When Does It Make Sense To Refinance

- You Now Qualify for a Lower Interest Rate: If interest rates go down or your credit has improved, you could save money with a lower rate. If your credit score isnt very high, refinancing with a co-signer could also help you pay less in interest.

- You Want to Lower Your Monthly Payment: You might be able to get a longer loan term by refinancing. This means youll be making payments longer but also lowers your monthly bill. You may end up paying more in interest over the extended loan term.

- Your Car Is Aging and/or Has High Mileage: Many lenders restrict your ability to refinance a vehicle once it reaches a certain age or mileage mark. If your car is close to 10 years old or is approaching 100,000 miles, then it might be time to crunch the numbers to see if one last refinance makes sense.

Here Are Some More Details About Auto Credit Express

- Not a direct lender Auto Credit Express isnt a lender. Its an online marketplace that connects people with lenders that offer auto financing.

- Harder to qualify with poor credit If you have credit scores below 500, you may have difficulty getting approved for an auto refinance loan with Auto Credit Express.

- Cash-out refinance eligibility To get a cash-out refinance loan with Auto Credit Express, you must have equity in your vehicle and be current on your auto loan payments. Your vehicle must be less than 10 years old and have fewer than 100,000 miles on it. You may also have to meet a minimum loan amount and other requirements, which vary by lender in the Auto Credit Express network.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: Usaa Auto Loan Approval Odds

The 4 Best Companies To Refinance Your Auto Loan

If youre stuck with a bad rate on your current auto loan, you could be paying significantly more than you need to. Refinancing your auto loan can help you get a better rate and pay less for your car over time if your car is worth more than you owe or your credit score has improved or interest rates have dropped since you got your loan. Auto refinancing may not be the right option if your loan has prepayment penalties or you owe more than your car is worth.

In this review, we at the Home Media reviews team will take a close look at which lenders offer the best auto loan rates for refinancing. Our experts have researched the top lenders in the industry based on their rates, reputations, availability and customer experience to help you get started.

Myautoloan: Most Popular Marketplace

Starting APR:1.89%Loan terms: 24 to 84 monthsAvailability: 48 states Minimum credit score:575

Rather than a direct provider of auto loans, myAutoloan is an online marketplace where you can compare offers from a number of lenders in one place. After you enter your personal information, lenders will provide loan offers for you to choose from.

The myAutoloan marketplace can help borrowers looking to refinance their auto loans find rates as low as 1.89%. Those with less-than-ideal credit history can refinance their vehicle loans through the site, which can find loans for people with credit scores of 575 and above. However, the lowest rates are reserved for people with the highest credit scores.

Read Also: Usaa Rv Loan Reviews

Use A Car Loan Payment Calculator1

An auto loan payment calculator lets you see if refinancing your car will help you pay off your loan sooner, or lower your monthly payment.

To calculate your potential new monthly payment, simply type in the amount remaining on your loan, your estimated rate and the length of the new car loan you want.

Once you are ready to apply for an auto loan, youll need to gather:

- Documents to verify your residence, employment, income and your Social Security number

- Your financial history, with bank statements and credit history

- Your current loan information

- Your vehicle registration and mileage

- Proof of car insurance

You can apply online for an auto loan with U.S. Bank.

Same-day loan decision is available and you can always check your applications status during the process.

When Can You Refinance

You do not need to wait any minimum amount of time before refinancing your car loan. You just have to meet all the requirements for the new loan to refinance. Refinancing is possible immediately after buyingeven before you make your first monthly payment. Just be sure that you actually end up with a better deal, and that refinancing doesnt cause you to pay more for your vehicle.

In some cases, you may be unable to refinance until you have documentation from your states Division of Motor Vehicles . Gathering registration details may slow you down somewhat.

Recommended Reading: How Much Car Can I Afford Based On Salary

The Best Reason For Refinancing: Pay Less Interest

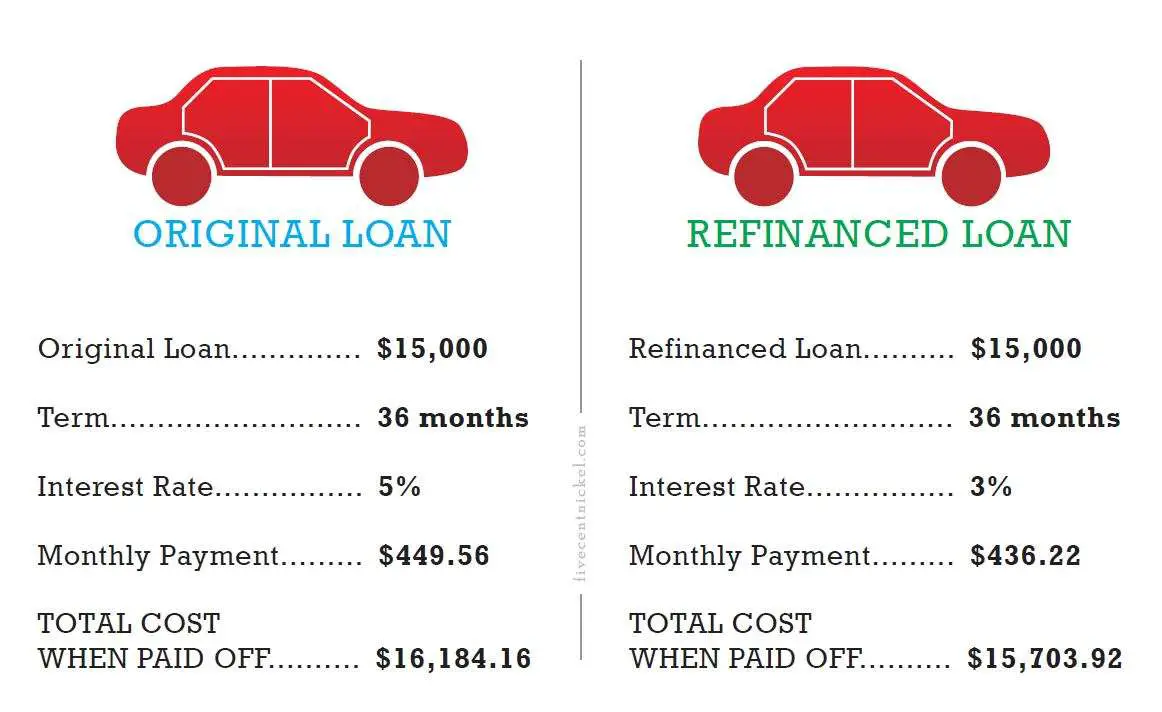

If you can borrow at a lower interest rate, it may make sense to refinance. This lower rate means that you pay less for the car after all external financing costs are included. Since the interest rate is also part of the monthly payment calculation, the required payment should also decrease. As a result, your monthly cash flow becomes easier to manage.

If you can replace an existing loan at a lower rate, its best to refinance as soon as possible. Most auto loans amortize loans, which means you pay a fixed monthly payment with built-in interest costs.

You pay back your debt over time, but most interest costs are paid back at the beginning of the loan so lower this rate sooner than later to start lowering costs. The depreciation table shows you exactly how much you can save by refinancing.

You Took A Rebate Rather Than A 0% Apr Deal

Automakers frequently offer incentives on new vehicles to boost their sales, such as 0% APR financing and rebates. Often, consumers with excellent credit who qualify for these types of deals have a choice between a large rebate or a low-financing offer. For example, you may have a choice between a cash rebate of $2,000 or 0% APR financing. If you take the rebate, youd have a 4.00% APR. If you choose the 0% APR financing offer, you will lose the $2,000 rebate. In the spirit of have your cake and eat it, too, we typically suggest taking the rebate from the automaker and then refinancing in a month to a lower APR from another lender. To continue the example, if you take the $2,000 rebate with 4.00% APR financing, wait a month, and then refinance to 2.99%, you obtain a large cash rebate and a low APR.

You May Like: Fha Loan Refinance Calculator

Decide Which Deal Is Best For You

With your best refinance offer from a new lender in hand, contact your current lender and see if they will match or beat the rates, terms and costs of the mortgage loan. Then choose the lender that provides you with the best offer.

Once youve made a choice, ask the lender or broker to lock in the rate in writing. You should receive a document stating your lock-in rate, the duration of the lock-in rate and any interest rate reductions.

The benefit of the lock-in rate is to safeguard you from rising interest rates during escrow, although it could backfire if rates drop. In that case, talk to your lender and try to reach a compromise.

Final Tips For Auto Loan Refinancing

Most banks will only refinance auto loans from other banks. Don’t be surprised if your current bank turns you down.

Avoid cash-out refinance offers .

They may be a good option for home mortgages, but they’re not the best when it comes to cars as they add to the length and cost of your loan. Cars lose value quickly, so a cash-out refinance is not likely to save you any money.

Read Also: How Much Car Can I Afford For 300 A Month

When You Shouldnt Refinance Your Car Loan

If youre in the middle of shopping for a personal loan, mortgage or other financing option, now is not the right time to refinance your auto loan. Applying for a loan would hurt your credit score and possibly cause you to receive a higher interest rate on any loan offers.

If your current auto loan has a prepayment penalty, then refinancing could incur that penalty. Depending on the penalty and your current interest rate, it may not be worth refinancing. If youre not sure whether your loan has a prepayment penalty, look up the loan contract or call the lender and ask them. Some prepayment penalties only apply if you recently took out the loan, so its best to verify over the phone or through documentation.

When Can You Refinance A Car Loan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you recently bought a car, you may wonder when you can refinance your car loan to reduce the interest rate or lower the payment.

Strictly speaking, you can refinance your auto loan as soon as you find a lender that will approve the new loan. That may be a challenge since most lenders wont refinance until the original car loan has been open for at least two to three months.

Delayed lender approval can be an obstacle to refinancing your car loan, but there are potential benefits to waiting.

Read Also: Typical Motorcycle Loan

Can You Refinance Car Loan With Same Bank

The answer to whether or not you can refinance an auto loan with the same bank depends. While it is only sometimes possible, you should always check with your current lender first if you‘re considering refinancing.

Similarly, you may ask, can you refinance a loan with the same bank?

There’s nothing cheap about refinancing a mortgage. You don’t have to stress about a down payment, but you will have to pay closing costs. These are fees paid to the lender for processing the loan. But if you refinance with your same lender, the bank might waive or reduce some of the closing costs.

can you refinance with your current lender? If you refinance with your current lender, you may be able to get a break on certain closing costs, such as the appraisal fee. You may be able to negotiate better terms. You have likely already met with your lender and its loan officers, which could give you leverage when trying to refinance.

Likewise, when should you refinance your car loan?

You do not need to wait any minimum amount of time before refinancing your car loan. You just have to meet all the requirements for the new loan in order to refinance. You can refinance immediately after buyingeven before you make your first monthly payment.

Should I refinance with the same lender?

Things To Watch Out For When Refinancing A Car Loan

Just like with any financial arrangement, it is important to keep your eyes out for red flags. Ensure that the lending agency is reputable and offers a reasonable interest rate. Make sure that you are dealing with a proven institution and be sure to read all the fine print. If you are unsure as to the meaning of a phrase, it is better to ask.

Take a look at the cost of refinancing the vehicle. Are there any upfront expenses? Are you going to be paying more down the line? If so, how much more? Make sure that you have all of the information above before making your decision. As always, avoid deals that seem too good to be true. Understand your rights and the responsibilities of the lender. Be certain that you are comfortable with the arrangement and that it is in your best financial interests.

You May Like: Usaa Auto Refinance Rates

Here Are Some More Details About Rategenius

- Lending platform RateGenius is an online platform that partners with more than 150 lenders to provide refinance offers to people who qualify for a loan.

- Eligibility requirements Your vehicle must be no more than 10 years old and have fewer than 150,000 miles. Plus, your existing auto loan must have a balance of at least $10,250, and you must have a combined household income of at least $2,000 per month. Keep in mind that this lender may offer different terms on Credit Karma.

- Range of credit histories considered Lenders in the RateGenius network consider applicants with less-than-perfect credit, though interest rates could be significantly higher than someone with good or excellent credit would get.

Why Refinance Your Car Loan

Most borrowers choose to refinance their car loan in order to pay less interest on a monthly basis. When you refinance an auto loan to a lower interest rate, you can save hundreds or even thousands in total interest over the life of the loan.

You may end up with a lower monthly payment, which will free up money you can use to pay off other loans. A lower payment will also reduce your debt-to-income ratio, which reflects your monthly debt payments divided by your monthly gross income. If youre planning to apply for a mortgage at some point, a low DTI could also help you qualify for a better interest rate.

Conversely, some borrowers choose to refinance their car loan to a shorter term so they can repay the loan faster. You can also refinance a car loan to a longer term, which can provide some wiggle room in your budget. Another reason to refinance could be if you first got the car loan with a co-signer and want to remove them from the loan.

Recommended Reading: Stilt Loans

When Should You Consider Refinancing Your Car

Refinancing a car isn’t for everyone and deciding when to refinance can be challenging. The benefits of refinancing might be limited or non-existent in certain instances. For example, if you have a poor payment history on your current loan or are close to paying it off, it may not be to your advantage to refinance.

However, there are times when refinancing your car can benefit you. Consider refinancing your car if any of the following situations apply to you.

Your credit score increased

Your credit score is one of the main factors a lender considers when determining loan approval and credit terms. If you financed your car with a low credit score, refinancing your car could get you a better interest rate or even reduce your monthly payment

Interest rates have dropped

If you bought your car when interest rates were high, refinancing your vehicle can save you money, possibly more than you realize. An interest rate decrease of only 2% to 3% could save you hundreds if you do not extend the term of your loan. An auto loan calculator can show you how interest rates affect your monthly payment and the total amount you could pay in interest.

You didnt shop around for rates initially

Your monthly payment is too high

Is Your Loan Balance Higher Than The Value Of Your Vehicle

Kelley Blue Book offers resources and tools for finding used-car values. If the outstanding loan amount is higher than the cars market value , you may have trouble getting approved for a new loan or see little difference in the new loan terms offered to you. Some lenders may allow you to roll the outstanding balance on your current loan into your new loan, but keep in mind that this will add to your overall debt.

Also Check: What Happens If You Default On A Sba Disaster Loan

Can I Refinance My Car With The Same Lender

by R1CU | Sep 7, 2020 | Auto Loan, Auto Refinance, , Loans, ResourceOneBlog |

There are many different reasons why you might choose to refinance your auto loan. Refinancing can help you get a lower interest rate on your car loan, give you more manageable monthly payments, and even change the timeline on your loan. At Resource One Credit Union, we can help you to explore your options if you are thinking about refinancing. We can also answer any outstanding questions that you might have about refinancing your car loan, such as, When should I refinance my car loan? and, Is it easier to refinance with my current lender or a new lender?