What Is Mortgage Pre

Pre-qualification is how lenders determine if you fit the basic financial criteria for a home loan.

To get pre-qualified, you tell a lender some basic information about your credit, debt, income, and assets, and it tells you how much you may be able to borrow. Tell is the key word here. The information used for pre-qualification is self-reported, which means the lender typically doesnt verify it or look at your credit report.

Save For A 20% Down Payment

You dont need to pay for private mortgage insurance when you put 20% down on your loan. PMI can add quite a bit of money to your monthly payment, so avoiding it can significantly reduce what you pay each month. You may also be able to avoid paying for mortgage insurance if you have a VA loan and pay the funding fee upfront.

How To Calculate Monthly Income For Self Employed Mortgage Borrowers

If the borrower is self-employed or a 1099 wage earner, two years of tax returns and income as 1099 is mandatory.

- Lenders will take the adjusted income after all deductions that filers report to the Internal Revenue Service

- Lenders will go off the Schedule C of the tax returns from the previous two years

- Lenders ill take borrowers adjusted annual income to qualify income

- The sum of the two years income from borrowers tax returns are added and divided by 24 months to determine the monthly income

- If the income from the most recent tax returns are lower than the reported income from the previous year, then the income of the most current year tax returns divided by 12 months will be used

Borrowers who wrote off depreciation can add depreciation back to the tax returns and can add it to income.

Read Also: Usaa Car Loan Refinance

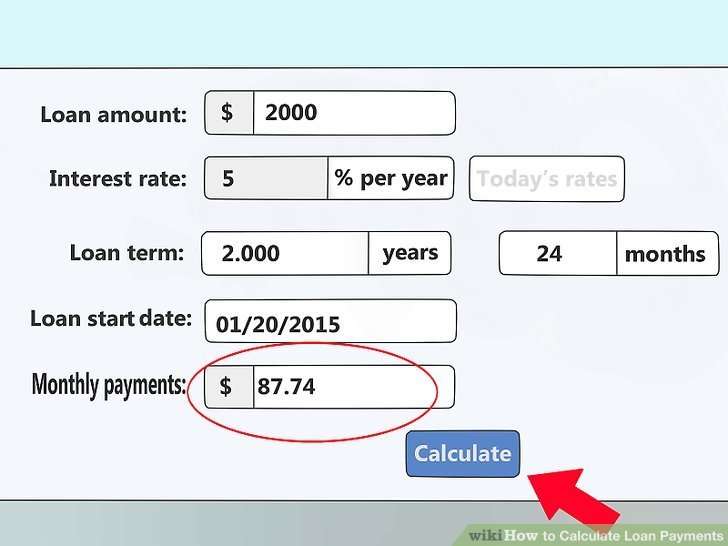

How Do I Calculate My Mortgage Payment

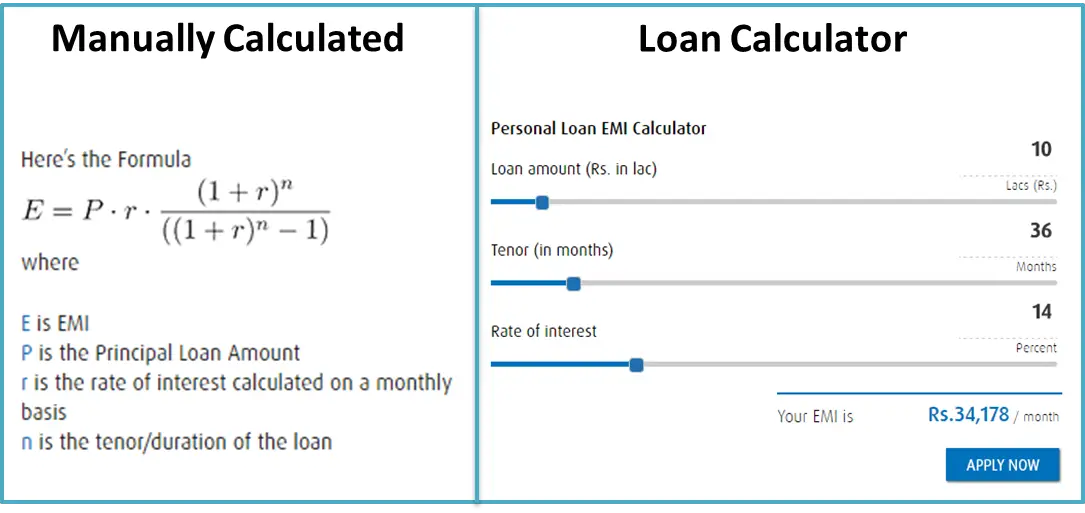

There are two ways to go about calculating a monthly mortgage payment. You can go old school and figure it out using a fairly complicated equation, or you can use a mortgage payment calculator. Either way, youll need to know several variables, so lets run through these.

- Loan Amount: If youre buying a home, youll want to put in the price of the homes youre looking at and subtract your down payment. If youre far enough along, you may be able to also add any costs being built into the balance. For a refi, include the expected balance after you close.

- Interest Rate: You want to look at the base rate and not the annual percentage rate . You use the lower base interest rate because your monthly payment doesnt contemplate closing costs. Knowing APR is still useful, but its more in the context of the overall cost of the loan as opposed to monthly expenses.

- Term: This is how long you have to pay the loan off. Longer terms mean smaller payments, but more interest paid. Shorter terms have the opposite properties.

- Property Taxes: Since property taxes are often built into your mortgage payment, having a fairly accurate estimate will help you get a better picture of cost. Regardless of whether you have an escrow account, these need to be accounted for as a cost of ownership.

How Do Mortgage Lenders Decide How Much You Can Borrow

When you visit your lender to get a mortgage for your home, they will tell you the maximum amount that you are allowed to borrow. But how do they reach this total and what factors do they take into consideration?

How do they determine that one borrower can take on a bigger mortgage than the next? This decision is made by mortgage companies by considering a wide range of factors, including your credit information, your salary and much more.

Here Are Some Of The Common Ways That Lenders Determine How Much You Can Borrow:

1. Percentage Of Gross Monthly Income

Many lenders follow the rule that your monthly mortgage payment should never exceed 28% of your gross monthly income.

This will ensure that you are not stretched too far with your mortgage payments and you will be more likely to be able to pay them off. Remember, your gross monthly income is the total amount of money that you have been paid, before deductions from social security, taxes, savings plans, child support, etc.

2. Debt To Income Ratio

Another formula that mortgage lenders use is the Debt to Income ratio, which refers to the percentage of your gross monthly income that is taken up by debts. This takes into account any other debts, such as credit cards and loans. Many lenders say that the total of your debts shouldnt exceed 36% of your gross monthly income.

For more info about mortgages and your home, contact your mortgage professional.

Read Also: Usaa Certified Auto Dealers

Salary Is Just One Part Of The Mortgage Equation

Many home buyers want to frame their budget in terms of their income.

Its common to wonder how many times your salary you can borrow for a mortgage.

But mortgage lenders dont think that way. And thats because income is only one small part of the mortgage equation.

When all things are considered, like your debt, down payment, and mortgage rate, you might find you could borrow as much as 6 or 7 times your salary for a mortgage. Or your budget could be smaller.

The answer is different for everyone.

Advantages Of A Mortgage

- Youll achieve homeownership. A mortgage allows you to purchase a home without paying the full purchase price in cash. Without a mortgage, few people would be able to afford to buy a home.

- You can cash in your equity. Equity in your home the difference between the market value of your home and the amount you owe on the mortgage can give you access to money when you need it. Many homeowners take out home equity loans or home equity lines of credit to pay for home improvements, medical bills or college tuition.

- Your credit score may improve. Having a mortgage loan in good standing on your credit report improves your credit score. That credit score determines the interest rate you are offered on other credit products, such as car loans and credit cards.

- You may have extra tax benefits. The tax code currently provides tax benefits of homeownership. You may be eligible for a deduction for the interest paid on your mortgage, private mortgage insurance premiums, points or loan origination fees and real estate taxes. And when you sell your primary residence, you may be able to exclude all or part of your gain on the sale of your home from taxable income.

Recommended Reading: What Is The Commitment Fee On Mortgage Loan

Is The House Too Expensive

Another thing a mortgage calculator is very good for is determining how much you can afford. This is based on things like your income, credit score and your outstanding debt. Not only is the monthly payment important, but you should also be aware of how much you need to have for a down payment.

As important as it is to have this estimate, its also critical that you dont overspend on the house by not considering other things like emergency funds and your other financial goals. You dont want to put yourself in a position where youre house poor and can never afford to go on vacation or retire.

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums? Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

You May Like: Usaa Car Loans Bad Credit

Finding The Right Down Payment Amount

A purchase calculator can help you determine the down payment you need. There are minimum down payments for various loan types, but even beyond that, a higher down payment can mean a lower monthly payment and the ability to avoid mortgage insurance.

On the flip side, a higher down payment represents a more significant hurdle, particularly for first-time home buyers who dont have an existing home to sell to help fund that down payment. The calculator can show you options so that you can balance the amount of the down payment with the monthly mortgage payment itself.

How Do I Determine The Amount Of A Home Equity Loan

Borrowers who qualify for a home equity loan may decide to use the proceeds immediately. Unlike a home equity line of credit , which requires a monthly payment that is based on the portion of a home equity line that you have utilized, home equity loans require monthly payments that are based on the total loan amount. According to the Federal Trade Commission, Knowing just the amount of the monthly payment or the interest rate is not enough. You should understand the fees and terms that are associated with a home equity loan.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Future Changes That Might Make An Impact

The lender will assess whether youd be able to pay your mortgage if:

- interest rates increased

- you or your partner lost their job

- you couldnt work because of illness

- your life changed, such as having a baby or a career break.

Its important that you also think ahead and plan how youd meet your payments.

For example, you can help to protect yourself against unexpected drops in income by building up savings when you can.

Try to make sure it contains enough for three months outgoings, including your mortgage payments.

The Fha Upfront Funding Fees

Once you get your mortgage loan guaranteed by the FHA, youre required to pay a Funding Fee. This fee is the upfront cost, plus, monthly insurance premium payable.

At the time of publication, the current FHA Upfront Funding Fee is 2.25% of your mortgage amount. So, to calculate it, multiply 2.25% by your mortgage amount.

For instance, assume that you want to buy a new home in Sacramento thats going for $400,000. Get the Upfront Funding Fee by calculating $400,000 * 2.25% = $9,000.

You can settle this amount by paying cash at closing or by spreading it over the duration of your loan. As an incentive, the FHA refunds part of this amount if you finish paying off your mortgage early.

You May Like: Avant Refinance Loan Application

How Does A Credit Union Determine Your Mortgage Loan Amount

Record-low mortgage loan rates are driving a scorching hot real estate market, despite the COVID-19 pandemic gripping the world. Southwest Missouri is having a record year for real estate transactions as people are buying and refinancing homes while the low rates continue. Todays blog from Volt Credit Union explains how a credit union determines your mortgage loan amount.

Related Post: How to Take Advantage of Record-Low Rates on Mortgage Loans

What Is An Interest

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. After that period, you’ll need to pay principal and interest, which means your payments will be significantly higher. You can make principal payments during the interest-only period, but you’re not required to.

Recommended Reading: Does Fha Loan On Manufactured Homes

Mortgage Rates Affect How Much You Can Borrow For A Mortgage

You dont have to be a math prodigy to work out that the less interest you have to pay on a loan, the more you can afford to borrow.

But lets look at some examples in action. Were making all the same assumptions we used in our earlier examples, except for your monthly inescapable expenses and the interest rates you qualify for.

All weve done is use our mortgage calculator to come up with the figures. And you can do that to match your own circumstances just as easily as we have.

What Is A Fixed

A fixed-rate mortgage is a home loan that has the same interest rate for the life of the loan. This means your monthly principal and interest payment will stay the same. The proportion of how much of your payment goes toward interest and principal will change each month due to amortization. Each month, a little more of your payment goes toward principal and a little less goes toward interest.

You May Like: Does Va Loan Work For Manufactured Homes

Other Methods Of Calculating Your Borrowing Power

The assessment rate used by banks can make or break, or at least slow down your plans to rapidly grow your investment portfolio.

One method we use to help our clients is to spread the risk by getting loans with multiple lenders.

For example, we may apply for 3 mortgages with one major bank or lender so you can finance the purchase of 3 properties.

These types of banks are APRA-regulated which means youll have to deal with the borrowing power restrictions that come with a higher assessment rate.

However, for the next 3 properties you purchase, you may be better off applying with a non-bank lender that isnt regulated by APRA.

Youll pay a slightly higher interest rate but youll have a much higher borrowing power because you wont be assessed at a higher assessment rate.

How To Use A How Much Can I Borrow Mortgage Calculator

With this calculator, you can run some what-if scenarios. For example, you may consider:

-

How long will I live in this home? That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. The longer term will provide a more affordable monthly payment, but youll pay a lot more interest over the long term. A 15-year fixed-rate mortgage will cost you way less interest over the life of the loan, but your monthly payment will be considerably more.

-

Is an adjustable-rate mortgage a better option for me? If you plan on being in this home for just a few years, a 5/1 ARM could be a good option. Youll enjoy a lower initial interest rate thats fixed for five years, but the rate changes annually after that.

-

Am I trying to buy too much house? Sure, lenders may be more than happy to put your name on a big loan, but how do you feel about it? Are you comfortable with how it may impact your monthly budget, or are you feeling a bit stretched? Consider how your new home costs may impact your other spending goals, such as travel and savings.

-

How much of a down payment should I make? Its always the big question. Are you putting down as little as possible and having to make up for it with larger monthly payments and possibly having to pay mortgage insurance?

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Getting Started With Calculating Your Mortgage

People tend to focus on the monthly payment, but there are other important features that you can use to analyze your mortgage, such as:

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly, and over the life of the loan

- Tallying how much you actually pay off over the life of the loan, versus the principal borrowed, to see how much you actually paid extra

Use the mortgage calculator below to get a sense of what your monthly mortgage payment could end up being,

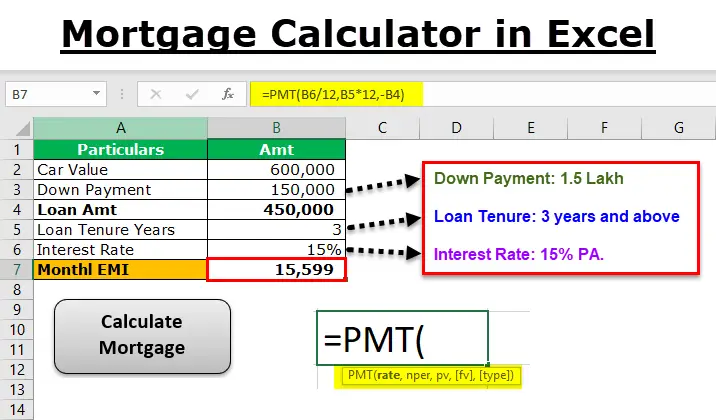

How Do Mortgage Lenders Calculate Monthly Payments

For most mortgages, lenders calculate your principal and interest payment using a standard mathematical formula and the terms and requirements for your loan.

Tip

The total monthly payment you send to your mortgage company is often higher than the principal and interest payment explained here. The total monthly payment often includes other things, such as homeowners insurance and taxes. Learn more.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

What Happens If You Cant Pay Your Mortgage

If you fall on hard financial hard times, there are several steps you can take that will help you avoid foreclosure while youre working things out. Be prepared to provide documentation and letters detailing your situation.

Request a forbearance. Contact your loan servicer and request a mortgage forbearance. This option allows you to stop making payments for a set time period that will vary based on your loan servicers policies. Make sure you understand the repayment options after the forbearance period ends. They typically include an option to repay the entire past due balance, to make extra payments for a set time or defer the missed payment balance payoff until you sell or refinance your home.

Request a loan modification. If youre not eligible for a forbearance, discuss mortgage modification options with your loan servicer. You may be able to negotiate a reduced interest rate, a longer term or a combination of both. Make sure you keep track of all written correspondence from your lender and respond quickly to requests for additional documentation.