How Student Loan Interest Rates Are Set

Interest rates on federal student loans change on July 1 and continue for all new loans made through June 30 of the following year. The interest rates are fixed and do not change over the life of the loan.

The new interest rates are set by a formula based on the high yield of the last 10-year Treasury Note auction in May, plus a margin.

For example, the high yield on the May 11, 2022 auction was 2.94%. Adding the 2.05% margin to this yields the 4.99% interest rate on undergraduate Federal Direct Stafford Loans. The margin is 3.6% for graduate Federal Direct Stafford Loans and 4.6% for Federal Direct Grad PLUS and Parent PLUS loans.

The recent increases in interest rates on federal education loans arent intentional, but rather the result of a formula for interest rates enacted by Congress in the Higher Education Act of 1965. The current formula has been in effect since 2013.

Direct Unsubsidized Loans : 6595%

A direct unsubsidized loan has a fixed interest rate and no subsidized payments. Graduate students may borrow up to $20,500 in unsubsidized loans each year, while professional students may borrow up to $40,500 per year. The interest rate on these loans is 6.595%. This means that if you take out a $10,000 unsubsidized loan at the beginning of your second year of law school and dont pay it back until graduation day, the total amount you will have paid by then will be $16,318 .

What’s Happening Right Now With Inflation

In June, inflation surged to 9.1% over the previous year, reaching its highest level since November 1981, according to the Bureau of Labor Statistics. Gas prices rose 11.2% in June, bringing the increase in energy to 41.6% over the past 12 months. Food prices also increased by 1% last month, bringing that 12-month increase to 10.4% overall.

During periods of high inflation, your dollar has less purchasing power, making everything you buy more expensive, even though you’re likely not getting paid more. In fact, more Americans are living paycheck to paycheck, and wages aren’t keeping up with inflation rates.

Don’t Miss: How Much Down Payment For Land Loan

Student Loan Interest Rates Unsubsidized Are Out For 2018 2020

- Interest rates for Direct Unsubsidized Loans, Direct PLUS Loans, and Direct Subsidized Loans are out for 2018 2020.

- The fixed interest rate on these loans is based on the first disbursement date of your loan and is set by the Department of Education.

Interest rates for Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans first disbursed on or after July 1, 2018 and before July 1, 2019 are available on the Federal Student Aid website.

The Most Valuable College Majors

College is a big investment regardless of how you pay for it, and some forward-planning will help ensure that your investment pays off. A Bankrate study of the most valuable college majors found that STEM degrees have consistently high median incomes and low unemployment rates, while arts degrees rank near the bottom in terms of overall value.

Of course, there are plenty of factors that influence the value of your degree, including the cost of your school, the likelihood that youll need an advanced degree and the fulfillment you find in your chosen career path. A performing arts degree may not be as financially rewarding as a degree in computer engineering, but it allows many graduates to pursue their dreams and land a satisfying job after college.

If youre looking for the most bang for your buck, these five college majors at the top of our rankings are a good place to start your search:

| Degree |

|---|

Recommended Reading: How To Find Your Student Loan Account Number

What Is Capitalized Interest On A Student Loan

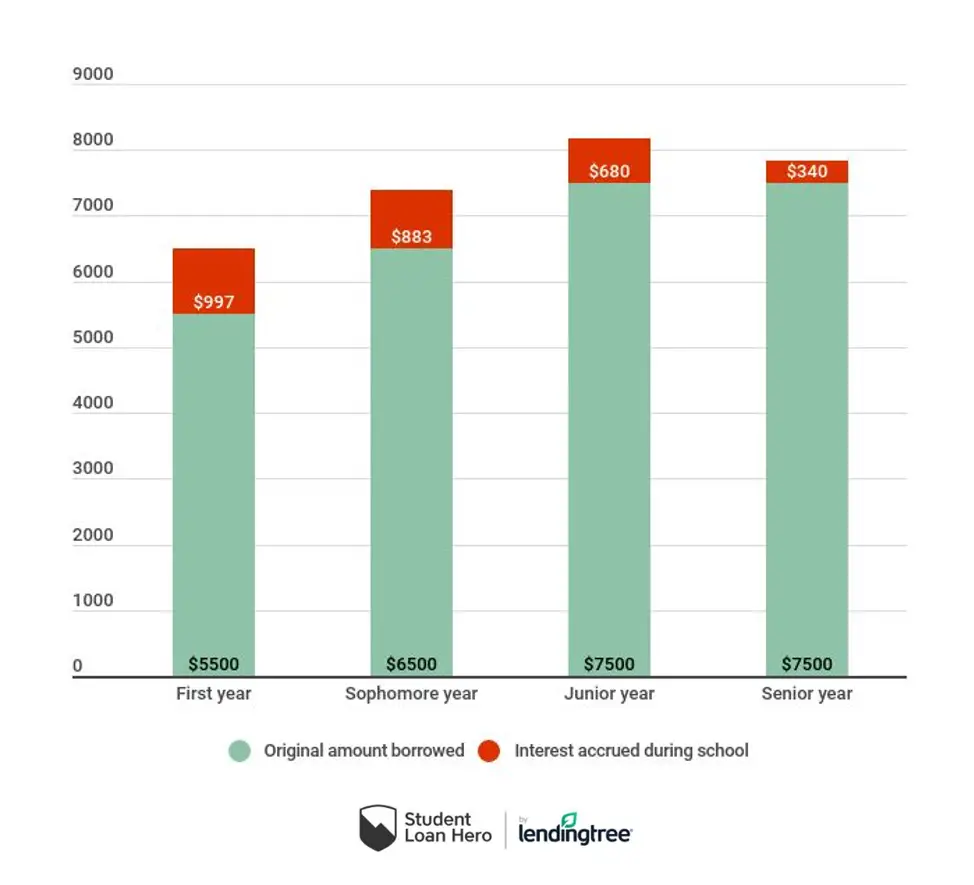

Capitalized interest refers to the process of adding any accrued interest to your loans principal balance. When this happens, your loan balance grows and you begin accruing interest on the new, larger amount. Essentially, you are charged interest on your interest.

Interest only capitalizes during certain periods of your loans lifeexactly when that happens varies based on your loan. However, its common for interest to capitalize when you first begin repayment and after any temporary deferment or forbearance.

Is Now A Good Time To Buy A House

No, said Los Angeles-based real estate investing adviser André Stewart, CEO of InvestFar, a startup.

I think the housing market is already experiencing a correction as interest rates are astronomically high,” Stewart said. “The Fed is going to have to lower rates by the beginning of next year to get us out of a recession and help stabilize the economy.”

Read Also: What Debt To Income Ratio For Home Loan

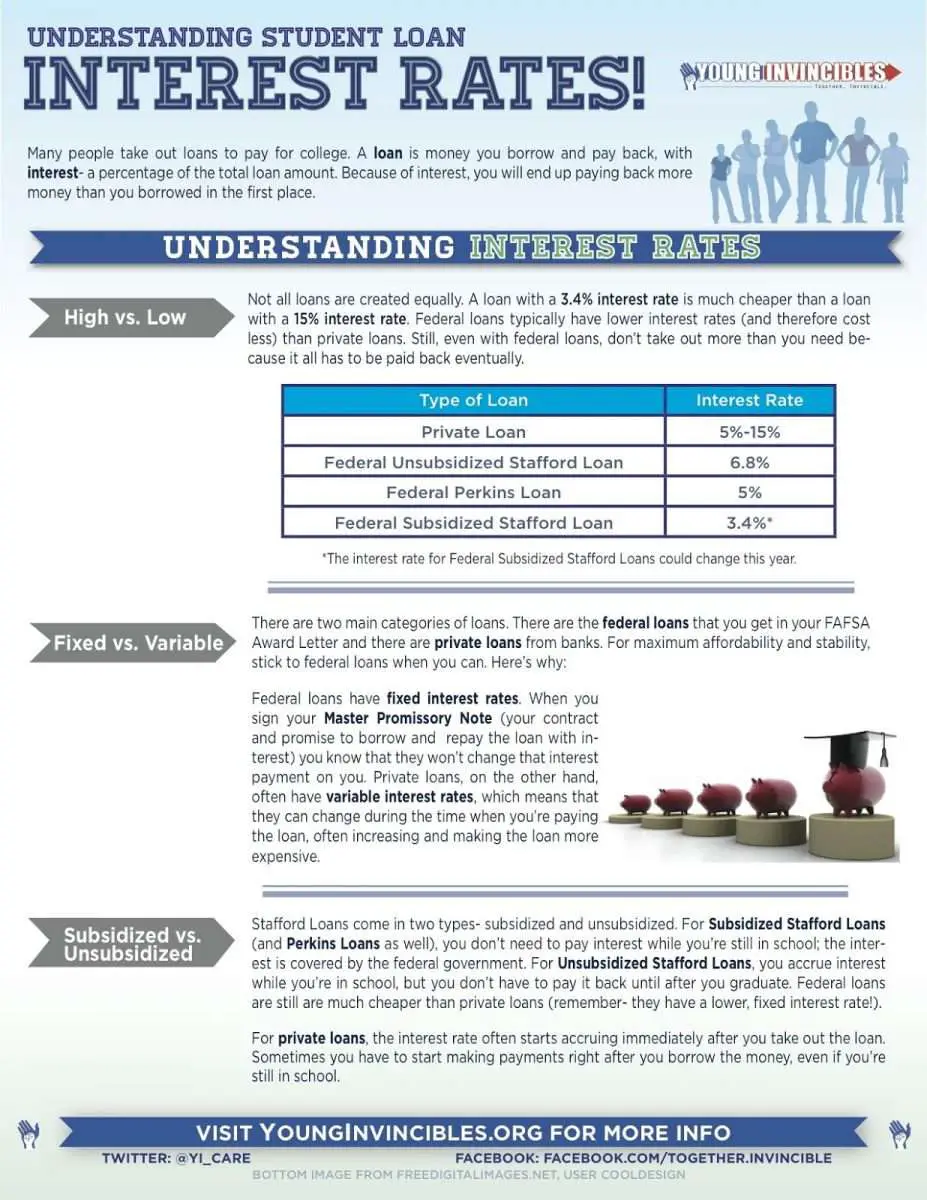

Student Loan Interest Rates

Applicants may have the choice of a fixed or variable interest rate loan.

- A fixed interest rate is set at the time of application and does not change during the life of the loan unless you are no longer eligible for one or more discounts.

- A variable interest rate may change quarterly during the life of the loan, if the interest rate index changes. This may cause the monthly payment to increase, the number of payments to increase, or both.

Interest rates for private student loans are credit based. Therefore, the interest rate is not the same for every borrower. Our lowest rates are only available to applicants with the best credit. The APR will be determined after an application is submitted. It will be based on credit history, the selected repayment option and other factors, including a cosigners credit history . If a student does not have an established credit history, the student may find it difficult to qualify for a private student loan on their own or receive the lowest advertised rate.

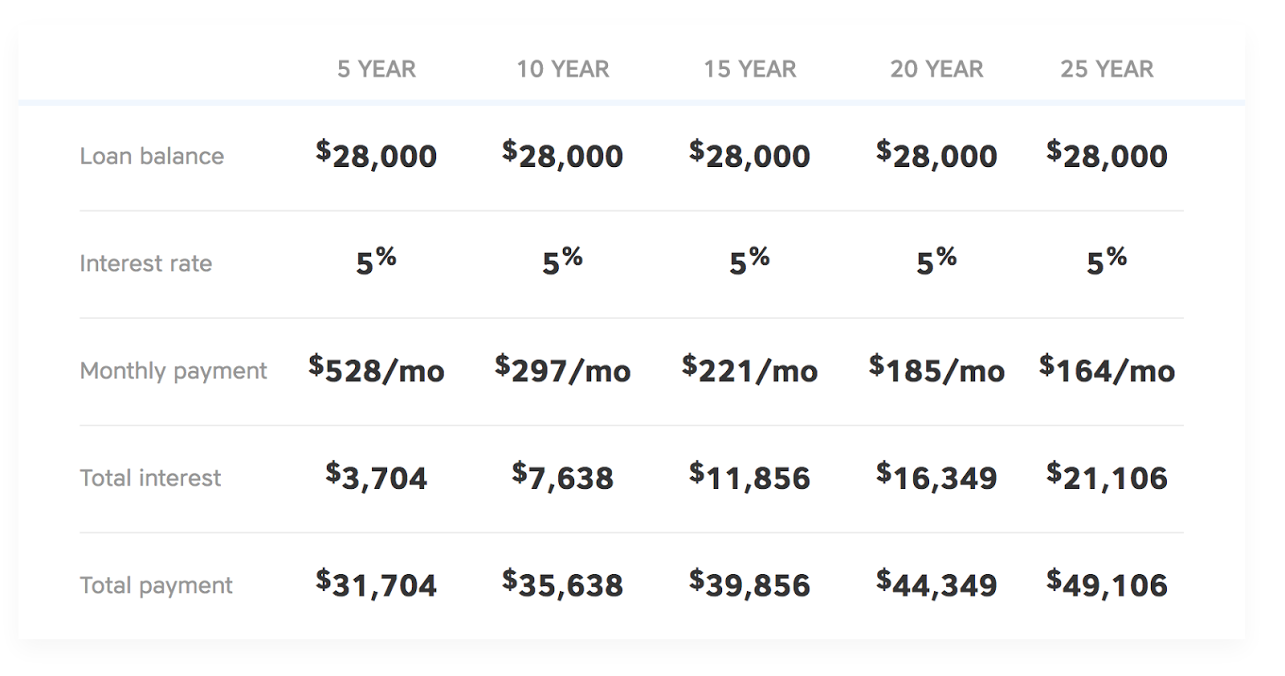

How Does The Interest Rate Impact The Total Cost Of A Loan

The interest rate has a huge impact on both the monthly payment and the total interest paid over the life of the loan. For example, a $50,000 loan with a 4% interest rate and a 10-year term will cost $60,748 in total.

However, if that loan has an 8% interest rate and a 10-year term, the total cost will be $72,797. Thats why its crucial to choose the lowest interest rate possible.

Don’t Miss: Can I Get Loan For Starting New Business

How Often Does Student Loan Interest Compound

Most student loans charge simple interestmeaning youre only charged interest on your principal balance. Generally, youll be charged a daily rate of interest, which will stay the same throughout your repayment term.

However, there are some student loans that charge compound interest, which is when your accrued interest begins racking up its own interest fees. In some cases, even loans with simple interest can compound. For example, if you have a federal student loan in forbearance and dont make payments during this period, the unpaid interest that accrues will be added to your loan balancethis process of compounding is also referred to as capitalization.

If youre not sure how interest compounds on your student loan, contact your lender directly.

Should You Borrow Private Student Loans

There are cases where private student loans can be beneficial. For example, private loans typically come with higher borrowing limits, so if you max out your federal loan options you can still secure money for college by applying for private student loans.

Highly qualified borrowers may also find better deals on the private market. Graduate students and parents of undergrads face the highest interest rates and origination fees on federal loans. If you have a healthy financial history, you could potentially qualify for lower rates and fees with private student loans.

But be sure to weigh any savings with the loss of federal student loan perks. If you later have trouble repaying your loans, a private lender may not do as much to help you.

Read Also: Langley Federal Credit Union Auto Loan

If You Decide To Take Out Private Loans

There are ways to address the impact of increasing interest rates, if you plan on taking out student loans for the next school year.

Even though variable interest rates may initially be lower than fixed interest rates, variable interest rates have nowhere to go but up. However, private student loans often offer a choice between fixed and variable interest rates.

When considering a private student loan, the fixed interest rates are likely to be lower on shorter repayment terms than longer repayment terms.

Should You Take Out A Student Loan Now

With federal student loan rates at record lows, now might be the best time in history to take out a student loan. Always exhaust all your options for federal student loans first by using the Free Application for Federal Student Aid form, then research the best private student loans to fill in any gaps. Whether you choose federal or private loans, only take out what you need and can afford to repay.

If you have private student loans, this may be a great time to refinance. All of the best student loan refinance companies are offering competitive rates and can cater to unique debt situations.

Also Check: How To Pay Suncoast Car Loan Online

Who Sets The Interest Rates On Federal Student Loans

The interest rates for federal student loans are based on the high yield of the last 10-year Treasury Note auction in May, as specified by Congress in the Higher Education Act of 1965.

The high yield for the auction that occurred on May 11, 2022 was 2.943%, up from 1.684% in 2021 and 0.70% in 2020. The interest rates on federal student loans are calculated by adding fixed margins of 2.05%, 3.6% and 4.6% to the high yield.

The interest rates have increased in part because of moves by the Federal Reserve Board to control inflation. The Federal Reserve tries to control inflation by increasing the Federal Funds Rate. Since these efforts are unlikely to be successful, student loan interest rates are likely to continue increasing next year and the year after until supply chain issues resolve on their own.

Interests On Federal Student Loans

Most student loans in Canada are gotten from the National Student Loan Service Centre. While many students choose federal loans, it is possible for you to access extra funding from provincial loans every year.

Federal loans allow an interest rate of 2.5% plus prime. This means that the interest on federal student loans is added to the average bank prime rate in Canada. Plus prime varies with time, although it remains at 3.95% as of January 2020. Based on this, the interest on federal students loans sums up to about 6.45%.

Read Also: How Much Do You Put Down With An Fha Loan

Interest Rates For Fixed

Loan Status Any StatusWARNING This system may contain government information, which is restricted to authorized users ONLY. Unauthorized access, use, misuse, or modification of this computer system or of the data contained herein or in transit to/from this system constitutes a violation of Title 18, United States Code, Section 1030, and may subject the individual to civil and criminal penalties. This system and equipment are subject to monitoring to ensure proper performance of applicable security features or procedures. Such monitoring may result in the acquisition, recording, and analysis of all data being communicated, transmitted, processed, or stored in this system by a user. If monitoring reveals possible evidence of criminal activity, such evidence may be provided to law enforcement personnel.

ANYONE USING THIS SYSTEM EXPRESSLY CONSENTS TO SUCH MONITORING.

Why Would The Interest Rate Be Different From The Apr

- Discover Student Loans have zero fees, and no interest capitalization during the deferment period – as a result, the deferment period APR will be less than the interest rate.

- For our student loans, accrued interest capitalizes at the start of the repayment period – since we do not charge fees, and assuming you make all your scheduled payments on time, the repayment period APR will be equal to the interest rate.

Also Check: Will Refinancing My Car Loan Hurt My Credit

What Areyour Repayment Options

You can start paying back your undergraduate loan while youre in school to save money or wait until youre finished. You can also choose to pay off your loan early to reduce the total loan costthere are no penalties for early repayment.6

Pay more during school, save more

How the interest repayment option works:You pay your monthly interest while in school and during your 6-month grace period to lower your loan cost.1 For example, as a freshman you may save 12%7 on the total loan cost if you choose this option instead of paying everything after school.

Your grace period is the amount of time after youre no longer enrolled in school and before principal and interest payments begin.

This may be right for you ifYou want to reduce your total loan cost as much as possible and can afford to pay more each month.

Keep in mind Your undergraduate student loan payments will likely be larger while youre in school and in your grace period than with our fixed or deferred options.

Pay some during school, save some

How the fixed repayment option works:You pay $25 a month8 while in school and during your 6-month grace period to lower your loan cost.1 For example, as a freshman you may save as much as 6%7 on the total loan cost if you choose this option instead of paying everything after school.Your grace period is the amount of time after youre no longer enrolled in school and before principal and interest payments begin.

Pay everything after you finish school

Undergraduate Student Loan Rates

To qualify for an undergraduate private student loan, you usually have to be a U.S. citizen or permanent resident. Private lenders will almost always require a cosigner unless the borrower has a good credit score and stable salary.

Private loans can be used to cover the cost of attendance, including tuition, fees, room and board, and living expenses.

Here are undergraduate student loan rates from several private lenders:

| Lender |

To compare your options, check out our picks for the best private student loans.

Don’t Miss: How Long Does It Take To Get Loan From Bank

Historical Student Loan Interest Rates

While private student loan rates vary greatly based on your creditworthiness and the lenders policies, federal student loan interest rates are standardized. Everyone who qualifies for federal student loans gets the same fixed rate, regardless of their credit or financial history. Federal interest rates are set annually by Congress and take effect each July.

Heres a look at previous interest rates on federal student loans:

| School year |

|---|

British Columbia Student Loans

Student Aid BC recently reduced repayment interest to prime. This means that your interest could fluctuate along with the bank prime rate, but there wont be any extra interest on top of this, like most other provinces have. If the prime rate is 3.95%, then your interest percentage will be 3.95%.

British Columbia surpasses expectations again with its online application process. A step-by-step walk through is provided, and borrowers are also provided with a budget worksheet and an approximate funding limit even before they finish applying.

Also Check: Can You Refinance An Upstart Loan

How To Calculate How Much Interest You Will Owe

Every month, the interest amount you owe on your loan is recalculated using a daily interest formula based on your total outstanding loan amount:

Interest amount = Outstanding principal balance x Number of days since last payment x Interest rate factor

The interest rate factor is your annual interest rate divided by the number of days in the year. Your loan servicer is responsible for billing you monthly and explaining how your payments are applied to the principal balance.

You can use our student loan payment calculator to see how much your loan will cost in the long run.

If you apply for forbearance or deferment or sign up for an income-driven repayment plan, your loans will accrue more interest over time, increasing the total interest paid.

> > Read More:How Student Loan Interest Works

Graduate Student Loan Rates

Graduate private student loans can be used to pay for a variety of graduate and professional degrees, including medical, law, veterinary, dental, pharmacy school, and more.

Private lenders are less likely to require a cosigner for graduate students, though adding one may help borrowers qualify for a lower interest rate.

Here are graduate student loan rates from several private lenders:

| Lender |

To compare your options, check out our picks for the best graduate student loans.

Also Check: What Do You Need For Home Loan Pre Approval

How Is Student Loan Interest Calculated

Federal student loans and most private student loans use a simple interest formula to calculate student loan interest. This formula consists of multiplying your outstanding principal balance by the interest rate factor and multiplying that result by the number of days since you made your last payment.

- Interest Amount= × Number of Days Since Last Payment

The interest rate factor is used to calculate the amount of interest that accrues on your loan. It is determined by dividing your loans interest rate by the number of days in the year.

Learn About Typical Student Loan Rates As You Weigh Your Student Loan Options

If you have student debt or are planning to borrow money for college, pay special attention to your student loan interest rates. The higher the rates, the more youll pay, while lower rates will mean repaying less.

So what is the average student loan interest rate? Form 2006 through 2021, average federal student loan rates were 4.66% and 6.22% for undergraduate and graduate loans, respectively. However, your rate may be well outside this range, depending on the type of loan you take out, including federal and private student loans, as well as whether you had a cosigner.

Heres an overview of the average student loan interest rates you can expect, along with an explanation of how these rates are set.

Read Also: How To Apply For Fortiva Personal Loan