Calculating Your Average Car Payment

When you’re shopping for your next vehicle, it can be helpful to know what you’ll owe per month.

The easiest way to do this is by using an auto loan calculator. Available online, auto loan calculators consider your down payment, total amount borrowed, interest rate, and term length.

Using this information, an auto loan calculator provides you with a monthly amount, so you’ll know your car payment before moving forward with your purchase.

When you’re shopping for a used car, finding an example in excellent condition is a prime consideration. Shift’s certified mechanics perform extensive 150-point inspections on every car and have complete vehicle history reports, so you know your used car feels as good as new

There’s More To A Loan Than A Monthly Payment

That same wise shopper will look not only at the interest rate but also the length of the loan. The longer you stretch out the payments, the more expensive the loan will be. Let’s take that same $20,000 loan above at 5% at 5 years and see how much we can save by paying it off in 3 years. So, $20,000 at 5% for 36 months will cost $21,579.05 saving you $1,066.43. Using the calculator above you will see that the monthly payment for the 5 year loan is $377.42 and the monthly payment for the 3 year loan is $599.42. If you can easily handle the higher payment the savings are well worth it.

If your credit drastically improves & your initial loan was at a higher interest rate, it may be worth looking into refinancing at a lower rate.

Keeping Your Car Payments Low

Because the average car payment for both new and used vehicle buyers continues to increase, most borrowers who have bad credit will most likely be more interested in buying a used car. Since used vehicles generally sell for less, its safe to say your monthly payment likely wont reach the current average new car monthly payment. But, depending on your loan term, interest rate, and specific vehicle, the monthly payment could be higher than anticipated.

So, in order tokeep your monthly payments cost-friendly, youll need to stay on top of your budget before and after you take out a new loan.

Before you sign the papers:

-

Research and plan Look at your current finances to determine how much youll be able to afford each month without overextending your budget. Online tools such as ourCar Loan Estimator can help you get an idea of how much you might be paying for a car loan. Lenders look at various things such as your income and monthly bills to determine your maximum allowed monthly payment.

After you sign the papers:

Also Check: Does The Capital One Pre Approval Car Loan Work

How Is A Car Payment Determined

There are several factors that will determine your payment on an auto loan. Here’s what goes into the calculation:

Let’s say you qualify for a $30,000 loan on a new car with a 3.74% interest rate over 60 months. Your monthly payment would be $549, and you’d pay $2,939 in interest over the life of the loan. If you were to extend your repayment term to 72 months, the monthly payment would drop to $466, but the total interest paid would jump to $3,538.

Now let’s say you manage to reduce the interest rate to 3.24% by putting down $5,000 but keep the term at 60 months. Your new loan amount would be $25,000, your monthly payment would be $452, and you’d pay $2,113 in total interest charges.

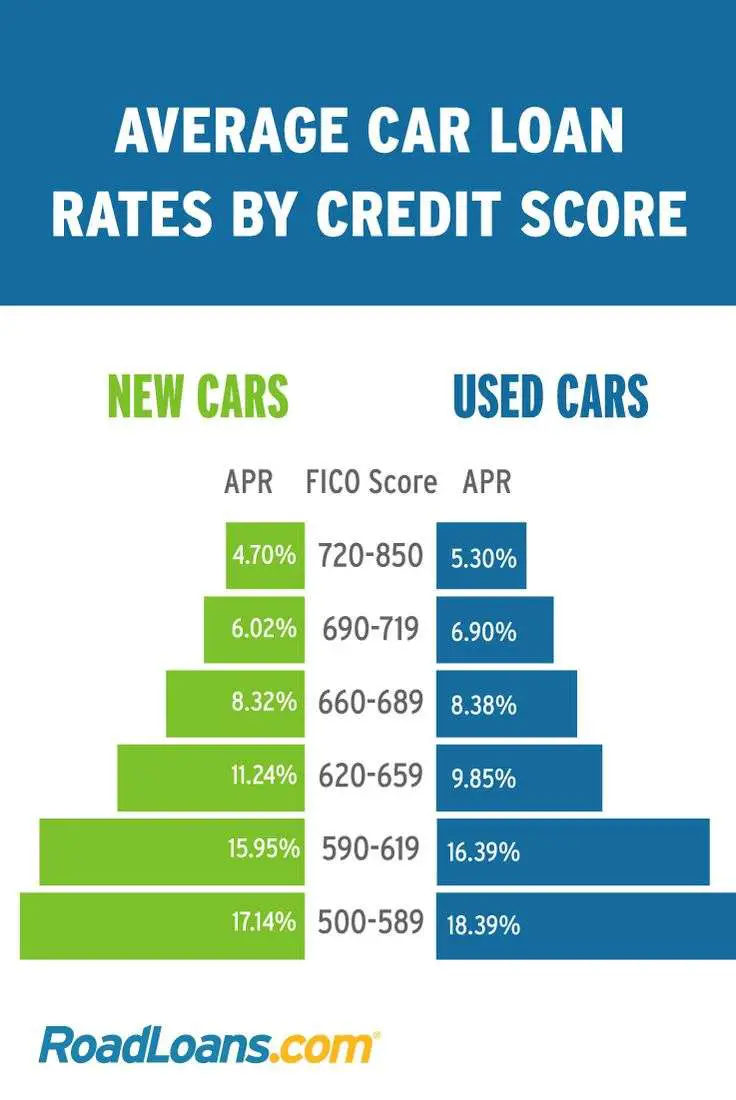

What Affects An Apr For Car Loans

It’s important to know and understand your credit score before researching car loans. , according to NerdWallet.com, in the lender’s determination of your interest rate, or APR. Simply put, bad credit equals a higher APR and good credit equals a lower APR. Some lenders won’t even offer a loan at all to someone with bad credit. The type of car you are interested in also affects the APR for a car loan. Generally, new cars offer lower APR loans while used cars offer a bit higher.

The basic scale for credit scores is:

- Bad: 300-629

- Good: 690-719

- Excellent: 720-850

People with bad credit scores, typically anything below 630, will likely face difficulty being approved for a loan and high interest rates if they are approved. This is because lenders see these borrowers as risky or more likely to default on their loans than those with better credit. When a borrower defaults on a car loan, the lender repossesses the vehicle and then sells it. However, they may lose money in the sale. Because of this risk, the financing of the loan costs more.

Read Also: Usaa Auto Refinance Rates

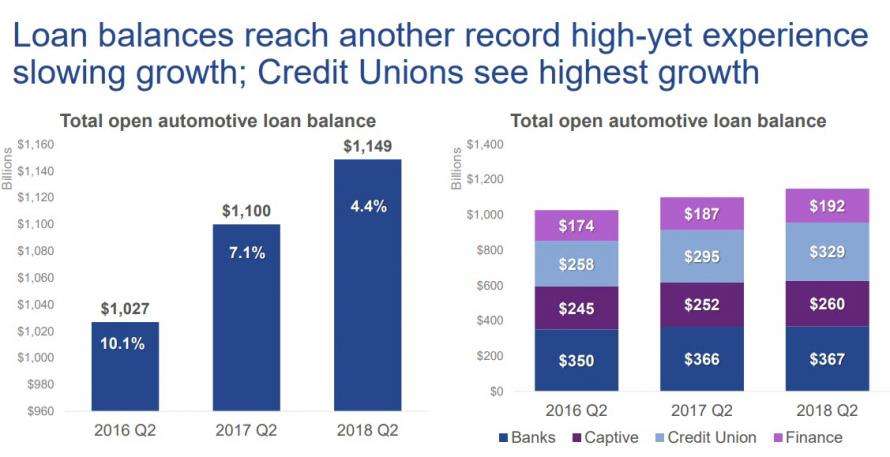

Banks And Credit Unions

Most banks who offer auto loans provide similar rates as low as 3% to the most qualified customers. However, there is much variance amongst banks in the highest allowed APR, with top rates ranging from as low as 6% to as high as 25%. Banks who provide higher rate loans will generally accept applicants with worse credit, while more risk averse lenders wont offer loans to applicants with scores below the mid-600s.

The typical large bank has specific eligibility requirements for loans, including a mileage and age maximum for cars, and a dollar minimum for loans.

Generally, credit unions extend loans at lower interest rates than banks, have more flexible payment schedules, and require lower loan minimums . However, credit unions tend to offer loans exclusively to their membership, which is often restricted to certain locations, professions, or social associations.

| Financial Institution |

|---|

| 14.99% |

What To Do With Your Trade

Although it’s convenient to trade in your old vehicle to the dealer at the time of purchasing another, it’s not to your best advantage. You are likely to get the least value from the dealer, as they have to move it yet again and need to ensure a safe profit margin on selling it. They do not have to take your old automobile, and will offer you what will make them the highest profit. Some dealerships may offer artificially high trade in values, but only offer them in association with a higher price on the vehicle they sell you.

Selling Your Used Car Privately

The best option typically is to sell your vehicle privately. It seems even government agencies are freely giving out this advice from the Arizona Attorney General to the FTC. Don’t underestimate the value of your old car. Go to Kelly Blue Book online to do your valuation research. If you can sell it, even for a small amount, it’s extra bargaining power for your new vehicle.

Each year Americans buy roughly double as many used vehicles as new vehicles. You can put a”for sale” sign on your car parked out front if you live in a high traffic area. Sites like Craigslist or Auto Trader can also help send buyers your way.

Another option with your old automobile is to keep it. An old pick up truck used for heavy work can help protect the value of a new vehicle by minimizing wear and tear, along with depreciation. Automotive insurance companies typically offer multiple vehicle discounts.

You May Like: What’s Needed To Qualify For A Home Loan

Whats The Average Monthly Car Payment

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The average monthly car loan payment in the U.S. was $609 for new vehicles and $465 for used ones originated in the third quarter of 2021, according to credit reporting agency Experian.

While it’s helpful to use average car loan payments as a benchmark, your actual car loan payment is determined by several factors. Let’s take a look at the factors that contribute to the amount of your car loan payment.

How Does My Credit Score Affect My Car Payment

Your credit score will play a role in the interest rate you receive on your car loan. And since interest affects your monthly payment, borrowers with better credit scores will typically receive lower rates.

While it looks like people spend about the same amount per month on their car payments, your borrowing power will be impacted with a lower credit score.

There may only be a $30 difference between the average monthly payments for super prime and deep subprime borrowers, but the latter are paying significantly more toward interest.

| Deep subprime 300 to 500 | $546 | $411 |

When youre ready to shop for a car, its important to pay attention to car loan interest rates in addition to the loan term. Youll be able to afford much more car for the same amount of money when you have a higher score.

Also Check: Refinance Through Usaa

It May Free Up Cash You Can Use To Pay Off More

Lets say youre deciding between a 60-month car loan and an 84-month car loan. The smaller monthly payment that comes with the longer loan term may free up resources to pay down other high-interest debt more quickly. But this only makes sense if the interest rate on your debt is significantly higher than your car loans interest rate.

Say youre buying that new vehicle at 3% APR, and you also happen to have a credit card balance of $10,000 with a 20% APR. If you choose the seven-year loan term on the car and apply the extra $143 that youd have available each month to your credit card debt, you could save on interest overall. Because even though youd end up paying more interest on the longer-term loan than on the shorter, youd be able to pay off your higher-interest credit card debt in less time, potentially saving you more interest in the end.

What Are The Disadvantages Of Short Term Loans

So why not go for a short-term loan and take advantage of a lower rate? For most of us, the main problem is the size of the monthly payment for short-term loans. After all, its no fun making luxury car-like monthly payments on a nonluxury car, such as a Honda Accord or Toyota Camry, even if you know in your mind that it is the more intelligent financial decision.

We all face restrictions with monthly budgets and often have no choice but to spread out the cost of a vehicle. With that in mind, Autotrader always advises against buying more car than you can afford.

Don’t Miss: Can I Refinance Fha Loan

How Can I Lower My Monthly Car Payment

- Build up a good credit score andconsistent payment history before applying

- If youre already paying a high monthly amount, consider auto loan refinancing to a lower APR

- Consider refinancing your auto loan to a longer term so you can pay less every month

- Dont have good enough credit to lower your payment? Try refinancing your loan with a co-signer

- Consider buying a used car

Pay Off Some Old Debt

When you complete an auto loan, lenders look at your debt-to-income ratio to see if you can comfortably afford to continue making payments in case of an emergency. This is a ratio based on your total monthly debt to income. The lower your DTI, the more favorable you look to lenders the higher your DTI, the less likely lenders are to give you a low interest rate or approve the amount you need to finance your car.

Pay off as much outstanding debt as you can before applying for a car loan. Whether thats student loans, medical bills or credit cards, pay it to lower your DTI. This proves to lenders youre responsible with credit.

Make sure to do some extensive research on the cost of your desired car as well as the cost of financing. A little preplanning and research can set you up for a positive car purchase experience and lay the groundwork for future purchases.

You May Like: Usaa Preferred Dealerships

What If Your Car Payment Is Lower Than Average

If your car payment is lower than the average, then you dont have to do anything, right? Wrong! Just because youre paying less than your neighbor probably is doesnt mean you cant still save money by refinancing it!

After all, interest rates change over time and could have gone down since youre initial loan. The same thing can be said if you improve your credit after you take out your car loan or if you didnt shop around when you took out your loan. Since you can save even if you can only cut a percentage point or two off the cost of your loan, it makes sense to check refinancing rates every so often.

The Internet Has Changed Automotive Shopping

Research Before You Shop

After you have determined the car you want to buy, go to Edmunds.com to find the invoice price. Do not shop without this information in hand. It’s your leverage in the negotiating process. If you don’t have this piece of information, the dealer will work from the MSRP which is a much higher price. Consider MSRP as retail price and invoice price as dealer cost.

Never pay higher than invoice price. And don’t worry, the dealer still makes a profit. There is something called holdback which the manufacturer gives the dealer for each vehicle. It’s usually 2-3 % which they receive quarterly. At times the manufacturer also offers dealer incentives for specific models.

If you have looked ahead and planned your purchase, note that some times of the year are better than others to buy a car. Salesmen work on commission and have monthly, quarterly and yearly goals to meet. So buying at the end of one of these periods can save you money, especially if the salesman hasn’t hit his quota.

Get a Free Online Quote

If you have made a decision on the exact vehicle you want, visiting the dealership late in the day may work to your advantage because everyone is eager to go home. Aside from the information we provide here, you may want to read some personal stories of sale negotiations to better visualize and prepare yourself:

Read Also: Usaa Car Loan Pre Approval

How Much Are Monthly Car Payments

Average monthly car payments are based on more than just the cost of the vehicle. Your expected monthly cost is based on how much you are borrowing to finance that vehicle in order to pay off the loans principal, along with your interest rate and loan term.

| Average |

|---|

Source: Experian State of Automotive Finance Market Q3 2021

How Long Can I Finance A Car

Before considering which car loan terms are best for you, its probably best to consider which options are available. In general, car loan length is available in 12-month increments lasting between two and eight years. Youll find available loans of 24, 36, 48, 60, 72, 84, and 96 months. According to the credit experts at Experian, the average car loan length was nearly 72 months or close to 6 years. Car loan terms for used vehicles were about six months shorter.

Don’t Miss: Can I Refinance An Fha Loan

Youll Make Smaller Monthly Payments

A longer loan term can mean lower monthly auto loan payments. For example, say youre financing a $30,000 new-car purchase over five years with a 3% annual percentage rate, or , with no down payment in a state with no sales tax. Your monthly payments would be $539 each. If you were to opt for a seven-year loan, all other loan terms being the same, youd make monthly payments of $396 a difference of $143 per month.

But keep in mind that with a longer-term loan, youre making more payments. For this example, youd make 84 monthly payments on the seven-year loan versus the 60 payments with the five-year term. Youll also pay more in interest overall with the longer loan.

Should You Make A Larger Down Payment

While there are 10% and 20% rules of thumb for down payments on used and new cars , dont take them as limitations. If your budget allows you to make a large down payment, its wise to consider it. The less you finance, the less interest youll pay throughout the loan.

For example, if you buy a $30,000 used car and put 10% down , youll finance $27,000. If your loan is a 48-month term at 5% interest, youll pay $2,846 in interest. However, if you have $6,000 to put as a down payment, your interest charges would fall to $2,530 $316 in savings.

There is one potential exception to this, and thats if you receive special 0% financing. In this case, you may want to put down only what you need to qualify. Then, you can consider other uses for the remainder of the cash, such as paying off other debt or investing.

Remember: You have the potential to lose your money when investing, so speak with a financial advisor before doing so.

Read Also: Is The Student Loan Forgiveness Program Legit

Who Is Dave Ramsey And Whats His Advice

Have a #NewYearsResolution to get your finances in shape? ‘s #TotalMoneyMakeover is only $4.95 right now as the Members Deal of the Day! Today only

RELATED: Can You Negotiate at CarMax?

Dave Ramsey has entered the 29th year of his eponymous radio show, where he shares his personal finance advice. You can watch segments on YouTube or listen to his podcast. His weekday radio show also airs on more than 600 affiliates nationwide and boasts more than 17 million listeners. And his YouTube account has more than 2 million subscribers.

The segment from 2017 in which Ramsey answered one listeners questions about purchasing a new car is still insightful today. The caller and his wife were considering getting her a new car because she commuted to work for one hour each way. She was driving a 2001 Ford Mustang with about 200,000 miles on it.

The husband wanted to wait until they had saved enough money to pay for a new car in full. But the wife felt unsafe in the old Mustang and wanted a different car sooner. The couple had saved $7,000 above their emergency fund. Ramsey agreed with both. Seeing that she needed a new car, he suggested they purchase an improvement, and the $7,000 should afford her a needed upgrade.

She can move up three to four times the car she is in now, he said. However, he also strongly suggested the couple not take out a loan but rather work on saving more toward the car she would eventually like in the future.