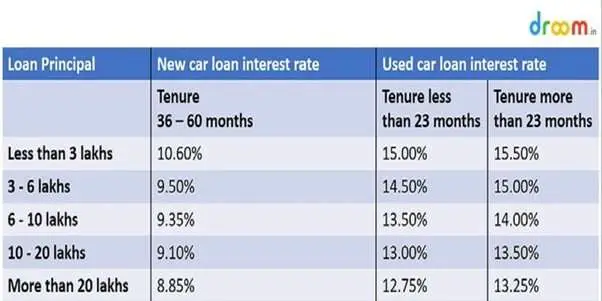

Check Latest Car Prices In India

With the automobile industry expanding at a rapid pace and with more and more car manufacturers establishing their bases in India, buying a car has become a hassle-free procedure. Car prices in India vary depending on the segment of the car purchased and with the additional features provided by the manufacturer. BankBazaar offers a comprehensive list of car prices across various models of cars sold in India. Be it a hatchback, sedan, luxury sedan, SUV or MUV, we equip you with the necessary pricing information to help you decide on the right car suited for your needs and current financial situation.

Also Check: How Much Time It Takes To Get Personal Loan

Compare Loans Before Visiting A Car Dealer

It’s important to look at loans before you go to a car dealership. You’ll be able to negotiate better, as you’ll know:

- exactly how much you can spend

- the best interest rate you can get

- how much your repayments will be

Car dealerships will try to sell you add-on car insurance. This includes loan protection, gap cover, and tyre and rim protection. These products are not good value for money. Don’t feel pressured to buy them.

Checklist For Getting A Car Loan

Get Pre-qualified and then pre-approved by lenders Have Car Insurance: in order to qualify for car loans you will need to show that you are insured to;

Mar 2, 2021 This depends on the term of the loan, type of car and your credit score. but when you apply for the loan, they will do a hard pull,;

Feb 18, 2020 The single best advice I can give to people is to get preapproved for a car loan from your bank, a credit union or an online lender, says;

You May Like: Can You Refinance Your Car Loan With The Same Company

What Credit Score Do You Need To Get A Car Loan

Think you dont have a good enough credit score for a car loan? You might be pleasantly surprised. Car dealerships arent shy about their desire to sell you a shiny new ride, even if your credit score is on the low side. You might end up with a higher interest rate on your car loan than average but you can always refinance it later onafter the loan helps you build your credit score. Heres a quick look at everything you need to know about credit scores and applying for a car loan.

More content about

How To Get Best Interest Rate Car Loan

To get the best interest rate car loan you must follow the tips as mentioned below:

- Check the best discount and offers : Always check current offers and cheapest car loan interest rates offered to employees of large reputed companies.

- Compare car loan rates based on loan amount : Some banks offer the lowest interest rate for car loans for high loan amounts. Loan amount can vary by the value of the car used for calculating LTV.

- Do not apply for a loan amount more than what you are eligible for : Applying for an amount higher than your eligibility may lead to rejection of your loan application.

- Do not apply with multiple banks : Simultaneous loan applications get recorded in your CIBIL report and can hurt your chances of getting a loan.

- Carefully decide on which type of insurance would be necessary : Check and compare the cost, coverage and claim settlement ratio of car insurance. You must avail of comprehensive, third Party, or zero dep insurance.

Also Check: How Much Home Loan Can I Get On 70000 Salary

How Do I Apply For A Car Loan

As mentioned, every lender and dealership has its own loan requirements. However, there are a few personal and financial details that youll have to provide to qualify the best car loan in 2021, such as your:

- Name, address, and other personal information

- Bank account details and other financial information

- Employment status and job title

- Vehicle make, model, and cost

- Down payment amount

Although your may be less significant for some lenders and dealerships, you may also have to fill out a credit application, so they can check your credit report. The healthier your credit is, the easier it will be to get approved for a car loan with a decent interest rate and repayment plan.

Ford Partners With Jiosaavn And Google Search To Promote The Freestyle Flair

Ford India has launched a new campaign of the Ford Freestyle Flair Edition with JioSaavn and Google search. Ford has come out with a fun, quirky, and unique way to promote the Freestyle Flair. The company has used the search behaviour on Google and JioSaavn to bring out the exciting character of the car. Google search continues to be a key feature in car research and purchase. Around 68% of individuals use search without an idea of buying a car and around 98% of the buyers use the feature to purchase a car. Ford wishes to launch the new features of the car during the festive season in the country.

1 September 2020

Don’t Miss: Which Credit Union Is Best For Home Loan

Before You Go Shopping

If you have time to delay your car purchase, work on building your credit. That means:

-

Paying bills on time. A payment that goes 30 days past due can devastate your score, so pay at least the minimum on time.

-

Keeping credit card balances low compared to your credit limits. How much of your limits you’re using is called your credit utilization, and it has a big effect on your score. You can try a number of tactics to lower your credit utilization in order to bump up your score.

-

Avoiding applications for other credit within six months of applying for a car loan.

-

Keeping credit card accounts open unless there’s a compelling reason to close them. Closing cards reduces your overall credit limit, which can hurt your credit utilization.

If you end up with a higher-rate loan than you wanted, keep an eye on your scores. You may be able to refinance your auto loan at a lower rate after youve made on-time payments for six to 12 months.

The Kia Sonet Gtx+ Automatics Launched In India At A Price Point Of Rs1289 Lakh

The Kia Sonet was launched recently in India. However, the price tags of the top-variant models of the car were not revealed at the time of the launch. The automakers have recently revealed the prices of the petrol and diesel variants of the top-spec model.

The Kia Sonet GTX+ will be available in both petrol and diesel variants and will come with automatic transmission setups. Both the cars have been priced at Rs.12.89 lakh . As per the latest revelations of the prices, the petrol range of the car now starts at Rs.6.71 lakh and goes up to Rs.12.89 lakh and the diesel variant starts at Rs.8.05 lakh and goes up to Rs.12.89 lakh. There is a total of 17 different trims of the car on the basis of the engine, trim, and so on. The two petrol unit variants of the car churns out 83 hp and 120 hp respectively. The diesel unit is a 1.5-litre setup which churns out 100 to 115 hp of max power and 240 Nm to 250 Nm of peak torque.

30 September 2020

Also Check: Does Refinancing Car Loan Hurt Credit