How To Determine How Much Money You Want To Borrow

Determine how much money you want to borrow: You may need to list your desired loan amount on your loan application. As a general rule, its a good idea to minimize the amount of debt you take on. Check your credit: Its smart to know the condition of your credit before applying for a personal loan.

Personal Loan Payment: Your Loan Term

The next factor that drives your monthly payment is your loan term. Loan term is the number of years you take to repay the loan. Most personal loans are installment loans with fixed interest rates. This means you make equal monthly payments and repay the loan by the end of its term. Most personal loans allow you to prepay your loan, zeroing out your balance sooner and saving on interest charges.

The chart below shows how one, five, seven, 10 and 15 year terms impact the payment of a $10,000 loan at an 8% interest rate.

Notice that even though longer loan terms result in lower monthly payments, your total interest paid is higher sometimes much higher. Personal finance specialists generally recommend using long-term loans only for long-term purposes. For instance, a ten-year loan for college tuition or a sizable home renovation can be a sensible choice. But you probably dont want to still be paying off your wedding loan on your tenth anniversary.

The loan term, like the loan amount, affects what lenders charge. Longer terms are riskier to lenders, and they normally charge higher rates to compensate for that extra risk. Here are typical interest rates for highly-qualified applicants at different terms from the same lender:

- 2 years: 4.44% to 13.29%

- 5 years: 4.94% to 14.49%

- 7 years: 5.39% to 14.99%

- 12 years: 6.89% to 14.99%

Be sure to check rates for the term you want when using the MoneyRates calculator.

How To Get A 10 000 Dollar Loan

If youre ready to get a $10,000 personal loan, follow these three steps:

- Check your credit. Lenders will review your credit to determine your creditworthiness as well as your rates and terms.

- Compare lenders and pick a loan option. Be sure to compare as many personal loan lenders as you can to find a loan that…

- Complete the application and get your funds. Once youve…

Also Check: Who Pays Appraisal Fee For Va Loan

Where To Find The Best Personal Loans For You

You can apply for personal loans from online lenders, banks and credit unions. The interest rate and fees will vary between lenders, but the lending process can also be quite different for each.

Banks and credit unions have physical branches, offering both an in-person and digital lending options for borrowers. However, there may be a limited number of credit union branches in each state. Online lenders operate strictly online, so borrowers will not meet with anyone face-to-face during the loan process, but there may be customer service available via phone, chat and/or email.

The type of lender is important, but what makes a loan the best personal loan for you? As you search for a personal loan, youll want to consider low interest rate loans, those with few or no fees and flexible repayment terms. These factors will ultimately affect the affordability and cost of the loan.

Depending on your circumstances, you may not qualify for a personal loan that checks all three of these boxes, so your best course of action may be to review the available options and choose a personal loan that will be the least expensive. Student Loan Hero offers a personal loan marketplace that features lenders that may have options suitable for your personal loan needs.

Requirements To Receive A Personal Loan

Lenders focus on two key factors when evaluating personal loan applicants their debt-to-income ratio and creditworthiness. Not only is it important that the borrower earns enough to comfortably afford the monthly loan payments, but can they prove it? Thats where the DTI ratio and credit score come in.

The DTI ratio, or the percentage of gross monthly income used on monthly minimum debt payments, sheds light on the borrowers current debt load in relation to how much they earn. The credit score demonstrates how theyve handled credit in the past. Ideally, you want an acceptable DTI and good or excellent credit score to qualify for a personal loan with competitive terms.

A lower credit score isnt necessarily a deal-breaker, though. However, you can expect the cost of borrowing to be substantially higher since your chances of defaulting on the loan payments are higher from the lenders perspective.

The average personal loan interest rate was between 10.3 percent and 12.5 percent for borrowers with excellent credit as of July 1, 2022. These figures are significantly higher for borrowers with bad credit scores, with average interest rates ranging from 28.5 percent to 32 percent.

Read Also: Where To Send Loan Forgiveness Application

What Is A $10000 Loan

A $10,000 personal loan can be a useful financial tool, whether you want to consolidate high-interest debt, cover an emergency expense or pay for a home improvement project. Of course, there are cases where you may want to borrow more or less than that amount. But if youre searching for $10,000 loans, you can learn about a few lenders …

What To Do With Your Trade

Although it’s convenient to trade in your old vehicle to the dealer at the time of purchasing another, it’s not to your best advantage. You are likely to get the least value from the dealer, as they have to move it yet again and need to ensure a safe profit margin on selling it. They do not have to take your old automobile, and will offer you what will make them the highest profit. Some dealerships may offer artificially high trade in values, but only offer them in association with a higher price on the vehicle they sell you.

Selling Your Used Car Privately

The best option typically is to sell your vehicle privately. It seems even government agencies are freely giving out this advice from the Arizona Attorney General to the FTC. Don’t underestimate the value of your old car. Go to Kelly Blue Book online to do your valuation research. If you can sell it, even for a small amount, it’s extra bargaining power for your new vehicle.

Each year Americans buy roughly double as many used vehicles as new vehicles. You can put a”for sale” sign on your car parked out front if you live in a high traffic area. Sites like Craigslist or Auto Trader can also help send buyers your way.

Another option with your old automobile is to keep it. An old pick up truck used for heavy work can help protect the value of a new vehicle by minimizing wear and tear, along with depreciation. Automotive insurance companies typically offer multiple vehicle discounts.

Also Check: What Is The Largest Student Loan I Can Get

What Does This Personal Loan Calculator Show

Affordability is a prime concern when taking out a personal loan. A personal loan calculator helps give you a better idea of the total cost of borrowing so you can determine if it suits your budget.

Note that some types of loans, such as federal student loans for example, tend to be much less expensive than a personal loan, so youll want to compare all your options.

Student Loan Heros free personal loan calculator shows the total cost of the loan, the total amount paid in interest and the monthly payment amount.

To use this personal loan payment calculator, fill in the following information:

- Personal loan balance: The amount you wish to borrow from your selected lender.

- Interest rate: Its better to enter the annual percentage rate here. Your APR includes the interest rate and additional loan fees and is a more accurate measure of your cost of borrowing.

- Term in years: The loan term expressed in years rather than months .

What Is Peer To Peer Lending

The majority of these lenders are regular people with some extra money to invest. The entire process is called peer-to-peer lending, or abbreviated as P2P lending . P2P borrowers generally offer loans with more favorable terms because of the relatively low risk and low cost for the P2P service providers.

You May Like: How To Get Car Loan Account Number

Why It May Be Worth Waiting To Borrow

Lenders will use a borrowers to measure risk and determine the likelihood of the personal loan being repaid. Excellent credit is preferred by lenders because it means the borrower is low risk, but it is not absolutely required to secure a personal loan.

Even though less-than-perfect credit may not disqualify you from being eligible for a personal loan, approval is not guaranteed. Odds of approval are much higher when you have a better credit score, so waiting to borrow until your credit score improves isnt a bad idea. Not only can it improve your odds of approval for the requested loan amount, but a higher credit score may also get you access to competitive loan terms.

Personal Loan Payment: Your Interest Rate

The biggest influence on your personal loan payment is likely to be your interest rate. As you have seen in the charts above, lenders apply different interest rates depending on the length and amount of the loan. But the most important factor lenders use when setting your interest rate is your credit rating. Personal loan interest rates from mainstream lenders range from under 6% to over 36%.

The chart below illustrates monthly payments for a $5,000 loan over a five-year period for interest rates ranging from 5% to 25%.

| Personal Loan Payments By Interest Rate |

|---|

| Loan Amount |

| $3,805.40 |

Don’t Miss: Can You Get Student Loan For Online Courses

Some Used Cars Are A Real Bargain

Before you take the plunge of buying a new car, consider a used one. Frugal shoppers know that new cars depreciate as soon as they are driven off the lot, and in fact lose on average 15-25% of its value each year the first five years. Buying one that’s a couple years old can still provide you with a reliable vehicle for thousands less while letting someone else take the depreciation hit. If you trade in every few years then depreciation is something to consider, so look for vehicles that traditionally hold their value such as Honda, Toyota or Lexus. If you keep your automobile until it falls apart, then depreciation is not a concern for you. New models for the upcoming year usually arrive late summer or early fall. Although selection may be limited, this is a great time to consider buying last year’s model because the dealer will need to make room for the new ones.

Do Not Buy a Lemon!

Check the used car history by the VIN# on sites like Carfax or AutoCheck. This will help eliminate anything that looks questionable. Anything that says it’s a salvage should raise a red flag. Salvage vehicles are those in accidents that the insurance company has determined repair costs are more than it is worth. Some shops will try to repair them and sale them at a steep discount. These are given salvage titles. Unless you are mechanically savvy, it’s best to avoid these.

Program Cars Are Often a Great Value

What Is A Down Payment

A down payment is the amount of money you pay upfront when buying a vehicle. Some lenders require down payments while others dont, but you may want to consider putting money down regardless of the requirements. If you dont have the cash to put down, trading in your old vehicle is a form of a down payment as well. Your trade-in cars value will be subtracted from the total loan amount, just like a cash payment.

Recommended Reading: Should I Refinance My Truck Loan

Cost To Repay A $10k Loan

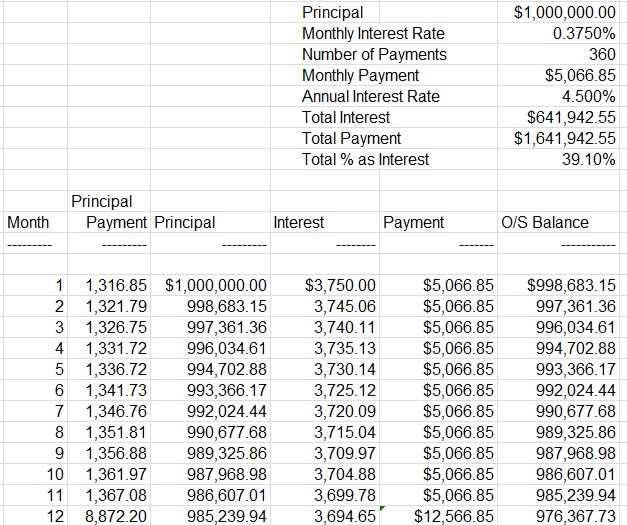

The table below shows the relationship between your repayment term, interest rate, monthly payment, and total interest charges. The interest rates in the table are hypothetical and for illustration purposes only.

| Repayment term |

|---|

Keep reading: Personal Loans With 550 Credit Score: Can I Get One?

Jamie Young is an authority on personal finance. Her work has been featured by Time, Business Insider, Huffington Post, Forbes, CBS News, and more.

What Credit Score Do You Need For A $10000 Personal Loan

Your credit score is a major factor when it comes to qualifying for a personal loan. It also impacts the interest rates you might get: Generally, borrowers with good credit usually a score of 670 or higher will qualify for lower interest rates compared to borrowers with bad credit.

To get approved for a $10,000 personal loan, youll typically need a credit score of 620 or higher though keep in mind that some lenders are willing to work with borrowers who have scores lower than this. If you have poor credit and can wait to get a personal loan, it might be a good idea to work on building your credit so you can qualify for better rates in the future.

Recommended Reading: Sallie Mae Student Loan Forgiveness

These Lenders Offer $10000 Personal Loans

In many cases, an unsecured personal loan may be your best option if you have strong creditor a creditworthy cosigner and are looking to consolidate debt .

Personal loans are also a solid option for handling a major expense, like a wedding, or if you need to access emergency funds fast. Thats because you wont need to put up collateral to qualify.

Granted, a home equity loan can make better sense for home renovations if youd qualify for a tax deduction but even then, if youre risk-averse, an unsecured personal loan may make more sense.

| LightStream |

| Best Egg Reviews |

How To Use Our Personal Loan Calculator

We built our calculator to help make the decision to apply for a loan much easier. Whether you need a loan for debt consolidation, medical expenses, home improvement projects, a move, or even a wedding, here are some questions it can help you answer: – What is the maximum loan amount I can afford? – How do I compare my existing loan to others? – How can I pay off my loan early? – If I increase my monthly payments how much money will I save in interest? – How much interest will I pay on my loan?

Also Check: Can You Change Loan Type Before Closing

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How To Borrow $10000 Without Credit Check

The best way to borrow $10,000 with no credit check is to apply for a personal loan from Oportun, which does not use applicants credit history as a condition for approval . Approval is still not guaranteed, though, as Oportun will look at things like your income and employment status to determine your ability to pay.

Don’t Miss: How To Consolidate Perkins Loan

Start With The Interest Rate

The higher your credit score, the lower the interest rate you will likely qualify for on a personal loan. If you think you might be in the market for a personal loan in the future, its a good idea to get to work building up your credit score. Contest any errors in your credit report, pay your bills on time and keep your credit utilization ratio below 30%.

Once you’re ready to shop for a personal loan, don’t just look at one source. Compare the rates you can get from credit unions, traditional banks, online-only lenders and peer-to-peer lending sites.

When you’ve found the best interest rates, take a look at the other terms of the loans on offer. For example, its generally a good idea to steer clear of installment loans that come with pricey credit life and credit disability insurance policies. These policies should be voluntary but employees of lending companies often pitch them as mandatory for anyone who wants a loan. Some applicants will be told they can simply roll the cost of the insurance policies into their personal loan, financing the add-ons with borrowed money.

This makes these already high-interest loans even more expensive because it raises the effective interest rate of the loan. A small short-term loan is not worth getting into long-term debt that you can’t pay off.