Statement Of Service Requirements

In order for active duty service members to be eligible for a VA home loan, the VA requires a signed statement from your unit commander or a designated representative. The statement must list you by name, rank, Social Security number, and also the nature of your current active duty service commitment or the length of your current assignment.

There isn’t a standard form for the statement of service, but it must include:

- Official letterhead

- Eligibility for reenlisting

Understanding The Va Loan Statement Of Service Letter

Service members, military Veterans, and qualified surviving spouses have the benefit of the Veterans Administration home loan. VA home loans offer up to 100% financing, flexible guidelines, affordable payments, and can be used multiple times. One of the most popular process-related VA questions we receive from active service members involves the VA statement of service letter. Examples of some questions include:

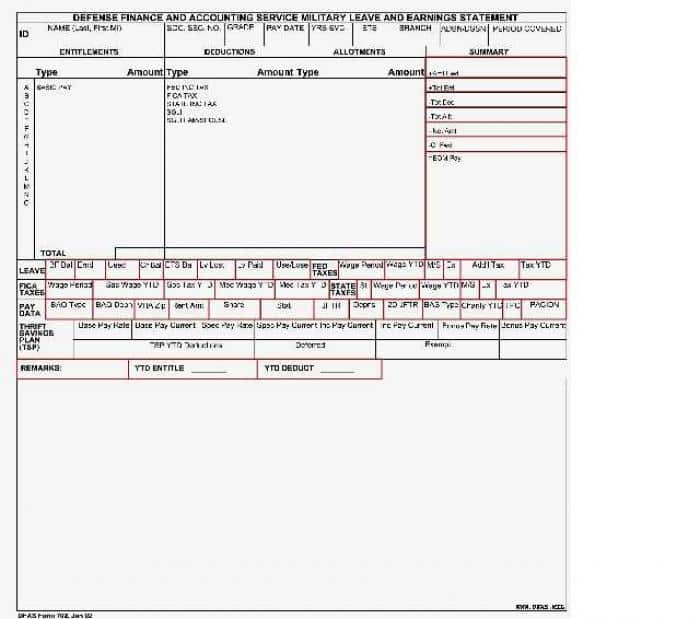

- Why do you need a statement of service? You have my LES.

- Who completes the statement of service?

- What information is included in the letter?

Recommended Reading: Can I Buy Two Houses With Va Loan

Are Housing Prices In My Area Too High For A Va Loan

VA loans are designed to help veterans become homeowners no matter where they live, so dont let a costly housing market stop you from exploring this option. In fact, with the recent passing of the Blue Water Navy Act of 2019 veterans and active duty can take advantage of zero down VA loans past the county loan limits well into the million dollar plus jumbo territory. For example, a qualified veteran can put zero down payment when purchasing $1.5 million dollar home.

Also Check: Can The Bank Loan You Money

Read Also: What’s The Average Student Loan Interest Rate

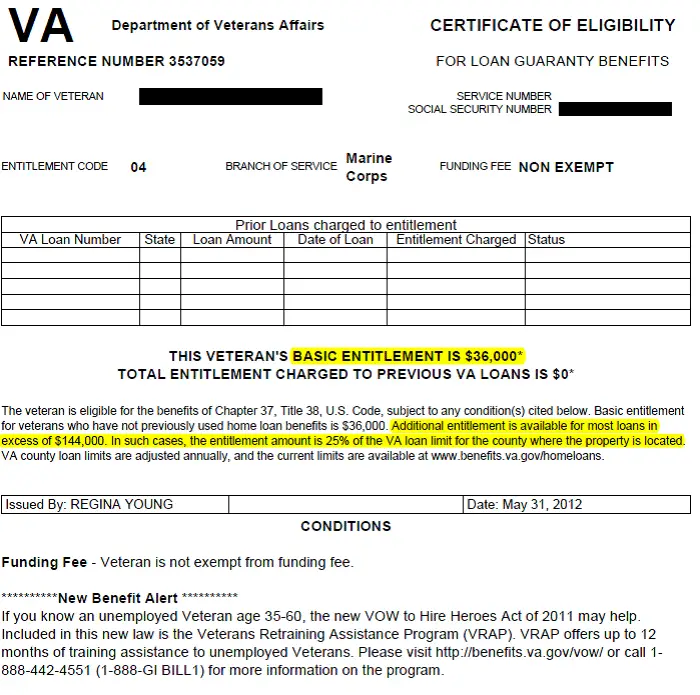

Va Statement Of Service Vs Certificate Of Eligibility

The statement of service and certificate of eligibility sound similar, and you may even think one would cancel out the other, but they dont.

The COE tells lenders that you are eligible for the VA loan program. Without it, lenders cant process your VA loan request. On the other hand, the statement of service serves as a source of income verification. It doesnt state anything about your eligibility for the VA loan, even if youre actively serving.

The COE includes details such as how long you served, your discharge status, and, most importantly, whether youre eligible for a VA loan.

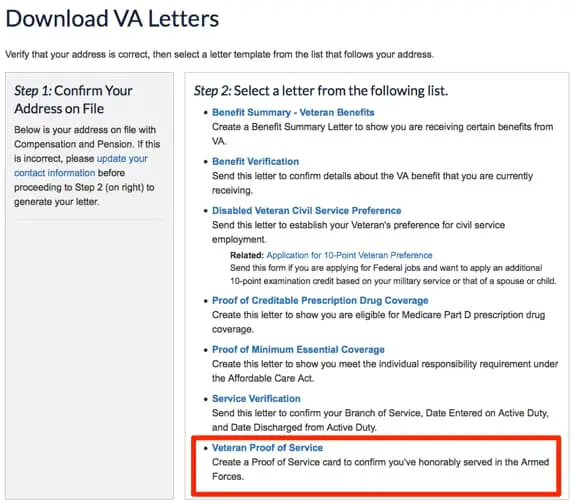

You can obtain your COE by accessing your VA portal account, completing VA form 26-1880 and mailing it to the address on the form, or asking your lender to obtain it for you. Some lenders use the Web LGY system to access your COE and move the process along.

Va Loan Credit And Income Eligibility

The VA doesnt set a minimum credit score requirement for a VA loan. However, some lenders may only approve borrowers with a credit score of 620 or higher. To be eligible for a VA loan, your income must also be consistent and stable. You need to provide your most recent pay stubs, tax returns from the last two years, and information about other income sources

You May Like: How Much Will My Student Loan Payment Be

Statement Of Service Letter Requirements For A Va Loan

VA home loans are such a great way for our military to affordably finance a new home. The benefits are many and our service members deserve it. We also feel that education and answering questions for Veterans and Service Members is key. Some of the most popular questions we receive on VA loans stem from the VA Statement of Service. Additionally it is one of the most misunderstood VA requirements. A popular question is Why do you need a statement of service when you have my LES?. Then another is How does my C.O. complete the statement of service letter?.

So lets answer these questions and give an example to make things easier.

Besides the normal proof of income and asset statements, VA loans have 3 primary required forms. These are:

- Certificate of Eligibility

- DD214 Veterans only

- Statement of Service Active Duty Military or Reserves

Foremost, the VA certificate of eligibility is required on all VA loans. It states how much entitlement is available to finance a VA home loan. So basically entitlement determines loan amount and down payment amount. The next step depends on a borrowers military status. Discharged Veterans must provide a dd214 which breaks down the service dates, discharge status, and more. Lenders use this form to request the VA COE. But active duty or reservists may be required to provide the statement of service. Which is the topic of this article.

Are There Exceptions To The Requirements

Although the VA does not tolerate any exceptions to the VA Loan Eligibility service requirements, there has been one recent change to VA Loan qualification. It is specifically for surviving spouses who decide to remarry after their beloved veteran passed away.Before 2021, spouses who remarried after the age of 57 could still qualify for a VA Home Loan. As of Jan 5, 2021, that age requirement dropped to 55, making the requirements slightly more lenient.

Recommended Reading: How To Refinance Car Loan With Capital One

What Does The Va Loan Statement Of Service Include

Your VA loan statement of services comes in the form of a letter that lists:

- Your name, birth date and Social Security number

- Your dates of military service, including terms of active duty

- The branch in which you served

- The type of discharge you received if you no longer serve

- Your rank pay rate as a military member

- Whether you lost any time

- Whether you can return to military service

The statement should be on official government letterhead and signed by the person who wrote or created the document.

Why Income Verification Matters

Income verification is just as important as credit score verification. Lenders must determine that you can afford the loan. They need to see beyond a reasonable doubt that you can pay the mortgage monthly and that your income will continue for the foreseeable future.

Lenders need proof of income whether youre applying for a conventional loan or a nonconforming loan, such as a VA loan. Lenders use your income to determine what loan amount you can afford. Without income verification, lenders cant determine how much you can afford and wouldnt be able to issue a loan.

When you submit your VA statement of service early in the application process, you show lenders how much you make and what you can afford, speeding up the process and getting you into your home faster.

You May Like: Can You Have More Than One Loan With Onemain Financial

Va Home Loan Requirements

Meeting the requirements for a home loan shift when using your VA benefits.

VA home loans are insured by the U.S. Department of Veterans Affairs. They offer 100% financing and no mortgage insurance, making them a great option for members of the U.S. Armed Forces who serve to protect our security. The Department of Veterans Affairs doesnt issue the loans. Rather, borrowers acquire a loan by applying for a mortgage with a VA-approved lender.

GETTING A VA LOAN

Va Loan Eligibility Requirements

First of all, you need to make sure youre eligible for a VA loan. The government has service requirements for veterans or those on active duty, and also offers opportunities for certain military spouses to qualify for VA loans. You can get more information from the governments website, but the basic requirements include:

- Youre currently on active military duty, or youre a veteran who was honorably discharged and met the minimum service requirements.

- You served at least 90 consecutive active days during wartime or at least 181 consecutive days of active service during peacetime.

- Or, you served for more than six years in the National Guard or Selective Reserve.

If your spouse died in the line of duty, you may qualify for a VA loan.

In order to apply, you need to obtain a VA Certificate of Eligibility, or COE. Without this certificate, you wont be able to get your loan.

Recommended Reading: What Is The Max Conforming Loan Amount

Va Mortgage Loan Options

Purchase loan:

If you are a conventional home buyer, you will most likely be looking to secure VA-backed purchase loans. This loan will help you buy, build, or improve a home with a competitive interest rate and the option to put no money down without restriction.

Interest Rate Reduction Refinance Loan :

If you already have a VA home loan and would like to reduce your monthly mortgage payment or interest, an Interest Rate Reduction Refinance Loan could be the right choice for you.

Cash-out refinance loan:

A VA-backed cash-out refinance loan can help you take cash out of your home equity. This loan will replace your current loan with a new VA loan under different terms. You can also use a VA cash-out refinance to refinance a non-VA loan into a VA-backed loan.

We would also like to mention that the VA offers a Native American Direct Loan . If you are veteran, and either you or your spouse is Native American, you may qualify for this loan. Because the VA directly backs this loan, you do not need to contact a private lender the U.S. Department of Veterans Affairs will serve as your lender.

Other Va Loan Requirements

You should also keep these other VA loan eligibility requirements in mind:

- VA loan limit: Since Jan. 1, 2020, there have been no official limits to the value of VA loans, but your lender may impose their own terms and your entitlement will still be pegged to conforming mortgage limits.

- Property type: Investment properties and vacation homes cannot be purchased using VA loan proceeds. Furthermore, you must occupy the home and use it as your primary residence.

- The VA does not specify a minimum credit score requirement. However, borrowers might have a hard time getting approved by a lender if they dont have at least a 620 FICO Score.

- Income: Borrowers need to show they have the income to make the mortgage payments. Its equally important to not have a huge debt load since the lender will assess your debt-to-income ratio , or the percentage of your monthly income thats spent on debt payments.

- Assets and down payment: There is no down payment requirement for VA loans, but the lender may have overlays that mandate a down payment in place for borrowers with lower credit scores.

- Reserve funds: Many lenders require borrowers to have an adequate amount of reserves generally two to three months of mortgage payments before clearing you to close on your loan.

Its also possible to use home loan benefits after bankruptcy, as long as sufficient time has passed, typically two years after filing for Chapter 7 bankruptcy or 12 months after Chapter 13 bankruptcy.

Read Also: Can I Refinance My Fixed Rate Home Loan

How Does A Va Loan Work

VA loan process is an opportunity to get a loan to people with disabilities, war veterans, military personnel, or their widows. This is a loan issued by private lenders with the support of the US Department of Veterans Support.

The Law on VA credit has existed since 1944 when it was adopted in the legislative system. Over the past two years, the popularity of the VA loans process has doubled. Thus, for example, in 2018, 8% of all purchases was carried out thanks to this law.

How do VA loans work? This is a prototype of a mortgage loan, but the state gives guarantees. The state itself takes on a small risk of payment.

If a citizen fails to repay the loan or loses his home through a buyout, then the state will pay for it. Thanks to such a system, obtaining such a loan is easier than any other home loan.

Who Qualifies For A Va Loan

Active Duty servicemembers, veterans and their families are eligible. You or your spouse must meet at least one of the following requirements:

- Served 90 consecutive days of active service during wartime

- Served 181 days of active service during peacetime

- Served more than 6 years with the National Guard or Reserves

- Are the spouse of a military member who lost their life in the line of duty, or as the result of a service-related disability. You usually cannot have remarried.

According to a recent report released by Navy Federal Credit Union,* not all eligible military members are aware that they can buy a home with a VA loan. Nearly 15% of respondents who had recently taken out a non-VA loan mortgage said they weren’t aware of the VA loan benefit.

Don’t Miss: Sallie Mae Student Loan Forgiveness

Security America Mortgage Inc

Security America Mortgage is one of the leading VA Home Loan Lenders in the nation We are not a government agency. We pride ourselves on providing excellent customer service to ensure that each Veteran we serve ends up living happily ever after in the home of their dreams. This is a private website that is not affiliated with the U.S. government, U.S. Armed Forces, or Department of Veteran Affairs. U.S. government agencies have not reviewed this information. This site is not connected with any government agency.

Contact Us Today! Call toll-free:

Va Loan Property Requirements

VA home loans must be used for the purchase of a primary residence. This can include the purchase of a single-family house, townhouse or condominium in a VA-approved complex. These loans can also be used to construct a new home and purchase a manufactured home and lot. Theres also the option to refinance an existing VA loan. Refinancing is an option if you want to get a lower interest rate, reduce your monthly payment, cash out your equity, or refinance from a conventional or FHA loan to a VA mortgage.

Recommended Reading: Can You Add To Your Home Loan For Renovations

Why Do Applicants Need A Va Statement Of Service

Just like when someone applies for a conventional mortgage loan, income verification is a big part of the loan process as lenders need to verify that youre able to repay the loan they grant you. The same goes for the VA home loan approval process. Lenders will read through statements of service to fully understand the borrowers current financial situation as well as any other important information regarding their employment history. All of this information combined together will help the lender decide if the applicant will be approved for VA financing.

If youre still considered active duty in the military, lenders will want to see 12 months of guaranteed income. This should include any additional payment amounts as well so the lender has a full picture of where you stand financially.

Your Home Must Qualify For Va Loan

This is one of the harder aspects of VA loan restrictions to explain. Before you can purchase your home using VA loans, your property must qualify. The VA will send a specially appointed VA appraiser to assess the house. Here is a good breakdown of the VA property requirements but in general, your home must be a conventional home in good working condition.

Also Check: How To Refinance An Auto Loan

Proof Of Service Requirements For Va Home Loans

Are you an active duty service member looking to buy property with a VA home loan?

When you start the process of applying for a VA mortgage, one of the first things youâre required to do is prove that youâre on active duty and in good standing with your branch of the service. Where your loan officer is concerned, that might mean simply showing your current military ID card and a Leave and Earning Statement, but the Department of Veterans Affairs requires something more.

In order to be approved for a VA home loan, the VA requires you to provide a signed statement from your unit commander or a designated representative. The statement must list you by name, rank, Social Security number and also the nature of your current active duty service commitment or the length of your current assignment.

Thatâs a bit complicated compared to the requirements retirees and honorably separated military members have to do to show proof of service in those cases itâs simply a matter of submitting a copy of the DD form 214 which acts as proof of service and also shows the nature of the discharge.

Both a statement of service for active military and a DD-214 for veterans are essential for obtaining a Certificate of Eligibility. This is a formal VA document indicating your eligibility for a VA home loan.

Check VA Loan Eligibility Today!

Also Check: Does Fha Loan Require Down Payment

Proof Of Service For Veterans

Statements of Service are a bit complicated compared to the requirements retirees and honorably separated military members have to show for proof of service in those cases it’s simply a matter of submitting a copy of the DD-214 form, which acts as proof of service and also shows the nature of the discharge. Those who left the military under circumstances other than fully honorable may have a difficult time getting qualified for a VA mortgage. Veterans who served in a Guard or Reserve component may also be asked for a Points Statement.

Both a statement of service for active military and a DD-214 for Veterans are essential for obtaining a Certificate of Eligibility. This is a formal VA document indicating your eligibility for a VA home loan.

Learn More:See the full list of VA loan eligibility requirements

Don’t Miss: How To Find Your Student Loan Account Number

Is The Statement Of Service The Same As A Certificate Of Eligibility

While these official documents are similar, you will need both to successfully obtain a VA mortgage. The Certificate of Eligibility alerts lenders that you have met your service requirements while the statement of service verifies your income either as a current or discharged military member. Other important documents to gather for your application include at least 2 months of statements for all your bank and retirement accounts, a copy of your driver’s license or state ID card and W-2 tax forms for the past 2 years .