How Can I Pay Less Interest On My Car Loan

Interest charges can add thousands of dollars to the amount you have to repay. But there are ways you may be able to minimize the impact on your wallet if you need to finance your car purchase.

- 0% APR financing If you have excellent credit and the auto manufacturers finance division offers special financing, you may be able to take advantage of 0% APR financing for a certain amount of time.

- Early repayment If you have a simple interest loan, you can reduce your interest charges by paying more than the minimum due each month or paying off the balance early.

- Shorter loan term Choosing a shorter repayment term will lower the total amount of interest you pay in the long run. But itll increase your monthly payments, so be sure you can afford it.

- Refinance down the road If interest rates drop or your credit improves after you get your car loan, you may be able to get a lower rate by refinancing.

Can I Get 0% Financing On A Car Loan

You may see dealerships advertising 0% financing on their cars. With 0% financing, you buy the car at the agreed-on price, and then make monthly payments on the principal of the car with no interest for a set number of months. However, keep these points in mind:

- 0% interest may only be offered for part of the loan term.

- To be approved, youll need spectacular credit .

- Negotiating the car price will be difficult.

- 0% interest car financing is only available to certain models.

- You may not get as much money for your trade-in vehicle.

- The loan structure will likely be set in stone.

Historical Auto Loan Rates

Auto loan rates are at historically low levels as a result of an overall low interest rate environment. Over the last decade, the average interest rate on a 48 month auto loan from a commercial bank has fallen by over 40%. This is largely a result of the 2009 financial crisis, after which interest rates were lowered to incentivize consumers to stimulate the economy by spending on items like cars rather than saving.

Loans from auto finance companies have historically carried lower rates than loans from commercial banks. The large car manufacturers have “captive finance” arms that exclusively provide loans for consumers purchasing the parent companys cars this enables automakers to provide lower rates, as the car purchase, rather than the interest, is the manufacturers primary revenue stream.

*The Federal Reserve stopped reporting data on auto finance company interest rates after 2011.

Also Check: Becu Autosmart

Your Credit Score And Average Interest Rates

If you dont know your credit score, chances are, youre one of 2.7 million Aussies who are too afraid to ask. Knowing your credit score allows you to fix your credit history if necessary. Equifax offers a credit score band for you to gain some insight on where you are if youre looking at an interest rate on a car loan:

- Excellent 833 1,200

Savvy is rated 4.8 for customer satisfaction by 2685customers.

Simple Interest Car Loans

Most auto loans are simple interest loans, which means that the amount of interest you pay each month is based on your loan balance on the day your payment is due. If you pay more than the minimum due, the interest you owe and your loan balance can decrease.

On a simple interest loan, interest is front-loaded and amortized. With an amortized loan, part of your monthly car payment goes to the principal, which is the amount you borrowed, and part of your payment goes to the interest charges. Because the loan is front-loaded, a larger portion of each car loan payment applies to interest at the beginning of the loan term and at the end of the term more applies to the principal balance.

For example, If you have a $25,000 car loan with a 48-month term and a 4% interest rate, youll pay an estimated $83 in interest and $481 in principal during the first month of the loan term. By the last month, youll only pay an estimated $2 in interest, and $563 will apply to the principal amount.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

How Do You Apply For An Auto Loan

With most people using auto loans to buy a new or used vehicle, the loan process is fairly streamlined. It is also very similar to getting any other loan. The process typically looks like this:

How To Choose The Best Auto Loan For Your Needs

When choosing an auto loan, you should consider:

- The interest rate

- The amount of interest youll pay over the term

- Any additional fees

These factors will all vary depending on what you qualify for and which lender you go with. The best loan for your needs will depend on your priorities.

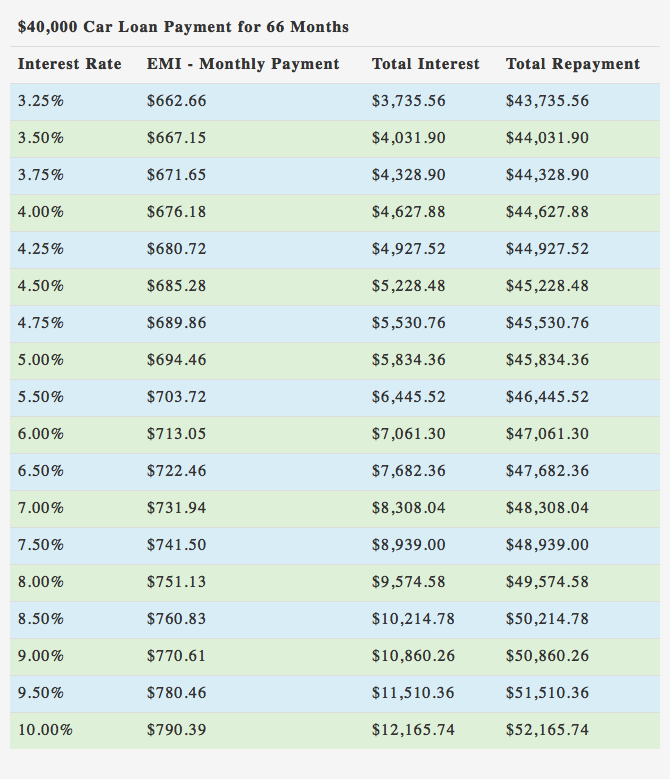

Typically, people choose the loan option with the lowest interest rate, but its important to consider the term as well. Will you end up paying more overall because you entered into a long-term loan? Would you pay less overall if you chose a higher interest rate option with a shorter term? Compare the options and ask yourself these questions to get a clear idea of the total cost.

Youll also need to factor in any additional fees. If those fees cancel out the savings you would have gotten, another lender might be a better choice.

At the end of the day, the best auto loan is one that fits into your budget. You may end up choosing to pay more in interest over a longer term because the lower monthly payments fit into your monthly budget better. There are a lot of moving pieces to consider, so take your time reviewing the math and your personal budget before choosing an auto loan.

You May Like: Do Pawn Shops Loan Money

How Average Interest Rates Vary For Loans For New And Used Vehicles

The average interest rates on auto loans for used cars are generally higher than for loans on new models. Higher rates for used cars reflect the higher risk of lending money for an older, potentially less reliable vehicle. Many banks wont finance loans for used cars over a certain age, like 8 or 10 years, and loans for the older models that are allowed often carry much higher APRs. One leading bank offers customers with good credit interest rates as low as 2.99% for purchasing a new model, but the minimum interest rate for the same loan on an older model from a private seller rises to 5.99%.

The typical auto loan drawn for a used car is substantially less than for a new model, with consumers borrowing an average of $20,446 for used cars and $32,480 for new. However, terms longer than 48 or 60 months are generally not allowed for older model used cars, as the potential risk for car failure grows with age.

Some Used Cars Are A Real Bargain

Before you take the plunge of buying a new car, consider a used one. Frugal shoppers know that new cars depreciate as soon as they are driven off the lot, and in fact lose on average 15-25% of its value each year the first five years. Buying one that’s a couple years old can still provide you with a reliable vehicle for thousands less while letting someone else take the depreciation hit. If you trade in every few years then depreciation is something to consider, so look for vehicles that traditionally hold their value such as Honda, Toyota or Lexus. If you keep your automobile until it falls apart, then depreciation is not a concern for you. New models for the upcoming year usually arrive late summer or early fall. Although selection may be limited, this is a great time to consider buying last year’s model because the dealer will need to make room for the new ones.

Do Not Buy a Lemon!

Check the used car history by the VIN# on sites like Carfax or AutoCheck. This will help eliminate anything that looks questionable. Anything that says it’s a salvage should raise a red flag. Salvage vehicles are those in accidents that the insurance company has determined repair costs are more than it is worth. Some shops will try to repair them and sale them at a steep discount. These are given salvage titles. Unless you are mechanically savvy, it’s best to avoid these.

Program Cars Are Often a Great Value

Don’t Miss: How To Reclassify A Manufactured Home

The Higher Your Credit Score The Less It Will Cost To Borrow

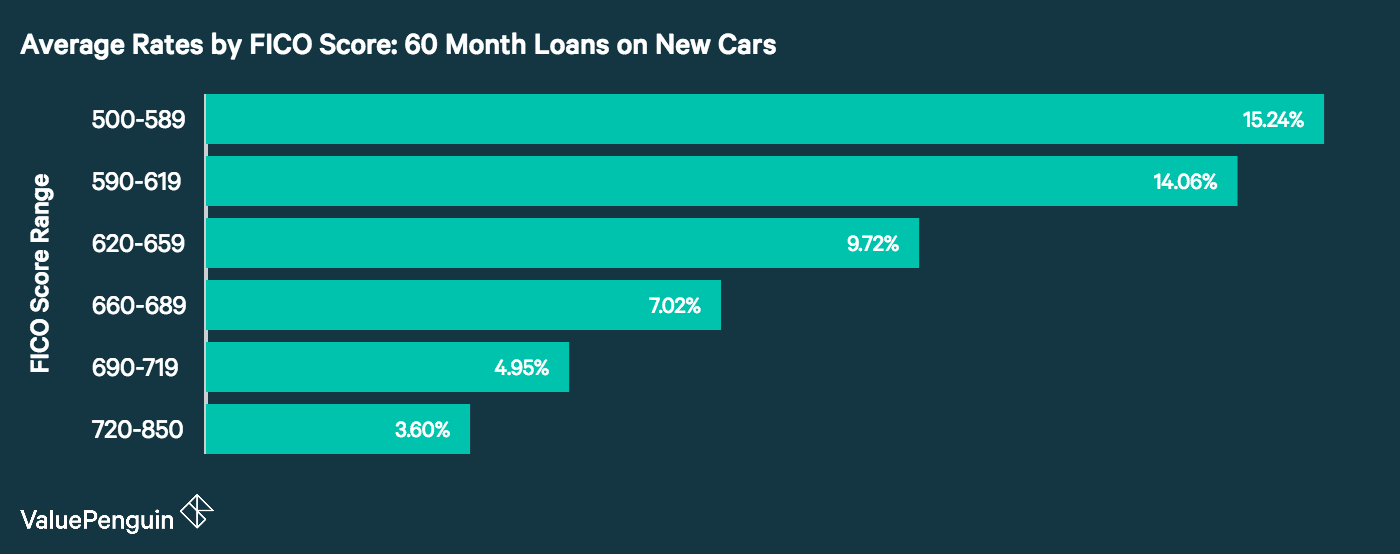

are a numerical representation of your credit history. It’s like a grade for your borrowing history ranging from 300 to 850, and includes your borrowing, applications, repayment, and mix of credit types on your credit report. Companies use credit scores to determine how risky they think lending to you would be, and therefore how much they want to charge you for the privilege.

Auto loans are no exception to the longstanding rule that having a lower credit score makes borrowing more expensive. In the data above, the cheapest borrowing rates went to people with the best credit scores. Meanwhile, those with the lowest credit scores paid about 10 percentage points more to borrow than those with the highest scores.

The interest rate also has a big effect on monthly payment. Using Bankrate’s auto loan calculator, Insider calculated how much a borrower paying the average interest rate would pay for the same $30,000, 48-month new car auto loan:

| Super Prime | 2.34% | $655 |

With the interest rate as the only factor changed, a person with a credit score in the highest category will pay $655 a month, while a person with a score in the lowest category would pay $829 a month, or $174 more for per month for the same car.

What To Do With Your Trade

Although it’s convenient to trade in your old vehicle to the dealer at the time of purchasing another, it’s not to your best advantage. You are likely to get the least value from the dealer, as they have to move it yet again and need to ensure a safe profit margin on selling it. They do not have to take your old automobile, and will offer you what will make them the highest profit. Some dealerships may offer artificially high trade in values, but only offer them in association with a higher price on the vehicle they sell you.

Selling Your Used Car Privately

The best option typically is to sell your vehicle privately. It seems even government agencies are freely giving out this advice from the Arizona Attorney General to the FTC. Don’t underestimate the value of your old car. Go to Kelly Blue Book online to do your valuation research. If you can sell it, even for a small amount, it’s extra bargaining power for your new vehicle.

Each year Americans buy roughly double as many used vehicles as new vehicles. You can put a “for sale” sign on your car parked out front if you live in a high traffic area. Sites like Craigslist or Auto Trader can also help send buyers your way.

Another option with your old automobile is to keep it. An old pick up truck used for heavy work can help protect the value of a new vehicle by minimizing wear and tear, along with depreciation. Automotive insurance companies typically offer multiple vehicle discounts.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Average Interest Rates For Good Credit

Car buyers who have a credit rating from about 700 to 850 have good-to-excellent credit. These buyers will pay between 3% and 4% interest on their car loan. When shopping for a new or used car dealerships usually advertise no money down for qualified buyers — to qualify for this option you often need a very good credit score over 800. It may make more sense to wait a few months and increase your credit score before applying for a loan. You could save thousands of dollars on your car purchase with a lower interest rate.

The Average Interest Rates For Car Loans With Bad Credit

Experian, one of the country’s three main credit bureaus, issues quarterly reports that study data surrounding the auto loan market. Their State of the Automotive Finance Market report from the fourth quarter of 2020 found that the average interest rates for both new and used auto loans look like this:

| Average New Car Loan Interest Rate | Average Used Car Loan Interest Rate | |

| Super prime | ||

| 14.20% | 20.30% |

As you can see, your credit score has a major influence on the interest rate you can qualify for. Auto lenders base interest rates on several factors, including the length of the loan, the vehicle’s age and mileage, and the state you live in but your credit score is by far the most important factor.

Your interest rate ultimately determines your monthly payment and the total cost of financing. So, unfortunately, a bad credit score means you end up paying more in the long run.

Don’t Miss: How Long For Sba Loan Approval

Understand The Terms Of Your Loan

Be sure you fully understand the terms and disclosures of your loan. Know the interest rate, the number of months the loan covers, and the final monthly payment. If you see a cost in the loan terms that doesnt make sense, ask for an explanation and dont proceed until you understand it and feel its justified. Check to see if there is any prepayment penalty if you try to pay off your loan early, and understand what fees will be incurred for things like late payments or returned checks.

Average Auto Loan Interest Rates: Facts & Figures

The national average for US auto loan interest rates is 5.27% on 60 month loans. For individual consumers, however, rates vary based on credit score, term length of the loan, age of the car being financed, and other factors relevant to a lenders risk in offering a loan. Typically, the annual percentage rate for auto loans ranges from 3% to 10%.

Don’t Miss: How To Refinance An Avant Loan

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what’s known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Auto Loans Interest Rates Wef 10062020

| Scheme | Interest Rate w.e.f. 10.06.2020 |

|---|---|

|

i) SBI Car Loan, ii) NRI Car Loan, iii) Assured Car Loan Scheme |

|

|

SBI Car Loan, NRI Car Loan |

From 7.70% to 8.40% |

|

Certified Pre-owned Car Loan Scheme |

Men: 2.25% above 1-year MCLR i.e. 9.25% p.a. For Women: 2.20% above 1-year MCLR i.e. 9.20% p.a. |

|

Certified Pre-owned Car Loan Scheme |

From 9.75% to 13.25% |

|

3.25% above 1 year MCLR i.e. 10.25% p.a |

|

|

SBI Two-Wheeler Loan |

16.25% p.a. to 18.00% p.a. |

Finer pricing for New Car Loans based on CIC scores w.e.f. 10.06.2020

| CIC SCORE |

|---|

|

For Women concession of 5 basis points in this category of 600-688 CIC Score |

| -1 |

Mean Rate for Auto Loans : 9.52%

Interest Rates

Upto 1 lakh

Recommended Reading: Usaa Auto Refinance Phone Number

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.