Current & Historic Federal Student Loan Interest Rates

With the passing of the Coronavirus Aid, Relief, and Economic Security Act , no interest will accrue on federal student loans in repayment until January 31, 2022effectively setting the interest rate at 0%. Payments made during this time will first apply to unpaid interest accrued from before March 13, 2020, then directly towards the principal balance of the loan.

In the following table,;you will find the current and historic interest rates for federal loans. These rates coincide with the academic year that the loans were taken out .

It should be noted that;all of these are fixed rates, meaning that they do not change over time.

| Loan type | |

| 6.31% | 6.84% |

Federal student loans are issued by the Department of Education to eligible students who fill out the Free Application for Federal Student Aid, or FAFSA. The interest rates on these loans are set once a year and are based on the 10-year Treasury note.

Heres how interest works for different borrowers:

An added cost to federal loans worth mentioning comes in the form of an origination fee. Unlike most private lenders, the Department of Education deducts a fee from your loan amount prior to disbursement. This deduction means that your loan amount will be a bit higher than the funds disbursed to your school.

Here are the current and historical origination fees for federal student loans.

| Loan type | |

| 4.27% | 4.29% |

Student Living Allowances For School Year 2018 To 2019

Actual monthly allowance by province/territory

These are the monthly amounts a student receives based on the cost of shelter, food, miscellaneous expenses and public transportation in their province or territory.

| LIVING SITUATION | |

|---|---|

| SINGLE STUDENT AWAY FROM HOME | |

| Shelter | 495 |

| Miscellaneous | 234 |

| SINGLE PARENT | |

| Shelter | 818 |

| Miscellaneous | 234 |

| Shelter | 989 |

| Miscellaneous | 467 |

| Miscellaneous | 104 |

| SINGLE STUDENT LIVING AT HOME | |

| Shelter | |

| Miscellaneous | 201 |

Note: Provinces and territories determine their monthly ceiling .

Interest Rates On Student Loans

Whether you have a federal or a private student loan, an interest rate is the rate charged to borrow money. Its calculated as a percentage of your Current Principal. There are two primary types of interest rates: fixed and variable.

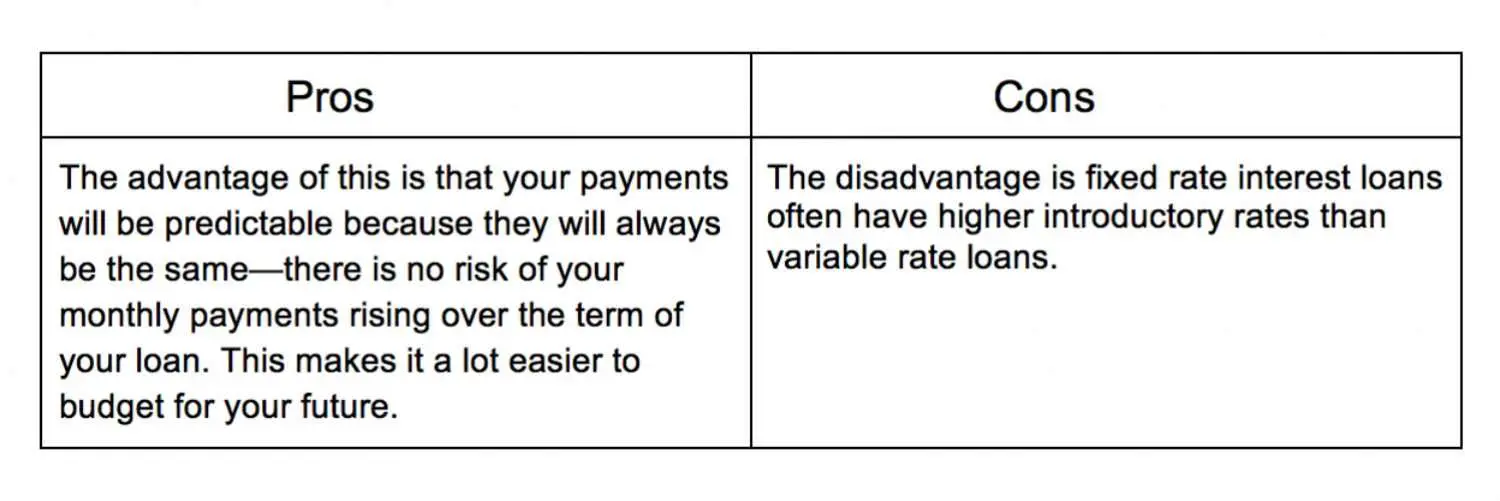

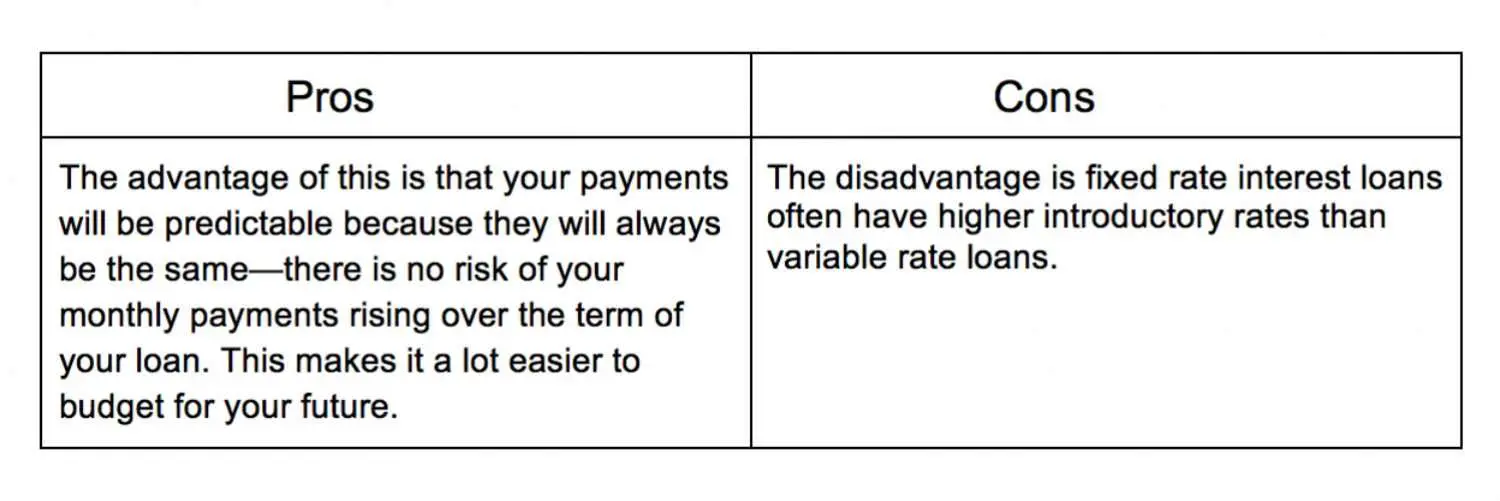

A fixed interest rate is an interest rate that stays the same for the life of the loan.

A variable interest rate is an interest rate that may go up or down due to an increase or decrease to the loans index. Variable rate Sallie Mae loans applied for on or after April 1, 2021, use the Secured Overnight Financing Rate as the index. Variable rate Sallie Mae loans applied for before April 1, 2021, use the London Interbank Offered Rate as the index. These loans will be converted to SOFR in the second quarter of 2022.

Both LIBOR and SOFR are common rates used for loans and reflect the ups and downs of the market at large.

Federal student loans only offer a fixed interest rate. Our private student loans generally offer a choice of fixed or variable rates.

Don’t Miss: What Is Certificate Of Eligibility Va Home Loan

How Interest Rates Affect Repayment

Student loan rates determine the total amount of money a borrower must repay over the course of their loan term.;

For example, lets say you were to take out a $50,000 student loan with an annual interest rate of 5%. That would mean in addition to the $50,000 youve got to borrow for your education, youll need to repay an extra $2,500 worth of interest at the end of each year. However, most student loan interest compounds, meaning, interest is charged on interest. That means your interest payment would be even more than $2,500.

How Can I Reduce The Interest Rates On My Student Loans

The interest rate on federal student loans, while fixed annually for the life of the loan, does fluctuate over time. For example, for the 2021-2022 school year, Direct subsidized and unsubsidized loans for undergraduates increased to 3.73% from 2.75% for the 2020-2021 school year.

To adjust the rate on an existing student loan, borrowers generally have two options. They can refinance or consolidate the loans with hopes of qualifying a lower interest rate.

Refinancing a federal loan with a private lender eliminates them from federal borrower protections such as income-driven repayment plans or Public Service Loan Forgiveness. The federal government does offer a Direct Consolidation loan, that allows borrowers to consolidate their federal loans into a single loan. This will maintain the federal borrower protections but wont necessarily lower the interest rate. When federal loans are consolidated into a Direct Consolidation Loan, the new interest rate is a weighted average of your original federal student loans rates.

Refinancing student loans with a private lender may allow qualifying borrowers to secure a lower interest rate or preferable loan terms. Note that extending the repayment term will generally result in an increased cost over the life of the loan.

To see how refinancing could work for your student loans, take a look at the student loan refinance calculator.

Read Also: When Can I Apply For Second Ppp Loan

How Exactly Are Student Loan Interest Rates Determined

Federal student loan interest rates are determined by federal law and based on the results of a U.S. Treasury auction that takes place each May. Rates either go up, go down, or stay the same depending on the results of that auction.

Federal law fixes Direct Loan interest rates at 2.05 percentage points above the 10-year Treasury yield on notes sold to investors. Parent PLUS Loan rates are fixed at 4.60 percentage points above the 10-year Treasury yield. In the May 12, 2021 Treasury auction, the yield on the 10-year note came in at 1.684, so the new Direct Loan interest rate for the 2021-22 academic year will be 3.734%, and the Direct Parent PLUS loan rate is projected to be 6.284%.

My Student Loans Are Currently Paused Does This Affect Me

Federal student loan payments are currently paused through September 30, 2021 through temporary student loan forbearance. Interest rates on federal student loans are temporarily set to 0%. However, this student loan relief is for current student loans only. This interest rate increase applies to new student loans borrowed. If this student loan relief expires, your federal student loan payments and regular interest rate will resume starting October 1, 2021. Its possible that President Joe Biden may extend this student loan relief beyond September 30, but absent an extension, you should expect to restart student loan repayment on October 1.

You May Like: What Is Escrow In Mortgage Loan

How Much Can You Borrow

In addition to private loans, there are three main types of federal student loans: Direct Subsidized, Direct Unsubsidized, and Direct PLUS.

First, consider a Direct Subsidized Loan. Subsidized federal loans are simple to obtain, usually less expensive than PLUS or private loans, dont require a or cosigner, and have built-in protections and repayment options that unsubsidized, PLUS, and private loans don’t have. Subsidized federal loans are available for undergraduate students only. Unsubsidized federal loans can be taken out by both undergrads and graduate/professional students.

What Does This Mean For Borrowers

If a borrower took out loans before July 1, then the new interest rate increase won’t be applied to those loans. However, after July 1, the increased rates will apply to any loans taken out. Still, borrowers do not need to be making any payments on loans until at least October, and if the payment pause is further extended, as Education Secretary Miguel Cardona recently hinted at, the interest rate once payments restart will depend on when the loans were first taken out.

Kantrowitz said that even if payments do restart in October, if interest rates continued to be kept at zero, it “doesn’t save you all that much money.” A report released on April 5 by Upgraded Points a travel research group found that the pause on interest during the pandemic has only saved borrowers on average $2,001.

So in the grand scheme of things, this interest rate increase on student loans will likely not significantly impact payments, and are actually low compared to previous years.;

Meanwhile, Democrats are calling for Biden to cancel $50,000 in student debt per borrower, which Kantrowitz said would immediately impact borrowers with debt loads under $50,000.

Don’t Miss: What Kind Of Loan Do I Need To Buy Land

How Interest Rates Work On Student Loans And How To Spot A Good One

When it comes to interest rates and student loans, most people know one thing: a lower interest rate is better than a higher interest rate. For the upcoming school year, the good news is that student loans are being offered at near historically low interest rates, so there are many good deals to be had.

However, its probably no surprise that theres more to an interest rate than meets the eye. Digging into the fine print can reveal ways to pay off your loan faster or expose landmines that could end up costing you more money.

So today, lets ditch the bank speak and talk like humans. Let us give you the scoop on how interest rates can work with you or against you.

How Much Can I Save By Going With A Variable

The potential savings offered by a variable-rate loan will depend upon the lender selected and the repayment length chosen.

Our most recent review of the best refinance rates shows that borrowers on a 5-year loan can get an interest rate of around 2%, while those who opt for a fixed-rate loan can get an interest rate of around 3%. However, not all lenders offer the same discount for selecting a variable-rate loan. At times we have seen some lenders offer the same starting rate in both the variable and fixed-rate category.

For private student loan borrowers, the discount for selecting a variable-rate loan is about the same as the discount in a refinance.

Ultimately, the only way to know for certain how much one might save by selecting a variable-rate loan is to shop around for both loan types and compare the potential costs.

You May Like: Can Closing Costs Be Included In Refinance Loan

How Do Lenders Set Private Student Loan Rates

To get a private student loan, you will apply directly to the lender. Each private lender has its own underwriting process and standards for student loan applicants; these eligibility requirements help lenders decide whether to give an applicant a loan, and at what interest rate.

To qualify for a private student loan, you must meet the lenders underwriting standards or apply with a cosigner who does. Common eligibility requirements for approval include your credit score, credit history such as whether youve paid bills on time and income. The lender might also consider factors such as what degree you are working toward and your career history or field of study.

Unlike federal student loans that offer universal rates, private lenders use their own lending models to set and offer individualized rates for each borrower. Here are the three main factors that affect the rates lenders offer on private student loans.

1. Your credit score

Lenders use your credit score and history to set private student loan interest rates. Typically, the better your credit, the more likely a lender is willing to finance a loan at a lower rate. Thats because youve shown youre capable of repaying your debts and pose a lower risk of default.

To get the most favorable rates and terms on a private student loan, lenders generally require a credit score in the good-to-excellent range, which means a score of at least 670 but the higher, the better.

To maintain a good credit score:

How To Calculate How Much Interest You Will Owe

Every month, the interest amount you owe on your loan is recalculated using a daily interest formula based on your total outstanding loan amount:

Interest amount = Outstanding principal balance x Number of days since last payment x Interest rate factor

The interest rate factor is your annual interest rate divided by the number of days in the year. Your loan servicer is responsible for billing you monthly and explaining how your payments are applied to your principal balance.

You can use our student loan payment calculator to see how much your loan will cost in the long run after interest is accounted for.

Note that if you enter into forbearance or deferment on your loans, or sign up for an extended or income-driven repayment plan, your loans will accrue more interest over time making them more costly.

>> Read More: How Student Loan Interest Works

Read Also: What Is The Average Auto Loan Interest Rate

How Are Mortgage Rates Determined The Truth About

We know that a mortgage is a loan on a house, there for the mortgage rates are simply the interest rate on that loan. These rates are determined by the lender.

Jul 24, 2018 Factors That Determine Your Interest Rate · Credit Score · Debt-to-Income Ratio · Type of Loan · The Amount of Your Mortgage · Where You Live.

Banks, therefore, calculate the interest rates on the money they lend based on the interest rates they are getting on the money they have;

Credit History/Credit Score; Mortgage Points; Down Payment Amount; Loan Type; Loan Term; Type of Interest Rate. Mortgage rates are updated regularly and are;

Understand Capitalized Interest On A Student Loan

Capitalized interest is a second reason your loan may end up costing more than the amount you originally borrowed.

Interest starts to accrue from the day your loan is disbursed . At certain points in timewhen your separation or grace period ends, or at the end of forbearance or defermentyour Unpaid Interest may capitalize. That means it is added to your loans Current Principal. From that point, your interest will now be calculated on this new amount. Thats capitalized interest.

Don’t Miss: What Is The Role Of Co Applicant In Home Loan

Interest Rates For Private Student Loans

Interest rates on private student loans are almost always higher than those for federal loans, but with the historically low lending rates offered in 2019-2020, the market has suddenly become much more competitive.

That is important to students who have reached their borrowing limit on federal loans, but still need money to complete a degree. It also helps students have a good credit score or a co-signer with a good credit score, and could be eligible for the lowest rates available from private lenders.

A survey of six lenders SunTrust, Ascent, SoFi, CommonBond, Discover and Sallie Mae showed fixed rates ranging from 4.29% to 12.49%, while variable rates were offered from 1.80% to 14.18%.

Prospective students should keep a close eye on interest rates if they are considering private student loans. If available rates are 3% to 4%, it can be an enticing option compared to federal student loans.

You can also consolidate private student loans, possibly saving money on your monthly payment, depending on your credit score and income.

With a variable rate, though, you might start with a very low rate and end up with one in the double digits.

Federal student loans are funded through the government and credit scores are not a factor. Private student loans, on the other hand, are acquired from a bank, credit union or online lenders and credit scores are a big factor in determining the interest rate.

How To Choose A Loan

If youre trying to choose between student loan providers, there are few things you should consider, including:

- Interest rates

- Loan eligibility requirements for you or your cosigner

- Repayment terms, such as number of years, options for paying while in school, penalties for early repayment, and grace periods after youre no longer in school

- Options for forbearance;if you cant pay for some reason

- The lenders reputation

If youre looking for a private student loan, its important to make sure that youre working with a lender that doesnt issue predatory loans, that is, loans with terms that are likely to put the borrower into default.

Published in:Private Student Loans

About the Author

Carol Katarsky is a contributing writer for Nitro. She is an award-winning journalist with extensive experience writing about both finance and education. Her corporate and non-profit clients include AIG, Children’s Hospital of Philadelphia, and the Project Management Institute. She lives in Philadelphia with her husband, son, and one cat more than she should. Read more by Carol Katarsky

More Articles in Private Student Loans

Don’t Miss: How To Eliminate Student Loan Debt

What Is The Average Student Loan Interest Rate

So, what is the average student loans interest rate?

The interest rate on a student loan varies based on the type of student loan. Federal student loans have a fixed interest rate, meaning it is set for the life of the loan. This interest rate is set annually by Congress. The current interest rates for federal student loans disbursed between July 1, 2021 and July 1, 2022 have been set at:

;;3.73% for Direct Subsidized Loans and Direct Unsubsidized Loans for undergraduate students

;;5.28% for Unsubsidized Loans for graduate or professional students

;;6.28% Direct PLUS loans for parents, graduate or professional students

Private student loan interest rates vary by lender and each have their own criteria for which rates you qualify for. Private lenders also may offer different interest rates if you have a cosigner on your student loan. Private student loans also may offer variable interest rates, meaning they can start lower than a fixed interest rate but then go up over time, based on market changes.

The interest rates on private student loans can vary anywhere from 1% to 13%, depending on the lender, the type of loan, and on individual financial factors including the borrowers credit history.

Recommended: Types of Federal Student Loans