Mefa: Best For Borrowers Who Prefer Fixed

Loans from the Massachusetts Educational Financing Authority are only available to borrowers at public and nonprofit schools borrowers attending for-profit schools arent eligible. MEFA offers fixed-rate loans to graduate and undergraduate students.

- Minimum credit score: 670

- Terms: 10 or 15 years

- Maximum loan amount: Up to cost of attendance

Student Loan Consolidation Work

It is common to accumulate many different student loans. Although you get all of your federal student loans from the Department of Educations Direct Loan program, the loans are still serviced by different loan servicers. Thus, you might make several loan payments every month to satisfy your debt obligations. If this is a burden for you, you can apply to consolidate your loans in the direct student loan consolidation program.

With this program, you fill out an application, and the lender determines if you are eligible to consolidate. You should be able to get approved if you dont have any late payments on your record. Once you consolidate your loans, you will be left with only one payment to make every month.

Another advantage of this offer is that you can gain access to alternative repayment plans. When you consolidate, the government offers several repayment plans that you can choose from to help you pay off your debts with ease. For example, you may be able to stretch the repayment term of your loans out to 30 years, which will give you a much lower monthly payment to work with. You can also choose to use a graduated repayment plan or the income-based repayment.

Consolidating Once

Consolidating Private Loans

What Happens To Student Loans When You Die

If you have federal student loans, your loans will be discharged tax-free upon your death. The same rule applies to federal Parent PLUS loans.

Private loans, on the other hand, work differently. For instance, if your private loan originated before 2018, your lender may hold a cosigner or your estate responsible for any outstanding student loans.

Private student loan borrowers who originated loans after 2018 won’t run into the same problem, however. In 2018, Congress updated the Truth in Lending Act , which requires creditors and lenders to release co-signers and your estate from financial obligations related to student debt.

Read Also: How To Calculate Student Loan Debt

Federal Student Loans For Bad Credit

You can get a federal student loan if you have bad credit or no credit. Most federal student loans donât require a credit check. There are four main types of federal student loans, and they all come from the Department of Education:

Federal student loans are a popular option to pay for college. But federally backed financial aid isnât the only option available to students.

Should I Check My Credit Score Before Getting A Student Loan

No matter what type of student loan you decide to use, you may want to learn how to check and monitor your credit scores regularly. This can help you know where you stand before you apply for student loans or other lines of credit. It can also help you track your progress and make sure the information in your is accurate.

One way to monitor your credit is by using . With CreditWise, you can access your TransUnion® credit report and weekly VantageScore® 3.0 credit scoreâwithout hurting your score. CreditWise is free for everyone. You donât even have to be a Capital One customer to enroll.

You can also get annual free copies of your credit reports from each of the major credit bureaus by visiting AnnualCreditReport.com.

Read Also: Can You Include Closing Costs In Loan

Q4 How Much Interest Rate Should I Expect On Emergency Loans

The interest rate has nothing to do with how quickly you get a loan. It mainly depends on your credit score and your installments. The interest rate will increase if you choose more time to repay the loan. Moreover, it also depends on the amount, as some lenders charge obnoxious rates on smaller loans and meager rates on large loans. You can bargain with the lender to reduce the interest rates, so you wont pay a huge sum while returning the loan.

Financing May Be An Application Away

As with most words, the meaning of the term private varies widely with context. In the financial world, it usually refers to loans or credit lines offered by a private institution, rather than a government organization.

While each type of loan has its pros and cons, the decision of whether to obtain a private or government-backed loan will depend on your individual situation and financial needs. No matter what type of loan you decide to obtain, be sure to do your research before entering into an agreement with a lender.

You May Like: Pnc Bank Auto Loan Phone Number

Types Of Student Loans

Since private loans dont offer the same protections that federal loans do, the general advice is to seek private student loans after youve exhausted every federal option.

Federal student loans

Federal student loans are the first choice for many due to their low rates, flexible repayment options and federal protections.

The U.S. Department of Education offers the following loan options:

- Direct Subsidized

To apply for federal loans and additional financial aid, students must submit the Free Application for Federal Student Aid once every school year. Your school will calculate how much youre eligible to borrow based on the cost of attendance and your familys financial information.

The federal government limits how much a student can borrow annually and over their entire college career based on the academic year, loan type, if the borrower is an undergraduate or graduate student, or if the borrower is an independent or dependent student.

Pros and Cons of federal student loans

| Pros |

| Strict borrowing limits that apple per year and over the students lifetime |

Private student loans

Private student loans are similar to personal loans, as they are issued by private banks or credit unions.

Private student loan lenders look at students’ and to determine interest rates and loan approval. Since most students don’t have enough credit history, lenders often require a qualifying cosigner.

Pros and cons of private student loans

| Pros |

Generally, private lenders will allow you to:

Student Loans For Bad Credit

Thereâs a lot to think about when it comes to student loans. And applying for a student loan with bad credit or no credit can make things feel even more complicated. Plus, you might be wondering if you can even get a student loan with poor credit.

The good news is that for many federal student loans, credit isnât a significant factor. But for private student loans and some federal loans, credit does matter. Here are some things to know about student loans and when credit comes into play.

Key Takeaways

- Federal and private student loan options are available to borrowers with bad credit scores.

- Federal student loans typically donât require any credit checks.

- A co-signer can help you qualify for a private student loan.

- Alternatives to student loans, such as scholarships and work-study programs, can help you reduce your need for student loans.

Recommended Reading: How Much Loan Can You Afford

What Credit Score Do I Need For Bad Credit Student Loans

You can borrow money with a minimum credit score of 500-670 FICO points. For example, you can apply for federal student loans or private loans from an institution that looks at your future potential and merit, not your repayment history. How can you get a loan with a minimum credit score?

- Take advantage of a co-signer, such as one of your parents, in which case even private financial institutions or online lenders wont pay attention to your adverse credit history.

- Seek help from the state and get a federal student loan.

- If you already have a minimum income of $30,000 yearly, you can receive private student loans based on your potential earnings, like the Stride Funding Income Share Agreement.

If your credit scores exceed 670, you will have no problem getting a student loan, even without a cosigner.

Potential Benefits Of Isas

- Possible lower costs If you dont get a high-paying job right out of college, you dont have to worry about student loan payments taking up a huge chunk of your income. Keep in mind that federal student loans also offer income-driven repayment plans, so this isnt a unique benefit of ISAs.

- Job placement Schools that offer ISAs have an incentive to help you get a high-paying job out of college. As a result, you may get more help with job placement.

You May Like: How To Take Out Business Loan

How Do I Or Loan Companies Know I Have Bad Credit

Typically, a person knows if they have bad credit. For example, if a person makes a habit of never paying their bills on time, or not paying at all, has a car repossessed, or has been evicted from an apartment or house that person probably knows his credit score is on the low side. For those who dont know their score, a person is entitled to one free credit report each year. Organizations such as FreeCreditReport.com provide reports, or you can contact one of the credit bureaus and requesting a free report. Also, some companies will allow you to check your credit before officially applying for credit. This is called a soft credit check. Soft credit checks do not affect your credit, whereas a hard credit check, such as when someone applies for a credit card or student loan, will affect your credit score. If youre turned down for credit, you can request a credit report for free as well. A company that pulls your credit report to decide whether to extend credit to someone will have access to the persons credit report, so that company would know if you have good or bad credit

Why Would Someone Want Student Loans For Bad Credit

Student loans for bad credit are an option for borrowers who might not otherwise be able to secure a student loan from a traditional bank due to factors like bad or no credit. Without alternative student loan options, many students wouldnt be able to attend school.

Some 43.4 million borrowers have federal student loan debt and the average public university student borrows approximately $30K to complete their undergraduate degree, according to Education Data Initiative. Without federal and private student loan options, higher education would be out of reach for many people.

To be sure, student loan debt is a major issue in this country Americans owe $1.75 trillion as of 2022 and its essential that student loan borrowers develop a debt repayment plan. But bachelors and graduates degrees can still put students on the path to higher earning potential over their careers.

You May Like: What Happened To Ocwen Loan Servicing

Best For Loan Comparison: Credible

A trusted player in the loan game since 2012, Credible offers risk-free loan comparison to prospective borrowers. Credible is a free service that lets you compare private student loans and more youll find personal loans, mortgages, refinancing and credit cards.

With over 2,200 educational institutions that work with lenders on Credible, youll have options. And connecting with lenders takes less than 3 minutes and a short survey.

Youll be able to compare your personalized offers, terms and rates side-by-side. Checking your rates wont hurt your score, so you can shop around safely and make the most informed decision possible.

Lenders with Credible do prefer borrowers with good credit, so a cosigner will improve your chances of getting good loan offers. Every lender with Credible offers fee-free loans.

Choosing and signing on for a loan can be daunting. Credibles knowledgeable Client Success Team will help you from the beginning to the end of this process. Engage with them via Credibles chat feature to get started today.

Are Private Student Loans Worth The Cost

You should apply for federal loans first and exhaust all of your resources before applying for a private loan because they can be quite expensive. However, if youre determined to further your education and a private loan is the only option, then its worth the cost. After all, its helping you pay for your education and a four-year experience you wouldnt otherwise have. Additionally, college can help you qualify for a higher paying job.

Recommended Reading: How To Apply For Stafford Student Loan

Review Your Credit Report

Check your free annual credit report to determine what negative credit items could be affecting your overall score. To repair your credit, youll have to face these issues head-on. The first step is identifying and understanding the negative items on your credit report.

If you find anything in your report which is inaccurate, dont let it go! Credit bureaus have existing processes in place to allow consumers to dispute information on their credit report. Make sure you file a dispute requesting the removal of incorrect information.

Which Student Loan Is The Best For Bad Credit

Each lender is different, and its hard to say which is best for borrowers with bad or no credit. In general, if you dont have a cosigner and dont have a credit history, Funding U or Ascent will be your best option.

Because Edlys loan payments depend on your income, its hard to compare how much youll pay with them compared to a traditional lender.

Also Check: Does Va Loan Have To Be Primary Residence

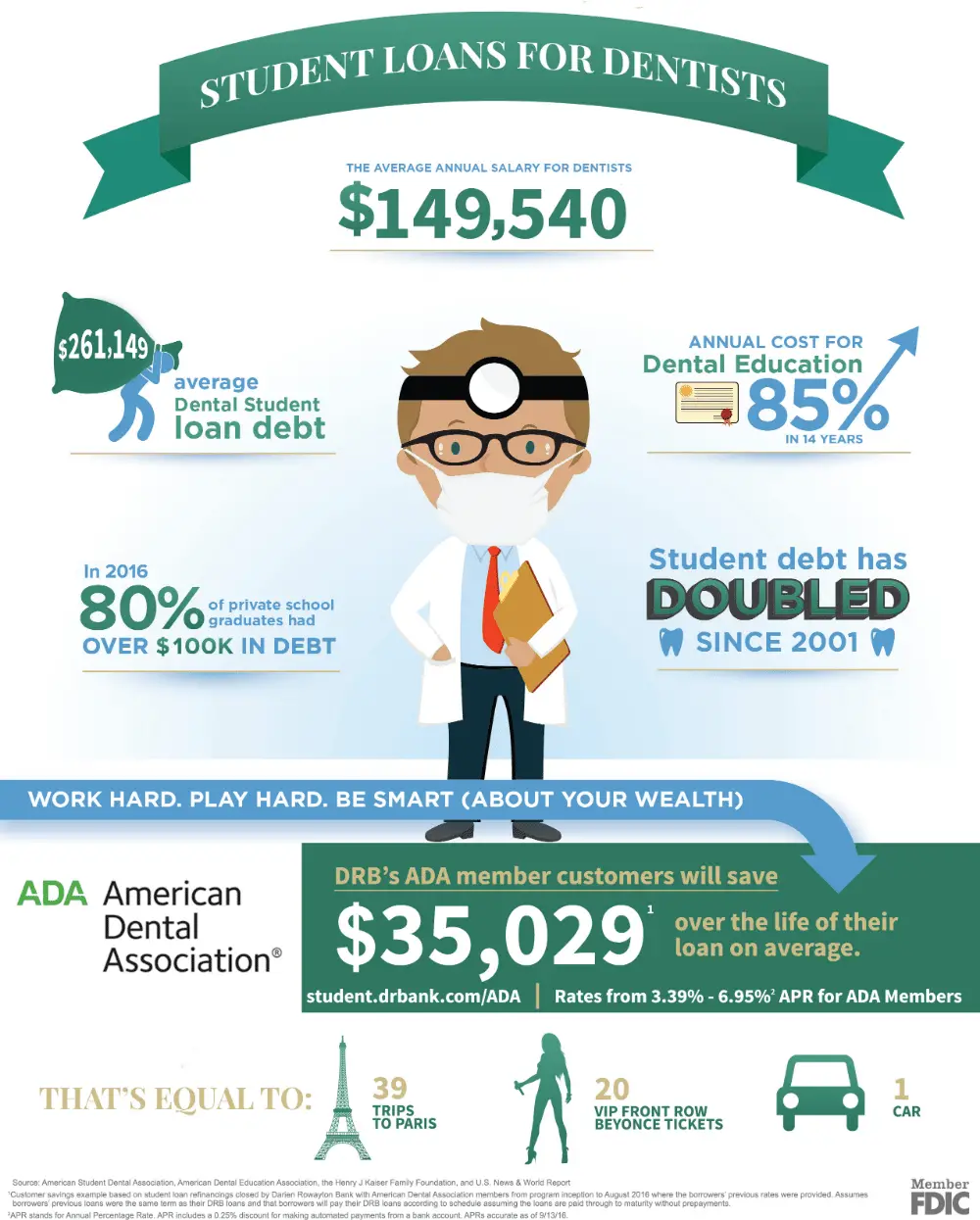

What Is The Average Student Loan Interest Rate

Congress sets federal student loan interest rates each year the actual rate you get will depend on the type of federal loan you take out. Here are the rates you can expect for the 2022-23 academic year:

- Direct Subsidized Loans: 4.99%

- Direct Unsubsidized Loans : 4.99%

- Direct Unsubsidized Loans : 6.54%

- Direct PLUS Loans: 7.54%

Private student loan interest rates are set by individual lenders according to market conditions. Here are the average rates offered to borrowers with credit scores below 680 who applied for a private student loan through Credible in May 2022:

- Five-year variable-rate loans: 4.99%

Keep Reading: Student Loans for DACA Recipients

Provide Proof Of Income

As part of the loan application process, youll have to show you have income. Providing proof of income shows the lender that you have the ability to make loan payments when it is time to repay the loan. Income verification is especially important if the loan payments are due before you finish school. The more income you can prove, the better the chances of getting approved for a loan with a decent interest rate. If you are a full-time student, it may be up to your co-signer to provide proof of income

Read Also: What Is Loan To Value Mean

Which Lenders Offer Student Loans For Bad Credit

Technically, the Department of Education provides student loans for borrowers with bad credit, as its Office of Federal Student Aid doesnt even check your credit report in most cases. If you maximize your federal loan allotment and need to borrow private student loans for bad credit, there are some lenders that either require you to apply with a cosigner or lower their bar for qualification on your own. Just keep in mind that applying for bad-credit loans without cosigner support almost certainly means youll face higher interest rates, increasing your cost of borrowing.

Talk To A Credit Union

When you start looking for a loan, you might want to consider starting small and starting local. If you have a local bank you deal with , applying for a loan through them could work, especially is its a relatively small bank. A smaller local bank might be more willing to take a risk on a loan for a local person than a large corporate bank might be. Another option is applying through a credit union. Credit unions often help their members when other banks will not. If joining a credit union is an option, you might want to consider going that route to attain the additional funding you need.

Also Check: What Is Needed For An Auto Loan

Final Words: How Do I Get An Immediate Student Loan

Sudden expenses can arrive at any time, and a quick loan can be a lot helpful in such situations. If you are looking for emergency loans for students with bad credit, we shared the four best companies that offer such loans. They can help you get a loan from $200-$35,000. However, as you increase the loan amount, they might require you to show them proof that you can repay the loan easily.

We recommend checking all of them and comparing their lenders to see which offers the most suitable terms and conditions. Once you are satisfied with them, pursue that lender and get your money.