How To Impact Your Ltv Calculation

One of the simplest ways to assist reduce your loan-to-value ratio is to pay down your home loans principal on a daily basis.

This happens over time just by making your monthly payments, assuming that theyre amortized .

Youll reduce your loan principal faster by paying a little bit more than your monthly amortized mortgage payment .

Va Loan: Up To 100% Ltv Allowed

VA loans are guaranteed by the U.S. Department of Veterans Affairs.

VA loan guidelines allow for 100 percent LTV, which means that no down payment is required for a VA loan.

The catch is, VA mortgages are only available to certain home buyers, including:

- Activeduty military service persons

- Veterans

- Members of the Selected Reserve or National Guard

- Cadets at the U.S. Military

- Air Force or Coast Guard Academy members

- Midshipman at the U.S. Naval Academy

- World War II merchant seamen

- U.S. Public Health Service officers

- National Oceanic & Atmospheric Administration officers

Learn more about the benefits of 100% LTV VA financing here.

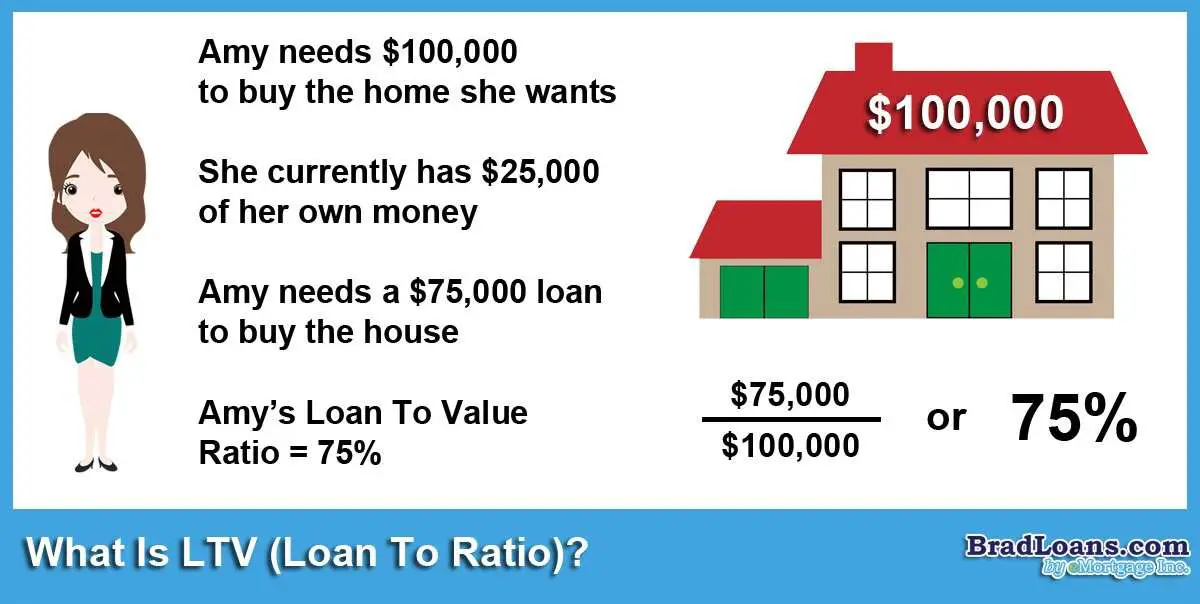

How Is Ltv Calculated

LTV is a relatively straightforward concept with massive implications for borrowers. Want to know your LTV ratio? Just use this simple formula:

* 100 = LTV

In this case, LA refers to your loan amount and PV is the property value. Lets quickly walk through each step you need to take to figure out LTV:

How does that work in a real-world scenario? Heres how itd look if you were buying a $500,000 house with a 10% down payment option:

Read Also: Stilt Loan Requirements

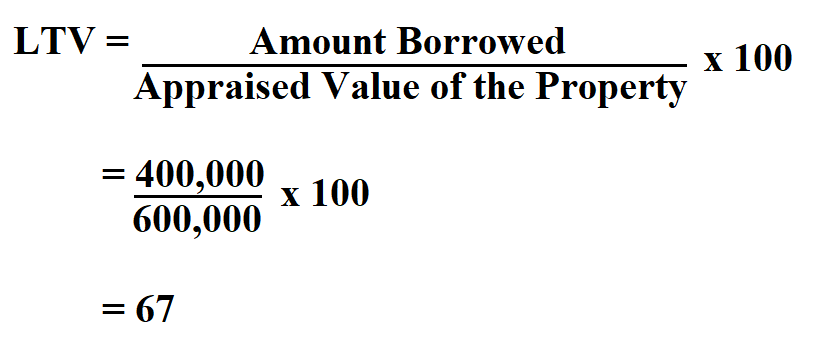

Divide Your Mortgage Amount By The Appraised Value Of The Property

Once you’ve calculated the total mortgage amount and the current appraised value of the property, you can find the LTV ratio. For example, if your property has a value of $300,000 and your mortgage amount is currently $180,000, then you can calculate the LTV ratio as:

**LTV ratio = x 100**LTV ratio = x 100LTV ratio = 0.6 x 100* *LTV ratio = 60%

Your LTV ratio is 60%, which is an ideal LTV ratio. With this ratio, you likely won’t need to purchase private mortgage insurance to offset the risk to the financial institution.

Do You Have To Pay Back A Home Equity Loan

Yes, just like any typeof credit, you must pay back a home equity loan within the timeframe laid outin your terms. Failure to do so can result in legal action or in a lendertaking your property as payment. However, you generally have a much longer timeto pay back a home equity loan, as well as more flexible terms aroundrepayment.

Need help securing a loan to purchase your dream property? Our experienced brokers have access to hundreds of competitive home loan deals, so we can help you find the right lender for you.

Read Also: Usaa Auto Refinance

Recommended Reading: Usaa Home Loan Credit Score Requirements

Conventional Loan: Up To 97% Ltv Allowed

Conventional loans are guaranteed by Fannie Mae or Freddie Mac. Both groups offer 97 percent LTV purchase mortgages, which means you will need to make a downpayment of 3 percent to qualify.

97 percent loans are available via most mortgage lenders, and private mortgage insurance is often required.

As compared to an FHA loan, conventional loans to 97 percent LTV are advised for homeowners with high credit scores. In most other cases, FHA loans are preferred.

How To Calculate Loan

To calculate LTV, you would divide the mortgage amount over the property value. If you are purchasing a home, the property value would be the purchasing price of the home, while the mortgage amount would be the purchasing price subtracted by the amount of your down payment. If you are refinancing or switching mortgage lenders, you may be required to have a home appraisal to get an up-to-date home value. Appraisal fees are typically paid by the borrower.

You May Like: Www Upstart Com Myoffer

How Is Lvr Calculated

When taking out a mortgage, what is LVR? is one of the first questions you should ask. This is vital as your LVR can greatly impact your borrowing capacity.

Before approving the loan, you will typically be asked to obtain an independent valuation of the prospective property.

From there, your lender calculates the LVR score on your home loan.

This is achieved by dividing the home loan by the property valuation.

Then, this figure is multiplied by 100, to create a percentage.

Heres an example to explain the concept in more detail.

Tyler and Haley are purchasing their first home.

The property was valued at $500,000 and they have a $100,000 deposit.

Therefore, to buy the property, the couple needs to borrow $400,000.

In this scenario, Tyler and Haleys LVR score is 80%. The equation is as follows: $400,000 / $500,000 x 100 = 80%.

Generally, the difference between your home loan and the valuation is your home deposit.

Therefore, the larger your deposit amount, the less money you will need to borrow.

This translates into a lower LVR score.

Conversely, the lower your deposit, the higher the home loan youll need.

This means your LVR will be much higher.

How To Calculate Ltv

Your loan-to-value ratio is the way of expressing what proportion you continue to owe on your current mortgage. Heres the essential loan-to-value ratio formula:

When the Current loan balance is divided by the Current appraised value you get the LTV calculation

Example: You currently have a loan balance of $140,000 . Your home currently appraises for $200,000. So your loan-to-value equation would appear as:

$140,000 ÷ $200,000 = .70

Convert .70 to a percentage which gives you a loan-to-value ratio of 70%.

You May Like: Upstart Loan Calculator

Buy A Less Expensive Home

You may know what your dream home looks like, but can you afford it? If your dream house is out of reach right now, consider looking for a more affordable option. It may make money sense to buy a home that lets you make a larger down payment and lowers your LTV.

Bonus: If you want to add on to your home later, your lower LTV will make it easier to refinance or get a home equity loan in the future.

What Does A High Ltv Ratio Indicate

A high LTV ratio is a sign that the homebuyer is making a low down payment relative to the size of the mortgage. It indicates a bigger mortgage, in which case the borrowers fees will be higher, and the homebuyers income must be sufficient to be approved for the loan. In the case of a high LTV ratio, the lender might also require that the borrower have mortgage reserves, which represent cash on hand to pay the mortgage if income is interrupted.

Recommended Reading: How Much Can I Qualify For A Car Loan

What Does The Loan

The LTC ratio is used to calculate the percentage of a loan or the amount that a lender is willing to provide to finance a project based on the hard cost of the construction budget. After the construction has been completed, the entire project will have a new value. For this reason, the LTC ratio and the LTV ratios are used side by side in commercial real estate construction.

The LTC ratio helps to delineate the risk or risk level of providing financing for a construction project. Ultimately, a higher LTC ratio means that it is a riskier venture for lenders. Most lenders provide loans that finance only a certain percentage of a project. In general, most lenders finance up to 80% of a project. Some lenders finance a greater percentage, but this typically involves a significantly higher interest rate.

While the LTC ratio is a mitigating factor for lenders that are considering the provision of a loan, they must also consider other factors. Lenders will also take into account the location and value of the property on which the project is being built, the credibility and experience of builders, and the borrowers credit record and loan history as well.

Recommended Reading: Is There Any Loan For Buying Land

Make Regular Mortgage Payments

Making on-time mortgage payments will lower your principal balance and build your equity. It can be helpful to think of the ratio as a bookshelf, where the top shelf is the loan amount and the bottom shelf is the property value.

Any sturdy bookshelf will be bottom-heavy , with the heaviest books on the bottom and will want to keep the top shelf light. The more you pay off your loan and lighten the top shelf, the sturdier the bookshelf, and the more reliable you look to lenders.

At some point, youll have paid off enough of your loan to reach an 80% LTV ratio, meeting the 20% down payment requirement. This means you no longer need to pay private mortgage insurance, saving you hundreds of dollars per year.

Recommended Reading: Usaa Refinance Auto

What Is A Good Ltv Ratio

While that 90% LTV ratio isnt completely unusual, some lenders may balk at a loan with such a high LTV. Lenders will always prefer borrowers who are able to cover a larger share of the purchase price than those who require more extensive financing. That doesnt necessarily mean your loan application will be rejected if your LTV ratio is above a certain threshold, but lower is always better.

As a general rule, borrowers should aim for LTV ratios no higher than 80% if you want to secure more favorable financing terms. That being said, dont feel discouraged if you cant crack that threshold. After all, saving up enough money to cover a 20% down payment on a house isnt always feasible. You still have plenty of other options to consider, such as government-backed mortgages and various types of home loans.

What Is A Good Loan To Value Ratio

From a lenders perspective, an 80% loan to value ratio is ideal because it minimizes their risk of losing money if the borrower defaults. Thats why home buyers with 20% down, and an 80% LTV, get special perks like avoiding mortgage insurance.

But and its a big but it doesnt always make sense to aim for 80% LTV. Because a 20% down payment is simply not doable for many home buyers.

Therefore, a good loan to value ratio depends on your home buying goals. For one person, 100% might be a good LTV. For another, 70% might be ideal.

Heres what to consider.

If your goal is to make a small down payment and buy a home sooner, look for one of these mortgage programs with high LTV allowances:

- USDA loan 100% LTV

- Conventional 97 loan 97% LTV

- HomeReady & Home Possible 97% LTV

- FHA loan 96.5% LTV

If your goal is to get the lowest possible interest rate and minimize your overall loan costs, you should aim for a lower LTV. This usually means getting a conventional loan with 10%20% down.

Read Also: Cars You Can Afford Based On Salary

Do You Need An 80% Loan

No. Many times you can buy a home with a loan-to-value ratio greater than 80%. For example, you may qualify for a conventional loan with an LTV as high as 90% to 95%. You will pay for private mortgage insurance until you get to 80% LTV, however. The advantage of getting a conventional loan with an 80% LTV is that you can avoid paying for private mortgage insurance , which can lower your monthly mortgage payment!

When you buy a home with an FHA loan, you may qualify for a mortgage with an LTV as high as 97.5%. When you buy a home with a VA loan, your loan-to-value ratio can be as high as 100% — that is, you are not required to make a down payment. Note that these loans come with mortgage insurance premiums or fees youll need to pay.

What Is A Good Ltv Ratio For A Mortgage

Generally, a good LTV to aim for is around 80% or lower. Managing to maintain these numbers can not only help improve the odds that youll be extended a preferred loan option that comes with better rates attached. It can also boost your chances of being able to avoid paying mortgage insurance and potentially being able to save thousands of dollars in mortgage payments.

In other words, should your LTV come in higher than 80%, youll likely have to pay extra for mortgage insurance. Mortgage insurance basically serves as a form of risk mitigation for lenders that helps protect them in case you default on the loan and helps provide them with needed reassurance if they opt to take on the risk of lending to you.

However, be advised that an acceptable LTV ratio can differ based on the type of mortgage that youre getting. This is true in the case of FHA loans and VA loans as well.

Recommended Reading: Specialized Loan Servicing Lawsuit

How Ltv Is Used

An LTV calculation is used by lenders during the underwriting process when borrowers are purchasing a home. Its also a factor when a borrower attempts to refinance their mortgage , or when they want to borrow against the equity theyve earned on their home .

The amount of a down payment, the appraised value of a property and the sale price will all have an impact on LTV ratios, which can impact a home buyer in that if the LTV is too high, a loan can easily be denied.

Guide To Homebuying: Loan

Finance Writer

Homebuying is a learning experience for most people. Youâll be met with all sorts of new information from real estate laws to lending rules. By the time you close on a house, youâll probably have a whole new vocabulary!

One word that youâll be familiar with by the end of the process? Loan-to-value ratio.

Letâs break down what this means, why itâs important, and how to find your loan-to-value ratio.

Don’t Miss: Strongly Recommended For First Time Buyers

Loan To Value Example

Mr John wants to buy a new house and has applied for a mortgage at a bank. The bank needs to perform its risk analysis by determining the loan to value of the loan. An appraiser of the new house shows that the house is worth $300,000 and Mr John has agreed to make a down payment of $50,000 for the new house. What is the loan to value ratio?

- Loan amount: $300,000 $50,000 = $250,000

- Value of asset: $300,000

Using our formula we can substitute the values for the variables in the equation:

For this example, the loan to value amount is 0.83333. However, you would express the ratio in percentage by multiplying by 100. So the loan to value amount would be 83.33%. The loan to value ratio is above 80%, so analysts would consider it high.

Consider another scenario where the owner of the new house Mr John wants to buy is willing to sell the house at a price lower than the appraised value, say $280,000. This means that if Mr John still makes his down payment of $50,000, he will need only $230,000 to purchase the house. So his mortgage loan will now be $230,000.

Let us calculate the loan to value of the new loan application.

- Loan amount = $230,000

- Value of house = $300,000

The Loan to value amount would be 0.7667. Converting the loan to value to percentage would be 76.67%. The loan to value ratio is less than 80% so it is low-risk for the mortgage bank. Note that the loan to value formula used the appraised value of the house and not the selling price.

Rbi Guidelines On Ltv For Home Loan

The Reserve Bank of India has fixed the Loan-To-Value ratio for lenders at 90% for home loans up to Rs. 30 Lakhs. This implies that if the LTV ratio is 90%, you have to pay the remaining 10% of the property value yourself. The rest of the amount can be funded by taking a home loan.

Take a look at the RBI guidelines over the Home loan LTV ratio.

|

Loan Slab |

|

|

Up to Rs. 30 Lakhs |

90% of the Property Value |

|

Between Rs. 30 Lakhs and Rs. 75 Lakhs |

80% of the Property Value |

|

Higher than Rs. 75 Lakhs |

75% of the Property Value |

Since the LTV ratio is required to compute the minimum down payment you have to make while purchasing a property, it plays a vital role in the approval of home loans.

Read Also: Usaa Auto Calculator

What Is A Good Lvr

LVR is one of the most important factors your lender will consider when they evaluate your home loan application.

As a general rule, the lower your LVR score, the higher your deposit will be.

From a lenders perspective, this equals higher loan security.

For borrowers, this means a far greater likelihood that your home loan will be approved.

As a rule, many lenders look favourably on an LVR of 80% or below.

As this is at the higher end though, it should be coupled with a house deposit of at least 20%.

In most cases, if you have an LVR of 80 or less, your lender will not require you to take out an LMI. However, some lenders will require you to pay LMI unless you have an LVR score of 60 or less.

This requirement is in place for two key reasons:

For borrowers who wish to qualify for a low-interest home loan, or For properties which are considered high-risk purchases .

Of course, there is a way to gauge whether or not your LVR score will help you attain a home loan.

This table shows LVR scores and their level of risk.

LVR Risk level

91 100 High risk