How Do I Apply For A Title Loan

To apply for a car Title Loan, please bring the following items to an Advance America location near you:

To qualify for a car Title Loan, your car must be registered in your name, must be paid off and you should have possession of the title. In some states, your gross monthly income will also determine the Title Loan amount offered. At our location, one of our employees will inspect your vehicle and determine its value.

Knoxville Biz Ticker: Becky Massey Announces $8 Million Grant For Knoxville Downtown Island Airportyour Browser Indicates If You’ve Visited This Link

Senate Transportation and Safety Committee Chairman Becky Massey announces $8 million grant for Knoxville Downtown Island Airport , August 27, 2021 — Senate Transportation and Safety Committee Chairman Becky Massey said today that the Knoxville Downtown Island Airport will receive an $8 million state grant to fund improvements.

The Knoxville News-Sentinel on MSN.com

Advance America Rates Fees And Terms

Advance America charges different rates, fees and terms depending on where you live and the type of loan you get.

Payday loans

Advance America payday loans usually come with a flat fee of $15 to $20 per $100 borrowed instead of interest.

Terms are either 14 or 30 days, depending on if you paid once a month or every two weeks.

This means youll get an annual percentage rate of 200% to 450%. But it can top 700% in some cases.

While it offers payday loans from $50 to $1,800, how much you can borrow depends on your state. And if you borrow online, the minimum loan amount is usually $100.

Installment loans

Advance America installment loans come with interest and fees that usually range from 150% to 400% APR, depending on your state. In many states, rates are higher if you make payments in cash or get paid once a month.

Repayment terms can range from 6 to 24 months, though they can be as short as 90 days. Loan amounts tend to run from $100 to $2,500.

Title loans

Advance America isnt very transparent about the cost of its title loans in every state. But it varies depending on whether you borrow online or in person.

Generally, online title loans range from $2,000 to $25,000 with rates as low as 36% APR if you borrow over $5,000.

In-store title loans often range from $400 to $10,000 with rates from around 120% to 300% APR. Advance America doesnt disclose the range of terms available on title loans in most states.

Also Check: Usaa Rv Loan Terms

How Will I Know If I Am Qualified For A Title Loan

To find out if you are qualified for a Title Loan, simply visit your closest Advance America location with your vehicle for inspection, vehicle title, government issued ID, and proof of residence. Our friendly team member will have you complete an easy Title Loan application and inspect your vehicle. Upon completion of this process, you will know if you qualify for a Title Loan. Before you head to our store, you can use our Title Loan estimator tool to see what amount you may qualify for.

Are Diagnostic Tests For Cars Free

There are literally thousands of diagnostic trouble codes that the check engine light might refer to. The only way to even get started is to connect a scan tool. Some auto repair shops charge for auto diagnostic services, but some places, such as autoparts stores, offer to scan your vehicle for free.

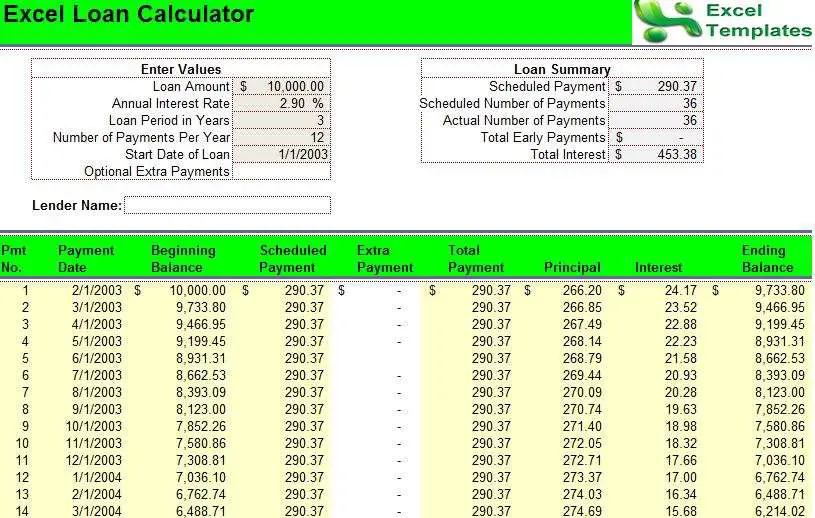

Recommended Reading: How To Calculate Amortization Schedule For Car Loan

What Is Interest Rate

Interest rate is the amount charged by lenders to borrowers for the use of money, expressed as a percentage of the principal, or original amount borrowed it can also be described alternatively as the cost to borrow money. For instance, an 8% interest rate for borrowing $100 a year will obligate a person to pay $108 at year-end. As can be seen in this brief example, the interest rate directly affects the total interest paid on any loan. Generally, borrowers want the lowest possible interest rates because it will cost less to borrow conversely, lenders seek high interest rates for larger profits. Interest rates are usually expressed annually, but rates can also be expressed as monthly, daily, or any other period.

Interest rates are involved in almost all formal lending and borrowing transactions. Examples of real-world applications of interest rates include mortgage rates, the charge on a persons outstanding debt on a credit card, business loans to fund capital projects, the growth of retirement funds, amortization of long-term assets, the discount offered by a supplier to a buyer for paying off an invoice earlier, and much, much more.

Simple vs. Compound Interest

Does Oreilly Scan Codes For Free

A check engine light is often the first warning of a potential problem. OReilly Auto Parts offers free check engine light testing to help you diagnose the problem. Most of our stores can loan you a code reader for OBD 1& 2 systems for vehicles from 1996 and up, except in areas where it is prohibited by law.

Don’t Miss: Mortgage Loan Originator License California

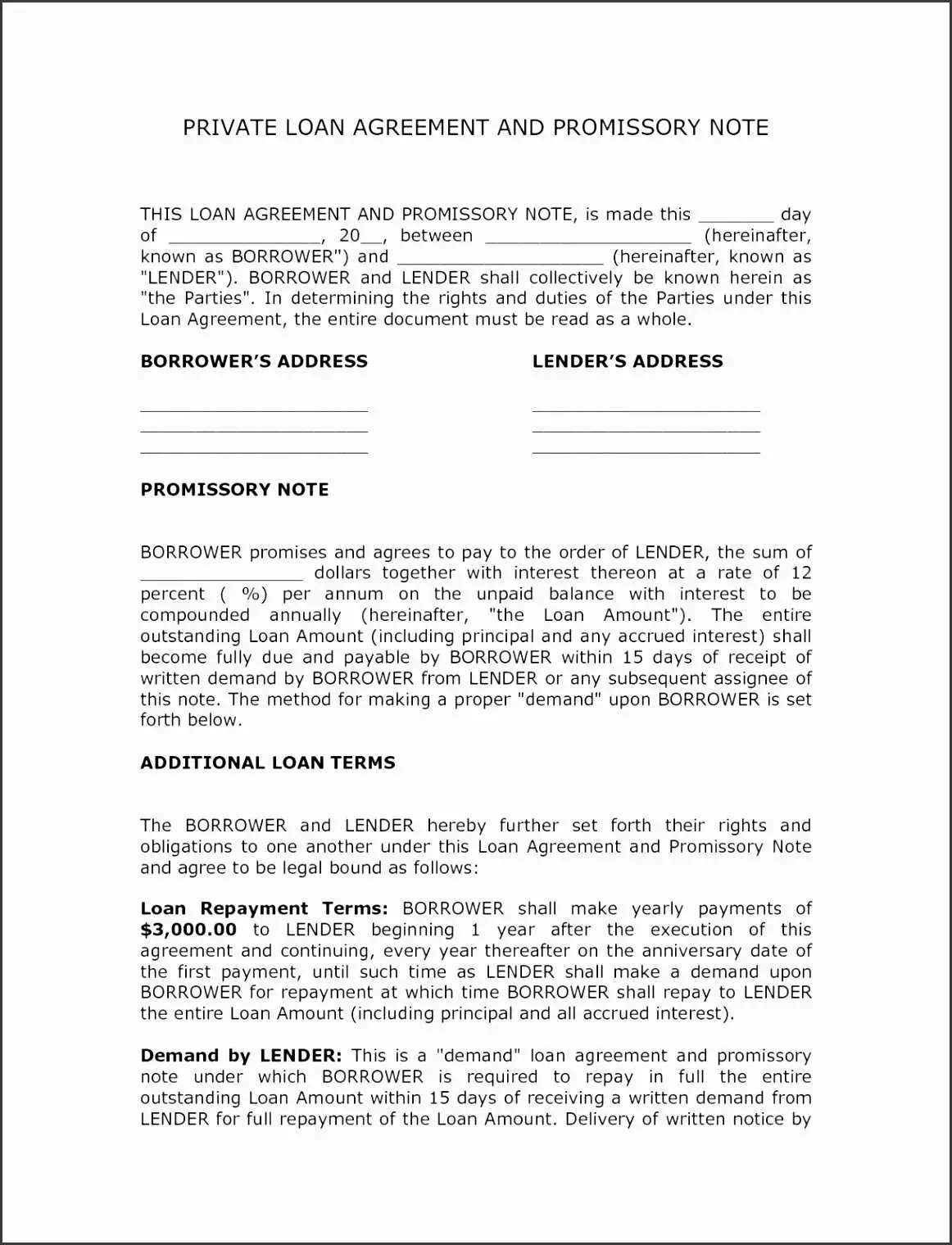

I Got A Flex Loan Whats Next

Flex loans are revolving lines of credit. This means that your line of credit opens back up as you pay down your balance similar to a credit card. You can continually draw from it for as long as you need. This sets flex loans apart from other short-term loan options that require you to reapply after your loan is paid off.

You can withdraw money from your loan account up to your credit limit and choose to pay the minimum amount due or pay off your balance. By paying your balance, you save on interest. The longer you hold a balance, the more youll pay in the long run.

What Is A Title Loan

If you own the title to your vehicle, a Title Loan allows you to borrow money based on its value. Your car is used as collateral for the loan so you can get the money you need immediately, and keep driving your car while you pay back your personal loan. Title Loans are ideal for individuals looking for a fast solution to short-term financial needs.

You May Like: Where Can I Find My Student Loan Account Number

Should I Get A Drill Or Impact Driver

Do You Need an Impact Driver? If you need to drill holes and drive the occasional medium-sized screw, a regular drill will suit you fine. If youve got a deck to build, a plywood subfloor to install, a tree house to screw together or any other job involving lots of wood screws, consider investing in an impact driver.

Does Advance Auto Parts Do Free Diagnostics

We offer a variety of free services at our stores. Stop by your local store for free engine code scanning on most OBD II vehicles! We cannot guarantee the problem can be resolved during the visit, but we are happy to refer you to one of our local professional technicians if more comprehensive diagnosis is needed.

Don’t Miss: Arvest Construction Loan

Advance Auto Free Services:

- Free Oil & battery recycling: If you change your own oil, or have an old car battery in your garage, you might be wondering what to do with it. Look how happy you make the guy at Advance Auto when you give him a jug of toxic goo!

- Free Electrical / Battery Testing: Do you need a new battery? I dont know either, but they can test your battery, starter, and alternator for free for you

- Free Windshield Wiper Installation Ever try to replace wipers yourself? It can be a headache, so have them do it at the store when you buy new ones

- Free Loaner Tools If youre handy, you might be working on a project that requires a spring compressor or specialized puller that youll never need again. You can borrow all kinds of tools from your local Advance Auto Parts if you leave a deposit

- Free In-Store Pickup Although their website offers free shipping if you spend $75+, you might not want to pay for shipping at all. If thats the case, or if you need your order immediately, just place it online, and specify free in-store pickup and get it in an hour!

- Free car battery installation Buy any battery at their store, and they will install it for free!

- Free chicken wings and beer This is actually the only free thing on this list that they dont offer everything else is true!

Well, there you have it. Lots of free services as well as free advice for your DIY automotive projects from ASE certified team members.

How Much Do You Have To Put Down On A 203k Loan

The minimum down payment is 3.5% for applicants with a credit score above 580. For homebuyers with a credit score between 500-580, the typical down payment required is 10%. Gifted funds are allowed from friends and family, and there are also down payment assistant programs that might be available. Connect with a mortgage advisor to decide which mortgage program will save you the most money.

If your credit score is wavering, learn how to improve your credit score in less than 60 days which we blogged about here.

You May Like: Rv Loan 600 Credit Score

Read Also: What Credit Score Is Needed For Usaa Auto Loan

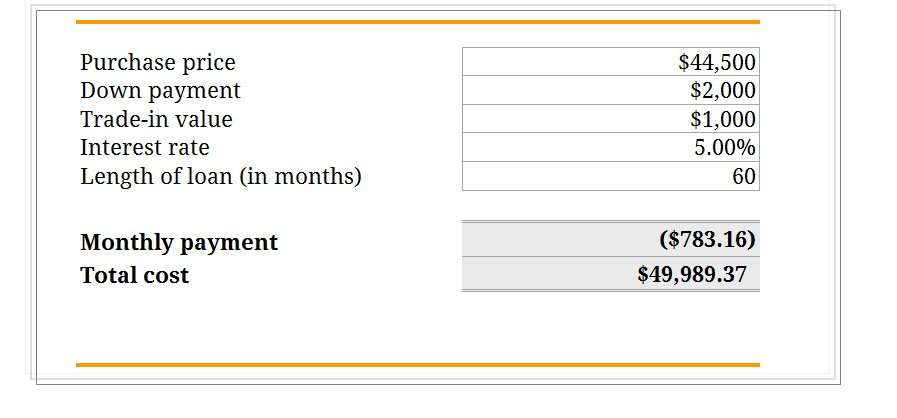

What You Need To Know When Buying A Vehicle

If youve never purchased an automobile before, or even if you have, you should know that the process is anything but simple. This purchase entails a major expense, and although many consumers assume that a vehicle is an asset, the truth is that youre paying for a tool, plain and simple, one that transports you from point A to point B. Automobiles dont gain value . So you need to take great care to select a vehicle that suits both your budget and your purposes. Whether you opt for a modern model or you go for a classic beauty, there are things you need to know going into the process. Here are the key points to consider when youre planning to purchase a new or used car.

Get pre-approved

You can absolutely finance through a dealer if you so choose, and many consumers opt to go this route when purchasing a car, be it new or old. But the truth is that you have more bargaining power when you show up with a pre-approved loan in your back pocket. And chances are good that your bank, credit union, or other trusted lending institution are going to give you a better deal than what youll get from a dealership. Of course, pre-approval also gives you a good idea of your budget going in. So before you even consider signing on the dotted line, talk to lenders about getting pre-approved for a car loan.

Use AAA

Consider a certified pre-owned vehicle

Calculate up-front costs

Inspect the vehicle

How Do Advance America Loans Compare

See how Advance America holds up to other payday loans available online.

MUST READ:

The Consumer Financial Protection Bureau no longer requires lenders to consider your ability to repay a loan. This could put you at risk of getting caught in a cycle of debt. Carefully review your finances and the loan cost to make sure it fits your budget.

Before you take out a short-term loan

Payday loans, installment loans and auto title loans come with high rates and fees which can trap you in a cycle of debt. Borrowers may find themselves taking out a second or third loan because they couldn’t pay back the first one on time.

Consider alternatives before opting for a short-term loan:

- Local resources. Government agencies, nonprofits and local charities often offer free financial services and help with food, utilities and rent for those in need.

- Payment extensions. Talk with your bill providers about a longer payment plan or extension on your due date if you’re behind on payments.

Read Also: Capitalone Autoloans.com

What Does A Vehicle Diagnostic Check

Car diagnostic tests scan your cars components and systems to check for issues with components like the engine, transmission, oil tank, throttle, and many more. Car diagnostic tests are typically carried out when a vehicles dashboard shows a check engine signal or other warning light illumination.

Tools For Loan At Napa Auto Parts

Only select Napa Auto Part locations offer tools for loan or rent. Contact your local Napa Auto Parts store to see if they or another location close to you offer loaner tools.

Editors Note: We reached out to NAPA corporate for more information, but they made it seem like we were asking for the moon.

Read Also: Advance Auto Loaner Tools

The Upfront Mortgage Insurance Premium:

FHA loans have a hefty upfront mortgage insurance premium equal to 1.75% of the loan amount. This is typically bundled into the loan amount and paid off throughout the life of the loan.

For example, if you were to purchase a $100,000 property and put down the minimum 3.5%, youd be subject to an upfront MIP of $1,688.75, which would be added to the $96,500 base loan amount, creating a total loan amount of $98,188.75.

And no, the upfront MIP is not rounded up to the nearest dollar. Use a mortgage calculator to figure out the premium and final loan amount.

However, your LTV would still be considered 96.5%, despite the addition of the upfront MIP.

Qualifying For An Fha Loan

Qualifying for an FHA loan is much easier than trying to qualify for a conventional mortgage loan. No matter your income level, you can gain access to an FHA loan. You can check with several different lenders to see what their requirements are and there is no minimum income level required to qualify.

However, you should still have a reasonable debt-to-income ratio, so you can show you can afford the monthly payments. Borrowers with lower credit scores or less-than-perfect credit are also likely to get approved for the 3.5% down payment. However, if you can pay a bit more toward the down payment of the home, your score can even be between the 500 and 580 mark, and you could still qualify.

Don’t Miss: Usaa Car Loan Number

What You Need To Know About Advance America Loans

Advance America is a large lender that offers online loans and in-person lending at more than 1,400 physical locations. It offers payday loans, installment loans, title loans and personal lines of credit to people with less-than-perfect credit.

Payday loan amounts can start at as little as $100, but both the minimum and maximum loan amounts can vary by state.

Dont Miss: Can I Refinance My Sofi Personal Loan

Does Advance Auto Rent Tools

Advance AutoLoaner TooltoolborrowAdvance AutotoolAdvance Auto

Were here to help by providing these specialty tools with our AutoZone Loan-A-Tool service. Its the most complete selection of seldom-used, expensive-to-own, specialty tools that will help you do the job right. When youre done with the job, just return it to get a full refund of your deposit.

Likewise, does OReilly Auto Parts rent tools? If you need a tool for your repairs, rental tools are available from OReilly Auto Parts. You can rent useful tools like a belt tool kit, wrench set, harmonic balancer tools, and much more. Leave a deposit with us when you pick up the tool and well refund your money when you return it.

Also to know, what tools can you rent at AutoZone?

Miscellaneous Loaner/Rental Tools Products

- Loaner Torque Wrench.

Can you borrow jumper cables from AutoZone?

Get reliable jumper cables from AutoZone and be prepared for battery trouble at any time. We carry battery booster cables from trustworthy brands like Associated Equipment, Deka, Duralast, and Energizer. Buy your cables on AutoZone.com and get free next day delivery or pick them up today at an AutoZone near you.

Recommended Reading: Is It Better To Get A Fixed Or Variable Student Loan

What Is Advance America And Is It Legit

Advance America is licensed lender that offers payday loans, installment loans, auto title loans across 26 states. It also offers lines of credit in Kansas. Its a founding member of the Community Financial Services Association , a body that encourages fair lending practices with full disclosure.

However, its faced lawsuits from multiple states over its high interest rates and fees. It doesnt hurt to double-check your states laws before you sign off on your loan.

Can You Put At Least 35% Down

The big advantage of an FHA loan is that you can get away with putting as little as 3.5% down, assuming your credit score is up to snuff. Another bonus of an FHA loan? Up to 100% of your FHA down payment can come from a gift. If you cant scrape together that 3.5%, though, youll have to wait and save up more down payment funds before getting an FHA loan.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

What If I Cannot Pay Or Will Be Late Repaying My Title Loan

Advance America will work with you to establish payment arrangements for your Title Loan. And we’re committed to collecting past due accounts in a professional, fair and lawful manner. Past due payments may impact your ability to transact with Advance America or other lenders. If you are unable to pay your loan on time, please contact us at your local store or our toll free number 5626480.

What Are The Benefits Of Flex Loans

- Not a payday loan. Flex loans function like lines of credit. You can borrow however much or little you want, and you only pay interest on the amount you take out.

- No late fees. You wont be charged a late fee if you miss your due date. This makes it easier to pay back your loan, although take caution: The larger your balance, the more you owe in interest.

- Variety of in-store services. Residents of Tennessee have access more than just flex loans. You can pay your bills, make copies and send faxes at any of the Advance Financial 24/7 store locations.

You May Like: Drb Refinance Reviews