Can I Use Scanned Copies Of Documents E

Yes. All PPP lenders may accept scanned copies of signed loan forgiveness applications and documents containing the information and certifications required by SBA Form 3508, 3508EZ, or lender equivalent. Lenders may accept any form of Econsent or E-signature that complies with the requirements of the Electronic Signatures in Global and National Commerce Act .

As with all documents in the PPP process, its important to make sure that any documents you send to your lender are easy to read and are as high-quality as you can make them. This will make the process significantly faster and easier.

If electronic signatures are not feasible, then when obtaining a wet ink signature without in-person contact, lenders should take appropriate steps to ensure the proper party has executed the document. This guidance does not supersede signature requirements imposed by other applicable law, including by the lenders primary federal regulator.

Be sure to provide good-quality copies of all your documents, and make sure theyre legible, properly filled out, and accurate.

for loan forgiveness?

Finally Able To Apply

Fountainheads PPP loan forgiveness application

Finally, I was able to apply, and honestly, it could not have been any simpler. Once I clicked on the link to go to the portal I simply signed up for an account.

Next it took me to a screen and I hit Start New Forgiveness Request. From there, you put in your loan information, answer some other questions about your loan, your business, and thats it.

It honestly took me less than 10 minutes to get the whole thing filled out, once I had the answer to a few of their questions. There were two questions that I wasnt 100% sure about how to answer, so I found a local SBA help number and called for some clarification.

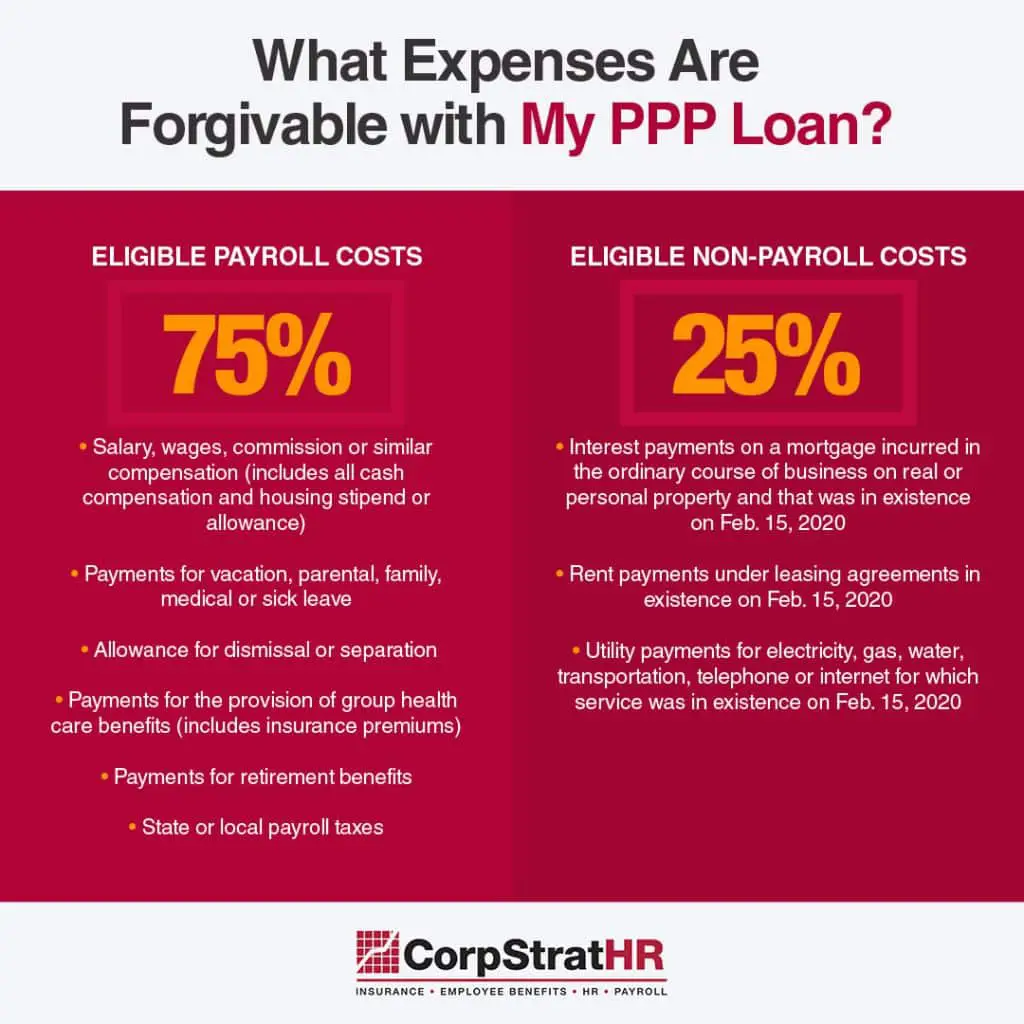

What Is The Paycheck Protection Program

The Paycheck Protection Program provides forgivable emergency loans. The program is designed for Paycheck Protection so businesses keep and rehire employees. As a result, if you spend your loan on payroll, rent, mortgage interest, or utilities then the government will forgive your loan so you dont have to pay it back.

Read Also: Easy Online Loans With Bad Credit

Loan Forgiveness Nonpayroll Costs Faqs

Answer: Yes, eligible business mortgage interest costs, eligible business rent or leasecosts, and eligible business utility costs incurred prior to the Covered Period and paidduring the Covered Period are eligible for loan forgiveness.Example: A borrowers 24-week Covered Period runs from April 20 through October 4.On May 4, the borrower receives its electricity bill for April. The borrower pays itsApril electricity bill on May 8. Although a portion of the electricity costs were incurredbefore the Covered Period, these electricity costs are eligible for loan forgivenessbecause they were paid during the Covered Period.

Answer: Nonpayroll costs are eligible for loan forgiveness if they were incurred duringthe Covered Period and paid on or before the next regular billing date, even if the billingdate is after the Covered Period.Example: A borrowers 24-week Covered Period runs from April 20 through October 4.On October 6, the borrower receives its electricity bill for September. The borrowerpays its September electricity bill on October 16. These electricity costs are eligible forloan forgiveness because they were incurred during the Covered Period and paid on orbefore the next regular billing date ..

What Happens If My Ppp Loan Is Not Forgiven

If only a portion of your loan is forgiven, or if your forgiveness application is denied, then you must repay any remaining balance due on the loan and accrued interest on or before the maturity date of the loan . There is no prepayment penalty for paying your loan off early.

NOTE: Interest accrues during the time between the disbursement of the loan and SBA remittance of the forgiveness amount. If your loan is forgiven, you will not be responsible for that interest. However, you are responsible for paying the accrued interest on any amount of the loan that is not forgiven. Your lender is responsible for notifying you when the SBA remits the loan forgiveness amount and the date on which your first payment is due, if applicable.

In specific cases, you may submit a PPP forgiveness appeal with the SBA. Note: Submitting an appeal doesnt not guarantee that you will get loan forgiveness.

Recommended Reading: What Size Loan Do I Qualify For

Do I Qualify To Apply For A Ppp Loan Using Womply

In general, yes, but here are the basic qualifications :

- Sole proprietor

- self-employed individuals

- pretty much anyone who has 1099 income

As long as you were in operation on or before February 15, 2020 and reported taxable earnings/income for 2019 or 2020, you can likely apply for PPP assistance.

What about if you collected unemployment? According to Womply, If you are self-employed or a 1099 then you likely cannot use your PPP funds to pay yourself and continue to collect unemploymentbecause the payment you make to yourself counts as income, which in most cases will disqualify you from continuing to receive unemployment..

Basically, you cant get a PPP loan and unemployment at the same time.

Wondering how you can use your PPP loan money? Heres what you can use your PPP loan on

- Payroll costs, including benefits

Application Dates For A Third

As noted above, applications for Round three first-draw PPP loans from approved community financial institutions started Mon., Jan. 11, 2021. Second-draw applications began on Wed., Jan. 13. That was followed by first- and second-draw loans from small lenders with less than $1 billion in assets on Fri., Jan. 15, 2021. All SBA 7 lenders were approved to accept first and second draw applications starting on Tues., Jan. 19, 2021.

Also Check: What Loan Do I Need To Buy Land

Ppp Forgiveness & Related Resources

How to applyLINK Harvest BorrowersHow to applySBA loan nameSBA loan numberIMPORTANTSBA Forgiveness Applications and InstructionsFor Borrowers with loans of $150,000 or lessFor Borrowers with loans greater than $150,000How long with the forgiveness process take?

How Large Can My Loan Be

In general, borrowers may receive a loan amount of up to 2.5X the average monthly payroll costs in the one year prior to the loan or the calendar year . No loan can be greater than $2 million. If you are a seasonal or new business, you will use different applicable time periods for your calculation. Payroll costs will be capped at $100,000 annualized for each employee.

You May Like: How Does Cosigning An Auto Loan Work

Sba Ppp Loan Forgiveness Faqs

Read the SBAs answers to frequently asked questions about PPP loan forgivenessFAQs

We understand you may have questions about PPP loan forgiveness and have put together the responses below to help keep you informed.

The Small Business Administration and the Department of Treasuryestablish the guidelines for PPP loan forgiveness.For the latest information, visit the official websites: SBA and U.S. Treasury

Ppp Loan Forgiveness: How To Access The New Portal

With the Paycheck Protection Program Loans ending earlier this year on May 31, the time has come to apply for loan forgiveness for many small businesses. The U.S. Small Business Administration recently announced the opening of a new portal that will streamline the process of helping over 11 million small business owners in a quick and efficient way. Did your small business receive a PPP loan in 2020-2021? See if you have the opportunity to have your loan forgiven using the new portal!

You May Like: How Do Mortgage Lenders Determine Loan Amount

Can I Still Get A Ppp Loan For My Business Nonprofit Or Church

The short answer is, No, you cant, according to the Small Business Administration . But, while the PPP loan may no longer be available for businesses, nonprofits, or churches, there are still plenty of accessible small business funding opportunities if you know where to look. We can help. Heres what to know about PPP loans, PPP forgiveness, and alternate sources of relief monies.

Summary

Second Draw Ppp Loan Forgiveness Terms

Second Draw PPP Loans qualify for full loan forgiveness if during the 8 to 24 week covered period following loan disbursement:

- Employee and compensation levels are maintained in the same manner as required for the First Draw PPP loan

- The loan proceeds are spent on payroll costs and other eligible expenses and

- At least 60 percent of the proceeds are spent on payroll costs

Also Check: How To Find My Student Loan Number

When Can I Apply For Ppp Loan Forgiveness

You can apply for PPP loan forgiveness as soon as all of your loan proceeds have been used, which at the earliest is the first day after your selected covered period .

However, you must apply for loan forgiveness within 10 months of the last day of your covered period in order to receive a deferment on your loan payments. If you wait longer, youll have to start making payments on the balance and deferred interest of your loan .

Can Ppp Lenders Use Scanned Copies Of Documents E

Yes. All PPP lenders may accept scanned copies of signed loan forgiveness applications and documents containing the information and certifications required by SBA Form 3508, 3508EZ, or lender equivalent. Lenders may accept any form of Econsent or E-signature that complies with the requirements of the Electronic Signatures in Global and National Commerce Act .

If electronic signatures are not feasible, then when obtaining a wet ink signature without in-person contact, lenders should take appropriate steps to ensure the proper party has executed the document.

This guidance does not supersede signature requirements imposed by other applicable law, including by the lenders primary federal regulator.

Recommended Reading: What Is The Lowest Mortgage Loan Amount

Bevor Sie Zu Google Weitergehen

- Google-Dienste anzubieten und zu betreiben

- Ausfälle zu prüfen und Maßnahmen gegen Spam, Betrug und Missbrauch zu ergreifen

- Daten zu Zielgruppeninteraktionen und Websitestatistiken zu erheben. Mit den gewonnenen Informationen möchten wir verstehen, wie unsere Dienste verwendet werden, und die Qualität dieser Dienste verbessern.

- neue Dienste zu entwickeln und zu verbessern

- Werbung auszuliefern und ihre Wirkung zu messen

- personalisierte Inhalte anzuzeigen, abhängig von Ihren Einstellungen

- personalisierte Werbung anzuzeigen, abhängig von Ihren Einstellungen

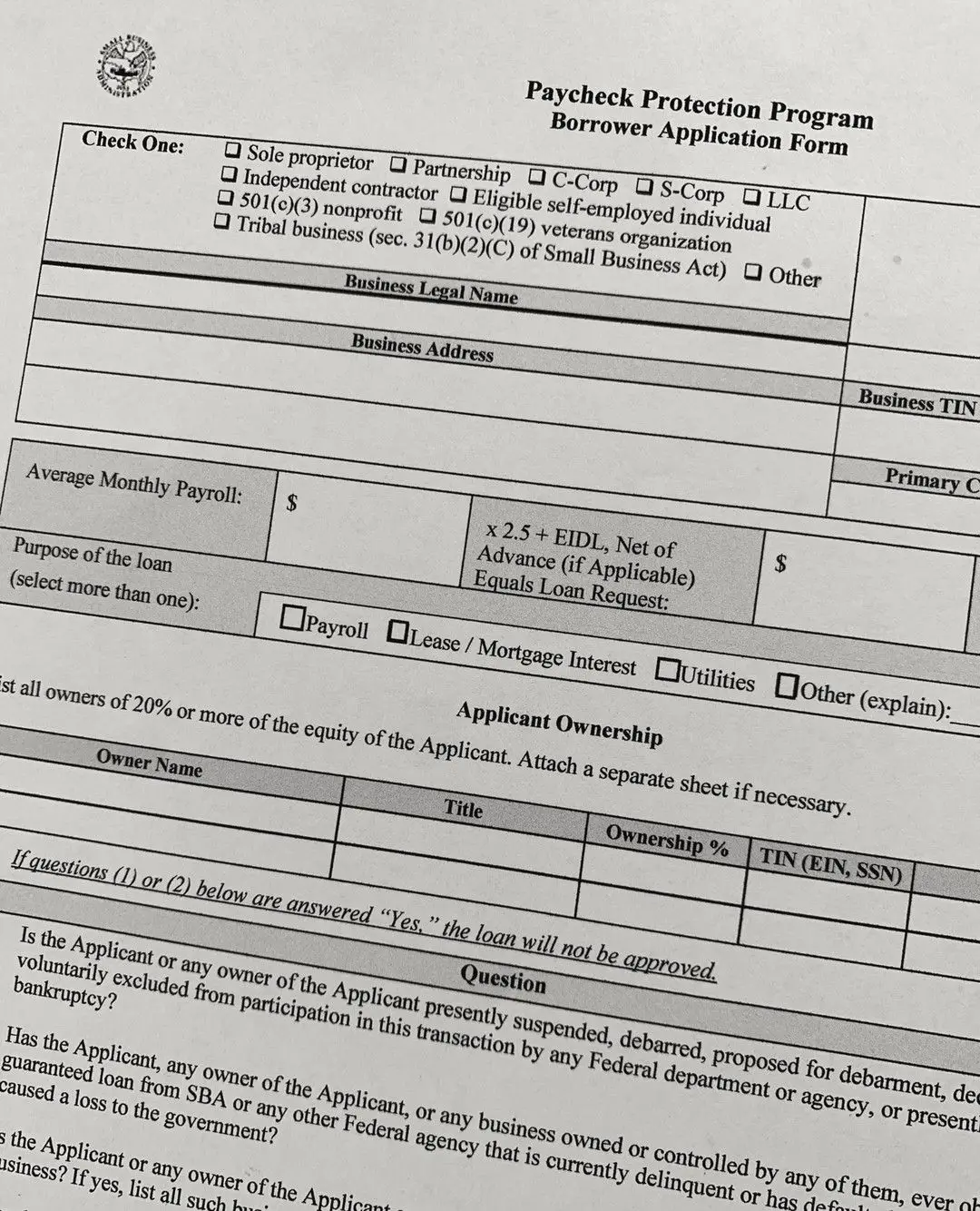

Application Process For A Third

New first- and second-draw loans followed a pattern similar to that followed with previous PPP loans. Business owners could download and fill out the loan application from the SBA website.

The first-draw application was five pages long, including instructions, and the second-draw application was six pages, including instructions.

You May Like: How To Make Personal Loan Agreement

If A Borrower That Was Eligible For A First Draw Ppp Loan Files For Bankruptcy Protection After Disbursement Of The First Draw Ppp Loan Is That Borrower Eligible For Loan Forgiveness Of Its First Draw Ppp Loan

Yes. If a borrower that was eligible for a First Draw PPP Loan files for bankruptcy protection after disbursement of the First Draw PPP Loan, that borrower is eligible for loan forgiveness, provided it meets all requirements for loan forgiveness set forth in the PPP Interim Final Rules, including but not limited to, loan proceeds are used only for eligible expenses and at least 60% of the loan proceeds is used for eligible payroll costs.

Which Loan Forgiveness Application Should Sole Proprietors Independent Contractors Or Self

Sole proprietors, independent contractors, and self-employed individuals who had no employees at the time of the PPP loan application and did not include any employee salaries in the computation of average monthly payroll in the Borrower Application Form automatically qualify to use the Loan Forgiveness Application Form 3508EZ or lender equivalent and should complete that application if they borrowed over $150,000.

If they borrowed $150,000 or less, they should use the new streamlined form 3508S with January 19, 2021 revision date.

Recommended Reading: How To Find My Student Loan Account Number For Irs

When Can I Submit My Ppp Loan Forgiveness Application

If you received a Paycheck Protection Program, your loan is fully forgivable, if spent properly. As you use up your PPP loan funds, you may start to wonder what the PPP forgiveness application deadline is.The short answer? It depends on when you got your loan. For all the details, read on.

Do I Need My Sba Loan Number To Apply For Ppp Forgiveness

No, if your loan was for $150K or less and your lender has opted in to the SBAs direct forgiveness portal. As you enter the system and start a new forgiveness request you will be prompted to enter the SSN, or EIN, or ITIN you used to apply for your loan, and the approximate amount of your loan . The SBAs system will be able to locate your loan and provide you with your SBA loan number/s.

Don’t Miss: How To Transfer Car Loan From One Bank To Another

Is There Anything That Is Expressly Excluded From The Definition Of Payroll Costs

Yes. The Act expressly excludes the following:

- i. Any compensation of an employee whose principal place of residence is outside of the United States

- ii. The compensation of an individual employee in excess of $100,000 on an annualized basis, as prorated for the period during which the payments are made or the obligation to make the payments is incurred

- iii. Federal employment taxes imposed or withheld during the applicable period, including the employees and employers share of FICA and Railroad Retirement Act taxes, and income taxes required to be withheld from employees

- and iv. Qualified sick and family leave wages for which a credit is allowed under sections 7001 and 7003 of the Families First Coronavirus Response Act .

The Amount Of Forgiveness Of A Ppp Loan Depends On The Borrowers Payroll Costs Over An Eight

The eight-week or 24-week period starts on the date your lender makes a disbursement of the PPP loan to the borrower. The lender must disburse the loan no later than 10 calendar days from the date of loan approval. The Paycheck Protection Program Flexibility Act of 2020, which became law on June 5, 2020, extended the covered period for loan forgiveness from eight weeks after the date of loan disbursement to 24 weeks after the date of loan disbursement, providing substantially greater flexibility for borrowers to qualify for loan forgiveness. The 24-week period applies to all borrowers, but borrowers that received an SBA loan number before June 5, 2020, have the option to use an eight-week period

Recommended Reading: Best Loan To Consolidate Debt

Key Takeaways For Applying Through Womply

The process is very simple and there is significant money that drivers can get for payroll! Also, Womply makes it very easy for you to apply.

In Jays case, he did hear from Womply, and they needed to confirm some more information, but again, the whole process was simple. Hes currently waiting to hear back about his application we will update when he does!

Ready to get started on your own PPP application? Get started using Womply here.

Readers, have you taken a PPP loan? What questions do you have about the PPP loan process?

What Do I Need To Apply

You will need to complete the Paycheck Protection Program loan application and submit the application with the required documentation to an approved lender that is available to process your application. The program expires on March 31, 2021, but we recommend applying as soon as possible, as funds are expected to go quickly.

Don’t Miss: How Much Can The Bank Loan Me

How Do I Apply For Ppp Loan Forgiveness

The SBA has established an online PPP forgiveness platform called the SBA PPP Direct Forgiveness Portal. If your PPP loan was for $150,000 or less, AND if your lender has opted-in to the use of the platform, you will be able to submit your PPP loan forgiveness application online directly to the SBA, using the electronic equivalent of SBA Form 3508S. For full details, read our post about the new SBA PPP Direct Forgiveness Portal and other recent rule changes. Check the SBAs list of PPP lenders who have opted-in to the SBA PPP Direct Forgiveness Portal.

Heres the SBAs recording of a training webinar for use of the direct forgiveness portal.

If your lender has not opted-in, youll want to get together all of your documentation as outlined here and then contact your PPP lender. IMPORTANT NOTE: Womply is not involved with PPP forgiveness. Please contact your PPP lender for information on their forgiveness process. If your lender has opted-in you can apply via the SBAs direct forgiveness portal. If your lender has not opted-in, you will submit the appropriate form and documentation to your PPP lender and continue to communicate with your lender throughout the loan forgiveness process. They will provide you with the correct loan forgiveness form to fill out for your applicationeither the SBA Form 3508, SBA Form 3508EZ, SBA Form 3508S, or a lender equivalent. Your lender can provide further guidance on which form you should use.

If I Submit My Ppp Loan Forgiveness Application Within The Deadline Do I Have To Make Payments On The Loan Until The Sba Approves My Loan Forgiveness

Yes. If only a portion of your loan is forgiven, or if your forgiveness application is denied, then you must repay any remaining balance due on the loan and accrued interest on or before the maturity date of the loan . There is no prepayment penalty for paying your loan off early.

NOTE: Interest accrues during the time between the disbursement of the loan and SBA remittance of the forgiveness amount. If your loan is forgiven, you will not be responsible for that interest. However, you are responsible for paying the accrued interest on any amount of the loan that is not forgiven. Your lender is responsible for notifying you when the SBA remits the loan forgiveness amount and the date on which your first payment is due, if applicable.

Also Check: Is It Hard To Get Sba Loan