How Long Does It Take To Get An Sba Express Loan

Of course, situations arise in which you just cant wait that long. In cases where emergency funding is needed, you may be interested in the SBA Express Program. Its a slimmed-down version of the 7 product in that you can only borrow up to $350,000. But, this lends itself to faster SBA loan approval times.

The SBA promises a turnaround time of 36 hours for their express loans. But, that doesnt include the time it takes for the lender to approve the loan, which could tack on another few weeks. So, instead of 60-90 days, youre looking at 30-60 days for the SBA loan processing time when all is said and done.

Underwriting With The Bank

Once your complete loan application is submitted, the next step is underwriting. During underwriting the lender reviews the information in your application, pulls your credit, and determines your strength as a borrower by analyzing the likely risks and benefits of lending you money. If youre working with a preferred lender, the bank has someone internally review and potentially approve the loan. If working with a bank not on the preferred lender list, once the application passed through internal underwriting, the information will also be sent to the SBA for additional review.

Its important to note that the underwriting process is not a speedy one. The minimum amount of time for a lender to review your application is 60 to 90 days. This timeline can also be extended if the lender asks you for additional information, which is not uncommon. Third party packagers function as a liaison during this process to keep things moving forward.

How Long Does It Take For An Sba Disaster Loan To Be Approved

If your business has been impacted by a natural disaster, you may be eligible for an SBA Disaster Loan. These loans can provide much-needed financial assistance to help you get your business back up and running. But how long does it take for an SBA Disaster Loan to be approved? In this blog post, we will provide a complete guide to the application process. We will also discuss how long it usually takes for a loan to be approved.

Also Check: How Much House Can I Afford Loan Calculator

How Do I Apply For An Sba Loan

You can determine your eligibility for an SBA loan by using the lender match tool. Once you have completed a business plan that includes financial statements and projections, you can begin the application process. Choose a loan product and apply to various lenders so you get a competitive loan and interest rate.

You Can Apply For A Ppp Loan Too

SBA guidance allows you to apply for a PPP loan in addition to an EIDL, so long as you don’t use the funds from each loan for the same expenses. For example, if you decide to apply for a PPP loan and use those funds strictly for payroll, you cannot subsequently use funds from an EIDL for payroll, as well.

Also Check: How Often To Refinance Home Loan

When To Explore Other Financing Opportunities

In some instances, it makes more sense to research and apply for other small business loan options. If you cant wait for months to get approved for an SBA loan, alternative funding is probably your best bet.

In addition, if you dont have strong personal and business credit scores, you may not get approved for an SBA loan.

If this is the case, you should search for loans with more lenient credit history requirements. In addition, if you intend to use your funds for a specific purpose like buying equipment, a more specific loan may be the way to go.

Gathering Documents To Speed Up The Sba Loan Approval Process

Much of the waiting time spent during the SBA loan approval process possibly up to 30 days youll spend gathering documentation for the lender to process. Luckily, the SBA conveniently outlines this for you in this checklist.

After youve applied, it can be another few weeks before you receive a decision. This extra SBA loan processing time is because the lender must weigh details ranging from the loan amount to the purpose of the financing.

Once youre approved for the loan, be prepared to wait some more. There will likely be more documents for you to fill out as things are finalized in this part of the SBA loan closing process. From there, by the time the documents are processed, and the lender sends the funds to your account, it could be yet another couple of weeks before the money arrives.

Read Also: How Much Can I Loan

Why Wait For The Longer Sba Loan Processing Time

You may be wondering what the benefits of an SBA loan are, especially if youve got to wait for it. Chief among the pros of an SBA loan is youre not giving anything up. As a business owner, you can borrow anywhere from $500 to $5.5 million.

Another attractive feature is the long-term nature of the products. For example, some repayment terms extend for more than two decades . The SBA also caps the amount borrowers should repay in interest. The longer-term combined with the cap translates into a lower interest rate for business owners like you when cash flow is tight. The SBA loan approval process is a bit of a waiting game, so lets get to it.

Determine How Much Financing You Need

Once you know the type of business youre looking to fund, its time to determine how much small business financing you need. Begin the process by creating detailed financial projections that include start-up costs. This exercise helps you understand your costs and highlights areas you can potentially save. For example, maybe its possible to begin your business online rather than in a brick and mortar location, or to wait a year before hiring additional employees.

Once you think you know how much financing you need, you can begin to research business loans. Understanding the true cost of a business loan can be tricky. Your repayment terms interest rate and length of the loan will determine your monthly payment, which has a direct impact on your businesss cash flow.

You can easily compare business loans with an online loan calculator. This tool helps you quickly see how much your monthly payments will be with different interest rates and repayment terms. You can also compare different scenarios side-by-side, which provides a clear picture of what you need to aim for when working with lenders.

You May Like: What Does Loan Forgiveness Mean

Sba Continues To Approve Eidl Applications

According to the most recent EIDL data, the SBA approved just over 3.8 million EIDL applications for a total of $321.8 billion to date. That’s an increase of over 7K applications since their last update at the end of December.

This week we received reports of new EIDL approvals and increase request approvals from a large number of owners.

What Happens After Your Sba Economic Injury Disaster Loan Is Approved

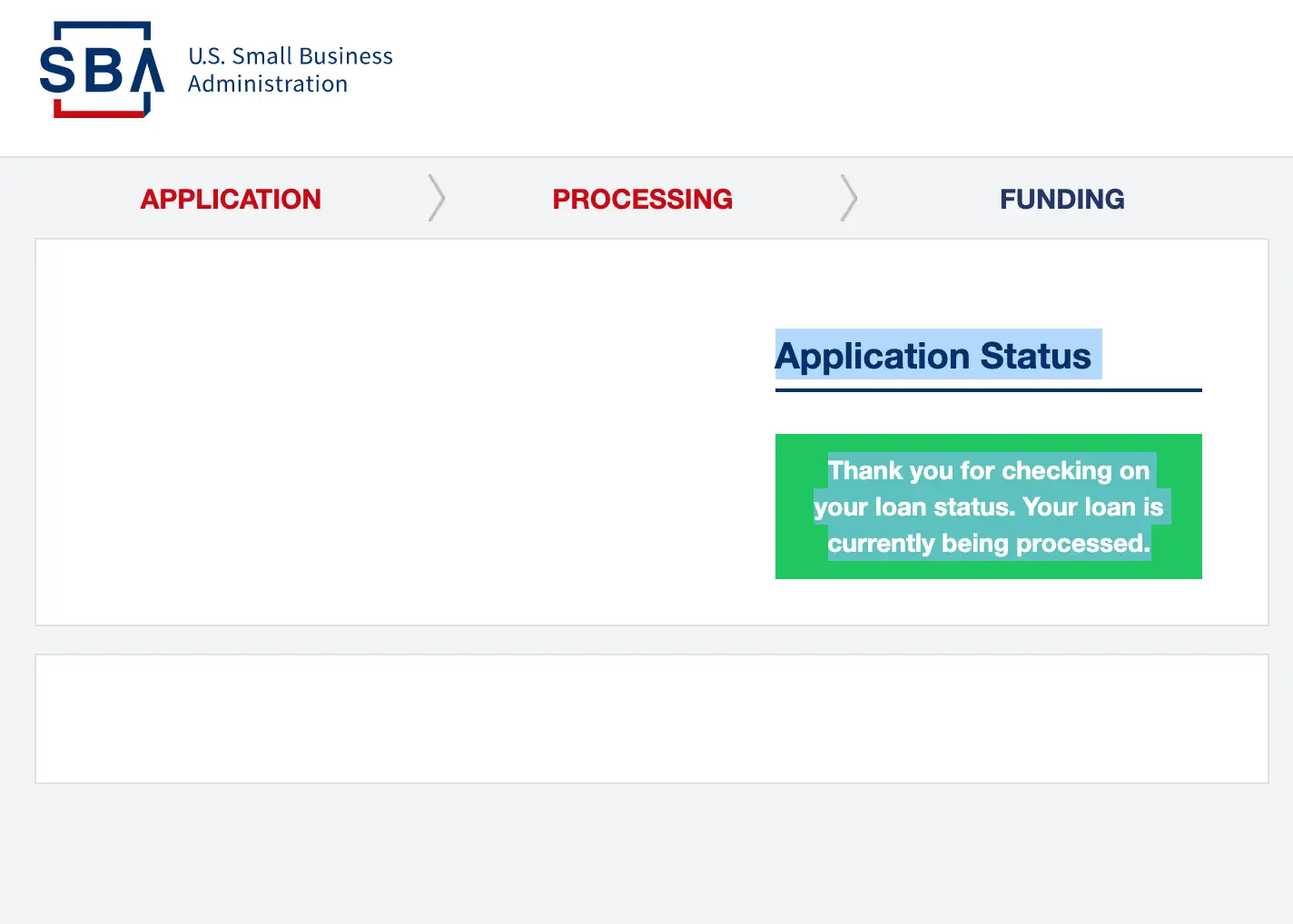

After your SBA loan is approved, you may experience an extended window of processing time, usually somewhere around 21 days. Given the volume of applications, you may experience a longer delay.

Unfortunately, theres not a whole lot you can do here other than check on the status of your EIDL application.

Also Check: How Do Loan Originators Get Paid

Location And Business Type Standard

Because the coronavirus pandemic applies to all 50 U.S. states Washington, D.C. and U.S. territories, virtually any small business in the United States and its territories qualifies by location.

In addition to what most people would consider a business, these standards and loan availability options also apply to sole proprietorships, independent contractors, and self-employed persons.

Sba Will Still Process Reconsiderations And Appeals

The deadline to apply for the EIDL program for the first time was December 31st, 2021, but the SBA will continue to process applications after the deadline. In addition to increases, the SBA will still process reconsiderations and appeals in 2022 as long as your initial application was filed by December 31st, 2021.

If your EIDL application is denied, you have six months from the date of denial to request a reconsideration. If you receive a denial on March 1, 2022 for exampleyou have until September 1, 2022, to request a reconsideration. December 31st was the deadline for NEW EIDL submissions.

Appeals are more time-sensitive they must be made within 30 days of the date of decline. Below is a chart illustrating the different EIDL loan timeframes.

Don’t Miss: Who Can Apply For Ppp Loan

Van Hollen Cardin Urge Sba To Process Pending Eidl Applications Using Available Funds

Today, U.S. Senate Appropriations Subcommittee on Financial Services and General Government Chair Chris Van Hollen and U.S. Senate Committee on Small Business & Entrepreneurship Chair Ben Cardin sent a letter to U.S. Small Business Administration Administrator Isabella Casillas Guzman urging the agency to process pending COVID Economic Injury Disaster Loan Program applications using available funds.

Last week, the SBA announced that the deadline for existing borrowers to submit applications for loan modifications, rehearings, and appeals would by May 6. Yesterday, May 5, the SBA alerted the borrowers that the agency would no longer be accepting applicationsone day ahead of its own deadlinedue to a lack of funding. By the SBAs own admission, there may still be funding available for transfer to the program to meet demand.

The senators urged the SBA to use its transfer authority to accommodate borrowers who want to submit for a modification, rehearing, or appeal. The senators wrote, By prematurely shutting down the program, the agency appears to have prioritized its own administrative needs over those of the thousands of borrowers that await decisions on their applications. Furthermore, it has done so in a way that has needlessly confused borrowers and raised expectations..

You can read the full letter here or below:

Dear Administrator Guzman:

Sincerely,

What Is The Application Process For Eidl Loans

If youâre thinking about applying for an EIDL loan, youâll need to know where to startâand luckily, the loan assistance application process is fairly streamlined and straightforward.

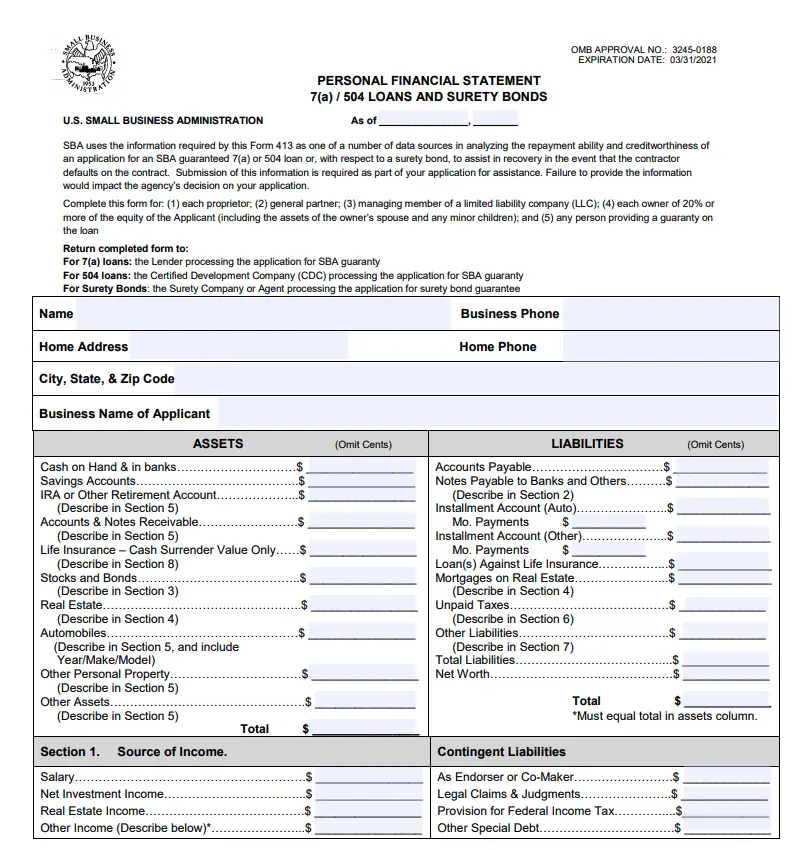

Small businesses interested in applying for an EIDL loan can apply directly through SBA.gov. According to the SBAâs EIDL Application Checklist, in order to apply for an EIDL loan, youâll need to submit

- A schedule of liabilities

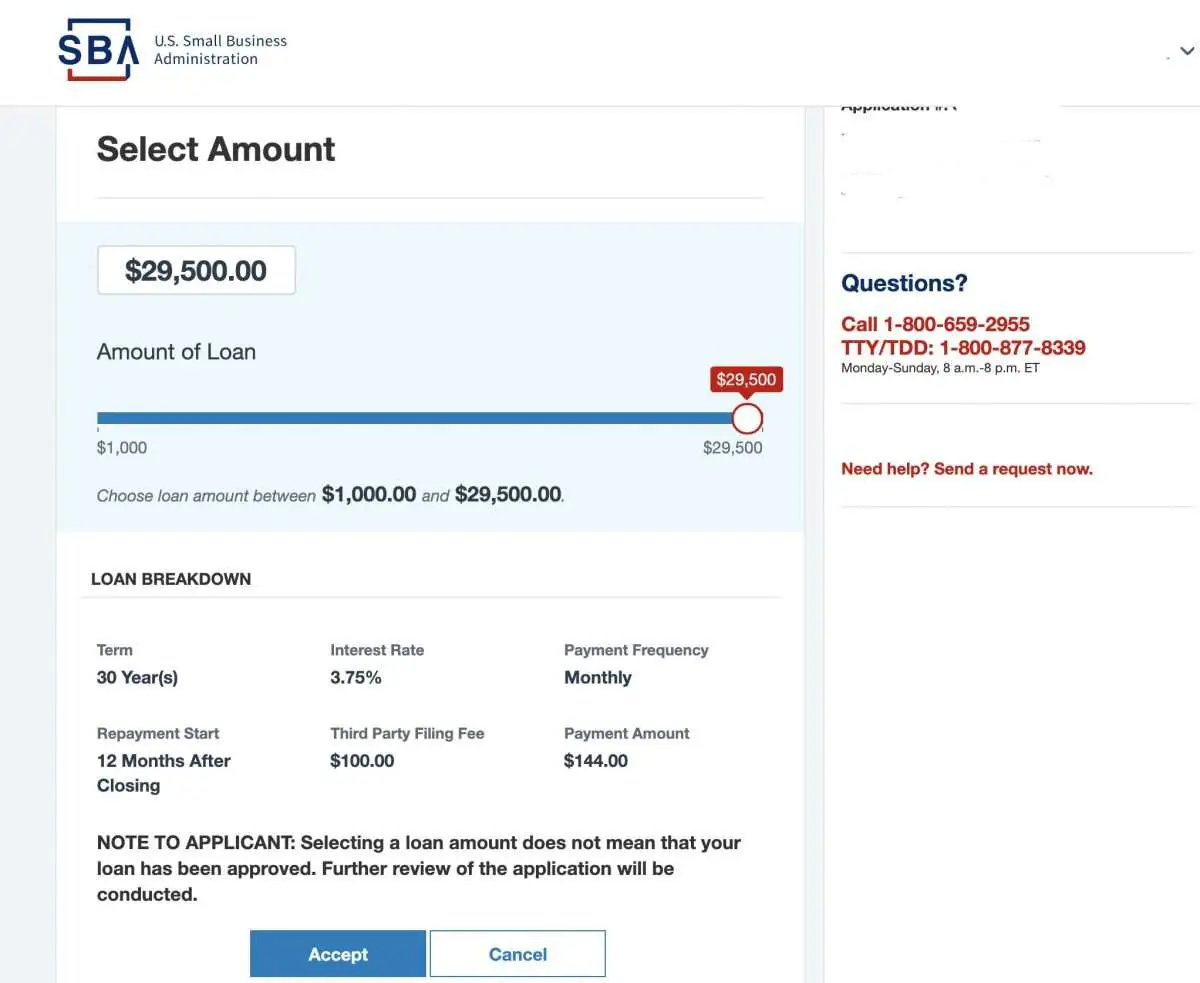

After submitting an application through the SBA portal, youâll receive a loan quote. Itâs important to note that the quote is NOT an approvalâand it doesnât necessarily reflect how much your EIDL loan will be. The loan quote is an estimate of your qualified loan amount you can apply for any loan amount up to your quote maximum.

Once you confirm your loan amount, your application is sent to a loan officer for review. Depending on your application, the loan officer may request additional information before approving or denying the loan.

Once the loan officer signs off on the loan, youâll receive an email that lets you know whether your loan was approved or denied. If your loan was approved, the email will have next steps on how to sign your loan documents and receive your funds. If your loan was denied, the email will outline the reason for the denial.

Recommended Reading: What Credit Union Has The Best Auto Loan Rates

Get The Funding You Need To Keep Your Business Moving Forward Through Covid

Thereâs no denying that COVID is presenting major challenges for small businesses. But now that you have a better understanding of the Economic Injury Disaster Loan program youâre armed with the information you need to submit an applicationâand, hopefully, secure the funding you need to keep your business moving forward through the pandemic.

What Are Some Alternatives To A Sba Disaster Loan

SBA disaster loans are not the only option for small businesses struggling to recover from a natural disaster. There are other types of loans available that may be better suited to your needs. Here are some alternatives to an SBA disaster loan:

- Business interruption insurance

- Traditional bank loans

- Crowdfunding campaigns

Each have their own set of pros and cons that youâll need to weigh before making a decision. Be sure to do your research and speak with a financial advisor before taking out any kind of loan.

Business interruption insurance can help cover the costs of lost revenue and expenses incurred during the downtime caused by a natural disaster. However, this type of insurance is not always available and can be expensive.

Small business grants can provide much-needed financial assistance, but they are often difficult to obtain.

Lines of credit can be a great option for businesses that need flexibility in how they use the funds. However, lines of credit typically have higher interest rates than other types of loans.

Traditional bank loans may be more difficult to obtain after a natural disaster, but they usually have lower interest rates than alternative financing options.

Crowdfunding campaigns can be a great way to raise money from friends, family, and the public. However, it can be difficult to reach your fundraising goal.

Read Also: What Is An Fha House Loan

Benefits Of An Sba Loan For Your Business

Having access to working capital and business lines of credit is often essential for a business to run. However, it can be difficult for small businesses with limited financial histories to receive funding through a bank. The SBA partially guarantees loans and partners with financial institutions to provide small businesses with various loan products to meet their needs.

Entrepreneurs need to be well-positioned to launch and grow their businesses, said Andrew Flamm, regional director of the Pace University Small Business Development Center, via phone to The Balance. SBA loans provide opportunities to stabilize the business further.

SBA loans can be beneficial because:

- They are available to new businesses and startups. Traditional business loans, on the other hand, may require companies to have been in operation for several years and greater collateral.

- There are longer repayment periods .

- Applicants can use personal assets as a guarantee on their loans.

SBA loans can be used to purchase:

- Short-term fixed assets such as equipment

- Long-term fixed assets such as commercial real estate

- Working capital to enhance operating capital

- Refinance existing debt

Lenders in the SBAs Preferred Lender Program do not require the agencys approval for loan requests, which can expedite the process.

Why Wait To Get Approved For An Sba Loan

While an SBA loan can take some time, its often worthwhile because of the many benefits it offers. Several of the most noteworthy perks of SBA loans include:

- Low Interest Rate: If youre eligible for an SBA loan, youre likely lock down a low interest rate that you may not find elsewhere. Of course, your creditworthiness will determine your interest rate but you may be able to secure a rate as low as 6.75%.

- Longer Repayment Terms: Depending on the SBA loan you apply for, you can expect longer repayment terms than other small business loans and a payment schedule that aligns with your business plans.

- Low Down Payments: Most business loans require high down payments that may go up to 30%. With an SBA loan, you may be able to put as little as 10% to 20% down. If youre short on cash flow, this is a huge benefit for your business.

- Flexibility: While some business loans will only allow you to use the money to cover equipment or invoices, SBA loans tend to be quite flexible. For example, with an SBA 7 loan, youre free to use the funds for just about any business purpose.

- SBA Resource Access: The SBA has no shortage of resources for business owners. As an SBA borrower, you may receive access to organizations like SCORE, which open the doors to networking events, mentorship programs, and training opportunities.

Recommended Reading: What Is The Maximum Student Loan

How Does The Sba Loan Process Work

As a first time SBA loan applicant, you may find the application process to be fairly complicated. The good news is that there are many resources available for applicants.

Before you apply for any SBA loan, its in your best interest to understand how the loan process works:

Step 1: Youll collect the appropriate documents and submit your SBA loan application. This part of the process can take anywhere from one to 30 days.

Step 2: The loan officer will review your application and underwrite the loan within 10 to 14 days.

Step 3: The lender will hopefully approve your loan and send you a commitment letter. You can expect this step to take between 10 to 21 days.

Step 4: In the final step, the SBA lender will close on the loan in about seven to 14 days.

Rest assured, the lender will communicate with you throughout the process and inform you of any hurdles that may cause delays.

How Long Does It Take To Receive Eidl Funds After Approval

- Step 1: Gather your information, including revenues and business details

- Step 2: Apply for the EIDL loan online. It may take over two hours, so plan enough time.

- Step 3: Wait for the SBA to review your application.

- Step 4: Review your offer and sign the loan agreement.

- Step 5: Wait for the funds to be deposited

You May Like: What Is Home Loan Insurance

Sba Loan Closing Process For A 504/cdc Product

Next up is the SBAs 504 loan program. If youve not heard of this product, its designed to help small businesses with long term, fixed-rate financing to acquire fixed assets for expansion or modernization, according to the agency. The loans are facilitated through Certified Development Companies, which throws a wrench into the SBA loan processing time.

The Certified Development Companies are brought into the process because the loans require two layers of approval the SBA and its partner, the CDC. As a result, how long it takes for SBA 504/CDC loan approval will vary. But, you can expect to wait from a month to a month and a half from when you complete the application to receiving financing. However, SBA loan processing times of up to six months arent unheard of for this particular product.