Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, you’ll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

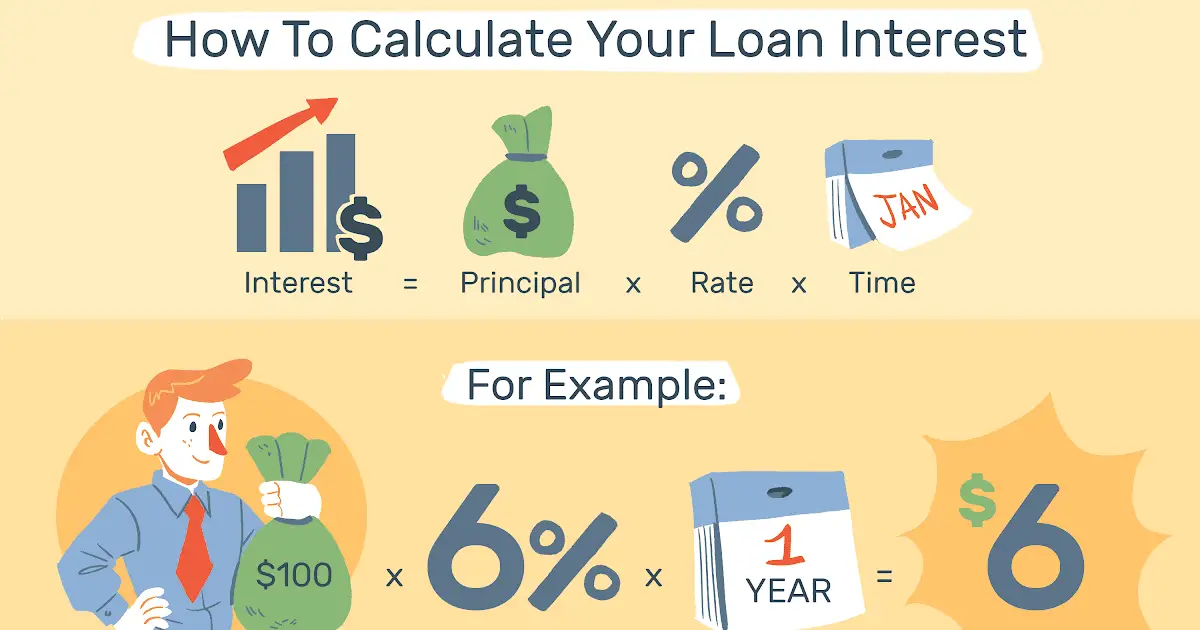

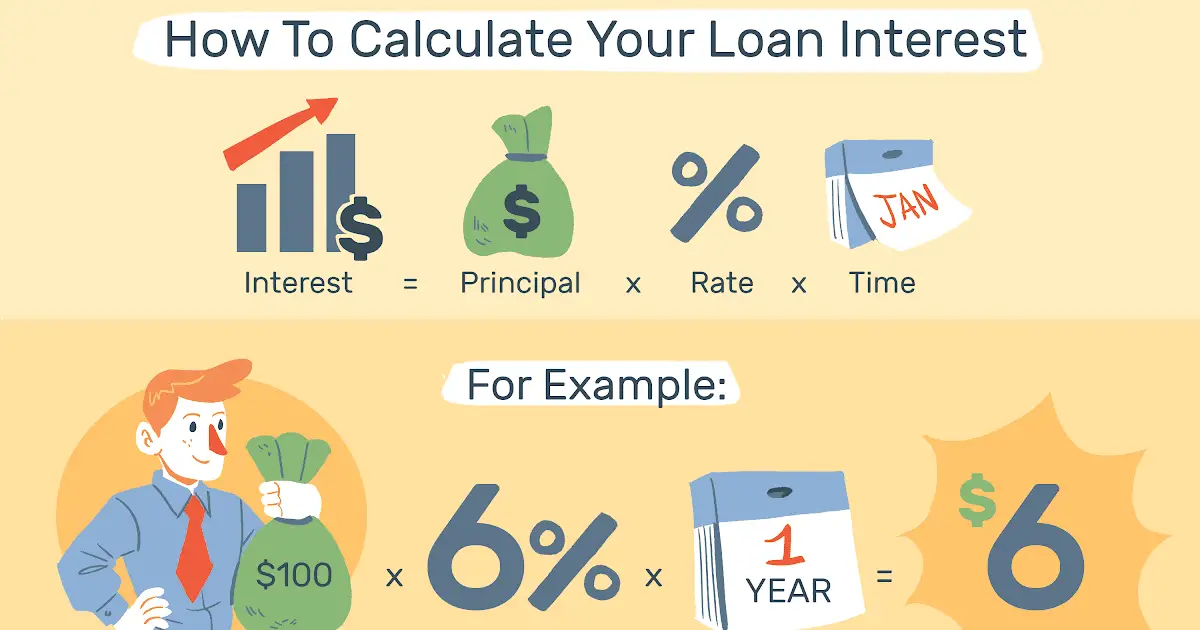

How To Calculate Interest

An Interest-only Mortgage Calculator is what you need to figure out the total amount you’ll be putting down when you take out an interest-only mortgage loan. The calculator will give you a vivid picture of the cost you will pay during the interest-only period as well as during the amortization phase of the loan.

How Much Extra Should You Pay To Payoff Your Mortgage Early

You dream of paying off your mortgage early.

You long for the day when you are debt free.

But how do you do it?

How much must you pay each month to be out of debt by a certain date?

What if you wanted to pay off your mortgage in 15 years instead of 30? How much would you save?

The good news is this mortgage payoff calculator makes figuring out your required extra payment easy.

You choose how quickly you’d like to pay off your mortgage, and the calculator will tell you the required extra monthly payment to get it done. It will also tell you how much interest you’ll save!

However, before you start making your extra payments, there are a few factors you’ll want to consider first . . . .

Read Also: Does The Capital One Pre Approval Car Loan Work

Choose An Accelerated Option For Your Mortgage Payments

An accelerated payment option lets you make weekly or biweekly payments. With this option, youre putting more money toward your mortgage than with a monthly payment.

Accelerated payments can save you money on interest charges. By accelerating your payments, you make the equivalent of one extra monthly payment per year.

Calculating Interest On A Credit Card

Itâs a good idea to think of using a credit card as taking out a loan. Itâs money that is not yours, youâre paying to use it, and itâs best that you pay it back as soon as you can.

For the most part, working out how much you pay in interest on your credit card balance works much the same way as for any other loan. The main differences are:

- Your basic repayment is a minimum amount set by your credit card company. It might be a set dollar amount, similar to any other loan, or it might be a percentage of your balance. Itâs best to pay more than the minimum amount, because often, it doesnât even cover the cost of interest. Paying only the minimum is how you wind up with a massive credit card debt.

- If you make purchases on your card before paying off previous amounts, it will be added to your balance and youâll pay interest on the whole lot. This will change your minimum payment amount as well, if the minimum payment is based on a percentage of your balance.

Itâs always a good idea to pay off as much of your credit card balance as you can, as early as you can. This way, you avoid getting hit by high interest rates.

So when youâre calculating your interest, just remember to use the right amount for your repayment value and add any extra purchases onto your balance, and the above method should work to calculate your interest.

Read Also: Upstart Vs Avant

What Other Expenses Does Homeownership Entail

It’s important to recognize that the estimated total cost of your home purchase is only an estimate and not necessarily representative of future conditions. There are many factors that are not taken into account in the calculations we illustrated above we include a few below for your consideration.

Taxes

While these fixed fees are charged regularly, they have a tendency to change over time, especially in large metropolitan areas like New York and Boston. New-home purchases often have their values reassessed within a year or two, which impacts the actual taxes paid. For that reason, your originally forecasted tax liability may increase or decrease as a result of new assessments.

HOA Dues

For buyers considering condos, homeowners associations can increase their monthly dues or charge special HOA assessments without warning. This can make up a large portion of your housing expenses, especially in large cities with high maintenance fees. You might also be subject to increased volatility in HOA fees if the community you live in has issues keeping tenants or a troubled track record.

Maintenance Costs

Finally, typical mortgage expenses don’t account for other costs of ownership, like monthly utility bills, unexpected repairs, maintenance costs and the general upkeep that comes with being a homeowner. While these go beyond the realm of mortgage shopping, they are real expenses that add up over time and are factors that should be considered by anyone thinking of buying a home.

How To Get A $300000 Mortgage

Applying for a mortgage can be quite simple especially when using a rate-shopping tool like Credible.

When filling your mortgage application out, youll want to have some financial details on hand, including your income, estimated credit score, homebuying budget, and info regarding your assets and savings.

Heres a step-by-step guide on how the mortgage process usually goes:

Also Check: Usaa Pre Approval Auto Loan

How To Avoid Credit Card Interest

Smart consumers don’t waste their money on credit card interest and employ a variety of strategies to minimize charges.

The ideal strategy is to pay your bill in full before the due date so you don’t get charged interest. But if you take cash out of an ATM with your credit card, or pay anything less than the full amount on your statement, you will incur finance charges.

Cash advances are usually excluded from the grace period rule. In other words, there are no interest-free days for cash advances, and thereâs usually a service fee to pay as well. Interest on cash advances is charged immediately from the day the money is withdrawn.

The best strategy is to avoid cash advances and pay your credit card bills in full every month.

Related:Why you need a wealth plan, not a financial plan.

Remember: Credit cards are convenient tools that can be used to your advantage, but you must be careful and stay out of debt. Only buy what you can afford to pay for immediately.

Already in debt? Don’t worry. Calculate credit card interest and payoff time-frames by running some scenarios through our Credit Card Interest Calculator. Realize the cost of staying in debt, make a payoff plan, and get out of debt!

Example Of Mortgage Interest Over Time

To illustrate how amortization works, consider a traditional, fixed-rate mortgage for $100,000 at an annual interest rate of 2% and a time to maturity of 30 years.

The monthly mortgage payment would be fixed at $369.62.

The first payment would include an interest charge of $166.67 and a principal repayment of $202.95. The outstanding mortgage balance after this payment would be $99,797.05.

The next payment would be equal to the first, $369.62, but with a different proportion of interest to principal. The interest charge for the second payment would be $166.33, while $203.29 will go toward the principal.

This example applies to a basic, fixed-rate loan. If you have a variable- or adjustable-rate mortgage, it is also likely to apply a greater portion of your monthly payment to interest at the outset and a smaller portion as time goes on. However, your monthly payments will also adjust periodically, based on prevailing interest rates and the terms of your loan.

There is also a less common type of mortgage, called an interest-only mortgage, in which the entirety of your payment goes toward interest for a certain period of time, with none going toward principal.

Don’t Miss: Signing Loan Agent

Why Do Banks Charge Different Interest Rates

While the cash rate is one of the main things banks will consider when setting commercial interest rates, itâs not the only one. Banks will also be keeping an eye on overhead costs, as well as maintaining a healthy margin between the loan and deposit rates theyâre offering.

Generally speaking, online banks tend to offer cheaper home loan rates and more generous savings account rates than their larger counterparts, as they have fewer overhead costs to worry about. The flipside to this is that larger banks tend to offer more when it comes to physical branches and face-to-face services.

How To Calculate How Much Interest You’ll Pay On A Mortgage

You can figure out how much interest you’ll pay each month by looking at an amortization table for your loan. You can ask your lender for one or use an online mortgage calculator that has an option to break down your amortized payments by month or year.

When you close on your mortgage, you can also look at the fifth page of your Closing Disclosure form to see the total amount of your finance charges and the total interest percentagethe amount you pay in interest relative to the loan amount over the loan’s term.

However, how much you actually pay in interest will depend on whether you repay the mortgage over the full term, refinance your mortgage or pay off the mortgage early when you sell the home.

Read Also: Usaa Apply For Auto Loan

Refinance To A Shorter Term

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

How Are Mortgage Repayments Calculated

You essentially have two different things that you need to pay off when it comes to your mortgage – the sum you have borrowed, referred to as the capital, and the interest charged on that loan.

With a repayment mortgage, your monthly payment is made up of two different parts. Part of the monthly payment will go towards reducing the size of your outstanding debt, while the rest will go towards covering the interest charged on that debt.

Let’s look at an example. Say you’ve borrowed £200,000 for 25 years, at an interest rate of 3%.

Over the lifetime of the mortgage, you’ll be charged £84,478 in interest, meaning you need to pay back £284,478 over 300 months .

Your monthly repayment will be £284,478/300 = £948.

- Find out more: mortgage repayment calculator

You May Like: Can You Use A Va Loan For Investment Property

How Much Will The Monthly Payment On A $150000 Mortgage Be +

It depends on which point in the amortization schedule you currently are at. You are only required to take care of the interest during the initial phase in an interest-only loan. Once that phase elapses, you begin to bear the cost of the loan principal. It is possible to know how much you’ll be paying at any point in these two phases. Using the interest-only calculator on this page, you’ll get a fair idea of what to expect monthly.

How To Calculate Repayments On A Mortgage

To calculate how much interest you’ll pay on a mortgage each month, you can use the monthly interest rate. Generally, you’ll find this by dividing your annual interest rate by 12. Then, multiply this by the amount of principal outstanding on the loan. Note that this means you’ll pay less interest later in the life of the mortgage, but keep in mind that this won’t always hold true for adjustable rate mortgages.

TL DR

Divide you annual mortgage interest rate by 12 to get your monthly rate. Multiply this number by the total amount outstanding on the loan to get how much interest you owe for the month.

Recommended Reading: Refinance Conventional Loan

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

How To Lower The Interest On Your Mortgage

With the above factors in mind, here are a few things you can do to help lower your interest payments when you get a mortgage:

- Improve your credit. Although it can take time, try to improve your credit before taking on a mortgage. One potentially quick way to do this is by paying down credit card debt or consolidating credit card debt with a personal loan. However, you should avoid taking on a new loan if you plan on buying a home in the near future as new debt could compromise mortgage approval.

- Save up a large down payment or buy a cheaper home. While you may want to move right away, taking more time to save up a large down payment could help you secure a lower interest rate and avoid extra mortgage insurance costs. If you can’t wait, consider a less expensive home to increase the amount of your down payment relative to the home’s cost.

- Choose a shorter term or variable rate. Regardless of the loan amount, a shorter term and variable rate can also help you lock in a lower interest rate. However, they both come with additional risk as it may be difficult to afford the large payments in the future.

Read Also: How Long Do Sba Loans Take To Get Approved

How Do Mortgage Repayments Work

For most of us, buying a property will involve taking out a mortgage. Its one of the biggest loans we will take out, so its really important to understand just how your repayments work and what your options are for reducing them.

When you buy a property, what you pay will be made up of two parts – your deposit and your mortgage. The larger your deposit you have in place, the smaller the mortgage you will need to borrow.

So for example, if your deposit is worth 10% of the purchase price, then you will need to take out a mortgage for the remaining 90%.

The amount that the mortgage will cost you to pay off will be determined by two additional factors – the term of the mortgage and the interest rate.

You will then make a monthly repayment towards the mortgage so that it is paid off when you reach the end of your mortgage term.

Calculating Arms Refinances And Other Mortgage Types

The equations that we’ve provided in this guide are intended to help prospective borrowers understand the mechanics behind their mortgage expenses. These calculations become more complicated if you’re trying to account for ARMs or refinances, which call for the use of more specialized calculators or spreadsheet programs. You can better understand how these loan structures work by referring to one of our guides about mortgage loans below:

You May Like: Usaa Graduate Student Loans

Understanding The Amortization Schedule

Of course, your mortgage payment doesn’t just consist of interest. If it did, you’d never get the loan paid off. Each month, you’ll also pay off some of the principal — the money you actually borrowed. Lenders use a mathematical formula, called an amortization formula, to set your payment so that the total combined amount you pay in interest and principal is the same each month, which helps immeasurably with financial planning. For the loan in the previous example, the formula produces a monthly payment of $1,199.10. If your first payment included $1,000 in interest, then the principal portion is $199.10.