Single Family Housing Guaranteed Loan Program

- National Homeownership Month:Annual Lender Rankings

What does this program do?

The Section 502 Guaranteed Loan Program assists approved lenders in providing low- and moderate-income households the opportunity to own adequate, modest, decent, safe and sanitary dwellings as their primary residence in eligible rural areas. Eligible applicants may purchase, build, rehabilitate, improve or relocate a dwelling in an eligible rural area with 100% financing. The program provides a 90% loan note guarantee to approved lenders in order to reduce the risk of extending 100% loans to eligible rural homebuyers so no money down for those who qualify!

Who may apply for this program?Applicants must:

- Meet income-eligibility

- Agree to personally occupy the dwelling as their primary residence

- Be a U.S. Citizen, U.S. non-citizen national or Qualified Alien

What is an eligible rural area?Utilizing this USDA’s Eligibility Site you can enter a specific address for determination or just search the map to review general eligible areas.

Why does Rural Development do this?

This program helps lenders work with low- and moderate-income households living in rural areas to make homeownership a reality. Providing affordable homeownership opportunities promotes prosperity, which in turn creates thriving communities and improves the quality of life in rural areas.

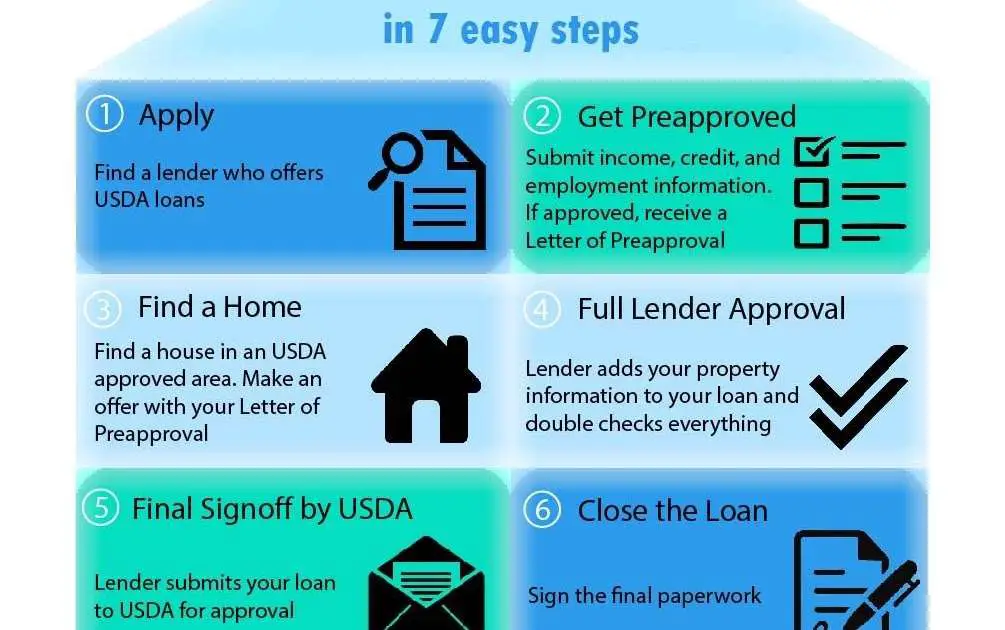

How do I apply?

This list of active lenders is searchable by state and every effort is made by the SFHGLP team to keep this up to date.

Usda Income Eligibility Deductions

According to the USDA mortgage underwriting guidelines, the allowable deductions to determine an adjusted income can include:

- $480 for each minor child under 18

- $480 for each disabled or handicapped individual who is not the applicant or co-applicant on the loan

- $480 for each full-time student 18 years or older

- $400 for each elderly or disabled applicant

- Total amount of medical expenses for any elderly family member that exceeds 3 percent of gross annual income

- Actual cost of child care for children 12 years and younger with full documentation of cost

People like this loan because there is no down payment, and there is 100 percent financing, Tremols says. They are all simple 30-year fixed loans with no balloons, no interest-only or adjusted interest rate.

Debt Ratios 2020 To Maintain Changes Rolled Out In 2014

The program adopted new debt ratio requirements on December 1, 2014. There are no planned updates to this policy in 2020.

Prior to December 2014, there were no maximum ratios as long as the USDA computerized underwriting system, called GUS, approved the loan. Going forward, the borrower must have ratios below 29 and 41. That means the borrowers house payment, taxes, insurance, and HOA dues cannot exceed 29 percent of his or her gross income. In addition, all the borrowers debt payments added to the total house payment must be below 41 percent of gross monthly income.

For example, a borrower with $4,000 per month in gross income could have a house payment as high as $1,160 and debt payments of $480.

USDA lenders can override these ratio requirements with a manual underwrite when a person reviews the file instead of the algorithm. Borrowers with great credit, spare money in the bank after closing, or other compensating factors may be approved with ratios higher than 29/41.

Read Also: Do Mortgage Loan Officers Make Commission

What Are The Benefits Of A Usda Loan

The USDA loan program can bridge many of the obstacles you may face with a conventional home loan. The three major benefits are:

- Low rates USDA loan rates are comparable to conventional loan rates and may at times be lower

- No down payment required Unlike conventional loans that usually require a 20% down payment, most USDA borrowers do not need to make a down payment. However, most are required to make a $1,000 investment at closing. You can use this $1,000 investment for earnest money or any transaction-related costs.

- No Private Mortgage Insurance Conventional loan borrowers who are unable to meet the lenders down payment requirements typically must buy expensive PMI. With a USDA loan, youre only required to pay a 1% upfront fee. You can choose to pay this fee in cash or roll it into your monthly mortgage payment. Additionally, your monthly mortgage payment will include a small USDA annual fee of 0.35% thereafter.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Is Usaa Good For Auto Loans

How Usda Income Limits Work

USDA loan income limits act like an eligibility threshold. If your households combined total income is less than USDAs limit, you can apply for the USDA zero-down loan program.

USDA sets new limits every year in the spring . These limits are capped around 15% above the average median income for households in the area.

Standard income limits for the Single-Family Housing Guaranteed Loan Program as of May 12, 2021 are as follows:

- 1-4 member households increased to $91,900

- 5-8 member household increased to $121,300*

Higher income limits apply in areas with higher costs of living. For example, a homebuyer applying for a USDA loan in Sacramento County, California could not have a combined total household income greater than $104,200 in a household of 1-4 or $137,550 in a household of 5-8.

*Households of 8 or more get an 8% increase to their total household income limit for qualifying. The 8% gets applied to the 1-4 member household limit for each additional member. Calculate your citys USDA income limit!

Usda Loan Credit Requirements

The minimum credit score needed to get a USDA loan is 640 . However, this is the minimum credit score required for an automated approval. If your credit score is below a 620, but you have sufficient compensating factors, you may still be able to get a USDA loan. Your application will have to be manually reviewed in order to obtain an approval.

In addition to the credit score requirements, you must also satisfy other conditions related to your credit. This includes mandatory waiting periods after major credit events, such as a bankruptcy, foreclosure, or short sale .

Additionally, you must be able to show at least 3 trade-lines on your credit report, such as credit cards or auto loans. If you do not have sufficient trade-lines on your credit report, you may still qualify with alternative forms of credit, such as phone bill, utility payments, or even a gym membership.

You May Like: Do Underwriters Verify Bank Statements

Rural Repair And Rehabilitation Usda Loans And Grants

These loans and grants provide money to low-income people so that they can repair or improve their home to get rid of health or safety hazards or to make the place safer or more sanitary. To get one of these loans, you must make below 50 percent of the areas median income and be unable to obtain affordable credit elsewhere to get one of these grants, you must be 62 years or older and be unable to repay one of these loans. You can get up to a $20,000 loan with a 20-year term at 1 percent interest, a $7,500 grant, or the combination of both for up to $27,500. Visit the USDA website to learn more about Single Family Housing Repair Loans and Grants.

Minimum Credit Score For A Usda Home Loan

- There is technically no minimum score for a USDA loan

- However most mortgage lenders impose overlays to avoid high-risk lending

- You might find the requirement to be credit scores of 640 or higher

- It may be difficult to gain USDA loan approval without scores that high

Technically, there is no minimum credit score required to obtain a USDA home loan. However, lenders often impose overlays over USDA guidelines to ensure the borrowers are creditworthy.

Looking to refinance or get pre-approved? Quickly get matched with a top mortgage lender today!

Generally, youll need a or higher to get approved for a USDA loan, though its possible to go lower with an exception or a manual underwrite. But lets face it, many would consider a score that low bad credit or on the cusp.

When doing a manual underwrite, you should have compensating factors to allow for the lower credit score. Your mortgage rate will also be higher to account for increased risk.

Also note that a higher credit score may be required if your DTI exceeds the allowable ratios.

In any case, you should really try to attain much higher credit scores if you want to get any type of mortgage, and favorable terms on said loan.

As with any other mortgage, its advisable to check your credit several months in advance to ensure your credit is on good shape, and if not, take steps to improve it before applying.

Recommended Reading: How Long Before Sba Loan Is Approved

Income And Credit Qualification Requirements For Usda Loans

How Do I Qualify for USDA Loan:

Besides the property needing to be in a USDA location, the borrower needs to be qualified for USDA mortgage requirements.

The maximum debt to income ratios required is 28% front-end ratio and 41% back-end debt to income ratios. There is also a maximum income cap. Borrowers cannot be making $500,000 per year and qualify for a USDA loan.

The borrowers household income cannot exceed 115% of the countys median income. Maximum income requirements vary from county to county. Household income requires all income by the heads of household to be used.

Also Check: Who Has The Best Mortgage Loan Rates

Single Family Guaranteed Housing Usda Loan

This loan can help moderate-income households buy a modest home in a rural area. To qualify, your income cant exceed 115 percent of the median income for the area you must be able to afford the mortgage payments, taxes and insurance for the property and you must have a reasonable credit history. These loans are for 30 years, and the interest rate varies, depending on the lender. Any state housing agency can issue these loans. For more details, visit our USDA home loans resource page with more information and eligibility.

Read Also: Drb Student Loan Review

Minimum Qualifications For Usda Loans

At a minimum, USDA guidelines require:

- U.S. citizenship or legal permanent resident

- Ability to prove creditworthiness, typically with a credit score of at least 640

- Stable and dependable income

- A willingness to repay the mortgage – generally 12 months of no late payments or collections

- Adjusted household income is equal to or less than 115% of the area median income

- The property serves as the primary residence and is located in a qualified rural area

Lenders may have their own internal guidelines and requirements in addition to those set by the USDA’s Rural Development program.

What’s The Difference Between Fha And Usda Loans

FHA loans and USDA loans differ in the requirements needed to qualify for the loan. Both are government-backed, but FHA requires a down payment of 3.5 percent, or $3,500 for every $100,000 in your home’s sale price, whereas the USDA requires no down payment.

FHA also has no specific location requirements, whereas the USDA loan requires that your residence is in a rural area.

FHA also has more lenient credit score requirements. They don’t enforce minimum credit score requirements at all, though lenders typically require a 580 minimum, and you can get an FHA approval without a credit score.

Learn more about FHA loans.

Heres a quick look at the difference in the requirements:

| USDA Loans |

| No income limitations |

Also Check: Usaa Rv Buying Service

What Kinds Of Loans Does Usda Offer

Fixed rate loans All USDA loans are fixed-rate mortgages. In a fixed rate mortgage, your interest rate stays the same during the whole loan period, normally 30 years. The advantage of a fixed-rate mortgage is that you always know exactly how much your monthly payment will be, and you can plan for it.

Usda Rural Loans Guidelines

USDA Rural Development home loans or USDA loans are typically used by medium income households to purchase homes in eligible areas. The funds can also be used to build, repair, renovate or relocate a home, or purchase and prepare sites, including providing water and sewage facilities, although it might be tough to find a lender willing to take on some of the available options.

USDA home loans are available in all 50 states as well as the Virgin Islands, Western Pacific & Puerto Rico. The general guidelines for the loan program are the same throughout all eligible areas. Check with an USDA approved lender to see if they will lend in all areas.

There are two different types of USDA loans. There is a direct program that is handled by your local USDA service center. These loans are for low income households. The second type of USDA loan is the 502 Guaranteed program. These loans are catered to more of a average household income. These loans are done by lenders and banks and are insured through the USDA Rural Development program.

What are the terms?

You May Like: How Much Of A Loan Can I Get For A Car

Qualifying For A Usda

Income limits to qualify for a home loan guarantee vary by location and depend on household size. To find the loan guarantee income limit for the county where you live, consult this USDA map and table.

USDA guaranteed home loans can fund only owner-occupied primary residences. Other eligibility requirements include:

-

U.S. citizenship

-

A monthly payment including principal, interest, insurance and taxes thats 29% or less of your monthly income. Other monthly debt payments you make cannot exceed 41% of your income. However, the USDA will consider higher debt ratios if you have a above 680.

-

Dependable income, typically for a minimum of 24 months

-

An acceptable credit history, with no accounts converted to collections within the last 12 months, among other criteria. If you can prove that your credit was affected by circumstances that were temporary or outside of your control, including a medical emergency, you may still qualify.

Applicants with credit scores of 640 or higher receive streamlined processing. Below that, you must meet more stringent underwriting standards. You can also qualify with a nontraditional credit history.

Applicants with credit scores of 640 or higher receive streamlined processing. Those with scores below that must meet more stringent underwriting standards. And those without a credit score, or a limited credit history, can qualify with nontraditional credit references, such as rental and utility payment histories.

What Is The Minimum Credit Score For A Usda Loan

Approved USDA loan lenders typically require a minimum credit score of at least 640 to get a USDA home loan. However, the USDA doesnt have a minimum credit score, so borrowers with scores below 640 may still be eligible for a USDA-backed mortgage.

If your credit score is below 640, theres still hope. Your loan will just need to go through manual USDA underwriting, and you may need to compensate with a low debt-to-income ratio, a hefty savings account, or other financial factors that reduce your risk as a borrower.

Recommended Reading: Autosmart Becu

Usda Lenders Set Maximum Loan Amounts

USDA qualifies applicants using income from each adult earner in the household, regardless of whether theyre obligated on the loan. Add each adults annual income to find your households total annual income to get an idea of where you stand.

If you are paid by the hour, calculate your annual income using the following formula:

x 52 = Total Annual Income

USDA lenders use these income calculations to determine your repayment ability:

All income is calculated and verified using the following documentation:

- Paystubs

- W-2s

- Third-party employer verification

After income is verified, USDA lenders review these additional financial factors to determine your repayment ability:

- Debt-to-income ratio

- Assets and savings

- Previous rental or mortgage payment history

Repayment ability helps USDA lenders determine a loan amount the buyer can afford. In other words, your lender sets your max USDA loan amount. But not all income types are eligible. Below are the most common types of income USDA does not allow for qualifying:

- Earned income from a minor

- Earned income of an adult, full-time student beyond $480

- Earned income tax credit

- Lump-sum allowances from inheritances, capital gains or life insurance policies

- Housing assistance payments

- Earned income from caregivers, such as live-in nurses

Business Is Always Personaltm

At Finance of America Mortgage, we dont see customers as numbers and paperwork. For us, doing business is about making human connections. We listen to the people we serve. We find the right mortgage solution for their specific needs. And we help them achieve their dreams of homeownership. Youll see it in everything we do.

©2022 Finance of America Mortgage LLC is licensed nationwide | | NMLS ID # 1071 | 1 West Elm Street, Suite 450, Conshohocken, PA 19428 | 355-5626 | AZ Mortgage Banker License #0910184 | Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act | Georgia Residential Mortgage Licensee #15499 | Kansas Licensed Mortgage Company | Licensed by the N.J. Department of Banking and Insurance | Licensed Mortgage Banker NYS Banking Department | Rhode Island Licensed Lender | Massachusetts Lender/Broker License MC1071. For licensing information go to: www.nmlsconsumeraccess.org

Loans made or arranged pursuant to a California Finance Lenders Law license.

A preapproval is not a loan approval, rate lock, guarantee or commitment to lend. An underwriter must review and approve a complete loan application after you are preapproved in order to obtain financing.

This information is provided by Finance of America Mortgage. Any materials were not provided by HUD or FHA. It has not been approved by FHA or any Government Agency.

Complaints? Email us at

Read Also: Prosper Loan Denied After Funding