Lump Sums For Federal Student Loans

Federal student loan settlements are rarer and often more expensive. The Department of Education has many ways to collect the full amount you owe.

Some of the options include wage garnishment and tax refund offset from your income tax returns. These methods allow the federal government to recoup their losses from your unpaid student loans.

However, itâs often possible to negotiate a settlement to pay off federal student loans with a lump sum if youâre in default. The three most common scenarios include:

Federal student loan holders almost never accept settlements for less than 85% of the outstanding principal balance and interest balance. This doesnât save you a ton of money, but it does avoid years of further interest accruing.

Option : Extend Your Loan Term

If you’re not interested in an income-driven repayment program but still want to maintain federal benefits, you can simply lengthen the term of your loan to an extended plan, which sets your repayment term at 25 years.

You’ll need to contact your loan servicer to ask about extending your term.

Remember that extending your repayment term may lower your payments now but will ultimately result in your paying more over the life of the loan.

Refinance Some Or All Of Your Loans

If you have solid finances, you may qualify for a lower interest rate and lower monthly payment through student loan refinance. Refinancing also gives you the opportunity to change your term.

You could opt for a shorter or longer term depending on your overall goals. Getting a longer term with a lower interest rate would allow you to decrease your monthly payments the most. But it would also leave you paying more overall than if you went with a shorter term.

» MORE:Dont wait to refinance these student loans

You can refinance federal and private student loans. Refinancing always transfers your loans to a private lender: you cant transfer private loans to the federal government.

If you refinance federal student loans, youll lose the protections that come along with them, like the current federal student loan payment and interest freeze.

» MORE:Government student loans: What are the benefits?

Recommended Reading: Usaa Rv Loan Calculator

Consequences For Not Paying Student Loans

Some of the consequences for being in default include:

- The balance of your loan, plus the interest, become due immediately

- You can no longer receive deferment or forbearance

- The notice of default will appear on your credit report and affect your credit score

- Tax refunds and federal benefit payments can be garnished

- Your loan holder can take you to court

And there is an even more frightening consequence on the horizon for some defaulted borrowers: You may lose your home.

The federal government hires law firms to place liens on the homes and bank accounts of people in default and the result of that could be your home is foreclosed on.

Should I Pay Off My Student Loans With My Emergency Fund

When you’ve rolled over all the available student loan funds, you may have to write those charges off your credit card, which will cost you more money in the long run. Ideally, your emergency fund should include three to six months of expenses. But it can be just as overwhelming as paying off student debt.

Read Also: Can I Buy A Second House With My Va Loan

How Can I Get My Student Loan Discharged If I Become Disabled

Certain types of student loans may be discharged if you qualify for the Total and Permanent Disability Discharge Program. The loans that qualify are Federal Family Education Loan Program Loans, Perkins Loans, and Direct Loans, and also the Teacher Education Assistance for College and Higher Education Grant service obligations. To apply and to get status information about your application, you can create an account at DisabilityDischarge.com or call 888.303.7818. For more information about the TPD process, visit StudentAid.gov.

Should I Pay Off My Student Loans 2021

Interest and payments on federal student loans will be suspended until 09/30/2021, so you don’t have to make payments until then if you don’t want to. But once interest rates start to rise again, the payments keep the loan balance from increasing over time. This is important when there is no forgiveness.

Read Also: How Long Does Sba Take To Approve

Watch Out For Student Loan Scams

Roughly 43 million Americans have some amount of student loan debt. That makes student lending a prime target for scammers looking to make quick money.

Often these scams take the form of people claiming to help you get out of debt or reduce your payments for a fee. If something sounds too good to be true, it usually is, so be on the lookout for these kinds of scams.

While some of these services are real, its also usually possible for you to do what they do on your own without paying for the service. Many of these companies will simply help you consolidate your loans and take a fee from you. Often, theyll consolidate your loans into private loans with fewer protections.

You can go to studentaid.gov on your own and consolidate your federal loans for free while keeping the protections and benefits offered by federal loans.

When Should I Apply For A Deferment Or Forbearance

If you have any trouble making your payments, please contact us immediately to explore your options. We can help. Also, learn more about other Repayment Plans.

To learn more about deferments and forbearances, click here.

To apply for a deferment or forbearance, log in to your Nelnet.com account, and then click Repayment Options.

Recommended Reading: 84 Month Auto Loan Usaa

Use Forbearance Or Deferment

If you cant make any payment right now, consider contacting your lender or servicer to request a deferment or forbearance. Each will pause your payments for a period of time .

For example federal borrowers can access up to 36 months of unemployment deferment and up to 36 months of economic hardship deferment throughout the life of the loan. Cancer patients can request deferment during treatment and for up to six months after treatment ends.

Federal student loan forbearance, meanwhile, has no limit through the life of your loan and you can request up to 12 months at a time. You can request a forbearance if youre dealing with medical expenses, youve lost your job or youre experiencing other financial challenges.

Options for forbearance vary among private student loan companies. If you have private student loans, ask your lender which options are available to you.

While forbearance and deferment will temporarily stop your payments, youll always end up paying more in the long run. Interest continues to build during the pause and capitalizes, or rolls into your principal, when payment restarts.

Your Guide To Canada Student Loan Forgiveness

Jordann

Student loan debt is a big problem in Canada, and its not going away any time soon. The average new graduate is carrying $28,000 in student loan debt. Pair that with high housing costs and low wages, and its no surprise that most millennials are putting off major life milestones because they simply cant afford it.

There is a small glimmer of hope for those struggling with provincial and federal student loans, and it comes in the form of student loan forgiveness. I took advantage of New Brunswick student loan forgiveness when I wiped out $16,000 of my $42,000 in student loan debt. Without that loan forgiveness program and others like it, theres no way I could have paid off $38,000 in two years.

If youre one of the many young Canadians dealing with high student loan debt, Ive put together a list of possible resources for you to tap to reduce your debt burden. Before you jump to your province and start going click happy, there are a few things you should know:

First, most of these programs are only for publicly funded student loans. If you have loans through a private lender, skip to the bottom of this blog post for additional resources.

Second, every province has a repayment assistance program . A RAP is there if you cant make your minimum student loan payments. Its not student loan forgiveness, its just there to help you if you are having trouble earning enough money to make your minimum payments. Ive listed a few of them below.

Enjoy!

You May Like: Usaa Credit Score For Mortgage

How Do You Pay Off A Student Loan

You can pay off a student loan by making one lump sum payment that takes care of your total loan balance. You should easily be able to find the lump sum amount on your loan servicerâs website.

My advice: only do this if your savings account is strong and you donât have other, higher-interest payments such as credit card debt or a personal loan. Also, if youâre on track to obtain Public Service Loan Forgiveness or other student loan forgiveness, it might be better to wait.

Alternatively, you may be able to negotiate a lump sum settlement for less than the total amount owed.

Check For Cash Back Specials Or Rebates

Though its not knocking down your interest rate, cash back specials and refinancing rebates offered through many servicers and lenders in the private space could help you spend less money in the long run if you use the cash right.

Credible, for instance, will offer you a $200 gift card if youre able to find a lower rate than what it offers you.

Recommended Reading: Does Va Loan Cover Manufactured Homes

Should You Save Or Pay Off Student Loans Early

You should only pay off your student loan earlier if you have built up a solid financial foundation by: Saving at least one month on one-off costs. Set up automatic contributions to your retirement account, such as a 401 or Roth IRA. In general, pay off all credit card debt at a higher interest rate than student loans.

Adjust Your Payment Plan

Experimenting with different payment plans is a sure way to maximize your money and pay less in interest over time, even if the rate at which youre borrowing stays the same. That can include steps such as selecting a shorter repayment plan or making multiple payments a month. Be sure to also prioritize paying off the loans with the highest interest rate.

Many people find a way to bring in extra income, anything from online tutoring or yard work to a traditional part-time job to put toward student loan debt, says Micheletti. If you can pay more, make sure to contact your lender or servicer and request that your extra payments go toward the outstanding balance, versus your next payment.

Don’t Miss: Transfer Auto Loan To Another Bank

If You Have One Private Loan

The best way to get lower payments on a private student loan is to refinance.

Your private loans don’t offer loan forgiveness or income-driven repayment, so you don’t need to worry about losing any federal loan benefits. That means, you’re not locked into a particular program or servicer, so you might as well shop around for the best deal.

What If I’m Behind On My Payment Or Anticipate Having Some Difficulty Making My Payment

If youre having trouble making payments or worried that making your payments could become difficult, contact Nelnet right away. We can help you take advantage of options that may be available to help you lower payments or postpone your payments . Log in to your Nelnet.com account and click Repayment Options.

Also Check: Usaa Approved Car Dealerships

Can Student Loans Affect My Social Security Benefits

If you have federal student loans with a payment schedule and no late payments, you don’t have to worry about losing your Social Security benefits. The federal government can only claim your Social Security benefits or withhold wages if you are in default. So keep paying your student debt every month.

Who You Need To Repay

You may have loans or lines of credit that you need to repay to the government and/or your financial institution.

In some provinces and territories, Canada Student Loans are issued separately by the federal and provincial or territorial governments. This means that you could have more than one loan to pay back.

Verify your contracts to determine where your debt comes from and where you need to repay it.

Recommended Reading: Fha Limits Texas

Understanding What Type Of Loan You Have

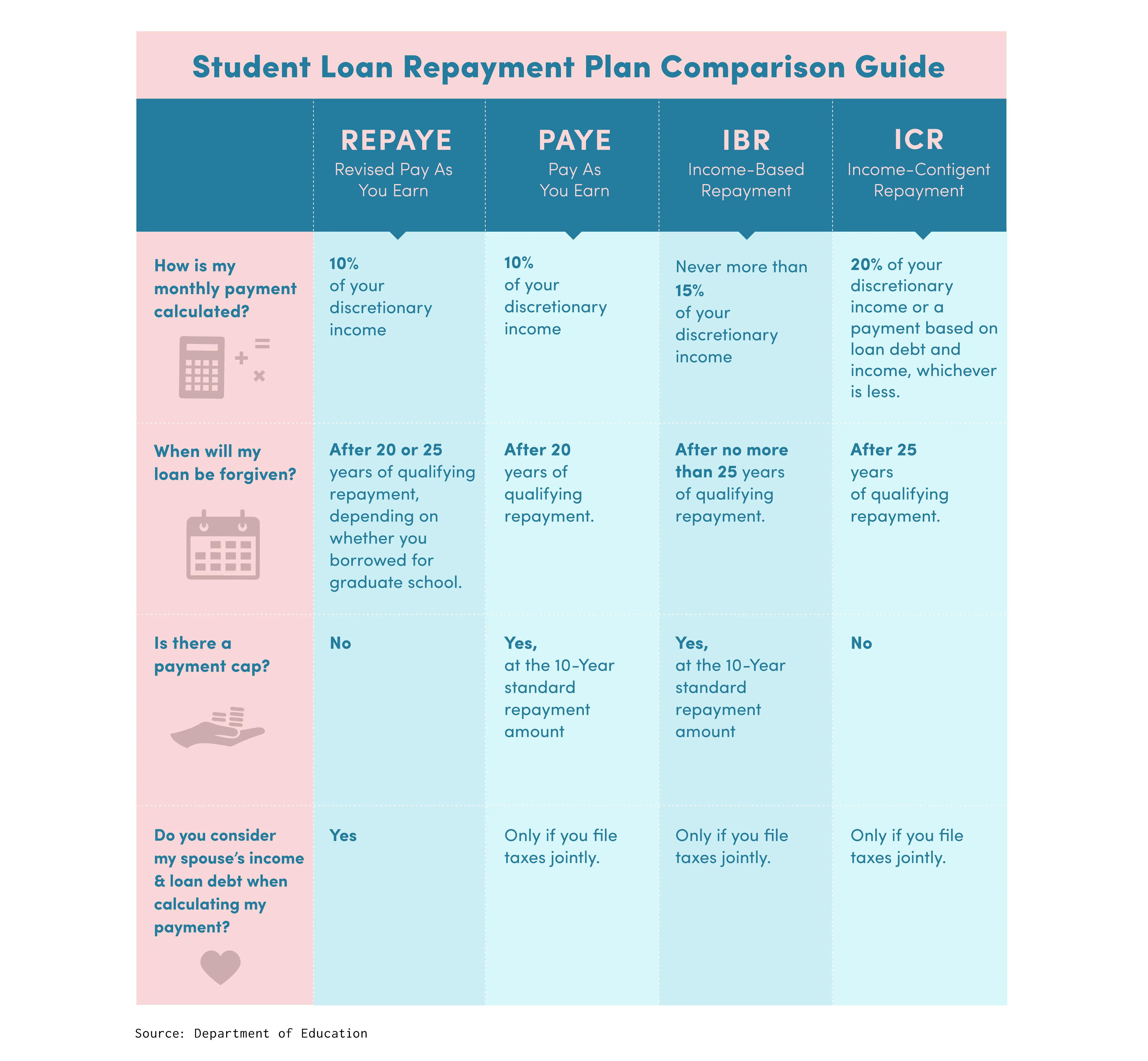

Before you learn how to lower student loan payments, lets start by understanding the type of loan you have. This will determine your repayment plan options.

If you have been granted a private student loan, by either a bank or a financial institution, there is no standard repayment plan. It will likely differ, depending on your lender. However, if you have received a student loan by the U.S. Department of Education, then you are repaying a federal student loan. Know that most federal loans come with a grace period, which means you shouldnt have to start paying them off until after you graduate .

Featured Topics

Even if you dont get a job immediately following graduation, you will be required to begin paying off your student loans, and its important to understand how to reduce student loan payments.

You may notice that your loan is either subsidized or unsubsidized. This doesnt affect your repayment options, but for claritys sake, the federal government will pay for the interest on subsidized loans, but for unsubsidized loans, the interest begins accruing as soon as the loan is given .

If your federal student loans dont fully cover your school costs, you might consider applying for a private student loan at Credit.com. Knowing how much you can afford to pay per month will be determined by your debt-to-income ratio.

Should You Save Or Pay Your Student Loans Free

A good reason to cancel your student loan is that it lowers your debt-to-income ratio . It measures the amount of your monthly debt payments versus your monthly income. Paying off your student loan not only frees you from those monthly payments, but it also makes it easier for you to achieve other financial goals.

Recommended Reading: Sss Loan Application

Student Lines Of Credit

If you have a student line of credit through your financial institution, you’ll have to pay the interest on the amount of money you borrow while youre still in school.

After you graduate, many financial institutions give you a 4 to 12-month grace period. During this time, you only have to pay the interest on your line of credit. After this period, youll pay back your debt through a repayment schedule agreed upon with your financial institution.

Contact your financial institution to get information about paying back your student line of credit.

When Can I Settle My Student Loans

You typically cant settle if your student loans are in good standing and you make timely payments every month. Even if youre a little late on your last payment, youre usually not considered eligible until your loan is in default. However, its not a good idea to intentionally default in order to reach a settlement lenders typically wont agree to settle until theyve exhausted all of their tools for collecting the debt.

You might qualify for federal student loan debt settlement if:

- You cant afford the loan: You must prove that you cant afford to repay your loan through pay stubs and bills or recent tax returns.

- Youve redefaulted: If youve defaulted on the same loan more than once, options like rehabilitation, income-driven repayment plans, deferment or forbearance may no longer be available to you. Instead, a settlement might be one of your last options.

For private student loans, most loans will default after 120 days of nonpayment, though this depends on your lender. If you can show your lender that you dont have income or assets to pay back your loan, it might accept a settlement offer. However, youll still need to have an offer worth accepting, which usually includes a lump-sum offer or a final amount paid over the course of a few installments.

Also Check: What Degree Do You Need To Be A Loan Officer

Ways You Can Quit Paying Your Student Loans

Money, Home and Living Reporter, HuffPost

More than 40 million Americans have student loan debt. Of those borrowers, 5.6 million owe more than $50,000. That kind of crushing five-figure debt can take a real financial and mental toll.

If you fantasize about running off to a foreign country or faking your own death just so you wont have to pay back your student loans, know that theres a real way out.

Actually, there are eight ways, and theyre all perfectly legal.

Should You Go To School At Night To Pay Off Student Loans

Working during the day and taking classes in the evening will save you money and the hassle of applying for student loans. At the same time, payments on the current student loan balance are only due upon completion of studies.

Average monthly student loan paymentWhat is the average length of time to pay off student loans? According to Ellie Bidwell of News and World Report, the average time it takes students to pay off loans is 10 to 20 years, and it takes the average student 21 years to pay off loans.How do you calculate loan interest rates?The interest on government student loans and many private student loans is calculated using a â¦

Don’t Miss: Va Second-tier Entitlement Calculator 2020