What You Should Know

- Variable mortgage rateshave historically performed better than fixed mortgage rates, although interest rates have generally fallen over the past few decades.

- 5-year fixed mortgages are the most popular in Canada.

- Insured high-ratio mortgageswill have the lowest possible mortgage rate, but youâll need to pay formortgage default insurance.

- Typically, longer mortgage term lengths will have a higher mortgage rate compared to shorter mortgage terms.

- Closed mortgage rates are lower than open mortgage rates, but open mortgages allow you to make principal prepayments of any amount withoutmortgage penalties.

How To Calculate Interest On Home Loan

In general, home loans are long-term loans and it is important to figure out your overall interest liability towards the loan at the first place. You can calculate the same using one of the two methods listed below:

Why Are Rates Lower For A 15

Rates for mortgages are set based on bond prices in the mortgage-backed securities market. Investors of bonds want to park their cash in a more low-risk investment, one that offers a decent rate of return that will keep up with the rate of inflation.

Since inflation rates tend to go up over time, longer-term loans will have higher interest rates compared to short-term ones. Thats because investors cant accurately project inflation rates farther in advance.

Freddie Mac and Fannie Mae, both government-supported agencies, also impose price adjustments for loan levels, driving up costs of 30-year mortgages. Many 15-year mortgages dont have these additional fees, which is reflected in a lower rate.

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

Recommended Reading: How Are Student Loan Rates Determined

Popular Calgary Mortgage Brokers

Calgarians have historically been perceived as less-rate sensitive compared to homebuyers in other regions of the country. Thats due to a large percentage of the workforce being blue-collar, high-wage earners in the oil and gas sectors.

But things have changed with the internet making it easier to find the best rates. Thats forced mortgage brokers and lenders to compete harder for mortgage business.

Speaking of brokers, Calgarians have no shortage of options when it comes to mortgage brokerages. The largest traditional broker networks in the city include Dominion Lending Centres, TMG the Mortgage Group and M3 Mortgage Group.

Some of the top deep-discount brokers servicing Calgary include:

- intelliMortgage Inc.

- True North Mortgage

- Servus Credit Union

- First Calgary Financial

These lenders are all reasonably competitive, but only one can have the best deal at any given time. Fortunately, we track all these lenders, making that comparison easy.

Other Factors Besides Your Credit Score

Remember, FICO is looking only at the difference your credit score makes in the chart above.

Lenders will check more than your credit history when you apply for a new mortgage loan. They will also need to know your:

- Debt-to-income ratio This ratio measures how much of your income goes toward existing monthly debts

- Income stability Homebuyers need to show W-2 forms or pay stubs to prove a steady income. If youre self-employed, you can provide tax forms or even bank statements

- Down payment Most loans require a minimum down payment amount . Putting more than the minimum down could help lower your interest rate

- Home equity for refinancing Mortgage refinance lenders will check your home equity which, measures how much your home value exceeds your mortgage debt. Having more equity can lower your rate

In short, the better your personal finances look, the lower your mortgage interest rate will be. Taking steps like raising your credit score or savings for a bigger down payment before you buy can help you get the best rates available.

Recommended Reading: How To Start The Fha Loan Process

How Do You Calculate A Mortgage Payment

In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance , taxes and homeowners association fees.

Your lender will be able to provide you with a line-item breakdown of your mortgage payment. Using a mortgage calculator is an easy way to find out what your monthly payments will be. You can also look at an amortization schedule, which shows you how much youll pay over time.

Completed Or Resale Private Properties

If you are buying a completed or resale private property, there are competitive home loans with fixed or floating interest rates from major banks in Singapore that you can choose from. Do note that you cannot take HDB loans for private properties.

Check out the latest mortgage home loan interest rates offered by major banks in Singapore for resale private properties, and private properties that are still under construction below:

You May Like: Do Pawn Shops Loan Money

Mortgage Rates Chart For 2022

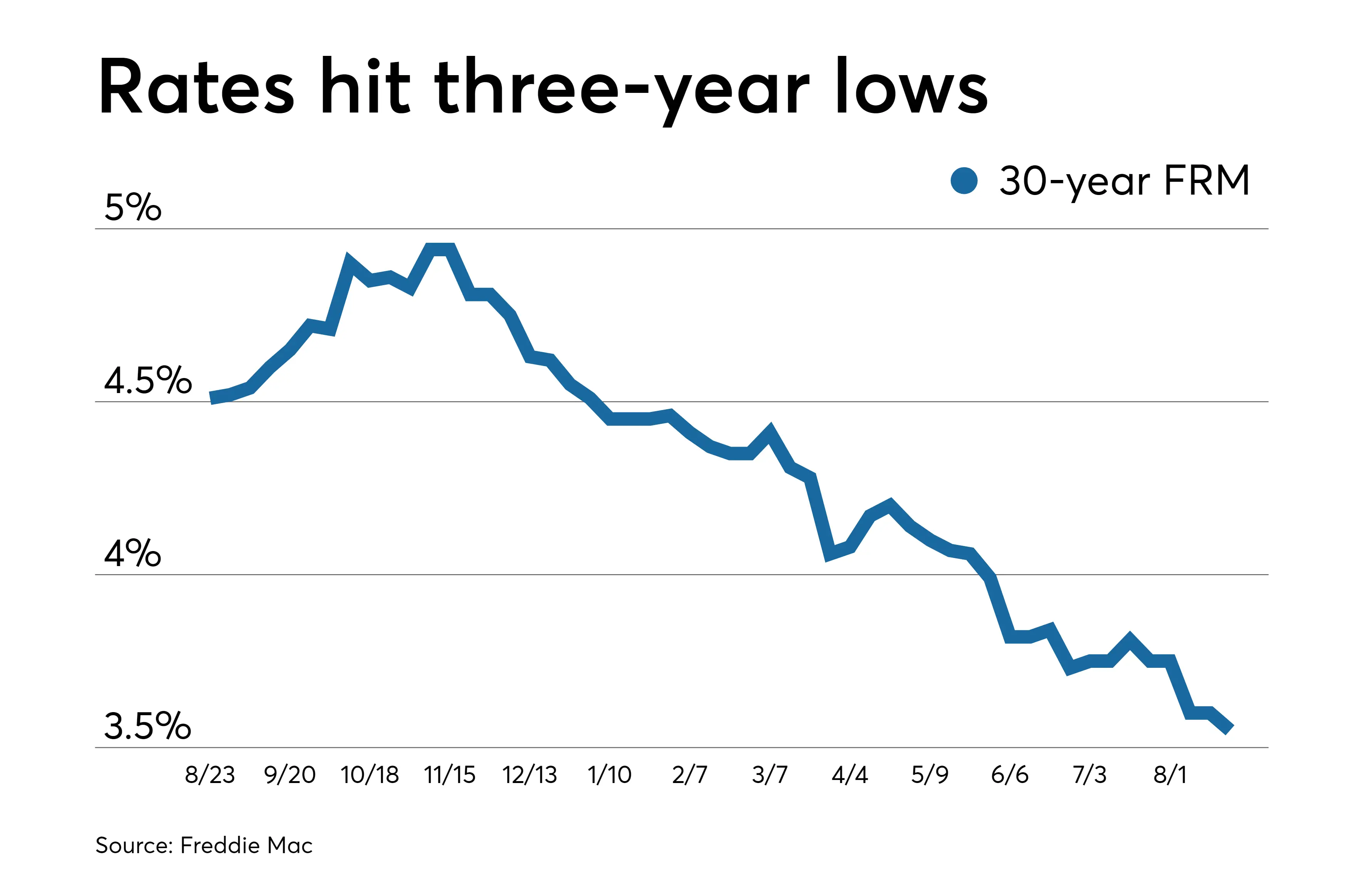

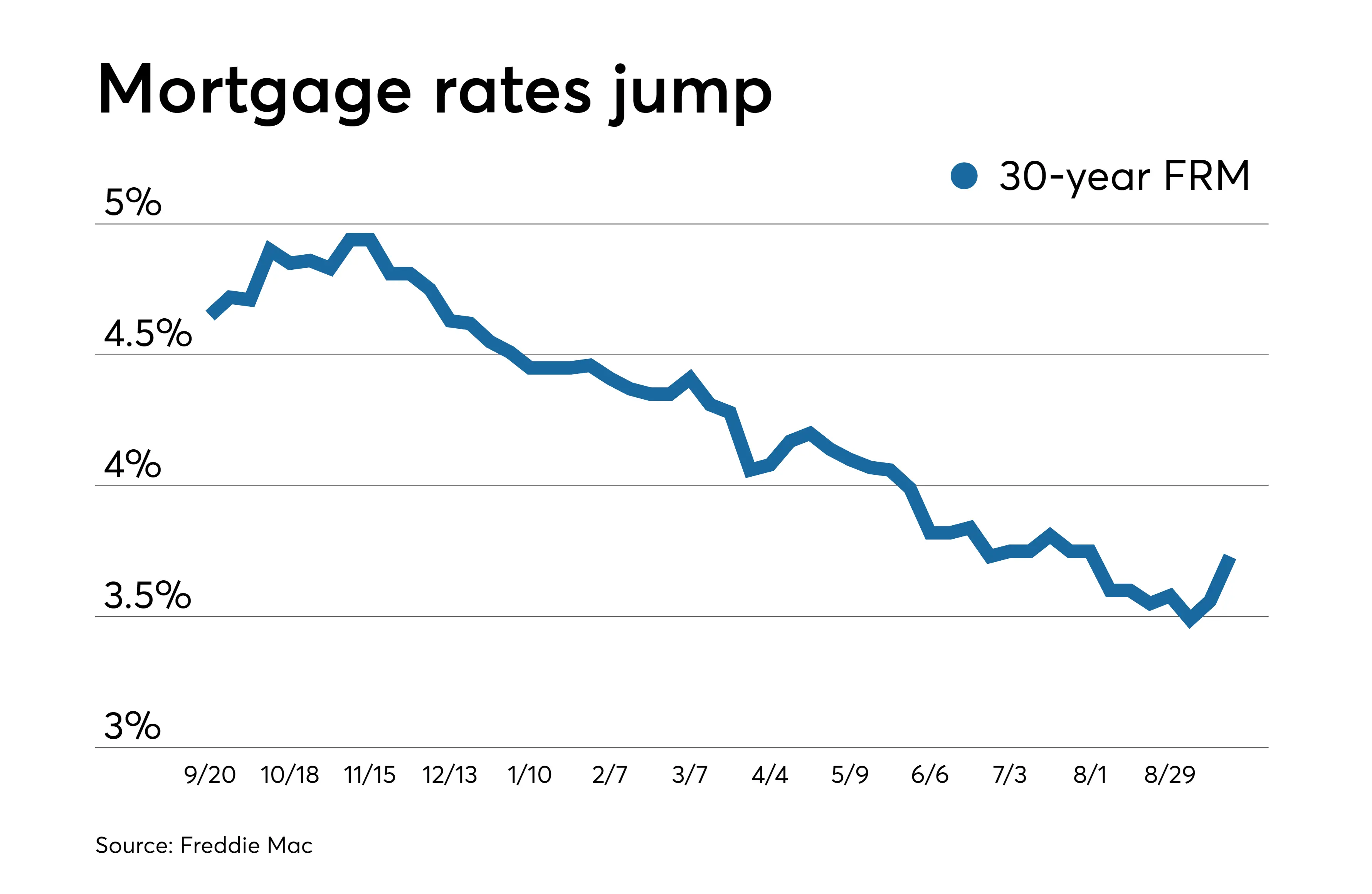

Mortgage interest rates fell to record lows in 2020 and 2021 during the Covid pandemic. Emergency actions by the Federal Reserve helped to push mortgage rates below 3% and keep them there.

But with inflation surging to four-decade highs, mortgage interest rates have risen in 2022. And policy tightening by the Fed could push them higher still.

Those who are in a position to lock an interest rate sooner rather than later may be wise to do so.

What Determines Mortgage Rates

Mortgage rates fluctuate for the same reasons home prices change supply, demand, inflation, and even the U.S. employment rate can all impact mortgage rates. The demand for homes isnt necessarily a sign of where mortgage rates are headed. The best indicator of whether rates will go up or down is the 10-year Treasury bond rate.

When a lender issues a mortgage, it takes that loan and packages it together with a bunch of other mortgages, creating a mortgage-backed security , which is a type of bond. These bonds are then sold to investors so the bank has money for new loans. Mortgage bonds and 10-year Treasury bonds are similar investments and compete for the same buyers, which is why the rates for both move up or down in tandem.

Thats why, in a slumping economy, when more investors want to purchase safer investments, like mortgage-backed securities and treasury bonds, rates tend to go down. The Federal Reserve has been purchasing MBS and treasury bonds, and this increased demand has led to the lowest mortgage rates on record.

Don’t Miss: How Much Personal Loan Can I Get On 30000 Salary

Why Do People Need Mortgages

The price of a home is often far greater than the amount of money that most households save. As a result, mortgages allow individuals and families to purchase a home by putting down only a relatively small down payment, such as 20% of the purchase price, and obtaining a loan for the balance. The loan is then secured by the value of the property in case the borrower defaults.

Average Interest Rate: Getting The Best Rate For Your Home

When taking out a mortgage for your new home, one of the most important things is its mortgage rate. This will determine how much you pay with each mortgage payment and can be influenced by numerous factors. Depending on the lender, mortgage rates can also vary greatly in their terms.

In this guide, we go over essential information about mortgage rates, including tips on how to get better rates on your mortgage.

You May Like: What Is The Emi For 20 Lakhs Home Loan

Faqshome Loans In Malaysia

Update: As of 2nd January 2015, Base Lending Rate has been updated to Base Rate to reflect the recent changes made by Bank Negara Malaysia, and subsequently by major local banks. Buying a house is probably the most important purchase you’ll ever make. Your home loan is likely to be not only your biggest household expense, but the largest financial commitment of your lifetime. For this reason, we’ve compiled a short guide to explain how a home loan works, and what you need to know before you apply for a mortgage.

Why Did My Home Loan Get Rejected

dont get your hopes dashed! Top 10 Reasons Your Loan Application Was RejectedBank Loan Execs Share Why Home Loan Applications Are Rejected

- Unfavourable credit score.

- Not submitting the right documents.

- Flaws in the documents prepared.

- Different banks have different policies, you may get accepted at one but rejected at the next.

Also Check: How To Discharge Student Loan Debt

What About Shorter Fixed

Lenders typically offer an initial rate to entice buyers to get a mortgage with them. This initial rate is usually fixed for a set amount of time.

Traditionally, the fixed period is between two and five years, although longer-term options are becoming increasingly common on the market. The average rate for a five-year year fix is about 1.74%. After the initial five-year period, the mortgage would revert to the SVR, which is usually around 4.1%.

Average Mortgage Interest Rate By Type

There are several different types of mortgages available, and they generally differ by the loan’s length in years, and whether the interest rate is fixed or adjustable. There are three main types:

- 30-year fixed rate mortgage: The most popular type of mortgage, this home loan makes for low monthly payments by spreading the amount over 30 years.

- 15-year fixed rate mortgage: Interest rates and payments won’t change on this type of loan, but it has higher monthly payments since payments are spread over 15 years.

- 5/1-year adjustable rate mortgage: Also called a 5/1 ARM, this mortgage has fixed rates for five years, then has an adjustable rate after that.

Here’s how these three types of mortgage interest rates stack up:

| Mortgage type |

Read Also: Is Cash Loan Usa Legit

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score of both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Can I Withdraw Excess Money Paid Into My Home Loan Account

Absolutely and at zero cost. But, in order for you to be able to access that piled up cash deposited into your home loan account, you need to make additional payment on top of your monthly instalment.

For example, if your monthly instalment amount is RM1,000 and you have been consistently topped up extra RM500 over 12 months or so period, you will be able to withdraw that additional payments anytime you want it.

But remember, there a difference between making additional payment and prepayment. For the latter, you cannot withdraw part of the money deposited as you are redeeming the home loan.

Recommended Reading: What Kind Of Mortgage Loan Should I Get

Interest Rates On New Home Loans

As of January 2022, the current interest rate for new home loans in Australia is 2.52% this number is on a downhill trend. In January 2021, the interest rate was 2.79%, and in January 2020, it was 3.26%.

The drop in the interest rate between 2020 to 2021 was larger than 2021 to 2022. Therefore, if the interest rate follows the same trend, the interest rate for new home loans will drop by roughly 0.15% by January 2023.

When Should You Lock In Your Mortgage Rate

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock it in, the rate should be preserved as long as your loan closes before the lock expires.

If you dont lock in right away, a mortgage lender might give you a period of timesuch as 30 daysto request a lock, or you might be able to wait until just before closing on the home.

Once you find a rate that is an ideal fit for your budget, its best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While its not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan.

If you dont lock in your rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement in order to lower your interest rate costs.

Also Check: How To Qualify For 3.5 Fha Loan

How To Use A Housing Loan Calculator

iMoney has created a housing loan calculator that makes calculating the monthly repayments easy for you. To use the mortgage calculator just scroll up to the top of this page, type in the property price that you would like to borrow and for how long. It will do all the calculations and will present you with the best mortgage deals for you.iMoney has created a housing loan calculator that makes calculating the monthly repayments easy for you. To use the mortgage calculator just scroll up to the top of this page, type in the property price that you would like to borrow and for how long. It will do all the calculations and will present you with the best mortgage deals for you.

Typical Ontario Mortgage Amounts

Finding the right mortgage has a lot to do with determining what you can afford. And that depends on where you live.

Below are typical mortgage amounts for someone putting down 20% in select Ontario cities. Theyre based on a 30-year amortization and average purchase prices as tracked by the Canadian Real Estate Association :

- Barrie and District: $570,800

| 2,130 | 0.10% |

Thanks to Ontarios stable economy and housing market, it tends to have lower arrears rates than other provinces.

Recommended Reading: Chase Recast Mortgage

You May Like: Which Bank Has The Best Personal Loan Rates

What Determines My Mortgage Interest Rate

Your mortgage rate is influenced by a variety of factors that fit into two categories:

- The current economic climate: Factors like inflation and the Federal Reserves benchmark rate can have a big influence on current mortgage rates

- The specifics of your financial life: Within the context of the mortgage market, your personal finances help determine your precise interest rate

While you cant control the federal funds rate or other economic conditions, you can do things to improve your personal finances before applying for a mortgage loan.

Any change to one of the following seven things can directly impact the specific interest rate youll qualify for.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: How To Get 10000 Loan Instantly

Should I Get An Open Or Closed Mortgage In Ontario

With an open mortgage, you can pay down as much of your principal as you want in a given year without restriction. However, open mortgage rates are higher. So you are essentially paying more for flexibility.

With a closed mortgage, prepayments are restricted and interest penalties are enforced on any overpayment, but your rate will be lower than an open mortgage rate.

In Ontario, closed mortgages are the more popular option as most people donât expect to pay more than their monthly mortgage payment. However, an open mortgage could be a good choice if youâre planning to move soon or expect to receive a lump sum of money during your mortgage term.