Gathering Documents To Speed Up The Sba Loan Approval Process

Much of the waiting time spent during the SBA loan approval process possibly up to 30 days youll spend gathering documentation for the lender to process. Luckily, the SBA conveniently outlines this for you in this checklist.

After youve applied, it can be another few weeks before you receive a decision. This extra SBA loan processing time is because the lender must weigh details ranging from the loan amount to the purpose of the financing.

Once youre approved for the loan, be prepared to wait some more. There will likely be more documents for you to fill out as things are finalized in this part of the SBA loan closing process. From there, by the time the documents are processed, and the lender sends the funds to your account, it could be yet another couple of weeks before the money arrives.

Filling Out The Paperwork

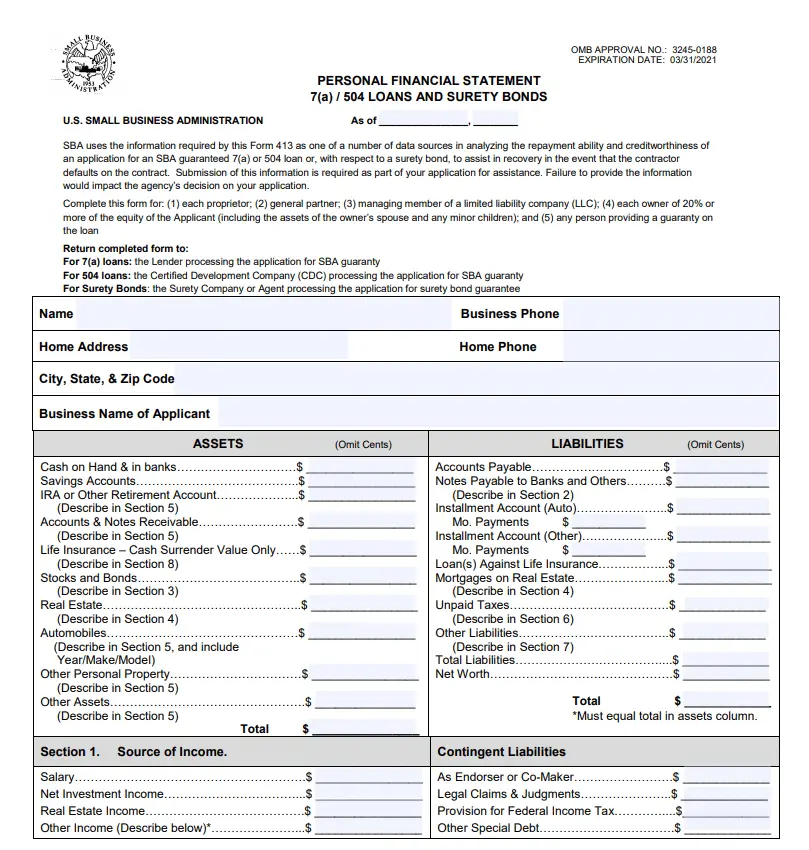

How long it takes to get an SBA loan depends primarily on you. If you don’t provide all the requested information, your loan can sit for weeks. For example, you might be asked for a balance sheet, which is an up-to-date list of your assets and liabilities. You need to provide your federal Employer Identification Number if you have one. If you forget to include it, the SBA has to get back to you, and your application might be stalled for weeks.

Working with an SBA partner, you should be able to find out exactly what you need to complete a loan application. The lender will also review your application before you submit it.

References

Whats The Timeline For An Sba Loan

When you add up the time involved for each step listed above, the SBA loan process generally takes 60 to 90 days, depending on the lender and the size of the loan. Usually, the larger the loan and the longer the term you apply for, the harder a lender will scrutinize your application, which might extend the SBA loan timeline.

Lender experience matters as well. Lenders in the SBAâs Preferred Lender Program have full authority over underwriting and credit checks without SBA review. With less experienced lenders, the SBA takes a more active role, lengthening the process.

The actual SBA loan timeline to approval actually isnât much longer than that of standard business term loans from a bank. But the most time-consuming part of the process happens before you even apply, and it relies on your ability to pull together all of the material required to submit your SBA loan application successfully.

You May Like: What Does Va Loan Mean

Find A Bank To Finance Your Loan

Many banks provide SBA lending services, likely including the bank you use for personal banking. However, your personal bank may not be the best place to start. Instead, refer to the SBAs list of SBA Preferred Lenders. These banks have a proven track record of servicing SBA loans.

Its also important to talk to lenders about what types of businesses they fund and if yours is a project theyd consider financing. For example, some banks are open to start-ups while others only provide financing for established businesses. In order to increase your chances of being approved for SBA lending, consider applying to more than one bank approval outcomes can vary from lender to lender.

If sourcing and applying to multiple banks sounds like an endeavor thats too time consuming or overwhelming, you do have the option of working with a loan packaging service provider. Working with a third-party packager can be helpful in many ways. Youll get help understanding exactly what should go in your application and what lenders are looking for. Once your application is complete, your provider can send your application to multiple lenders at once, which saves you time and increases your chances of being offered favorable loan terms. Applying to multiple banks means youre more likely to get multiple offers and have more power as a borrower.

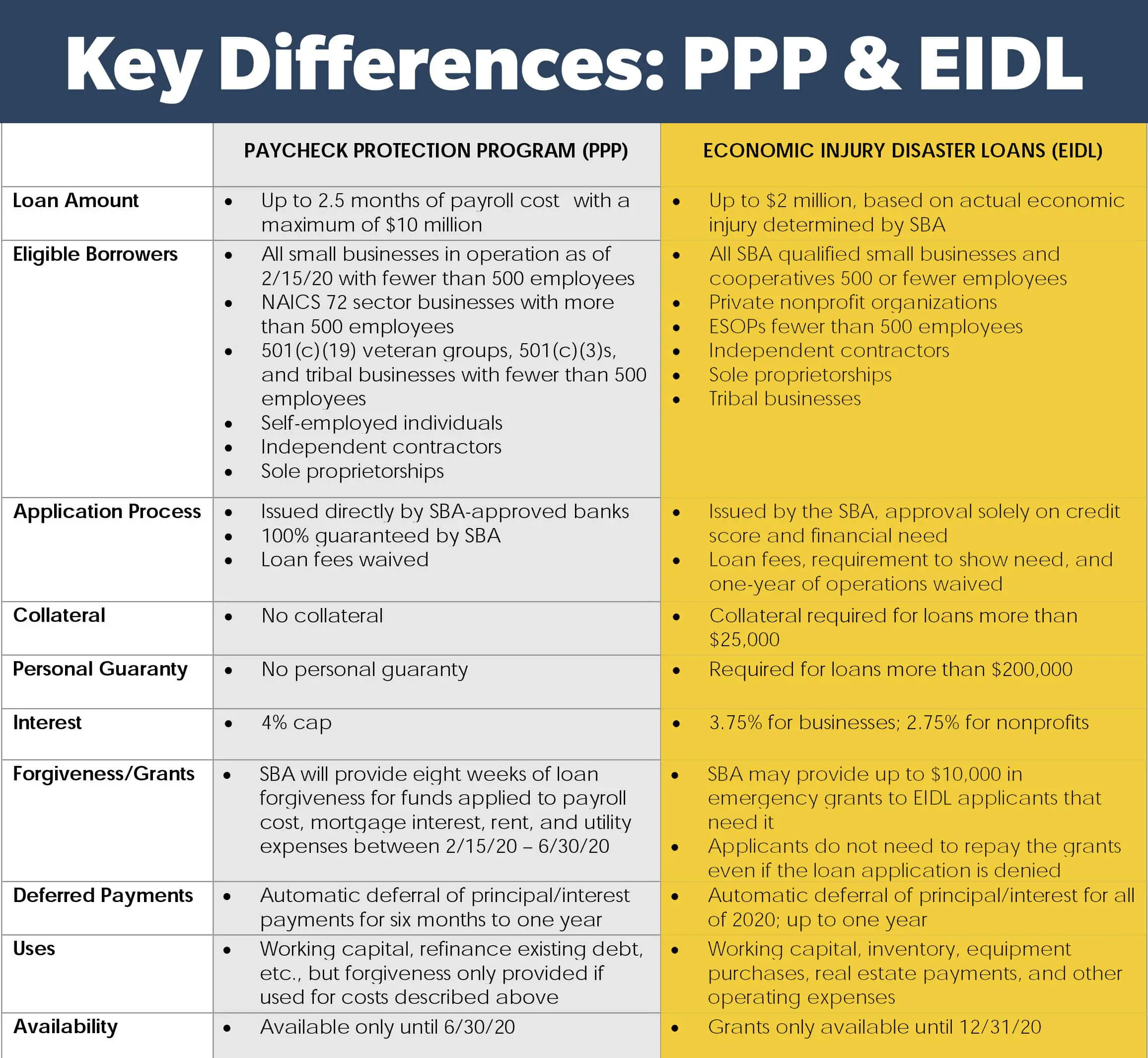

How Long Does The Covid Sba Loan Take

The Small Business Administration is no longer offering loans specifically relating to the COVID-19 pandemic, but you might be able to find an SBA loan that fits your needs with our SBA business loan calculator.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

Read Also: What Is The Best Loan Repayment Plan

What Factors Include The Sba Processing Time

Depending on the lender and loan size, the SBA loan process might take 60 to 90 days. This is comparable to the time it takes for other types of small company financing.

Gathering the necessary papers is often the most time-consuming component of the procedure. The sort of loan program you apply for and the quantity of money you want to borrow will be taken into account. You ought to anticipate that the methodology should take more time assuming you apply for an enormous loan with an extensive length than if you request a more modest loan with a more limited term.

Moreover, the moneylender you pick will affect what amount of time it requires. While all SBA Preferred Lender Program banks have the power to guarantee and lead credit minds SBA loans, they are not any different either way. Some are unpracticed, requiring SBA inclusion, which postpones the endorsement cycle.

Preparing The Sba Loan Application Package

The first step in the SBA loan process is preparing your application package. This includes having a clear picture of your business goals and determining how much financing you need. Once you have a goal in place and know the amount youll seek to borrow based on your business needs, you should find an SBA-approved lender and complete your loan application package.

The documents youll need during the application vary by lender but will typically include:

- Business License

Read Also: How Do Loan Payments Work

Sba 504/cdc Loan Process Vs Equipment Financing Timeline

If youâre looking to finance a fixed asset with an SBA 504/CDC loan, but you want to do it faster than the SBA loan timeline allows, l0ok into equipment financing. Working with a lender to get financing specifically for equipment allows you to work faster and with less paperworkâin some instances, all you need to get the process going is a quote for the equipment you want to finance.

A sample timeline could be:

And equipment financing is easier to qualify for than an SBA loanâsince the loan is self-secured .

When To Explore Other Financing Opportunities

In some instances, it makes more sense to research and apply for other small business loan options. If you cant wait for months to get approved for an SBA loan, alternative funding is probably your best bet.

In addition, if you dont have strong personal and business credit scores, you may not get approved for an SBA loan.

If this is the case, you should search for loans with more lenient credit history requirements. In addition, if you intend to use your funds for a specific purpose like buying equipment, a more specific loan may be the way to go.

Also Check: What Is The Minimum Income For Fha Loan

Can I Reapply For An Sba Loan If Denied

You may be able to reapply for an SBA loan, depending on the reason you were denied, the type of loan and the lender status.

If you were denied because you dont meet SBA requirements you may be able to ask for reconsideration. For example, if you were denied due to a previous criminal history and you want to appeal, you can request a reconsideration of an adverse character determination within 6 months of the date of SBAs decision.

In some cases you may not be able to reapply for a year, but the lender may be able to request reconsideration. The SBA guidelines state that once your application is submitted to the SBAs Loan Guaranty Processing Center , an applicationdeclined by the LGPC may not be approved by any Lender under its PLP Authority. ETran and SBA One will not permit the submission of such an application under any Lenders PLP authority for a period of 12 months from the date of the withdrawal, screen-out, or decline of the application.

PLP refers to the Preferred Lender Program which refers to lenders approved to make a number of decisions about SBA loans to streamline the process. Etran and SBA One are technology systems used by the SBA.

If your application for a COVID-19 Economic Injury Disaster Loan was declined, you have up to six months to reapply. This program offers working capital loans of up to $2 million with a repayment term of 30 years at 3.75% for small businesses.

How Long Does The Sba Have To Approve Ppp Forgiveness

When the coronavirus pandemic hit in 2020, it caused a lot of panic for business owners. Suddenly, they werent able to operate in the way that they had been, and a lot of companies didnt know how they would be able to survive.

Thankfully, the US Government announced a new loan scheme that would support businesses throughout this time. This loan scheme was called the Paycheck Protection Program.

Along with offering the PPP loan scheme, the US Government also offered a forgiveness scheme. This would allow those who received these loans to get the loan forgiven before the expiry date if they fit the necessary criteria. The PPP loan scheme is new, and because of this, a lot of people are still struggling to figure out the application for PPP loan forgiveness. In this quick guide to the SBA PPP loan forgiveness, well be taking a look at how you apply for loan forgiveness, and more importantly, how long it takes for your application to be approved. So, lets dive right in.

Also Check: Strange But True Free Loan From Social Security

How Long Does It Take To Get An Sba Loan Approved

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

Small Business Administration loans are loans given out to small businesses by the federal government to help them get access to the funding they need. They require an application process, and approval times for these loans depend on the kind of loan that you take out. While some loans, like an SBA 7 loan, may take two to three months, other loans, like SBA 504 loans, may take as few as 30 days.

Certain loans, like express loans or disaster loans, may distribute funds even faster than any other SBA loans upon approval. Lets talk about SBA loan types and their disbursement processes.

Wait Out The Sba Loan Timeline When

- You need a substantial loan: SBA loans can go into the multi-millions, so sit tight if you need access to large sums of money.

- Timeâs on your side: If you donât truly need the money right away, youâre better off going through the SBA process and getting a lower interest rate.

- You need a longer payback period: SBA loans offer some of the longest terms in the game, which means you get more time to pay back what you owe.

But if none of these apply to you, and you need cash-in-hand soon, consider the alternatives.

Read Also: What Is The Best Student Loan Program

Patience Doesnt Have To Be A Virtue

When pursuing an SBA loan, patience is a virtue. But, you dont necessarily need to wait out the approval process. The rise of fintech has introduced a segment of online lenders like Funding Circle that are designed to deliver speedy business loans in a fraction of the time it takes the government agency. The answer to how long does it take to get an SBA loan? doesnt have to be one that deters you. Get funding quickly and easily: You can apply directly through Funding Circle for an SBA 7 loan today.

asdfad

What Is An Sba Loan

An SBA loan is a government-backed loan for small businesses that can be used to fund startup costs, expansions, real estate purchases, and other expenses. A private lender issues this type of loan, but the federal government backs it.

A lending institution, such as a bank or credit union, is used to acquire an SBA loan. The lender then applies to the SBA for a loan guarantee, which implies that if you default on an SBA loan, the government will pay the lender the guaranteed amount.

According to the SBA, everyone with at least 20% ownership in a corporation must offer an unqualified personal guarantee. This guarantee holds you and your personal assets liable if your firm fails to make payments.

Recommended Reading: What Is My Auto Loan Credit Score

Can I Sell My House If I Have An Sba Loan

The SBA will be willing to release the mortgage/lien so that the owner can be allowed to sell or refinance the property under the proper circumstances. ⦠The borrower must not receive any of the sales or refinance consideration. Although all proceeds must be distributed in order of priority, it is possible.

You May Like: Usaa Auto Refinance Rate

What Is The Sba Loan Procedure

Because each firm is different, there is no standard schedule for seeking and receiving money. However, in general, an SBA loan application consists of the following steps:

The papers will be the first thing your loan specialist lender will ask for. Even for the most organized company owner, gathering all of the essential documents for your SBA loan package might take weeks.

Heres a quick rundown of everything youll need to apply for an SBA loan:

Recommended Reading: What Is Personal Loan Used For

How Long Is The Eidl Funding Timeline

Many anxious business owners need to know how long does getting an EIDL loan take, so lets start there. After applying for an EIDL, most applicants will receive a funding decision within 21 days. If approved, disbursements are typically made within a week. However, be aware that the EIDL approval timeline can vary based on how many applications the SBA is processing.

One beneficial change to the program is that the deferment window has been raised to 30 months. No payments are due within that time, although the loans will accrue interest over that period.

When Will The Sba Begin Sending Email Invites To The First Priority Group

The SBA will begin sending email invites to businesses and nonprofit organizations that received the EIDL Advance in an amount less than $10,000 starting on . It may take several weeks before all emails are sent to businesses in the first priority group so please do not be alarmed if you do not receive your email invite right away. The invite to apply will be sent to the primary contact email address associated with your original EIDL application. All communications from SBA will be sent from an official government email with an @sba.gov ending. Please do not send sensitive information via email to any address that does not end in @sba.gov.

Recommended Reading: How Do I Find Who Has My Student Loan

Step : Get Ready To Do Business

The process is finished, and you are officially on your way! You will receive your loan payment schedule approximately one week before your first payment is due. Your payments must be made on the first day of the month.Because no two loans are alike, we cant guarantee exactly how long it will take to provide your financing. But most of the time it takes approximately 60 days-a period that is comparable with or better than most bank loans. However long it takes, you can be sure that TMC Financing is doing everything in its power to speed the process along and see your business reach new heights of success.

Anticipate Inquiries On Your Business And Personal Finances

Lenders have SBA guidelines they follow when determining a borrowers eligibility, and one of them is looking at your business and personal finances. They do this to ensure that your business is in a position to repay the loan comfortably. That said, lenders will ask questions about your finances some will even need proof of financial stability.

Read Also: How Much Interest Rate For Commercial Loan

How Can I Increase My Chances Of Getting Approval For An Sba Loan

We try our best to accept your business and qualifications. Unlike some others, like banks, for example, weve made the requirements less extreme.

If youd like to improve your chances though, try these three tips:

Easy enough? Apply for your SBA Disaster Loan today.

We hope things are clearer for you now when it comes to SBA Disaster Loans maybe a bit less of a disaster?

If you have any further questions, were here to help. Dont hesitate to reach out.

How Long After Sba Loan Approval For Funds

The SBA is a very reputed agency in the United States and is also widely renowned in all nations. The agency helps low-income or middle-class businesses and small businesses buy a property for business for the first time at a very affordable credit. The agency also helps new hospitals, institutional and commercial buildings closer to the market rate. However, the agency is not responsible for mortgaging government properties as the United Nations have a different policy for those purposes.

In the year 1930, when the great depression hit the United States, there was a drastic decrease in business loans and various other land property ownerships. The loan amount was very high, and low-income businesses couldnt afford their own properties. As a result, the government felt a need to implement an action that would make the properties affordable for the financially backward parts of the society. Therefore, the Small Business Administration was established in 1934 to counter all these problems.

| Case Of SBA | |

| Emergency Cases | After one month |

After approval, the time is taken for funds mainly depends on the situation of the business that wants to buy a property. The entire process is fast-tracked in emergency cases, and funds are allocated in one month. However, it takes approximately two months to get funds in standard cases. Emergency cases are generally those where the business doesnt have a property and is currently struggling to get established.

Read Also: How Are Monthly Student Loan Payments Calculated