$200 Airline Fee Credit

Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to your Business Platinum Card® Account.11American Express relies on accurate airline transaction data to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 4 weeks, simply call the number on the back of your Card. See terms & conditions for more details.

Improving Your Personal Credit Score

While there are lenders that will not consider your personal credit score, most will. To increase your loan options, you should work on improving your score. You can do that by doing some of the following:

- Avoid poor marks

- Accounts receivable and payable

You will also need to provide information about yourself and the company. Many fail to obtain small business loans because they do not include every document and detail necessary. Do not let this happen to youuse DoNotPay.

Our app will guide you through the process by making sure you submit all the required paperwork and do not omit any detail when filling out the application form. When you , all you need to do is:

Looking for an online lender? Specify that in our questionnaire, and we will introduce you to our Find Online Business Loan Lender product.

Small Business Bank Loans & Financing: Apply Today

At Huntington, our goal is to help grow your business. Our experienced relationship managers will work closely with you to help pinpoint the best loan option for your small business. From lines of credit to term loans, we offer solutions and insights that will help you succeed.

Business Term & Real Estate LoansBusiness Line of CreditSBA-Guaranteed Business LoansDental & Vet Practice Loans

Read Also: What Is The Max Home Loan I Can Get

Small Business Loan Program

These low-interest direct loans help small businesses take steps toward expanding and creating jobs.

- The applicant must employ 15 or fewer employees, including the owner

- The company must be 100 percent Missouri owned and 100 percent Missouri located

- The company must be registered with the Secretary of State in good standing

- The company must receive tax clearance from the Department of Revenue.

- The company may not be a retail or gambling entity, a check cashing service , a pawn broker service, resale of donated or used goods, liquidation sales, day labor services, job training services, sale or distribution of alcohol or tobacco products, web based or print newspapers or magazines, radio or television stations, or speculative real estate company.

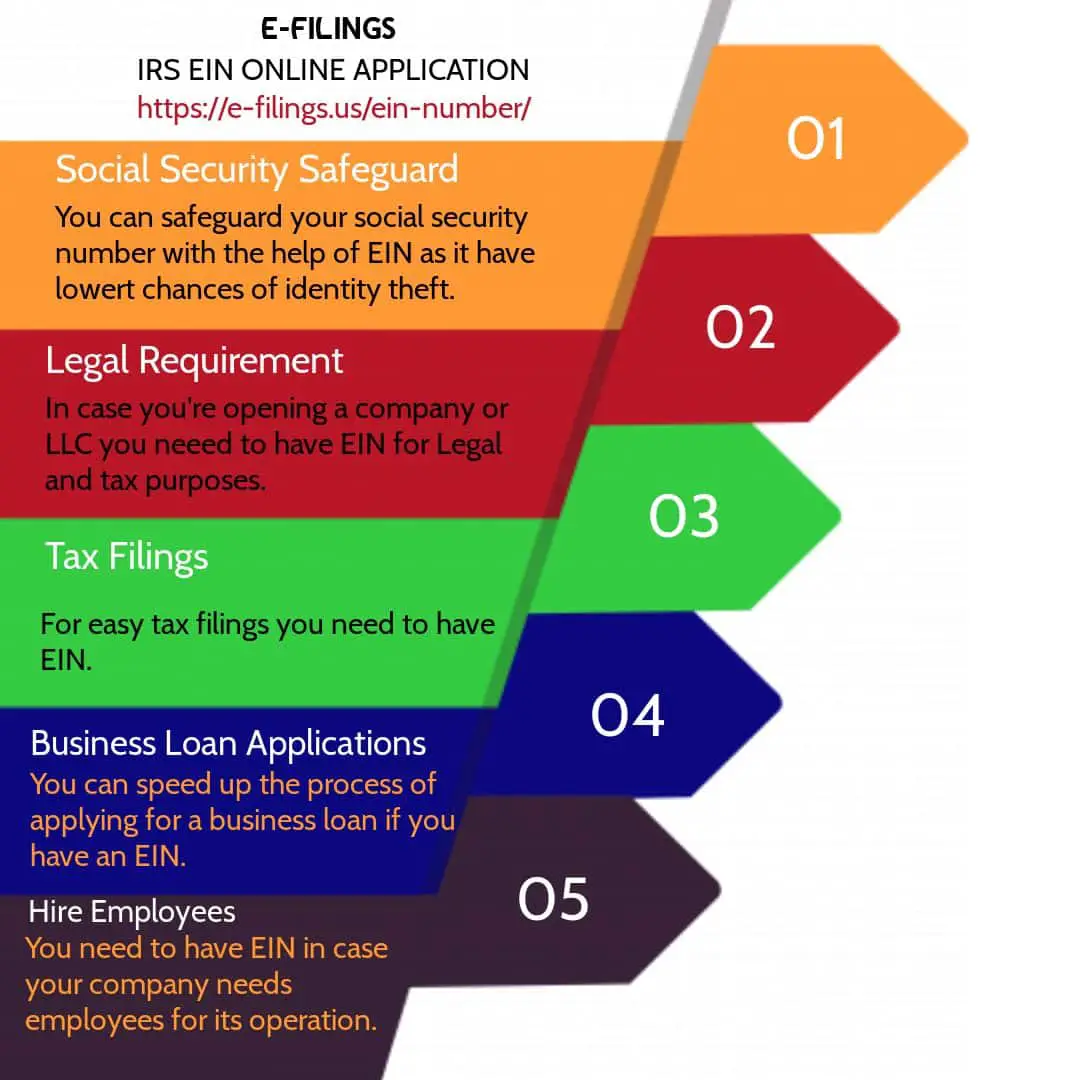

What Do You Need To Qualify For Business Credit Cards Using Only An Ein

EIN-only cards arent your run-of-the-mill business credit cards. EIN-only cards still offer the same high credit limits as other business credit cards, but theres no personal liability. That presents a lot of risk for card issuers, who could wind up holding the bag for tens of thousands of dollars if your business isnt able to cash up.

Because EIN-only cards are riskier than personal and business credit cards, credit card companies enforce stricter eligibility requirements. These requirements vary by issuer, but in general, small-business owners will need the following to qualify for an EIN-only card.

- A stellar business credit history

- Annual revenue over $1 million

- One year’s worth of cash reserves

- At least one year of business history

- 10 or more employees

All of these requirements show your card issuer that your business is stableand therefore less of a risk.

Stand out to lenders and get better business financing options with Credit Sesame’s free credit monitoring and debt analysis tools.

Read Also: Where Can I Get 500 Loan With Bad Credit

Key Benefits Of Small Business Loans

Fueling Growth: Many small business owners want to grow their company, but that can require significant cash investment. A small business loan allows you to invest in your business without tying up your cash. It can allow you to finance expansion to a new location, invest in marketing campaigns, hire additional staff, and more.

Buying Equipment: When equipment necessary to the operation of your business fails, a short-term small business loan can help get operations moving again without a four-year or longer loan obligation.

Investing in renovations and other projects: There are times when ramping up a new project requires upfront costs that might exceed a business ability to cover with cash flow, but will be recouped in 60 or 90 days as their customer pay their invoices. In that case, the ability to get in and out of the financing quickly at a lower total dollar cost could make more sense than making payments on a longer-term loan for several years.

Bridging seasonal cash flow gaps: Many seasonal businesses sometimes borrow to meet short-lived cash flow demands during lulls that exist between their busy seasons. Doing so requires the business to ensure that it has sufficient cash flow during that slow period to make the larger periodic payments often associated with a short-term loan.

Can My Small Business Qualify For A Loan

Many small business owners rely on borrowed capital to start, run, and grow their business however they often believe they dont have good enough credit to get a loan. Depending upon the nature of the business need, a business credit profile, revenue, time in business, whether or not the business has adequate collateral, and other factors, there are more options available today than ever before. And each small business lender weighs each factor differently. The local bank has been small business traditional source for borrowed capitaland still remains a viable option for those businesses that can meet their potentially strict criteria. However, there are additional choices, which could make sense for your business, once you understand the landscape of potential loan options, including interest rates, loan amounts, and term lengths.

Don’t Miss: How Much Bank Loan For House

Alternative Business Credit Cards

There are a few business credit cards that wont require a personal guarantee, though they do come with some limitations.

Secured Credit Cards

With a secured credit card, you make a security deposit that establishes the amount of your credit line. With some secured business credit cards, you can apply with your EIN instead of your SSN and avoid personal liability. One such card is theWells Fargo Business Secured credit card.

The Wells Fargo Business Secured card requires a security deposit of between $500 and $25,000 while giving you a choice between earning cash back and earning reward points. Responsible use of the card can help you build your business credit while not requiring a personal guarantee or your SSN.

Prepaid Business Credit Cards

A prepaid business credit card offers low risk for card issuers, so most credit card companies dont require a check on your personal credit history when you apply.

A prepaid business credit card basically acts like a debit card. You make up-front payments on your card, which you can then spend until your money is gone. The difference between a prepaid business credit card and a debit card, though, is that a prepaid business credit card can help build your business credit history faster.

One note, though: most prepaid cards dont offer points and rewards programs. So dont expect the airline miles or hotel stays youd get with other business cards.

Also Check: How Much Can The Bank Loan Me

Lenders That Offer Financing With No Personal Guarantee

As Ive already said, lenders that do not require a personal guarantee are uncommon. But, theyre not impossible to find. Heres a list of a some lenders who may not require an SSN or an ITIN to apply for a line of credit or a loan.

Business Credit Cards

These business credit cards are fairly easy for companies of all sizes, including freelancers and individual contractors, to qualify for and require no personal guarantee.

Recommended: How to Use Business Gas Cards to Build Your Business Credit

Corporate Credit Cards

Rather than base your credit limit on your FICO score, you may be able to meet revenue requirements for one of these corporate cards with no personal guarantee. You may need an actual S or C corporation to qualify .

Business Loans

While you may be required to share your SSN during the initial application process to ensure that you meet minimum credit requirements, these lenders have funding options that require no personal guarantee.

Alternative Financing

The Best Financing Options For Startups

If youve already started your hunt for a loan, youre well aware that there is a seemingly infinite amount of small business lines of credit and loans out there, available from banks and online lenders. New businesses are considered high risk, so their options will be more limited.

Here are options to consider:

Recommended Reading: Sample Letter To Remove Student Loan From Credit Report

How Do I Get A Business Loan

Itâs easy. First, youâll decide which loan is right for your business and then fill out an application either online or with a business banker. Youâll want to get together some documents to make it easier to apply such as your business and personal tax returns, financial statements and legal documents like your articles of incorporation.

What Are My Options

First and foremost, your best option is to contact us right now and discuss what options ABC has for you. With 20 years industry experience and over $100,000,000 funded, we can help you get the best possible business loan with just using your EIN. Click above or call 1-800-549-2744 to get started.

The three most common types of loans for businesses using their EIN are:

- Invoice Factoring

- Accounts Receivable Financing

- Merchant Cash Advances

Invoice Factoring is a financial transaction between a businessowner and a lender in which the business sells its invoices for discounted sum. This process allows a business to receive a lump of capital up front as opposed to waiting for all its invoices to clear. Typically, the discount is around 5% of the total. This covers fees that the lender may encounter, as well as protects against any losses.

Accounts Receivable Financing is basically the same as invoice factoring, except instead of the business selling its invoices, the lender uses the invoices as collateral. The business will receive a loan and then pay it back with money received from the invoices over time. If managed well, this is a lucrative option because the business received a lump sum and also maintains control over its invoices.

Recommended Reading: Online Loans That Are Legit

What If You Have Bad Personal Credit

Another reason you might want to apply for business credit using your EIN and not your SSN is that you have a low FICO score. If youre in this boat, there are steps you can take to remedy the predicament. These steps will vary based on your situation.

In all cases, the first step will be to learn about the common errors often reported by consumer credit bureaus and leverage them to your advantage. For example, you might learn how to best deal with vehicle repossessions and defaulted loans or what can be disputed in a credit file and how to do so.

Recommended:

Loans And Lines Of Credit

Real Estate Term Loans

Build equity with real estate term loans

Loans up to $5 million for purchasing, refinancing or improving property, with fixed payments and term lengths up to 20 years.

Lines of Credit

Improve cash flow for your daily operations

Bridge the gap between your goals and the cash flow required to achieve them. Line amounts up to $5 million.

SBA Loans

More options than your traditional loans

If youâre looking for long terms, fixed rates and lower equity requirements, look to SBA 504 and SBA7 loans.

What you need to qualify

Eligibility requirements for Capital One loans and lines of credit products: have been in business for at least 2 years 1 and have or open a business checking account.

Lending Benefits at a Glance

Recommended Reading: Do I Qualify For Student Loan Forgiveness

How Fundera By Nerdwallet Works

Getting a business loan can be challenging, and several factors cost, speed, repayment schedule can play a role in deciding which product is right for you. Let us help you through the process.

1. Fill out one simple application

Answer a few questions about your business to get personalized lending options. Its free and wont impact your credit score.

2. See your business loan options

It takes about three minutes to get options from our network of vetted small-business lenders. Compare interest rates and repayment terms to choose the best product for your needs.

3. Get your loan

If the lender approves you, youll sign closing documents in order to receive funds. Some lenders can approve and fund loans within one business day.

Personal And Friends/family Funding

Yes, personal funding is a viable option and is one of the ways many small business owners access capital. But using personal funds or personal loans is a gamble, and youll need to do a solid job of calculating all of your costs so that you dont run out of money before the business can support itself.

Even if you use personal funds to start, we advise you to start taking steps to establish business credit right away. That way you can start to leverage business credit and access more capital in the future. The business should be able to stand on its own without commingling personal assets and credit.

There are a few different options when it comes to personal funding:

Personal Credit Cards: if you cant secure a business credit card , a personal credit card with a reasonably high limit can help you get those first few purchases and your business underway. Keep a close eye on your credit utilization and pay your bills on time, because putting business expenses on personal credit cards can hurt your personal credit scores.

Savings/Home Equity: Dipping into your savings is an even riskier business, but if you have a good amount set aside this could be the cheapest option for you. Borrowing against your home equity is a cheap option but very risky.

Recommended Reading: What Credit Score Do You Need For An Fha Loan

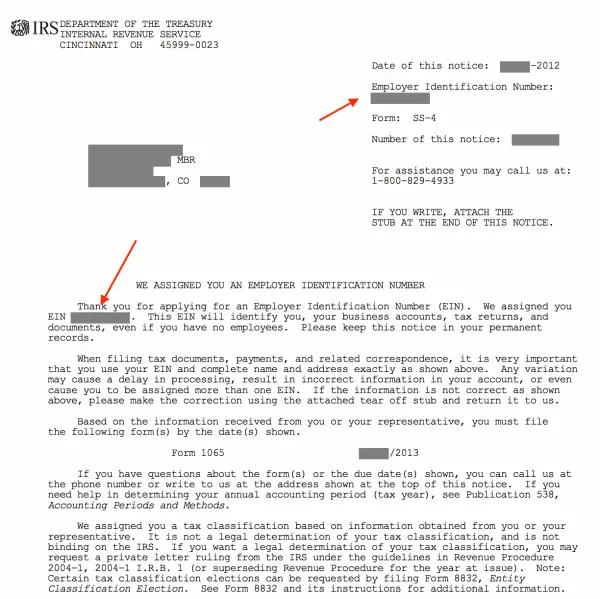

How To Get An Ein For Business Credit

Applying for an EIN is a relatively quick and straightforward process. The IRS has a free online application EIN assistant that walks you through the steps. To apply by fax or mail, fill out IRS Form SS-4. Both forms request your name, business industry, business structure, and number of employees. With the online application, you could receive an EIN number in a day.

How To Apply For A Loan Using An Ein Number

Applying for a loan using an employer identification number, or EIN number, can only legally be done as a business entity. Using an EIN in place of a social security number on a personal credit application is a crime. However, legitimate businesses with an EIN number and other corporate documents, such as a license and state incorporation, can apply for loans and credit cards. In some cases, however, the owners social security number may still be required.

Read Also: Can I Use Home Equity Loan To Buy Another House

How Does Paypal Business Loan Work

You must complete a 5-10 minute online questionnaire to determine your businesss eligibility. Your application may take longer to complete if your identity cannot be automatically verified.

Once the questionnaire is complete, estimated loan terms can be customized by adjusting the loan amount and duration to compare the costs of financing.

Once you select your desired terms and complete your application, if approved, you will be prompted to electronically sign a contract including bank instructions so that payments can be debited weekly from your business checking account.

Heres How To Get Business Credit With Just An Ein +more Options

By Joe

Lately, Ive found quite a bit of online content that pertains to getting business credit with just your EIN, and Ive seen some pretty good information. But, I havent found a thorough answer to the core question, which is, How can you get business credit using your EIN andnot your SSN?

First of all, if youre not up-to-date with the lingo, what youre essentially looking for here is business credit without a personal guarantee. Luckily, there are lenders that do not require a personal guarantee for business financing, but most of the good options are not common nor easy to find. So, lets explore everything you need to know.

Heres whats in store:

Don’t Miss: Who Can Use The Va Home Loan

How To Get Startup Business Loans Using The Ein Number

Even if you are looking for a startup loan, you will have to have a registered company before you can apply.

If you apply for a startup business loan with the EIN number, the lender will credit your business as a separate entitythis way, you can avoid the loan having an impact on your personal .

Lenders usually also check your personal credit as well but will not do so in the following cases:

Bear in mind that these loans do come with higher interest rates as the risk of investment is greater for the lender.

EIN-only loans include:

- Invoice factoring

- Accounts receivable financing

Aside from the EIN number, you will need a plethora of other business-specific documents to prove you qualify for the loan. If you are not sure what exactly you need to get a loan, you can register for DoNotPay and let us help you with the entire process.