Fha Credit History Standards

Your credit score is just a three-digit number. Your credit history details your payments for each of your debt accounts.

Lenders look for red flags in your credit history that might indicate you will not repay the loan. Occasional, infrequent late payments on a credit card, for example, will not raise a concern if you can explain why they occurred.

Collections and late payments are evaluated on a case-by-case basis. Lenders may overlook occasional late payments on your cable bill or clothing store credit card. A serious delinquency in these types of accounts would reflect negatively on your credit score. However, lenders are more concerned about late payments on your rent or mortgage. Lenders see a history of late rent and mortgage payments as a sign you may default on future home loans.

If you defaulted on a federal student loan or have another unpaid federal debt, you will be required to come up to date and have the debt either paid off in full or be current for several months. Similarly, judgments against you must be paid. Sometimes credit issues are beyond your control. The FHA realizes this and creates programs that take into account how one’s credit history may not reflect that person’s true willingness to pay on a mortgage.

If you experienced a bankruptcy, short sale, foreclosure or a deed in lieu of foreclosure in the last two years, check out this foreclosure page to learn about your mortgage options.

Fha Dti Ratio Standards

You must show lenders you have the means to make your monthly loan payments consistently.

Lenders use several tools to assess your ability to repay a loan. One of the most important is a number called the debt-to-income ratio . Your DTI ratio is the total of all of your debt divided by your gross monthly income. The lower the ratio, the less of a debt load you carry.

How Much Can You Cash Out With An Fha Loan

The FHA cash-out refi program has a maximum allowed loan-to-value ratio of 80% of the appraised value of your home, meaning you must maintain at least 20% equity in the home. The amount youd pocket from the transaction depends on how much you still owe on your current mortgage.

Example: On a $250,000 home, you are required to keep at least $50,000 in home equity after the cash-out refinance. Since you can borrow up to 80% of the homes value, the biggest FHA loan you could potentially get would be $200,000.

Now assume you still owe $150,000 on your existing mortgage. After using the new mortgage to pay off that balance, $50,000 remains. Once you subtract closing costs, say $3,000, the remaining $47,000 would be available to you as a lump sum.

Note the 80% allowable LTV ratio might not apply if your home is expensive and your loan exceeds the FHA limit. Each year, the FHA sets dollar limits for mortgages it will insure. In 2022, the limit is generally $420,680, although designated high-cost areas have special limits as high as $970,800.

Recommended Reading: Usaa Rv Financing

Fha Down Payment Faqs

What is the minimum FHA down payment?

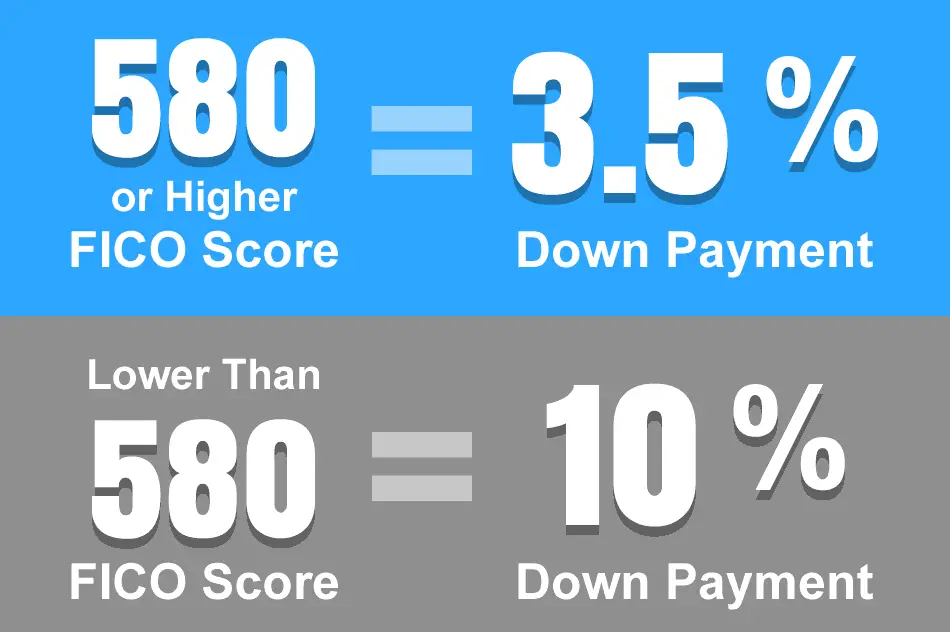

The minimum FHA down payment is 3.5%. Applicants with credit scores between 500-579 must put down at least 10%.

What is the average FHA down payment?

The average first-time homebuyer in the U.S. puts 7% down, according to the National Association of Realtors. But most FHA borrowers put down less than 5%.

What happens if I put 20% down on an FHA loan?

If you put 20% down on an FHA loan, you would pay a lower annual mortgage insurance premium. The premium requirement would also stop after 11 years.However, if you have 20% to put down and your credit score is 620 or higher, you may want to pursue a conventional loan instead. Conventional loans do not require mortgage insurance if you put down 20%, and the private mortgage insurance requirement falls off at 22% equity.

Can you put less than 3.5% down on an FHA loan?

No. But you can use grants or forgivable loans from local down payment assistance programs, as well as gift funds, to reach the minimum 3.5% FHA down payment. FHA loans do not have a minimum borrower contribution, which means a relative, friend, or your employer can pay your full down payment on your behalf.

Can I get an FHA loan with no down payment?

No. FHA loans require at least 3.5% down for borrowers with credit scores of 580 or higher, and a 10% down payment from borrowers with scores between 500-579. The USDA and VA loan programs offer 0% down payment mortgages, but you must meet the eligibility requirements.

Are Fha Appraisals Stricter Than Conventional Mortgage Appraisals

They can be. But lenders require appraisals for conventional loans as well. And if the appraisal comes up short, conventional borrowers face the same dilemma as FHA homebuyers pay the difference in cash or walk away from the sale.

Appraisers for a conventional loan also determine the value of the property and look out for any livability or potentially hazardous issues. Most properties need to have the basics running water, access to sewage services, heat and hot water, sufficient living space, no obvious safety hazards or infestations in order to qualify for financing.

But only FHA-approved appraisers can conduct appraisals for FHA loans. Again, most homes will meet the FHAs criteria. But an appraiser may call out certain issues for repair, and lenders cannot approve an FHA loan until those fixes are made and documented.

Read Also: How Does Someone Take Over A Car Loan

Can You Borrow With Your Current Income

Though you may feel that your finances are ready for a new home, the bank may not feel the same way. Mortgage lenders use a complex set of criteria to determine whether you qualify for a home loan and how much you qualify for, including your income, the price of the home, and your other debts.

The pre-qualification process can provide you with a pretty good idea of how much home lenders think you can afford given your current salary, but you can also come up with some figures on your own by learning the criteria that lenders use to evaluate you.

Will Underwriter Approve My Fha Loan

The guarantor will also check to see if the lender meets the lenders basic criteria. In order to qualify for an FHA loan, you actually have to meet two different sets of criteria those of the government as well as those of the lender.

What do FHA underwriters look for approval?

Common Checkpoints and Documents Lenders credit ratings and credit reports. Debt-to-income ratio, or DTI. Bank statements showing current, validated assets. Salary slots showing year to date earnings, and other employment documents.

Why do underwriters deny FHA loans?

There are three popular reasons for being turned down for an FHA loan bad credit, a high debt-to-income ratio, and insufficient money overall to cover the down payment and closing costs.

Dont Miss: Usaa Refinance Rates Auto

Don’t Miss: Car Loan Interest Rate With 600 Credit Score

Fha Foreclosure Waiting Period

If you have previously lost a home to foreclosure, you’ll have to wait three years before applying for an FHA loan. There are some exceptions, however, for circumstances like a serious illness.

Those who have experienced bankruptcy can also qualify for an FHA loan, though you’ll have to demonstrate that you’re now on better financial footing. Some allowances may be made on an individual basis, but in general, you’ll need to wait two years after a Chapter 7 bankruptcy and at least a year after a Chapter 13 bankruptcy to apply for an FHA mortgage.

How Much Can I Borrow

Use our FHA mortgage calculator to determine the highest monthly payment and the maximum loan amount you can qualify for. We can help you understand how a lender looks at your ability to make payments.

How much you can borrow depends on circumstances. The interest rate, for example, is determined in part by your credit history and FICO® scores. The better your FICO® scores are, the better the interest rates. Your current debts will also factor into things. Use our FHA Loan Calculator to learn more.

Don’t Miss: Usaa Car Loan Rates

How Are Fha Loan Limits Determined

The FHA Loan Limits, which are updated annually, are determined based on two factors. The first is geography. Loan limits vary based on the county where the property is located, except for those that are in metropolitan areas where the limits are set using “the county with the highest median home price within the metropolitan statistical area,” according to HUD.

Limits are also set based on a percentage of conforming loan limits set by the Federal Housing Finance Agency . A “conforming loan” is one that falls under these limits and is eligible to be purchased by Fannie Mae or Freddie Mac, but isn’t explicitly guaranteed by anyone. The FHA uses the national conforming loan limits to set its own limits for the loan amount it will insure. For example, the FHA’s minimum national loan limit “floor” for low-cost areas is typically set at 65% of the national conforming amount for the U.S.

What Is The Fha Waiting Period For Borrowers With Previous Bankruptcy

Bankruptcy does not automatically disqualify a borrower from obtaining an FHA loan. Minimum 2 years since discharge of chapter 7 bankruptcy. Borrower with less than 2 years discharge may qualify for financing so long as they meet the extenuating circumstances as defined by FHA/HUD. Same rule applies for borrower with chapter 13 bankruptcy.

However, borrower with chapter 13 bankruptcy may still qualify if the bankruptcy has been discharged less than 2 years if the lender is willing to do a manual underwrite with satisfactory payment history under the chapter 13 plan.

Recommended Reading: Auto Loans Usaa

Fha Loan Requirements For Sellers

From a lending perspective, there are no specific FHA loan requirements for the sellers of a home that will be financed with an FHA insured mortgage. However, sellers can do a lot to help make their home better suited to be sold to someone who plans to use FHA financing.

You can see from the appraisal checklist that the home must pass a thorough inspection. As a seller, it is important to make sure that your home meets all of the requirements set for an FHA approved home.

You must also be mindful of how you price your home. If there is a high concentration of FHA financed homes in your area, then you could use that to your advantage when pricing your home. Think about the future negotiation that may occur as it relates to covering borrower closing costs.

Fha 203 Appraisal Requirements

Homes in the 203 loan program must be appraised and inspected by FHA-approved appraisers who use a specific FHA process. An FHA appraisal not only determines the homes value, but it determines if the property meets minimum property standards. These standards ensure that the property is structurally sound and livable and that it serves as adequate collateral for the loan.

Borrowers are responsible for the appraisal cost, which typically ranges from $300 to $700.

Heres a look at some of the FHA 203 appraisal requirements:

- Home must be a single real estate entity.

- Home must be accessible to vehicles.

- Property must be free of conditions that endanger safety or health of occupants.

- Home must have a safe drinking water supply.

- Foundation must be in good condition.

- Utilities must be in working order.

You May Like: Loan Officer License California

The Home Inspection And Appraisal

The FHA home appraisal is required before closing to determine the market value of the property. Depending on the size of the house, the average appraisal cost is $300-$600. The FHA home inspections are done before closing to ensure the home meets minimum property requirements. Home inspections cost $250-$400 on average, depending on the homes square footage.

Are Fha Loans Only For First

No, you do not need to be a first-time home buyer to use an FHA loan. Lower credit score minimums and down payments certainly make FHA loans attractive to first-time home buyers, but current homeowners are eligible, too. In fiscal year 2020, about 83% of FHA purchase loans were made to first-time home buyers which means 17% went to borrowers who were already homeowners.

Read Also: Bayview Loan Servicing Class Action Lawsuit

You May Like: Nslds Ed Gov Legit

Fact : Fha Loans Dont Have Income Or Geographic Limits

Other lowdownpayment mortgage programs have eligibility requirements. Many are limited to those with low, very low, or moderate income. Or they are available to only certain groups.

The VA loan, for example, allows 100% financing. But you must be an eligible military borrower to use it.

The USDA Rural Development loan also allows 100% financing, but the program requires you to buy in a designated rural area and imposes income limits, too.

For most buyers, FHA mortgages require a 3.5% down payment. This makes the FHA mortgage one of the most lenient mortgage types available nationwide.

Your down payment money could be a gift from a family member, employer, charitable organization, or government homebuyer program.

How Much Can You Borrow

FHA loan requirements limit how much you can borrow. In most of the United States, the loan limit is $294,515 for a single-family home. However, in counties with high real estate values, that limit can go as high as $679,650 in the lower 48 states and up to $721,050 in Hawaii .

Higher loan limits are allowed for 2, 3 or 4-unit residences, ranging as high as $1,386,650 for a 4-unit residence in Honolulu. For a complete table of loan limits by county, see the FHA Mortgage Limits List on the HUD website.

You May Like: Mountain America Mortgage Rates

How Do You Qualify For An Fha Loan

Because FHA loans are backed by a government agency, they’re usually easier to qualify for than conventional loans. The purpose of FHA loans is to make homeownership possible for people who would otherwise be denied loans.

You don’t need to be a first-time homebuyer to qualify for an FHA loan. Current homeowners and repeat buyers can also qualify.

The requirements necessary to get an FHA loan typically include:

- A credit score that meets the minimum requirement, which varies by lender

- Good payment history

- No history of bankruptcy in the last two years

- No history of foreclosure in the past three years

- A debt-to-income ratio of less than 43%

- The home must be your main place of residence

- Steady income and proof of employment

Why Do The Fha Property Requirements Exist

FHA loans are backed by the Federal Housing Administration , which is part of the U.S. Department of Housing and Urban Development .

These loans are designed to help low- to moderate-income folks on the path to homeownership. Borrowers with credit scores as low as 580 can qualify for FHA loans with just 3.5% down.

But because the government backs these mortgages, the FHA wants to make sure that borrowers are buying homes that are safe, livable, and will afford them good quality of life. They dont want low-income borrowers ending up with properties that are unsafe or that they cant afford to maintain.

Appraisals are required by lenders, but theyre good for you, too.

Recommended Reading: Best Fha Refinance Lenders

Down Payments Assistance Programs And Grants

Saving up for the down payment can be a major obstacle people face when trying to buy a house. It’s why so many people are never able to transition from renters into owners. Borrowers with high credit scores and low debt-to-income ratios might seem like ideal candidates for an FHA loan, but might still not have enough money saved to put down on a new home.

Down Payment Assistance programs, sometimes referred to as grants, can provide homebuyers with funds to cover up front and closing costs when buying a house. Borrowers will need to meet the eligibility requirements of the specific program they’d like to use. Credit scores, household income, family size, and homebuyer education requirements will likely be factors.

Fha Loan Down Payments

Your down payment is a percentage of the purchase price of a home, and is the upfront amount you put down for that home. The minimum down payment youre able to make on an FHA loan is directly linked to your credit score. Your credit score is a number ranging from 300 to 850 thats used to indicate your creditworthiness.

An FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can be in the 500 579 range. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans. A mortgage calculator can help you estimate your monthly payments, and you can see how your down payment amount affects them.

Note that cash down payments can be made with gift assistance for an FHA loan, but they must be well-documented to ensure that the gift assistance is in fact a gift and not a loan in disguise.

Recommended Reading: Usaa Car Refinance Rates

Fha Home Loan Process Timeline

For many homebuyers, the biggest concern is whether or not they can afford the home of their dreams. An FHA loan may be the right loan for you, allowing you to purchase your dream home without the expense of a significant down payment. Purchasing a home is both a huge financial investment and a personal one this will be your primary residence for several years to come.

If you are a first-time homebuyer, you may be wondering how to start the FHA loan process. At CIS Home Loans, we developed this guide to break down the FHA loan process step by step.

Recommended Reading: Can I Use Va Loan For Investment Property