Choose The Form That Applies To You

You must apply for forgiveness through your PPP lender.

- Youll either use:

- Form 3508S. Consider using this form if your loan is $150,000 or less. This simple form requires you to provide less information and the processing time may also be shorter than other forms.

- Form 3508EZ. Consider using this form if you are not eligible for Form 3508S, and you meet one of the two eligibility conditions.

- Form 3508. Consider using this form if you do not meet the eligibility conditions for either of the other forms.

Bidens New Student Loan Forgiveness Changes May Wind Up Costing Some Borrowers

MAY 24: U.S. President Joe Biden attends the Quad Leaders summit on May 24, 2022 in Tokyo, Japan. …

The Biden administration is in the process of implementing significant new federal student loan forgiveness initiatives. These programs may ultimately help millions of borrowers get closer to having their student loans cancelled.

But depending on the specific program and the exact timing of that loan forgiveness, some borrowers may wind up getting hit with a surprise penalty: extra taxes.

Ppp Loan Forgiveness Calculation Form

Now that the calculations in the worksheets are completed, you should be able to fill out the rest of the application. Well go back to page 1 of the application.

First youll fill out some basic information about your business:

This information should be straightforward, and you will generally use the information you used to apply unless it has changed from the time you applied.

If this is your first PPP loan, check the box that says First Draw PPP Loan. If its your second PPP loan, check the box that says Second Draw PPP Loan.

Note: You must submit a forgiveness application for your first PPP loan before, or at the same time, as the second draw forgiveness application is submitted.

SBA PPP Loan Number: ________________________

This is the number assigned by the SBA to your loan. If you dont have it, ask your lender.

Lender PPP Loan Number: __________________________

Enter the loan number assigned to the PPP loan by the Lender. Again, if you dont know, ask your lender.

PPP Loan Amount: _____________________________

This is the amount you received.

PPP Loan Disbursement Date: _______________________

Again, this is when the funds were deposited in your bank account. If you received more than one disbursement, use the date of the first one.

Employees at Time of Loan Application: ___________

Enter the total number of employees at the time of the Borrowers PPP Loan Application.

Employees at Time of Forgiveness Application: ___________

Covered Period: _________ to __________

Don’t Miss: How Long For Sba Loan Approval

Borrower Defense To Repayment Loan Forgiveness

Do you need a student loan forgiveness form? Yes

Form: U.S. Department of Education Application for Borrower Defense to Loan Repayment

When to submit the application: ASAP

Where to submit form: Online

If you went to a school that misled you or engaged in some kind of fraud or misconduct, you could be eligible for student loan forgiveness through the Borrower Defense to Loan Repayment law.

You can fill out the application online, and if you have any supporting documentation, that can help as well.

Preview of Borrower Defense application

When Must Payroll Be Paid And/or Incurred To Be Eligible For Forgiveness

Payroll costs are considered paid on the day that paychecks are distributed or the borrower originates an ACH credit transaction. Payroll costs incurred during the borrowers last pay period of the covered period are eligible for forgiveness if paid on or before the next regular payroll date otherwise, payroll costs must be paid during the covered period to be eligible for forgiveness. Payroll costs generally are incurred on the day the employees pay is earned . For employees who are not performing work but are still on the borrowers payroll, payroll costs are incurred based on the schedule established by the borrower .

Don’t Miss: When Should I Refinance My Fha Mortgage

Getting Ready To Apply

The SBA is working on an online SVOG application platform. Until the platform is up and running, the SBA suggests that interested entities:

- Register under the Data Universal Numbering System , which provides a unique nine-digit business identification number.

- Register in the System for Award Management .

- Gather documents that confirm number of employees and monthly revenues, floor plans, copies of contracts, and any other information that seems pertinent.

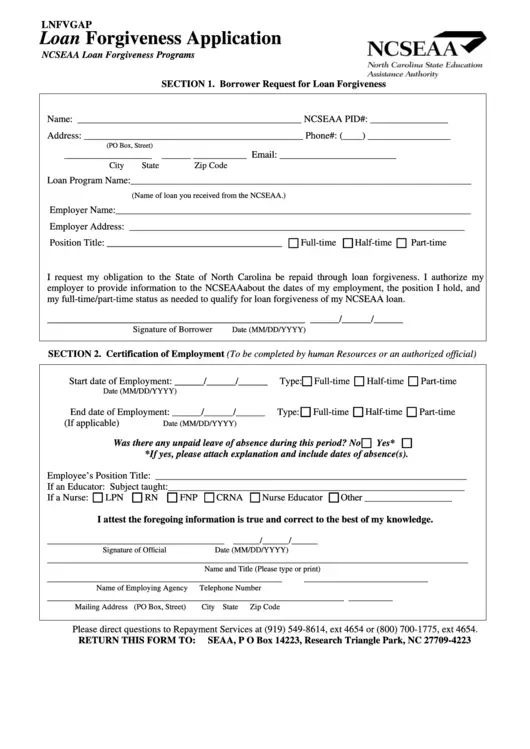

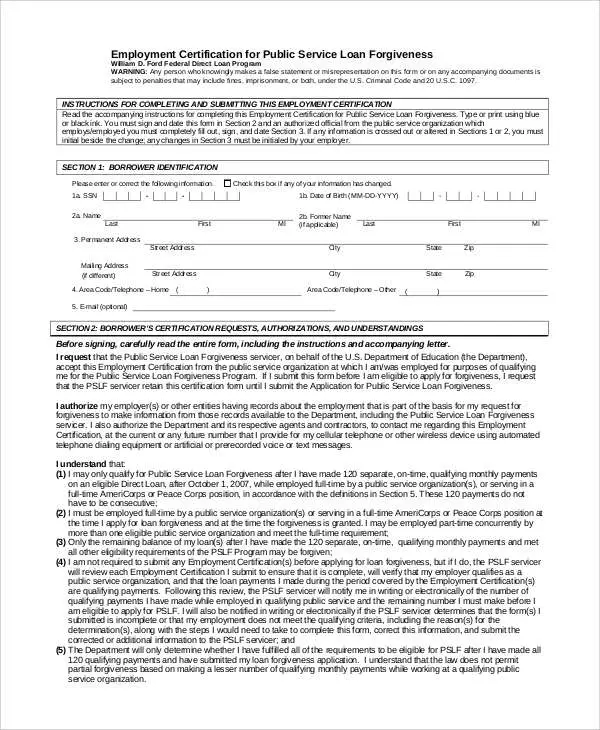

Public Service Loan Forgiveness

Public Service Loan Forgiveness cancels the remaining debt on eligible student loans after the borrower makes 120 qualifying monthly payments in an eligible repayment plan while working full-time in an eligible public service job.

The entire remaining debt is forgiven, including the outstanding interest and principal balance. If the borrower has made more than 120 qualifying payments, the extra payments will be refunded to the borrower.

The 120 qualifying payments do not need to be consecutive. It takes at least 10 years to qualify, since borrowers cannot make 120 qualifying payments in less than 10 years.

Payments that were paused during the pandemic under the payment pause and interest waiver count toward forgiveness.

Deferments and forbearances count toward loan forgiveness for borrowers who suspended repayment while serving on active duty in the U.S. Armed Forces. For example, the military service deferment counts toward PSLF.

Eligible public service jobs include working directly for a government agency , working for a 501 tax-exempt charitable organization or working in public interest law for a non-profit organization.

Eligible repayment plans include Standard Repayment and the four income-driven repayment plans: Income-Contingent Repayment , Income-Based Repayment , Pay-As-You-Earn Repayment and Revised Pay-As-You-Earn Repayment .

Read Also: Loan Originator License California

How To Apply For Ppp Loan Forgiveness

To apply for PPP loan forgiveness, whether you have employees, or are self-employed, you must fill out a completed loan forgiveness application and submit it to your lender according to your lenders instructions. If you fall into one of these two categories, you may qualify for forgiveness:

- Self-employed with no W-2 employees

- Filed Schedule C with Form 1040 to the IRS to report business income

You must fill out the following on the standard forgiveness application:

- PPP Loan Forgiveness Calculation Form must submit with the application to your lender

- PPP Schedule A must submit with the application to your lender

- PPP Schedule A Worksheet used to determine if you meet the FTE employee headcount and pay requirements

- PPP Borrower Demographic Information Form requests information about each borrowing companys specific owners, managers, and other stakeholder information.

Student Loan Forgiveness For Doctors And Nurses In Canada

Eligible family doctors, residents in family medicine, nurse practitioners, and nurses can get Canada Student Loan forgiveness through the federal government. However, only the federal portion of the loan can be forgiven .

Eligibility For Student Loan Forgiveness For Doctors and Nurses in Canada

To qualify for this type of Canada Student Loan forgiveness, you must:

- Have a Canada Student Loan thats in good financial standing

- Be working as an eligible medical professional in an under-served or remote region with a lack of proper healthcare .

- Have been employed for at least one consecutive year in an underserved or remote community and provided at least 400 hours of in-person service.

- Submit an this application

Eligible Medical Professionals

To qualify for Canada Student Loan forgiveness, you must be one of the following medical professionals :

- Family

- Nurse Practitioner

- Family Medical Resident

You may get Canada Student Loan forgiveness for nurses and family doctors and if you are:

- Enrolled in full-time studies

- Repaying a student loan

- In your non-repayment period

If your loan is in its repayment period, your monthly payments are still mandatory. That said, youre allowed to work as an eligible medical professional in more than one remote or under-served community and with multiple employers if you perform at least 400 in-person hours over a maximum period of 12-months.

Check out what happens to your student debt when you die.

Recommended Reading: Va Mpr Checklist

Targeted Eidl Advance: Forgiveness

There is no formal application process for Targeted EIDL Advance forgiveness. When you receive the funds, you are free to use them immediately. The only requirement is that you must spend the advance only for the expenses listed above. Although there is no application or accounting requirement, you should keep a detailed record of how you spend advance funds in the event the SBA has questions at a later date.

Targeted Eidl Advance: Non

You may not use your EIDL Advance for:

- Replacing lost sales or profits

- Business expansion

- Refinancing long-term debt

Consequences of EIDL non-permitted use: If you use all or part of your advance for non-permitted uses, it will not be forgiven and may be subject to immediate payback.

Because the EIDL loan and loan advance are considered disaster funds, if the SBA determines you misused the funds, the penalty could be immediate repayment of one-and-a-half times the original loan amount, plus possible criminal charges.

You May Like: Can I Use Va Loan For Investment Property

How Does Sba Loan Forgiveness Work

There is a lot to digest here and hopefully it will make sense once you approach it methodically. In this article, we provide both background information as well as details on specific questions related to the application when that information is available in official guidance.

Before we dive into details, lets quickly review the Paycheck Protection Program loan program.

- The PPP loan program is an SBA loan program under the SBA 7 program, and was created by the CARES Act that became law March 27, 2020.

- On June 5, 2020 the President signed the Paycheck Protection Program Flexibility Act, which changed some provisions, and on June 16, 2020 Treasury released a new PPP Forgiveness Application and instructions.

- The Economic Aid Act passed on December 27, 2020 provided more funding to PPP loans, created a second draw loan program, and made further changes. On January 16, 2021 the SBA released a new Interim Final Rule with forgiveness guidelines, along with the three updated forgiveness applications referenced above.

The basic premise of PPP is that business ownersincluding those who are self-employedcan apply for a loan of 2.5 times their average monthly payroll. Once they get the loan, they are required to spend the funds during a specific period of time on approved expensesmostly for payrolland if they do so, can apply to have the entire amount forgiven.

Overall the process is supposed to work like this:

Well go into more details in this article.

Some Borrowers May Be Taxed On Student Loan Forgiveness

Generally, whenever a debt is reduced, waived, forgiven, or cancelled, the debtor or borrower may have to pay taxes on that cancelled balance. The lender would send the borrower a 1099-C form during tax time, which would show the amount of loan cancellation. The borrower may then have to report the cancelled debt on their tax return as income, leading to higher taxes. When large amounts of debt are cancelled, this can potentially result in significant tax liability for the borrower.

Certain types of student loan forgiveness are not taxable. Public Service Loan Forgiveness is not taxable under federal law, and that is also true for relief under the Limited PSLF Waiver. So those borrowers getting student loan forgivness under that program would not have to worry about federal taxation.

Loan forgiveness under IDR, however, is more complicated. This type of student loan forgiveness is generally taxable. However, the American Rescue Plan Act the stimulus bill passed by Congress and signed by President Biden last year temporarily exempts all federal student loan forgiveness from federal taxation through the end of 2025. That means that for borrowers expecting immediate or imminent student loan forgivness as a result of the new IDR Adjustment, they shouldnt have to pay any federal income taxes.

Student loan forgiveness of $100,000 could result in a $25,000 to $30,000 tax bill, depending on the borrowers federal tax bracket and other potential tax exemptions or deductions.

You May Like: Auto Loan Usaa

Consider Applying As Soon As Possible

Although you have until the maturity date of the loan to apply for loan forgiveness, we encourage you to complete your PPP forgiveness application as soon as you are able, as payments of the principal and interest will become due when your deferral period ends. You may want to consider the following, before deciding when to apply:

- To get full forgiveness, make sure you have used all your PPP funds for eligible costs. You have up to 24 weeks to do so.

- When you submit a loan forgiveness application and the SBA notifies Wells Fargo of the loan forgiveness amount, or that the loan is not eligible for forgiveness, your payment deferral period will end. At that point, loan payments on any amount not forgiven, including any interest, will become due and you will need to start making monthly payments, if applicable.

- Any payments made towards your PPP loan balance prior to the date you submit your loan forgiveness application may be returned to you, if loan forgiveness is approved, up to the approved loan forgiveness amount.If you have repaid your loan in full before submitting a loan forgiveness application, you will not be eligible for forgiveness.

- If you have more than one PPP loan, you must first apply for forgiveness on your First Draw PPP Loan before applying for forgiveness on your Second Draw PPP Loan.

Student Loan Forgiveness In Canada

Home \ Debt \ Student Loan Forgiveness In Canada

Join millions of Canadians who have already trusted Loans Canada

According to a Canada Student Loans Program Statistical Review, 625,000 students received student loans during the 2018 2019 school year. Plus, the average loan amount was somewhere in the $5,700 range, while the average loan balance was over $13,300 by the time students completed their education.

Statistics also showed that around 330,000 students entered the Repayment Assistance Plan because they couldnt afford their loan payments . Are you a Canadian student struggling to pay off student loan debt? If so, you may be able to resolve the situation by getting loan forgiveness.

Recommended Reading: Loan Options Is Strongly Recommended For First-time Buyers

Repayment Assistance For Students With Permanent Disabilities

If you are applying with a disability

If you were confirmed to have a permanent disability when you applied for OSAP while you were a postsecondary student, you do not need any further documentation.

If you were not confirmed as having a permanent disability when you applied for OSAP, you will be required to complete a Verification of Permanent Disability form. You will also need to provide medical documentation to support your permanent disability.

Repayment terms

If you have a permanent disability, you can apply to the debt reduction stage immediately when you enter repayment, without receiving any interest relief as part of stage one.

The governments of Canada and Ontario help borrowers who have permanent disabilities pay off their loans in 10 years.

You can also provide documentation to have your disability-related expenses considered when your affordable monthly payment is calculated. To do this, you must:

- complete a Repayment Assistance Plan for Borrowers with a Permanent Disability Expenses form from National Student Loans Service Centre

- provide proof of your expenses and insurance coverage

Additional Ppp Forgiveness Requirements

In addition to the PPP loan’s permitted uses, you must also adhere to some additional requirements:

- You have your choice of between eight and 24 weeks from the first distribution of any loan amount to spend your loan funds.

- Payroll costs must make up 60% or more of the amount forgiven. This includes the first three categories listed under permitted uses above.

- Non-payroll costs can make up no more than 40% of the amount forgiven and are defined as the last seven categories under permitted uses.

- To receive full forgiveness, you must retain all full-time-equivalent employees according to the baseline used to establish your loan, except as described in the Tip box above. You must do this within the covered period for your loan or by June 30, 2021, whichever comes first.

- The amount forgiven will also be reduced in proportion to any reduction in an employee’s salary or wages during the covered period greater than 25% of the average amount that employee made during the base period unless an exception applies.

- If you have any ownership interest in an S corporation, C corporation, partnership, or sole proprietorship , the maximum personal compensation you can count toward forgiveness for all companies you own is limited based on the length of the forgiveness period as a percentage of your 2019 or 2020 compensation, not to exceed $100,000. Health insurance and retirement plan costs are not part of this cap.

Don’t Miss: Usaa Student Loans Review

Biden Makes Big Changes To Key Student Loan Forgiveness And Repayment Programs

In April, the Biden administration announced historic reforms to federal student loan income-driven repayment programs, which include Income Based Repayment , Revised Pay As You Earn , and other plans. IDR plans allow federal student loan borrowers to make payments based on their income and family size. After 20 or 25 years in the program , any remaining balance can be forgiven.

IDR plans have also been a required element of the Public Service Loan Forgiveness program, which can eliminate federal student loan debt for borrowers in as little a 10 years if they work in full-time careers for government agencies or nonprofit organizations. Last October, the Biden administration announced sweeping, temporary changes to the PSLF program, as well, called the Limited PSLF Waiver initiative.

Taken together, the Limited PSLF Waiver program and the temporary changes to IDR, which the administration is calling the IDR Adjustment, will allow the Department of Education to count many more loan periods towards student loan forgiveness under both IDR and PSLF, including:

- Any past time period in which the borrower was in a repayment status, regardless of the type of repayment plan or the specifics of a particular payment

- 12 or more prior months of consecutive forbearance, or 36 or more months of cumulative forbearance

- Any prior months spent in deferment before 2013 and

- Periods of repayment prior to loan consolidation.