When Is An Fha Loan The Right Choice

At first glance, the Conventional 97 loan seems like the clear winner for borrowers with sparse cash to spare. But thats only when all things are equal.

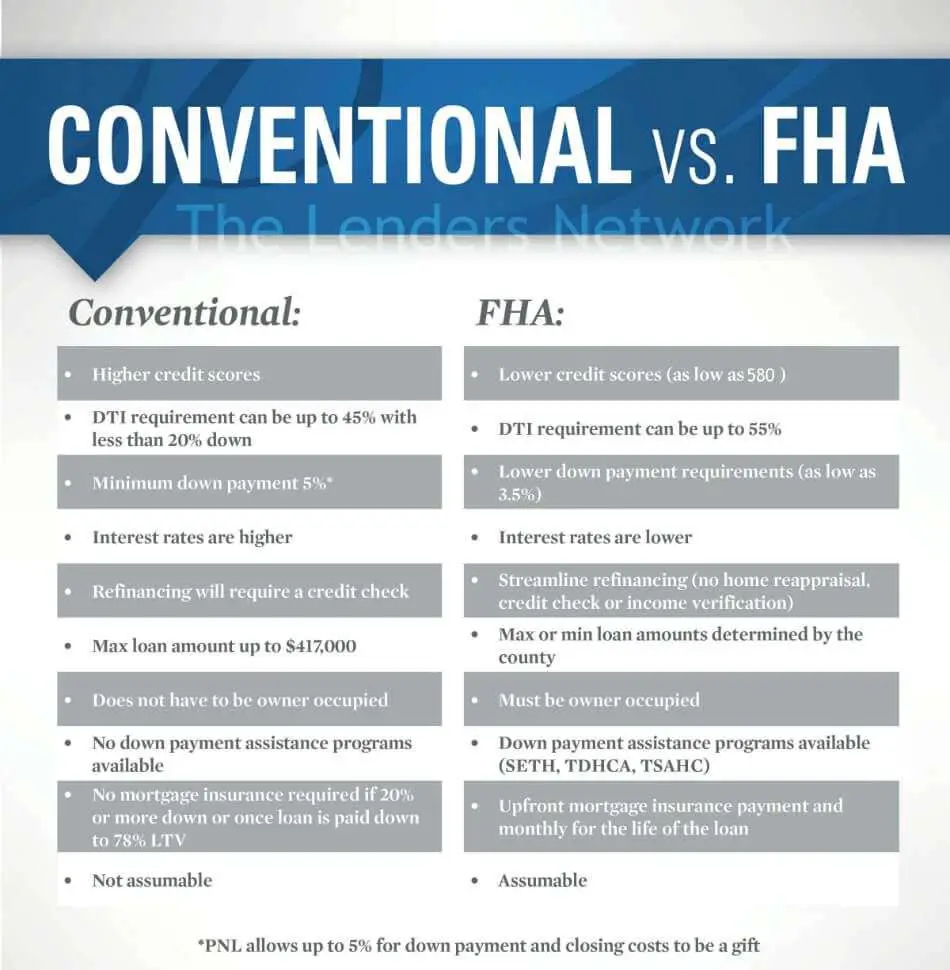

Once you introduce a lower credit score, all of the variables start to change. Heres why: The lower your credit score, the higher your interest rate is likely to be for a conventional loan. Once your credit score falls below 620, you no longer qualify for the Conventional 97 loan.

Private mortgage insurance generally costs more than FHA mortgage insurance payments for borrowers with credit scores under 720.

All of this means that if your credit has been negatively impacted, the FHA loan may not only be your better option from the standpoint of your interest rate, it may also be the only one of the two options for which you are eligible.

Fha Loans Help Make Homeownership More Accessible

When you get an offer from a buyer pre-approved for an FHA mortgage, it means they have received conditional approval from their lender, and that their loan size meets or exceeds the contract price. To obtain pre-approval, the buyer must meet a set of lending criteria for their mortgage following FHA requirements these are generally easier to meet than those of conventional loans in several ways.

For example, FHA loan borrowers can qualify for a mortgage with a . By contrast, conventional loan borrowers will usually need a credit score of 620 or above.

In addition, an FHA-backed buyer may have a slightly higher DTI ratio, a calculation of their monthly debts divided by their gross monthly income. FHA loans allow for higher DTI than conventional loans, as high as 57% in certain cases, whereas a conventional loan might be capped at a DTI of 45 to 50%.

Mortgage insurance works a little differently for FHA loans, too. A buyer who puts less than 10% down with an FHA mortgage is going to pay MI for the life of the loan, and FHA buyers who put 10% or more down have to pay MI for 11 years.

Minor And Major Repairs Cannot Exceed $10000 In Costs

The appraiser also must report if the property is insurable and meets the minimum property standards without needing repairs, or if it is insurable with repair escrow and requires repairs costing no more than $10,000.

If the home requires over $10,000 in repairs to meet the MPS, then the appraiser deems it uninsurable. In this instance, the FHA will not insure the loan, meaning the buyers loan will not close.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Why Do Sellers Not Like Fha Loans

Buyers love FHA loans for their flexible guidelines and low down payment requirements. You can even use gift funds for 100% of your down payment in some cases.

But sellers dont love them as much. In fact, some sellers wont accept an FHA offer.

Why?

Many sellers look at FHA loans as the last resort. They assume buyers are weak or barely qualify for financing. They worry the financing will fall through and theyll be stuck putting their house on the market again.

While that reputation still lingers , lets dig a little deeper.

Fha Loans Are Hugely Popular With First

Chances are if youre a first-time home buyer, youll use an FHA loan over a conventional loan.

Just look at the chart above from the Urban Institute, which details the FTHB share of purchase mortgages by loan type.

As you can see, the FHA was dominated by FTHB with an 82.8% share in October 2018. Yes, nearly 83% of those who used an FHA loan for a home purchase were first-timers.

Meanwhile, only 47.8% share of purchase loans backed by the GSEs went to first-timers.

The reason this might be the case is due to the low credit score requirement coupled with the low down payment requirement.

Since first-timers are often short on down payment funds , FHA tends to be a good fit.

FHA borrowers also generally have higher DTI ratios, higher LTVs, smaller loan amounts, and lower credit scores relative to GSE borrowers.

However, if you have student loans, which a lot of first-timers probably do, the FHA can treat them a bit more favorably when qualifying you for a mortgage.

Recently, they made a change where just 0.5% of the outstanding loan balance is used as the monthly payment for DTI purposes, down from the former 1%.

Meanwhile, Fannie Mae may calculate your DTI using 1% of the outstanding student loan balance, which could make qualifying for an FHA loan easier.

So if you have student loan debt, pay close attention to this rule, and/or check out the more flexible guidelines offered by Freddie Mac.

Also Check: How To Find Your Student Loan Number

When A Conventional Loan Makes Sense

Each situation is flexible, but your qualifications or preferences should be close to these if you want to try for a conventional loan:

- Your credit score is at least 620.

- You have a down payment equal to at least 3%, or 20% if you want to avoid PMI.

- You have a low debt-to-income ratio, or DTI, which compares your monthly debt payments to your monthly gross income.

- You want flexible repayment terms.

Sellers Must Complete Major Repairs Before Closing

In the FHA appraisal process, the seller must complete repairs that are necessary to maintain the safety, security, and soundness of the Property, preserve the continued marketability of the property, and protect the health and safety of the occupants for the loan to close.

Examples of necessary repairs include:

- Inadequate forms of egress

- A leaking or worn out roof

- Foundation damage

- Defective paint surfaces in homes constructed pre-1978

The appraiser will not require the seller to complete cosmetic and minor repairs such as peeling paint or missing handrails, but they will report the defects and consider them when valuing the property.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Whats A Conventional Loan

A conforming loan is one that meets, or conforms to, the Federal Housing Finance Agencys conforming loan limits. The maximum loan limits vary by region, and property type. This cap is adjusted every year, and in 2021 the limit for single-family homes is $548,250 to $822,375.

Conventional loans are one of the most popular types of mortgages. Nearly all home loans that arent backed by a federal agency are conventional mortgages. There are two main types of conventional mortgages: Conforming and non-conforming, or jumbo loans.

Any mortgage that exceeds the maximum loan limit is considered a jumbo loan, or non-conforming loan. Jumbo loan rates tend to be higher than conforming loans, and these types of mortgages usually require larger down payments.

Because they arent insured by the government, conventional loans typically have more strict borrower standards for things like your credit score and debt-to-income ratio. Generally speaking, conventional loans are designed for people who have higher credit scores and enough money for a down payment, says Andrina Valdes, chief operating officer at Cornerstone Home Lending. However, certain conventional mortgages require as little as 3% down. But if you have a down payment of less than 20% youll usually be required to pay private mortgage insurance , which you can later get rid of PMI once your loan-to-value ratio reaches 80%.

Could An Fha Loan Work Against You

So, how might an FHA loan work against you in a sellers market? It all has to do with the homeowners perception.

A lot of sellers are wary of accepting an offer from a home buyer with an FHA loan, because they consider it a riskier mortgage product compared to conventional financing.

There are two reasons for this perception:

You May Like: Texas Fha Loan Limits 2020

What Are The Closing Costs For Sellers

HUD allows sellers to contribute money toward the buyers closing costs. Whether or not you choose to do that is up to you. Those details are typically determined during the negotiating stage and written into the real estate purchase agreement.

Generally speaking, HUD allows sellers to contribute up to 6%of the sales price toward the Borrowers origination fees, other closing costs and discount points. All of this is outlined in HUD Handbook 4000.1, also known as the Single Family Housing Policy Handbook.

These are some of the most common questions sellers have regarding FHA loans. If you have a question that is not included above, feel free to send it to us via email.

Option #: The Seller Can Make Repairs

Even if the seller has said they wont make repairs, they will sometimes come around if the necessary repairs are inexpensive or if they can do it themselves.

For instance, if chipping paint is the issue, the seller shouldnt have any problem scraping the affected area and spending $50 on paint. Its cheap and easy.

Give the real estate agents a copy of the home appraisal so they can see the issues first hand. The listing agent might be able to convince the seller to make repairs to meet FHA requirements in the interest of closing.

Read Also: How To Calculate Amortization Schedule For Car Loan

All Included Appliances Must Meet Fha Guidelines

The FHA requires that appliances that remain and that contribute to the market value opinion are operational. In laymans terms: If the appliance is staying, it must be functional. Appliances include refrigerators, ranges, ovens, dishwashers, disposals, microwaves, washers, and dryers.

The appraiser may test the appliances during the appraisal. If the utilities are not on at the time of the appraisal, the appraiser may require a re-observation at a later time when utilities are back on or, they may complete the appraisal under the extraordinary assumption that utilities and mechanical systems, and appliances are in working order.

Conventional Loan Vs Fha Loan For Buyers

If youre looking to buy a house, an FHA loan can be an attractive option. It offers two key advantages over a conventional loan:

- Low credit score requirement

- Low down payment option

Some conventional loans allow a 3% minimum down payment, which is lower than FHAs 3.5% requirement, but thats generally reserved for borrowers with credit scores in the 700s or better.

Another substantial difference is when you pay mortgage insurance on your loan.

Conventional loans only make you pay private mortgage insurance if you put less than 20% down for a down payment.

But FHA loans?

They add a mortgage insurance premium thats typically paid over the life of the loan regardless of how much you put down.

The good news is the Federal Housing Administration lowered the mortgage insurance premiums in 2015, so borrowers pay less to buy a house with an FHA loan.

Read Also: How Do I Find Out My Auto Loan Account Number

Are Fannie Mae And Fha The Same Thing

People seem to confuse these two, maybe because they both start with the letter F.

So lets put it to rest. The answer is NO.

Fannie Mae is one of the two government-sponsored enterprises along with Freddie Mac that issues conforming mortgages.

The FHA stands for Federal Housing Administration, a government housing agency that insures residential mortgages.

They have a similar mission to promote homeownership and compete with one another, but they are two completely different entities.

Ultimately, Fannie Mae is a private sector company, while the FHA is a government agency that represents the public sector.

How To Use The Moneygeek Fha Vs Conventional Loan Calculator

All new FHA borrowers pay a premium into an insurance fund that reimburses lenders when a borrower allows a foreclosure. The insurance fund and promise of repayment backed by the U.S. Government gives lenders the confidence to lend money to people who might not qualify for a conventional loan. There are two FHA mortgage insurance premiums new borrowers must pay. The first is a one-time, up-front premium. This is call the “Up-Front Mortgage Insurance Premium” . The second is the on-going, annual fee that’s calculated every year. As your loan balance falls, the annual premium is recalculated and decreases.

The calculator above shows you how much your UFMIP will be, and how much you can expect to pay during the first year of your loan. As mentioned, expect your annual amount due to decrease with each passing year.

| Input |

|---|

Also Check: Fha Loan Limits Texas

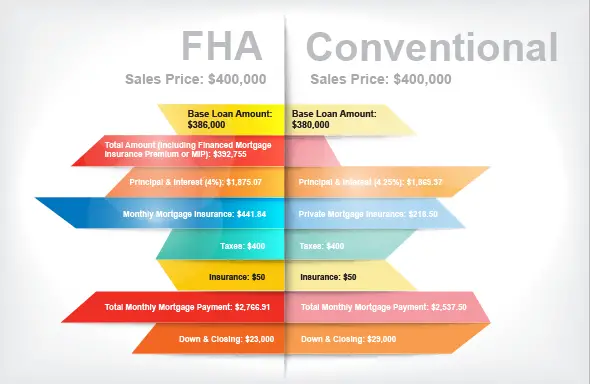

What Are The Dollars And Cents Differences Between Fha And Conventional 97

If all things were equal, this would be a simple question. However, there are so many potential variables, including your homebuying circumstances and goals, that the answer is complicated.

If your primary cost concern is about how much youre going to pay out of pocket to get yourself into a home, and youve got a solid credit score, then the Conventional 97 is the way to go. Not only are you able to put down as little as 3% , but you also wont be required to pay 1.75% for the upfront mortgage insurance premium and theres a good chance your private mortgage insurance is going to cost less too.

Plus, theres the additional benefit of having your Private Mortgage Insurance automatically canceling once your loan-to-value ratio reaches 78%.

But things take a quick turn if your credit score falls below 620.

How To Decide Between A Conventional Loan Vs Fha Loan

Picking a loan program isnt a walk in the park.

If you have 20% saved for a down payment and a great credit score, a conventional loan can be a smart option. And VA loans are popular for service members, veterans, and their families.

But if your credit score is a little low or you want to buy a home with a smaller down payment, FHA loans can be what youre looking for.

And if youre not sure?

Thats okay, too.

Because the Wendy Thompson Lending Team is here to help.

Well help you pick the best home loan program for your credit score and financial goals and walk you through the lending process.

If youre ready to find your dream home, call the Wendy Thompson Lending Team today!

Dont make that mistake, contact the Wendy Thompson Lending Team today!

You can start the process by clicking the yellow ‘See if I’m Eligible’ button on the right side bar under the ‘Start your quote for a Home Loan’ or call Wendys Team directly at 250-2294, to get started on living the American Dream in the home of your Dreams!

You May Like: Aer Scholarship For Spouses

Fha Vs Conventional Refinance Programs

Both FHA and Conventional home loans allow you to refinance your mortgage to get a lower mortgage payment and better interest rate.

FHA Loan Refinance Programs

- Home Equity Conversion Mortgage

- FHA Streamline Refinance Borrowers can quickly refinance their loan to a lower rate without much documentation with an FHA streamline refinance. Streamline refinancing works the same as a traditional refinance but requires less paperwork, no credit check, or income verification.

- Cash-Out Refinance FHA borrowers can turn their equity into cash with an FHA cash-out refinance. Borrow up to 80% of the loan-to-value ratio of the home.

- Home Equity Conversion Mortgage A HECM is a reverse mortgage available to homeowners 62 years of age and older to convert the equity in their home into a stream of income. You do not need to have an FHA loan to be eligible homeowners with conventional loans can also use the HECM program.

- Home Equity Loan and HELOC

- Cash-Out Refinance

Rejecting Fha Loans Can Toe The Discrimination Line

Most of the aspiring home buyers counseled by the Urban League of Philadelphia can barely meet the credit score and other requirements to qualify for FHA loans, Reyes Pardo said, so conventional loans are out of reach. Some are working to break cycles of generational poverty.

Nationally, FHA loans account for about 15% of residential mortgages. In Philadelphia, roughly 32% of originated mortgages for one-unit, single-family primary residences were FHA insured in 2019, according to an analysis of the most recently available federal mortgage data.

A sellers decision to go with one type of loan product over another looks neutral on its face, but when you look at its impact, it may be discriminatory if it disadvantages groups of people who are protected under the Fair Housing Act, including people of color and women who are single parents, said Garcia at the Pennsylvania Human Relations Commission.

The Fair Housing Act protects various populations from housing discrimination, but it doesnt prohibit sellers from accepting the most financially beneficial offer for their own self-interest, said Rachel Wentworth, executive director of the Housing Equality Center of Pennsylvania. The group has fielded calls from people about potential discrimination because of record-low housing supply.

The Philadelphia-based financial counseling nonprofit Clarifi has seen clients with FHA loans passed over during bidding wars, said Chelsea Barrish, vice president of program impact.

Recommended Reading: Do Pawn Shops Loan Money

What Is The Difference Between Fha And Conventional Home Loans

Which loan is better,conventional orFHA? It depends on your income, credit score, employment & assets, and other differences between the two mortgage loans. Did you know you that you can borrow more money with a conventional mortgage? And that the FHA loan requires a minimum credit score of 500?

I know that this mortgage stuff is confusing. But, you should be congratulated for taking a few minutes to determine which mortgage loan is best for you. After all, you will probably make a monthly payment for the next 30-years. Here is a comparison of the FHA and conventional home loans.

Why Do Sellers Prefer Conventional Financing Over Fha Loans

Many sellers prefer conventional financing or any financing over FHA loans. Why?

They feel that buyers who can secure any other financing option are stronger buyers. FHA buyers have a reputation for having low credit scores, little money to put down, and less than optimal qualifying requirements.

Sellers want a sure thing when they sell their home. They dont want a risky buyer that may lose financing in the middle of the process, forcing the buyer to put the home back on the market.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan