Are Heloc Rates Fixed

Like credit cards, HELOCs typically have variable interest rates, meaning the rate you initially receive may rise or fall during your draw and repayment periods. However, some lenders have begun offering options to convert all or part of your variable-rate HELOC into a fixed-rate HELOC, sometimes for an additional fee.

The Disadvantages Of A Home Equity Loan

Taking out a home equity loan, or HELOC, to finance a new car does have certain disadvantages. First and foremost, borrowers must be certain they can maintain the regular monthly payment on their loan. This can sometimes be difficult, especially if the borrower is still paying off their first mortgage. Unlike a standard auto loan, where default means repossession, failure to pay off a home equity loan can put the borrower’s home at risk for foreclosure.

What Special Protections Are Available For High

A high-cost mortgage is a home equity loan that is: secured by your principal residence and the APR exceed certain threshold amounts that are tied to market conditions. If you have a high-cost mortgage, you may have additional rights under federal law, the Home Ownership and Equity Protection Act and the CFPB has more information about your special rights.

If instead you have a higher-priced mortgage with an APR higher than a benchmark rate called the average prime offer rate , you may have additional rights. You may be entitled to these rights if your higher-priced mortgage is used to buy a home, for a home equity loan, second mortgage, or a refinance secured by your principal residence. These additional protections do not apply to HELOCs. If you have a higher-priced mortgage, the CFPB has additional information about your rights.

Recommended Reading: Refinancing A Fha Loan To A Conventional Loan

Current Local Auto Loan Rates

We publish current local auto loan rates for new & used vehicles. Car buyers can use these quotes to estimate competitive loan rates before dealing with an auto dealership in a negotation where the dealer has the upper hand and charges too high of an interest rate or tries to require unneeded extended warrany programs as a condition for extending funding.

When To Choose A Home Equity Loan

Home equity loans are likely the better choice when you need a set amount of money instead of an open-ended credit line.

- Debt consolidation A lump sum from a home equity loan can be used to consolidate high-interest debt sitting on different credit cards.

- Emergency bills If your car breaks down or your water heater fails, a lump sum from a home equity loan can cover the bill from your mechanic or plumber.

- Major purchases A lump sum from a home equity loan can help pay for major purchases like an engagement ring.

- Home renovation If youre planning to renovate your home in one push and know the amount youll need, a home equity loan may make more sense than a HELOC.

- Medical treatments A home equity loan can pay for medical and dental procedures such as fertility treatments or veneers.

You May Like: Mlo Endorsement To A License Is A Requirement Of

Home Equity Lines And Loans

Home equity is the difference between your homes market value and the amount you owe on your mortgage. With a Horizon Bank Home Equity Line of Credit or Term Loan, you have flexible options to achieve your goals. You can renovate and improve your home, consolidate debt, finance education, and make major purchases. Get started today.

The Big Picture: Types Of Refinancing

First, let’s cover the basics. Both cash-out refinancing and home equity loans are types of mortgage refinancing. There are several other types of mortgage refinancing, and you need to consider whether refinancing is appropriate for you before looking at the differences between cash-out refinancing and home equity loans.

At the broadest level, there are two common methods for a mortgage refinance, or refi. One is a rate-and-term refinance, in which you effectively swap your old mortgage for a new one. In this type of refinancing, no money changes hands, other than costs associated with closing and funds from the new loan paying off the old loan.

The second type of refi is actually a collection of different options, each of which releases some of the equity in your home:

- A cash-out refinance effectively pays out some of the equity in your home as cashyou emerge from the closing with a new mortgage and a check for cash.

- A home equity loan gives you cash in exchange for the equity you’ve built up in your property as a separate loan.

In this article, we’ll look at these two types of mortgage refinancing.

Also Check: Refinance Auto Loan Usaa

Is A Heloc Tax Deductible

Interest paid on a HELOC is tax deductible as long as its used to buy, build or substantially improve the taxpayers home that secures the loan,according to the IRS. Interest is capped at $750,000 on home loans . So if you had a $600,000 mortgage and a $300,000 HELOC for home improvements on a house worth $1.2 million, you could only deduct the interest on the first $750,000 of the $900,000 you borrowed.

If you are using a HELOC for any purpose other than home improvement , you cannot deduct interest under the tax law.

Bmo Harris Bank: Best Home Equity Line Of Credit For Different Loan Options

Overview: BMO Harris Bank has more than 500 branches spread across eight states. However, customers nationwide can bank with BMO online. Its HELOCs start at $25,000, come with flexible repayment terms and have no setup fees.

Why BMO Harris Bank is the best home equity line of credit for different loan options: BMO Harris has a standard variable-rate HELOC, but you can also lock in all or part of your line at a fixed rate for a five- to 20-year term.

Perks: There are no application fees or closing costs, and you get a 0.5 percent discount when you set up autopay with a BMO Harris checking account.

What to watch out for: Borrowers may have to repay setup costs if the line of credit is closed within 36 months. Depending on the state in which you live, you may also have to pay mortgage taxes and an annual fee.

| Lender | |

|---|---|

| $25,000 to $150,000 | |

| Fees | BMO Harris covers the setup costs, but the borrower may have to repay those costs if the line of credit is closed within 36 months. Depending on the state, borrowers may also have to pay mortgage taxes. In some states, there is a $75 annual fee during the draw period. |

Also Check: Capitol One Autoloans

Help From The Mortgage Lender

Most mortgage lenders and banks dont want you to default on your home equity loan or line of credit, so they will work with those struggling to make payments. Its important to contact your lender as soon as possible. The last thing you should do is ignore the problem. Lenders may not be so willing to work with you if you have ignored their calls and letters offering help for months.

When it comes to what the lender can actually do, there are a few options. Some lenders will offer certain borrowers a modification of their home equity loan or line of credit. Modifications can include adjustments to the terms, the interest rate, the monthly payments, or some combination of the three, to make paying off the loan more affordable.

Using A Home Equity Loan For A Remodel

A home equity loan lets you borrow a lump sum amount of money against the equity in your home on a fixed interest rate and with fixed monthly payments over a fixed term of between five and 20 years, much like your first mortgage except with a shorter term.

How much you can borrow depends on your homes market value and mortgage balance , but this will usually be between 80% and 90% of what its currently worth minus your existing mortgage.

As an example, if your home is worth $500k and your current mortgage balance is $375k, a home equity loan could let you borrow up to $75k.

These are secured loans that use your home as collateral, meaning that you could lose this in the event that you are unable to make payments.

Technically, you can use the lump sum of money that you get from a home equity loan for anything, but it is typically used for home improvement projects, paying for college, medical expenses, debt consolidation, business or wedding expenses.

Home improvement projects are the most common purpose, though, with the US Census Bureaus Housing Survey confirming that approximately 50% of home equity loans are used in this way.

Home Equity Loan ProsHome Equity Loan Cons

Don’t Miss: Sss Loan Application

When A Home Equity Loan Makes Sense

- You need money now , and you know exactly how much

- You need to pay off high-interest debt

- You want the certainty of a fixed interest rate

If you know exactly how much you need to borrow, a home equity loan can be a better option than a HELOC. Home equity loans tend to have lower interest rates than HELOCS, and the rates are usually fixed for the life of your loan.

Since youll also have a fixed repayment period of typically 10 or 15 years youll know exactly what your monthly payment will be when you take out your loan.

A home equity loan can be a better choice than a HELOC when you know that you need a predetermined amount of money for a specific purpose, like a home improvement project or paying off high-interest debt. Thats because youll typically get a lower, fixed rate than youd pay on a HELOC.

When using a home equity loan to pay off higher interest debt, keep in mind that you may end up stretching out your payments over a longer period of time, which wipe out some or all of the savings you get by lowering your rate.

If you pay off a five-year car loan with a 10- or 15-year home equity loan, for example, youll be making twice or three times as many monthly payments. Theyll be much smaller, but it will take you longer to pay down your loan principal. Make sure to compare the total repayment costs of both options.

Pros And Cons Of A Cash

The primary advantage of a cash-out refinance is that the borrower can realize some of their property’s value in cash.

With a standard refinance, the borrower would never see any cash in hand, just a decrease to their monthly payments. A cash-out refinance can possibly go as high as an approximately 125% loan-to-value ratio. This means the refinance pays off what they owe, and then the borrower may be eligible for up to 125% of their homes value. The amount above and beyond the mortgage payoff is issued in cash just like a personal loan.

On the other hand, cash-out refinances have some drawbacks. Compared to rate-and-term refinancing, cash-out loans usually come with higher interest rates and other costs, such as points. Cash-out loans are more complex than a rate-and-term and usually have higher underwriting standards. A high credit score and lower relative loan-to-value ratio can mitigate some concerns and help you get a more favorable deal.

Read Also: Does Capital One Do Auto Refinancing

Which Is Better A Home Equity Loan Or Line Of Credit

If you’re going to use your home as collateral for a loan, you’ve got choices. Here’s how to decide what to do and whether to do it.

Welcome to the 2-Minute Money Manager, a short video feature answering money questions submitted by readers and viewers.

Todays question is about borrowing by using your house as collateral specifically, the difference between home equity loans and home equity lines of credit.

Watch the following video, and youll pick up some valuable info. Or, if you prefer, scroll down to read the full transcript and find out what I said.

You also can learn how to send in a question of your own below.

For more information, check out Heres How to Get a Large Loan Fast and 4 Ways Home Equity Loans Can Sink Your Finances. You can also go to the search at the top of this page, put in the words home equity loan and find plenty of information on just about everything relating to this topic.

And if youd like to compare current offers on mortgages and home equity loans, along with lots of other financial products, be sure and visit our Solutions Center.

Got a question of your own to ask? Scroll down past the transcript.

When To Apply For A Home Equity Line Of Credit

Those with larger expenses that will be spread out over a period of time, may find the benefits of a HELOC much more appealing. When you apply for a home equity line of credit, you have access to an approved limit of cash, but you dont need to pay any interest on the money until you actually start to withdraw it from the line. Its great when you dont need the funds all at once. Your payments are based on the balance you withdraw from your HELOC, rather than the total of your approved amount. The line allows you to draw funds when you need them. As you pay down the balance, you can continue to re-use the line for the entire term of the loan. There will be a pre-specified draw period and repayment period. You also have the peace of mind in knowing you have access to funds in the event of an emergency. A HELOC is ideal for borrowing needs including:

- Home improvement projects that are spread out over time

- Ongoing Educational expenses

- Large expenses, such as new appliances

- A combination of expenses

Recommended Reading: Becu Auto Loan Early Payoff Penalty

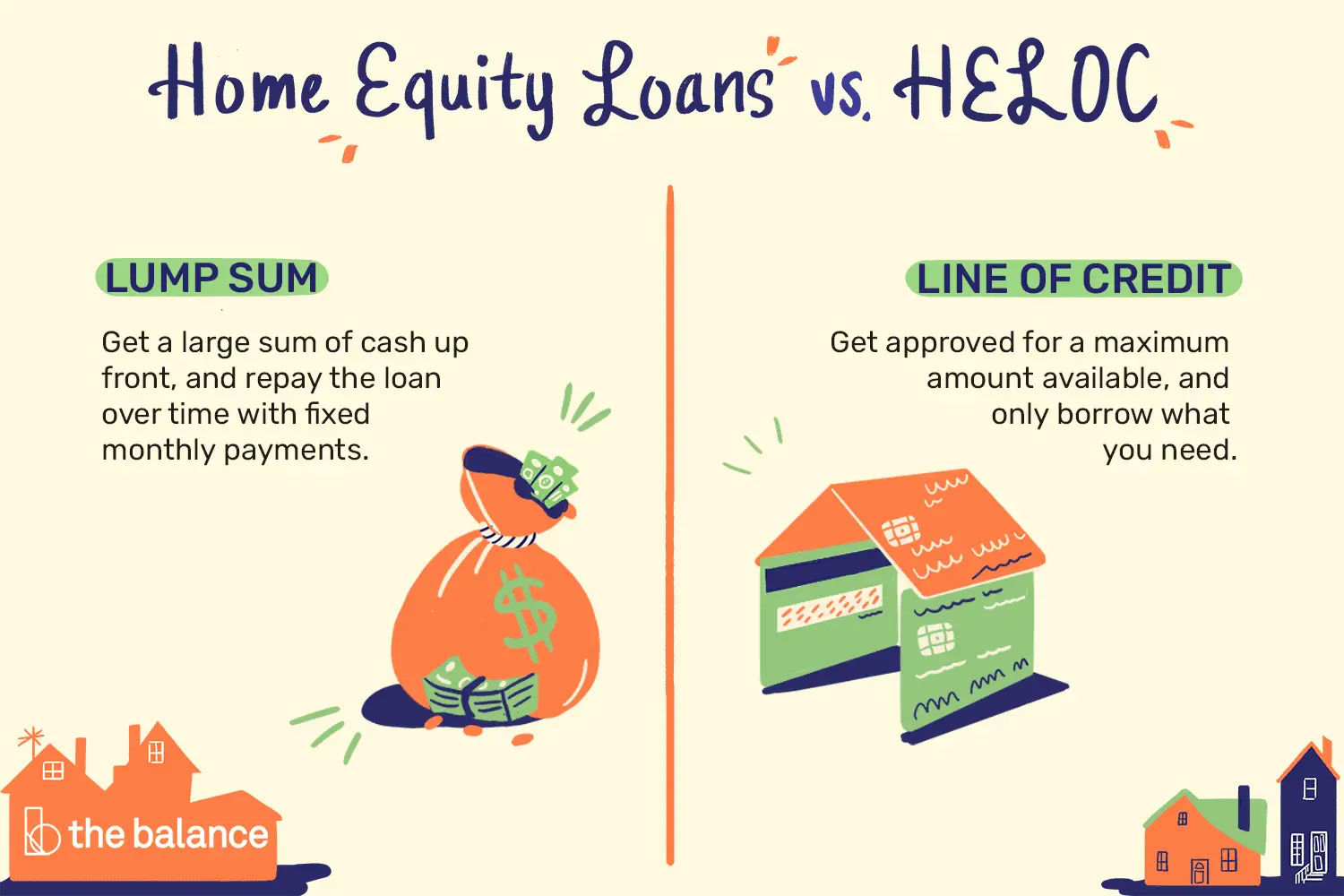

Home Equity Loan Vs Home Equity Line Of Credit: How Are They Different

Home equity loans and home equity lines of credit are both similar financial tools used by homeowners who need a quick source of funding. If youre considering borrowing against your home, you want to understand the differences between a home equity loan vs. home equity line of credit.

A home equity loan and a home equity line of credit both allow you to tap into your equity. But they differ in how you borrow and how your interest rate works. This guide will help you understand the home equity loan vs. home equity line of credit basics so you can decide which is right for you.

Safeguards And Protections For Helocs

What federal safeguards apply to HELOCs?

Under federal law, lenders must tell you:

- about the terms and costs of the line of credit in most cases when you get an application

- the APR and payment terms

- the charges by the creditor to open, use, or maintain the account, like an application fee, annual fee, or transaction fee

- the charges by other companies to open the line of credit, like an appraisal fee, fee to get a credit report, or attorneys fees

- about any variable-rate feature

Lenders must give you a brochure describing the general features of HELOCS.

If you decide not to take the HELOC because of a change in terms from what you expected, the lender must return all of the fees you paid.

Lenders also must give you three business days, including Saturdays, but not Sundays, to cancel a HELOC, which usually starts to run from when you opened the plan, or when you received all material disclosures, whichever occurs last:

- You may cancel the HELOC for any reason.

- To cancel, you must inform the lender in writing within the three-day period. Then the lender must cancel its security interest in your home and must also return fees you paid to open the plan.

- If the required notice and disclosures are not provided, you may have up to three years after opening the plan to rescind the HELOC.

- For more information, see The Three-Day Cancellation Rule.

How can I avoid possible pitfalls with a HELOC?

Read Also: Does Advance Auto Rent Tools

Which Gets Me Money Faster: A Heloc Or A Home Equity Loan

If you need money as quickly as possible, a HELOC will generally process slightly faster than a home equity loan. Multiple lenders advertise home equity loan processing timelines from two to six weeks, whereas some lenders advertise that their HELOCs can close in less than 10 days. The actual closing time will fluctuate based on the amount borrowed, property values, and the of the borrower.

Is A Home Equity Line Or Loan Right For You

A HELOC gives you the flexibility of a financial backstop thats there when you need it. If your roof needs repair or a tuition bill comes due when youre short of cash, drawing on a home equity line of credit can be a convenient solution. You decide when to use the funds, and you pay interest only on the money you actually use. On the flip side, with a HELOAN, you get a lump sum of cash at loan closing, and know how much your monthly payments will be and how long it will take to pay off the loan.

With either, the amount you can borrow will depend on the value of your home and the amount of equity you have available. And with both, its important to remember that youre using your home as collateraland it could be at risk if its value drops or theres an interruption in your income.

But if you qualify and your financial situation is stable, a home equity line or a home equity loan could be a helpful, cost-effective tool for making the most of your homes value.

Ready to apply? Apply online now

You May Like: Can I Refinance A Fha Loan