Does Refinancing My Car Hurt My Credit

The process of refinancing can temporarily lower your score. When you apply for a loan and a hard inquiry is submitted, your credit score will drop a few points. Following approval, a new loan account will lower the average age that your credit score holds which can lead to a lower score.

But these two factors are a small part of what makes up your credit score and sticking with a monthly payment you cannot afford will likely lead to larger credit issues down the road.

Car Loan Application Checklist

You can expedite your car loan application by getting your finances in order and by being ready to provide any required documentation.

Proof of Employment: Most lenders want to see that you are employed and earning enough income to cover your car payments. Copies of your bank statements, pay stubs, or notice of assessment should be adequate. Some lenders also accept government assistance or benefits.

: Your 3-digit credit score is a measure of your creditworthiness. If you are not sure what your credit score is, you can check it for free here.

Your credit report also details how you have managed your finances over time. Typically, lenders want to see your debt-to-income ratio, payment history, and account balance. You can improve your credit score by paying bills on time.

Bank Details: You will need to show that you have a bank account in Canada. A void cheque to set up your monthly payment is typical.

Drivers License and Proof of Residence: A government-issued ID such as your drivers license is used to confirm your province of residence and address. Other documents that may be requested include your utility bills.

Vehicle Information: Duh! Of course, you need to know the type, make, and purchase price of the vehicle you want.

Proof of Car Insurance: Before driving off the lot, you may have to show you have purchased car insurance.

How Do Lenders Come Up With Car Loan Interest Rates

A few different factors help lenders determine the car loan interest rates youll be offered. The more well-rounded your application, the better your chances of scoring a low rate. Although there are many factors that may play a role in your interest rate, these are the four main points lenders consider when reviewing your application:

- Those with higher scores generally have access to lower car loan rates, so improving your credit history is an important part of getting a low interest rate on your car loan.

- Income. Lenders consider your income because it reflects your ability to pay back the loan. They also want to see a low debt-to-income ratio to make sure you can afford your loan.

- Loan term. The loan term impacts the interest rate that youre offered as well as how much interest youll pay over the life of the loan. A lender could offer you a lower interest rate on a longer loan term, but this doesnt mean youll save money: youll pay more interest on a longer loan term.

- Vehicle. Your vehicles make and model can also play a role car loan rates, especially if youre buying a used car. Since its possible that your car will be used as collateral to secure the loan, lenders often charge higher interest for cars that are of poorer quality and are more likely to break down.

- Type of interest rate. Banks and credit unions can offer fixed and variable interest rates on a car loan. Generally, variable-rate car loans have lower starting rates than fixed-rate car loans.

You May Like: Does Usaa Refinance Student Loans

Which Lender Is The Most Trustworthy

We’ve reviewed each institution’s Better Business Bureau score to help you make the best decision possible when choosing an auto loan. The BBB measures businesses based on factors like truthfulness in advertising, honesty about business practices, and responsiveness to consumer complaints. Here is each company’s score:

| Lender | |

| Clearlane by Ally | D- |

A majority of our top picks are rated A or higher by the BBB, with the exception of Clearlane by Ally. Keep in mind that a high BBB score does not guarantee a good relationship with a lender, and that you should keep doing research and talking to others who have used the company to get the most helpful information you can.

The BBB currently rates Clearlane by Ally a D- because of 53 complaints filed against the business, including one unresolved complaint. Due to the lenders’ BBB scores, you might prefer to use a different auto loan company on our list.

Best Auto Loans: 10 Top Providers

There is no one best auto loan provider for everyone. While most people looking for loans will want to find a provider offering the lowest annual percentage rate , the interest rate you receive depends on your credit history as well as a number of other factors. Different financial institutions may also offer different minimum and maximum loan amounts.

Finding the best provider also depends on which type of car loan you need: a new car loan, used car loan, or a refinancing loan. The table below shows some information for a few of the best auto loan providers for a variety of borrower types. Some of the providers listed below administer loans directly to customers, while others are brokers that match customers with loans. Both can be good places to start when looking for the best auto loans.

| Auto Loan |

|---|

| Varies by lender |

Based on the available information, we think some of the best auto loans can be found from the following companies:

- PenFed Credit Union: Lowest APR

- Auto Approve: Best for Refinancing

- Auto Credit Express: Best for Bad Credit

Don’t Miss: How Long For Sba Loan Approval

What Credit Score Do Credit Unions Require For Auto Loans

There isnt a minimum credit score that all require for auto loans. It depends on the credit union, the type and age of the car, and the borrowers other qualifications such as employment history and income. The higher your credit score, the lower your rate will generally be. Typically, a credit score over 720 will give borrowers the very best rates.

Best Online Auto Loan: Lightstream

LightStream

- 2.49% to 10.99%

- Minimum loan amount: $5,000

LightStream offers a fully online process for its extensive list of vehicle loan options. It’s very transparent about its rates and terms, and it has few restrictions on what kind of car it will finance. It’s also strong on customer service, receiving the top score in the J.D. Power 2020 U.S. Consumer Lending Satisfaction Study for personal loans.

-

No restrictions on make, model, or mileage

-

Offers unsecured loans to borrowers with excellent credit

-

Prefers borrowers with good credit

LightStream is the online lending arm of SunTrust Bank. It stands out for its online lending process. Borrowers can apply online, e-sign the loan agreement, and receive funds via direct deposit as soon as the same day.

LightStream also offers a remarkably wide range of auto loan options, including new and used dealer purchases, refinancing, lease buyouts, and classic cars. It even offers unsecured loans for those with excellent credit.

Rates from the lender start as low as 2.49%, which includes a 0.5%-point discount for autopay. The maximum APR on an auto loan is 10.99%.

You May Like: Capital One Pre Approved Auto Loan Program

Best For Excellent Credit: Lightstream

- : New/Used/Refinance: 2.49% to 9.49%, Lease Buyout: 3.49% to 10.49%

- Loan range: $5,000 to $100,000

- Loan length: 24 to 84 months

- Available in all 50 states

If you have a good or excellent credit score, you might want to consider LightStream in addition to Bank of America. A part of SunTrust Bank, Lightstream focuses on auto loans to customers with good or better credit.

Because it focuses on a narrow subset of customers, its rates don’t go too high For a 36-month loan for a new car purchase between $10,000 and $24,999, interest rates range from 2.49% to 6.79%. However, borrowers with lower credit scores may find better rates elsewhere.

Carvana: Most Seamless All

Starting APR:3.9%Loan amounts:$1,000 to $85,000Loan terms: 0 to 72 monthsAvailability:48 states Minimum credit score:None

You may know Carvana as an online car shopping portal, but the company now also offers auto financing on vehicles you buy through the site. Carvanas financing rates are average for the industry, but the ability to buy a car online and finance it at the same time creates a quick, seamless car buying experience thats hard to find elsewhere.

At 3.9% APR, Carvana has the highest starting interest rates of any of the providers on our list. But when it comes to both loan amounts and loan terms, Carvana is relatively flexible. You can borrow anywhere from $1,000 to $85,000 and choose up to 72 months to pay your loan back.

Carvana could be a great option for people with bad credit history, as the company does not have a minimum credit score. Keep in mind, however, that the best auto loan rates are reserved for those with the highest credit scores.

Also Check: Usaa Auto Refinance Rates

The Verdict: Should I Get A Car Loan

As long as you choose a loan that fits your budget and you make regular payments, a car loan is a great option if you dont have a wad of cash stashed under the mattress. Understanding car loan rates in Canada can be daunting, but if you keep in mind the tips and information above, youll be able to successfully navigate the process and get a car loan for your next vehicle.

If you liked this article, you may also like:

How Do You Transfer A Car Loan To Another Person

Unfortunately, it is not always possible to transfer a loan to someone else. As each lender has different conditions, it is best to check the terms and conditions of your current contract.

Depending on the length of the loan and the vehicles age, it is possible to owe more than the car is worth on the resale market. A bank is unlikely to sign a new loan agreement against a depreciated vehicle.

Also Check: How To Transfer A Car Loan To Someone Else

Whats A Good Car Loan Interest Rate

So, what is a good car loan rate today? According to the National Credit Union Administration , the average 60-month new car loan from a credit union has an interest rate of 3.09%. From a bank, the average rate is 4.81%. So, if you find these rates or better, you know youre getting a fair rate on your car loan.

What Is Conditional Financing

Conditional financing is a statement from your lender listing out conditions you must meet in order to receive your loan funds. If the financing is contingent or conditional, the lender can change your agreement later, leaving you with less advantageous terms. Never take a car from a dealer until the financing down payment amount, interest rate, length of the loan and monthly payments is finalized.

Also Check: Does Carvana Prequalify Hurt Credit

Best For Bad Credit: Oportun

Oportun

- Capped at 35.99%

- Minimum loan amount: $300

Opportun is our choice as the best for bad credit since it offers personal loans with limited credit score requirements and an easy online application, and funds available within 24 hours.

-

Wide range of credit situations accepted

-

Easy online application with instant approval

-

Pre-qualify with a soft credit check

-

Only available in 35 states

-

High interest rates

Having less-than-perfect credit shouldnt keep you from getting the car you need. While you shouldnt expect the low rates those with great credit receive, you can avoid overpaying with Oportun. Through this online lender, you can get a loan for a car that you purchase from an auto dealer or a private party. Since buying through a private party can be cheaper, this can save you big bucks over dealerships.

Oportun will lend to people with limited or no credit history. You should have proof of income to apply. Loan amounts can range from $300 to $10,000, so you can get the car you want. Best of all, Oportun does not require a hard credit check when prequalifying and checking rates. So, looking around wont hurt the score youre trying to fix. The application takes only a few minutes, is completely online, and results in an instant decision. If you live in one of the states where Oportun is available, this is an excellent choice.

What Kind Of Average Auto Loan Rates Can You Expect

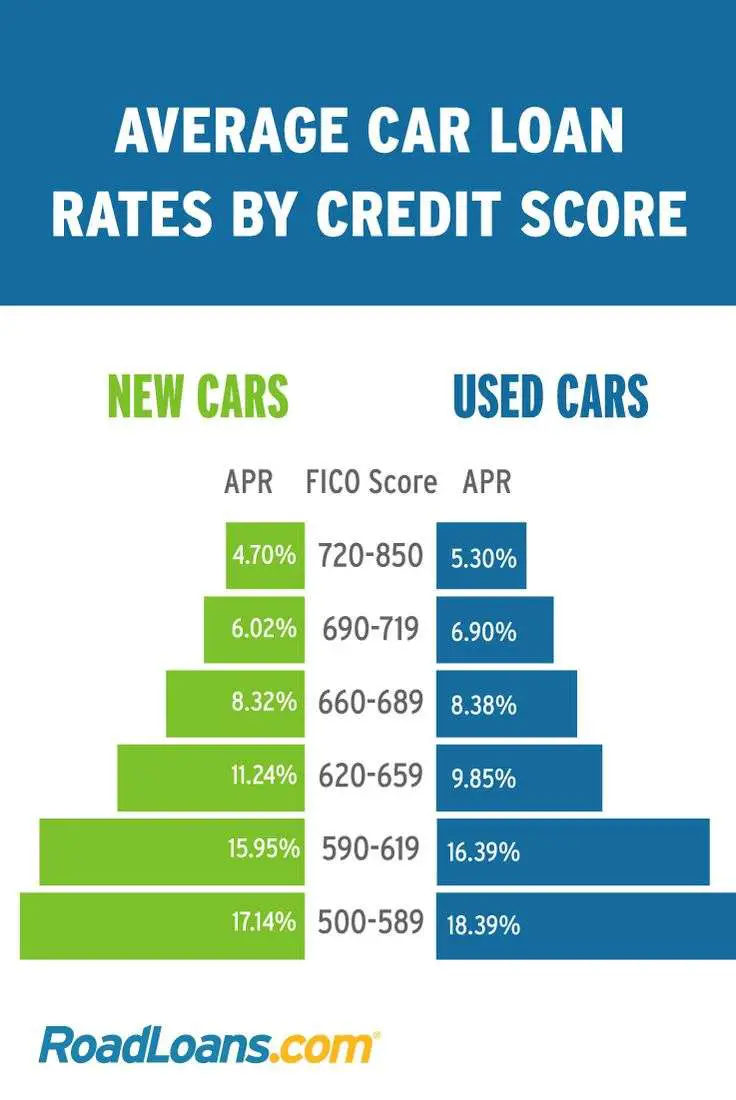

Average auto loan rates are always in flux depending on market conditions. In 2021, new car loan rates range from 2.34 percent to 14.59 percent. The difference between a low and high annual percentage rate is based largely on your credit score.

This article will explain the factors that determine how lenders set APRs and offer tips for finding the lowest auto loan rates. Also read our review of the best auto loan providers to learn about and compare the top lenders in the industry.

Don’t Miss: Usaa Used Car Loan Rate

Best Overall: Penfed Credit Union

PenFed Credit Union

- As low as 0.99%

- Minimum loan amount: $500

PenFed Credit Union provides some of the best rates available. It also has flexible loan amounts and a number of auto loan options for members. Even though membership is required, a disadvantage for some, PenFed makes the requirements to join fairly straightforward.

-

Offers new, used, and refinance loans

-

Loan amounts from $500 to $100,000

-

Provides rate discounts for using its car buying service

-

Borrow up to 125% on new and used vehicles

-

High minimum loan amount for longer terms

-

Excellent credit history required for lowest rates

-

Membership in the credit union is required

Our top pick for auto loan rates, PenFed Credit Union, offers some of the lowest rates available.

At PenFed, rates for 36-month refinance loans start as low as 1.79%. Deep discounts are available for members who use the credit union’s car buying service, with rates starting as low as 0.99% annual percentage rate for a new car and 1.99% APR for a used vehicle.

You’ll have to become a member of the credit union, but the requirements to join are fairly easy to meet. Car loans from PenFed start as low as $500 and move up to $100,000, a wide range that beats out many of the lenders we surveyed.

How Do Lenders Determine Your Auto Loan Rate

Much like insurance companies, lenders determine auto loan rates based on information about you and your vehicle. Here are some of the factors that can affect your car loan rate:

- :By far the biggest influence on your rate is your credit score. People with the highest credit scores get the best auto loan rates.

- Loan term:Generally, the longer your loan term, the higher your interest rate will be.

- Vehicle age:Banks and other lenders often charge higher interest rates on older cars.

- New or used vehicle: Most lenders save their lowest interest rates for new car loans. If you want a used car loan, you might pay a higher interest rate.

- Down payment:Some lenders will adjust interest rates based on what percentage of a vehicles cost you put down when you buy it.

Be sure to compare auto loan quotes from lenders before making a decision. Some lenders may weigh factors such as your credit score differently than others. Do the math and look at the total cost of your loan over its lifetime, and not just the APR.

Don’t Miss: Fha Maximum Loan Amount Texas

What Minimum Credit Score Is Required For A Car Loan

Most buyers with a score of 660 and sufficient income can easily get approved for a car loan from a traditional bank or credit union.

There is, however, no explicit rule about what score is required for a car loan. Beyond credit, lenders also evaluate loan applications on their employment history, income, the value of the car, and more. Below that 660 score threshold, alternative lenders can be an attractive option. They offer more flexible standards, albeit at less favourable rates.

Want to see what kind of car loan you can qualify for? Use the comparison tool below:

Compare current car loan interest rates!

You May Like: Auto Calculator Usaa

What Is A Car Loan And How Does It Work

A car loan is a personal loan that is used to purchase a vehicle preowned or new. Over time, you will pay back the amount you borrowed from the lender, plus interest.

The car serves as collateral for the loan, and if you are unable to make payments on time, the lender can seize the vehicle.

You can get a car loan from a bank, dealership, online lender, or credit union.

An online lender is convenient and you can easily compare rates without leaving your home. Online lenders like Canada Drives and Car Loans Canada have partnerships with dealerships which accelerates the process from applying for a loan to getting your new car.

The various terms you should understand when applying for a car loan include:

Principal: This is the amount you borrow to purchase a vehicle.

Interest rate: This refers to the effective interest rate you pay on your loan. The car loan rate you qualify for varies with your , vehicle age, down payment, and the lenders prime rate.

The interest rate can be fixed or variable. For most car loans, your monthly payments stay the same . When you make a payment, a portion goes to offset the principal amount owed and the remainder goes to interest.

Loan Term: This is the length of time you have to pay back the car loan. It can range from 1-8 years .

The combination of a lower interest rate and a shorter loan term can help you save money on your car loan. Use the car loan calculator below to test various scenarios.

Also Check: Fha Limits Texas