How Much Cash Do You Need For A Conventional Loan Down Payment

A lot of first-time homebuyers think they need a 20% down payment to qualify for a conventional loan.

Thats simply not true.

Conventional loan down payment requirements are as low as 3%. Thats only $9,000 down for a $300,000 home, or $6,000 down for a $200,000 home.

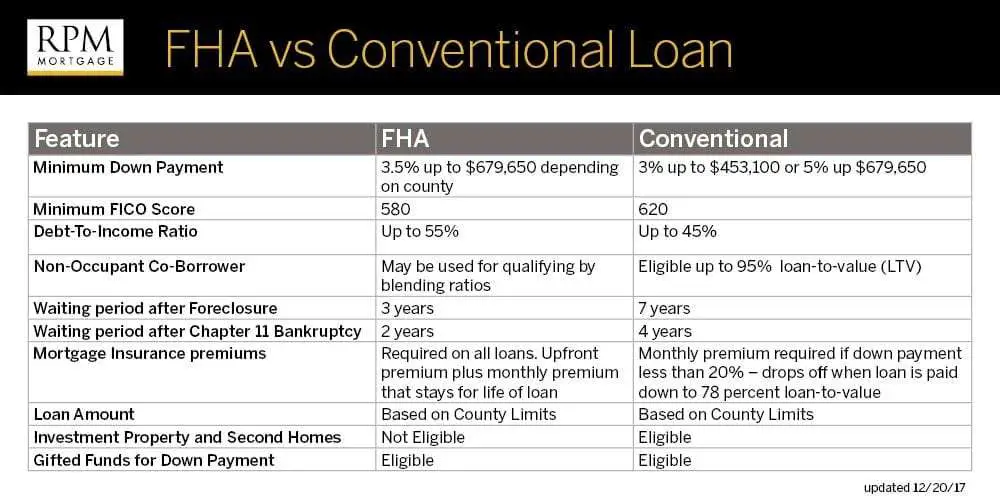

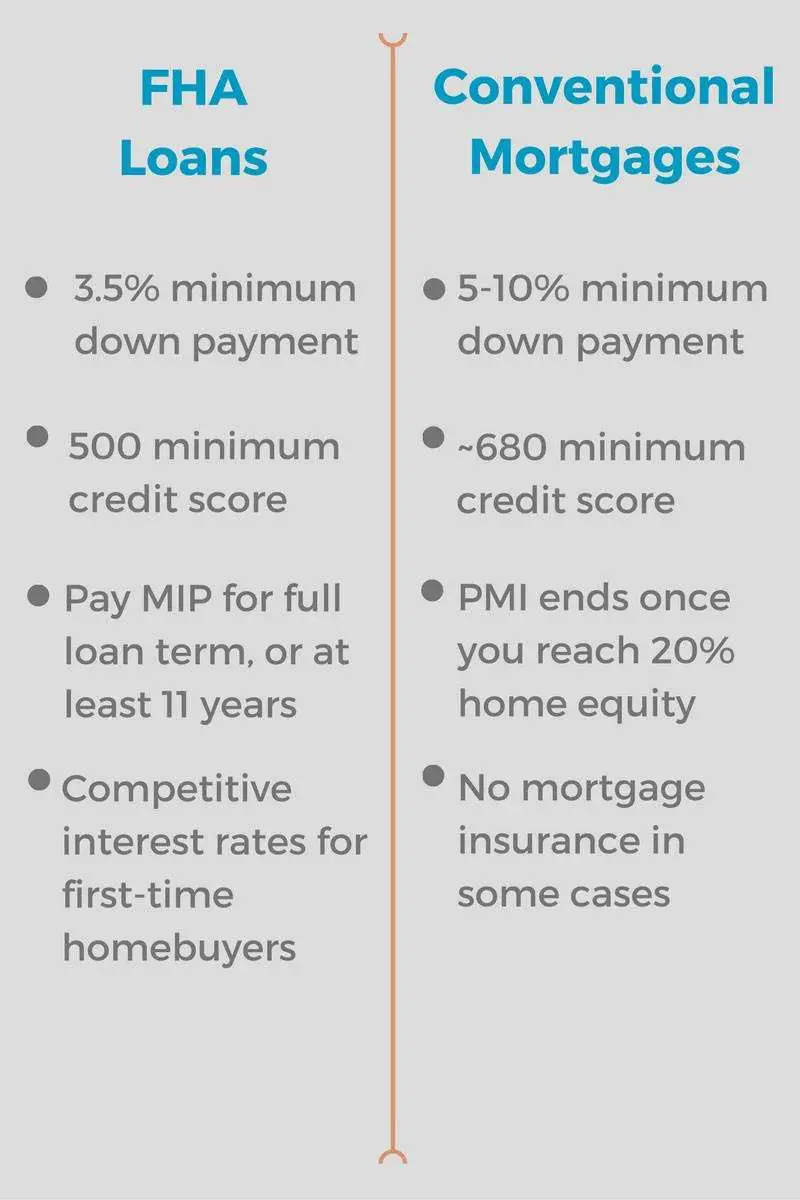

Even an FHA loan requires a larger down payment of 3.5%.

The low conventional loan down payment requirements have made mortgage borrowing more accessible to qualified borrowers. Heres how you can get into a home using a conventional loan, perhaps more easily than you thought.

How Your Down Payment Impacts Your Offers

When youre on the hunt for the right home, time is of the essence. Homes at entry-level price ranges typically sell quickly, and you want to put your best foot forward when making an offer because youll probably have competition. When markets are competitive and sellers receive multiple offers, they want to see buyers best offers, including a sizable down payment. From a sellers viewpoint, buyers who have more money to put down are more attractive because they have more skin in the game.

A higher down payment can indicate to a seller that you have enough cash on hand and solid finances to get a final loan approval without a hitch. Also, a higher down payment could beat out other offers that ask for sellers to pay closing costs or offer below the asking price. Someone with a sizable down payment is unlikely to request such assistance, and sellers are more likely to work with a buyer who has the money and motivation to see the purchase through with minimal haggling.

Can You Get Down Payment Assistance On A Manufactured Home

Securing funding for a manufactured home comes with its own set of hurdles. The answer to whether you can get down payment assistance on a manufactured home is it depends.

FHA, VA and conventional loans require the manufactured home be secured to a base. If the manufactured home is not secured to a base, you will need to apply for whats called a chattel loan. Research your local down payment assistance programs and see what their specific requirements are. From there, contact your lender to see if they work with these programs. Rocket Mortgage® does not offer financing on manufactured homes.

You May Like: Drb Student Loan Refinancing Review

Seal The Deal At Closing

Once your offer is accepted and an inspection is completed, youre on your way to closing. Youll have to get updated pay stubs and other financial paperwork just before closing to prove your employment status hasnt changed and that youll be able to make your mortgage payments. Within 24 hours of closing, youll do a final walk-through of the property to make sure repairs, if any, were made and that the home is vacant.

At the closing table, youll sign a lot of paperwork to finalize the loan and transfer ownership of the home from the sellers name to yours. Youll also be required to bring a cashiers check made out to the escrow company, or wire closing funds to the company. Dont forget to bring your identification, too.

After signing all of the closing documents, youll be handed the keys to your new home, and youll officially be a first-time homeowner.

Oregon Down Payment Assistance Programs

Oregon Housing and Community Services offers down payment assistance programs for first-time buyers. Theyre intended for low-and very low-income families and individuals, with particular focus on underserved populations. Up to $15,000 may be available.

The state agency sends money to various local agencies which provide direct assistance to home buyers.

Theres a list of those agencies on the OHCSs website, together with the county or counties each serves. Links are provided there to every agency. Also check out HUDs list of other homeownership assistance programs in the state.

Also Check: Caliber Home Loans 1098 Form

Whos Eligible For Down Payment Assistance

Not everyone will qualify for down payment assistance and each state has its own rules for determining eligibility. Generally, its based on your income and how much home youre buying. In Virginia, for example, your earnings have to be at or below 80% of the area median income where youre planning to buy. In other states, the limit may be as high as 120%.

Many of these programs are limited to first-time buyers. If youve owned a home previously, you might not be able to qualify. In some cases, homebuyers also have to attend special training where they learn about the mortgage process and the financial responsibilities that go along with owning a home.

Find out now: How much house can I afford?

What Down Payment Assistance Is

Down payment assistance uses grants or low-interest loans to help you come up with the money youll need for a down payment on a home.

You have to apply for the assistance. How much you get will depend on the program and where you live.

Some programs offer assistance as a percentage of the home sale price. You may find a program that offers borrowers 15% of the homes purchase price. Other programs cap assistance at a certain dollar amount.

Every program has different qualification criteria and funding amounts. How much youll need to save and contribute to the down payment will depend on the assistance program you use.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Vermont Down Payment Assistance Programs

The Vermont Housing Finance Agency ASSIST Second Mortgage is open only to first-time buyers. It can provide up to $7,500 toward your down payment and closing costs.

That comes in the form of an interest-free, 30-year second mortgage. But you dont have to make any monthly payments. The loan typically falls due only when your first mortgage ends: normally, when you pay it off, refinance, or sell your home.

Learn more at the VHFAs website . And check out HUDs list of other homeownership assistance programs in the state.

Do All Conventional Loans Have Private Mortgage Insurance

No. You only need PMI when you put down less than 20%.

Private mortgage insurance is often avoided because it protects the lender, not the buyer, even though the buyer pays for it. But its not a bad thing. It has helped millions of first-time buyers net tens of thousands of dollars in home equity that they would have missed out on.

| Pro Tip: Another upside of PMI is that if you do put down less than 20%, youll only be obligated to pay PMI until you reach 20% equity in the home. |

Thats an advantage over some government programs that require an upfront and annual mortgage premium , regardless of your down payment.

With an FHA loan, the MIP requirement ends after 11 years if you put down 10% or more. But youll still owe an upfront fee of 1.75% of the loan, plus mortgage insurance for those first 11 years.

Most FHA and USDA borrowers pay mortgage insurance for the life of the loan or until they 1) Gain 20% equity and 2) refinance into a conventional loan.

It is also possible to avoid PMI while paying only 10% down by taking out a second mortgage alongside your primary conventional loan. Well explore this piggyback loan method more later in this guide.

Recommended Reading: Usaa Auto Loan Refinance

Iowa Down Payment Assistance Programs

The Iowa Finance Authority offers grants and loans as down payment or closing cost assistance.

- The loan could provide 5% of the homes purchase price, up to $5,000, with no monthly payments. The loan would come due when you sell or refinance the home

- The grant could pay $2,500 toward closing costs or a down payment

First-time homebuyers and veterans may qualify for either type of assistance. Others can also qualify if theyre homebuying in a low-income Census tract. And the Iowa Finance Authority runs a similar program for repeat homebuyers.

All programs have income limits and price caps on eligible homes. Youd also need a credit score of 640 to qualify.

Learn more at the IFAs website. And take a look at HUDs list of alternative programs in Iowa.

Fannie Mae Or Freddie Mac

- Conventional loans backed by Fannie Mae or Freddie Mac, which require only 3 percent down

- Best for: Borrowers with strong credit but a minimal down payment

The government-sponsored enterprises Fannie Mae and Freddie Mac set borrowing guidelines for loans theyre willing to buy from conventional lenders on the secondary mortgage market.

Both programs require a minimum 3 percent down payment. To qualify, homebuyers will need a minimum credit score of 620 and a relatively unblemished financial and credit history. Fannie Mae accepts a debt-to-income ratio as high as 50 percent in some cases.

Youll need to pay for private mortgage insurance, or PMI, if youre putting less than 20 percent down, but you can get it cancelled once your loan-to-value ratio drops below 80 percent.

Also Check: Usaa Pre Approved Car Loan

New Mexico Down Payment Assistance Programs

The New Mexico Mortgage Finance Authoritys FIRSTDown program offers help with closing costs and down payments to first-time buyers. It provides up to $8,000 as a 30-year second mortgage at a relatively low interest rate.

This program must be used in conjunction with New Mexicos FIRSTHome mortgage financing program. There are caps on household incomes and home purchase prices. But those may be higher if youre buying in a target area.

Find those caps and much more information on the authoritys website. And read HUDs list of other homeowner assistance programs in New Mexico.

Va Loan: No Down Payment

With VA loans, the Department of Veterans Affairs guarantees a portion of the mortgage.

Because the VA is backing you, you wont be required to pay for mortgage insurance. But you will be charged a one-time funding fee, which can range from 1.4% to 3.65% of your total loan amount.

VA loans are available to regular military personnel, veterans, reservists and National Guard personnel. They’re also open to spouses of service members who died on active duty or as a result of a service-connected disability.

Most people in the military will qualify after six months of service. Youll also need to show a Certificate of Eligibility, which you can apply for through the VA.

As with USDA loans, your credit score and debt ratios will have a big impact on your eligibility for a VA loan.

Don’t Miss: Does Va Loan Work For Manufactured Homes

Crowdfunding Your Down Payment

If your family cant gift or loan you enough money, there is an opportunity for friends, coworkers and associates to help with your down payment.

The internet truly has a site for everything, including sites such as FeatherTheNest.com and HomeFundIt.com that can help you raise funds to cover all or a portion of your down payment. These sites operate somewhat like a gift registry, where people donate cash to help you begin a new chapter of your life.

But be aware, any donations to the FeatherTheNest.com are charged a 7.9% credit card processing fee plus 30 cents per donation. That means a $100 donation would cost the giver $108.20.

HomeFundIt.com actually provides an opportunity to earn $1,500 toward your closing costs if you partake in free homebuyer education courses. Money plus knowledge wed call that a win-win. Unlike FeatherThe Nest.com, HomeFundIt.com is offered by CMG Financial, a mortgage banking firm. So any money acquired through that site must be used with a CMG loan program.

Minnesota Down Payment Assistance Programs

The Minnesota Housing Finance Agency provides two types of down payment assistance loans to eligible borrowers:

- Monthly Payment Loan Borrow up to $17,000 at the same rate you pay on your first mortgage. Pay that down each month over 10 years

- Deferred Payment Loan First-time buyers can borrow up to $11,000 free of interest. You make no payments, but the balance will come due when you finish paying off the mortgage, refinance, or sell the home

Discover more at the MHFAs website. And check HUDs list of other homeownership assistance programs in Minnesota.

Recommended Reading: What Does Usaa Certified Dealer Mean

Providing Down Payment Assistance On Fha And Conventional Loans

Chenoa Fund

Chenoa Fund is a national down payment assistance program administered by CBC Mortgage Agency, a federally chartered governmental entity. CBC Mortgage Agency specializes in providing down payment assistance financing under FHA and FNMA conventional guidelines.

CBC Mortgage Agency has a mission to increase affordable and sustainable homeownership, specifically for creditworthy, low- to moderate-income individuals. CBC Mortgage Agency partners with reputable mortgage lenders on a correspondent basis to provide loans for qualified homebuyers. Through the Chenoa Fund program, CBC Mortgage Agency has several product options to choose from that include down payment assistance in the form of second mortgages on FHA-insured loans and FNMA conventional loans.

Chenoa Fund Down Payment Assistance

While many people do manage to purchase a home by saving for a down payment over a period of years, increasing home prices and stagnant or low wages can make this quite difficult. By helping responsible homebuyers to overcome the challenge of the minimum investment required for a mortgage, CBC Mortgage Agency is helping create healthy communities by improving the balance between homeownership and other types of housing. This way, new homeowners can start building equity for their future now, rather than potentially waiting for years to save up a down payment while home prices become even more unaffordable.

FHA Loans

Chenoa Fund Down Payment Assistance for Conventional Loans

How Much House Can You Afford

When you are pre-approved for a mortgage, a lender will tell you the maximum loan amount for which you qualify, based on responses in your application. Your mortgage application asks about your estimated down payment amount, income, employment, debts, and assets. A lender also pulls your credit report and credit score. All of these factors influence a lenders decision about whether to lend you money for a home purchase, how much money, and under what terms and conditions.

As a general guideline, many prospective homeowners can afford to mortgage a property that costs between 2 and 2.5 times their gross income. For example, if you earn $100,000 per year, you can afford a house between $200,000 and $250,000.

Rather than simply borrowing the maximum loan amount a lender approves, youre better served by evaluating your estimated monthly mortgage payment. Say, you get approved for a $300,000 loan. If your monthly mortgage payment and other monthly debts exceed 43% of your gross monthly income you might have trouble repaying your loan if times get tight. In other words, be cautious about buying more house than you can reasonably afford.

Beyond buying a house, you may also want to contribute to other financial goals such as saving for retirement, starting a family, shoring up an emergency savings fund, and paying down debt. Taking on a too-high monthly mortgage payment will eat up cash that could otherwise go toward some of these important goals.

Also Check: Usaa Car Loans Credit Score

Hire A Home Inspector

When you decide on a home you like and make an offer, its important to have the home thoroughly inspected before the deal can be finalized. You want to make sure there arent any unknown structural issues, or anything else that could affect the livability of your new place. Inspections usually take a few hours, and cost a few hundred to a few thousand dollars, depending on the size of the home.

Down Payment Assistance Programs By State

Depending on whose addition skills you trust, there are between 2,000 and 2,500 DPA programs in the U.S. These are typically run by state and local governments, and nonprofits at the community level.

We list some of the biggest programs in each state below.

The U.S. Department of Housing and Urban Development also lists many homeownership assistance programs including DPA on its State Pages.

While we have made reasonable efforts to make sure the information above is correct at the time of posting, it is subject to change without notice. Please check relevant websites for more information.

Read Also: Does Va Loan Work For Manufactured Homes

California Down Payment Assistance Programs

The California Housing Finance Agency MyHome Assistance Program provides down payment help for eligible buyers. This takes the form of a second mortgage of up to 3.5% of the homes purchase price, or $11,000 for FHA loan-financed homes whichever is less.

The program provides 3% for homes financed with conventional or USDA loans.

This is a first-time home buyer down payment assistance program. So it wont help if youre selling an existing home.

However, CalHFA defines first-time homebuyer as someone who has not owned and occupied their own home in the last three years. So many whove previously owned homes may qualify.

Check out the MyHome Assistance Program webpage for more information. Youll find some income limits there. If youre a teacher or fire department employee, certain program limits may not apply.

Also take a look at HUDs list of alternative programs for California.

No Down Payment: Usda Loans

MISHKANET.COM” alt=”Fha vs conventional loan calculator > MISHKANET.COM”>

MISHKANET.COM” alt=”Fha vs conventional loan calculator > MISHKANET.COM”> The U.S. Department of Agriculture offers a 100% financing mortgage. The program is formally known as a Section 502 mortgage, but, more commonly, its called a Rural Housing Loan or simply a USDA loan.

The good news about the USDA Rural Housing Loan is that its not just a rural loan its available to buyers in suburban neighborhoods, too. The USDAs goal is to help low-to-moderate income homebuyers, wherever they may be.

Many borrowers using the USDA loan program make a good living and reside in neighborhoods that dont meet the traditional definition of a rural area.

For example, college towns including Christiansburg, Virginia State College, Pennsylvania and even suburbs of Columbus, Ohio meet USDA eligibility standards. So do the less-populated suburbs of some major U.S. cities.

Some key benefits of the USDA loan are :

- Theres no down payment requirement

- Theres no maximum home purchase price

- You may include eligible home repairs and improvements in your loan amount

- The upfront guarantee fee can be added to the loan balance at closing mortgage insurance is collected monthly

Just be aware that USDA enforces income limits yours must be near or below the median income for your area.

Another key benefit is that USDA mortgage rates are often lower than rates for comparable, low- or no-down-payment mortgages. Financing a home via the USDA can be the lowest-cost path to homeownership.

Read Also: Sss Housing Loan