Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

Aside From Salary What Determines Your Home Buying Budget

Even though salary is a huge determining factor in affordability, other factors also impact your budget.;

The reality is, two applicants earning $70,000 a year might qualify for two different mortgage amounts based on factors such as:;

- Down payment

- Debt-to-income ratio

- Employment history

We showed you the numbers above. But heres a little more information on what each factor means and why its important to a mortgage lender.

Down payment

Most home loan programs require a minimum down payment between 3% and 5%.

A bigger down payment reduces the amount you have to borrow to buy a home. This lets you either afford more house by keeping your down payment percentage small or reduce your monthly housing expenses by taking out a smaller loan.

If you put down at least 20 percent, you can avoid PMI, which will make your monthly payments more affordable and can increase your buying power.

When youre budgeting for a down payment, remember to include closing costs in your calculation, too.

Closing costs are typically between 2 and 5 percent of the loan amount, which can add a few thousand dollars to your out-of-pocket costs.

Your credit score also plays a role in affordability. The higher your credit score, the lower your mortgage rate.;

Interest not only determines your total loan cost, but it also affects how much you pay on a monthly basis.;

Debt-to-income ratio

When calculating affordability, your lender also considers your current debt load.;

Employment history

Who Can Help You In The Mortgage Market

There are many lenders in Canada serving the mortgage market: banks, other large financial institutions & mortgage brokers. Most mortgage brokers in your town or city have access to a broad range of local & nationwide lenders. A good mortgage broker is normally able to put you into a program at a competitive rate. Banks like the Bank of Nova Scotia are national and can also provide immediate financing for your loans. In practice, however, most buyers end up pre-qualifying with a bank or a realty institution through their real estate agent or mortgage broker. In that process, your needs and requirements are taken into consideration and matched with a lender that can provide the best service for you. In other words, you may end up with a completely different bank holding your paper than when you started. As long as the loan is backed and it meets your terms, you should feel confident in signing it.

Read Also: How Long Until You Can Refinance An Fha Loan

How Much Mortgage Can I Borrow On My Salary

Lots of potential homeowners come to us for advice about how much house they can afford based on the salary they earn. Most mortgage lenders will consider lending;4 or 4.5 times a borrowers income, so long as you meet their affordability criteria. In some cases, you could find lenders willing to go up to;5 times income.

In a few exceptional cases, you might be able to borrow as much as;6;or;7 times your income. Although to find lenders willing to lend at levels this high, its likely you will need help from a specialist mortgage broker.

According to the most recent;Annual Survey of Hours and Earnings, the average annual salary in the UK is £28,677.

However, this amount is not representative of everyone and its important to know that even on a lower income, you may still be able to get a mortgage.

To find out how much you could get, make an enquiry. Well match you with an expert who can source the best mortgage loans for your circumstances via their whole-of-market access.

The following topics are covered below…

How To Check Home Loan Eligibility

Individuals can easily check their home loan eligibility criteria on the official website of their preferred lending institution. Although most key requirements are usually the same, certain eligibility criteria may differ from lender to lender. These eligibility criteria are basically a set of parameters based on which a lender can assess a borrowers creditworthiness and past repayment behaviour. It depends on several factors, including credit history, age, credit score, financial obligations of an individual along with FOIR and financial status.Another easier and quick way to determine loan eligibility is to use an online home loan eligibility calculator. One can use this calculator to work out a personalised quote that can possibly meet the loan amount requirement on favourable and affordable means.

Don’t Miss: How Much Do I Pay For Student Loan

How Can I Drop An Ltv Band

To drop a loan-to-value band youll need to secure a larger deposit or increase your equity, which will allow you to secure a smaller mortgage in relation to the value of your property. If you cant afford a larger deposit, the only other way to secure a lower LTV is to buy a cheaper property, which would mean your deposit takes up a higher proportion of the propertys value and would reduce your LTV accordingly.

Multiply Your Annual Income By 25

In this rule of thumb, you begin with your gross annual income. Thats the income from your W-2 . Multiply this number by 2.5 to estimate the maximum value of the home you can afford. However, keep in mind that the lower the interest rate you can obtain, the higher the home value you can afford on the same income. This is why your credit score is so important. Lets take a look at a few examples.

How much house can I afford if I make $50K per year?

On a 50k salary, how much mortgage could you afford? According to this rule of thumb, you could afford $125,000 . Lets say you have a 4.5 percent interest rate and choose a 30-year mortgage. Your monthly mortgage payment would be $633. With interest, youd pay a grand total of $228,008.

How much house can I afford if I make $70K per year?

Lets look at a mortgage on 70k salary. Assuming the same 4.5 percent interest rate and a 30-year term, you could afford a mortgage of $175,000 . This translates into $887 per month, totaling $319,212 after 30 years.

How much house can I afford if I make $100K per year?

If youre wondering with 100k salary how much house can I afford, the 2.5 rule gives you a mortgage of $250,000. Using a 4.5 percent interest rate and a 30-year term, this translates into $1267 monthly, which equals $456,017 over 30 years.

How much house can I afford if I make $200K per year?

Recommended Reading: When To Apply For Ppp Loan Forgiveness

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

Mortgage Affordability And Your Down Payment

Because Canada has minimum down payment rules in place, the amount of money you’ve saved for a down payment can limit your maximum mortgage affordability. The minimum down payments in Canada are:

- 5% of the purchase price up to $500,000, plus

- 10% of any part of the price between $500,000 and $1 million, or

- 20% of the total purchase price for homes valued at over $1 million.

Let’s consider an example. If your down payment amount is fixed at $15,000, the maximum home price you will be able to afford is $15,000 divided by 5%, or $300,000. If your down payment is $30,000, then your maximum affordability will increase to $550,000. You can run the numbers yourself on our mortgage affordability calculator.

Recommended Reading: How To Find Student Loan Interest

What If You Can’t Afford A House

There’s nothing more frustrating than wanting to buy a home and either getting denied for a mortgage or deciding you can’t really afford it. This can be an especially big problem for people who live in areas where housing is very expensive.

If you can’t afford a home, don’t get discouraged. Saving for a larger down payment can help you qualify for a better interest rate and make mortgage payments lower so you’re better able to afford monthly costs.

You can also consider options such as looking for a cheaper home you could fix up over time, or buying a home that has room for tenants or roommates who can help you subsidize costs.

Home Loan Amount Calculation

The final approved or sanctioned amount would be lesser if you have multiple credit cards, rental expense, car or personal loan reported on your;:

If you shop around using credit cards, the total of minimum payment each month on all cards is REQUIRED to be deducted from your NET pay to reach the loan eligibility.

This is generally 10% of your total credit limit. In our example, this comes out to be INR 1,000 per month.

Now, reduce your NET pay by another 1k to reach at 44,250.

#2Car, Personal, Gold loan

If you have an existing car, personal or gold loan, do deduct the monthly EMI amount from your net pay. In our case, we have assumed to have none.

#3Home Rent

If you are trying to take a home loan for an under construction property, the bank will reduce the final amount by the rent you pay monthly.

We have assumed to be buying ready to move in home and hence no more deductions.

At this point, you should have the NET pay that the bank will consider for finding your maximum loan qualification.

To answer your question: How much loan will I get approved for, simply multiply 44,250 by 60.

You May Like: What Is My Monthly Loan Payment

Got $1000 The 10 Top Investments Wed Make Right Now

Our team of analysts agrees. These 10 real estate plays are the best ways to invest in real estate right now. By signing up to be a member of Real Estate Winners, youâll get access to our 10 best ideas and new investment ideas every month. Find out how you can get started with Real Estate Winners by .

Christy Bieber is a full-time personal finance and legal writer with more than a decade of experience writing for the â¦Learn More

- Learn More About Real Estate Market

Who Is This Calculator For

This calculator is most useful if you:

- Are a new potential homeowner needing to know your budget constraints

- Have decided on a new home but want to ensure you can afford it

- Are looking to plan and budget for the future

Once you’re entered your information and obtained your results, you can use the;Get FREE Quote box at right to request personalized rate quotes tailored to you from mortgage lenders.; This will give you a better idea of what interest rate to expect and help gage your ability to qualify for a mortgage.

Don’t Miss: How To Apply Loan In Sss

Should I Take The Maximum I Can Borrow

Again, this all comes down to your own personal level of affordability, and how comfortable you are with being able to afford the maximum amount. Remember that the bigger the mortgage, the higher your repayments are going to be, so while it can be tempting to take the maximum amount offered particularly if it means you can afford a larger property it may be wise to exercise a bit more caution.

What Will My Monthly Repayments Be

Your repayments, like the amount of interest you pay and how much you can borrow in the first place, will depend on a number of factors. These include:

- the interest rate

- how long youâll be paying it off for

- the frequency of the repayments

As an example, if youâre taking out a loan of $250,000 for 25 years and paying an interest rate of 3.50% p.a., your monthly repayments will be $1,252.;

If youâre able to commit to more frequent repayments – that is, by paying weekly or fortnightly – youâll be able to save more in interest over the life of your mortgage. For example, letâs say you opt to pay your loan in fortnightly installments, in which case youâd be paying $577 per fortnight. Because youâre making more frequent repayments, over 25 years, you could pay more than $1,000 less than if you were paying monthly.

Don’t Miss: Can You Refinance Your Car Loan With The Same Company

The Rules Of Home Affordability

Mortgage lenders use something called qualification ratios to determine how much they will lend to a borrower. Although each lender uses slightly different ratios, most are within the same range. Some lenders will lend a bit more, some a bit less. We have taken average qualification ratios to come up with our three rules of home affordability.

Can I Borrow Up To Five Times My Salary

It is possible to borrow five times your salary but only if you meet the lenders affordability tests and requirements for loan-to-value and minimum salary. To get a mortgage of this scale, youre likely to need a deposit of at least 10%, if not more to have access to a wider range of mortgage deal and may face a maximum lending cap. Some borrowers may look to lengthen their mortgage term to thirty years help make monthly payments more affordable.

You May Like: Are There Student Loan Forgiveness Programs

How Much Income Is Needed For A 200k Mortgage

A $200k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $54,729 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a broader range of interest rates.

How Lenders Decide How Much You Can Afford To Borrow

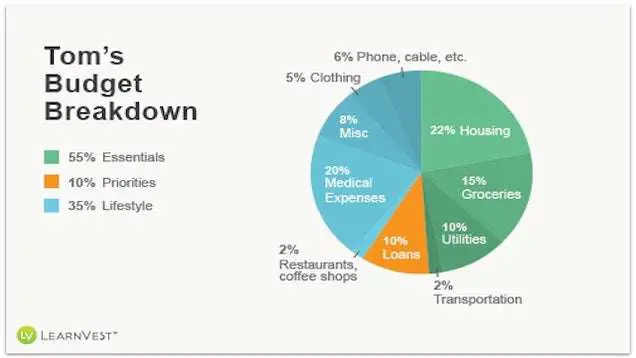

Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio.

Your;debt-to-income ratio;is the percentage of pretax income that goes toward monthly debt payments, including the mortgage, car payments, student loans, minimum credit card payments and child support. Lenders look most favorably on debt-to-income ratios of 36% or less or a maximum of $1,800 a month on an income of $5,000 a month before taxes.

Recommended Reading: How To Calculate Amortization Schedule For Car Loan

I Don’t Know What To Enter For Property Taxes Or Homeowners’ Insurance

You can leave these and most other boxes blank if you don’t know what those costs might be, and the Mortgage Qualifying Calculator will generate an answer without them. The same for the inputs under Down Payment and Closing Costs, and Total Monthly Debt Payments. But your results will be more accurate and useful if you can provide these figures.

Is A Large Down Payment Really Necessary

Coming up with a down payment is one of the biggest struggles for many home buyers. And technically, you don’t need a 20% down payment.

You can qualify for FHA loans with a down payment as low as 3.5%, and many conventional mortgage lenders also allow you to put down less than the 20% recommended amount.

But, if you don’t put down at least 20%, you’ll typically have to pay private mortgage insurance monthly. PMI typically costs around 0.5% to 1% of the total loan value. It’s insurance that protects the lender in case you get foreclosed on and the lender doesn’t recoup all costs. It doesn’t benefit you at all, but you’re the one stuck paying.

You’re also at serious risk of becoming trapped in your home if you put too low a down payment.

If you need to move, your home is worth exactly what you paid for it, and you put down either no down payment or a very low down payment, you could still have serious financial problems.

You’d likely need to pay realtor commissions equal to around 6% of the home’s value for selling your home — plus a few thousand dollars for closing costs. This is money you might not have, especially if you’re moving because the home’s become unaffordable due to a job loss.

The risks are very substantial. So, if you can’t afford to make a 20% down payment, think seriously about whether you can actually afford a home.

Read Also: How To Apply For Direct Loan

How Much Do I Need To Make To Afford A 150k House

This depends on the amount youre able to put down as a deposit. If youre a first-time buyer and only have a 5% deposit to put down, youd need to be earning around £32,000 to be offered the £142,500 mortgage required for a £150,000 house. If on the other hand you could put down a deposit of 10% you might only need to earn £30,000, or if you had a 20% deposit, youd need a smaller mortgage of £120,000 and therefore a lower salary of around £27,000. Remember that if youre buying jointly, the income requirements can be split between you.