How Much Can I Borrow

The maximum amount you can borrow each academic year depends on your grade level and dependency status. See the chart below for annual and aggregate borrowing limits. You may not be eligible to borrow the full annual loan amount because of your expected family contribution or the amount of other financial aid you are receiving. To see examples of how your Subsidized or Unsubsidized award amount will be determined. Direct loan eligibility and loan request amount must be greater than $200 for a loan to be processed.

If you are a first-time borrower on or after July 1, 2013, there is a limit on the maximum period of time that you can receive Direct Subsidized Loans. This time limit does not apply to Direct Unsubsidized Loans or Direct PLUS Loans. If this limit applies to you, you may not receive Direct Subsidized Loans for more than 150 percent of the published length of your program. See your financial aid adviser or for more information.

Variable Vs Fixed Loan Interest Rates

A variable interest rate can fluctuate over the life span of a loan. A fixed interest rate is just as it sounds fixed and unchanging for the life of a loan.

While all federal student loans come with a fixed interest rate, offer students the flexibility of a variable interest rate in addition to a fixed interest rate option. At the time of your loan disbursement, you might discover that variable interest rates are lower than the federal student loan fixed rate, but there are advantages to having a stabilized rate.

To learn more, see our resource page.

How A Direct Unsubsidized Loan Works

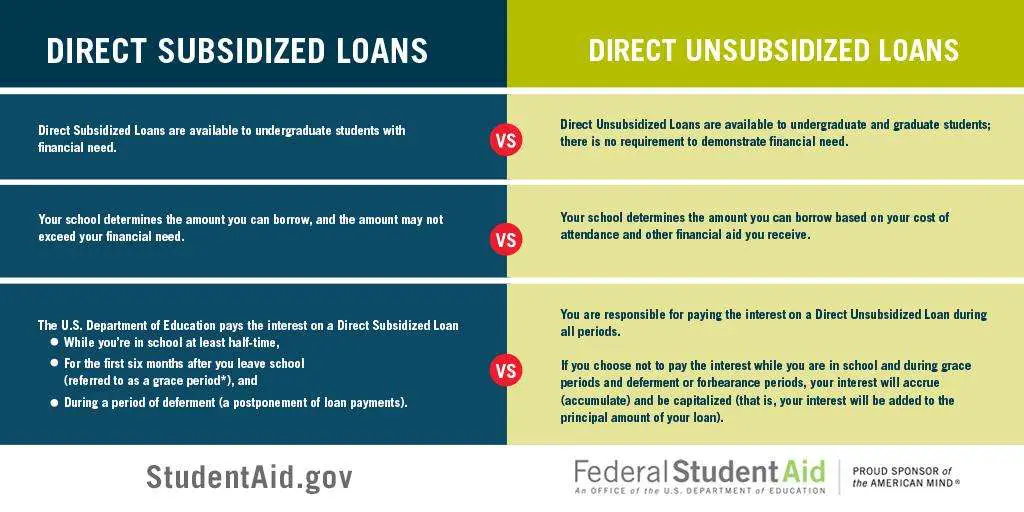

The key differences between an unsubsidized loan and a subsidized loan are the interest, loan limit and eligibility.

Unsubsidized student loans are more expensive than subsidized loans because interest starts accruing sooner on unsubsidized loans. The borrower is responsible for the interest that accrues on unsubsidized student loans during in-school and grace periods, as well as deferments and forbearances. Borrowers can choose to pay the interest as it accrues or to defer paying the interest until the student loans enter repayment. All federal student loans have a fixed interest rate.

If the borrower does not pay the interest as it accrues, the interest will capitalize and be added to the principal loan balance when the loan enters repayment. This can increase the size of the loan by as much as a tenth to a quarter. It also leads to interest compounding, since interest will be charged on the capitalized interest.

Don’t Miss: Is Student Loan Refinancing Worth It

Paying Off Federal Loans Vs Private Loans

Theres no definite answer when it comes to which can be paid off faster, federal student loans or private student loans. It depends on the amount of your loans, how much your payments are, your interest rate, and how much money youre making after school:

- How much is your monthly student loan payment?

- Did you choose a repayment plan where you make payments during school, or did you have a grace period after graduation?

- Is there a cosigner on the loan? Are they helping with payments?

- Are you keeping up with your payments and paying interest that accrues before it capitalizes ?

What Are Direct Unsubsidized Loans

One of the biggest differences between subsidized versus unsubsidized loans is who can qualify. Unlike subsidized loans, Direct Unsubsidized Loans are available to all students regardless of financial need. That includes both graduate and undergraduate students.

However, like subsidized loans, your educational institution determines how much you can borrow. Although it’s not based on financial need, colleges determine this amount based on your cost of attendance and other financial aid.

The other key differentiator is that, unlike subsidized loans, the federal government does NOT cover the interest while the student is in school. Interest will start to accrue as soon as the loan is disbursed. Any interest that has accrued on the loan before the borrower leaves school will be capitalized back into the principal amount of the loan.

That means that if your loan was for $10,000 and you accrued $1,000 of interest during school, your loan is now for $11,000 instead of $10,000. A slightly higher principal may not seem like much when you graduate, but it can add up to potentially paying thousands extra over the life of your loan.

This is a major benefit of paying off student loan interest while in school. If you can swing it, any interest you can pay while still in school can help to greatly reduce the total amount you pay overall.

Recommended Reading: What Size Mortgage Loan Can I Qualify For

Loan Limits On Unsubsidized Student Loans

Unsubsidized loans generally allow higher loan limits than on subsidized loans, letting students borrow more money.

An independent undergraduate student will qualify for a higher loan limit than a dependent undergraduate student on an unsubsidized federal student loan. Dependent undergraduate students may qualify for the same limits as independent students if their parent was denied a Federal Parent PLUS Loan due to an adverse credit history.

Federal student loans have an annual loan limit per academic year, and an aggregate loan limit, which is the total amount a student can borrow for their education.

What If My Educational Or Career Plans Change Or Something Happens After Im Out Of School And Working

A change in career goals, the loss of a job, or other unexpected changes in your situation could make repaying your loan more difficult than you expected. In some cases, and at the lenders option, you may be permitted to temporarily stop making your payments, or your lender may accept smaller payments than scheduled. This is called a forbearance. In addition, for some loans, you may defer repayments temporarily which may help. The promissory note outlines the specific terms under which you may be granted a deferment. Contact your loan servicer if you think you may need to make arrangements. To view your servicers contact information, please visit the National Student Loan Data System .

Don’t Miss: Can You Refinance Your Car Loan With The Same Company

What Is A Stafford Loan

Also known as William D. Ford Federal Direct Loans, Stafford loans are a government-backed direct loan program. If a student defaults, the government is responsible for paying back the lender. They are, by far, the most common type of federal student loan.

This;type of loan;has fixed;interest rates, which are lower, as compared to;private loans. There is no need for;credit history;and you can opt for loan forgiveness programs if youre unable to pay back the full amount.

Subsidized Stafford loans have a few borrowing limits. For example, a first-year financially dependent undergraduate student can take out a Stafford loan worth $5,500 in total and a maximum amount of $3,500 from this loan can be subsidized.

How Much Should I Borrow So That I Know I Can Afford To Pay It Back

Planning ahead is essential to managing debt. If you plan to borrow each year you are in school, estimate the total amount you will borrow. Then use a sample loan repayment estimator to estimate how much you will have to pay each month. Then decide how much to borrow, you can use the criteria lenders use when they consider an applicants ability to repay.

The total monthly payment for all debts should not exceed 8% of your gross monthly salary.

Don’t Miss: Does Refinancing Car Loan Hurt Credit

Should I Take Out Federal Or Private Student Loans

As you consider how to pay for college, its wise to take advantage of any grant or scholarship opportunities available to you before you start to look at financing options. If you do have to borrow money, its almost always best to start with federal loans. These loans come with many benefits unique to the federal government, like income-driven repayment plans, long forbearance and deferment periods and loan forgiveness options.

If grants, scholarships and federal loans dont cover your costs, you may need to stack on private student loans to finance the remaining balance. While these should typically be a last resort, you may qualify for low interest rates if you have good credit.

Direct Subsidized And Direct Unsubsidized Loans

What is the difference between a Direct Subsidized and a Direct Unsubsidized Loan?;The federal government pays the interest for Direct Subsidized Loans while the student is in college or while the loan is in deferment. Interest begins accruing for Direct Unsubsidized Loans as soon as the loan is taken out.

How much can I borrow?;For subsidized loans, the maximum is $3,500 for freshmen, $4,500 for sophomores and $5,500 for juniors and seniors. Undergraduates who are not eligible for Direct Subsidized Loans may borrow an identical amount in a Direct Unsubsidized Loan. Undergraduates may also borrow an additional $2,000 in a Direct Unsubsidized Loan after they have exhausted their initial subsidized/unsubsidized eligibility. Graduate students may borrow a Direct Unsubsidized Loan for up to $20,500. Undergraduates may not borrow subsidized loans in excess of their financial need . No student may borrow unsubsidized loans in excess of his/her cost of attendance.

What are the interest rates?2021-2022 Direct Loan Interest Rates and Fees

| Direct Loan Program | |

| 5.28% | 1.057% |

*Direct Loan Fee: The Subsidized and Unsubsidized Federal Direct Loans have a 1.059% origination fee which will be deducted from the gross amount of the loan borrowed.

When are the payments due?;Repayment begins six months after leaving college. Payments are made monthly, and you have 10 years to repay the loan.

How do I apply?

Entrance and Exit Interviews

Office of the Ombudsman

Don’t Miss: Which Credit Union Is Best For Home Loan

Features Of Unsubsidized Student Loans

Unsubsidized student loans;accrue interest over the duration of your studies, during;deferment, and;grace periods. While you are not obligated to pay interest during these periods, your refusal to pay will result in the interest amount being added to the principal amount, which increases the overall payable interest, as well.

is a breakdown of the features of;unsubsidized loans:

- A fixed interest rate of 2.75% for undergraduates and 4.30% for graduate students.

- A loan origination fee of 1.069%.

- You receive a six-month;grace period;after graduating, during which you dont have to pay interest on your loan. However, it still accrues in your principal amount.

- The interest is capitalized in the duration of your studies.

- There is no requirement for proof of financial need. Practically anyone can apply for an unsubsidized student loan.

Unsubsidized loans;are best for graduate students and people who cant demonstrate the;financial need;for a loan.

How Are Federal Student Loans Disbursed

If you submitted the Free Application for Federal Student Aid , you put yourself in the running for federal student loans from the government. These federal student loans include subsidized and unsubsidized direct loans, as well as PLUS loans, which your parents can apply for separately.

If youre a first-time borrower, youll need to complete student loan entrance counseling before your funds can be disbursed. Found online at the Federal Student Aid website, entrance counseling goes over your responsibilities as a borrower. It takes just 20 to 30 minutes to complete.

Once your loan is ready to be disbursed, the Department of Education will send it directly to your school. Your school will apply that money to cover tuition and any other fees. As noted above, if theres a remainder left over, your school will send it to you.

You can then use that money to cover living expenses throughout the semester. Alternatively, you could return the loan money so you dont end up paying interest on it. In fact, you have a 120-day window after the loan is disbursed during which you can return some or all of the funds.

Federal student loan timeline

- Accept federal loans listed on your schools financial aid award package

- Complete entrance counseling

- Confirm with your school that it received the funds to cover tuition and fees

- Employ the remainder of your loan disbursement toward additional expenses or return unused funds to the education department

Also Check: Which Bank Gives Loan For Land Purchase

How Much Can I Borrow With A Subsidized Loan

The quantity youll be able to borrow with a backed student loan is set by your faculty, and the quantity cannot exceed your monetary want. The quantity youll be able to borrow annually additionally is dependent upon your yr in class and your dependency standing. The following chart reveals the annual and mixture limits for backed loans as decided by the U.S. Department of Education.

Should You Choose A Subsidized Or Unsubsidized Student Loan

Paying for college can be tough for families. Saving for college and applying for scholarships and grants can go a long way to foot the bill. Still, even with a healthy savings plan and plenty of financial aid, many families will need to take out student loans to cover the cost of college.

If this is the case for your family, it is important to know that you are not alone.

;take out some kind of student loan to pay for college. The overwhelming majority of these student loans are federal loans.

In fact, 92 percent of student loans are federal loans. There are many benefits to federal loans, but it can be difficult to understand the differences between all kinds of loans. Here is what students need to know about subsidized versus unsubsidized loans and which is best for you when it comes to paying for college.

Recommended Reading: When Can I Apply For Second Ppp Loan

Federal Student Loan Fees

When you are approved for a direct federal loan, you may be surprised to learn that you won’t receive the full amount. The reason is that you must pay a loan fee of (1.057% for Direct Subsidized and Direct Unsubsidized, and 4.228% for Direct PLUS loans issued between Oct. 1, 2020, and Oct. 1, 2022, which is taken out of your loan principal. However, you still have to pay interest on the full principal even though you don’t actually get that amount.

For example, someone with a $7,500 loan and a 1.057% loan origination fee would receive $7,420.73. But they are still responsible to pay the full $7,500 when it comes time for repayment.

Be aware that, in response to the COVID-19 pandemic, there is 0% interest and a suspension of payments from March 13, 2020, through Jan. 31, 2022.

Where Can I Find Information About The Interest Rates For Federal Direct Loans

The Federal Government sets the interest rate July 1st of each year.

The interest rates are the same for Stafford Loans in the Federal Direct Loan Program and FFELP, but the Direct Loan Program offers lower interest rates in the PLUS and Grad PLUS programs.

For interest rates, please visit the Loan Comparison Chart or select a specific loan program to view.

Also Check: How To Transfer Car Loan To Another Person

Monitoring Your Loan Limits And Debt

It is your responsibility to monitor your Federal Direct Subsidized and Unsubsidized aggregate and annual loan limits. If you reach your total undergraduate aggregate limit, total Federal Direct Subsidized and Unsubsidized aggregate loan limits or your annual loan limit, you will not be eligible to receive any additional Federal Direct Subsidized and Unsubsidized loans, see Federal Direct Subsidized and Unsubsidized loan limit amounts. If the Financial Aid and Scholarship Services Office determines at any time you have exceeded your annual or aggregate loan limits, your awards could be reduced or cancelled after you have received the funds, see examples of students owing loan funds back to ASU.

Comparison Of Loan Repayment Schedules While In College

| ; |

|---|

Detailed analysis . . .

The above analysis assumes all loans are unsubsidized and half is disbursed at the beginning of each semester: freshman year loan: $5,500, sophomore year loan: $6,500, junior year loan: $7,500 and senior year loan: $7,500 for a total of $27,000 disbursed. Assumes a 4.5 percent fixed interest rate for the entire four years. Analysis provided by Pamela Heestand, a member of the Paying For .;

You May Like: When To Apply For Ppp Loan Forgiveness

Are Unsubsidized Loans Bad

Unsubsidized loans have many benefits. These loans, unlike subsidized loans, can be used for undergraduate and graduate school, and students do not need to show financial need to qualify. The interest does begin accruing as soon as you take out the loan, but you don’t have to pay the loans back until after you graduate, and there are no credit checks when you apply, unlike private loans.

Subsidized Student Loans: Pros And Cons

FutureFuel Advertiser Disclosure

Our team at FutureFuel works hard to find and recommend products and services that we believe are of high quality. We sometimes earn a sales commission or advertising fee when recommending various products and services to you. Similar to when you are being sold any product or service, be sure to read the fine print to help you understand what you are buying. Be sure to consult with a licensed professional if you have any concerns. FutureFuel is not a lender or investment advisor. We are not involved in the loan approval or investment process, nor do we make credit or investment related decisions. The rates and terms listed on our website are estimates and are subject to change at any time.

Advertising Disclosure: Some of the links in this post are from our sponsors. We may get paid when you click a link. We strive to introduce you only to unbiased and honest recommendations; however, any opinions, analyses or reviews that may be presented are those of the authors alone, and have not been approved or otherwise endorsed by FutureFuel.io.

With the cost of going to college at an all-time high, student loans are no longer a facility. Instead, they have become a necessity. As a result, every seven out of ten students in the US have some level of student debt. Because of this, subsidized student loans are on the rise, with the government and other institutions helping people out by paying part of the loan amount.

Don’t Miss: What Is Portfolio Loan In Real Estate